0000712534false00007125342024-08-262024-08-260000712534us-gaap:CommonStockMember2024-08-262024-08-260000712534frme:DepositarySharesMember2024-08-262024-08-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): August 26, 2024

FIRST MERCHANTS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | |

| Indiana |

| (State or other jurisdiction of incorporation) |

| 001-41342 | 35-1544218 |

| (Commission File Number) | (IRS Employer Identification No.) |

200 East Jackson Street

P.O. Box 792

Muncie, IN 47305-2814

(Address of principal executive offices, including zip code)

(765) 747-1500

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.125 stated value per share | FRME | The Nasdaq Stock Market LLC |

| Depositary Shares, each representing a 1/100th interest in a share of Non-Cumulative Perpetual Preferred Stock, Series A | FRMEP | The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01 OTHER EVENTS

First Merchants Bank, the wholly-owned banking subsidiary of First Merchants Corporation (the “Company”), has entered into a Branch Purchase and Assumption Agreement with Old Second National Bank, a national banking association headquartered in Aurora, Illinois, pursuant to which First Merchants Bank will sell five branches located in Illinois, representing approximately $304 million in total deposits and $12 million in total loans as of June 30, 2024, to Old Second National Bank. The sale is expected to result in approximately $23 million of gain and should allow the Company to capitalize on the valuation premium and redeploy the capital in balance sheet restructuring efforts driving shareholder value. Subject to the receipt of regulatory approvals from the required federal and state banking agencies, the parties expect the sale to be consummated in the fourth quarter of 2024.

On August 27, 2024, the parties issued a joint press release announcing the execution of the Branch Purchase and Assumption Agreement, a copy of which is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect”, and similar expressions or future or conditional verbs such as “will”, “would”, “should”, “could”, “might”, “can”, “may”, or similar expressions. These forward-looking statements include, but are not limited to, statements regarding the Company’s goals, intentions and expectations related to the divestiture.

By their nature, forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results and performance to vary materially from those expressed or implied by any forward-looking statement include: the timing and availability of the regulatory approvals necessary to consummate the divestiture and the gains and charges related thereto. Forward-looking statements speak only as of the date they are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, subsequent events, or circumstances or other changes affecting such statements except to the extent required by applicable securities laws.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

(d) Exhibits.

| | | | | |

| Exhibit 99.1 | |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | First Merchants Corporation |

| | (Registrant) |

| | |

| | By: /s/ Michele M. Kawiecki Michele M. Kawiecki

Executive Vice President, Chief Financial Officer |

Dated: August 27, 2024 | | |

FOR IMMEDIATE RELEASE

OLD SECOND BANCORP, INC. AND FIRST MERCHANTS CORPORATION ANNOUNCE TRANSACTION INVOLVING CHICAGOLAND BRANCH OPERATIONS

_____________________________________

Old Second National Bank Acquires 5 Illinois Branches from First Merchants Bank

_____________

Proposed Acquisition to Add $304 Million in Deposits and $12 million in loans

_____________

CHICAGO, IL--(August 27, 2024)—Old Second Bancorp, Inc. (“Old Second Bancorp”) (NASDAQ: OSBC), the parent company of Old Second National Bank (“Old Second”), and First Merchants Corporation (“First Merchants Corp.”) (NASDAQ: FRME), the parent company of First Merchants Bank (“First Merchants”), jointly announced today that Old Second and First Merchants have entered into a Purchase and Assumption Agreement where Old Second will purchase 5 Illinois branch locations in the Southeast Chicago MSA as well as certain branch related loans and deposits from First Merchants.

The acquisition enhances Old Second’s position as one of the largest banks headquartered in Chicago and adds meaningfully to its existing branch network and in the Southeast Chicago market, allowing for improved scale and penetration. The sale by First Merchants completes its branch exit from suburban Chicago markets.

Old Second anticipates assuming approximately $304 million in deposits and purchasing approximately $12 million in branch-related loans from this acquisition. Old Second will pay a deposit premium of 7.5%, or approximately $23 million, in estimated cash consideration to First Merchants. The branches to be acquired by Old Second will operate as First Merchants branches until closing and will be re-branded as Old Second branches immediately upon closing of the transaction. Pending regulatory approval, the closing is expected to occur near year-end 2024.

Keefe, Bruyette & Woods, Inc. served as financial advisor, and Nelson Mullins Riley & Scarborough LLP served as legal advisor to Old Second Bancorp. Stephens Inc. served as financial advisor, and Dentons Bingham Greenebaum LLP served as legal advisor to First Merchants Corp.

ABOUT OLD SECOND BANCORP

Old Second Bancorp, Inc., headquartered in Aurora, Illinois, is the bank holding company for Old Second National Bank, which celebrated 150 years of operation in 2021. Old Second's common stock trades on The NASDAQ Stock Market under the symbol "OSBC". More information about Old Second is available by visiting the "Investor Relations" section of its website www.oldsecond.com.

Old Second National Bank, Member FDIC, provides full service banking which includes customary consumer and commercial products and services that banks provide including demand, NOW, money market, savings, time deposit, individual retirement and Health Savings Accounts; commercial, industrial, consumer and real estate lending, including installment loans, agricultural loans, lines of credit and overdraft checking; safe deposit operations; trust services; wealth management services, and an extensive variety of additional services tailored to the needs of individual customers. The Bank also offers a full complement of electronic banking services including web and mobile banking and corporate cash management. As of June 30, 2024, Old Second has approximately $5.7 billion in assets, $4.5 billion in deposits and $4.0 billion in loans.

ABOUT FIRST MERCHANTS CORPORATION

First Merchants Corporation is a financial holding company headquartered in Muncie, Indiana. The Corporation has one full-service bank charter, First Merchants Bank. The Bank also operates as First Merchants Private Wealth Advisors (as a division of First Merchants Bank).

First Merchants Corporation’s common stock is traded on the NASDAQ Global Select Market System under the symbol “FRME.” Quotations are carried in daily newspapers and can be found on the company’s Internet web page (http://www.firstmerchants.com).

FORWARD-LOOKING STATEMENTS

This press release and statements by our management may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding our expectations with respect to the proposed transaction. Forward-looking statements are based on our current beliefs, expectations and assumptions and on information currently available and, can be identified by the use of words such as “expects,” “intends,” “believes,” “may,” “will,” “would,” “could,” “should,” “plan,” “anticipate,” “estimate,” “possible,” “likely” or the negative thereof as well as other similar words and expressions of the future. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements anticipated in such statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements include, among others: (i) the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period; (ii) the risk that integration of the operations of the branch locations with Old Second will be materially delayed or will be more costly or difficult than expected; (iii) the effect of the announcement of the transaction on employee relationships, customer relationships and operating results; and (iv) the satisfaction of closing conditions, including, but not limited to, the receipt of requisite regulatory approvals. For a discussion of additional factors that could cause actual results to differ materially from those described in the forward-looking statements, please see the risk factors discussed in Old Second Bancorp’s Form 10-K for the year ended December 31, 2023, its Forms 10-Q for the quarters ended March 31, 2024 and June 30, 2024, and other reports that are filed with the U.S. Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made and, except as required by law, Old Second Bancorp does not assume any duty to update forward-looking statements.

| | | | | | | | |

| OLD SECOND NATIONAL BANK CONTACT: | | FIRST MERCHANTS BANK CONTACT: |

| Bradley S. Adams | | Nicole M. Weaver |

| Executive Vice President, Chief Operating Officer and | | First Vice President and |

| Chief Financial Officer | | Director of Corporate Administration |

| (630) 906-5484 | | (765) 521-7619 |

| BAdams@oldsecond.com | | nweaver@firstmerchants.com |

| www.oldsecond.com | | www.firstmerchants.com |

| | |

| | |

| | |

Document and Entity Information Document

|

Aug. 26, 2024 |

| Entity Listings [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 26, 2024

|

| Entity Registrant Name |

FIRST MERCHANTS CORP

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity File Number |

001-41342

|

| Entity Tax Identification Number |

35-1544218

|

| Entity Address, Address Line One |

200 East Jackson Street

|

| Entity Address, Address Line Two |

P.O. Box 792

|

| Entity Address, City or Town |

Muncie

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

47305-2814

|

| City Area Code |

765

|

| Local Phone Number |

747-1500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000712534

|

| Amendment Flag |

false

|

| Common Stock, $0.125 stated value per share |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.125 stated value per share

|

| Trading Symbol |

FRME

|

| Security Exchange Name |

NASDAQ

|

| Depositary Shares, each representing a 1/100th interest in a share of Non-Cumulative Perpetual Preferred Stock, Series A |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, each representing a 1/100th interest in a share of Non-Cumulative Perpetual Preferred Stock, Series A

|

| Trading Symbol |

FRMEP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=frme_DepositarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

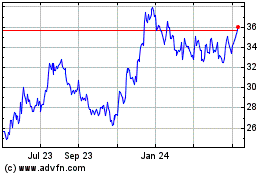

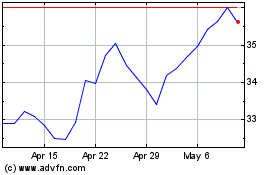

First Merchants (NASDAQ:FRME)

Historical Stock Chart

From Aug 2024 to Sep 2024

First Merchants (NASDAQ:FRME)

Historical Stock Chart

From Sep 2023 to Sep 2024