Permanent TSB Sells Portfolio of Accounts to Citi for EUR1.2 Billion

October 27 2020 - 3:21AM

Dow Jones News

By Joe Hoppe

Permanent TSB Group Holdings PLC said Tuesday that it has agreed

to sell a portfolio of performing property loan accounts to a U.K.

branch of Citigroup Inc, for around 1.2 billion euros ($1.42

billion) on completion.

The Dublin-listed lender said the portfolio, a pool of 3,700

buy-to-let loan accounts linked to around 3,400 borrowing

relationships, had a gross balance sheet value of EUR1.4 billion,

and a net book value of EUR1.2 billion. In 2019, it generated gross

interest income of around EUR15 million and an operating profit of

around EUR2 million.

All loans originated as loans secured on buy-to-let properties,

largely consist of interest-only repayment terms, have an average

balance of around EUR375,000 and an average remaining term of 10

years. The portfolio will continue to be serviced by Permanent TSB

for six months, before transferring the title. After completion,

Citibank NA London will syndicate the portfolio via

securitization.

"This transaction will increase the Bank's transitional Total

Capital Ratio by 2.1%, strengthen the balance sheet and provide us

with resources to compete in our core markets of personal

mortgages, personal lending and SME lending," said Chief Executive

Eamonn Crowley.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

October 27, 2020 04:06 ET (08:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

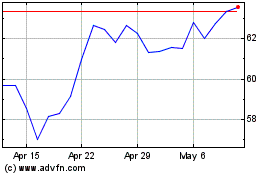

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2024 to May 2024

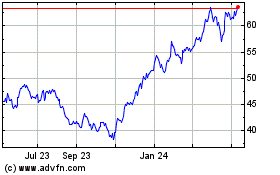

Citigroup (NYSE:C)

Historical Stock Chart

From May 2023 to May 2024