false

0000046765

0000046765

2024-09-10

2024-09-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 10, 2024

HELMERICH & PAYNE, INC.

(Exact name of registrant as specified in

its charter)

| DE |

|

1-4221 |

|

73-0679879 |

(State or other jurisdiction of

Incorporation) |

|

(Commission File

Number) |

|

(I.R.S. Employer

Identification No.) |

222 North Detroit Avenue

Tulsa, OK 74120

(Address of principal executive offices

and zip code)

(918) 742-5531

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

symbol(s) |

|

Name of each exchange on which registered |

| Common Stock ($0.10 par value) |

|

HP |

|

NYSE |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2.):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 7.01 | REGULATION FD DISCLOSURE. |

In

connection with the Offering (as defined below), Helmerich & Payne, Inc., a Delaware corporation (the “Company”),

is furnishing under this Item 7.01 the information included in Exhibit 99.1 hereto, which is incorporated

herein by reference. The information included in Exhibit 99.1 is excerpted from information being delivered to potential investors

in connection with the Offering and is provided in this Item 7.01 to satisfy the Company’s public disclosure requirements under

Regulation FD.

The information

in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor

shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities

Act”), or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth

by specific reference in such filing.

On September 10, 2024, the Company issued

a press release in accordance with Rule 135c under the Securities Act announcing that, subject to market and other conditions, the

Company intends to offer senior unsecured notes (the “Notes”) in a private offering (the “Offering”) to eligible

purchasers that is exempt from registration under the Securities Act.

A copy

of the press release is attached as Exhibit 99.2 to this Current Report on Form 8-K and incorporated into this Item 8.01 by

reference.

The information

contained in this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, does not constitute an offer to

sell, or a solicitation of an offer to buy, any of the Notes in the offering or any other securities of the Company, and none of such

information shall constitute an offer, solicitation or sale of securities in any jurisdiction in which the offer, solicitation or sale

would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

| |

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

HELMERICH & PAYNE, INC. |

| |

|

| |

By: |

/s/ William H. Gault |

| |

Name: |

William H. Gault |

| |

Title: |

Corporate Secretary |

| |

|

|

| |

Date: |

September 10, 2024 |

Exhibit 99.1

RISK FACTORS

KCA Deutag International Limited’s (“KCA

Deutag”) independent auditors issued qualified audit reports for KCA Deutag’s consolidated financial statements for the

years ended December 31, 2023 and 2022.

In July 2022, KCA Deutag exited its businesses

in Russia in response to the war in Ukraine and related UK and Jersey-imposed sanctions. The Russian businesses were accounted for as

discontinued operations in KCA Deutag’s consolidated financial statements for the year ended December 31, 2022. The independent

auditors’ report of such financial statements contained a qualification as to scope regarding such discontinued operations. Auditors

issue a qualified report as to scope when they are unable to obtain sufficient audit evidence to determine whether adjustments are necessary

to amounts reflected in the financial statements. As a result of Jersey sanctions banning the provision of audit services to entities

connected with the Russian Federation, KCA Deutag’s independent auditors could not obtain sufficient audit evidence with respect

to such discontinued operations in order to determine whether any adjustments were necessary. In light of such qualification in the 2022

audit report, KCA Deutag’s independent auditors modified their audit report of the consolidated financial statements for the fiscal

year ended December 31, 2023 because of the possible effect of the scope limitation on the comparability of amounts in fiscal 2023

with corresponding amounts in fiscal 2022. Although KCA Deutag’s Russian operations have been discontinued and are only relevant

to the company’s results of operations and financial position in a historical comparison context, as a consequence of the scope

limitation, the 2022 consolidated financial statements could nonetheless contain a material misstatement as to the amounts relating to

such discontinued operations.

We are not providing all of the information that would be required

if this offering were being registered with the Securities and Exchange Commission (“SEC”).

The offering memorandum does not include all of

the information that would be required if we were registering this offering with the SEC. The historical consolidated financial

statements of KCA Deutag have been prepared in accordance with UK-adopted international accounting standards, IFRS Interpretations Committee and the Companies (Jersey) Law 1991 (“UK IFRS”) and do not satisfy the requirements

of Rule 3-05 of Regulation S-X as promulgated by the SEC under Securities Act of 1933, as amended.

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

OF KCA DEUTAG INTERNATIONAL LIMITED

The

following summary historical consolidated financial information presented as at and for the years ended December 31, 2023 and 2022

has been derived from KCA Deutag’s audited consolidated financial statements, which were prepared in accordance with UK IFRS.

The following summary historical consolidated financial information presented as at June 30, 2024 and for the six months ended June 30,

2024 and 2023 has been derived from KCA Deutag’s unaudited condensed consolidated financial statements, which were prepared in accordance with UK IFRS.

KCA Deutag’s historical results are not necessarily

indicative of the results that may be expected in the future, and the results as at and for the six months ended June 30, 2024 are

not necessarily indicative of results expected for the current fiscal year or any future period. The information set forth below is only

a summary.

| | |

Year ended December 31, | | |

Six months ended June 30, | |

| (In millions) | |

2023 | | |

2022 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

(unaudited) | |

| Statements of consolidated income | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

$ | 1,614.5 | | |

$ | 1,087.3 | | |

$ | 865.7 | | |

$ | 763.2 | |

| Cost of sales | |

| (1,370.9 | ) | |

| (995.8 | ) | |

| (721.0 | ) | |

| (655.5 | ) |

| Gross Profit | |

| 243.6 | | |

| 91.5 | | |

| 144.7 | | |

| 107.7 | |

| Administrative expenses | |

| (49.2 | ) | |

| (39.9 | ) | |

| (27.0 | ) | |

| (22.3 | ) |

| Net impairment gain on financial and contract assets | |

| 3.0 | | |

| 8.4 | | |

| — | | |

| — | |

| Amortization of intangible assets | |

| (8.8 | ) | |

| (4.0 | ) | |

| (4.0 | ) | |

| (3.5 | ) |

| Operating profit before exceptional items | |

| 188.6 | | |

| 56.0 | | |

| 113.7 | | |

| 81.9 | |

| Exceptional items – net operating costs | |

| (21.8 | ) | |

| (18.7 | ) | |

| (10.6 | ) | |

| (10.1 | ) |

| Operating profit (loss) | |

| 166.8 | | |

| 37.3 | | |

| 103.1 | | |

| 71.8 | |

| Finance costs | |

| (169.5 | ) | |

| (100.7 | ) | |

| (79.3 | ) | |

| (84.8 | ) |

| Finance income | |

| 7.7 | | |

| 19.5 | | |

| — | | |

| — | |

| Profit (loss) before taxation | |

| 5.0 | | |

| (43.9 | ) | |

| 23.8 | | |

| (13.0 | ) |

| Taxation | |

| (47.2 | ) | |

| (36.5 | ) | |

| (20.5 | ) | |

| (18.6 | ) |

| Profit (loss) from continuing operations | |

| (42.2 | ) | |

| (80.4 | ) | |

| 3.3 | | |

| (31.6 | ) |

| Profit (loss) from discontinued operations | |

| 8.5 | | |

| (294.2 | ) | |

| — | | |

| 8.9 | |

| Loss for the period | |

| (33.7 | ) | |

| (374.6 | ) | |

| 3.3 | | |

| (22.7 | ) |

| Loss attributable to: | |

| | | |

| | | |

| | | |

| | |

| Owners | |

| (49.7 | ) | |

| (388.1 | ) | |

| (5.3 | ) | |

| (30.0 | ) |

| Non controlling interests | |

| 16.0 | | |

| 13.5 | | |

| 8.6 | | |

| 7.3 | |

| | |

$ | (33.7 | ) | |

$ | (374.6 | ) | |

$ | 3.3 | | |

$ | (22.7 | ) |

| Statements of consolidated cash flows | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by (used in): | |

| | | |

| | | |

| | | |

| | |

| Operating activities | |

$ | 288.1 | | |

$ | 144.3 | | |

$ | 58.4 | | |

$ | 92.0 | |

| Investing activities | |

| (181.0 | ) | |

| (535.6 | ) | |

| (43.5 | ) | |

| (89.1 | ) |

| Financing activities | |

| (158.7 | ) | |

| 441.4 | | |

| (74.9 | ) | |

| (77.2 | ) |

| | |

As of December 31, | | |

As of | |

| (In millions) | |

2023 | | |

2022 | | |

June 30, 2024 | |

| | |

| | |

| | |

(unaudited) | |

| Consolidated balance sheets | |

| | | |

| | | |

| | |

| Total assets | |

$ | 2,376.9 | | |

$ | 2,234.3 | | |

$ | 2,359.9 | |

| Total property and equipment | |

| 948.3 | | |

| 841.0 | | |

| 949.8 | |

| Non-current liabilities | |

| 1,384.9 | | |

| 1,279.9 | | |

| (1,405.1 | ) |

| Total equity | |

| 477.4 | | |

| 540.7 | | |

| 470.1 | |

SUMMARY UNAUDITED PRO FORMA CONDENSED COMBINED

FINANCIAL INFORMATION

The following summary unaudited pro forma

condensed combined statements of operations information for the nine months ended June 30, 2024 and the year ended

September 30, 2023 is presented as if each of (i) the Company’s acquisition of the entire issued share capital of KCA Deutag,

(ii) the Company’s entrance into and borrowings under the term loan agreement, dated as of August 14, 2024, (iii) this offering of

senior notes, (iv) the redemption of KCA Deutag’s outstanding notes and (v) the prepayment of KCA Deutag’s outstanding loans and

credit facilities (collectively, the “Transactions”) had occurred on October 1, 2022. The summary unaudited pro forma

condensed combined balance sheet information is presented as if the Transactions had occurred on June 30, 2024 and, as

adjusted, to reflect the preliminary adjustments to comply with generally accepted accounting principles in the United States

(“U.S. GAAP”) and conform to H&P accounting policies.

The following summary unaudited pro forma condensed

combined financial information has been prepared for informational purposes only and does not purport to represent what the actual consolidated

results of operations or the consolidated position of the Company would have been had the pro forma events occurred on the dates assumed,

nor are they necessarily indicative of future consolidated results of operations or consolidated financial position. Future results may

vary significantly from the results reflected because of various factors.

| | |

Year ended | | |

Nine months ended | |

| (In thousands) | |

September 30, 2023 | | |

June 30, 2024 | |

| Statements of combined operations | |

| | | |

| | |

| Operating revenues | |

| | | |

| | |

| Drilling services | |

$ | 4,477,177 | | |

$ | 3,358,735 | |

| Other | |

| 9,744 | | |

| 7,979 | |

| | |

| 4,486,921 | | |

| 3,366,714 | |

| Operating costs and expenses | |

| | | |

| | |

| Drilling services operating expenses, excluding depreciations and amortization | |

| 2,981,596 | | |

| 2,228,118 | |

| Other operating expenses | |

| 4,477 | | |

| 3,307 | |

| Depreciations and amortization | |

| 568,942 | | |

| 435,710 | |

| Research and development | |

| 30,046 | | |

| 32,105 | |

| Selling, general and administrative | |

| 281,889 | | |

| 231,732 | |

| Asset impairment charges | |

| 12,097 | | |

| — | |

| Restructuring charges | |

| 5,700 | | |

| 8,200 | |

| Gain on reimbursement of drilling equipment | |

| (48,173 | ) | |

| (24,687 | ) |

| Other (gain) loss on sale of assets | |

| 5,616 | | |

| 1,118 | |

| | |

| 3,842,190 | | |

| 2,915,603 | |

| Operating income | |

| 644,731 | | |

| 451,111 | |

| Other income (expense) | |

| | | |

| | |

| Interest and dividend income | |

| 36,093 | | |

| 35,189 | |

| Interest expense | |

| (135,566 | ) | |

| (101,432 | ) |

| Gain on investment securities | |

| 11,299 | | |

| 102 | |

| Other | |

| 9,081 | | |

| 2,991 | |

| | |

| (79,093 | ) | |

| (63,150 | ) |

| Income before income taxes | |

| 565,638 | | |

| 387,961 | |

| Income tax expense (benefit) | |

| 202,667 | | |

| 132,813 | |

| Net income from continuing operations | |

$ | 362,971 | | |

$ | 255,148 | |

| Net income attributable to owners | |

| 360,297 | | |

| 251,842 | |

| Net income attributable to non-controlling interests | |

| 2,674 | | |

| 3,306 | |

| | |

$ | 362,971 | | |

$ | 255,148 | |

| (In thousands) | |

As of June 30, 2024 | |

| Balance sheet data | |

| | |

| Total assets | |

$ | 7,315,659 | |

| Property, plant and equipment, net | |

| 4,128,024 | |

| Long term debt, net | |

| 2,421,283 | |

| Total shareholders’ equity | |

| 2,931,730 | |

Exhibit 99.2

NEWS RELEASE

September 10, 2024

Helmerich & Payne, Inc. Announces

Private Offering of Senior Notes

TULSA, Okla.—September 10, 2024 (BUSINESS

WIRE)-- Helmerich & Payne, Inc. (NYSE:HP) (“H&P” or the “Company”) announced today that it intends

to offer senior unsecured notes (the “Notes”) in a private placement to persons reasonably believed to be qualified institutional

buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and to non-U.S. persons

outside the United States in compliance with Regulation S under the Securities Act (the “Offering”). The timing

of pricing and terms of the Notes are subject to market conditions and other factors.

The Company intends to use the net proceeds from the

Offering, together with the proceeds of its term loan credit facility and cash on hand, to finance the purchase price for its previously

announced pending acquisition (the “Acquisition”) of KCA Deutag International Limited (“KCAD”), to repay certain

of KCAD’s outstanding indebtedness, and to pay related fees and expenses. The net proceeds from the Offering will result in a corresponding

reduction to the commitments under the Company’s existing bridge loan facility for purposes of financing the Acquisition.

The Notes will be subject to a “special mandatory

redemption” in the event that the consummation of the Acquisition does not occur on or before October 25, 2025, or if the Company

notifies the trustee of the Notes that it will not pursue the consummation of the Acquisition.

The Notes have not been registered under the Securities

Act or any state or other jurisdiction's securities laws and may not be offered or sold in the United States to, or for the benefit of,

U.S. persons absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable securities

laws of any state or other jurisdiction.

This press release does not constitute an offer to

sell or the solicitation of an offer to buy any security, nor shall there be any sale of the Notes or any other security of the Company,

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities

laws of any such jurisdiction. The Offering is being made solely pursuant to a private offering memorandum and only to such persons and

in such jurisdictions as are permitted under applicable law.

About

Helmerich & Payne, Inc.

Founded in 1920, Helmerich & Payne, Inc.

is committed to delivering industry leading drilling productivity and reliability. H&P operates with the highest level of integrity,

safety and innovation to deliver superior results for our customers and returns for shareholders. Through its subsidiaries, the Company

designs, fabricates and operates high-performance drilling rigs in conventional and unconventional plays around the world. H&P also

develops and implements advanced automation, directional drilling and survey management technologies.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of

1934, as amended. All statements other than statements of historical facts included in this communication are forward-looking statements.

Forward-looking statements may be identified by the use of forward-looking terminology such as “may,” “will,”

“expect,” “intend,” “estimate,” “anticipate,” “believe,” “predict,”

“project,” “target,” “continue,” or the negative thereof or similar terminology, and such include,

but are not limited to, statements regarding the consummation of the Acquisition, the terms of Offering and the intended use of the net

proceeds therefrom.

Forward-looking statements are based upon current plans,

estimates, and expectations that are subject to risks, uncertainties, and assumptions, many of which are beyond our control and any of

which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. Although we

believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations

will prove to be correct. The inclusion of such statements should not be regarded as a representation that such plans, estimates, or expectations

will be achieved. Factors that could cause actual results to differ materially from those expressed in or implied by such forward-looking

statements include, but are not limited to, our ability to consummate the Acquisition on the terms currently contemplated, risks and uncertainties

related to economic, market or business conditions, including those which might affect the Offering, and additional factors disclosed

in our 2023 Annual Report on Form 10-K, including under Part I, Item 1A— “Risk Factors” and Part II, Item

7— “Management’s Discussion and Analysis of Financial Condition and Results of Operations” thereof, as updated

by subsequent reports (including the Company’s Quarterly Reports on Form 10-Q) we file with the Securities and Exchange Commission.

All forward-looking statements, expressed or implied,

included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should

also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf

may issue. All forward-looking statements speak only as of the date they are made and are based on information available at that

time. Because of the underlying risks and uncertainties, we caution you against placing undue reliance on these forward-looking statements.

We assume no duty to update or revise these forward-looking statements based on changes in internal estimates, expectations or otherwise,

except as required by law.

HP Contacts:

Dave Wilson, Vice President of Investor Relations

investor.relations@hpinc.com

918-588-5190

Media

Stephanie Higgins

Director of Communications

Stephanie.Higgins@hpinc.com

(918) 588-2670

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

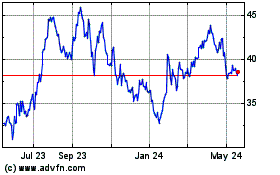

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Aug 2024 to Sep 2024

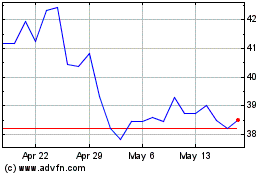

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Sep 2023 to Sep 2024