This press release constitutes a "designated

news release" for the purposes of the Company's prospectus

supplement dated May 17, 2021, to its short form base shelf

prospectus dated January 29, 2021

Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”), a growing North American

precious metals producer, is pleased to report production for the

first quarter ended March 31, 2022. Production results, outlook and

costs throughout this release production results are based on the

Company’s 100% interest in the Cosalá Operations and 60% interest

in the Galena Complex.

Highlights

● For Q1-2022, consolidated attributable

production totalled approximately 300,000 silver ounces and

1,274,000 silver equivalent1 ounces. This represents a 45% increase

in silver production and an 80% increase in silver equivalent

production compared with Q4-2021.

● The Company estimates consolidated Q1-2022

cash cost2 per silver ounce of negative $9.55 per ounce and

consolidated Q1-2022 all-in sustaining cost2 per silver ounce of

$0.42 per ounce.

● Silver production is expected to continue

to increase into the second half of 2022 as production ramps-up

into the higher-silver grade Upper Zone of the San Rafael deposit

at the Cosalá Operations and the Galena Hoist project at the Galena

Complex is completed.

● The Company’s silver equivalent production

guidance remains at 4.8 to 5.2 million ounces in 2022 with further

increases forecast at 7.0 to 7.4 million ounces in 2024, increases

of approximately 240% and 375%, respectively, compared with

2021.

● The balance sheet continues to improve with

the resumption of mining at the Cosalá Operations in Q4-2021 and

stronger metal prices. The Company has a cash and cash equivalents

balance of $7.1 million as of March 31, 2022, compared with a cash

and cash equivalents balance of $2.9 million as of December 31,

2022. The working capital deficit is estimated to also have

improved since December 31, 2021 as a result of increased

production and cash flows from the Cosalá Operations and

notification of loan forgiveness under the U.S. CARES Act.

“The Company had a strong start to the 2022 and we expect that

trend to continue as silver production ramps-up at both our Cosalá

Operations in Sinaloa and the Galena Complex in Idaho over the rest

of the year,” stated Americas President and CEO Darren Blasutti.

“The Company’s balance sheet is steadily improving with the strong

current silver, zinc and lead prices. Current spot silver and zinc

are trading over 10% and 20% higher, respectively, than the average

realized price the Company received this quarter. Strong metal

prices and increasing silver production are expected to generate

improved cash flow in the coming quarters.”

Consolidated Quarterly Production*

Q1 – 2022

Q4 – 2021

% Increase

(Q-over-Q)

Silver Production (ounces)

300,316 oz

206,548 oz

45%

Zinc Production (million pounds)

9.6 Mlbs

4.2 Mlbs

129%

Lead Production (million pounds)

6.4 Mlbs

4.6 Mlbs

39%

Silver Equivalent Production

(ounces)

1,274,470 oz

707,876 oz

80%

* Silver equivalent ounces for Q1-2022 and Q4-2021 were

calculated based on silver, zinc and lead realized prices during

each respective period throughout this press release.

Cosalá Operations

The Cosalá Operations benefitted from its first full quarter of

production in Q1-2022 following the resolution of the illegal

blockade in Q4-2021. The operation had a successful quarter despite

some minor ramp-up challenges including a 5-day period during the

quarter without production. The Cosalá Operations produced 127

thousand ounces of silver, 3.9 million pounds of lead and 9.6

million pounds of zinc in Q1-2022. Cash costs per silver ounce and

all-in sustaining costs per silver at the Cosalá Operations

benefitted from strong current zinc and lead prices which have

increased into Q2-2022.

The Cosalá Operations is expected to increase silver production

through 2022 due to the growing contribution from higher-grade

silver areas in the Upper Zone of the San Rafael mine in the second

half of 2022. Silver production from the Cosalá Operations for the

year continues to be estimated at 0.7 to 0.9 million ounces. Zinc

production from the Cosalá Operations is expected to be

approximately 36 to 40 million pounds while lead production is

expected to be 13 to 15 million pounds.

Galena Complex

The Galena Complex attributable production was approximately 174

thousand ounces of silver and 2.5 million pounds of lead in

Q1-2022. Silver production is estimated to increase in H2-2022 from

a combination of mining higher tonnage in higher-grade silver

copper stopes. The Company aims to complete the Galena Hoist

project in Q4-2022 which will increase hoisting capacity at the

operation in Q4-2022 and beyond. Cash costs per ounce and all-in

sustaining costs per ounce at the Galena Complex are also

anticipated to improve with the completion of the Galena Hoist

project given that most of the operations costs are fixed and are

expected to decrease on a per silver ounce basis assuming expected

higher silver and lead production beyond 2022.

Attributable metal production from the Galena Complex in 2022 is

estimated to be 0.7 to 0.9 million silver ounces and 9 to 11

million pounds of lead.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a growing precious

metals mining company with multiple assets in North America. The

Company owns and operates the Cosalá Operations in Sinaloa, Mexico,

manages the 60%-owned Galena Complex in Idaho, USA, and is

re-evaluating the Relief Canyon mine in Nevada, USA. The Company

also owns the San Felipe development project in Sonora, Mexico. For

further information, please see SEDAR or www.americas-gold.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas Gold and

Silver’s expectations, intentions, plans, assumptions and beliefs

with respect to, among other things, estimated and targeted

production rates and results for gold, silver and other metals, the

expected prices of gold, silver and other metals, as well as the

related costs, expenses and capital expenditures; the

recapitalization plan at the Galena Complex, including the expected

production levels and potential additional mineral resources

thereat; the expected timing and completion of the Galena Hoist

project and the anticipated benefits thereof including increased

hoisting capacity at the operations and expected improvements to

cash costs per ounce and all-in sustaining costs per ounce

following such completion; the expected continuity of full

production levels at the Cosalá Operations and the continuity of

legal access for employees and contractors; the expectations

regarding the level of support from the Mexican government with

respect to the long-term stability of Cosalá Operations, and its

ability to maintain such support in the near- and long-term.

Guidance and outlook contained in this press release was prepared

based on current mine plan assumptions with respect to production,

costs and capital expenditures, the metal price assumptions

disclosed herein, and assumes no adverse impacts to operations from

the COVID 19 pandemic and no further adverse impacts to the Cosalá

Operations from blockades and is subject to the risks and

uncertainties outlined below. Often, but not always,

forward-looking information can be identified by forward-looking

words such as “anticipate”, “believe”, “expect”, “goal”, “plan”,

“intend”, “potential’, “estimate”, “may”, “assume” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions, or statements

about future events or performance. Forward-looking information is

based on the opinions and estimates of Americas Gold and Silver as

of the date such information is provided and is subject to known

and unknown risks, uncertainties, and other factors that may cause

the actual results, level of activity, performance, or achievements

of Americas Gold and Silver to be materially different from those

expressed or implied by such forward-looking information. With

respect to the business of Americas Gold and Silver, these risks

and uncertainties include risks relating to widespread epidemics or

pandemic outbreak including the COVID-19 pandemic; the impact of

COVID-19 on our workforce, suppliers and other essential resources

and what effect those impacts, if they occur, would have on our

business, including our ability to access goods and supplies, the

ability to transport our products and impacts on employee

productivity, the risks in connection with the operations, cash

flow and results of the Company relating to the unknown duration

and impact of the COVID-19 pandemic; interpretations or

reinterpretations of geologic information; unfavorable exploration

results; inability to obtain permits required for future

exploration, development or production; general economic conditions

and conditions affecting the industries in which the Company

operates; the uncertainty of regulatory requirements and approvals;

fluctuating mineral and commodity prices; the ability to obtain

necessary future financing on acceptable terms or at all; the

ability to operate the Company’s projects; and risks associated

with the mining industry such as economic factors (including future

commodity prices, currency fluctuations and energy prices), ground

conditions, illegal blockades and other factors limiting mine

access or regular operations without interruption, failure of

plant, equipment, processes and transportation services to operate

as anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital and construction expenditures, reclamation activities,

labor relations or disruptions, social and political developments

and other risks of the mining industry. The potential effects of

the COVID-19 pandemic on our business and operations are unknown at

this time, including the Company’s ability to manage challenges and

restrictions arising from COVID-19 in the communities in which the

Company operates and our ability to continue to safely operate and

to safely return our business to normal operations. The impact of

COVID-19 on the Company is dependent on a number of factors outside

of its control and knowledge, including the effectiveness of the

measures taken by public health and governmental authorities to

combat the spread of the disease, global economic uncertainties and

outlook due to the disease, and the evolving restrictions relating

to mining activities and to travel in certain jurisdictions in

which it operates. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated, or intended. Readers are cautioned not to

place undue reliance on such information.

The 2022 and 2024 production outlook expectations set out in

this press release are considered forward-looking statements and

represent management’s good faith estimates or expectations of

future production results as of the date hereof. Outlook is based

upon certain assumptions, including, but not limited to, metal

prices, certain exchange rates, the completion of the

Recapitalization Plan at the Galena Complex on time and on budget,

including the completion of the Galena hoist project and related

engineering by Q4-2022, the Cosalá Operations remaining at full

production and not experiencing any unanticipated work stoppages or

interruptions, the Cosalá Operations accessing higher-grade silver

areas in the Upper Zone of the San Rafael mine staring in the

second half of 2022 and other assumptions. For example, 2022

production outlook includes actual results through March 31, 2022.

Production estimates include the Galena Complex and assumes the

completion of the Recapitalization Plan on time and on budget.

Assumptions used for purposes of production outlook may prove to be

incorrect and actual results may differ from those anticipated.

Production outlook cannot be guaranteed. As such, investors are

cautioned not to place undue reliance upon production outlook and

forward-looking statements as there can be no assurance that the

plans, assumptions, or expectations upon which they are placed will

occur.

Additional information regarding the factors that may cause

actual results to differ materially from this forward‐looking

information is available in Americas Gold and Silver’s filings with

the Canadian Securities Administrators on SEDAR and with the SEC.

Americas Gold and Silver does not undertake any obligation to

update publicly or otherwise revise any forward-looking information

whether as a result of new information, future events or other such

factors which affect this information, except as required by law.

Americas Gold and Silver does not give any assurance (1) that

Americas Gold and Silver will achieve its expectations, or (2)

concerning the result or timing thereof. All subsequent written and

oral forward‐looking information concerning Americas Gold and

Silver are expressly qualified in their entirety by the cautionary

statements above.

Non-IFRS Financial Measures

This press release makes reference to certain non-IFRS measures,

including certain metrics specific to the industry in which we

operate. These measures are not recognized measures under

International Financial Reporting Standards as issued by the

International Accounting Standards Board (“IFRS”), do not have a

standardized meaning prescribed by IFRS and, therefore, may not be

comparable to similar measures presented by other companies.

Rather, these measures are provided as additional information to

complement those IFRS measures by providing further understanding

of our results of operations from management’s perspective.

Accordingly, these measures are not intended to represent, and

should not be considered as alternatives to net income or other

performance measures derived in accordance with IFRS as measures of

operating performance or operating cash flows or as a measure of

liquidity. In addition to our results determined in accordance with

IFRS, we use non-IFRS measures including cash costs per ounce, all

in sustaining costs per ounce and average realized silver, zinc and

lead prices. We believe these non-IFRS measures provide useful

information to both management and investors in measuring our

financial performance and condition and highlight trends in our

core business that may not otherwise be apparent when relying

solely on IFRS measures. For further information regarding these

non-IFRS measures, please refer to “Non-GAAP and Other Financial

Measures” in our management’s discussion and analysis for the

financial year ended December 31, 2021 (the “FY2021 MD&A”),

which is incorporated by reference herein and is available on our

SEDAR profile at www.SEDAR.com or the Company’s website at

www.americas-gold.com.

1Silver equivalent ounces for the 2022 guidance, and 2023 and

2004 outlook references were calculated based on $22.00/oz silver,

$0.95/lbs lead and $1.30/lbs zinc throughout this press release.

Silver equivalent ounces for Q4-2021 and full year 2021 were

calculated based on silver, zinc and lead realized prices during

each respective period throughout this press release.

2This metric is a non-GAAP financial measure or ratio. The

Company uses the financial measures “Cash Cost”, “Cash Cost/Ag Oz

Produced”, “All-In Sustaining Cost”, and “All-In Sustaining Cost/Ag

Oz Produced” in accordance with measures widely reported in the

silver mining industry as a benchmark for performance measurement

and because it understands that, in addition to conventional

measures prepared in accordance with IFRS, certain investors and

analysts use this information to evaluate the Company’s underlying

cash costs and total costs of operations. Cash cost is determined

on a mine-by-mine basis and include mine site operating costs such

as mining, processing, administration, production taxes and

royalties which are not based on sales or taxable income

calculations, while all-in sustaining cost is the cash cost plus

all development, capital expenditures, and exploration spending. A

full reconciliation of these non-GAAP financial measures will be

provided when the Company reports its quarterly results on or

before May 12, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220419005413/en/

Stefan

Axell

VP, Corporate Development &

Communications

Americas Gold and Silver

Corporation

416-874-1708

Darren Blasutti President and CEO Americas Gold and Silver

Corporation 416‐848‐9503

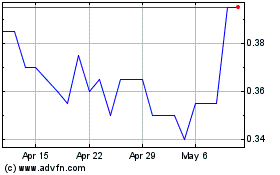

Americas Gold and Silver (TSX:USA)

Historical Stock Chart

From Mar 2024 to Apr 2024

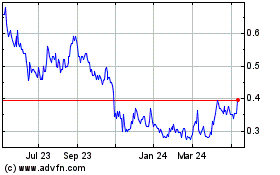

Americas Gold and Silver (TSX:USA)

Historical Stock Chart

From Apr 2023 to Apr 2024