Albion Tech&Gen VCT Statement Regarding The Proposed Issue Of A Prospectus

December 07 2021 - 5:50AM

UK Regulatory

TIDMAATG

Statement regarding the proposed issue of a prospectus

LEI Code 213800TKJUY376H3KN16

Albion Development VCT PLC, Albion Enterprise VCT PLC, Albion

Technology & General VCT PLC, Albion Venture Capital Trust PLC,

Crown Place VCT PLC and Kings Arms Yard VCT PLC ("The

Companies")

Statement regarding the proposed issue of a prospectus for the

Albion VCTs Prospectus Top Up Offers

The Companies are pleased to announce (further to the

announcement made on 18 October 2021) that, subject to obtaining

the requisite regulatory approval, the Companies intend to launch

prospectus top up offers of new ordinary shares for subscription in

the 2021/2022 and 2022/2023 tax years (the "Offers").

The current intention is for the Companies, in aggregate, to

raise up to GBP80 million, with over-allotment facilities of up to

a further GBP20 million in aggregate, before issue costs, as

follows:

Amount to be raised under Over-allotment facility

each Offer

------------------------- -------------------------- -----------------------

Albion Development VCT GBP15 million GBP6 million

PLC Offer

------------------------- -------------------------- -----------------------

Albion Enterprise VCT PLC GBP20 million GBP3 million

Offer

------------------------- -------------------------- -----------------------

Albion Technology & GBP20 million GBP4 million

General VCT PLC Offer

------------------------- -------------------------- -----------------------

Albion Venture Capital GBP10 million -

Trust PLC Offer

------------------------- -------------------------- -----------------------

Crown Place VCT PLC Offer GBP7 million GBP5 million

------------------------- -------------------------- -----------------------

Kings Arms Yard VCT PLC GBP8 million GBP2 million

Offer

------------------------- -------------------------- -----------------------

Any election to make use of their over-allotment facility will

be subject to the decision of the individual boards of the

Companies in the light of investments and disposals made and

anticipated by them at the relevant time.

Full details of the Offers will be contained in a prospectus

that is expected to be published on or around 6 January 2022 and

will be available on the Albion Capital website (

https://www.globenewswire.com/Tracker?data=kmQPIidiMhYKm31h9Hqg-UWU3JP1kLy0ruobU83f8pAdi-nBmqaOlx3T6UHFNjtDld7mv_AQkzlpj9UKjWOpsTYr9b5cEaq1zrUng3OmAOg=

www.albion.capital).

Enquiries:

Will Fraser-Allen

Managing Partner, Albion Capital

Investment Manager

Tel: 0207 601 1850

7 December 2021

(END) Dow Jones Newswires

December 07, 2021 06:50 ET (11:50 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

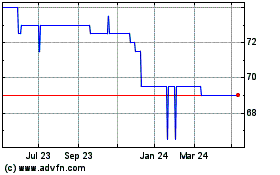

Albion Technology & Gene... (LSE:AATG)

Historical Stock Chart

From Mar 2024 to Apr 2024

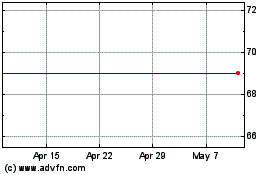

Albion Technology & Gene... (LSE:AATG)

Historical Stock Chart

From Apr 2023 to Apr 2024