TIDMAEO

RNS Number : 3979C

Aeorema Communications Plc

19 October 2020

The Information communicated within this announcement is deemed

to constitute information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Aeorema Communications plc / Index: AIM / Epic: AEO / Sector:

Media

19 October 2020

Aeorema Communications plc ('Aeorema' , the ' Company' , or the

'Group')

Final Results

Aeorema Communications plc, the AIM-traded live events agency,

announces its audited results for the year ended 30 June 2020.

Overview

-- Earnings enhancing acquisition of Eventful Ltd.

o access to the venue sourcing and incentive travel events

market

o successful integration, diversifying and enhancing offering to

existing and new clients

-- Addition of Strategy Director and associated team in May

delivering results - focusing on brand strategy and

communications

-- An encouraging number of multi-national blue-chip client wins seen in 2020 so far

-- Virtual events offering expanded

-- Team adapting quickly and capitalising on an increasing

requirement for virtual and hybrid events

-- Post-period end, opening of an office in New York to service clients in North America

-- Revenues of GBP5,475,425 (2019: GBP6,765,280)

-- Operating loss (pre-exceptional items) of GBP175,043 (2019 profit restated: GBP384,483)

-- Maintained strong cash position - GBP1,721,217 at 30 June 2020

The Company's annual general meeting ("AGM") is expected to be

held in late November and a separate announcement will be made in

due course to confirm postage of the Annual Report and Accounts for

the year ended 30 June 2020 and the notice of AGM to shareholders,

as well as availability of the documents on the Company's website

www.aeorema.com .

**S**

For further information visit www.aeorema.com or contact:

Mike Hale Aeorema Communications Tel: +44 (0) 20 7291

plc 0444

John Depasquale / Liz Allenby Capital Limited Tel: +44 (0)20 3328

Kirchner (Corporate (Nominated Adviser and 5656

Finance) Broker)

Kelly Gardiner (Sales)

Catherine Leftley St Brides Partners Ltd Tel: +44 (0) 20 7236

1177

Chairman's Statement

This year saw a complete reshaping of the events business. It

went from live to virtual overnight. Our industry was faced with

event cancellations, national lock downs and global travel bans.

Despite these major challenges, I am pleased to report the Group

has finished the year in a strong, secure, and promising

position.

Notwithstanding the challenges we have all faced in recent

months with the COVID-19 pandemic, Aeorema has adapted quickly to

the changes in the live events industry and is now capitalising on

the increasing requirement for virtual and hybrid events.

The Group was able to make a first significant acquisition

within the year and diversify its operating businesses to meet the

requirements of the new environment.

In March, the Group acquired Eventful Ltd ("Eventful"). Eventful

provides venue sourcing, strategic event planning and management

and incentive travel services. The acquisition was immediately

earnings enhancing and gave Aeorema access to the venue sourcing

market which rounded out the Group's offering to clients. It also

opened doors to new clients and opportunities to cross-sell.

Despite the challenges I am pleased to report Eventful posted

profits before tax of GBP11,223 for the 3 month period

post-acquisition. The team recently launched a pioneer incentive

product that helps clients continue to use this strong motivation

tool and, despite the current travel challenges, this has had a

good initial client reaction.

The Group has made significant executive appointments during the

year. We also made some strategic hires from a highly successful

creative and award-winning brand experience agency delivering

events worldwide, including creating a new senior Strategy Director

role. This team gave us an opportunity to strengthen our brand

engagement and strategic skills and has diversified and enhanced

the offering to existing and new clients, as well as providing the

Group with a wider and valuable network of blue-chip contacts

across multiple industries, offering opportunities for

cross-selling. With the integration of the team complete and them

now working together sharing client relationships, some significant

introductions have been made which has led to some significant and

highly profitable work from a major multinational technology

client. Several other global clients are expected to follow due to

this new team's expertise.

As we have reported in recent months, we anticipated making a

loss for the year as a result of the postponement and cancellation

of a number of live events. We saw revenue decrease 19% to

GBP5,475,425 (2019: GBP6,765,280) resulting in an operating loss

(pre-exceptional items) of GBP175,043 (2019 profit: GBP384,483).

The Group's cash position remains strong with in excess of GBP1

million as at the date of this announcement. However, given

continuing uncertainties, the Board is not recommending the payment

of a full year dividend. It is the Board's intention to return to

paying dividends as soon as possible.

Outlook

As mentioned, there has been a major shift in traditional event

delivery and the ways clients communicate with their stakeholders.

Even ahead of the COVID-19 pandemic, it was clear that there were

going to be a number of changes to the live events industry and the

way live events were being run and staged. There was already an

increasing focus put on digital and hybrid events, particularly

with the desire for a more environmentally sustainable method of

running events, but the immediate impact of the COVID-19 pandemic

created an acceleration of the need for digital and hybrid events.

Aeorema, with its experience and ability to be agile, has been

quick to adapt.

We have introduced innovative ways of running virtual events and

making them more successful; we have launched a robust and flexible

technology platform to help run virtual events and this has had a

very positive response from clients; we have launched a New York

office to service our clients there and to enter the extremely

large USA events market - this office has already enabled us to win

projects that we would not have won without it. We will continue to

look for ways to help our clients in this environment and grow our

business and revenue and although we believe the physical events

business will return, it will be different with many hybrid

physical and virtual events. With our foundations, and the

exceptional hard work undertaken by every member of the team so far

this year, we are ideally positioned to be a leader in this new

market.

The Board and I want to congratulate and thank all the staff.

They have faced unique challenges with great energy and commitment.

They have protected cash flow and have also driven new initiatives.

They have contained costs and critically they have maintained

morale and creativity in the most trying of circumstances.

We also want to thank our shareholders. Your support has been

excellent and very much appreciated and we remain motivated by this

support to grow revenue and profit.

M Hale

Chairman

16 October 2020

Chief Executive Officer's Report

The Year of the Great Reset. This year we saw a complete shift

from traditional channels to virtual world communications. I am as

proud as ever of our Cheerful Twentyfirst and Eventful teams, who

were at the coal-face as live events were wiped off the board and

replaced with virtual briefs.

Our agencies embraced the pivot to virtual events like a new

pitch, exploring best practice and creative ways to break out of

the traditional mould and to build an experience to suit. The

enlarged team moved quickly and strategically to pioneer the rapid

shift to virtual and brought our clients with us along the way.

Through March, April and May we focused our agency approach on

supporting our clients through this transition, and developing

their trust with virtual and its opportunities. And there are so

many opportunities.

It is difficult to pick one highlight from this financial year.

I'm delighted to share several moments that stand out. The Cheerful

Twentyfirst agency rebrand in September 2019, where our new bold

colours and dynamic logo aligned our branding with our modern

agency values. We celebrated multiple major award wins, including

the Global Campaign Experience Awards and Creative Team of the Year

for the second year running. Our experiential projects with new

clients, who shared, "I've worked with different production

companies over the years, but Cheerful Twentyfirst is far and away

the best - words cannot describe how good you are." Then there is

our international work in Cannes during 2019, where we delivered a

revolutionary and sustainable brand activation that continues to

garner attention for innovation and creative flair to this day.

We have continued to invest in new offerings with the Eventful

team and new talent as we see the shape of the agency adapting to

virtual communications. Most notably, we welcomed our Strategy

Director, Hannah Luffman, alongside new senior appointments in

technical and creative. Hannah's reputation for client-work and

experience in audience engagement has proved invaluable to our

growth.

Outlook

Our delivery in the world of Virtual events has been enhanced by

the curation of our own robust platform. We believe we were the

first agency to curate a solution that holistically responded to

clients' needs: agency creative, communications strategy and

branding, packaged alongside a tried and tested platform offering.

Fondly named KIT, launched post-period end, the platform is a

sophisticated solution that hosts and delivers online events, with

refined engagement tools that address specific needs. The secure

technology is brandable and scalable, while giving users a

personalised experience. Since KIT's launch in September, we have

had many client requests for platform demonstrations.

Our expansion into the US was a historic moment for the agency.

In September 2020 we very proudly opened our New York office and

appointed New York talent. The expansion has already been highly

successful and looks to yield strong traction with current US

clients and in new opportunities. Within the first 10 business days

of opening, we secured three new clients with live projects already

underway on the East and West Coasts.

In equally as exciting news, our incentives business Eventful is

unveiling a luxury product that will charter a new course for

corporate rewards within the UK. In partnership with luxury hotels,

we see this new offering as a significant opportunity to lead the

way in restructuring and re-energising the local travel and

incentives market both locally and abroad.

The development of the Group's offering to now include strategy

and virtual experiences as chargeable avenues has reignited

opportunities across the board. Excitingly and off the back of

this, we are seeing bigger conversations and a bigger 'piece of the

pie' with returning and new clients alike. I am optimistic that the

momentum already seen in Q1 2020-2021 reflects continued positive

growth ahead for both operating businesses. A strong finish to a

challenging year, we continue to make waves in the UK and globally

as Game Changers in purpose, strategy, creative and value.

S Quah

CEO

16 October 2020

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2020

Notes 2020 2019

GBP GBP

Continuing operations

Revenue 2 5,475,425 6,765,280

Cost of sales (3,629,770) (4,584,117)

-------------------------- ------ ------------

Gross profit 1,845,655 2,181,163

Other income 3 82,601 -

Administrative expenses (2,103,299) (1,796,680)

------ ------------ ------------

Operating (loss) /

profit pre-exceptional

items 4 (175,043) 384,483

-------------------------- ------ ------------

Exceptional items 5 (23,184) -

-------------------------- ------ ------------

Operating (loss) /

profit post exceptional

items (198,227) 384,483

-------------------------- ------ ------------

Finance income 6 556 611

Finance costs (20,253) (2,850)

-------------------------- ------ ------------

(Loss) / profit before

taxation (217,924) 382,244

Taxation 7 20,497 (86,687)

------ ------------ ------------

(Loss) / profit and

total comprehensive

income for the year

attributable to owners

of the parent (197,427) 295,557

(Loss) / profit per

ordinary share:

Total basic earnings

per share 10 (2.16920)p 3.26564p

Total diluted earnings

per share 10 N/A 3.22011p

-------------------------- ------ ------------

There were no other comprehensive income items.

Statement of Financial Position

As at 30 June 2020

Notes Group Company

2020 2019 2020 2019

GBP GBP GBP GBP

Non-current assets

Intangible assets 11 573,931 365,154 - -

Property, plant and equipment 12 85,952 58,071 - -

Right-of-use assets 13 379,530 13,486 - -

Investments in subsidiaries 14 - - 1,141,540 614,751

Deferred taxation 7,611 - 30,253 -

------------ ------------ ---------- ----------

Total non-current assets 1,047,024 436,711 1,171,793 614,751

Current assets

Trade and other receivables 15 597,497 1,612,345 657,986 977,427

Cash and cash equivalents 16 1,721,217 2,211,161 11,298 3,606

------------ ------------ ---------- ----------

Total current assets 2,318,714 3,823,506 669,284 981,033

------------ ---------- ----------

Total assets 3,365,738 4,260,217 1,841,077 1,595,784

Current liabilities

Trade and other payables 17 (1,186,670) (2,223,027) (191,136) (88,397)

Lease liabilities 18 (85,070) (16,475) - -

Current tax payable (68,490) (74,616) - -

------------ ------------ ---------- ----------

Total current liabilities (1,340,230) (2,314,118) (191,136) (88,397)

Non-current liabilities

Lease liabilities 18 (300,689) - - -

Deferred taxation 8 - (7,529) - -

Provisions 19 (25,020) (24,186) - -

------------ ------------ ---------- ----------

Total non-current liabilities (325,709) (31,715) - -

------------ ------------ ---------- ----------

Total liabilities (1,665,939) (2,345,833) - -

Net assets 1,699,799 1,914,384 1,649,941 1,507,387

------------ ------------ ---------- ----------

Equity

Share capital 20 1,154,750 1,131,313 1,154,750 1,131,313

Share premium 9,876 7,063 9,876 7,063

Merger reserve 16,650 16,650 16,650 16,650

Other reserve 81,358 34,261 81,358 34,261

Capital redemption reserve 257,812 257,812 257,812 257,812

Retained earnings 179,353 467,285 129,495 60,288

------------ ------------ ---------- ----------

Equity attributable to

owners of the parent 1,699,799 1,914,384 1,649,941 1,507,387

------ ------------ ------------ ---------- ----------

Consolidated Statement of Changes in Equity

For the year ended 30 June 2020

Capital

Share Merger Other redemption Retained

Group capital Share premium reserve reserve reserve earnings Total equity

GBP GBP GBP GBP GBP GBP GBP

--------------------- -------------- --------- --------- ------------ ---------- -------------

At 30 June

2018 1,131,313 7,063 16,650 - 257,812 249,829 1,662,667

IFRS 16 adjustments - - - - - (10,222) (10,222)

Adjusted balance

at 1 July 2018 1,131,313 7,063 16,650 - 257,812 239,607 1,652,445

Comprehensive

income for

the year, net

of tax - - - - - 295,557 295,557

Dividends paid - - - - - (67,879) (67,879)

Share-based

payment - - - 34,261 - - 34,261

At 30 June

2019 1,131,313 7,063 16,650 34,261 257,812 467,285 1,914,384

Comprehensive

income for

the year, net

of tax - - - - - (197,427) (197,427)

Dividends paid - - - - - (90,505) (90,505)

Share-based

payment - - - 47,097 - - 47,097

Share issue 23,437 2,813 - - - - 26,250

At 30 June

2020 1,154,750 9,876 16,650 81,358 257,812 179,353 1,699,799

---------------------

The prior year adjustment relating to the first time adoption of

IFRS 16 is explained on pages 33 and 34 of the financial

statements.

Share premium represents the value of shares issued in excess of

their list price.

In accordance with section 612 of the Companies Act 2006, the

premium on ordinary shares issued in relation to acquisitions is

recorded as a merger reserve. The reserve is not distributable.

Other reserve represents equity settled share-based employee

remuneration, as detailed in note 23.

Capital redemption reserve represents a statutory

non-distributable reserve into which amounts are transferred

following redemption or purchase of a company's own shares.

The notes on pages 29 to 55 of the financial statements are an

integral part of these financial statements.

Statement of Cash Flows

For the year ended 30 June 2020

Notes Group

2020 2019

GBP GBP

------ ---------- ----------

Net cash flow from operating activities 25 (99,006) 981,846

Cash flows from investing activities

Payment for Acquisition of Subsidiary,

net of cash acquired (128,331) -

Finance income 6 556 611

Purchase of intangible assets 11 (10,000) -

Purchase of property, plant and equipment 12 (61,400) (48,731)

Repayment of leasing liabilities (101,258) (91,000)

Dividends received by the Company - -

Cash (used) / generated in investing

activities (300,433) (139,120)

Cash flows from financing activities

Dividends paid to owners of the Company (90,505) (67,879)

---------- ----------

Cash used in financing activities (90,505) (67,879)

Net (decrease) / increase in cash

and cash equivalents (489,944) 774,847

Cash and cash equivalents at beginning

of year 2,211,161 1,436,314

---------- ----------

Cash and cash equivalents at end

of year 1,721,217 2,211,161

------------------------------------------- ---------- ----------

Cash and cash equivalents

The amounts disclosed on the Statement of Cash Flows in respect

of cash and cash equivalents are in respect of the Statement of

Financial Position amounts:

Notes Group Company

2020 2019 2020 2019

GBP GBP GBP GBP

------ ---------- ---------- ------- ------

Cash and cash equivalents 16 1,721,217 2,211,161 11,298 3,606

1,721,217 2,211,161 11,298 3,606

---------------------------

Notes to the consolidated financial statements

For the year ended 30 June 2020

1 Accounting policies

Aeorema Communications plc is a public limited company

incorporated in the United Kingdom and registered in England and

Wales. The Company is domiciled in the United Kingdom and its

principal place of business is Moray House, 23/31 Great Titchfield

Street, London, W1W 7PA. The Company's Ordinary Shares are traded

on the AIM Market.

The principal accounting policies adopted in the preparation of

the financial statements are set out below. The policies have been

consistently applied to all the years presented, unless otherwise

stated.

The presentation currency is GBP sterling.

Going concern

The COVID-19 pandemic had a significant impact on the Group. The

imposition of international lockdowns and subsequent disruption

caused to international travel meant that all physical events

between March and June 2020 were either postponed or cancelled.

Like most companies within the events industry, both Aeorema

Limited and Eventful Limited had the majority of their jobs either

cancelled or postponed until later in 2020 or early 2021. Aeorema

Limited successfully held a few virtual events for a key client as

a substitute for the physical events that could no longer take

place, and the moving image department continued to produce and

edit films remotely throughout the lockdown.

In response to the UK government's introduction of the

Coronavirus job retention scheme the Group furloughed several

employees (see note 3) and arranged deferrals and payment plans

with HMRC for several outstanding tax liabilities.

Although the COVID-19 pandemic resulted in all the Group's live

events being cancelled, including Cannes Lions, the pandemic has

created opportunities for the Group to expand its offering to

clients. The Group maintains its core businesses (physical events

and exhibitions, moving image and venue sourcing), however, the

Group has also shifted its focus towards providing virtual events

via online platforms for clients. The impact of the COVID-19

pandemic on social distancing and international travel may be

long-lasting, and the Group has successfully moved towards

providing virtual events, delivering several virtual events post

year end for both existing and new clients, with more in the

pipeline, as well as launching a new online platform which can be

used by clients to host their virtual events.

The Group has also expanded its operations by launching a new US

subsidiary, Cheerful Twentyfirst Inc. The Group has delivered

several events for US based clients and UK based clients with US

based subsidiaries. The opening of a US subsidiary offers the

Group's US based clients and new potential US clients the

opportunity to work with a company that operates in the same time

zone and can therefore provide an improved service and uses the

same currency. The opening of a new office in the US is already

proving successful with several new briefs received from US based

clients since the launch post year end.

After reviewing the Group's detailed forecasts for the next

financial year, other medium term plans and considering the risks

outlined in note 26, the Directors, at the time of approving the

financial statements, have a reasonable expectation that the Group

has adequate resources to continue in operational existence for the

foreseeable future and have therefore used the going concern basis

in preparing the financial statements.

Basis of Preparation

The Group's financial statements have been prepared under the

historical cost convention and in accordance with International

Financial Reporting Standards (IFRS) as adopted by the European

Union, and with those parts of the Companies Act 2006 applicable to

companies reporting under IFRS.

The following new standards, amendments to standards and

interpretations have been applied for the first time from 1 July

2019. Their adoption has not had a material impact on the financial

statements:

-- IFRS 9 'Financial Instruments', effective 1 January 2019;

-- Annual Improvements to IFRS Standards 2015 - 2017 Cycle (effective 1 January 2019);

-- Interest Rate Benchmark Reform (Amendments to IFRS 9, IAS 39

and IFRS 7) (effective 1 January 2020);

-- COVID-19-Related Rent Concessions (Amendment to IFRS 16) (Effective 1 June 2020).

The following new standards, amendments to standards and

interpretations have been applied for the first time from 1 July

2019 and their adoption have had a material impact on the financial

statements:

-- IFRS 16 'Leases', effective 1 January 2019 (see page 33 for more details).

Future standards in place but not yet effective

No new standards, amendments or interpretations to existing

standards that have been published and that are mandatory for the

Company's accounting periods beginning on or after 1 July 2020 have

been adopted early.

The following standards and amendments are not yet applied at

the date of authorisation of these financial statements:

-- Definition of Material (Amendments to IAS 1 and IAS 8) (effective 1 January 2020); and

-- Definition of a Business (Amendments to IFRS 3) (effective 1 January 2020).

The Group does not believe that there would have been a material

impact on the financial statements from early adoption of these

standards / interpretations.

Basis of consolidation

The Group financial statements consolidate those of the Company

and all of its subsidiary undertakings drawn up to 30 June 2020.

Subsidiaries are all entities (including structured entities) over

which the Group has control. Subsidiaries are fully consolidated

from the date on which control is transferred to the Group. They

are consolidated until the date that control ceases.

Intra-group transactions, balances and unrealised gains and

losses on transactions between group companies are eliminated.

The merger reserve is used where more than 90% of the shares in

a subsidiary are acquired and the consideration includes the issue

of new shares by the Company, thereby attracting merger relief

under the Companies Act 2006.

Revenue

Revenue represents amounts (excluding value added tax) derived

from the provision of services to third party customers in the

course of the Group's ordinary activities.

As a result of providing these services, the Group may from time

to time receive commissions from other third parties. These

commissions are included within revenue on the same basis as that

arising from the contract with the underlying third party

customer.

The revenue and profits recognised in any period are based on

the satisfaction of performance obligations and an assessment of

when control is transferred to the customer.

For most contracts with customers, there is a single distinct

performance obligation and revenue is recognised when the event has

taken place or control of the content or video has been transferred

to the customer.

Where a contract contains more than one distinct performance

obligation (multiple film productions, or a project involving both

build construction and event production) revenue is recognised as

each performance obligation is satisfied.

The transaction price is substantially agreed at the outset of

the contract, along with a project brief and payment schedule (full

payment in arrears for smaller contracts; part payment(s) in

advance and final payment in arrears for significant

contracts).

Due to the detailed nature of project briefs agreed in advance

for significant contracts, management do not consider that

significant estimates or judgements are required to distinguish the

performance obligation(s) within a contract.

For contracts to prepare multiple film productions, the

transaction price is allocated to constituent performance

obligations using an output method in line with agreements with the

customer.

For other contracts with multiple performance obligations,

management's judgement is required to allocate the transaction

price for the contract to constituent performance obligations using

an input method using detailed budgets which are prepared at outset

and subsequently revised for actual costs incurred and any changes

to costs expected to be incurred.

The Group does not consider any disaggregation of revenue from

contracts with customers necessary to depict how the nature,

amount, timing and uncertainty of the Group's revenue and cash

flows are affected by economic factors.

Where payments made are greater than the revenue recognised at

the reporting date, the Group recognises deferred income (a

contract liability) for this difference. Where payments made are

less than the revenue recognised at the reporting date, the Group

recognises accrued income (a contract asset) for this

difference.

A receivable is recognised in relation to a contract for amounts

invoiced, as this is the point in time that the consideration is

unconditional because only the passage of time is required before

the payment is due.

At each reporting date, the Group assesses whether there is any

indication that accrued income assets may be impaired by assessing

whether it is possible that a revenue reversal will occur. Where an

indicator of impairment exists, the Group makes a formal estimate

of the asset's recoverable amount. Where the carrying value of an

assets exceeds its recoverable amount, the asset is considered

impaired and is written down to is recoverable amount.

Intangible assets - goodwill

All business combinations are accounted for by applying the

acquisition method. Goodwill acquired represents the excess of the

fair value of the consideration and associated costs over the fair

value of the identifiable net assets acquired.

After initial recognition, goodwill is measured at cost less any

accumulated impairment losses. At the date of acquisition, the

goodwill is allocated to cash generating units, usually at business

segment level or statutory company level as the case may be, for

the purpose of impairment testing and is tested at least annually

for impairment. On subsequent disposal or termination of a business

acquired, the profit or loss on termination is calculated after

charging the carrying value of any related goodwill.

Intangible assets - other

Intangible assets are stated in the financial statements at cost

less accumulated amortisation and any impairment value.

Amortisation is provided to write off the cost less estimated

residual value of intangible assets over its expected useful life

(which is reviewed at least at each financial year end), as

follows:

Intellectual property 25% straight line

Any gain or loss arising on the derecognition of the asset

(calculated as the difference between the net disposal proceeds and

the carrying amount of the asset) is included in the Statement of

Comprehensive Income in the year that the asset is

derecognised.

Fully amortised assets still in use are retained in the

financial statements.

Property, plant and equipment

Property, plant and equipment is stated in the financial

statements at cost less accumulated depreciation and any impairment

value. Depreciation is provided to write off the cost less

estimated residual value of property, plant and equipment over its

expected useful life (which is reviewed at least at each financial

year end), as follows:

Leasehold land and buildings Straight line over the life of the

lease (five years)

Fixtures, fittings and equipment Straight line over four years

-------------------------------------

Any gain or loss arising on the derecognition of the asset

(calculated as the difference between the net disposal proceeds and

the carrying amount of the asset) is included in the Statement of

Comprehensive Income in the year that the asset is

derecognised.

Fully depreciated assets still in use are retained in the

financial statements.

Impairment

The carrying amounts of the Group's assets are reviewed at each

period end to determine whether there is any indication of

impairment. If any such indication exists, the assets' recoverable

amount is estimated. For goodwill and intangible assets that have

an indefinite useful life and intangible assets that are not yet

available for use, the recoverable amount is estimated at each

annual period end date and whenever there is an indication of

impairment.

An impairment loss is recognised whenever the carrying amount of

an asset or its cash-generating unit exceeds its recoverable

amount. Impairment losses are recognised in the Statement of

Comprehensive Income in those expense categories consistent with

the function of the impaired asset.

Investments

Fixed asset investments are stated at cost less provision for

diminution in value.

Leases

In the current year, the Group, for the first time, has applied

IFRS 16 Leases. IFRS 16 introduces new or amended requirements with

respect to lease accounting. It introduces significant changes to

the lessee accounting by removing the distinction between operating

and finance leases and requiring the recognition of a right-of-use

asset and a lease liability at the lease commencement for all

leases, except for short-term leases and leases of low value

assets. The impact of the adoption of IFRS 16 on the Company's

financial statements is described below.

The date of initial application of IFRS 16 for the Company is 1

July 2019.

The Company has applied IFRS 16 using the full retrospective

approach, with restatement of the comparative information. The

application of IFRS 16 has resulted in the profit before taxation

for the year ended 30 June 2019 increasing by GBP7,234 to

GBP382,244 (previously GBP375,010). The application of IFRS 16 has

also resulted in the Group's net assets decreasing by GBP2,988 to

GBP1,914,384 (previously GBP1,917,372).

IFRS 16 changes how the Group accounts for leases previously

classified as operating leases under IAS 17, which were

off-balance-sheet.

Applying IFRS 16, for all leases (except as noted below), the

Group:

a) recognises right-of-use assets and lease liabilities in the

statement of financial position, initially measured at the present

value of future lease payments;

b) recognises depreciation of right-of-use assets and interest

on lease liabilities in the statement of profit or loss; and

c) separates the total amount of cash paid into a principal

portion (presented within financing activities) and interest

(presented within operating activities) in the statement of cash

flows.

Lease incentives (e.g. free rent period) are recognised as part

of the measurement of the right-of-use assets and lease liabilities

whereas under IAS 17 they resulted in the recognition of a lease

incentive liability, amortised as a reduction of rental expense on

a straight-line basis.

Under IFRS 16, right-of-use assets are tested for impairment in

accordance with IAS 36 Impairment of Assets. This replaces the

previous requirement to recognise a provision for onerous lease

contracts.

For short--term leases (lease term of 12 months or less) and

leases of low-value assets (such as photocopiers), the Group has

opted to recognise a lease expense on a straight-line basis as

permitted by IFRS 16. This expense is presented within

administrative expenses in the consolidated statement of

comprehensive income.

Trade and other receivables

Trade and other receivables are stated initially at fair value

and subsequently measured at amortised cost less any provision for

impairment.

Trade and other payables

Trade payables are recognised initially at fair value and

subsequently measured at amortised cost.

Cash and cash equivalents

Cash comprises, for the purpose of the Statement of Cash Flows,

cash in hand and deposits payable on demand. Cash equivalents are

short-term highly liquid investments that are readily convertible

to known amounts of cash and that are subject to an insignificant

risk of changes in value. Cash equivalents normally have a date of

maturity of 3 months or less from the acquisition date.

Bank loans and overdrafts comprise amounts due on demand.

Finance income

Finance income consists of interest receivable on funds

invested. It is recognised in the Statement of Comprehensive Income

as it accrues.

Taxation

Income tax on the profit or loss for the periods presented

comprises current and deferred tax. Current tax is the expected tax

payable on the taxable income for the year, using rates enacted or

substantively enacted at the end of the reporting period, and any

adjustment to tax payable in respect of previous years.

Deferred tax is provided on temporary differences between

carrying amounts of assets and liabilities for financial reporting

purposes and the amounts used for taxation purposes. The following

temporary differences are not provided for: the initial recognition

of goodwill; the initial recognition of assets or liabilities that

affect neither accounting nor taxable profit other than in a

business combination; the differences relating to investments in

subsidiaries to the extent that they will probably not reverse in

the foreseeable future. The amount of deferred tax provided is

based on the expected manner of realisation or settlement of the

carrying amount of assets and liabilities, using tax rates enacted

or substantively enacted at the end of the reporting period.

A deferred tax asset is recognised only to the extent that it is

probable that future taxable profits will be available against

which the assets can be utilised. Deferred tax assets and

liabilities are not discounted.

Pension costs

The Group operates a pension scheme for its employees. It also

makes contributions to the private pension arrangements of certain

employees. These arrangements are of the money purchase type and

the amount charged to the Statement of Comprehensive Income

represents the contributions payable by the Group for the

period.

Financial instruments

The Group does not enter into derivative transactions and does

not trade in financial instruments. Financial assets and

liabilities are recognised on the Statement of Financial Position

when the Group becomes a party to the contractual provision of the

instrument.

Equity

An equity instrument is a contract that evidences a residual

interest in the assets of an entity after deducting all of its

liabilities. Equity instruments are recorded at the proceeds

received, net of direct issue costs. The Group's equity instruments

comprise 'share capital' in the Statement of Financial

Position.

Foreign currency translation

Monetary assets and liabilities denominated in foreign

currencies are translated into sterling at the rates of exchange

ruling at the end of the reporting period. Transactions in foreign

currencies are recorded at the rate ruling at the date of the

transaction. All differences are taken to the Statement of

Comprehensive Income.

Share-based awards

The Group issues equity settled payments to certain employees.

Equity settled share based payments are measured at fair value

(excluding the effect of non-market based vesting conditions) at

the date of grant.

The fair value is estimated using option pricing models and is

dependent on factors such as the exercise price, expected

volatility, option price and risk free interest rate. The fair

value is then amortised through the Statement of Comprehensive

Income on a straight-line basis over the vesting period. Expected

volatility is determined based on the historical share price

volatility for the Company. Further information is given in note 23

to the financial statements.

Exceptional items

Exceptional items are one off, material items outside the normal

course of business which are not related to the Group's trading

activities.

Significant judgements and estimates

The preparation of the Group's financial statements in

conforming with IFRS required management to make judgements,

estimates and assumptions that effect the application of policies

and reported amounts in the financial statements. These judgements

and estimates are based on management's best knowledge of the

relevant facts and circumstances. Information about such judgements

and estimation is contained in the accounting policies and / or

notes to the financial statements. There are no critical judgements

that the directors have made in the process of applying the Group's

accounting policies.

2 Revenue and segment information

The Group uses several factors in identifying and analysing

reportable segments, including the basis of organisation, such as

differences in products and geographical areas. The Board of

directors, being the Chief Operating Decision Makers, have

determined that for the year ending 30 June 2020 there is only a

single reportable segment.

All revenue represents sales to external customers. Four

customers (2019: five) are defined as major customers by revenue,

contributing more than 10% of the Group revenue.

2020 2019

GBP GBP

---------- ----------

Customer One 1,336,172 -

Customer Two 841,905 905,578

Customer Three 701,353 -

Customer Four 585,636 951,189

Major customers in the current year 3,465,066 1,856,767

Major customers in prior year 2,916,027

----------

4,772,794

---------- ----------

The geographical analysis of revenue from continuing operations

by geographical location of customer is as follows:

Geographical

market 2020 2019 2020 2019 2020 2019 2020 2019

Rest Rest

of the of the

UK UK Europe Europe World World Total Total

GBP GBP GBP GBP GBP GBP GBP GBP

Revenue 5,255,473 6,693,163 71,424 61,764 148,528 10,353 5,475,425 6,765,280

2020 2019

GBP GBP

--------------------------------------- ------------

Revenue from contracts with customers 5,420,350 6,696,305

Other revenue 55,075 68,975

Total revenue 5,475,425 6,765,280

--------------------------------------- ------------

Contract assets and liabilities from contracts with customers

have been recognised as follows:

2020 2019

GBP GBP

--------

Deferred income 293,281 333,305

Accrued income 49,890 245,989

-------- --------

Deferred income at the beginning of the period has been

recognised as revenue during the period.

3 Other income

Other income 2020 2019

GBP GBP

-------------------------------------------- -----

Coronavirus job retention scheme government

grant 82,601 -

-------------------------------------------- -----

During the year the Group received government grants under the

UK government's coronavirus job retention scheme.

4 Operating profit

Operating profit is stated after charging

or crediting: 2020 2019

GBP GBP

-------------------------------------------------- ----------

Cost of sales

Depreciation of fixtures, fittings and equipment 31,871 21,525

Amortisation of intangible assets 417 -

Administrative expenses

Depreciation of right-of-use assets 89,392 80,915

(Profit) / loss on foreign exchange differences (726) 9,229

Fees payable to the Company's auditor in respect

of:

Audit of the Company's annual accounts 6,000 6,000

Audit of the Company's subsidiaries 19,000 17,000

Interest on lease liabilities 20,253 2,850

Staff costs (see note 22) 1,570,373 1,221,559

---------- ----------

5 Exceptional items

Items that are material either because of their size or their

nature, or that are non-recurring, are considered as exceptional.

During the year, the Group incurred expenditure totalling GBP23,184

(2019: GBPnil) related to the acquisition of Eventful Limited. This

cost has been included in the consolidated Statement of

Comprehensive Income as an operating exceptional cost.

6 Finance income

Finance income 2020 2019

GBP GBP

------------------------ -----

Bank interest received 556 611

------------------------ -----

7 Taxation

2020 2019

GBP GBP

---------------------------------------------------- --------

The tax charge comprises:

Current tax

Prior period adjustment - 2,288

Current year (5,357) 74,616

--------

(5,357) 76,904

Deferred tax (see note 8)

Current year (15,140) 9,783

--------

(15,140) 9,783

Total tax charge in the statement of comprehensive

income (20,497) 86,687

Factors affecting the tax charge for the

year

Profit / (loss) on ordinary activities before

taxation from continuing operations (217,924) 382,244

Profit / (loss) on ordinary activities before

taxation multiplied by standard rate

of UK corporation tax of 19% (2019: 19%) (41,406) 72,626

Effects of:

Non-deductible expenses 20,909 11,773

Prior period adjustment - 2,288

20,909 14,061

Total tax charge (20,497) 86,687

---------------------------------------------------- --------

The Group has estimated losses of GBP375,762 (2019: GBP375,762)

available to carry forward against future trading profits. These

losses are in Aeorema Communications plc which is not currently

making taxable profits as all trading is undertaken by its

subsidiaries Aeorema Limited and Eventful Limited, therefore no

deferred tax asset has been recognised in respect of this

amount.

8 Deferred taxation

2020 2019

GBP GBP

----------------------------------------------- --------

Property, plant and equipment temporary

differences (13,978) (8,555)

Temporary differences (8,664) 1,026

Tax losses 30,253 -

--------

7,611 (7,529)

At 1 July (7,529) 2,254

Transfer to Statement of Comprehensive Income 15,140 (9,783)

At 30 June 7,611 (7,529)

----------------------------------------------- --------

9 Profit attributable to members of the parent company

As permitted by section 408 of the Companies Act 2006, the

parent Company's Statement of Comprehensive Income has not been

included in these financial statements.

10 Earnings per ordinary share

Basic earnings per share are calculated by dividing the profit

or loss attributable to owners of the parent by the weighted

average number of ordinary shares outstanding during the year.

Diluted earnings per share are calculated by dividing the profit

or loss attributable to owners of the parent by the weighted

average number of ordinary shares outstanding during the year plus

the weighted average number of ordinary shares that would have been

issued on the conversion of all dilutive potential ordinary shares

into ordinary shares. In view of the group loss for the year,

options to subscribe for ordinary shares in the company are

anti-dilutive and therefore diluted earnings per share information

is not presented.

The following reflects the income and share data used and

dilutive earnings per share computations:

2020 2019

GBP GBP

----------- -----------

Basic earnings per share

(Loss) / profit for the year attributable

to owners of the Company (197,427) 295,557

Basic weighted average number of

shares 9,101,356 9,050,500

Dilutive potential ordinary shares:

Employee share options 1,020,000 1,020,000

Diluted weighted average number of

shares 10,121,356 10,070,500

----------- -----------

11 Intangible fixed assets

Intellectual

Group Goodwill Property Total

GBP GBP GBP

-------------------------------- -------------

Cost

At 30 June 2018 2,728,292 - 2,728,292

At 30 June 2019 2,728,292 - 2,728,292

Acquisitions 199,194 10,000 209,194

At 30 June 2020 2,927,486 10,000 2,937,486

Impairments and amortisation

At 30 June 2018 2,363,138 - 2,363,138

At 30 June 2019 2,363,138 - 2,363,138

Charge for the year - 417 417

At 30 June 2020 2,363,138 417 2,363,555

Net book value

At 30 June 2018 365,154 - 365,154

At 30 June 2019 365,154 - 365,154

At 30 June 2020 564,348 9,583 573,931

---------- ------------- ----------

Goodwill arose for the Group on consolidation of its

subsidiaries, Aeorema Limited and Eventful Limited.

During the year the Company acquired 100% shareholding in

Eventful Limited. The goodwill on acquisition is formed as

follows;

GBP

---------

Assets acquired 91,036

Cash 225,111

Liabilities (35,649)

Total acquired 280,498

Cash consideration 353,442

Share issue consideration 26,250

Contingent consideration 100,000

Total consideration 479,692

Goodwill 199,194

---------

The Company incurred costs associated with the acquisition of

Eventful Limited of GBP23,184. These costs included legal and

professional fees and stamp duty. These costs have been included in

the consolidated Statement of Comprehensive Income as an operating

exceptional cost (see note 5).

For the period post-acquisition Eventful Limited had revenue of

GBP53,517 and a profit before taxation of GBP11,223. For the year

ended 30 June 2020 Eventful Limited had revenue of GBP255,688 and a

profit before taxation of GBP64,686.

Impairment - Aeorema Limited and Eventful Limited

Goodwill has been tested for impairment based on its future

value in use resulting in the carrying value above. The future

value has been calculated on a discounted cash flow basis using the

2020-21 budgeted figures as approved by the Board of directors,

extended in perpetuity to calculate the terminal value and

discounted at a rate of 10%. It is assumed that revenue will return

to pre-COVID-19 levels for the year ended 30 June 2022 and future

growth will be 2% for venue sourcing activities and 5% for event

and moving image production activities. Using these assumptions,

which are based on past experience and future expectations, there

was no impairment in the year.

12 Property, plant and equipment

Leasehold

Group land Fixtures, fittings Total

and buildings and equipment

GBP GBP GBP

--------------------------- -------------------

Cost

At 30 June 2018 58,536 119,030 177,566

Additions - 48,731 48,731

Disposals - (29,112) (29,112)

At 30 June 2019 58,536 138,649 197,185

Additions - 59,591 59,591

Acquisition of subsidiary - 1,809 1,809

Disposals - (26,867) (26,867)

At 30 June 2020 58,536 173,182 231,718

Depreciation

At 30 June 2018 58,536 81,986 140,522

Charge for the year - 21,525 21,525

Eliminated on disposal - (22,933) (22,933)

At 30 June 2019 58,536 80,578 139,114

Charge for the year - 31,871 31,871

Eliminated on disposal - (25,219) (25,219)

At 30 June 2020 58,536 87,230 145,766

Net book value

At 30 June 2018 - 37,044 37,044

At 30 June 2019 - 58,071 58,071

At 30 June 2020 - 85,952 85,952

-------------- ------------------- ---------

13 Right-of-use assets

Group Leasehold

GBP

----------

Cost

At 30 June 2018 404,574

At 30 June 2019 404,574

Additions 455,436

Disposals (404,574)

At 30 June 2020 455,436

Depreciation

At 30 June 2018 310,173

Charge for the year 80,915

At 30 June 2019 391,088

Charge for the year 89,392

Eliminated on disposal (404,574)

At 30 June 2020 75,906

Net book value

At 30 June 2018 94,401

At 30 June 2019 13,486

At 30 June 2020 379,530

----------

14 Non-current assets - Investments

Company Shares in subsidiary

GBP

---------------------

Cost

At 30 June 2018 3,274,703

Increase in respect of share-based

payments 34,261

At 30 June 2019 3,308,964

Increase in respect of share-based

payments 47,097

Acquisition of subsidiary 479,692

At 30 June 2020 3,835,753

Provision

At 30 June 2018 2,694,213

At 30 June 2019 2,694,213

At 30 June 2020 2,694,213

Net book value

At 30 June 2018 580,490

At 30 June 2019 614,751

At 30 June 2020 1,141,540

---------------------

Holdings of more than 20%

The Company holds more than 20% of the share capital of the

following companies:

Shares

Subsidiary undertakings Country of held

registration

---------- ----

or incorporation Class %

------------------ ---------- ----

England and

Aeorema Limited Wales Ordinary 100

England and

Eventful Limited Wales Ordinary 100

England and

Twentyfirst Limited (Dormant) Wales Ordinary 100

------------------ ---------- ----

The registered address of Aeorema Limited, Eventful Limited and

Twentyfirst Limited is 64 New Cavendish Street, London, W1G

8TB.

15 Trade and other receivables

Group Company

2020 2019 2020 2019

GBP GBP GBP GBP

---------- --------

Trade receivables 306,198 1,156,689 - -

Related party receivables - - 641,134 960,063

Other receivables 76,112 38,280 5,002 4,910

Prepayments and accrued income 215,187 417,376 11,850 12,454

597,497 1,612,345 657,986 977,427

-------- ---------- --------

All trade and other receivables are expected to be recovered

within 12 months of the end of the reporting period. The fair value

of trade and other receivables is the same as the carrying values

shown above.

At the year end, trade receivables of GBP157,239 (2019:

GBP32,616) were past due but not impaired. These amounts are still

considered recoverable. The ageing of these trade receivables is as

follows:

Group

2020 2019

GBP GBP

-------

Less than 90 days overdue 33,712 9,339

More than 90 days overdue 123,527 23,277

157,239 32,616

-------- -------

16 Cash at bank and in hand

Group Company

2020 2019 2020 2019

GBP GBP GBP GBP

---------- ------

Bank balances 1,721,217 2,211,161 11,298 3,606

1,721,217 2,211,161 11,298 3,606

---------- ---------- ------

17 Trade and other payables

Group Company

2020 2019 2020 2019

GBP GBP GBP GBP

------------------------------ ---------- -------

Trade payables 209,770 1,258,646 6,001 7,043

Related party payables - - 67,355 67,355

Taxes and social security

costs 381,777 388,869 - -

Other payables 113,582 59,677 100,000 -

Accruals and deferred income 481,541 515,835 17,780 13,999

1,186,670 2,223,027 191,136 88,397

------------------------------ ---------- -------

All trade and other payables are expected to be settled within

12 months of the end of the reporting period. The fair value of

trade and other payables is the same as the carrying values shown

above.

18 Leases

The balance sheet shows the following amounts relating to

leases:

Group 2020 2019

GBP GBP

---------

Right-of-use assets

Buildings 379,530 13,486

379,530 13,486

---------- ---------

Group 2020 2019

GBP GBP

-------

Lease liabilities

Current 85,070 16,475

Non-current 300,689 -

385,759 16,475

-------- -------

19 Provisions

Leasehold Total

Group dilapidations

GBP GBP

---------------------------------------------- --------

At 1 July 2019 24,186 24,186

Charged to statement of comprehensive income 834 834

At 30 June 2020 25,020 25,020

---------------- --------

Leasehold Total

Group dilapidations

GBP GBP

------------- --------

Current - -

Non-current 25,020 25,020

25,020 25,020

---------------- --------

Leasehold dilapidations relate to the estimated cost of

returning a leasehold property to its original state at the end of

the lease in accordance with the lease terms. The main uncertainty

relates to estimating the cost that will be incurred at the end of

the lease.

20 Share capital

2020 2019

GBP GBP

------------------------------- ----------------

Authorised

28,000,000 Ordinary shares

of 12.5p each 3,500,000 3,500,000

Allotted, called up and fully

paid Number Ordinary shares

GBP

------------------------------- ----------------

At 1 July 2018 9,050,500 1,131,313

At 30 June 2019 9,050,500 1,131,313

At 30 June 2020 9,238,000 1,154,750

------------------------------- ----------------

During the year 187,500 shares were issued as part of the

overall consideration for the acquisition of Eventful Limited.

Holders of these shares are entitled to dividends as declared

from time to time and are entitled to one vote per share at general

meetings of the company.

See note 23 for details of share options outstanding.

21 Directors' emoluments

Salary, Salary,

fees, bonuses fees, bonuses

and benefits and benefits

in kind in kind Pensions Pensions Total Total

2020 2019 2020 2019 2020 2019

GBP GBP GBP GBP GBP GBP

--------------- --------------- --------- --------- -------- --------

M Hale 13,333 20,000 - - 13,333 20,000

S Haffner 14,250 15,000 - - 14,250 15,000

R Owen 19,333 20,000 - - 19,333 20,000

S Quah 146,050 122,004 6,469 925 152,519 122,929

A Harvey 112,643 91,352 5,219 1,533 117,862 92,885

305,609 268,356 11,688 2,458 317,297 270,814

--------------- --------------- --------- --------- -------- --------

The remuneration of directors of the Company is set out

below.

The share options held by directors who served during the year

are summarised below:

Exercise Earliest exercise

Name Grant date Number awarded price date Expiry date

25 April 24 April

S Quah 2013 300,000 16.50p 25 April 2016 2023

22 August 17 November 22 August

S Quah 2018 300,000 29.00p 2020 2028

22 August 17 November 22 August

A Harvey 2018 300,000 29.00p 2020 2028

------------ --------------- --------- ------------------ ------------

Fees for S Haffner are charged by Harris & Trotter LLP, a

firm in which he is a member (see note 24).

22 Employee information

The average monthly number of employees (including directors)

employed by the Group during the year was:

Number of employees Group Company

2020 Number 2019 Number 2020 Number 2019 Number

Administration and production 28 21 5 5

------------ ------------ ------------

The aggregate payroll costs of these employees charged in the

Statement of Comprehensive Income was as follows:

Employment costs Group Company

2020 2019 2020 2019

GBP GBP GBP GBP

---------- -------

Wages and salaries 1,333,194 1,068,710 46,917 55,000

Social security costs 159,082 105,471 - -

Pension costs 31,000 13,117 - -

Share-based payments 47,097 34,261 - -

1,570,373 1,221,559 46,917 55,000

---------- ---------- -------

23 Share-based payments

The Group operates an EMI share option scheme for key employees.

Options are granted to key employees at an exercise price equal to

the market price of the Company's shares at the date of grant.

Options are exercisable from the third anniversary of the date of

grant and lapse if they remain unexercised at the tenth anniversary

or upon cessation of employment. The following option arrangements

exist over the Company's shares:

Date of Exercise Number of Number of

grant price Exercise period options 2020 options 2019

From To

--------- ------------- ------------- -------------- --------------

25 April 25 April 24 April

2013 16.5p 2016 2023 300,000 300,000

22 August 17 November 22 August

2018 29.0p 2020 2028 600,000 600,000

14 June

2019 26.0p 14 June 2022 14 June 2029 120,000 120,000

1,020,000 1,020,000

--------- ------------- ------------- -------------- --------------

Details of the number of share options and the weighted average

exercise price outstanding during the year are as follows:

Weighted Weighted

Number of average exercise Number of average exercise

options price options price

2020 2020 2019 2019

GBP GBP

---------- ------------------ ---------- ------------------

Outstanding at beginning

of the year 1,200,000 0.25 300,000 0.17

Granted during the

year - - 720,000 0.29

Outstanding at end

of the year 1,020,000 0.25 1,020,000 0.25

---------- ------------------ ---------- ------------------

Exercisable at the

end of the year 300,000 0.17 300,000 0.17

---------- ------------------ ---------- ------------------

The exercise price of options outstanding at the year-end was

GBP0.250 (2019: GBP0.250) and their weighted average contractual

life was 6.6 years (2019: 7.6 years).

Equity-settled share-based payments are measured at fair value

at the date of grant. The fair value as determined at the grant

date of equity-settled share-based payments is expensed on a

straight line basis over the vesting period, based on the Group's

estimate of shares that will eventually vest. The estimated fair

value of the options is measured using an option pricing model. The

inputs into the model are as follows:

Grant date 25 April 2013

Model used Black-Scholes

Share price at grant date 16.5p

Exercise price 16.5p

Contractual life 10 years

Risk free rate 0.5%

Expected volatility 104%

Expected dividend rate 0%

Fair value option 14.889p

--------------

22 August

Grant date 2018

Model used Black-Scholes

Share price at grant date 29.0p

Exercise price 29.0p

Contractual life 10 years

Risk free rate 0.75%

Expected volatility 40.33%

Expected dividend rate 0%

Fair value option 14.800p

--------------

Grant date 14 June 2019

Model used Black-Scholes

Share price at grant date 26.0p

Exercise price 26.0p

Contractual life 10 years

Risk free rate 0.75%

Expected volatility 40.33%

Expected dividend rate 0%

Fair value option 12.894p

--------------

The expected volatility is determined by calculating the

historical volatility of the Company's share price over the last

three years. The risk free rate is the official Bank of England

base rate.

The Group recognised the following charges in the Statement of

Comprehensive Income in respect of its share-based payment

plans:

2020 2019

GBP GBP

---------------------------- -------

Share-based payment charge 47,097 34,261

---------------------------- -------

24 Related party transactions

The Group has a related party relationship with its subsidiaries

and its key management personnel (including directors). Details of

transactions between the Company and its subsidiaries are as

follows:

2020 2019

GBP GBP

----------------------------------- --------

Amounts owed by subsidiaries

Total amount owed by subsidiaries 641,134 960,063

Amounts owed to subsidiaries

Total amount owed to subsidiaries 67,355 67,355

-------- --------

The company received dividends during the year of GBP300,000

(2019: GBP200,000) from its subsidiary, Aeorema Limited. The

company transferred a VAT receivable of GBP22,977 (2019: GBP22,810)

to Aeorema Limited due to being part of a common VAT group.

Aeorema Limited transferred a net amount of expenses to Aeorema

Communications plc during the year of GBP27,667 (2019:

GBP40,000).

Aeorema Limited paid expenses totalling GBP503,734 (2019:

GBP121,718) on behalf of Aeorema Communications plc during the

year.

During the year, Aeorema Limited made a net transfer of cash of

GBP110,505 to Aeorema Communications plc (2019: GBP82,879).

The compensation of key management (including directors) of the

Group is as follows:

2020 2019

GBP GBP

------------------------------ --------

Short-term employee benefits 338,293 294,997

Post-employment benefits 11,689 2,458

349,982 297,455

-------- --------

The share options held by directors of the Company are disclosed

in note 21. During the year, a charge of GBP41,556 (2019:

GBP33,761) was recognised in the Consolidated Statement of

Comprehensive Income in respect of these share options.

Harris and Trotter LLP is a firm in which S Haffner is a member.

The amounts charged to the Group for professional services is as

follows:

Harris and Trotter LLP - charged during

the year 2020 2019

GBP GBP

Aeorema Communications plc 14,250 15,000

Aeorema Limited 14,700 11,850

28,950 26,850

------------------------------------------ -------

At the year end, the Group had an outstanding trade payable

balance to Harris and Trotter LLP of GBP5,640 (2019: GBP4,500).

25 Cash flows

Group

2020 2019

GBP GBP

------------ ----------

Cash flows from operating activities

Profit / (loss) before taxation (217,924) 382,244

Depreciation of property, plant and equipment 31,871 21,525

Depreciation of right-of-use assets 89,392 80,915

Amortisation of intangible fixed assets 417 -

Dividends received by the Company - -

Loss on disposal of fixed assets 1,648 6,179

Share-based payment expense 47,097 34,261

Finance income (556) (611)

Interest on lease liabilities 20,253 2,851

(27,802) 527,364

Increase / (decrease) in trade and other

payables (1,075,254) 972,235

(Increase) / decrease in trade and other

receivables 1,014,847 (506,053)

Taxation paid (10,797) (11,700)

Cash generated / (used) from operating

activities (99,006) 981,846

----------------------------------------------- ----------

26 Financial instruments

Financial instruments recognised in the consolidated statement

of financial position

All financial instruments are recognised initially at their fair

value and subsequently measured at amortised cost.

Group Company

2020 2019 2020 2019

GBP GBP GBP GBP

---------- ---------- ----------

Financial Assets

Trade and other receivables 432,202 1,487,328 641,134 960,063

Cash and cash equivalents 1,721,217 2,211,161 11,298 3,606

Investments in subsidiaries - - 1,141,540 614,751

Total 2,153,419 3,698,489 1,793,972 1,578,420

Financial Liabilities

Trade and other payables 734,131 1,318,322 173,356 74,398

Accruals 188,260 206,716 17,780 13,999

Total 922,391 1,525,038 191,136 88,397

---------- ---------- ---------- ----------

The Group is exposed to risks that arise from its use of

financial instruments. There have been no significant changes in

the Group's exposure to financial instrument risk, its objectives,

policies and processes for managing those from previous periods.

The principal financial instruments used by the Group, from which

financial instrument risk arises, are trade receivables, cash and

cash equivalents and trade and other payables.

Credit risk

Credit risk arises principally from the Group's trade

receivables. It is the risk that the counterparty fails to

discharge its obligation in respect of the instrument. The maximum

exposure to credit risk at 30 June 2020 was GBP306,198 (2019:

GBP1,156,689). Trade receivables are managed by policies concerning

the credit offered to customers and the regular monitoring of

amounts outstanding for both time and credit limits. At the year

end, the credit quality of trade receivables is considered to be

satisfactory.

Liquidity risk

Liquidity risk arises from the Group's management of working

capital. It is the risk that the Group will encounter difficulty in

meeting its financial obligations as they fall due. The Group's

policy is to meet its liabilities when they fall due. The Group

monitors cash flow on a regular basis. At the year end, the Group

has sufficient liquid resources to meets its obligations of

GBP1,367,633 (2019: GBP1,960,169).

Market risk

Market risk arises from the Group's use of interest bearing

financial instruments. It is the risk that the fair value of future

cash flows of a financial instrument will fluctuate. At the year

end, the cash and cash equivalents of the Group net of bank

overdrafts was GBP1,721,217 (2019: GBP2,211,161). The Group ensures

that its cash deposits earn interest at a reasonable rate.

Capital risk

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern while maximising

the return to stakeholders. The capital structure of the Group

consists of equity attributable to equity holders of the parent,

comprising issued share capital, reserves and retained earnings as

disclosed in the Consolidated Statement of Changes in Equity. At

the year end, total equity was GBP1,699,799 (2019:

GBP1,914,384).

27 Pension costs defined contribution

The Group makes pre-defined contributions to employees' personal

pension plans. Contributions payable by the Group for the year were

GBP31,000 (2019: GBP13,117). At the end of the reporting period

GBP5,608 (2019: GBP1,605) of contributions were due in respect of

the period.

28 Dividends

On the 12 December 2019 a final dividend of 1 pence per share

(total dividend GBP90,505) was paid to holders of fully paid

ordinary shares.

In respect of the current year, and as a consequence of the

ongoing COVID-19 pandemic, the Board have decided that no final

dividend will be paid to shareholders.

29 Contingent liability

Company

The Company is a member of a group VAT registration with all

other companies in the Aeorema Communications group and, under the

terms of the registration, is jointly and severally liable for the

VAT payable by all members of the group. At 30 June 2020 the

Company had no potential liability under the terms of the

registration.

30 Post balance sheet events

On 1 July 2020 Cheerful Twentyfirst, Inc., a wholly owned

subsidiary of Aeorema Communications plc, was incorporated in the

United States of America.

31 Control

There is no overall controlling party.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MRBITMTMBBBM

(END) Dow Jones Newswires

October 19, 2020 02:00 ET (06:00 GMT)

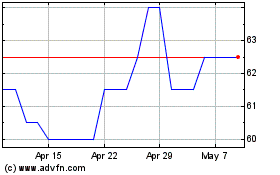

Aeorema Communications (LSE:AEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aeorema Communications (LSE:AEO)

Historical Stock Chart

From Apr 2023 to Apr 2024