TIDMANIC

RNS Number : 8200X

Agronomics Limited

06 May 2021

6 May 2021

Agronomics Limited

("Agronomics" or the "Company")

New Consultancy Agreement and Related Party Transaction

Agronomics, a leading listed company in alternative proteins

with a focus on cellular agriculture and cultivated meat, announces

that it has agreed revised terms of its consultancy agreement with

Shellbay Limited ("Shellbay"), principally concerning the fee

arrangements in connection with the provision of consultancy

services to the Company by Shellbay.

Background to and reasons for the changes to the agreement

The Company has since 2011 had a consulting agreement with

Shellbay which is owned by Mr Jim Mellon, Director and 22.75%

shareholder in the Company, as reported annually in the Company's

Report and Accounts. In December 2019, following shareholder

feedback and in consultation with the Company's advisers, the terms

of this agreement were altered for the subsequent 12 months on the

basis that from January 2021 new arrangements would be put in place

to (i) ensure the terms of Shellbay's appointment were consistent

with market standard terms for commensurate services; (ii) provide

greater transparency and corporate governance regarding the role of

Shellbay; and (iii) establish a remuneration structure fully

aligned with shareholders, and acceptable to existing and future

investors.

The independent Directors of the Company, being Mr Richard Reed

and Mr David Giampaolo ("Independent Directors"), in consultation

with the Company's Nominated Adviser, have now agreed terms of a

new consulting agreement with Shellbay (the "New Shellbay

Agreement"), effective from 1 July 2020 (the "Effective Date"),

details of which are set out below.

Summary of the principal terms of the New Shellbay Agreement

Services to be provided

Under the terms of the New Shellbay Agreement Shellbay will

provide certain consulting services including:

-- Reviewing prospective asset purchases;

-- Procuring and coordinating due diligence in relation to any

target approved by the Company;

-- Providing appropriate information to the Board in relation to

any proposed acquisition or disposal opportunity;

-- Providing transaction support services as requested by the Company;

-- Assisting in operating, developing and commercialising any

intellectual property and/or assets of the Company (including by

way of joint venture, licensing agreement or other

partnership);

-- Developing new markets and/or territories for assets and/or

intellectual property owned by the Company (including by way of

manufacturing, distribution and/or branding partnerships);

-- Supplying the Board with regular reports on the progress of

companies and intellectual property where the Company has an

interest (including any financings); and

-- Assisting with recruitment of management teams and

operational supply chain partners for relevant products and

intellectual property.

Annual Fees and Expenses

Shellbay shall not be paid an annual consultancy fee (whether

fixed or relating to the net asset value of the Company's assets)

but the Company shall reimburse it for all reasonable and properly

documented direct expenses incurred in performing the services

(including the direct costs of remunerating employees and/or

consultants), save that aggregate monthly expenses shall not exceed

GBP20,000 other than with the consent of the Company.

Fee

Shellbay shall be entitled to an annual fee equal to the value

of 15% of any increase between the Company's net asset value

("NAV") on a per issued share basis at the start of a reporting

period and 30 June ("Closing NAV Date") each year during the term

of the New Shellbay Agreement, with the first reporting period

being from 1 July 2020 to 30 June 2021, and annually thereafter.

The opening and closing NAV for each period will be based on the

audited financial statements of the Company for the relevant

financial year, with the opening NAV for each reporting period

being the higher of (i) 5.86 pence per share (the highest annual

audited NAV per share since the Company adopted its current

investment policy and reported NAV per share in September 2019)),

and (ii) the highest NAV per share reported at a Closing Date for

the previous reporting periods during the term of the agreement

(establishing a rolling high-watermark for Shellbay to qualify for

such fee). Any increase in NAV per share will then be applied to

the issued share capital at the end of the relevant period for the

purposes of determining the 15% fee. Any change in NAV per share

that arises from funds raised at a premium or discount to the

existing NAV per share will therefore be considered for the

purposes of calculating Shellbay's fee by reference to the annual

audited accounts (for clarity being an increase in respect of a

premium and a decrease in respect of a discount).

The Independent Directors believe these are more appropriate

incentivisation criteria than under the current agreement, under

which the high water mark was reset at the price of each equity

raise and have also noted that Shellbay has not historically

charged any commission or fees in relation to its own fundraising

efforts for the Company.

At the election of the Company, the performance fee shall be

payable either in whole or in part by the issue of new shares at a

price equal to the mid-price on the last day of the relevant

Performance Period or grant of nil price warrants over shares; or

in cash; or (with the agreement of Shellbay), in cash-equivalents

(such as shares), and other assets held by the Company.

Shellbay has agreed with the Company that any fee due for the

first reporting period will be taken in shares to the equivalent

value of the fee (with shares issued at the mid-market price of

Ordinary Shares at close of markets on the last day of the

performance period, being 30 June 2021).

Other fees and expenses

The Company shall also pay to the Shellbay any additional fees

as mutually agreed in connection with any proposed fundraising or

strategic acquisition or disposal of an asset or any subsequent

offer of shares.

Term

Save in limited circumstances where the appointment of Shellbay

can be terminated for cause, or where Mr Mellon ceases to be a

Director of the Company and hold greater than 10% of issued shares,

the agreement can be terminated by either party on 12 months'

notice after an initial 5 year period (the "Initial Period"). Where

the New Shellbay Agreement is terminated prior to expiry of the

Initial Period, other than for cause or with the agreement of

Shellbay, Shellbay shall receive fees for the duration of the

Initial Term in relation to assets held by the Company at such date

(reflecting the fact that NAV increases may be recorded in relation

to assets acquired during the terms of Shellbay's appointment after

the termination date).

Related Party Transaction

Mr Jim Mellon and Mr Denham Eke are Directors of the Company and

Mr Mellon is currently interested in 22.75 per cent. of the

Company's ordinary shares (held by Galloway Limited ("Galloway"),

which is indirectly wholly owned by Mr Jim Mellon, and of which Mr

Denham Eke is a director). In addition, Galloway is the owner of

100% of the issued shares of Shellbay, and Mr Eke is its sole

director.

Due to Mr Jim Mellon's and Mr Denham Eke's interests in the

transaction, entering into the New Shellbay Agreement constitutes a

related party transaction under the AIM Rules.

Accordingly, Mr Richard Reed and Mr David Giampaolo, being the

Directors who are independent of the transaction, consider having

consulted the Company's Nominated Adviser, that the terms of the

transaction are fair and reasonable insofar as the Company's

Shareholders are concerned.

Separately, it is also noted that the Board is actively seeking

the appointment of an additional independent non-executive

Director.

About Agronomics

Agronomics is a leading listed alternative proteins company with

a focus on cellular agriculture and cultivated meat. The Company

has established a portfolio of 16 companies at the Seed to Series B

stage in this rapidly advancing sector. It seeks to secure a 5-10%

initial ownership in technologies with defensible intellectual

property that offer new ways of producing food and materials with a

focus on products historically derived from animals. These

technologies are driving a major disruption in agriculture,

offering solutions to improve sustainability, as well as addressing

human health, animal welfare and environmental damage. This

disruption will decouple supply chains from the environment and

animals, as well as being fundamental to feeding the world's

expanding population. A full list of Agronomics' portfolio

companies is available at https://agronomics.im/ .

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014 which is part of UK law by

virtue of the European Union (Withdrawal) Act 2018.

For further information please contact:

Agronomics Beaumont Cenkos Peterhouse TB Cardew

Limited Cornish Limited Securities Capital

Plc Limited

The Company Nomad Joint Broker Joint Broker Public Relations

------------------ --------------- --------------------- ------------------------

Richard Reed Roland Cornish Giles Balleny Lucy Williams Ed Orlebar

Denham Eke James Biddle Max Gould Charles Goodfellow Joe McGregor

------------------ --------------- --------------------- ------------------------

+44 (0) 20 7930

0777

+44 (0) 1624 +44 (0) 7738

639396 +44 (0) 207 +44 (0) 207 +44 (0) 207 724 630

info@agronomics.im 628 3396 397 8900 469 0936 agronomics@tbcardew.com

------------------ --------------- --------------------- ------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRGZGGKFVFGMZM

(END) Dow Jones Newswires

May 06, 2021 09:30 ET (13:30 GMT)

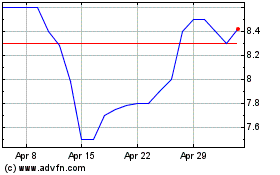

Agronomics (LSE:ANIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agronomics (LSE:ANIC)

Historical Stock Chart

From Apr 2023 to Apr 2024