TIDMARS

RNS Number : 8201N

Asiamet Resources Limited

27 September 2023

27 September 2023

2023 Interim Report & Financial Statements

Asiamet Resources Limited ("Asiamet" or the "Company") is

pleased to present its unaudited financial statements for the six

months ended 30 June 2023 ("Financial Statements") as extracted

from the Company's 2023 Half Year Report which is now available on

the Company website at www.asiametresources.com and will be

provided to shareholders who have requested a printed or electronic

copy.

The Financial Statements are set out below and should be read in

conjunction with the 2023 Half Year Report which contains the notes

to the Financial Statements.

All dollars in the report are US$ unless otherwise stated.

Interim Highlights Include:

-- Update to the Beruang Kanan Main ("BKM") Copper Project [Ore] Reserve statement (JORC 2012):

o 19.0Mt @ 0.7% Cu for 137kt of contained copper in the Proved

Reserve category

o 21.8Mt @ 0.6% Cu for 135kt of contained copper in the Probable

Reserve category

o 40.8Mt @ 0.7% Cu for 272kt of contained copper in the Proven

and Probable Ore Reserves category

o Low strip ratio of 1.2:1

o Ore Reserves are reported based on extraction by open-pit

mining and processing by heap-leach and solvent extraction /

electro-winning ("SX-EW")

-- Update to the BKM Feasibility Study:

o Initial 9.2 year mine life producing up to 20ktpa of copper

cathode per annum

o Life of Mine ("LOM") Revenue of $1.4 billion and EBITDA of

$655.3 million

o Capital cost of $208.7 million (excluding growth and

contingency of $26.7 million)

o Post Tax NPV8 $162.8 million, IRR 21.0% (post tax, excluding

closure costs)

o Payback Period 3.4 years

o C1 cash costs of $1.91/lb and AISC of $2.25/lb

o Base case uses consensus long-term copper price of

$3.98/lb

Post-Period End Highlights

-- Non-Executive Director Changes

o Appointment of Mr Matthew Doube and Non-Executive Director

o Retirement of Non-Executive Director, Mr Faldi Ismail

-- Project Financing

o Site visits completed as part of senior debt finance due

diligence process by proposed lead bank and Independent Technical

Expert (ITE) retained as part of bank due diligence process

o Several leading international metals trading groups are

undertaking detailed due diligence for financing tied to copper

cathode offtake

o Growing interest from Chinese Engineering, Procurement and

Construction ("EPC") contractor.

ON BEHALF OF THE BOARD OF DIRECTORS

Darryn McClelland, Chief Executive Officer

-Ends-

For further information, please contact:

Darryn McClelland

Chief Executive Officer, Asiamet Resources Limited

Email: darryn.mcclelland@asiametresources.com

Tony Manini

Executive Chairman, Asiamet Resources Limited

Email: tony.manini@ asiametresources .com

FlowComms Limited

Sasha Sethi

Telephone: +44 (0) 7891 677 441

Email: Sasha@flowcomms.com

Nominated & Financial Adviser

Strand Hanson Limited

James Spinney / James Dance / Rob Patrick

Telephone: +44 20 7409 3494

Email: asiamet@strandhanson.co.uk

Optiva Securities Limited

Christian Dennis

Telephone: +44 20 3137 1903

Email: Christian.Dennis@optivasecurities.com

Interim condensed consolidated statement of financial

position

As at 30 June 2023

30-Jun 31-Dec

2023 2022

Unaudited Audited

$'000 $'000

------------------------------ ---------- ----------

Assets

Current assets

Cash 2,259 5,185

Receivables and other assets 60 77

2,319 5,262

Non-current assets

Plant and equipment 34 36

Right-of-use asset 8 16

Receivables and other assets 65 67

107 119

---------- ----------

Total assets 2,426 5,381

------------------------------- ---------- ----------

Liabilities and Equity

Current liabilities

Trade and other payables 343 657

Provisions 294 288

Lease liabilities - 59

---------- ----------

637 1,004

Non-current liabilities

Provisions 551 550

----------

1,188 1,554

---------- ----------

Equity

Share capital 21,831 21,831

Equity reserves 67,303 66,921

Other comprehensive income 72 71

Accumulated deficit (84,715) (81,743)

Other reserves (3,246) (3,246)

Parent entity interest 1,245 3,834

Non-controlling interest (7) (7)

1,238 3,827

Total liabilities and equity 2,426 5,381

------------------------------- ---------- ----------

Note all references to $ are US dollars

Interim condensed consolidated statement of comprehensive loss

(unaudited)

For the six months ended 30 June

2023 2022

$'000 $'000

=========================================================== ======================= ========================

Expenses

Exploration and evaluation (951) (2,236)

Employee benefits (1,282) (1,073)

Consultants (55) (185)

Legal and Company Secretarial (60) (64)

Accounting and audit (2) (4)

General and administrative (134) (153)

Depreciation (16) (20)

Share-based compensation (382) (104)

(2,882) (3,839)

----------------------- ------------------------

Other Items

Foreign exchange losses (8) (54)

Finance costs - (5)

Impairment expense (82) (146)

Other income - 1

(90) (204)

----------------------- ------------------------

Net loss for the half year (2,972) (4,043)

----------------------- ------------------------

Items that may not be reclassified subsequently

to profit or loss:

Actuarial gain on employee service entitlements 1 -

----------------------- ------------------------

Total comprehensive loss for the half year (2,971) (4,043)

------------------------------------------------------------ ----------------------- ------------------------

Net loss attributable to:

Equity holders of the parent (2,945) (3,937)

Non-controlling interests (27) (106)

Total comprehensive loss attributable to:

Equity holders of the parent (2,945) (3,937)

Non-controlling interests (27) (106)

Basic and diluted loss per common share (cents per share) (0.15) (0.21)

Weighted average number of shares outstanding (thousands) 1,942,542 1,942,542

------------------------------------------------------------- ----------------------- ------------------------

Interim condensed consolidated statement of cash flows

(unaudited)

For the six months ended 30 June

2023 2022

$'000 $'000

---------------------------------------------------- --------- ---------

Operating activities

Loss for the half year (2,971) (4,043)

Adjustment for:

Depreciation 16 20

Share-based compensation 382 104

Net foreign exchange gain (3) (4)

Impairment expense 82 146

Finance cost 1 5

Movements in provisions 7 (80)

Changes in working capital:

Receivables and other assets (63) (145)

Trade and other payables (314) 180

Other adjustments:

Interest payments (1) (5)

Net cash flows used in operating activities (2,864) (3,822)

--------- ---------

Investing activities

Purchase of property, plant and equipment (6) (6)

Net cash flows used in investing activities (6) (6)

--------- ---------

Financing activities

Payment of principal portion of lease liabilities (58) (50)

Net cash flows from (used in) financing activities (58) (50)

--------- ---------

Net decrease in cash (2,928) (3,878)

Net foreign exchange differences 2 -

--------- ---------

Cash at beginning of the period 5,185 9,060

--------- ---------

Cash at 30 June 2,259 5,182

----------------------------------------------------- --------- ---------

Interim consolidated statement of changes in equity

(unaudited)

For the six months ended 30 June 2023

Total equity

Other attributable Non-

Share Equity comprehensive Accumulated Other to the controlling

capital reserves income deficit reserves parent interests Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

=============== ======== ========= ============== ============ ========= ============= ============ =========

Balance at 1

January 2023 21,831 66,921 71 (81,743) (3,246) 3,834 (7) 3,827

Loss for the

half year - - - (2,945) - (2,945) (27) (2,972)

Other

comprehensive

income 1 - - 1 - 1

-------- --------- -------------- ------------ --------- ------------- ------------ ---------

Total

comprehensive

income - - 1 (2,944) - (2,944) (27) (2,971)

Transactions

with owners in

their capacity

as owners

Contribution

by parent in

NCI - - - (27) - (27) 27 -

Share based

compensation - 382 - - - 382 - 382

Balance at 30

June 2023 21,831 67,303 72 (84,715) (3,246) 1,245 (7) 1,238

---------------- -------- --------- -------------- ------------ --------- ------------- ------------ ---------

Interim consolidated statement of changes in equity

(unaudited)

For the six months ended 30 June 2022

Total equity

Other attributable Non-

Share Equity comprehensive Accumulated Other to the controlling

capital reserves income deficit reserves parent interests Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

=============== ======== ========= ============== ============ ========= ============= ============ =========

Balance at 1

January 2022 19,393 65,975 49 (74,708) (3,246) 7,463 (7) 7,456

Loss for the

half year - - - (3,937) - (3,937) (106) (4,043)

-------- --------- -------------- ------------ --------- ------------- ------------ ---------

Total

comprehensive

loss - - - (3,937) - (3,937) (106) (4,043)

Transactions

with owners in

their capacity

as owners

Contribution

by parent in

NCI - - - (106) - (106) 106 -

Balance at 30

June 2022 19,393 65,975 49 (78,752) (3,246) 3,419 (7) 3,412

---------------- -------- --------- -------------- ------------ --------- ------------- ------------ ---------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZGZLVNLGFZG

(END) Dow Jones Newswires

September 27, 2023 03:15 ET (07:15 GMT)

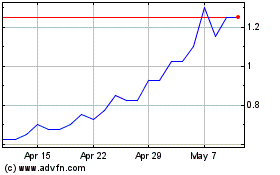

Asiamet Resources (LSE:ARS)

Historical Stock Chart

From Apr 2024 to May 2024

Asiamet Resources (LSE:ARS)

Historical Stock Chart

From May 2023 to May 2024