TIDMBSRT

RNS Number : 3020E

Baker Steel Resources Trust Ltd

05 November 2020

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

5 November 2020

30 October 2020 Unaudited NAV Statement

Net Asset Value ("NAV")

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 30 October 2020:

Net asset value per Ordinary Share: 76.2 pence

The NAV per share increased by 1.5% against the NAV per share at

30 September 2020 as the increase in price of Metals Exploration

plc following the resumption of trading in its shares on AIM,

outweighed decreases in other parts of the quoted portion of the

portfolio.

Th e Company had a total of 106,462,502 Ordinary Shares in issue

with a further 700,000 shares held in treasury as at 30 October

2020 .

Portfolio Update

The Company's top 12 investments were as follows as a percentage

of NAV:

30 October 2020 31 December 2019

Bilboes Gold Limited 20.8% 15.9%

Futura Resources Ltd 16.6% 15.0%

Polar Acquisition Ltd 11.0% 11.3%

Cemos Group plc 9.6% 10.0%

Tungsten West Limited 8.0% 8.0%

Anglo Saxony Mining Limited 4.3% 4.6%

Mines & Metals Trading

Peru PLC 4.0% 4.4%

Azarga Metals Corp 3.9% 2.7%

Nussir ASA 3.8% 4.1%

Metals Exploration plc 3.6% 1.8%

Black Pearl Limited Partnership 3.3% 3.4%

Sarmin Minerals Exploration 2.6% 3.7%

Listed Precious Metal Shares 5.4% 6.1%

Other Investments 2.6% 3.9%

Net Cash, Equivalents and

Accruals 0.5% 2.3%

Investment Update

Metals Exploration plc

On 8 September 2020 Metals Ex announced details of a debt

restructuring of both the Senior Facility and various pre-existing

Mezzanine debt facilities. As at 31 August 2020, the total amount

owing to the respective Lenders was approximately US$72 million for

the Senior Facility and approximately US$65 million under the

Mezzanine Facilities. During September a US$4 million repayment of

the Senior debt was made leaving an aggregate of approximately

US$134 million at the end of September 2020.

During the third quarter 2020, Metals Ex sold 16,094 ounces of

gold from its Runruno gold mine in the Philippines, generating free

cashflow of US$8.66 million. This was a significant improvement on

previous quarters due to higher gold recoveries and the increased

gold price.

On 23 October 2020 Metals Ex announced it had completed the debt

restructuring following an extraordinary general meeting of

shareholders. Importantly this debt restructuring did not include a

debt for equity swap which would have been highly dilutive if

enacted at close to the price of 0.75 pence per share at which

Metals Ex's shares were suspended in March 2020.

Once the debt restructuring was completed Metals Ex's shares

resumed trading on the AIM market on 26 October 2020 closing at 2.4

pence per share on 30 October 2020. At 30 September 2020 the

Company held Metals Ex shares at the discounted price of 0.5 pence

per share and the resumption of trading boosted the Company's NAV

by 2.9%.

Although all Metals Ex's cashflow in the near term will be

deployed towards paying down the debt, any further improvement in

production performance towards the targeted 100,000 ounces per

annum, or increase in the gold price, could result in the debt

being paid down more rapidly which would have a significant effect

on the value of Metals Ex.

Sarmin Minerals Exploration ("Sarmin")

On 28 September 2020 the Definitive Feasibility Study (DFS) into

Sarmin's Kanga Potash project in the Republic of Congo was issued

by Novopro a leading independent consultant in the potash

sector.

The pre-feasibility study completed in September 2018 adopted a

modular approach with phased development configuration from 400,000

tonnes per annum (tpa) to 2.4M tpa of Muriate of Phosphate (MOP)

whilst the DFS focussed on the most financially attractive scenario

of 600,000 tpa MOP.

The key results of the DFS based on an average MOP sales price

of US$282 per tonne are summarised as follows:

Capital Cost: US$ 457 million

Operating Cost: US$ 66.3 per tonne MOP (FOB Pointe Noire)

All-in Sustaining Cost: US$ 75.9 per tonne MOP (FOB Pointe Noire)

Post tax NPV (10%): US$ 511 million

Post tax IRR: 22.3%

The Kanga project's key advantages apart from its exceptional

geological characteristics are its proximity to the coast,

minimising the cost of product transport as well as access to long

term competitively priced natural gas. This results in both capital

and operating costs in the lowest part of the industry cost curve

making Kanga one of the most competitive MOP projects globally. It

also has the potential to be expanded on a modular basis up to 2.4M

tpa over 30 years.

Sarmin will now seek partners to finance the construction of the

project. The carrying value of Sarmin will be reviewed together

with those of the other unlisted positions at 31 December 2020 in

line with the Company's policy.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVZZMGMNDZGGZM

(END) Dow Jones Newswires

November 05, 2020 02:00 ET (07:00 GMT)

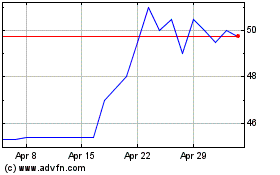

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Apr 2023 to Apr 2024