TIDMDRV

RNS Number : 6243I

Driver Group plc

15 December 2020

15 December 2020

DRIVER GROUP PLC

("Driver" or "the Group")

Preliminary Results and Dividend Declaration

Driver Group PLC (AIM: DRV), the global professional services

consultancy to construction and engineering industries, is pleased

to announce the dividend for the full year and its results for the

financial year ended 30 September 2020.

The final dividend for the full year of 0.75 pence per share

will be paid on 23 March 2021 to shareholders who are on the

register of members at the close of business on 19 February 2021,

with an ex-dividend date of 18 February 2021 subject to approval at

the AGM.

Financial & Operational Highlights

-- Revenue decreased by 9% to GBP 53.1m (2019: GBP 58.5m)

-- Underlying(*) profit before tax decreased by 17% to GBP 2.5m (2019: GBP 3.0m)

-- Profit for the year decreased to GBP 1.3m (2019: GBP 2.7m)

-- Net cash(**) increased to GBP 8.2m (2019: GBP 5.4m)

-- Utilisation(***) decreased to 72.0% (2019: 76.8%)

-- Earnings per share decreased to 2.6p (2019: 5.2p)

Mark Wheeler, Chief Executive Officer of Driver Group plc,

commented: " In spite of a challenging year, the business has

produced a good result, which is testimony to the work of all the

team. Activity levels in the early weeks of the new financial year

are encouraging and with a strong net cash position and the

availability of increased debt facilities, we believe that the

Group is well positioned for the coming year. "

* Underlying figures are stated before the share-based payment

costs and one off severance costs

** Net cash consists of cash and cash equivalents and bank

loans

*** Utilisation % is calculated by dividing the total hours

billed by the total working hours available for chargeable

staff

Enquiries:

Driver Group plc 020 7377 0005

Mark Wheeler (CEO)

David Kilgour (CFO

N+1 Singer (Nomad & Broker) 020 7496 3000

Sandy Fraser

Jen Boorer

Acuitas Communications 020 3687 0868

Simon Nayyar simon.nayyar@acuitsascomms.com

Fraser Schurer-Lewis fraser.schurer-lewis@acuitascomms.com

CHAIRMAN'S STATEMENT

IMPACT OF COVID-19

As I reported at the time of the interim results we have been

managing the effects and impact of the COVID-19 pandemic across our

global business since January 2020. We took action at an early

stage to protect both the business and our staff by implementing a

clear business continuity strategy which has enabled our clients

across key global regions and offices to be serviced effectively,

sustainably and without business interruption. As the pandemic

spread across the world with varying levels of impact we responded

to the requirements of the local governments and regulatory

authorities in the relevant jurisdictions and in some circumstances

in advance. We moved to a flexible home working model in every

region and office worldwide to protect the health and safety of our

staff. As local restrictions have been relaxed in some regions we

have moved to a hybrid working solution facilitating both a safe

work environment for our staff and ensuring our ability to fully

service the requirements of our clients.

As a consequence of our prompt response and continuing approach

to managing the impact of COVID-19 we have remained profitable and

cash generative throughout the financial year. In my report on the

interim results in June, I advised that although the impact of

COVID-19 on the Company had been limited to date the Board had

decided on a course of action which in the interests of prudence,

resilience, and long term strategic competitive positioning was

designed to maximise liquidity, preserve cash and enhance

operational flexibility. I am pleased to report that these prompt

actions and strong executive management, supported by more frequent

board meetings, have delivered a decent result for the year given

all the unprecedented and unavoidable circumstances and have

minimised the impact of the pandemic.

Following the appointment of Mark Wheeler as Group Chief

Executive Officer on 1st June 2020 a strategic review of the

business was commenced. The review is now complete and the Board's

agreed objective is to develop Driver Group into a higher margin

business on a steady growth curve by focussing on growth in expert

and arbitration services and reducing the share of Group revenue

derived from lower margin project services. Mark expands further on

the new strategy in his report.

THE BUSINESS TRADING PERFORMANCE

It is pleasing to note that whilst COVID-19 has created economic

uncertainty across the world which has resulted in lower economic

activity we have continued to be profitable and cash generative

throughout the financial year and ended the financial year with

GBP8.2m of net cash. The market uncertainty has led to delayed or

postponed client decisions which has resulted in lower market

activity and consequently Group revenue reduced by 9%. However, as

a result of strong management by the executive team we have

produced a profitable result allied just as importantly to strong

cash generation.

DIVID

One of the decisions made by the Board at the time of the

interim results in the early stages of the pandemic was to cancel

the interim dividend for the year in order to conserve cash. Given

the uncertainty about the effects of the pandemic and the various

responses to it by governments around the world including lockdowns

of varying severity I am confident this was the right decision.

But, given the strength of our operating performance and the

strength of the Group balance sheet the Directors now believe that

it is appropriate to recommend a final dividend of 0.75p (2019:

0.75p per share).

BOARD

During the financial year the Board appointed Elizabeth Filkin

CBE on 1st October 2019 and John Mullen on 1st June 2020 as

Non-executive Directors. Both bring substantial valuable experience

to our deliberations. Elizabeth is an acknowledged expert on

governance with great experience in both the public and private

sectors and John is not only one of the world's most highly

regarded quantum experts but knows the business intimately. We are

delighted that they have both joined us. On 31st May Gordon

Wilkinson left the business with our good wishes, having during his

tenure led the business through some extremely challenging times. I

am delighted to report that Mark Wheeler has shown excellent

leadership since he took over as Chief Executive. His unrivalled

understanding not only of our business but of this industry

worldwide allied to his personal relationship with so many of our

staff has meant that the Group is continuing to meet the challenges

of the pandemic while also working on a better, more productive

future for the business.

FORWARD GUIDANCE

In view of the continuing global uncertainty as a result of the

ongoing pandemic we are not in a position to reinstate forward

guidance at this point. We will review the position at the time of

our half year results.

OUTLOOK

Although the 2020 financial year has been challenging as a

result of the pandemic, I believe the financial results demonstrate

that the executive team have managed the business well in

maintaining profits and strong cash generation throughout the year.

The Group continues to maintain strict discipline over the

management of its net working capital position and I am pleased to

report that the Group's net cash balance at the year end was

GBP8.2m. In more normal times, Driver is conditioned to operating

with relatively low forward revenue visibility and that has been

made even more difficult because the pandemic has resulted in so

much global uncertainty. However, activity levels in the early

weeks of the new financial year are encouraging and with a strong

net cash position and the availability of increased debt

facilities, the Directors believe that the Group is well placed to

trade through this current uncertain market environment, and to

take advantage of the opportunities afforded as a consequence of

the disruption of COVID-19 in the Group's target markets.

I would like to pay particular tribute to our CEO Mark Wheeler

and CFO David Kilgour for the way they have managed the business

through the last year. I thank my Board colleagues, Peter Collini,

Elizabeth Filkin and John Mullen for their unstinting support and

most of all, I thank every one of our staff wherever they are in

the world for their continued diligence and loyalty. I am of course

also grateful for the confidence our shareholders have consistently

demonstrated and I assure them that the Group will continue to do

its utmost to repay that confidence.

Steven Norris

Non-Executive Chairman

15 December 2020

*Underlying figures are stated before the share-based payment

costs and one off severance costs

**Net cash consists of cash and cash equivalents, bank

loans.

***Utilisation % is calculated by dividing the total hours

billed by the total working hours available for chargeable

staff

CHIEF EXECUTIVE OFFICER'S REVIEW

INTRODUCTION

I am pleased to present my first CEO report in what has been a

very challenging but successful year. The COVID-19 pandemic has

caused significant market disruption globally which has seen a

reduction in activity as the economic uncertainty has resulted in

delays in claims and disputes proceeding. In response, we have

actively managed the business and our cost base to ensure we have

maintained profitability throughout the year.

It is especially pleasing that during the pandemic we have

achieved a strong cash performance increasing the net cash balance

from GBP3.3m at 31 March 2020 to GBP8.2m at 30 September 2020.

The Group's global operating footprint has proven to be a source

of significant operational strength and diversified risk with a

strong result in the Europe & Americas (EuAm) region offsetting

weaker performance in the Middle East (ME) and Asia Pacific (APAC)

regions following a greater early impact in these markets from the

pandemic. The market disruption has resulted in challenging trading

conditions during the year. However, we believe that based on our

track record of prudent business planning and management, our

exceptional team of world-class professional services experts and

our specialist understanding of sectors, markets and disciplines we

will be able to continue to perform well. Driver is well positioned

to benefit from the expected increase in dispute resolution

activity in the future as globally we move beyond the pandemic to a

market which will have seen significant numbers of contracts having

faced some form of disruption as a consequence of COVID-19, and

hence, requiring our services.

Our utilisation rates, which are, as ever, a key performance

indicator for a global professional services business such as

Driver, reduced to 72%, which considering the level of market

disruption demonstrates our ability to minimise the impact of the

pandemic over the past year.

Following my appointment as Group Chief Executive Officer on 1

June 2020 I have led a strategic review of the business which has

established a five year strategic plan. The key themes of the plan

are to focus growth on expert and dispute resolution services as we

seek both to grow revenue and improve our margin towards a double

digit operating profit margin over the life of the plan. To achieve

this target we will seek to grow both the geographic and sectoral

spread of our offering by recruiting and retaining our most

valuable asset, technically expert and suitably qualified

people.

STRATEGY

The Board believes that the execution of this strategy will

enhance shareholder value through:

-- Focus on growth on higher margin Diales revenue

-- Sustainable financial performance

-- Maintaining financial strength

-- Measured organic growth through enhanced and expanded geographic presence

sTAFF:

-- Retention and development of existing key staff

-- Focussed recruitment strategy

-- Culture

-- Move to risk and reward sharing

mARGIN:

-- Focus on higher margin work

-- Improve cost effectiveness of geographic presence

-- Risk based approach

-- Extract value from downtime

gROWTH:

-- Invest in technology and processes to enhance working

practices and improve services to clients

-- Edge growth around expertise

-- True global coverage

Over the last six months our confidence in our performance has

allowed us to take advantage of market opportunities when they have

arisen. We have strengthened our expert offering in the Middle

East, opened an office in New York (to both service our North

American clients and improve access to the important South American

markets), set up a strategic partnership in South Africa and

recently opened an office in Madrid. These low risk actions have

significantly improved our geographic and sectoral offering in both

Africa and the Americas which we expect to be an important source

of future measured growth towards our planned objectives. Moving

forward we will continue to review further potential opportunities

to broaden the geographic and sectoral coverage of our business and

with our strong balance sheet, Driver is in a good position to take

advantage of opportunities to achieve these aims in a controlled

and progressive manner.

I would like to take this opportunity on behalf of your Board to

thank all the team at Driver Group for their hard work and

commitment to the business during what has been a challenging

period, and to our loyal clients around the world. We are

appreciative of the support of all of them while we continue to

position the business for further growth and an even better

advisory offering as we begin the next decade.

Financial Performance HIGHLIGHTS

As noted, the economic uncertainty created by the pandemic has

resulted in a lower revenue during the year of GBP53.1m (2019:

GBP58.5m). The underlying* profit before tax was GBP2.5m (2019:

GBP3.0m) which is a margin of 4.7% (2019: 5.1%). The underlying

profit before tax is stated before the one-off severance cost of

GBP0.8m in 2020 following the exit of our previous Chief Executive

Officer and a credit for share-based payments in 2019 of GBP0.2m.

The reported profit for the year after tax is GBP1.3m (2019:

GBP2.7m).

REGIONAL BREAKDOWN

EUROPE AND AMERICAS

Across the EuAm region, there has again been a strong trading

performance, resulting in an overall increase in revenue of 4% to

GBP31.0m. The UK's revenue was GBP23.2m, (delivering a profit of

GBP3.1m) with a good performance across the whole of the UK market

for both claims and project services. Our European businesses

continued to perform well with a small drop in revenue to GBP6.6m

but an increase in profit of 37.5% to GBP0.9m, reflecting the

strength of our proposition. Our Technical Services team in London

has continued to grow, increasing revenues from GBP4.2m in 2019 to

GBP4.6m in 2020. The team offers forensic architecture and

engineering globally from the UK, a service which is showing demand

worldwide.

The newly opened office in New York, supported by two leading

resident experts, contributed GBP0.1m of revenue in the first month

of operation and alongside our Canadian business the pipeline of

opportunities is growing well.

ASIA PACIFIC

Whilst APAC started the year strongly, challenges in the second

half meant it was unable to meet its performance targets. The

results reflect a slowdown caused by the pandemic and downward

pressure on fees; but they are, nonetheless, disappointing for the

Group. Revenue was down across the region with the largest

reduction being in Singapore and Malaysia which were a combined 20%

below the 2019 position. This was mainly as a consequence of the

closure of a low margin project services business. Profitability

was improved in the region following the actions taken to reduce

the cost base and the closure of the project services business.

Additionally, following the recent departure of two senior members

of staff we have further streamlined the business and as a result

we move forward with a more cost efficient business in 2020/21 as

the region manages the impact of the pandemic, and we are well

placed to exploit future opportunities.

Middle East

ME has seen a significant contraction in market activity across

the whole region over the last couple of years. Additionally, this

year the region suffered market disruption from the COVID-19

pandemic and the various local and national governmental

restrictions imposed. As a result regional revenue reduced by 27%

from the 2019 level to GBP14.4m. Apart from a small increase in

revenue in Kuwait the decrease in revenue was felt across the

region. The drop in regional profit from GBP1.4m in 2019 to GBP0.1m

this year has been mitigated by actively managing our cost base and

ensuring we are in the appropriate position to take advantage of

the expected increase in opportunities after the pandemic. The

region is now under new leadership and this, combined with the

recent increase in the Diales presence in the region, leaves us

well positioned.

outlook

In spite of a challenging year, the business has produced a good

result, which is testimony to the work of all the team. Whilst the

pandemic continues to disrupt activity with various lockdowns

affecting our business globally the pipeline of opportunities has

been maintained into the new financial year.

We believe that we are, therefore, well positioned for the

coming year, and that we can build sustainable value for all our

stakeholders over the life of the strategic plan.

Mark Wheeler

Chief Executive Officer

15 December 2020

*Underlying figures are stated before the share-based payment

costs and one off severance costs

**Net cash consists of cash and cash equivalents, bank

loans.

***Utilisation % is calculated by dividing the total hours

billed by the total working hours available for chargeable

staff

CHIEF FINANCIAL OFFICER'S REVIEW

Income Statement 2020 GBPm 2019 GBPm

-------------------------------- ---------- ----------

Revenue 53.07 58.49

Cost of sales (39.16) (44.95)

Impairment movement (0.78) 0.40

-------------------------------- ---------- ----------

Gross Profit 13.13 13.94

Recurring operating expenses (10.52) (10.85)

Net finance costs (0.11) (0.09)

-------------------------------- ---------- ----------

Underlying(*) profit before tax 2.50 3.00

One off severance costs (0.76) -

Share-based payments credit - 0.25

-------------------------------- ---------- ----------

Profit before Tax 1.74 3.25

Tax expense (0.40) (0.50)

-------------------------------- ---------- ----------

Profit for the year 1.34 2.75

-------------------------------- ---------- ----------

In 2020 Driver Group managed the impact of the COVID-19 pandemic

and although the EuAm region performed well there was a slowdown in

activity levels in the ME and APAC regions. Overall, this resulted

in lower revenues and underlying(*) profit before tax than 2019. We

also absorbed the impact of the severance cost for our outgoing

Chief Executive Officer of GBP0.8m. The key financial metrics are

as follows:

Key Metrics 2020 2019

------------------------- ---------- ----------

Revenue GBP53.07m GBP58.49m

Gross Margin % 24.7% 23.8%

Profit for the year GBP1.34m GBP2.75m

Utilisation Rates 72.0% 76.8%

Basic earnings per share 2.6p 5.2p

------------------------- ---------- ----------

Total revenue decreased by 9% to GBP53.07m (2019: GBP58.49m) and

gross profit decreased by 6% to GBP13.13m (2019: GBP13.94m). The

reduction in gross margin was as a result of the lower revenues in

the APAC and ME regions, the impact of which has been offset by a

rationalisation of the cost base. Before the impact of impairment

provisions the operating gross profit has actually increased during

the year to GBP13.91m (2019: GBP13.54m). The profit for the year

has decreased by 51% to GBP1.34m (2019: GBP2.75m) as it is stated

after the inclusion of the one off severance cost for the outgoing

CEO of GBP0.77m in the year. The net cash** at the year end was

GBP8.2m (2019: GBP5.4m), after funding a dividend payment of

GBP0.65m.

The EuAm region increased revenue by 4.2% to GBP31.03m (2019:

GBP29.77m) and generated an increase in segmental profit of 2% to

GBP3.99m (2019: GBP3.91m). This strong performance was driven by

good revenues in the UK of GBP23.23m (2019: GBP21.41m) with a small

drop in revenues in mainland Europe of 4.6% to GBP6.61m (2019:

GBP6.93m) and a drop in revenues in Canada of 26% to GBP1.06m

(2019: GBP1.44m) following a change in leadership.

The ME region saw revenues drop during the year by 26.8% to

GBP14.37m (2019: GBP19.65m) due to a reduction in market activity

in the region and the impact of COVID-19. Revenues in Kuwait showed

a small increase at GBP0.97m (2019: GBP0.76m) otherwise revenues

were down across the region. Segmental profit for the region

decreased to GBP0.11m (2019: GBP1.45m).

The APAC region saw revenues drop by 15.5% to GBP7.67m (2019:

GBP9.07m). The reduction was mainly as a consequence of the

decision to close a low margin project services business in the

region resulting in a reduction in revenue of GBP1.58m. The

segmental result for the year was a profit of GBP0.51m (2019:

segmental loss GBP0.36m) which shows the benefit of the

restructuring last year and the business closure this year. The

APAC region continues to be a target for further growth

opportunity.

The utilisation(***) rate of chargeable staff across the

business as a whole for the year stood at 72.0%, a decrease from

76.8% in the prior year reflecting the impact of a weaker market in

the ME and APAC regions and the impact of the pandemic on market

activity. The variation in utilisation during the year ranged from

a low of 65% in the holiday month of August to a high of 77% in

October, June and July. The overall decrease in utilisation is

clearly impacted by the COVID-19 pandemic and has held up well

during the year when considering the level of market

disruption.

After a net interest charge of GBP0.11m (2019: GBP0.09m) the

underlying(*) profit before tax was GBP2.50m (2019: GBP3.00m) and

the reported profit before tax was GBP1.74m (2019: GBP3.25m). The

current year profit before tax includes one off severance costs for

the outgoing Chief Executive Officer of GBP0.77m while the previous

year includes a credit of GBP0.24m for share-based payments due to

the criteria for vesting of options not being met for that year.

Details of outstanding options can be found in the Report of the

Directors and Directors' Remuneration Report.

NET WORKING CAPITAL

Net cash(**) showed a strong improvement during the year to

GBP8.2m (2019: GBP5.4m) with net working capital decreasing as

there was a significant reduction in outstanding debtors and a

small increase in creditors.

TAXATION

The Group showed a tax charge of GBP0.40m (2019: GBP0.50m). The

tax charge includes the effects of expenses not deductible for tax

purposes and is calculated at the prevailing rates for the

jurisdictions in which the Group operates and, consequently, the

effective tax rate for the year was 23% (2019: 15%). The increase

in the effective rate is due to lower profits from jurisdictions

with lower tax rates.

EARNINGS PER SHARE

The basic earnings per share was 2.6 pence (2019: 5.2 pence).

Underlying(*) continuing basic earnings per share was 4.0 pence

(2019: 4.7 pence).

CASH FLOW

There was a net cash inflow from operating activities before

changes in working capital of GBP3.28m (2019: GBP3.44m), however

the current year does benefit by GBP1.05m from the amortisation of

right of use assets following the transition to IFRS 16 during the

year. The movement also reflects the reported profit for the year

of GBP1.34m (2019: GBP2.75m) after depreciation of GBP0.32m (2019:

GBP0.42m) and the one off severance charge of GBP0.77m (2019:

GBPnil). The prior year saw a benefit of GBP0.24m for the

share-based payment credit which was GBPnil in the current year.

There was a decrease of GBP2.06m in trade and other receivables

(2019: increase of GBP0.66m) reflecting improved cash collections

during the year, and a small increase in trade and other payables

of GBP0.24m (2019: decrease of GBP2.05m) resulting in a net cash

inflow from operating activities of GBP5.06m (2019: GBP0.1m). Net

tax paid in the year was GBP0.52m (2019: GBP0.62m).

There was a net cash outflow from investing activities of

GBP0.34m (2019: GBP0.29m) principally capital expenditure,

including IT spend, of GBP0.35m offset by interest received.

Net cash flow from financing activities was an outflow of

GBP0.98m (2019: GBP2.36m) with the current year reflecting the

dividends paid of GBP0.65m (2019: GBP0.27m) and repayment of

borrowings of GBP3.19m (2019: GBP0.98m) which includes scheduled

term loan repayments of GBP2.12m and lease repayments under IFRS 16

of GBP1.07m. Offsetting this is a drawdown of the GBP3m revolving

credit facility on 1st April 2020 to allow for unforeseen

circumstances as a consequence of the potential impact of the

pandemic but, this facility was not required and hence was repaid

on 1st October 2020.

cash flow GBPm

------------------------------------------------------ -------

Net cash(**) at 30 September 2019 5.40

Operating cash flow before changes in working capital 3.28

Decrease in Trade and other receivables 2.06

Increase in Trade and other payables 0.24

Tax paid (0.52)

Net interest paid (0.09)

Capital spend (0.35)

Repurchase of shares (0.02)

Dividends paid (0.65)

Repayment of leases (1.07)

Effects of Foreign Exchange (0.06)

Net cash(**) at 30 September 2020 8.22

------------------------------------------------------ -------

LIQUIDITY AND GOING CONCERN

The Group is in a strong financial position. At the year end the

Group had net cash balances of GBP8.2m (2019: GBP5.4m) together

with committed borrowing facilities of GBP7.0m (2019: GBP3.0m) of

which GBP4.0m were undrawn at 30 September 2020. At the start of

the COVID-19 pandemic GBP3.0m of the revolving credit facility was

drawn to meet any unforeseen contingencies. This was repaid on 1st

October 2020. The net cash and available facilities provide

significant liquidity entering into the new financial year.

In the interest of prudence, resilience and long term strategic

competitive positioning the Board, at the beginning of the

pandemic, took the following measures in order to enhance

operational flexibility and maximise liquidity:

-- The interim dividend was cancelled

-- Non-essential capital expenditure and discretionary operational expenditure were postponed

-- The Board members' salaries were deferred by 20%

-- Targeted reductions in pay for under utilised staff

-- The GBP3m revolving working capital facility was drawn for

any unforeseen circumstances as a consequence of the pandemic

-- Additional financing facilities along with a relaxation of covenants were agreed with HSBC

In carrying out their duties in respect of going concern the

Directors have completed a review of the Group's financial

forecasts for a period of more than twelve months from the date of

approving these financial statements. This review has included

sensitivity analysis and stress tests which took account of

reasonable and foreseeable scenarios including the impact of the

COVID-19 pandemic and related risks. Under all scenarios modelled

the Directors believe that any funding needs required will be

sufficiently covered by the existing cash reserves and the Group's

undrawn borrowing facilities. As such the Directors have a

reasonable expectation that the Group has sufficient resources and

hence these financial statements include information prepared on a

going concern basis.

DIVIDS

The Directors propose a dividend for 2020 of 0.75p per share

(2019: 0.75p per share). This will be paid on 23rd March 2021 to

shareholders who are on the register of members at the close of

business on 19th February 2021.

David Kilgour

Chief Financial Officer

15 December 2020

*Underlying figures are stated before the share-based payment

costs and one off severance costs

**Net cash consists of cash and cash equivalents, bank

loans.

***Utilisation % is calculated by dividing the total hours

billed by the total working hours available for chargeable

staff

Consolidated Income Statement

For the year ended 30 September 2020

2020 2019

GBP000 GBP000

-------------------------------------------------- -------- --------

REVENUE 53,074 58,486

Cost of sales (39,162) (44,950)

Impairment movement (778) 401

-------------------------------------------------- -------- --------

GROSS PROFIT 13,134 13,937

Administrative expenses (11,413) (10,760)

Other operating income 130 155

-------------------------------------------------- -------- --------

Underlying(*) operating profit 2,618 3,089

-------------------------------------------------- -------- --------

One off severance costs (767) -

-------------------------------------------------- -------- --------

Share-based payment charges and associated costs - 243

-------------------------------------------------- -------- --------

OPERATING PROFIT 1,851 3,332

Finance income 14 44

Finance costs (128) (131)

-------------------------------------------------- -------- --------

PROFIT BEFORE TAXATION 1,737 3,245

Tax expense (399) (497)

-------------------------------------------------- -------- --------

PROFIT FOR THE YEAR 1,338 2,748

-------------------------------------------------- -------- --------

(Loss)/profit attributable to non-controlling

interest (1) 1

Profit attributable to equity shareholders of

the Parent 1,339 2,747

-------------------------------------------------- -------- --------

1,338 2,748

-------------------------------------------------- -------- --------

Basic earnings per share attributable to equity

shareholders of the Parent (pence) 2.6p 5.2p

Diluted earnings per share attributable to equity

shareholders of the Parent (pence) 2.5p 4.8p

-------------------------------------------------- -------- --------

(*) Underlying figures are stated before the share-based payment

costs and one off severance costs

Consolidated Statement of Comprehensive Income

For the year ended 30 September 2020

2020 2019

GBP000 GBP000

------------------------------------------------------- ------- -------

PROFIT FOR THE YEAR 1,338 2,748

------------------------------------------------------- ------- -------

Other comprehensive income:

Items that could subsequently be reclassified to

the Income Statement:

Exchange differences on translating foreign operations (24) (25)

------------------------------------------------------- ------- -------

OTHER COMPREHENSIVE LOSS FOR THE YEAR NET OF TAX (24) (25)

------------------------------------------------------- ------- -------

TOTAL COMPREHENSIVE INCOME FOR THE YEAR 1,314 2,723

------------------------------------------------------- ------- -------

Total comprehensive income attributable to:

Owners of the Parent 1,315 2,722

Non-controlling interest (1) 1

------------------------------------------------------- ------- -------

1,314 2,723

------------------------------------------------------- ------- -------

Consolidated Statement of Financial Position

For the year ended 30 September 2020

2020 2019

-------------------------------

GBP000 GBP000 GBP000 GBP000

------------------------------- ------- -------- ------- --------

NON-CURRENT ASSETS

Goodwill 2,969 2,969

Property, plant and equipment 501 685

Intangible asset 182 -

Right of use asset 1,831 -

Deferred tax asset 308 268

------------------------------- ------- -------- ------- --------

5,791 3,922

CURRENT ASSETS

Trade and other receivables 17,819 20,189

Derivative financial asset 171 2

Cash and cash equivalents 11,215 7,526

------------------------------- ------- -------- ------- --------

29,205 27,717

------------------------------- ------- -------- ------- --------

TOTAL ASSETS 34,996 31,639

------------------------------- ------- -------- ------- --------

CURRENT LIABILITIES

Borrowings (3,000) (2,125)

Lease creditor (679) -

Trade and other payables (9,446) (9,197)

Derivative financial liability (178) (398)

Current tax payable (264) (428)

------------------------------- ------- -------- ------- --------

(13,567) (12,148)

------------------------------- ------- -------- ------- --------

NON-CURRENT LIABILITIES

Lease creditor (1,040) -

------------------------------- ------- -------- ------- --------

(1,040) -

------------------------------- ------- -------- ------- --------

TOTAL LIABILITIES (14,607) (12,148)

------------------------------- ------- -------- ------- --------

NET ASSETS 20,389 19,491

------------------------------- ------- -------- ------- --------

SHAREHOLDERS' EQUITY

Share capital 216 216

Share premium 11,496 11,496

Merger reserve 1,055 1,055

Currency reserve (449) (425)

Capital redemption reserve 18 18

Treasury shares (1,025) (1,000)

Retained earnings 9,075 8,127

Own shares (3) (3)

------------------------------- ------- -------- ------- --------

TOTAL SHAREHOLDERS' EQUITY 20,383 19,484

NON-CONTROLLING INTEREST 6 7

------------------------------- ------- -------- ------- --------

TOTAL EQUITY 20,389 19,491

------------------------------- ------- -------- ------- --------

Consolidated Cash Flow Statement

For the year ended 30 September 2020

2020 2019

GBP000 GBP000

-------------------------------------------------------- ------- -------

CASH FLOWS FROM OPERATING ACTIVITIES

Profit for the year 1,338 2,748

-------------------------------------------------------- ------- -------

Adjustments for:

Depreciation 321 418

Exchange adjustments 55 (69)

Amortisation of right of use asset 1,051 -

Finance income (14) (44)

Finance expense 128 131

Tax expense 399 497

Equity settled share-based payment charge/(credit) - (243)

-------------------------------------------------------- ------- -------

OPERATING CASH FLOW BEFORE CHANGES IN WORKING CAPITAL

AND PROVISIONS 3,278 3,438

Decrease/(increase) in trade and other receivables 2,056 (658)

Increase/(decrease) in trade and other payables 240 (2,053)

-------------------------------------------------------- ------- -------

CASH GENERATED IN OPERATIONS 5,574 727

Tax paid (519) (623)

-------------------------------------------------------- ------- -------

NET CASH INFLOW FROM OPERATING ACTIVITIES 5,055 104

-------------------------------------------------------- ------- -------

CASH FLOWS FROM INVESTING ACTIVITIES

Interest received 14 44

Acquisition of property, plant and equipment (167) (338)

Acquisition of intangible assets (182) -

-------------------------------------------------------- ------- -------

NET CASH OUTFLOW FROM INVESTING ACTIVITIES (335) (294)

-------------------------------------------------------- ------- -------

CASH FLOWS FROM FINANCING ACTIVITIES

Interest paid (107) (131)

Repayment of borrowings (3,191) (981)

Proceeds of borrowings 3,000 -

Proceeds from issue of new shares - 22

Purchase of Treasury shares (25) (1,000)

Dividends paid to equity shareholders of the Parent (653) (270)

-------------------------------------------------------- ------- -------

NET CASH OUTFLOW FROM FINANCING ACTIVITIES (976) (2,360)

-------------------------------------------------------- ------- -------

Net increase/(decrease) in cash and cash equivalents 3,744 (2,550)

Effect of foreign exchange on cash and cash equivalents (55) 69

Cash and cash equivalents at start of period 7,526 10,007

-------------------------------------------------------- ------- -------

CASH AND CASH EQUIVALENTS AT OF PERIOD 11,215 7,526

-------------------------------------------------------- ------- -------

Consolidated Statement of Changes in Equity

For the year ended 30 September 2020

Non-

Share Share Treasury Merger Other Retained Own controlling Total

capital premium shares reserve reserves(2) earnings shares(3) Total(1) interest Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

CLOSING

BALANCE AT

1 OCTOBER

2018 215 11,475 - 1,055 (382) 6,154 (3) 18,514 6 18,520

-------------- ------- ------- -------- -------- ----------- -------- --------- -------- ----------- -------

Profit for the

year - - - - - 2,747 - 2,747 1 2,748

Other

comprehensive

income for

the year - - - - (25) - - (25) - (25)

-------------- ------- ------- -------- -------- ----------- -------- --------- -------- ----------- -------

Total

comprehensive

income for

the year - - - - (25) 2,747 - 2,722 1 2,723

Dividends - - - - - (531) - (531) - (531)

Share-based

payment - - - - - (243) - (243) - (243)

Purchase of

Treasury

shares - - (1,000) - - - - (1,000) - (1,000)

Issue of new

shares 1 21 - - - - - 22 - 22

-------------- ------- ------- -------- -------- ----------- -------- --------- -------- ----------- -------

CLOSING

BALANCE AT

30 SEPTEMBER

2019 216 11,496 (1,000) 1,055 (407) 8,127 (3) 19,484 7 19,491

-------------- ------- ------- -------- -------- ----------- -------- --------- -------- ----------- -------

OPENING

BALANCE AT

1 OCTOBER

2019 216 11,496 (1,000) 1,055 (407) 8,127 (3) 19,484 7 19,491

-------------- ------- ------- -------- -------- ----------- -------- --------- -------- ----------- -------

Profit for the

year - - - - - 1,339 - 1,339 (1) 1,338

Other

comprehensive

income for

the year - - - - (24) - - (24) - (24)

-------------- ------- ------- -------- -------- ----------- -------- --------- -------- ----------- -------

Total

comprehensive

income for

the year - - - - (24) 1,339 - 1,315 (1) 1,314

Dividends - - - - - (391) - (391) - (391)

Share-based - - - - - - - - - -

payment

Purchase of

Treasury

shares - - (25) - - - - (25) - (25)

Issue of new - - - - - - - - - -

shares

-------------- ------- ------- -------- -------- ----------- -------- --------- -------- ----------- -------

CLOSING

BALANCE AT

30 SEPTEMBER

2020 216 11,496 (1,025) 1,055 (431) 9,075 (3) 20,383 6 20,389

-------------- ------- ------- -------- -------- ----------- -------- --------- -------- ----------- -------

(1) Total equity attributable to the equity holders of the

Parent.

(2) 'Other reserves' combines the currency reserve and capital

redemption reserve. The movement in the current and prior year

relates to the translation of foreign currency equity balances and

foreign currency non-monetary items.

(3) The shortfall in the market value of the shares held by the

EBT and the outstanding loan is transferred from own shares to

retained earnings.

NOTES

1 BASIS OF PREPARATION

The financial information has been prepared under the historical

cost convention, as modified by the revaluation of certain assets,

and in accordance with Applicable Accounting Standards.

The financial information set out above does not constitute the

Group's statutory accounts for the years ended 30 September 2020 or

2019. Statutory accounts for 2019 have been delivered to the

Registrar of Companies, and those for 2020 will be delivered in due

course. The auditor has reported on those accounts; their reports

were (i) unqualified, (ii) did not include a reference to any

matters to which the auditor drew attention by way of emphasis

without qualifying their report (iii) did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

The Financial Statements have been prepared on a going concern

basis. In reaching their assessment, the Directors have considered

a period extending at least twelve months from the date of approval

of this financial report.

The Directors continue to monitor developments across the

markets the Group operate in and the potential impact of COVID-19

in the short and medium term and is in particular focussed on the

key risks of: delays by clients in contracting for claims advice;

projects being suspended or planned projects not proceeding which

could potentially result in a reduction in staff utilisation

levels; and the impact of the current situation on the financial

stability of clients causing delays to payments.

As Driver's business is geographically well spread across the

world the Directors have been managing the impact of COVID-19 since

January 2020 when the Singapore and Hong Kong offices started

working remotely. As COVID-19 has spread, remote working has been

successfully adopted at varying times in the Middle East offices

and across Europe including the UK with minimal disruption of

service to our clients. The Directors have been closely monitoring

the impact on the business ensuring the welfare of the staff and

the clients.

The Directors have prepared cash flow forecasts and a reverse

stress test covering a period of more than 12 months from the date

of releasing these financial statements. This assessment has

included consideration of the forecast performance of the business

for the foreseeable future, the cash and financing facilities

available to the Group and the mitigating actions undertaken to

reduce the impact of COVID-19. In preparing these forecasts, the

Directors have considered sensitivities incorporating the potential

impact of COVID-19 such as a reduction in both revenues and debtor

receipts. The forecasts show that the Group could incur a further

reduction in revenues of up to approximately 15% compared to

existing depressed COVID-19 levels if combined with a minimal

change to the cost base and a reduction of cash collections by up

to 33% compared to current levels and still have sufficient

headroom to operate. In all scenarios, the Group remained in a cash

positive position with headroom throughout and as such there were

no concerns with the banking covenants associated with the Group's

facilities.

At 30 September 2020 the Group had cash reserves of GBP11.2m

with an undrawn amount of GBP2.0m from a revolving credit facility

of GBP5.0m (GBP3.0m drawn down) and an undrawn GBP2.0m Coronavirus

Large Business Interruption Loan Scheme Facility. In addition to

the above, the Group has also agreed a relaxation of its banking

covenants until 30 September 2021.

Based on the cash flow forecasts prepared including appropriate

stress testing, the Directors are confident that any funding needs

required by the business will be sufficiently covered by the

existing cash reserves and the undrawn additional credit facility.

As such these Financial Statements have been prepared on a going

concern basis.

2 SEGMENTAL ANALYSIS

REPORTABLE SEGMENTS

For management purposes, the Group is organised into three

operating divisions: Europe & Americas (EuAm), Middle East (ME)

and Asia Pacific (APAC). This has remained unchanged from the

previous year. These divisions are the basis on which the Group is

structured and managed, based on its geographic structure. The

following key service provisions are provided across all three

operating divisions: quantity surveying, planning / programming,

quantum and planning experts, dispute avoidance / resolution,

litigation support, contract administration and commercial advice /

management. Segment information about these reportable segments is

presented below.

Europe & Middle

Year ended 30 September Americas East Asia Pacific Eliminations Unallocated Consolidated

2020 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Total external revenue 31,033 14,373 7,668 - - 53,074

Total inter-segment revenue 53 576 24 (653) - -

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Total revenue 31,086 14,949 7,692 (653) - 53,074

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Segmental profit 3,988 111 511 - - 4,610

Unallocated corporate

expenses(1) - - - - (1,992) (1,992)

One off severance costs - - - - (767) (767)

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Operating profit 3,988 111 511 - (2,759) 1,851

Finance income - - - - 14 14

Finance expense - - - - (128) (128)

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Profit before taxation 3,988 111 511 - (2,873) 1,737

Taxation - - - - (399) (399)

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Profit for the period 3,988 111 511 - (3,272) (1,338)

------------------------------ --------- ------- ------------ ------------ ----------- ------------

OTHER INFORMATION

Non current assets 3,192 270 87 - 2,242 5,791

Reportable segment assets 16,061 8,796 2,117 - 8,022 34,996

Capital additions(2) 82 37 18 - 212 349

Depreciation and amortisation 543 327 247 - 255 1,372

------------------------------ --------- ------- ------------ ------------ ----------- ------------

(1) Unallocated costs represent Directors' remuneration,

administration staff, corporate head office costs and expenses

associated with AIM.

(2) Capital additions comprise additions to property, plant and

equipment and intangible assets. No client had revenue exceeding

10% of the Group's revenue in the year to 30 September 2020.

Europe & Middle

Year ended 30 September Americas East Asia Pacific Eliminations Unallocated Consolidated

2019 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Total external revenue 29,771 19,645 9,070 - - 58,486

Total inter-segment revenue 47 121 20 (188) - -

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Total revenue 29,818 19,766 9,090 (188) - 58,486

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Segmental profit/(loss) 3,908 1,446 (363) - - 4,991

Unallocated corporate

expenses(1) - - - - (1,902) (1,902)

Share-based payment charge - - - - 243 243

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Operating profit/(loss) 3,908 1,446 (363) - (1,659) 3,332

Finance income - - - - 44 44

Finance expense - - - - (131) (131)

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Profit/(loss) before taxation 3,908 1,446 (363) - (1,746) 3,245

Taxation - - - - (497) (497)

------------------------------ --------- ------- ------------ ------------ ----------- ------------

Profit/(loss) for the

period 3,908 1,446 (363) - (2,243) 2,748

------------------------------ --------- ------- ------------ ------------ ----------- ------------

OTHER INFORMATION

Non current assets 3,200 379 129 - 214 3,922

Reportable segment assets 11,707 9,609 3,832 - 6,491 31,639

Capital additions(2) 43 190 77 - 28 338

Depreciation and amortisation 99 145 100 - 74 418

------------------------------ --------- ------- ------------ ------------ ----------- ------------

(1) Unallocated costs represent Directors' remuneration,

administration staff, corporate head office costs and expenses

associated with AIM.

(2) Capital additions comprise additions to property, plant and

equipment and intangible assets. No client had revenue exceeding

10% of the Group's revenue in the year to 30 September 2019.

Geographical information

2020 2019

External revenue by location of customers GBP000 GBP000

------------------------------------------ ------- -------

UK 17,622 16,709

UAE 5,757 9,124

Oman 5,043 6,004

Saudi Arabia 2,589 806

Singapore 2,413 3,608

Netherlands 2,230 2,294

Germany 2,193 2,461

France 1,953 2,149

Qatar 1,877 3,582

Ireland 1,599 533

Australia 1,393 1,559

Canada 1,027 1,298

Indonesia 1,006 -

Spain 955 1,246

Malaysia 949 1,812

United States 943 771

Italy 506 514

Denmark 390 161

Belgium 365 570

Russia 353 365

Poland 327 485

Kuwait 286 430

South Korea 210 42

Hong Kong 193 288

Croatia 192 70

Vietnam 127 84

India 30 518

Luxembourg 5 114

Kazakhstan - 122

Other countries 541 767

------------------------------------------ ------- -------

53,074 58,486

------------------------------------------ ------- -------

Geographical information of Non current assets

2020 2019

GBP000 GBP000

------------ ------- -------

UK 4,927 3,396

UAE 275 184

Netherlands 144 10

Oman 123 129

Malaysia 75 43

Hong Kong 68 21

Qatar 53 38

Singapore 46 54

France 33 3

Australia 19 11

Kuwait 12 28

Canada 8 5

USA 8 -

------------ ------- -------

5,791 3,922

------------ ------- -------

3 TAXATION

Analysis of the tax charge

The tax charge on the profit for the year is as follows:

2020 2019

GBP000 GBP000

------------------------------------------------- ------- -------

Current tax:

UK corporation tax on profit for the year 88 165

Non-UK corporation tax 388 568

Adjustments to the prior period estimates (37) (37)

------------------------------------------------- ------- -------

439 696

Deferred tax:

Origination and reversal of temporary difference (40) (199)

------------------------------------------------- ------- -------

Tax charge for the year 399 497

------------------------------------------------- ------- -------

Factors affecting the tax charge

The tax assessed for the year varies from the standard rate of

corporation tax in the UK. The difference is explained below:

2020 2019

GBP000 GBP000

---------------------------------------------------------- ------- -------

Profit before tax 1,737 3,245

---------------------------------------------------------- ------- -------

Expected tax charge based on the standard average rate of

corporation tax in the UK of 19% (2019: 19%) 330 617

Effects of:

Expenses not deductible 8 (24)

Deferred tax - other differences (40) (199)

Foreign tax rate differences 124 206

Adjustment to prior period estimates (37) (37)

Utilisation of losses (47) (168)

Share options exercised - (11)

Unprovided losses 61 113

---------------------------------------------------------- ------- -------

Tax charge for the year 399 497

---------------------------------------------------------- ------- -------

Factors that may affect future tax charges

As at the balance sheet date there are no known reasons that

will affect future tax charges.

4 EARNINGS PER SHARE

2020 2019

GBP000 GBP000

------------------------------------------------------- ----------- ----------

Profit for the financial year attributable to

equity shareholders 1,339 2,747

Compensation for loss of office 767 -

Share-based payment charges and associated costs - (243)

------------------------------------------------------- ----------- ----------

Underlying profit for the year before share-based

payments and compensation for loss of office 2,106 2,504

------------------------------------------------------- ----------- ----------

Weighted average number of shares:

Ordinary shares in issue 53,962,868 53,942,035

Shares held by EBT (3,677) (3,677)

Treasury shares (1,786,937) (619,223)

------------------------------------------------------- ----------- ----------

Basic weighted average number of shares 52,172,254 53,319,135

------------------------------------------------------- ----------- ----------

Effect of Employee share options 2,558,796 3,462,087

------------------------------------------------------- ----------- ----------

Diluted weighted average number of shares 54,731,050 56,781,222

------------------------------------------------------- ----------- ----------

Basic earnings per share 2.6p 5.2p

Diluted earnings per share 2.5p 4.8p

Underlying basic earnings per share before share-based

payments and compensation for loss of office 4.0p 4.7p

------------------------------------------------------- ----------- ----------

5 CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

Some asset and liability amounts reported in the Consolidated

Financial Statements contain a degree of management estimation and

assumptions. There is therefore a risk of significant changes to

the carrying amounts for these assets and liabilities within the

next financial year. The estimates and assumptions are made on the

basis of information and conditions that exist at the time of the

valuation.

The following are considered to be key accounting estimates:

Impairment reviews

Determining whether goodwill is impaired requires an estimation

of the value in use of the cash generating units to which goodwill

has been allocated. The value in use calculation requires an entity

to estimate the future cash flows expected to arise from the cash

generating unit and a suitable discount rate in order to calculate

present value. An impairment review test has been performed at the

reporting date and no impairment is required.

Receivables impairment provisions

The amounts presented in the Consolidated Statement of Financial

Position are net of allowances for doubtful receivables, estimated

by the Group's management based on the expected credit loss within

IFRS 9. This is calculated using a simplified model of recognising

lifetime expected losses based on the geographical location of the

Group's entities and considers historical default rates, projecting

these forward taking into account any specific debtors and

forecasts relating to local economies. At the Statement of

Financial Position date a GBP2,559,000 (2019: GBP2,384,000)

provision was required. If management's estimates changed in

relation to the recoverability of specific trade receivables the

provision could increase or decrease. Any future increase to the

provision would lead to a corresponding increase in reported losses

and a reduction in reported total assets.

Revenue recognition on fixed fee projects

Where the Group enters into a formal fixed fee arrangement

revenue is recognised by reference to the stage of completion of

the project. The stage of completion will be estimated by the

Group's management based on the Project Manager's assessment of the

contract terms, the time incurred and the performance obligations

achieved and remaining.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BZLLFBLLFFBQ

(END) Dow Jones Newswires

December 15, 2020 02:00 ET (07:00 GMT)

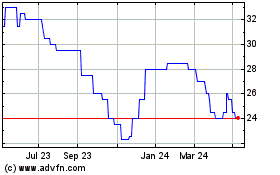

Driver (LSE:DRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

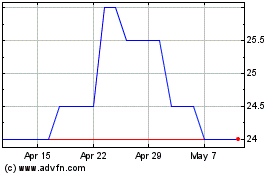

Driver (LSE:DRV)

Historical Stock Chart

From Apr 2023 to Apr 2024