i3 Energy PLC Operational and Financial Update (0370U)

March 31 2021 - 1:00AM

UK Regulatory

TIDMI3E

RNS Number : 0370U

i3 Energy PLC

31 March 2021

31 March 2021

i3 Energy plc

("i3", "i3 Energy", or the "Company")

Operational and Financial Update

i3 Energy plc (AIM:I3E) (TSX:ITE), the independent oil and gas

company with assets and operations in the UK and Canada, is pleased

to provide the following update.

Maiden Dividend

i3 has allocated CAD$2 million (GBP1.16 million) in relation to

its planned Q1 2021 dividend. The Company can only pay a dividend

out of distributable profits and i3 currently has retained losses.

i3 is expecting to effect a reduction of share capital to create

distributable reserves to offset the losses and create surplus

profits. A reduction of the Company's share capital is subject to

loan note holder, judicial, and shareholder approval by way of a

special resolution at a general meeting. i3 expects to shortly

distribute a special resolution and circular to its shareholders

which will specify the exact amount of the proposed reduction in

share capital and explain the background and reasons for the

reduction. Upon approval of the special resolution at the general

meeting, i3 will apply to the UK courts to confirm the reduction

and will immediately thereafter distribute the abovementioned

dividend payment to its shareholders.

Noel Gas Well

As announced on 23 February, in December 2020 i3 completed a

successful flow-test on a horizontal gas well into the prolific

Falher formation at its acreage in Northeast British Columbia

("BC"). The tie-in project in Noel, BC progresses on time and on

budget. Regulatory approvals and First Nation consultations are

ongoing, and construction is anticipated to commence once surface

access conditions allow, following spring breakup (an operational

lull during which snowmelt and frost-release create soft and muddy

ground conditions). The well is expected to be brought on at

approximately 500 boe/d.

Majid Shafiq, CEO of i3 Energy plc, commented:

"Although our balance sheet re-structuring has taken longer than

anticipated, we are delighted that we are close to entering the

final stages of the process to allow the declaration and payment of

our maiden dividend and commence delivery on our promise to

distribute at least 20% of our free cash flow annually to our

shareholders as dividends, subject to necessary consents. Our

Canadian production assets continue to perform well, and we are

actively advancing projects to maintain and grow production from

our current portfolio and are evaluating a number of production

acquisition opportunities. In the UK, negotiations with

counterparties for a farm-out of Serenity appraisal drilling

continue to be advanced."

END

Enquiries:

i3 Energy plc

Majid Shafiq (CEO) / Graham Heath c/o Camarco

(CFO) Tel: +44 (0) 203 781 8331

WH Ireland Limited (Nomad and Joint

Broker)

James Joyce, James Sinclair-Ford Tel: +44 (0) 207 220 1666

Canaccord Genuity Limited (Joint

Broker)

Henry Fitzgerald- O'Connor, James Tel: +44 (0) 207 523 8000

Asensio

Tennyson Securities (Joint Broker) Tel: +44 (0) 207 186 9030

Peter Krens

Camarco

Owen Roberts, James Crothers, Violet Tel: +44 (0) 203 781 8331

Wilson

Notes to Editors:

i3 Energy is an oil and gas Company with a low cost,

diversified, growing production base in Canada's most prolific

hydrocarbon region, the Western Canadian Sedimentary Basin and

appraisal assets in the North Sea with significant upside.

The Company is well positioned to deliver future growth through

the optimisation of its existing 100% owned asset base and the

acquisition of long life, low decline conventional production

assets.

i3 is dedicated to responsible corporate practices and the

environment, and places high value on adhering to strong

Environmental, Social and Governance ("ESG") practices. i3 is proud

of its performance to date as a responsible steward of the

environment, people and capital management. The Company is

committed to maintaining an ESG strategy, which has broader

implications to long-term value creation, as these benefits extend

beyond regulatory requirements.

i3 Energy is listed on the AIM market of the London Stock

Exchange. For further information on i3 Energy please visit

https://i3.energy/

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFBLLXFXLBBBL

(END) Dow Jones Newswires

March 31, 2021 02:00 ET (06:00 GMT)

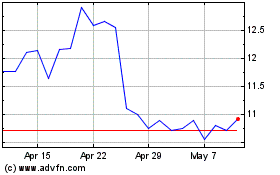

I3 Energy (LSE:I3E)

Historical Stock Chart

From Mar 2024 to Apr 2024

I3 Energy (LSE:I3E)

Historical Stock Chart

From Apr 2023 to Apr 2024