TIDMPSDL

RNS Number : 7165T

Phoenix Spree Deutschland Limited

29 March 2021

Phoenix Spree Deutschland Limited

(the "Company" or "PSD")

Financial results for the year ended 31 December 2020

Phoenix Spree Deutschland Limited (LSE: PSDL.LN), the UK listed

investment company specialising in German residential real estate,

announces its full year audited results for the financial year

ended 31 December 2020.

Financial Highlights

Year to 31 Year to 31 2020 v 2019

December 2020 December 2019

% change

Income Statement

-------------- -------------- -----------

Gross rental income ( m) 23.9 22.6 5.7

-------------- -------------- -----------

Profit before tax ( m) 37.9 28.6 32.5

-------------- -------------- -----------

Dividend ( cents (GBP pence))(1) 7.50 (6.75) 7.50 (6.30) -

-------------- -------------- -----------

Balance Sheet

-------------- -------------- -----------

Portfolio valuation ( m) 768.3 730.2 5.2

-------------- -------------- -----------

Like-for-like valuation growth

(%) 6.3 7.1 -

-------------- -------------- -----------

IFRS NAV per share ( ) 4.48 4.23 5.9

-------------- -------------- -----------

IFRS NAV per share (GBP)(1) 4.04 3.58 12.8

-------------- -------------- -----------

EPRA NTA(2) per share ( cents) 5.28 4.92 7.3

-------------- -------------- -----------

EPRA NTA(2) per share (GBP pence) 4.76 4.16 14.4

-------------- -------------- -----------

EPRA NTA(2) per share total return

( %) 8.8 9.1 -

-------------- -------------- -----------

Net LTV(3) (%) 33.1 32.6 -

-------------- -------------- -----------

Operational Statistics

-------------- -------------- -----------

Portfolio valuation per sqm (

) 3,977 3,741 6.3

-------------- -------------- -----------

Annual like-for-like rent per

sqm growth (%) -15.8 5.6 -

-------------- -------------- -----------

EPRA vacancy (%) 2.1 2.8 -

-------------- -------------- -----------

Condominium sales notarised (

m) 14.6 8.8 65.4

-------------- -------------- -----------

1 - Calculated at FX rate GBP/EUR 1:1.11 2 - New EPRA Best

Practice guidelines from October 2019 introduced three new measures

of net asset value: EPRA net tangible assets (NTA), EPRA net

reinvestment value (NRV) and EPRA net disposal value (NDV). EPRA

NTA is calculated on the same basis as EPRA NAV; and is the most

relevant measure for PSD and therefore now acts as the primary

measure of net asset value. Further information can be found on

page 16. 3 - Net LTV uses nominal loan balances as per note 23

rather than the loan balances on the Consolidated Statement of

Financial Position which take into account Capitalised Finance

Arrangement Fees in the balance.

EPRA NTA underpinned by significant condominium potential

-- Record condominium notarisations of 14.6 million (43

condominium units) during the year to 31 December 2020, a 65.4 per

cent increase from 8.8 million in the prior year.

-- Average achieved value per sqm of 4,320 for residential

units, a 19.2 per cent premium to book value of each property.

-- 70 per cent of Portfolio assets legally split into

condominiums, up from 58 per cent as at 31 December 2019.

-- A further 15 per cent are in application, over half of which

are in the final stages of the process.

Berlin rent controls ("Mietendeckel") and COVID-19

-- Collected rental income per sqm as at 31 December 2020 fell by 15.8 per cent, reflecting the implementation of the final phase of the Mietendeckel in November 2020.

-- Contracted rental income per sqm as at 31 December 2020 grew

by 4.1 per cent year on year. The Company may have the right to

collect the difference between rents at the contracted level and

the rates set by the Mietendeckel in the event that the

Mietendeckel is successfully challenged.

-- New tenant contracts which provide for the reversion to

market rents in the event that the Mietendeckel is ruled to be

unlawful.

-- Underlying EPRA vacancy of 2.1 per cent, a near record low,

reflecting the limited impact of COVID-19 and the Mietendeckel on

the supply of available rental property.

-- Final legal ruling by the Federal Constitutional Court on the

Mietendeckel anticipated in H1 2021. The Company and its legal

advisors remain of the view that the Berlin rent-cap is

unconstitutional and will be removed.

-- Limited impact on rent collection from COVID-19. In excess of

99 per cent of rents collected during 2020, with the collection

rate remaining consistent in 2021 to date.

Continued shareholder value and robust balance sheet

-- Successful refinancing of 37.8 million releasing 12.0 million

of cash. Net LTV remains conservative at 33.1 per cent.

-- Unchanged annual dividend of 7.50 cents. Dividend increased

or maintained since listing in June 2015.

-- Resumption of share buy-back programme in second half of 2020.

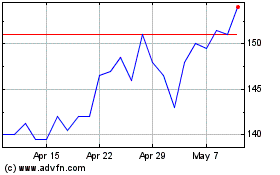

-- As at 26 March 2021, 1.5 per cent of the issued share capital

had been repurchased since the resumption of the share buyback

programme in September 2020 at an average 32 per cent discount to

year-end 2020 EPRA NTA.

Outlook

-- Long-term Berlin demographic trends expected to remain positive:

o Decreased availability of rental stock, exacerbated by the

Mietendeckel, continues to support market rents;

o Condominium pricing expected to remain strong, particularly

for centrally located Berlin apartments.

-- Mietendeckel will continue to materially impact Collected

Rents in 2021 compared to 2020 unless legal challenge is

successful.

-- Pending clarification of the legality of Mietendeckel rules,

the Company will continue to explore all options within the

existing Portfolio to optimise strategic flexibility.

-- Two new condominium construction projects, representing a

combined total of 34 units, are under construction, with expected

completion in early 2022.

-- Condominium sales of 2.9 million to 26 March 2021, a 240 per cent increase versus Q1 2020.

-- Robust business model, a strong balance sheet and good levels

of liquidity mean PSD remains well positioned regardless of the

outcome of the Mietendeckel constitutional review.

Robert Hingley, Chairman of Phoenix Spree Deutschland,

commented:

"I am pleased to report another resilient performance for the

year . We have adapted our strategy to mitigate any short-term

impact on the portfolio and maintained our strategic optionality as

we await a successful challenge of the new Berlin rent controls.

Further progress on condominium splitting, combined with an

acceleration in condominium sales at a premium to book value,

highlights the intrinsic value within the Portfolio. W e remain

confident in the longer-term demographics for Berlin residential

rental market."

Notes to the preliminary announcement

This announcement has been extracted from the annual report and

financial statements for the year ended 31 December 2020 (the

"Annual Report"), which will shortly be available on the Company's

website, www.phoenixspree.com/investors . All page references in

this announcement refer to page numbers in the Annual Report.

The Annual Report has also been submitted to the National

Storage Mechanism and will shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism . Printed

copies of the Annual Report will be distributed to shareholder on

or around 21 April 2021.

For further information, please contact:

Phoenix Spree Deutschland Limited

Stuart Young +44 (0)20 3937 8760

Numis Securities Limited (Corporate Broker)

David Benda +44 (0)20 3100 2222

Tulchan Communications (Financial PR)

Elizabeth Snow

Oliver Norgate +44 (0)20 7353 4200

CHAIRMAN'S STATEMENT

I am pleased to report that PSD has delivered another resilient

performance. As at 31 December 2020, the Portfolio was valued at

768.3 million by Jones Lang LaSalle GmbH, a like-for-like increase

of 6.3 per cent. The Euro EPRA NTA total return per share was 8.8

per cent over the year and the sterling return was 16.0 per cent,

reflecting a fall in the value of sterling. The Company has

additionally delivered record condominium sales and made further

progress in condominium splitting.

This result has been achieved despite the full implementation

during the financial year of the new Berlin rent controls (the

"Mietendeckel") and the negative impact that COVID-19 has had on

the German economy.

Adapting our strategy

During the course of 2020, the Company has complied with, and

fully implemented, the various components of the Mietendeckel. All

of our tenants have been notified as to how they will be affected

by the new rules and, where necessary, rent reductions have been

implemented in accordance with the new rent caps.

PSD has adapted its strategy to mitigate any short-term impact

on the Portfolio, while ensuring it maintains maximum strategic

optionality if, as expected, the Mietendeckel is found to be

unconstitutional. More details of the measures we have taken can be

found in the Report of the Property Advisor.

The financial impact on the Company and its medium-term strategy

are largely dependent on the timing and eventual outcome of the

legal ruling on the Mietendeckel. However, it is encouraging that

the increase in the Portfolio valuation reported by JLL during the

financial year assumes that it is fully implemented for its entire

five-year term. PSD is well positioned to withstand any financial

impact in the event that the new rental regulations are not

overturned. However, PSD and its legal advisors remain of the view

that this legislation will be successfully challenged in the German

Federal court during the first half of 2021.

COVID-19

The Company's overriding priority is the health and wellbeing of

its tenants, work colleagues and wider stakeholders during what has

been a period of significant disruption. Where necessary, the

Company continues to support its tenants, both residential and

commercial, through agreeing, on a case-by-case basis, the payment

of monthly rents or deferring rental payments.

Although the pandemic has caused unprecedented shrinkage in

Germany's post war economy, I am pleased to report that the impact

of COVID-19 on PSD's rent collection has been very limited, with

the level of rent arrears in line with 2019.

I am pleased that PSD and its Property Advisor have continued to

support all of their charitable causes and initiatives during the

pandemic and that PSD has committed to supporting an additional

Berlin charity, Laughing Hearts, in 2021. This charity supports

children living in children's homes and social care.

Share buy-backs and dividend

After fully considering the potential impact of both the

Mietendeckel and COVID-19, the Board is pleased to recommend an

unchanged further dividend of 5.15 cents per share (GBP 4.65 pence

per share). Since listing on the London Stock Exchange in June 2015

and including the announced dividend for 2020 and bought-back

shares held in treasury, 57.9 million has been returned to

shareholders. The Board is committed to continue to provide

shareholders with a secure dividend over the medium term.

During the past year, PSD has secured more flexible and

cost-efficient financing to support the medium and long-term

strategic objectives of the business, providing liquidity in order

to take advantage of opportunities arising from market disruption

caused by changes to the rent laws. However, following the onset of

the COVID-19 pandemic, the Board considered it prudent, at that

time, to suspend PSD's share buy-back programme pending greater

clarity on the financial impact that it might have. As it became

clearer that the pandemic was not materially affecting rent

collection levels, share buy-backs were resumed in September

2020.

Property Advisor

On 21 September 2020 the Company announced that its Property

Advisor, PMM Residential Limited, had changed its name and

rebranded as QSix Residential Limited. This name change has no

impact on the existing property advisory and investor relations

agreement as it relates to PSD and the Board look forward to

continuing its valued partnership in the years to come.

Governance and compliance

The Board recognises the importance of a strong corporate

governance culture and maintains the principles of good corporate

governance, as set out in the Association of Investment Companies

Code of Corporate Governance ("AIC Code"). Further details of how

the Company has applied the provisions of, and complied with, the

AIC Code can be found in the Directors' Report.

During the year, the Company announced the appointments of

Antonia Burgess and Greg Branch as independent, Jersey-based,

non-executive Directors. Antonia and Greg bring with them a wealth

of experience and insight across the real estate, legal and

financial services worlds, which complement and enhance the skill

set of the Board. As previously announced, Charlotte Valeur retired

as a non-executive board member in May 2020. I would like to

welcome Antonia and Greg and thank Charlotte for her service and

contribution to the Company.

Quentin Spicer has signalled his intention to retire from the

Board at the forthcoming Annual General Meeting. Quentin has

overseen the transformation of the Company from inception in 2007,

through to listing on the London Stock Exchange in 2015 and its

expansion thereafter. On behalf of the entire Board and of QSix, I

would like to express our gratitude for his dedicated service over

the past fourteen years. He has provided invaluable guidance and

leadership through a period of considerable change and leaves with

all of our very best wishes.

Corporate responsibility

The Board recognises the importance of operating with integrity,

transparency and clear accountability towards its shareholders,

tenants and other key stakeholders. We understand that being a

responsible Company, balancing the different interests of our

stakeholders and addressing our environmental and social impacts,

is intrinsically linked to the success and sustainability of our

business.

To this end, our 'Better Futures' Corporate Responsibility

('CR') Plan provides a framework to monitor existing activities

better. It has four key pillars that have been integrated

throughout our business operations: Protecting our Environment;

Respecting People; Valuing our Tenants and Investing in our

Communities. This year, we have evolved our CR pillars to align

with EPRA's Environmental, Social and Governance (ESG)

reporting.

Protecting our environment

We recognise that the nature of our business has environmental

and social impacts and that we have a responsibility to consider

and minimise these impacts, where possible. Our Environment Policy

sets guidance as to how PSD, QSix and other key suppliers should

operate to reduce this impact.

Our aim is to strengthen our ESG monitoring and reporting by

introducing EPRA's Sustainability Best Practice Recommendations and

capturing our ESG measurements within their framework. During the

financial year, the Company introduced measures to capture relevant

environmental data for all our buildings that use oil-based energy

and plans to increase coverage in the coming years to include the

buildings using gas and district heating.

Outlook

As we await the outcome of the legal challenge to the

Mietendeckel in 2021, the Board remains confident in the long-term

outlook for PSD, particularly given the strength of demand for

housing in Berlin and the strategic flexibility available to the

Company.

PSD remains well positioned to mitigate any short or medium-term

impact associated with the Mietendeckel and COVID-19. The Company

continues to be supported by a strong balance sheet with good

liquidity and we have maintained our strategic optionality in the

event the rules are found unconstitutional. There continues to be

positive condominium pricing trends and, with 70 per cent of the

portfolio now legally split into condominiums, there is ample scope

to launch further condominium projects, where appropriate.

We are closely monitoring the recent spike in COVID-19 infection

rates in Germany and will continue to support our tenants as we

await further progress on the planned European vaccination

programme.

REPORT OF THE PROPERTY ADVISOR

The Property Advisor's priority throughout 2020 has been to

protect and support the Company's tenants, colleagues and

communities throughout this period of disruption. The Property

Advisor has also continued to manage the impact on the Portfolio of

the introduction of the Mietendeckel (outlined in further detail

below) and the successful acceleration of the condominium strategy,

reaching record levels in 2020.

The Berlin Mietendeckel

Regulations introduced by the Berlin Red-Red-Green coalition

during 2020 to cap, or potentially reduce rents for private

non-subsidised rental properties ("the Mietendeckel") aim to

prevent rents being set at free market levels. This is despite the

fact that Germany already has in place, at the federal level,

tenant protections which rank amongst the strongest in the Western

world.

The uncertainty created by the Mietendeckel has significantly

disrupted the Berlin market. This has been reflected by a reduction

in Berlin transaction activity from prior peak levels, a

significant reduction in the availability of rental accommodation

for tenants who require it most, and a sharp decline in investment

in the stock of Berlin housing. Notwithstanding these impacts,

Jones Lang LaSalle GmbH, the Company's independent property

valuers, have confirmed that, as of 31 December 2020, there had

been no material adverse effect on Berlin residential sales

prices.

These measures have presented challenges to the Company's rental

business model, which has traditionally relied on re-letting at

market rates to justify the considerable investment that

significantly improves the standard of accommodation available to

our tenants. However, PSD is well positioned to withstand any

financial impact if the new rental regulations are not overturned.

Scenarios in the event that the Mietendeckel is not successfully

challenged have been rigorously stress-tested, including any

potential impact on rental income growth and loan covenants.

Moreover, with over 70 per cent of the Portfolio now legally split

into condominiums, the Property Advisor believes the Company has

significant strategic flexibility to adapt its business model by

selling parts of its Portfolio as individual apartments at a

premium to book value if required.

The 2020 Portfolio valuation undertaken by Jones Lang Lasalle,

the Company's independent property valuer, assumes that the

Mietendeckel is implemented for its full five-year lifespan and

therefore incorporates the negative impact on rental income caused

by the Mietendeckel measures. Notwithstanding the fact that the

majority of the Portfolio is now split into condominiums, just 7

per cent were valued under a condominium scenario (see note 17) as

at 31 December 2020 as these were the only active sales

projects.

Legal developments

Whilst the exact timing of a legal decision remains unclear,

developments challenging the legality of the Mietendeckel during

2020 have been encouraging.

In May 2020, the opposition in the Berlin House of

Representatives and a quorum of Federal Parliament MPs lodged cases

in Berlin's Regional Constitutional Court and the Federal

Constitutional Court. Additionally, in June 2020, twelve

constitutional complaints from private owners were filed with the

Federal Supreme Court.

In July 2020, a similar move to introduce a six-year rent freeze

in Bavaria was blocked by the Bavarian Constitutional Court. The

ruling stated that a federal state may not issue its own

regulations that contradict federal rental laws. Whilst this ruling

does not directly impact the legality of the Berlin Mietendeckel,

many of the basic legal arguments against the imposition of a

rent-cap are the same, namely that in Germany, residential tenant

law is governed by the German Civil Code and is therefore a matter

for the Federal and not State Government.

Maintaining strategic flexibility

Pending clarification of the legality of the Mietendeckel rules,

the Company has explored all options within the existing Portfolio

to optimise strategic flexibility. This includes condominium

splitting and sales at a premium to book value, share buybacks at a

discount to EPRA NTA, careful monitoring of capex projects and new

tenant contracts which could allow the retrospective collection of

market rents in the event that the Mietendeckel is ruled to be

unlawful. These measures have been outlined in greater detail

below.

New tenancy agreements

To avoid uncertainty among tenants as to their contractual

rental obligations during the period when the legality of

Mietendeckel remains unresolved, PSD has amended its tenancy

agreements in line with the rest of the industry. These new

agreements specify both rents currently payable as prescribed by

the Mietendeckel whilst in place ("Collected"), and free market

rents which would have been permissible under the German Civil Code

("Contracted").

The new tenancy contracts stipulate that, if the Mietendeckel or

any part thereof is voided, suspended, repealed, or otherwise

abolished, any higher Contracted rent permissible under the German

Civil Code shall once again be payable. If the voiding or

suspension were to be applied on an ex-tunc basis (i.e. from the

outset), back-payments could be sought to cover the difference

between the Collected rent and Contracted rent for the entire term

of the agreement. Tenants have, therefore, been advised by the

Berlin government to set aside appropriate reserves to cover this

possibility.

Measures introduced to comply with the Berlin Mietendeckel

Specifically, the measures introduced by PSD to comply with the

Mietendeckel in 2020 were as follows:

Post 23 February 2020:

-- First time letting and reletting: New rents may not exceed

the prescribed upper rent limit. In some instances, PSD has had to

lower the rent to a level below the rent paid by the previous

tenant.

-- Rent freeze on existing leases: For existing leases, a rent

freeze initially applied, but with no requirement to lower rents,

provided the rent level set at 18 June 2019 had not been increased

since that date. In instances where there had been a rent increase,

PSD reduced rental payments to the June 2019 level.

Post 23 November 2020:

-- Rent reductions: Where the rent limit (adjusted for location

surcharges or discounts) was exceeded by more than 20 per cent, PSD

has had to reduce the rent to 120 per cent of the prescribed rent

limit. Around 44 per cent of tenants have received rent

reductions.

Financial impact

Reported rental income for the financial year ended 31 December

2020 includes the impact of the Mietendeckel measures that have

been implemented to date.

The Property Advisor estimates that the financial impact of

these combined measures for the financial year ended 31 December

2020 was in the region of 4 per cent of gross rental income over

the full year. In the event that the Mietendeckel is not repealed

during 2021, it is estimated that the reduction of annualised net

rental income would be up to 20 per cent, reflecting the

implementation of all rental reductions for a full financial

year.

Financial highlights for the twelve-month period to 31 December

2020

million (unless otherwise stated) Year to Year to

31-Dec-20 31-Dec-19

--------- ---------

Gross rental income 23.9 22.6

--------- ---------

Investment property fair value gain 41.5 41.5

--------- ---------

Profit before tax (PBT) 37.9 28.6

--------- ---------

Reported EPS ( ) 0.31 0.22

--------- ---------

Investment property value 768.3 730.2

--------- ---------

Net debt (Nominal balances)(1) 254.4 237.8

--------- ---------

Net LTV (%) 33.1 32.6

--------- ---------

IFRS NAV per share ( ) 4.48 4.23

--------- ---------

IFRS NAV per share (GBP)(2) 4.04 3.58

--------- ---------

EPRA NTA per share ( ) 5.28 4.92

--------- ---------

EPRA NTA per share (GBP) 4.76 4.16

--------- ---------

Dividend per share ( cents) 7.5 7.5

--------- ---------

Dividend per share (GBP pence)(2) 6.75 6.3

--------- ---------

EPRA NTA per share total return for period

(%)(3) 8.8 9.1

--------- ---------

GBP EPRA NTA per share total return for

period (%)(2) 16.0 2.9

--------- ---------

(1 - nominal loan balances as per note 23 rather than the loan

balances on the Consolidated Statement of Financial Position which

consider Capitalised Finance Arrangement Fees in the balance as per

IAS 23.)

(2 - Calculated at FX rate GBP/EUR 1:1.11)

(3 - Further EPRA Net Asset Measures can be found in note

31.)

Financial results

Reported revenue for the financial year to 31 December 2020 was

23.9 million (31 December 2019: 22.6 million). Profit before

taxation was 37.9 million (31 December 2019: 28.6 million) which

was positively affected by a revaluation gain of 41.5 million (31

December 2019: 41.5 million).

The year-on-year rise in profit before tax is driven by a

property valuation increase alongside a smaller loss on the value

of interest rate swaps than in prior year, a larger gain on

disposal of condominiums and a decline in the performance fee due

to the Property Advisor.

Property expenses rose over the year, reflecting service charge

costs on the new acquisition in Brandenburg not present in the

prior year. The increase in administrative expenses reflects an

acceleration in the volume of assets undergoing separation into

condominiums at the land registry. Reported earnings per share for

the period were 0.31 cents (31 December 2019: 0.22 cents).

Reported EPRA NTA per share rose by 7.3 per cent in the period

to 5.28 (GBP4.76) (31 December 2019: 4.92 (GBP4.16)). After taking

into account the dividends paid during 2020 of 7.5 cents (6.5

pence), which were paid in June and October 2020, the Euro EPRA NTA

total return for the period was 8.8 per cent (2019: 9.1 per cent).

The sterling EPRA NAV per share total return was 16.0 per cent (31

December 2019: 2.9 per cent), reflecting a favourable exchange rate

movement during the financial year.

Dividend

The Board is pleased to declare an unchanged further dividend of

5.15 cents per share (GBP 4.65 pence per share) (31 December 2019:

5.15 cents, GBP 4.40 pence). The dividend is expected to be paid on

or around 7 June 2021 to shareholders on the register at close of

business on 14 May 2021, with an ex-dividend date of 13 May 2021.

Taking into account the interim dividend paid in October 2020, the

total dividend for the financial year to 31 December 2020 is 7.50

cents per share (GBP 6.75 pence per share) (31 December 2019: 7.50

cents, GBP 6.30 pence).

Since listing on the London Stock Exchange in June 2015 to 29

March 2021, including the announced dividend for 2020 and

bought-back shares held in treasury, 57.9 million has been returned

to shareholders. The dividend is paid from operating cash flows,

including the disposal proceeds from condominium projects, and the

Company will seek to continue to provide its shareholders with a

secure dividend over the medium term, subject to the distribution

requirements for Non-Mainstream Pooled Investments, and after full

consideration of the impact of the Mietendeckel and any ongoing

impact associated with COVID-19.

Table: Portfolio valuation and breakdown

31 December 31 December

2020 2019

Total sqm ('000) 193.2 195.2

------------ ------------

Valuation ( m) 768.3 730.2

------------ ------------

Like-for-like valuation growth

(%) 6.3 7.1

------------ ------------

Value per sqm ( ) 3,977 3,741

------------ ------------

Fully occupied gross yield (%) 2.4 2.9

------------ ------------

Number of buildings 98 98

------------ ------------

Residential units(1) 2,555 2,537

------------ ------------

Commercial units 139 142

------------ ------------

Total units 2,694 2,679

------------ ------------

(1 Unit increase year-on-year down to units due to units in the

new acquisition in Brandenburg being available for rent while being

under construction in prior year)

Like-for-like increase in Portfolio Valuation of 6.3 per

cent

The Berlin residential property market has remained resilient

during the financial year and, although transaction volumes

remained below peak levels, investment demand observed by Jones

Lang LaSalle GmbH ("JLL"), the Company's external valuers,

continues to support increased pricing. JLL have conducted a full

RICS Red Book property-by-property analysis, tied back to

comparable transactions in the Berlin market, and have provided a

Portfolio valuation with no matters of concern or material

uncertainty raised. The discounted cash flow methodology used by

JLL assumes that the Berlin rent cap ("the Mietendeckel") is fully

implemented by PSD and remains in place for its full five-year

lifespan.

As at 31 December 2020, the total Portfolio was valued at 768.3

million by JLL, an increase of 5.2 per cent over the twelve-month

period (31 December 2019: 730.2 million).

On a like-for-like basis, after adjusting for the impact of

acquisitions net of disposals, the Portfolio valuation increased by

6.3 per cent in the year to 31 December 2020, and by 3.6 per cent

in the second half of the financial year. This increase reflects

the combined impact of yield compression, supported by a further

decline in risk-free interest rates during the financial year.

The valuation as at 31 December 2020 represents an average value

per square metre of 3,977 (31 December 2019: 3,741) and a gross

fully occupied yield of 2.4 per cent (31 December 2019: 2.9 per

cent). Included within the Portfolio are nine properties valued as

condominiums, with all sales permissions granted, with an aggregate

value of 52.4 million (31 December 2019: five properties, 26.5

million).

Table: Rental income and vacancy rate

31 Dec 31 Dec 31 Dec 30 June 30 June

2020 2020 2019 2020 2020

Collected(1) Contracted(1) Collected(1) Contracted(1)

Total sqm ('000) 193.2 193.2 195.2 194.5 194.5

-------------- --------------- ------- -------------- ---------------

Annualised Rental Income

( m) 16.4 20.3 19.7 19.3 19.7

-------------- --------------- ------- -------------- ---------------

Gross in place rent

per sqm ( ) 7.5 9.3 9.0 8.9 9.1

-------------- --------------- ------- -------------- ---------------

Like-for-like rent per

sqm growth (%) -15.8 4.1 5.6 1.8 4.1

-------------- --------------- ------- -------------- ---------------

Vacancy % 6.8 6.8 6.7 8.0 8.0

-------------- --------------- ------- -------------- ---------------

EPRA Vacancy % 2.1 2.1 2.8 4.3 4.3

-------------- --------------- ------- -------------- ---------------

1 - New tenant agreements specify both rents currently payable

as prescribed by the Mietendeckel whilst in place ("Collected"),

and free market rents which would have been permissible under the

German Civil Code ("Contracted"). This is discussed further under

'New tenancy agreements' section above.

"Collected" like-for-like rental income per sqm decreased by

15.8 per cent

Collected rental income includes the impact of the Mietendeckel

measures that have now been fully implemented. It includes only

rental income that can be legally "Collected" under the terms of

the new Mietendeckel regulations.

As at 31 December 2020, Collected like-for-like rental income

per sqm was 7.5, a decrease of 15.8 per cent compared with the

prior year. This decline reflects the implementation of the final

phase of the Mietendeckel in November 2020, included in December

2020 rent per sqm disclosure.

On an annualised basis, Collected rental income for the month of

December 2020 was 16.4 million, a decrease of 16.7 per cent

compared with the prior year. On a like-for-like basis, excluding

the impact of acquisitions and disposals, Collected like-for-like

rental income was down 16.1 per cent over the same period.

"Contracted" like-for-like rental income per sqm increased by

4.1 per cent

Including any higher contractual rents permissible under the

German Civil Code, Contracted like-for-like rental income per sqm

was 9.3 as at 31 December 2020, an increase of 4.1 per cent

compared with the prior year.

On an annualised basis, Contracted rental income for the month

of December 2020 was 20.3 million, an increase of 2.8 per cent

during the financial year. On a like-for-like basis, excluding the

impact of acquisitions and disposals, Contracted rental income was

up 3.8 per cent over the same period.

The Property Advisor believes that Contracted rental growth

slowed primarily due to the impact of COVID-19 in temporarily

pausing the inward flow of population. This modest slowing compares

to a significant drop in rents in other capital cities such as

London and New York.

Table: EPRA Net Initial Yield (NIY) and "Topped up" Net Initial

Yield (NIY)

(All figures in million unless otherwise stated)

2020 2019

Investment property 768.3 730.1

------- -------

Reduction for NCI share and property

under development (11.3) (10.9)

------- -------

Completed property portfolio 757.0 719.2

------- -------

Estimated purchasers' costs 62.7 57.8

------- -------

Gross up completed property portfolio

valuation 819.7 777.0

------- -------

Annualised cash passing collected rental

income 16.4 19.7

------- -------

Property outgoings (2.8) (3.3)

------- -------

Annualised collected net rents 13.6 16.4

------- -------

Expected increase from Mietendeckel

rent cap expiry (1) 3.2 0

------- -------

"Topped up" Annualised net rents 16.8 16.4

------- -------

EPRA NIY (%) 1.7 2.1

------- -------

EPRA "Topped Up" NIY (%) 2.1 2.1

------- -------

(1 - Under EPRA guidelines, legally allowed lease incentives and

contracted step rents are included in the "Topped up" yield

calculation, since the expectation is that the Mietendeckel is

declared unconstitutional in 2021, the difference between

annualised contracted rents and annualised collected rents has been

included in this line.)

Vacancy at record lows

Reported vacancy as at 31 December was 6.8 per cent (31 December

2019: 6.7 per cent). On an EPRA basis, which adjusts for units

undergoing renovation, development or made available for sale, the

vacancy rate reduced to 2.1 per cent (31 December 2019: 2.8 per

cent), driven by a significant decline in available Berlin rental

property, caused by industry capacity withdrawal following the

introduction of the Mietendeckel.

Berlin Reversionary re-letting premium of 25.2 per cent

During the year to 31 December 2020, 269 new leases were signed,

representing a letting rate of approximately 11.6 per cent of

occupied units. The average Contracted rent achieved on new

lettings was 11.7 per sqm, a 1.5 per cent decrease on the prior

year, and an average premium of 25.2 per cent to passing rents.

This compares to a 36.4 per cent premium in the period to 31

December 2019. The decline in reversionary premium partially

reflects the inclusion of the re-lettings from the recent

acquisition in Brandenburg, where rents are lower than those

achieved in central Berlin. Looking solely at the Berlin portfolio,

the reversionary premium achieved was 33.9 per cent, down from 36.4

per cent in the prior period and reflecting the fact that the

Company has reduced unit renovation spend compared to 2020 and

offers the majority of its apartments in an "as is" state.

Following the introduction of the final phase of the

Mietendeckel on 23 November 2020, which required an automatic rent

reduction to all tenants in line with the new prescribed

Mietendeckel levels, the average reletting rental level on a

Collected basis for the Berlin portfolio was 7.6 per sqm, a

reversionary discount of 7.7 per cent. The Property Advisor

believes this rent level is little more than half the current

market rent and is required to be applied City-wide, regardless of

apartment micro location, size or condition. For this reason, the

Property Advisor believes the policy primarily benefits wealthier

households, in contrast to the main policy intention which was to

make housing more affordable for low-income households.

Limited impact from COVID-19 on rent collection

The Company's overriding priority is the health and wellbeing of

its tenants, work colleagues and wider stakeholders throughout this

period of unprecedented disruption. Where necessary, the Company

continues to support its tenants, both residential and commercial,

through agreeing, on a case-by-case basis, the payment of monthly

rents or deferring rental payments.

To date, the impact on rent collection has been limited. During

the year to 31 December 2020, 99.6 per cent of rents due had been

collected in total compared to 99.2 per cent in the prior year.

Residential rent collection remained particularly resilient and,

although a small number of the Company's commercial tenants were

impacted, 99.3 per cent of commercial rents were collected,

compared with 98.6 per cent in 2019.

Rent collection during the months of January and February 2021

has remained stable and the Company will continue to work

sensitively with any tenants in arrears to agree appropriate and

workable repayment schedules.

Portfolio investment

During the year to 31 December 2020, a total of 4.2 million was

invested across the Portfolio (31 December 2019: 6.5 million).

These items are recorded as capital expenditure in the financial

statements. A further 1.6 million (31 December 2019: 1.7 million)

was spent on maintaining the assets and is expensed through the

profit and loss account. The year-on-year decline in investment

reflects ongoing uncertainty in the Berlin rental market and the

decision to cease the programme of apartment renovations since this

investment cannot currently be recouped in the form of a rent

uplift on re-letting. As a result, apartments are mainly rented in

an "as is" condition, with expenditure focussed on areas which

guarantee tenant safety.

Table: EPRA Capital Expenditure

(All figures in ,000 unless otherwise stated)

31 December 2020 31 December 2019

Acquisitions 0 62

----------------- -----------------

Like-for-like portfolio 3,645 5,948

----------------- -----------------

Development 274 0

----------------- -----------------

Other 252 511

----------------- -----------------

Total Capital Expenditure 4,171 6,459

----------------- -----------------

Record condominium sales

PSD's condominium strategy involves the division and resale of

selected apartment blocks as private units. This is subject to full

regulatory approval and involves the legal splitting of the

freeholds in properties that have been identified as being suitable

for condominium conversion.

Condominium price growth across all major German cities has

remained robust during 2020 having been largely unaffected by

COVID-19 related disruptions. Industry data shows that, in the

fourth quarter of 2020, prices in Berlin had increased by 5 per

cent versus the same period in 2019.

During the financial year to 31 December 2020, 41 condominium

units and two undeveloped attic spaces were notarised for sale (31

December 2019: 18 units). The average achieved notarised value per

sqm for the residential units was 4,320, representing a 19.2 per

cent premium to the most recent assessed book value of each

property and an 8.6 per cent premium to the average residential

Portfolio value as 31 December 2020.

These sales represent a significant increase compared with the

first half of the financial year, during which eight residential

units and two attic spaces were notarised for sale, with an

aggregate value of 3.0 million. In total, the Company has notarised

for sale condominiums with an aggregate value of 14.6 million

during the year to 31 December 2020 (31 December 2019: 8.8

million), a 65 per cent increase compared with the prior year.

As at 31 December 2020, 70 per cent of the Berlin portfolio had

been legally split into condominiums, providing opportunities for

the implementation of further condominium sales projects, where

appropriate. A further 15 per cent are in application, over half of

which are in the final stages of the process.

The Company notes that the Federal Government has previously

discussed the introduction of legislation which may limit the

ability of landlords to split their properties into condominiums.

The implementation of any such measures would be likely to reduce

the stock of apartments available on the market. Given the high

proportion of the Portfolio already split into condominiums the

valuation impact on the Company's Portfolio is expected to be

positive.

Condominium construction

The Property Advisor has completed an exercise to examine the

financial viability of the creation of new condominium units within

the footprint of the existing Portfolio. Two new construction

projects, representing a combined total of 34 units across two

assets, have been granted planning approval.

The first project is for the construction of a new 23-unit

apartment block located in the footprint of a property acquired in

2018. Alongside this, the undeveloped attic of the same property

will be built out with the creation of four new units for sale as

condominiums, or for rental. The second project involves building

out the attic and renovating existing commercial units to create

seven new residential units in an existing asset bought in

2007.

Construction on both projects is expected to commence in the

middle of 2021 and the first units are projected to be available

for sale or rental in the first half of 2022. The total

construction budget for two combined projects is expected to be

11.8 million.

The Company also has building permits to renovate attics in 20

existing assets to create a further 49 units for sale as

condominiums, or as rental stock.

Debt and gearing

As at 31 December 2020, PSD had gross borrowings of 291.4

million (31 December 2019: 280.2 million) and cash balances of 37.0

million (31 December 2019: 42.2 million), resulting in net debt of

254.4 million (31 December 2019: 237.8 million) and a net loan to

value on the Portfolio of 33.1 per cent (31 December 2019: 32.6 per

cent).

Following a strategic review of PSD's liability structure, a new

240 million term loan on improved terms was completed in September

2019. The new facility was agreed with Natixis Pfandbriefbank AG

and comprised of two tranches, being a refinancing facility for 190

million which was drawn down in September 2019, and a further

acquisition facility for 50 million which was drawn down in two

parts in 2020.

The first drawdown of the acquisition facility comprised a 20.3

million facility signed in April 2020, replacing the existing 16.4

million facility acquired as part of the share deal acquisition of

the apartment complex in Brandenburg in December 2019. The new loan

was signed on improved terms with an extended duration and lower

interest rate.

The second drawdown comprised the remaining 29.7 million of the

acquisition facility. The 29.7 million drawdown refinanced 21.4

million of existing loans and offered more flexible terms, released

8.1 million of cash and had a maturity profile in line with the

Company's existing debt facilities. The new debt does not amortise,

whereas the replaced debt incurred amortisation of 1.5 per cent per

annum. Additionally, the new debt allows the sale of assets as

condominiums, offering more flexibility than the previous debt

provider terms.

The increase in gross debt in the period partly results from the

refinancing discussed above, offset by debt repayments associated

with the sale of condominiums during the year, and scheduled

repayments on existing debt.

Nearly all PSD's debt effectively has a fixed interest rate

through hedging. As at 31 December 2020, the blended interest rate

of PSD's loan book was 2.0 per cent (31 December 2019: 2.0 per

cent). The average remaining duration of the loan book at 31

December 2020 had decreased to 6.0 years (31 December 2019: 6.6

years)

EPRA Best Practice Reporting Metrics

In October 2019, the European Public Real Estate Association

(EPRA) published new best practice recommendations (BPR) for

financial disclosures by public real estate companies. PSD supports

this reporting standardisation approach designed to improve the

quality and comparability of information for investors.

The BPR introduced three new measures of net asset value: EPRA

net tangible assets (NTA), EPRA net reinvestment value (NRV) and

EPRA net disposal value (NDV). The Company has adopted these new

guidelines early and applies them in our 2020 Annual Report. EPRA

NTA is calculated in the same way as EPRA NAV has been calculated

in previous reports and is the most relevant measure for our

business and therefore now acts as our primary measure of net asset

value. Where relevant, the previously reported EPRA measures of net

assets are also included below for comparative purpose.

The following table sets out PSD's EPRA KPIs, and references

where more detailed calculations supporting the KPIs can be found

in the report.

Table: EPRA Metrics

Metric Balance Page reference Note reference

EPRA Earnings ( m) (4.5) 121 30

-------- --------------- ---------------

EPRA Net Tangible Assets

/ share (NTA) 5.28 122 31

-------- --------------- ---------------

EPRA Net Reinvestment

Value / share (NRV) 5.93 122 31

-------- --------------- ---------------

EPRA Net Disposal Value

/ share (NRV) 4.44 122 31

-------- --------------- ---------------

EPRA Capital Expenditure

( m) 4.2 14 N/A

-------- --------------- ---------------

EPRA Net Initial Yield

(%) 1.7 13 N/A

-------- --------------- ---------------

EPRA "Topped up" Yield

(%) 2.1 13 N/A

-------- --------------- ---------------

EPRA Vacancy (%) 2.1 1 N/A

-------- --------------- ---------------

EPRA Like-for-Like rental

income (%) (15.8) 1 N/A

-------- --------------- ---------------

Outlook

Predictably, the effect of Berlin rent controls, limiting rent

levels to well below free market levels, has been to reduce the

supply and quality of rental property. Since the Mietendeckel has

been implemented, the number of properties constructed prior to

2014 available for rent has fallen by 70 per cent. Moreover, at a

time when the need for sustainable, environmentally friendly

housing has become ever more apparent, levels of investment in the

fabric of existing properties in the wider market have reduced.

These trends are likely to continue whilst the Mietendeckel remains

in place.

Germany's National Statistics Office estimates that gross

domestic product fell 5 per cent in 2020, as the pandemic ended a

10-year growth period. However, the recession in Germany is

expected to be among the least severe in Europe , assisted by a

decisive fiscal response. By comparison, national output in 2020 is

estimated to have dropped by more than 9 per cent in Italy and

France, and by 11 per cent in the UK. After eight years of budget

surpluses, Germany recorded a budget deficit of almost 5 per cent

of GDP at the end of 2020. By contrast, the UK is expected to

record a deficit of 17 per cent of GDP for the financial year

ending March 2021. Under the German system of wage subsidies to

protect workers' jobs - similar to the UK furlough scheme - the

peak number of people accessing the support was the equivalent of

13 per cent of the labour force, compared with 26 per cent in the

UK.

Notwithstanding these headwinds, investor demand for German

residential property remains high, with CBRE reporting record

investment in 2020. The experience of German residential property

during a year of unprecedented economic disruption has been stable

and reliable cash flows. Whilst rental yields have fallen,

residential property has, compared to negative interest rates

available on German Bunds, offered an attractive risk adjusted

alternative.

The monetary policy pursued by the European Central Bank in the

wake of the COVID-19 pandemic has been extremely accommodating and

is set to remain so in the years ahead, as economies seek to regain

lost momentum. With interest rates set to remain at historically

low levels, relatively higher yields from residential real estate

will remain attractive to institutional investors, such as

insurance companies, pension funds and wealth managers, who are

increasingly looking favourably on multi-family housing as an

alternative to government bonds and other long-dated fixed income

instruments.

Low interest rates will continue to benefit the Condominium

market as well. Favourable mortgage rates, coupled with a lack of

available rental properties, and favourable mortgage versus market

rent dynamics, will continue to provide a tailwind for Condominium

pricing.

Demographic trends to date in Berlin's private rental market

have shown some signs of change in the wake of the Mietendeckel and

COVID-19. Scarcity of supply of high-quality rental property,

coupled with a growing realisation that working remotely is a

viable alternative to a daily city centre commute, has begun to

impact tenant settlement choices. Less densely populated areas in

the greener suburban areas of Berlin, where supply is less

constrained, with more affordable rents and strong commuter links,

now hold increasing appeal for tenants seeking to relocate. This

effect is likely to be seen in increased demand for apartments in

PSD's 2019 acquisition of the apartment complex in Brandenburg.

This phenomenon is by no means Berlin specific, with accelerating

rent momentum and yield compression being observed in many suburban

areas across Germany.

Looking specifically at PSD, the 2020 Portfolio valuation

conducted by JLL, by necessity, assumes that the Mietendeckel will

be in place for its full five-year term. However, the Company and

its legal advisors remain firmly of the view that the Berlin

rent-cap is unconstitutional and, although a formal timetable for a

legal ruling has yet to be published, it is currently expected that

the Federal Court will reach a final decision in the first half of

2021.

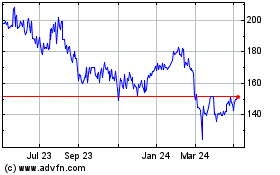

Prior to the announcement of the Mietendeckel laws, the shares

were valued at, or around, Net Asset Value. Although the shares are

currently valued at a significant discount to Net Asset Value, a

positive ruling on the Mietendeckel has the potential to materially

reduce this.

If the Mietendeckel were to be ruled to be legal then the

Property Advisor believes that there is unlikely to be an immediate

impact on the EPRA NTA of the Company but it may impact future

market volumes and ultimately prices of market transactions. The

Company, however, remains well positioned since it expects

condominium prices to continue to rise.

The German Federal Elections are due to be held in September

2021. Currently, there is a "Grand Coalition" led by Angela Merkel

between the CDU and the SPD which has been in power since the

previous Federal Elections in 2017. Any change in the Federal

Government make-up could lead to changes in the current regulations

around tax, compliance and tenant law. The Property Advisor

believes that the Company has a flexible enough business model to

adapt to new regulations caused by a change in Government.

PRINCIPAL RISKS AND UNCERTAINTIES

The Board recognises that effective risk evaluation and

management needs to be foremost in the strategic planning and the

decision-making process. In conjunction with the Property Advisor,

key risks and risk mitigation measures are reviewed by the Board on

a regular basis and discussed formally during Board meetings.

RISK IMPACT MITIGATION MOVEMENT

Legal risk Failing to comply The Property Advisor Unchanged

with current regularly monitors

laws and regulations the impact that

in Germany, the existing and proposed

UK and Jersey, laws or regulation

as well as proposed could have on

changes to laws, future rental

and failing to values and property

implement changes planning applications.

in policies and The Company has

procedures to appointed legal

take into account advisors in Jersey,

new laws could the UK and Germany

lead to financial who advise of

penalties and/or any relevant changes

loss of reputation in legal requirements

of the Company. and are periodically

invited to Board

meetings to report

any changes.

The Company recently

underwent a detailed

review of its

structure, carried

out by EY to ensure

it was working

within the confines

of the law and

regulations of

Jersey.

-------------------------- --------------------------- -----------

Tenant / Letting Property laws The Property Advisor Unchanged

and Political remain under regularly monitors

risk constant review the impact that

by the "Red-Red-Green" existing and proposed

coalition government laws or regulations

in Berlin and could have on

changes to property future rental

regulation and values and property

rent controls planning applications.

for all tenancies The Property Advisor

have negatively feels that the

affected rental Company has a

values in 2020. flexible enough

The most recent business model

tenant law changes to adapt to new

involve the Mietendeckel regulations caused

rent cap, which by a change in

was passed into Government.

law in February The Company has

2020. The Company's sought independent

response to this legal advice regarding

and the legal the Mietendeckel

situation regarding and has been advised

appeals to the that the legislation

German Constitutional is likely to be

Court are set found unconstitutional

out in pages and illegal and

7 to 9 of this should be successfully

Annual Report. challenged in

The German Federal the courts of

Elections are law in the first

due to be held half of 2021.

in September The Company set

2021. Currently, out last year

there is a "Grand how it intends

Coalition" led to adapt its strategy

by Angela Merkel during the period

between the CDU in which the Mietendeckel

and the SPD which remains in law

has been in power to mitigate any

since the previous short-term impact

Federal Elections on the portfolio.

in 2017. Any These measures,

change in the together with

Federal Government the financial

make up could impact in 2020

lead to changes are summarised

in the current on pages 7 to

regulations around 9.

tax, compliance

and tenant law.

-------------------------- --------------------------- -----------

Market risk Economic, political, Although the Board Unchanged

fiscal and legal and Property Advisor

issues can have cannot control

a negative effect external macro-economic

on property valuations. risks, economic

A decline in indicators are

Group property constantly monitored

valuations could by both the Board

negatively impact and Property Advisor

the ability of and Company strategy

the Group to is tailored accordingly.

sell properties The effects of

within the Portfolio COVID-19 on the

at valuations Company's operations

which satisfy and finances have

the Group's investment been limited,

objective. with strong rent

COVID-19 remains collection during

prevalent in 2020. Its outsourced

Germany and potential service providers

restrictions have also managed

to work and assembly to continue operating

have the possibility with limited disruption.

of negatively The Company does

impacting the not anticipate

Company's operations potential further

and tenants' disruption negatively

ability to pay impacting its

rents as they operations in

fall due. 2021 but will

continue to monitor

the situation.

The German Federal

government is

currently considering

introducing new

laws which would

allow States to

block the partitioning

of apartment blocks

into condominiums.

The Berlin Government

is likely also

to adopt this

stance should

the proposals

proceed into law.

This would likely

be a net positive

for the Company

since the supply

of condominiums

would be materially

reduced, increasing

the value of the

stock of over

1700 split units

owned by the Company.

-------------------------- --------------------------- -----------

Financial risk A fall in revenues The Group took Unchanged

could result on new covenants

in the Group when signing the

breaching financial 240 million debt

covenants of with Natixis;

a lender, and Interest coverage

also lead to ratio (ICR), debt

the inability yield, and Loan-to-Value

to repay any covenants. Only

debt and related the Debt yield

borrowing costs. and ICR covenants

A fall in revenue are "hard" covenants

or asset values resulting in an

could also lead event of default

to the Company in case of breach.

being unable The loan-to-value

to maintain dividend covenant is a

payments to investors. cash trap covenant

alone, with no

event of default.

The Company carried

out extensive

sensitivity analysis

prior to signing

these covenants

and even in the

most stressed

Mietendeckel rent

scenarios, no

covenants were

breached.

The Company's

debt with Berliner

Sparkasse contains

annual reporting

rental requirements

but does not contain

any specific covenants.

The Property Advisor

continues to model

its expected revenues

and Covenant levels,

and these are

reported to the

Board as part

of its Viability

assessment which

can be seen on

pages 61 to 63.

At no point in

the three-year

projection process

were any covenants

projected to be

breached. Furthermore,

these projections

also did not anticipate

any reduction

in the dividend

to meet other

requirements.

In the event that

rent levels or

property values

were to fall to

a point where

the covenants

were in danger

of being affected,

the Company would

use its surplus

cashflow and cash

reserves to pay

down the debt

balances to rectify

the situation.

At the most recent

covenant test

date, in January

2021, all covenants

were cleared.

-------------------------- --------------------------- -----------

Outsourcing risk The Group's future Since the Company Unchanged

performance depends listed on the

on the success London Stock Exchange,

of its outsourced the Property Advisor

third-party suppliers, has expanded headcount

particularly through the recruitment

the Property of several additional

Advisor, QSix, experienced London

but also its and Berlin-based

outsourced property personnel. Additionally,

management, IFRS senior Property

and German GAAP Advisor personnel

accountants, and their families

and its administrative retain a stake

functions. The in the Group,

departure of aligning their

one or more key interests with

third-party providers other key stakeholders.

may have an adverse In November 2018,

effect on the the Company announced

performance of that it had signed

the Group. a new Property

Advisor agreement

with QSix, committing

the Property Advisor

to the Company

for the foreseeable

future.

The key third

parties responsible

for property management,

accounting and

administration

are continually

monitored by the

Property Advisor,

and also have

to provide responses

annually to a

Board assessment

questionnaire

regarding their

internal controls

and performance.

These questionnaires

are reviewed annually

by the Board.

-------------------------- --------------------------- -----------

IT and Cyber The Company is Review of IT systems Unchanged

Security risk dependent on and infrastructure

network and information in place to ensure

systems of various these are as robust

service providers as possible. Service

- mainly the providers are

Property Advisor, required to report

Property Manager to the Board on

and Administrator, request, and at

and is therefore least annually

exposed to cybercrimes via the Board

and loss of data. questionnaires,

As cyber-crime on their financial

remains prevalent controls and procedures.

across Europe, A detailed review

this is considered of all IT processes

a significant led to the introduction

risk by the Group. of new invoice

A breach could payment software,

lead to the illegal as well as introducing

access of commercially new IT and Communication

sensitive information platforms to ensure

and the potential all communications

to impact investor, are carried out

supplier and in a secure environment.

tenant confidentiality Service providers

and to disrupt are also required

the business to hold detailed

of the Company. risk and controls

registers regarding

their IT systems.

The Board reviews

service organisations'

IT reports as

part of Board

meetings each

year.

-------------------------- --------------------------- -----------

Lack of Investment Availability The Property Advisor Increasing

opportunity of potential has been active

investments which in the German

meet the Company's residential property

investment objective market since 2006.

can be negatively It has specialised

affected by supply acquisition personnel

and demand dynamics and an extensive

within the market network of industry

for German residential contacts including

property and property agents,

the state of industry consultants

the German economy and the principals

and financial of other investment

markets more funds. It is expected

generally. that future acquisitions

will be sourced

from these channels.

While the market

in Berlin is currently

challenging due

to the recently

introduced Mietendeckel,

the Property Advisor

believes that

this will create

other opportunities,

including densification

projects within

the current Portfolio

and acquiring

in the suburbs

of Berlin, outside

the scope of the

Mietendeckel,

where the growth

potential is more

promising.

-------------------------- --------------------------- -----------

Going concern

The Directors have reviewed cashflows for the period of 12

months from the date of signing using assumptions which the

Directors consider to be appropriate to the current financial

position of the Group with regard to revenues, its cost base, the

Group's investments and borrowing and debt repayment plans. These

projections show that the Group should be able to operate within

the level of its current resources and expects to manage all debt

covenants for a period of at least twelve months from the date of

approval of the financial statements. The Group's going concern

assumption is based on the outcome of a variety of scenarios that

show the Group's ability to withstand the potential market

disruption arising from events such as the Mietendeckel, and

COVID-19. The Group's business activities together with the factors

likely to affect its future development and the Group's objectives,

policies and processes for managing its capital and its risks are

set out in the Strategic Report and in notes 3 and 32. After making

enquiries and having regard to the FRC's Guidance for Companies on

COVID-19 issued in December 2020, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future, and, therefore,

continue to adopt the going concern basis in the preparation of the

financial statements.

Viability Statement

The Directors have assessed the viability of the Group over a

three-year period. The Directors have chosen three years because

that is the period that broadly fits within the financing and

development cycle of the business. The Viability Statement is based

on a robust assessment of those risks that would threaten the

business model, future performance, solvency or liquidity of the

Group, as set out in the assessment of risks described earlier in

this document. For the purposes of the Viability Statement the

Directors have considered, in particular, the impact of the

following factors affecting the projections of cash flows for the

three-year period ending 31 December 2023:

a) the potential operating cash flow requirement of the

Group;

b) seasonal fluctuations in working capital requirements;

c) property vacancy rates;

d) rent arrears and bad debts;

e) capital and administration expenditure (excluding potential

acquisitions as set out below) during the period;

f) condominium sales proceeds;

g) the impact of the Mietendeckel in the event a legal challenge

is unsuccessful, which the Board considers to be unlikely; and

h) the continuing impact of COVID-19; and

i) condominium construction development costs

The assumptions on the effect of the Mietendeckel and COVID-19,

as they relate to the Company, were assessed by the Board. They are

intended to demonstrate the degree of stress that the Company is

able to withstand over an extended period. The Board considers that

it is unlikely that the more severe assumptions made with respect

to the Mietendeckel and COVID-19 will represent a real-life

scenario as the Company believes that the Mietendeckel will be

found unconstitutional and, as the Company's revenues and general

operations were relatively unaffected by COVID-19 in 2020, there is

not expected to be any significant impact from COVID-19 either in

2021.

In response to the risks posed by the Mietendeckel the Directors

applied additional stresses to the model as described below.

In the event that the Mietendeckel is not reversed, the Group

has estimated that it could have a material impact on its revenues

as set out in page 9. The cash impact of this fall in revenues

could be mitigated in full by reducing capital expenditure down to

a level of essential maintenance only, to preserve the condition of

the assets to required standards. Furthermore, as demonstrated in

2020, the Group could increase sales of condominiums over the

forecast period to mitigate any falls in revenue.

Financial modelling and stress testing was carried out on the

Group's cashflows taking into account the Mietendeckel and

COVID-19, and the following assumptions, which the Directors

consider to be reasonable estimates of a worst case scenario, were

made with respect to the operating metrics of the Company:

-- COVID-19 leads to an increase in tenant arrears up to

December 2021 - current tenant arrears stand at around 1 per cent

of total revenues;

-- Major changes in tenant law lead to necessary increases in legal and administrative expenses;

-- Regulatory authorities move to impede sales of condominiums,

leading to a fall in revenue arising from these sales;

-- Changes in local building regulations lead to an increase in

mandatory capex across all assets, as well as new projects;

-- dividends are maintained at current levels throughout the

projected three-year period but remain a potential source of

mitigation from interim 2021 onwards if cash retention is required;

and

-- the Mietendeckel remains in force throughout the projected period.

After applying the assumptions above, individually and

collectively, there was no scenario in which the viability of the

Company over the next three years was brought into doubt from a

cashflow perspective. Under the stresses set out above, mitigation

may be required in 2022 and 2023 and headroom could be obtained in

the following ways:

-- reducing the dividend to preserve cash;

-- cancellation of larger capital expenditure projects; and

-- selling individual assets, or condominiums to release cash.

Under these stressed assumptions used to assess viability,

including the impact of COVID-19, the Group is projected to be able

to manage all banking covenant obligations during the period using

the available liquidity to reduce debt levels, as appropriate.

The projection of cash flows does not include the impact of

further potential property acquisitions over the three-year period,

as these acquisitions are discretionary in nature, though the

cashflows do include the proposed condominium construction referred

to on page 15. In this respect, the Directors complete a formal

review of the working capital headroom of the Group for all

material acquisitions.

On the basis of the above, and assuming the principal risks are

managed or mitigated as expected, the Directors have a reasonable

expectation that the Group will be able to continue in operation

over the three-year period of their assessment.

Consolidated Statement

of Comprehensive Income

For the year ended

31 December 2020

Year Year

ended ended

Notes 31 December 31 December

2020 2019

'000 '000

Continuing

operations

Revenue 6 23,899 22,600

Property expenses 7 (16,437) (14,196)

Gross profit 7,462 8,404

Administrative

expenses 8 (3,263) (3,103)

Gain on disposal of investment property

(including investment property held

for sale) 10 2,178 858

Investment

property

fair value gain 11 41,458 41,491

Performance fee

due to property

advisor 27 439 (2,798)

Separately

disclosed

items 12 - (278)

Operating profit 48,274 44,574

Net finance charge 13 (10,417) (16,013)

Profit before

taxation 37,857 28,561

Income tax expense 14 (7,550) (5,817)

Profit after

taxation 30,307 22,744

Other - -

comprehensive

income

Total

comprehensive

income for the

year 30,307 22,744

================================= ==============================

Total

comprehensive

income

attributable

to:

Owners of the

parent 29,788 22,293

Non-controlling

interests 519 451

30,307 22,744

================================= ==============================

Earnings per share

attributable

to the owners of the

parent:

From continuing

operations

Basic ( ) 30 0.31 0.22

Diluted ( ) 30 0.30 0.22

================================= ==============================

Consolidated Statement

of Financial Position

At 31 December

2020

As at As at

Notes 31 December 31 December

2020 2019

'000 '000

ASSETS

Non-current assets

Investment

properties 17 749,008 719,521

Property, plant

and equipment 19 42 54

Other financial

assets at

amortised

cost 20 901 876

Deferred tax

asset 14 2,880 2,529

752,831 722,980

Current Assets

Investment

properties

- held for sale 18 19,302 10,639

Other financial

assets at

amortised

cost 20 - 1,590

Trade and other

receivables 21 8,414 7,937

Cash and cash

equivalents 22 36,996 42,414

64,712 62,580

Total assets 817,543 785,560

================================= ==============================

EQUITY AND

LIABILITIES

Current

liabilities

Borrowings 23 1,018 17,752

Trade and other

payables 24 9,018 7,236

Other financial

liabilities 26 - 6,951

Current tax 14 550 1,413

10,586 33,352

Non-current

liabilities

Borrowings 23 286,531 258,502

Derivative

financial

instruments 25 18,197 15,979

Deferred tax

liability 14 68,273 60,825

373,001 335,306

Total liabilities 383,587 368,658

================================= ==============================

Equity

Stated capital 28 196,578 196,578

Treasury shares 28 (17,206) (11,354)

Share based

payment

reserve 27 6,369 6,808

Retained

earnings 244,685 221,859

Equity

attributable

to owners of

the

parent 430,426 413,891

Non-controlling

interest 29 3,530 3,011

Total equity 433,956 416,902