TIDMSIXH

RNS Number : 3012S

600 Group PLC

15 November 2021

15 November 2021

The 600 Group PLC

Unaudited Interim Results for the six months ended 30 September

2021

The 600 Group PLC ("the Group"), the diversified industrial

engineering company (AIM: SIXH), today announces its unaudited

interim results for the six months ended 30 September 2021.

Financial highlights

-- Revenues up 34% to $34.0m (FY21 H1: $25.4m)

-- Underlying* operating profit of $1.4m (FY21 H1: $0.2m)

-- Net debt, excluding leases and $2.2m of USA PPP funding now

forgiven, of $14m (FY 20 H1: $16.7m, FY21 year end: $12.7m)

-- Orderbook at record $23m - more than double that of the same

time in the previous year and particularly strong in higher margin

Laser business

Strategic & operational highlights

-- Strong recovery from the pandemic with the Group emerging as

a leaner organization positioned for growth

o Activity now back above pre-pandemic levels with record order

book and enquiry pipeline

o Particularly strong demand in higher-margin laser business -

CMS winning large new orders including the largest in its history

and as TYKMA Electrox continues to transition from commoditized

products to a more custom machine focus

-- Strengthened operations and diversified business in key markets

o Integration of Laser Division processes - sales operation and

distribution network now serves both TYKMA Electrox and CMS

o Machine Tools Division established new German operation, a

substantial market that diversifies revenues and is expected to

make a maiden contribution to trading in the second half of the

year

-- Significant pipeline of opportunities ahead with the Group

well positioned for growth in both divisions

o Well positioned to capitalize on orderbook with improved

balance sheet, strengthened operations and skilled workforce

* from continuing operations, before adjusting items .

Paul Dupee, Chairman of the Group, commented:

"We have emerged from the pandemic with a record orderbook,

strengthened operations and the foundations for sustained growth.

The Group successfully retained our highly skilled workforce while

transforming into a leaner, more efficient organization. This

ensured we were able to seamlessly resume operations and capitalize

on the growing orderbook for our market-leading products and

services.

"Industrial activity has now surpassed pre-pandemic levels and

our forward sales are greater than ever before heading into the

second half of the year. Growth is particularly strong in our laser

division where we are benefitting from CMS' focus on high-end

machines and the strategic pivot by TYKMA to manufacture

higher-margin custom machines. As a result, our orderbook not only

reflects increased demand for our products, but also an improvement

in the quality of future earnings.

"While mindful of the ongoing uncertainty caused by COVID-19,

the Board is increasingly confident of the outlook for the Group

and excited about the opportunities ahead."

Enquiries:

The 600 Group PLC

Paul Dupee, Executive Chairman Tel: +1-407-818-1123 / 01924

Neil Carrick, Company Secretary 415000

Instinctif Partners Tel: 0207 457 2020

Tim McCall

Cenkos Securities plc (Nominated Adviser Tel: 020 7397 8900

and Broker)

Ben Jeynes / Max Gould (Corporate Finance)

Alex Pollen / Henry Nicol (Sales)

The 600 Group Plc

Chairman's Statement for the six months ended 30 September

2021

Overview

The six-month period ended 30 September 2021 has seen the Group

recover strongly from the impact of the COVID-19 pandemic with much

improved order intake, which has been particularly strong in the

higher-margin laser Division. Thanks to the operational cost

savings and government assistance programs during the pandemic the

businesses were able to keep their core teams and skilled

workforces together. This has allowed the businesses to react

quickly to the significant increase in activity now being seen

which is above pre-pandemic levels.

Revenue was up 34% to $34m on the same period last year and the

current order book at $23m is more than double that of the previous

year, providing a strong base for the second half of the financial

year. Working capital has increased to support the significant

uplift in activity, although borrowings are on a par with the

previous half year at $16.2m and include $2.2m of USA Government

Paycheck Protection Program (PPP) loans which were subsequently

forgiven in early November 2021 and will be shown as other income

in the second half of the year.

Results

Revenue was up 34% at $34.0m (FY 21 H1: $25.4m) with net

underlying operating profit (excluding adjusting items) at $1.4m

(FY21 H1: $0.2m).

After taking account of interest on bank borrowings, loan notes

and lease liabilities, the underlying profit for the Group pre-tax

before adjusting items was $0.7m (FY21 H1: loss $0.6m) and a profit

of $0.7m (FY 21 H1: loss $1.2m) after adjusting items.

The total profit for the financial period on continuing

activities was $1.8m (FY 21 H1: loss $1.1m), providing Basic

earnings of 1.52 cents (equivalent to 1.10p) per share (FY 210 H1:

loss 0.93 cents (equivalent to 0.78p loss). The underlying

continuing earnings per share (excluding adjusting items) were

0.45c (equivalent to 0.33p) (FY 21 H1: loss 0.36c (equivalent to

0.29p loss).

Given the continuing Global uncertainty no dividend is

proposed.

Financial position

Inventory levels have increased to support the significant

uplift in activity but also as a result of supply issues where

additional quantities are in transit due to extended delivery times

as a consequence of container and transport issues. The Laser

business has also brought forward several months of critical

components to secure supply and also hedge against price increases.

The machine tools Division has also invested in stock for the new

German operation during this period. Inventory overall has

increased by $5.4m since 31 March 2021 to $23.3m.

Trade and other receivables have also seen an increase from

$8.6m at March 2021 to $9.8m. Receivables in Lasers, in particular

on the custom higher specification sales, usually benefit from a

significant deposit with order which helps to keep working capital

lower in that Division.

Trade and other payables have increased in line with the revenue

increase leaving the overall working capital increase at 23%

($4.2m).

Investment in new equipment and improvement to the facilities at

CMS of $0.35m has been made during the period to bring more

operations in house and help improve efficiencies as the volumes

increase.

The three USA businesses took advantage in February 2021 of the

second round of Government assistance under PPP legislation

totaling $2.2m. These loans are included in debt at 30 September

2021 but were subsequently forgiven in early November 2021. The

forgiveness will be shown in other income in the second half of the

financial year.

Total debt, excluding leases, at 30 September 2021 was $16.2m

against $12.7m at 31 March 2021 and $16.7m at 30 September 2020.

The debt at 30 September 2021 includes the $2.2m of PPP funding

which has subsequently been forgiven.

The UK machine tools business also continues to have a

government assistance loan repayable in September 2023 under the

Coronavirus Large Business Interruption Loan Scheme (CLBILS). The

repayment date of the Sterling denominated loan notes of $10.8m was

extended by 18 months to 14 August 2023 in July as were the 43.95m

warrants to subscribe for ordinary shares at 20p.

Both Bank of America and HSBC continue to be very supportive

during these difficult times and the annual reviews of the working

capital facilities totaling $11m have recently been renewed for a

further 12 months. There remains very limited utilization of these

facilities and the Group remains covenant compliant.

Adjusting items

Adjusting Items have been noted separately to provide a clearer

picture of the Group's underlying trading performance and are set

out in note 4. The amortisation of acquisition intangibles relating

to the acquisition of CMS of $0.2m has been recorded as an

adjusting item in operating expenses as has the cost of prior

periods unpaid duty in TYKMA. As a consequence of the extension of

the repayment date of the loan notes a credit of $0.2m is recorded

in financial income in respect of the adjustment to the carrying

value of the amortised cost. The remaining discounted amount and

costs will be amortised over the remaining term to August 2023 and

the comparatives show the amortisation of the loan note discounting

costs as adjusting items within finance costs. As a result of the

change in the rate of UK Corporation tax from 19% to 25% there is a

credit of $1.3m shown in adjusting items taxation reflecting the

increased value of the deferred tax assets in the UK.

Operating activities

Industrial Laser systems

The industrial laser Division experienced significant order

growth from March 2021 onwards. This was particularly strong in the

higher margin custom products where CMS specialises and into which

the TYKMA Electrox business has migrated from the more commodity

end of the market.

The orderbook at the end of September 2021 was nearly $12m

against just over $3m at the same time last year.

New machinery and improvements to the CMS site have been made

during the period to improve efficiency and bring more operations

in house. The Laser Division has also seen disruption and price

increases in the supply chain. Several critical components

including micro processing chips have been bought forward several

months to secure supplies and hedge against price increases which

has pushed up stockholding levels.

The Laser Division internal sales operation and distribution

network now serves both TYKMA Electrox and CMS and further synergy

benefits are being gained in cross fertilization of technology and

product knowledge between the two businesses.

The development of new techniques and technology is forefront to

the Division and the Group is supportive of this through both

internal R &D and the search for appropriate bolt on

acquisitions.

The results of the division were as follows:

FY22 H1 FY21 H1

$m $m

Revenues 15.2 9.85

Operating profit* 1.79 0.24

Operating margin* 11.8% 2.4%

*from continuing operations, before adjusting items.

Machine tools and precision engineered components

Machine tool activity globally has seen a bounce back from the

effects of the COVID-19 pandemic and although there remains some

concern over COVID variants, supply chain and transportation

issues, the forecasts for the industry are for continued double

digit growth through 2021 and 2022. Both the UK and USA operations

experienced growth of over 25% against the same period in the prior

year, but Australian volumes struggled, and the business made a

small operating loss with much of the country in various lockdowns

until very recently. The Divisional growth overall was 21% up on

the same period last year.

Order intake remains strong and the Divisional orderbook at over

$10m is up over 130% on the same time last year.

The German operation, in Dortmund, was established during the

period, although only started trading in the second half of the

financial year, with this reporting period incurring the set-up

costs. This is an important market, almost the size of the USA, in

machine tools and where the Colchester brand name is well known.

The new operation will promote the direct sale of higher

specification machines, support the existing distribution

businesses and will reduce the impact of tariffs on UK to Europe

sales.

All businesses have seen price increases in their supply chains

and transportation cost increases and delivery issues due to

container shortages, dock and lorry delays resulting from the

increased global demand and labour shortages. Price increases and

transport surcharges have largely had to be passed on to the end

users.

The results of the division were as follows:

FY22 H1 FY21 H1

$m $m

Revenues 18.81 15.55

Operating profit* 0.78 0.74

Operating margin* 4.2% 4.8%

*from continuing operations, before adjusting items.

Summary and outlook

The Group has seen a significant increase in activity in this

first six months of the financial year and has a substantial order

book and enquiry pipeline going into the second half of the year.

The de-risking of the Group, both operationally and financially, in

the recent past has created a platform from which it is now

delivering on the strength of the Group's brands and technology and

expanding the businesses into increasingly diversified higher

margin niche markets worldwide.

Whilst there will continue to be concerns over COVID variants

and supply chain disruption, given the strong orderbook activity

and backlog the Board is confident that the fundamentals of brand

promotion, investment in new, higher end product capabilities into

new markets and selective acquisitions will lead to improved

shareholder value in the future.

Paul Dupee

Chairman

15 November 2021

The 600 Group Plc

Condensed consolidated income statement (unaudited)

For the 26 week period ended 30 September 2021

Before After Before After

Adjusting Adjusting Adjusting Adjusting Adjusting Adjusting

Items Items Items Items Items Items

26 weeks 26 weeks 26 weeks 26 weeks 26 weeks 26 weeks 52 weeks

ended ended ended ended ended ended ended

30 September 30 September 30 September 30 September 30 September 30 September 31 March

202 1 2 021 2 021 202 0 2 020 2 020 2 021

$000 $000 $000 $000 $000 $000 $000

----------------- ------------ ------------ ------------ ------------ -------------- ------------ --------

C ontinuing

Revenue 34,000 - 34,000 25,398 - 25,398 53,550

Cost of sales (21,769) - (21,769) (16,405) - (16,405) (34,554)

Adjusting

items in

cost of sales - (74) (74) - - - (79)

Gross profit 12,231 (74) 12,157 8,993 - 8,993 18,917

Net operating

expenses (10,787) - (10,787) (8,821) - (8,821) (16,376)

Adjusting

Items in

operating

expenses - (149) (149) - (370) (370) (313)

Operating

profit/(loss) 1,444 (223) 1,221 1 72 (370 ) (1 98 ) 2 ,228

Bank interest 7 - 7 6 - 6 3

Loan note

amortisation

adjustment - 186 186 - - - -

------------ ------------ ------------ ------------ -------------- ------------ --------

Financial

income 7 186 193 6 - 6 3

------------ ------------ ------------ ------------ -------------- ------------ --------

Bank and

other interest ( 535) - (535) ( 555) - (555) (1,126)

Interest

on lease

liabilities (1 85) - (185 ) (1 91) - (191) (373)

Loan note

amortisation - - - - ( 300) ( 300) (642)

------------ ------------ ------------ ------------ -------------- ------------ --------

Financial

expense ( 720) - (720) ( 746) ( 300) ( 1,046) (2,141)

Profit/(Loss) (1,2 38

before tax 731 (37 ) 694 (568 ) (670) ) 9 0

Income tax

(charge)/credit (197) 1,286 1,089 140 - 140 (2,663)

----------------- ------------ ------------ ------------ ------------ -------------- ------------ --------

Profit/(Loss)

for the period

attributable

to equity

holders of (2 ,573

the parent 534 1,249 1,783 (428) (670) (1,098) )

Basic EPS 0.45c 1.52c (0.36c) (0.93c) (2.19c)

Diluted EPS 0.45c 1.49c (0.36c) (0.93c) (2.19c)

Condensed consolidated statement of

comprehensive income (unaudited)

For the 26 week period ended 30 September

2021

26 weeks 26 weeks 52 weeks

Ended Ended Ended

30 September 30 September 31 March

2021 2020 2021

$000 $000 $000

--------------------------------------------- ------------- -------------- ---------

Profit/(Loss) for the period 1 ,783 (1,098) (2,573)

Other comprehensive (expense)/income:

Items that will not be reclassified

to the Income Statement:

Re-measurement of the net defined benefit

asset - 3 210

Property revaluation - 441 -

Deferred taxation - - (51)

--------------------------------------------- ------------- -------------- ---------

Total items that will not be reclassified

to the Income Statement: - 444 159

Items that are or may in the future

be reclassified to the Income Statement:

Foreign exchange translation differences 205 41 514

--------------------------------------------- ------------- -------------- ---------

Total items that are or may be reclassified

subsequently to the Income Statement: 205 41 514

--------------------------------------------- ------------- -------------- ---------

Other comprehensive income for the

period, net of income tax 205 485 673

Total comprehensive income/(expenses)

for the period 1 ,988 (613) (1,900)

--------------------------------------------- ------------- -------------- ---------

Condensed consolidated statement of financial position (unaudited)

As at 30 September 2021

As at As at As at

30 September 30 September 31 March

2021 2020 2021

$000 $000 $000

------------------------------------ ------------- ------------- ---------

Non-current assets

Property, plant and equipment 2,918 2,876 2,808

Goodwill 13,174 13,174 13,174

Other Intangible assets 3,561 3,723 3,726

Deferred tax assets 4,140 4,415 2,765

Right of use assets 8,252 8,712 8,988

------------------------------------ ------------- ------------- ---------

32,045 32,900 31,461

------------------------------------ ------------- ------------- ---------

Current assets

Inventories 23,306 18,735 17,941

Trade and other receivables 9,791 7,473 8,570

Taxation - 75 -

Deferred tax assets 809 1,463 809

Assets classified as held for sale - 1,563 -

Cash and cash equivalents 2,072 3,450 4,997

------------------------------------ ------------- ------------- ---------

35,978 32,759 32,317

------------------------------------ ------------- ------------- ---------

Total assets 68,023 65,659 63,778

------------------------------------ ------------- ------------- ---------

Non-current liabilities

------------- ------------- ---------

Employee benefits (1,090) (1,271) (968)

Loans and other borrowings (12,040) (14,325) (1,590)

Government Loans (1,616) (1,549) (1,656)

Lease Liabilities (7,139) (8,336) (7.801)

Provisions (203) - (248)

(22,088) (25,481) (12,263)

------------------------------------ ------------- ------------- ---------

Current liabilities

Trade and other payables (10,559) (5,956) (8,162)

Deferred tax liability - (195) -

Lease liabilities (1,471) (1,222) (1,505)

Taxation (368) - (546)

Provisions (201) (613) (188)

Government Loans (2,234) (2,234) (2,234)

Loans and other borrowings (2,398) (2,008) (12,202)

------------- ------------- ---------

(17,231) (12,228) (24,837)

------------------------------------ ------------- ------------- ---------

Total liabilities (39,319) (37,709) (37,100)

------------------------------------ ------------- ------------- ---------

Net assets 28,704 27,950 26,678

------------------------------------ ------------- ------------- ---------

Shareholders' equity

Called-up share capital 1,803 1,803 1,803

Share premium account 3,828 3,828 3,828

Revaluation reserve - 1,789 -

Equity reserve 201 201 201

Translation reserve (6,411) (7,089) (6,616)

Retained earnings 29,283 27,418 27,462

------------------------------------ ------------- ------------- ---------

Total equity 28,704 27,950 26,678

------------------------------------ ------------- ------------- ---------

Consolidated statement of changes in equity (unaudited)

As at 30 September 2021

Ordinary Share

share premium Revaluation Translation Equity Retained

capital account reserve reserve reserve Earnings Total

$000 $000 $000 $000 $000 $000 $000

--------------- -------- ------- ----------- ----------- ------- -------- -------

At 28 March

2020 1,803 3,828 1,348 (7,130) 201 28,508 28,558

--------------- -------- ------- ----------- ----------- ------- -------- -------

Loss for the

period - - - - - (1,098) (1,098)

Other

comprehensive

income:

Foreign

currency

translation - - - 41 - - 41

Property

revaluation - - 441 - - - 441

Net defined

benefit

movement - - - - - 3 3

--------------- -------- ------- ----------- ----------- ------- -------- -------

Total

comprehensive

income - - 441 41 - (1,095) (613)

--------------- -------- ------- ----------- ----------- ------- -------- -------

Transactions

with owners:

Credit for

share-based

payments - - - - - 5 5

--------------- -------- ------- ----------- ----------- ------- -------- -------

Total

transactions

with owners - - - - - 5 5

--------------- -------- ------- ----------- ----------- ------- -------- -------

At 30 September

2020 1,803 3,828 1,789 (7,089) 201 27,418 27,950

--------------- -------- ------- ----------- ----------- ------- -------- -------

Loss for the

period - - - - - (1,475) (1,475)

Other

comprehensive

income:

Foreign

currency

translation - - - 473 - - 473

Property

revaluation - - (1,789) - - 1,348 (441)

Net defined

benefit

movement - - - - - 207 207

Deferred tax - - - - - (51) (51)

-------- ------- ----------- ----------- ------- -------- -------

Total

comprehensive

income - - - 473 - 29 (1,287)

--------------- -------- ------- ----------- ----------- ------- -------- -------

Transactions

with owners:

--------------- -------- ------- ----------- ----------- ------- -------- -------

Credit for

share-based

payments - - - - - 15 15

--------------- -------- ------- ----------- ----------- ------- -------- -------

Total

transactions

with owners - - - - - 15 15

-------- ------- ----------- ----------- ------- -------- -------

At 31 March

2021 1,803 3,828 - (6,616) 201 27,462 26,678

--------------- -------- ------- ----------- ----------- ------- -------- -------

Profit for the

period - - - - - 1,783 1,783

Other

comprehensive

income:

Foreign

currency

translation - - - 205 - - 205

Total

comprehensive

income - - - 205 - 1,783 1,988

--------------- -------- ------- ----------- ----------- ------- -------- -------

Transactions

with owners:

Credit for

share-based

payments - - - - - 38 38

-------- ------- ----------- ----------- ------- -------- -------

Total

transactions

with owners - - - - - 38 38

--------------- -------- ------- ----------- ----------- ------- -------- -------

At 30 September

2021 1,803 3,828 - (6,411) 201 29,283 28,704

--------------- -------- ------- ----------- ----------- ------- -------- -------

Condensed consolidated cash flow statement (unaudited)

For the 26 week period ended 30 September 2021

26 weeks 26 weeks ended 52 weeks

ended ended

30 September 30 September 31 March

2021 2020 2021

$000 $000 $000

-------------------------------------------- ------------- --------------- ---------

Cash flows from operating activities

Profit/ (loss) for the period 1 ,783 (1,098) (2,573)

Adjustments for:

Amortisation of intangible assets 207 206 417

Depreciation 383 375 760

Depreciation of IFRS16 Right of use

assets 637 586 1,217

Net financial expense/(income) 527 1,040 2,138

PPP Funding forgiven - - (2,234)

Non-cash adjusting items 74 - (357)

(Profit)/loss on disposal of fixed

assets 1 9 ( 9) (489)

Equity share option expense 38 5 20

Income tax expense/(credit) ( 1,089) (140) 2,663

-------------------------------------------- ------------- --------------- ---------

Operating cash flow before changes

in working capital and provisions 2,57 9 965 1,562

(Increase) /decrease in trade and other

receivables (1,280) 799 (56)

(Increase)/decrease in inventories (5,519) 675 1,887

Increase/(Decrease) in trade and other

payables 2,274 (2,728) (631)

Employee benefit contributions (60) (9) (118)

Cash (used in)/generated from operations (2,006) (298) 2,644

Interest paid (535) (554) (1,126)

Lease interest (185) (191) (373)

Net cash flows from operating activities (2,726) (1,043) 1,145

-------------------------------------------- ------------- --------------- ---------

Cash flows from investing activities

Interest received 7 6 3

Proceeds from sale of property, plant

and equipment - 81 1,745

Purchase of property, plant and equipment (531) (180) (494)

Development expenditure capitalised (58) (38) (228)

Net cash from investing activities (582) (131) 1,026

-------------------------------------------- ------------- --------------- ---------

Cash flows from financing activities

Proceeds from/(Net repayment of) external

borrowing 1,096 (1,479) (5,063)

Government assistance loans - 2,234 4,468

UK CLBILS Loans - 1,549 1,656

IFRS 16 Lease payments (586) (674) (1,383)

Net cash flows from financing activities 510 1,630 (322)

-------------------------------------------- ------------- --------------- ---------

Net (decrease)/increase in cash and

cash equivalents (2,798) 456 1,849

Cash and cash equivalents at the beginning

of the period 4,997 2,878 2,878

Effect of exchange rate fluctuations

on cash held (127) 116 270

-------------------------------------------- ------------- --------------- ---------

Cash and cash equivalents at the end

of the period 2,072 3,450 4,997

-------------------------------------------- ------------- --------------- ---------

Notes relating to the condensed consolidated financial

statements

For the 26-week period ended 30 September 2021

1. Basis of preparation and accounting policies

These interim consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards in conformity with the requirements of the

Companies Act 2006. They do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 31 March 2021 Annual Report.

The financial information for the half years ended 30 September

2021 and 30 September 2020 does not constitute statutory accounts

within the meaning of Section 434 (3) of the Companies Act 2006 and

both periods are unaudited.

The annual financial statements of The 600 Group Plc ('the

Group') are prepared in accordance with International accounting

standard in conformity with the requirements of the Companies Act

2006. The comparative financial information for the year ended 31

March 2021 included within this report does not constitute the full

statutory Annual Report for that period. The statutory Annual

Report and Financial Statements for 2021 have been filed with the

Registrar of Companies. The Independent Auditors' Report on the

Annual Report and Financial Statements for the year ended 31 March

2021 was unqualified, did not draw attention to any matters by way

of emphasis and did not contain a statement under 498(2) - (3) of

the Companies Act 2006.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2021 annual financial statements.

2. SEGMENT ANALYSIS

IFRS 8 - "Operating Segments" requires operating segments to be

identified on the basis of internal reporting about components of

the Group that are regularly reviewed by the Board to allocate

resources to the segments and to assess their performance.

The chief operating decision maker has been identified as the

Board.

The Board consider there to be two continuing operating segments

being machine tools and precision engineered components and

industrial laser systems.

The Board assess the performance of the operating segments based

on a measure of operating profit/(loss). This measurement basis

excludes the effects of Adjusting Items from the operating

segments. Head Office and unallocated represent central functions

and costs.

The following is an analysis of the Group's revenue and results

by reportable segment:

Continuing

26 Weeks ended 30 September 2021 Machine

Tools

& Precision Industrial

Engineered Laser Head Office

Components Systems & unallocated Group Total

Segmental analysis of revenue $000 $000 $000 $000

--------------------------------- ------------ ---------- -------------- -------------

Total revenue 18,806 15,194 - 34,000

--------------------------------- ------------ ---------- -------------- -------------

Operating profit/(loss) pre-

adjusting items 780 1,791 (1,127) 1,444

Adjusting items - (74) (149) (223)

Group operating profit/(loss) 780 1,717 (1,276) 1,221

--------------------------------- ------------ ---------- -------------- -------------

Other segmental information:

Reportable segment assets 31,627 19,745 16,651 68,023

Reportable segment liabilities (10,045) (8,515) (20,759) (39,319)

Intangible & Property, plant

and equipment additions 40 478 71 589

Depreciation and amortisation 497 505 225 1,227

--------------------------------- ------------ ---------- -------------- -------------

2. SEGMENT ANALYSIS (continued)

Continuing

-------------------------------------------------------

26 Weeks ended 30 September Machine

2020 Tools

& Precision Industrial

Engineered Laser Head Office

Components Systems & Unallocated Total

Segmental analysis of revenue $000 $000 $000 $000

-------------------------------- ------------- -------------- -------------- --------

Total revenue 15,551 9,847 - 25,398

-------------------------------- ------------- -------------- -------------- --------

Operating profit/(loss) pre

adjusting items 737 238 (803) 172

Adjusting items - - (370) (370)

-------------------------------- ------------- -------------- -------------- --------

Group operating profit/(loss) 737 238 (1,173) (198)

-------------------------------- ------------- -------------- -------------- --------

Other segmental information:

Reportable segment assets 34,542 14,602 16,515 65,659

Reportable segment liabilities (19,802) (5,250) (12,657) (37,709)

Intangible & Property, plant

and equipment additions 76 135 - 211

Depreciation and amortisation 494 497 176 1,167

-------------------------------- ------------- -------------- -------------- --------

Continuing

-------------------------------------------------------

Machine

52 Weeks ended 31 March 2021 tools

& precision

engineered Industrial Head Office

components laser systems & unallocated Total

Segmental analysis of revenue $000 $000 $000 $000

-------------------------------- ------------- -------------- -------------- --------

Total revenue 32,219 21,331 - 53,550

-------------------------------- ------------- -------------- -------------- --------

Segmental analysis of operating

profit/(loss) before Adjusting

Items 2,801 1,836 (2,017) 2,620

-------------------------------- ------------- -------------- -------------- --------

Adjusting Items 452 (79) (765) (392)

-------------------------------- ------------- -------------- -------------- --------

Group operating profit/(loss) 3,253 1,757 (2,782) 2,228

-------------------------------- ------------- -------------- -------------- --------

Other segmental information:

Reportable segment assets 33,469 13,424 16,998 63,891

Reportable segment liabilities (10,781) (5,586) (20,187) (36,554)

Intangible & Property, plant

and equipment additions 176 432 114 722

Depreciation and amortisation 1,007 1,016 371 2,394

3. NET operating expenses

30 September 30 September 31 March 2021

2021 2020

$000 $000 $000

------------ ------------ -------------

- government assistance 62 380 2,989

- other operating income 7 10 26

Total other operating income 69 390 3,015

----------------------------- ------------ ------------ -------------

30 September 30 September 31 March 2021

2021 2020

$000 $000 $000

----------------------------- ------------ ------------ -------------

- administration expenses 9,058 7,741 16,263

- distribution costs 1,798 1,470 3,128

- adjusting items (note 4) 149 370 313

Total operating expenses 11,005 9,581 19,704

----------------------------- ------------ ------------ -------------

Total net operating expenses 10,936 9,191 16,689

----------------------------- ------------ ------------ -------------

4. Adjusting ITEMS

The directors have highlighted transactions which are material

and unrelated to the normal trading activity of the Group.

In the opinion of the directors the disclosure of these

transactions should be reported separately for a better

understanding of the underlying trading performance of the Group.

These underlying figures are used by the Board to monitor business

performance, form the basis of bonus incentives and are used for

the purposes of the bank covenants.

The items below correspond to the table below;

a) A charge of $0.07m was expensed in cost of sales relating to

US duty and tariff charges from prior year

b) As a result of the outsourcing of manufacturing in the UK in

the prior year, the existing premises were vacated and not sub-let

at the time and therefore provisions were made for unavoidable

costs in prior years, during the last financial year an assignment

of the lease was agreed and many of these provisions were reversed

resulting in a credit of $0.6m. During the current period some

previously paid costs have been refunded in relation to the

original premises costs.

c) The amortisation of the loan note costs and associated costs

are shown in financial expense. These are non cash movements and

relate to the discounting of the loan notes and associated costs

which unwind over the term of the notes. In the current period a

credit of $0.18m was recognised in financial income as the term of

the notes were extended.

d) A charge was incurred as a result of the acquisition of

Control Micro Systems Inc for legal and professional fees.

e) Amortisation of intangible assets, including customer

relationships, acquired through the Control Micro Systems Inc

deal.

f) Fees of $0.01m relating to historical legal claims were expensed in the period

g) Costs in relation to the Group reorganisation in prior

periods relating to the transfer of management functions to Orlando

Florida including the compensation for loss of office for the CFO's

and COO.

h) Profit on the disposal of the freehold premise in Brisbane,

Australia, sold in October 2020, generated a profit of $0.5m and

proceeds of $1.7m.

30 September 30 September 31 March

2021 2020 202 1

$000 $000 $000

--------------------------------------------------- ------------ ------------ --------

Items included in c ost of sales :

US Tariffs & Duty charges relating to prior years

(a) (74) - (79)

--------------------------------------------------- ------------ ------------ --------

(74) - (79)

--------------------------------------------------- ------------ ------------ --------

Items included in operating profit:

Unavoidable lease costs (b) 33 - 3 50

Right of use impairment (b) - - 2 27

Restructuring costs (g) - (195) (928)

Acquisition costs (d) - - (71)

Amortisation of acquisition intangibles (e) (172) (175) (343)

Legal costs (f) (10) - -

Profit on disposal of Australian property (h) - - 4 52

(1 49) (370 ) ( 313)

--------------------------------------------------- ------------ ------------ --------

Items included in financial income/(expense):

Amortisation of loan notes and associated expenses

(c) 1 86 (300) (6 42 )

Total adjusting items before tax (37) (670) (1,034)

--------------------------------------------------- ------------ ------------ --------

Income tax on adjusting items 1,286 - 2 57

Total adjusting items after tax 1,249 (670) (777)

5. Financial income and expensE

3 0 September 30 September 31 March

202 1 2020 2021

$000 $000 $000

Bank and other interest 7 6 3

Loan note amortisation adjustment 186 - -

Financial income 193 6 3

----------------------------------------- ----------------- ------------ --------

Bank overdraft and loan interest ( 36 ) ( 92) ( 172)

Other loan interest (4 89 ) (46 3) (90 7)

Finance charges on finance leases (10) - (12 )

Interest on employee benefit liabilities - - ( 35)

IFRS 16 - Lease interest (18 5 ) (1 9 1) (373)

Amortisation of loan note costs - (3 00) (642)

Financial expense (720 ) ( 1,046) (2,1 41)

----------------------------------------- ----------------- ------------ --------

6. Taxation

3 0 September 30 September 31 March

202 1 2020 202 1

$000 $000 $000

---------------------------------------------------- ------------- ------------ --------

Current tax:

Corporation tax at 2 5 % (202 0 : 19%): - - -

Overseas taxation:

- current period (197) - (526)

---------------------------------------------------- ------------- ------------ --------

Total current tax charge (197) - (526)

---------------------------------------------------- ------------- ------------ --------

Deferred taxation:

- current period - 140 (1,929)

- effect of rate change in UK 1,286 - -

- prior period - - ( 208)

---------------------------------------------------- ------------- ------------ --------

Total deferred taxation charge 1,286 140 (2,137)

---------------------------------------------------- ------------- ------------ --------

Taxation charged/(credited) to the income statement 1,089 140 (2,663)

---------------------------------------------------- ------------- ------------ --------

7. Earnings per share

The calculation of the basic earnings per share of 1.52c

(2020:loss 0.93c) is based on the earnings for the financial period

attributable to the Parent Company's shareholders of $1,783,000

(2020: loss $1,098,000) and on the weighted average number of

shares in issue during the period of 117,473,341 (2020:

117,473,341). At 30 September 2021, there were 8,190,000 (2020:

7,780,000) potentially dilutive shares on option and 43,950,000

(2020: 43,950,000) share warrants exercisable at 20p. The weighted

average effect of these as at 30 September 2021 was 2,100,375

shares (2020: 1,630,000) giving a diluted earnings per share of

1.49c (2020: loss 0.93c).

30 September 30 September 31 M arch

2021 2020 2021

------------------------------------- -------------- ------------ ------------

Weighted average number of shares Shares Shares Shares

Issued shares at start of period 117,47 3 ,3 41 117,473,341 117,473,341

Weighted average number of shares

at end of period 117,473,341 1 17,473,341 1 17,473,341

------------------------------------- -------------- ------------ ------------

Weighted average number of 8,190,000

(2020: 7,780,000) potentially

dilutive shares 2,100,375 1,630,000 2 ,040,000

------------------------------------- -------------- ------------ ------------

Total Weighted average diluted

shares 119,573,716 1 19,103,341 119,5 13,341

------------------------------------- -------------- ------------ ------------

3 0 September 30 September 3 1 March

202 1 2020 2021

$000 $000 $000

Total post tax earnings - continuing

operations 1 ,783 (1,098) (2,573)

Basic EPS 1. 52c (0.93c) (2.19c)

Diluted EPS 1. 49c (0.93c) (2. 19 c)

------------------------------------- ------------- ------------ ---------

Underlying earnings $000 $000 $000

------------------------------------- ------------- ------------ ---------

Total post tax earnings - continuing

operations 1 ,783 (1,098) (2,573)

Adjusting items - per note 4 1 ,249 (670) 777

Underlying earnings after tax 534 (428) (1,796)

------------------------------------- ------------- ------------ ---------

Underlying basic EPS 0.45c (0.36c) (1.53c)

Underlying diluted EPS 0.45c (0.36c) (1.53c)

8. RECONCILIATION OF NET CASH FLOW TO NET DEBT

30 September 3 0 September 3 1 March

2021 202 0 2021

$000 $000 $000

---------------------------------------- ------------ ------------- ---------

(decrease)/increase in cash and cash

equivalents ( 2,798) 456 1,849

(decrease)/Increase in debt and finance

leases ( 325) 2,345 6 , 820

---------------------------------------- ------------ ------------- ---------

(decrease)/Increase in net debt from

cash flows ( 3,123) 2,801 8,669

Net debt at beginning of period (21 ,991 ) (24,142) (24,142)

Government assistance loans USA - (2,234) (2 ,234 )

Government assistance loans UK - (1,549) ( 1,656)

Lease liabilities increase ( 199) ( 221) (502)

Loan costs amortization and adjustments 1 81 (305) (675)

Exchange effects on net funds 3 06 (574) (1,451)

---------------------------------------- ------------ ------------- ---------

Net debt at end of period (2 4,826 ) (26,224) (21,991)

---------------------------------------- ------------ ------------- ---------

9. Analysis of net DEBT

At Exchange/ At

3 1 March Reserve 3 0 September

202 1 movement Other Cash flows 2021

$000 $000 $000 $000 $000

---------------------------------- --------- --------- -------- ---------- -------------

Cash at bank and in hand 4,287 (124) - (2,769) 1,394

Short term deposits (included

within cash and cash equivalents

on the balance sheet) 710 (3) - (29) 678

4,997 (127) - (2,798) 2,072

Debt due within one year (977) - - (1,421) (2,398)

Debt due after one year (1,590) - - 325 (1,265)

Loan Notes due within one year (11,225) 269 10,956 - -

Loan Notes due after one year - - (10,775) - (10,775)

Lease liabilities (9,306) 124 (199) 771 (8,610)

Government assistance loans (3,890) 40 - - (3,850)

Total (21,991) 306 (18) (3,123) (24,826)

---------------------------------- --------- --------- -------- ---------- -------------

10. FAIR VALUE

The group considers that the carrying amount of the following

financial assets and financial liabilities are

a reasonable approximation of their fair value:

Trade and other receivables

Cash and cash equivalents

Trade and other payables

Loans and other borrowings

11. Principal Risks and Uncertainties

The principal risks and uncertainties affecting the Group remain

those set out in the 2021 Annual Report. Those which are most

likely to impact the performance of the Group in the remaining

period of the current financial year are the continuing issues

surrounding the COVID-19 pandemic which may result in exposure to

increased input costs, supply chain and delivery issues and a

downturn in its customers' end markets, particularly in North

America and Europe.

12. Post balance sheet events

On 11 November the three USA operations were all granted

forgiveness of their second round loans under the USA Government

Paycheck Protection Program ("PPP") which in total amounted to

$2.2m. These amounts are expected to be included in other income in

the Consolidated Income Statement for the year ended 31 March

2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPGBWGUPGGRP

(END) Dow Jones Newswires

November 15, 2021 02:00 ET (07:00 GMT)

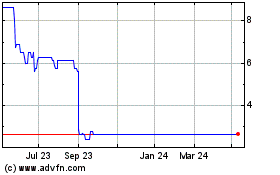

600 (LSE:SIXH)

Historical Stock Chart

From Mar 2024 to Apr 2024

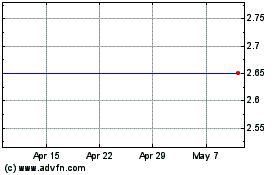

600 (LSE:SIXH)

Historical Stock Chart

From Apr 2023 to Apr 2024