TIDMSTB

RNS Number : 1092R

Secure Trust Bank PLC

03 November 2021

PRESS RELEASE

Secure Trust Bank PLC

LEI: 213800CXIBLC2TMIGI76

3 November 2021

For embargoed release at 07.00 am

SECURE TRUST BANK PLC

Secure Trust Bank: Capital Markets Event and new lending book

growth target

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018.

Secure Trust Bank PLC ('STB') will be hosting a capital markets

event for analysts and institutional investors at 10am today, 3

November 2021.

The event will cover STB's refreshed strategy and the

significant growth opportunities it sees across its businesses. The

event includes presentations from the CEO, CFO and management of

the Retail Finance, Vehicle Finance, Real Estate Finance and

Commercial Finance divisions.

Secure Trust Bank's refreshed strategy is built around three

priorities:

-- Grow: Generate growth and attractive returns in specialist

segments and exploit digital capabilities to build scale and drive

cost efficiency

-- Sustain: Create sustainable value through market expertise

and deep customer knowledge and utilise strong credit discipline,

capital allocation and risk management capabilities

-- Care: Help customers with simple, clear and compelling

products and deliver consistently excellent customer care and swift

outcomes

Secure Trust Bank also announces a new medium--term target for

Lending book growth using year-end 2020 balances as a base. (1) The

target is to deliver 15%+ compounded annual growth rate (CAGR),

over the medium term, demonstrating the potential the Group sees to

scale organically as it emerges from the pandemic. Other than this,

no new material trading information will be disclosed during the

event.

A live webcast of the presentation and slides will be available

at the following link at 10am:

Topic: Secure Trust Bank Capital Markets Day

Time: Nov 3, 2021 10:00 AM London

Join Zoom Meeting

https://us02web.zoom.us/j/81698076010?pwd=dnRnd2N3amJ6WkI3OWUxT3RzTHNpUT09

Meeting ID: 816 9807 6010

Passcode: 742975

Notes:

(1) At 31 December 2020 the Group's total net lending balances

less the Mortgages and Asset Finance portfolios (which have been

disposed of) was GBP2,270.8m.

Enquiries:

Secure Trust Bank PLC

David McCreadie, Chief Executive Officer

Rachel Lawrence, Chief Financial Officer

Tel: 0121 693 9100

Stifel Nicolaus Europe Limited (Joint Broker)

Robin Mann

Gareth Hunt

Stewart Wallace

Tel: 020 7710 7600

Canaccord Genuity Limited (Joint Broker)

Andrew Potts

Tel: 020 7523 8000

ENDS

Forward looking statements

This document contains forward looking statements about the

business, strategy and plans of STB and its current objectives,

targets and expectations relating to its future financial condition

and performance. Statements that are not historical facts,

including statements about STB's or management's beliefs and

expectations, are forward looking statements. By their nature,

forward looking statements involve risk and uncertainty because

they relate to events and depend on circumstances that will occur

in the future. STB's actual future results may differ materially

from the results expressed or implied in these forward-looking

statements as a result of a variety of factors. These include UK

domestic and global economic and business conditions, risks

concerning borrower credit quality, market related risks including

interest rate risk, inherent risks regarding market conditions and

similar contingencies outside STB's control, the COVID-19 pandemic,

expected credit losses in certain scenarios involving forward

looking data, any adverse experience in inherent operational risks,

any unexpected developments in regulation or regulatory, and other

factors. The forward-looking statements contained in this document

are made as of the date of this document, and (except as required

by law or regulation) STB undertakes no obligation to update any of

its forward looking statements.

About the Company:

Secure Trust Bank is an established, well--funded and

capitalised UK retail bank with a 69 year trading track record.

Secure Trust Bank operates principally from its head office in

Solihull, West Midlands, and had 940 employees (full-- time

equivalent) as at 30 June 2021. The Group's diversified lending

portfolio currently focuses on two sectors:

(i) Business Finance through its Real Estate Finance and Commercial Finance divisions,

(ii) Consumer Finance through its Vehicle Finance, Retail

Finance and Debt Management divisions

Secure Trust Bank PLC is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority.

Secure Trust Bank, PLC, One Arleston Way, Solihull, B90 4LH.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEASFAEFKFFFA

(END) Dow Jones Newswires

November 03, 2021 02:59 ET (06:59 GMT)

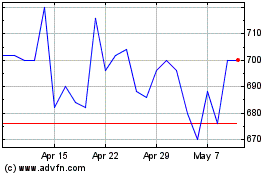

Secure Trust Bank (LSE:STB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Secure Trust Bank (LSE:STB)

Historical Stock Chart

From Apr 2023 to Apr 2024