Imperial Metals Announces Pricing on US$325M High Yield Notes Offering

March 06 2014 - 1:02PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Imperial Metals Corporation (the "Company") (TSX:III) announced today that it

priced at par its previously announced offering of US$325 million aggregate

principal amount of 7% Senior Notes due 2019 (the "Notes"). The Notes will

mature on March 15, 2019, and interest on the Notes will accrue and be payable

semi-annually on each March 15 and September 15, commencing September 15, 2014

The sale of the Notes is expected to be completed on or about March 12, 2014,

subject to customary closing conditions. The Company intends to use the net

proceeds of the Notes to repay existing indebtedness, to fund capital

expenditures related to the Red Chris project, and for general corporate

purposes.

The offer and sale of the Notes will not be registered under the United States

Securities Act of 1933, as amended (the "Securities Act") or the securities laws

of any state or the securities laws of any other jurisdiction. The Notes may not

be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements of the Securities Act and

applicable state securities laws. Accordingly, the Notes will be offered and

sold in the United States only to "qualified institutional buyers" in accordance

with Rule 144A under the Securities Act, and outside the United States in

reliance on Regulation S under the Securities Act. In addition, in all cases,

the Notes may only be offered and sold on a private placement basis pursuant to

an exemption from the prospectus requirements of the Securities Act (British

Columbia) and, if applicable, securities laws in other provinces and territories

in Canada. Further, the Notes may only be offered and sold outside the United

States and Canada on a private placement basis pursuant to certain exemptions

from applicable securities laws.

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy the Notes, nor shall there be any offer or sale of the Notes in

any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Imperial

Imperial is an exploration, mine development and operating company based in

Vancouver, British Columbia. The Company operates the Mount Polley copper/gold

mine in British Columbia and the Sterling gold mine in Nevada. Imperial has 50%

interest in the Huckleberry copper/molybdenum mine and has 50% interest in the

Ruddock Creek lead/zinc property, both in British Columbia. The Company is in

development of its wholly owned Red Chris copper/gold property in British

Columbia.

Cautionary Note Regarding "Forward-Looking Information"

This press release contains "forward-looking information" or "forward-looking

statements" within the meaning of Canadian and United States securities laws,

which we will refer to as "forward-looking information". Except for statements

of historical fact relating to the Company, certain information contained herein

constitutes forward-looking information. When we discuss the Notes offering;

mine plans; costs and timing of current and proposed exploration or development;

development; production and marketing; capital expenditures; construction of

transmission lines; cash flow; working capital requirements and the requirement

for additional capital; operations; revenue; margins and earnings; future prices

of copper and gold; future foreign currency exchange rates; future accounting

changes; future prices for marketable securities; future resolution of

contingent liabilities; receipt of permits; or other matters that have not yet

occurred, we are making statements considered to be forward-looking information

or forward-looking statements under Canadian and United States securities laws.

We refer to them in this press release as forward-looking information. The

forward-looking information in this press release may include words and phrases

about the future, such as: plan, expect, forecast, intend, anticipate, estimate,

budget, scheduled, targeted, believe, may, could, would, might or will.

Forward-looking information includes disclosure relating to the launch of the

Notes offering and the guidance on 2013 annual financial results (including

expected revenues) and project development plans, costs and timing. We can give

no assurance the forward-looking information will prove to be accurate. It is

based on a number of assumptions management believes to be reasonable, including

but not limited to: the continued operation of the Company's mining operations,

no material adverse change in the market price of commodities or exchange rates,

that the mining operations will operate and the mining projects will be

completed in accordance with their estimates and achieve stated production

outcomes and such other assumptions and factors as set out herein.

It is also subject to risks associated with our business, including but not

limited to: the risk that the financing may not be completed on the terms

expected or at all, involving the need to negotiate and execute a purchase

agreement and related documents, the need for continued cooperation of the

dealers and the need to successfully market the Notes; risks inherent in the

mining and metals business; commodity price fluctuations and hedging;

competition for mining properties; sale of products and future market access;

mineral reserves and recovery estimates; currency fluctuations; interest rate

risks; financing risks; regulatory and permitting risks; environmental risks;

joint venture risks; foreign activity risks; legal proceedings; and other risks

that are set out in the Company's Management's Discussion & Analysis in its 2012

Annual Report. If our assumptions prove to be incorrect or risks materialize,

our actual results and events may vary materially from what we currently expect

as provided in this press release. We recommend you review the Company's most

recent Annual Information Form and Management's Discussion & Analysis in its

2012 Annual Report, which includes discussion of material risks that could cause

actual results to differ materially from our current expectations.

Forward-looking information is designed to help you understand management's

current views of our near and longer term prospects, and it may not be

appropriate for other purposes. We will not necessarily update this information

unless we are required to by securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Imperial Metals Corporation

Brian Kynoch

President

604.669.8959

Imperial Metals Corporation

Andre Deepwell

Chief Financial Officer

604.488.2666

Imperial Metals Corporation

Gordon Keevil

Vice President Corporate Development

604.488.2677

Imperial Metals Corporation

Sabine Goetz

Shareholder Communications

604.488.2657

investor@imperialmetals.com

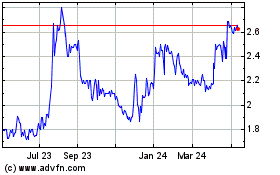

Imperial Metals (TSX:III)

Historical Stock Chart

From Mar 2024 to Apr 2024

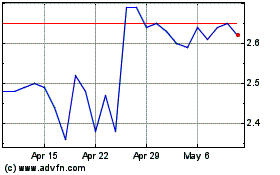

Imperial Metals (TSX:III)

Historical Stock Chart

From Apr 2023 to Apr 2024