false

0001270436

0001270436

2024-06-18

2024-06-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

| Registrant Name |

Cohen

& Co Inc. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 18, 2024

Cohen & Company

Inc.

(Exact name of registrant as specified in its

charter)

| Maryland |

|

1-32026 |

|

16-1685692 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Cira Centre

2929 Arch Street, Suite 1703

Philadelphia,

Pennsylvania |

|

19104 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (215) 701-9555

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

COHN |

|

The NYSE

American Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

As previously disclosed, on June 9, 2023,

J.V.B. Financial Group, LLC (the “Borrower”), a Delaware limited liability company and a broker dealer indirect subsidiary

of Cohen & Company Inc., a Maryland corporation, entered into the Third Amended and Restated Loan Agreement (the “Loan

Agreement”), with Byline Bank, as lender (the “Lender”), and the Borrower as borrower, pursuant to which, among other

things, the Lender agreed to make loans to Borrower, at the Borrower’s request from time to time, in the aggregate amount of up

to $15 million. Further, as previously disclosed, on December 22, 2023 and effective December 21, 2023, the Borrower and the Lender entered

into the First Amendment to Third Amended and Restated Loan Agreement, pursuant to which both the maturity date and the final date upon

which loans could be made under the Loan Agreement were extended to June 18, 2024.

On June 18, 2024, the Borrower and the

Lender entered into the Second Amendment to Third Amended and Restated Loan Agreement (the “Amendment”), pursuant to

which both the maturity date and the final date upon which loans can be made under the Loan Agreement were extended from June 18,

2024 to June 18, 2025. Except as described herein, no other changes were made to the Loan Agreement pursuant to the

Amendment.

The foregoing description of the Amendment does

not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy of which is attached

hereto as Exhibit 10.1 and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

* Filed electronically herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

COHEN & COMPANY INC. |

| |

|

| Date: June 18, 2024 |

By: |

/s/ Joseph W. Pooler, Jr. |

| |

|

Name: |

Joseph W. Pooler, Jr. |

| |

|

Title: |

Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 10.1

SECOND AMENDMENT TO

THIRD AMENDED AND RESTATED LOAN AGREEMENT

This Second Amendment to Third

Amended and Restated Loan Agreement (this “Amendment”) is made as of June 18, 2024, by and between J.V.B. Financial

Group, LLC, a Delaware limited liability company (“Broker/Dealer”), and Byline Bank (“Lender”),

with reference to the following facts:

A. Pursuant

to the terms and conditions of that certain Third Amended and Restated Loan Agreement, dated as of June 9, 2023, as amended by that

certain First Amendment to Third Amended and Restated Loan Agreement, dated as of December 22, 2023, and effective as of December 21,

2023 (the “Loan Agreement”) by and between Broker/Dealer and Lender, Lender agreed to make a revolving loan commitment

to Broker/Dealer in the principal amount of Fifteen Million Dollars ($15,000,000) (the “Loan”). Capitalized terms

used and which are not otherwise defined herein shall have the meanings ascribed to them in the Loan Agreement.

B. Broker/Dealer

has requested Lender to amend the Loan Agreement in order to extend the borrowing termination and maturity dates of the Loan, and Lender

has agreed to such request, upon the terms and subject to the conditions set forth below.

NOW,

THEREFORE, in consideration of the terms and conditions contained herein, and of any loans or extensions of credit heretofore,

now or hereafter made to or for the benefit of the Broker/Dealer by the Lender, and for other good and valuable consideration, the receipt

and adequacy of which are acknowledged, the Broker/Dealer and the Lender agree as follows:

Section 1. Incorporation.

The foregoing recitals are hereby made a part of this Amendment.

Section 2. Amendments

to Loan Agreement. Subject to the satisfaction of

the conditions precedent set forth in Section 4 of this Amendment, the Loan Agreement is amended as follows:

2.1 The

definition of “Revolving Loan Borrowing Termination Date” in Section 1(a) of the Loan Agreement is

amended and restated in its entirety as follows:

“Revolving

Loan Borrowing Termination Date” means June 18, 2025.

2.2 The

definition of “Revolving Loan Maturity Date” in Section 1(a) of the Loan Agreement is amended and

restated in its entirety as follows:

“Revolving

Loan Maturity Date” means June 18, 2025.

Section 3. Representations

and Warranties. In order to induce Lender to execute

and deliver this Amendment, Broker/Dealer represents and warrants to Lender that as of the date hereof:

3.1 The

representations and warranties set forth in Section 5 of the Loan Agreement are true and correct.

3.2 Broker/Dealer

is in compliance with the terms and conditions of the Loan Agreement and no Event of Default or Unmatured Event of Default has occurred

and is continuing under the Loan Agreement or shall result after giving effect to this Amendment.

3.3 The

copies of Broker/Dealer’s certificate of formation and operating agreement (with all amendments thereto) as certified by Broker/Dealer

remain true and complete, and there has been no change in such documents or the ownership of Broker/Dealer since last delivered to Lender.

3.4 The

execution and delivery of this Amendment (and the other documents set forth in Section 4 of this Amendment) and the performance

of the Loan Documents as modified herein have been duly authorized by all requisite company action by or on behalf of Broker/Dealer. This

Amendment has been duly executed and delivered on behalf of Broker/Dealer.

Section 4. Conditions

Precedent. Lender’s consent hereunder shall

be subject to Broker/Dealer having delivered, or having caused to be delivered, to Lender, the following items, all of which shall be

in form and substance acceptable to the Lender:

4.1 This

Amendment, duly executed by Broker/Dealer;

4.2 The

Fifth Amended and Restated Revolving Note in the original maximum principal amount of the Revolving Loan Commitment, duly executed by

Broker/Dealer;

4.3 A

Reaffirmation of Guaranty by each Guarantor, duly executed by such Guarantor;

4.4 A

Reaffirmation of Pledge and Security Agreement, duly executed by Holdings LP;

4.5 An

updated Compliance Certificate as contemplated by Section 7(g)(iv) of the Loan Agreement in the form attached as Exhibit A

to the Loan Agreement; and

4.6 such

other documents, agreements and certificates in connection as Lender may require.

Section 5. Miscellaneous.

5.1 Except

as specifically amended herein, the Loan Agreement shall continue in full force and effect in accordance with its original terms. Reference

to this specific Amendment need not be made in the Loan Agreement, the Revolving Note, or any other instrument or document executed in

connection therewith, or in any certificate, letter or communication issued or made pursuant to or with respect to the Loan Agreement,

any reference in any of such items to the Loan Agreement being sufficient to refer to the Loan Agreement as amended hereby.

5.2 Broker/Dealer

agrees to pay on demand all costs and expenses of or incurred by Lender in connection with the preparation, execution and delivery of

this Amendment, including the fees and expenses of Lender’s counsel.

5.3 This

Amendment may be executed in any number of counterparts, and by the different parties on different counterpart signature pages, all of

which taken together shall constitute one and the same agreement. Any of the parties may execute this Amendment by signing any such counterpart

and each of such counterparts shall for all purposes be deemed to be an original. Delivery of a counterpart hereof by facsimile transmission

or by e-mail transmission of an Adobe portable document format file (also known as a “PDF” file) shall be effective

as delivery of a manually executed counterpart hereof.

5.4 This

Amendment shall be governed by, and construed in accordance with, the internal laws of the State of Illinois.

Section 6. WAIVER

OF JURY TRIAL. BROKER/DEALER AND LENDER EACH HEREBY

WAIVE ALL RIGHTS TO TRIAL BY JURY IN ANY ACTION OR PROCEEDING WHICH PERTAINS DIRECTLY OR INDIRECTLY TO THIS AMENDMENT OR THE LOAN DOCUMENTS,

THE OBLIGATIONS, THE COLLATERAL, ANY ALLEGED TORTIOUS CONDUCT BY BROKER/DEALER OR LENDER OR WHICH, IN ANY WAY, DIRECTLY OR INDIRECTLY,

ARISES OUT OF OR RELATES TO THE RELATIONSHIP BETWEEN BROKER/DEALER AND LENDER. IN NO EVENT SHALL LENDER BE LIABLE FOR LOST PROFITS OR

OTHER SPECIAL, EXEMPLARY, PUNITIVE OR CONSEQUENTIAL DAMAGES.

Section 7. VENUE.

TO INDUCE LENDER TO ACCEPT THIS AMENDMENT, BROKER/DEALER IRREVOCABLY AGREES THAT, SUBJECT TO LENDER’S SOLE AND ABSOLUTE ELECTION,

ALL ACTIONS OR PROCEEDINGS IN ANY WAY, MANNER, OR RESPECT, ARISING OUT OF OR FROM OR RELATED TO THIS AMENDMENT SHALL BE LITIGATED IN COURTS

WITHIN COOK COUNTY, STATE OF ILLINOIS AND EACH OF THEM HEREBY CONSENTS AND SUBMITS TO THE JURISDICTION OF ANY LOCAL, STATE OR FEDERAL

COURT LOCATED WITHIN SAID COUNTY AND STATE. BROKER/DEALER HEREBY WAIVES ANY RIGHT IT MAY HAVE TO TRANSFER OR CHANGE THE VENUE OF

ANY LITIGATION BROUGHT AGAINST BROKER/DEALER BY LENDER IN ACCORDANCE WITH SECTION 7 OF THIS AMENDMENT OR UNDER ANY OF THE

LOAN DOCUMENTS.

[Signature Page Follows]

IN

WITNESS WHEREOF, the parties have executed this Amendment as of the date first above written.

| |

BROKER/DEALER: |

| |

J.V.B.

FINANCIAL GROUP, LLC |

| |

|

| |

By: |

/s/ Douglas Listman |

| |

Name: |

Douglas Listman |

| |

Title: |

Chief Financial Officer |

| |

|

| |

LENDER: |

| |

BYLINE

BANK |

| |

|

| |

By: |

/s/ Cate Gula |

| |

Name: |

Cate Gula |

| |

Title: |

Vice President |

[Signature Page to Second

Amendment to Third Amended and Restated Loan Agreement]

v3.24.1.1.u2

Cover

|

Jun. 18, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 18, 2024

|

| Entity File Number |

1-32026

|

| Entity Registrant Name |

Cohen

& Co Inc.

|

| Entity Central Index Key |

0001270436

|

| Entity Tax Identification Number |

16-1685692

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

Cira Centre

|

| Entity Address, Address Line Two |

2929 Arch Street, Suite 1703

|

| Entity Address, City or Town |

Philadelphia

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19104

|

| City Area Code |

215

|

| Local Phone Number |

701-9555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

COHN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

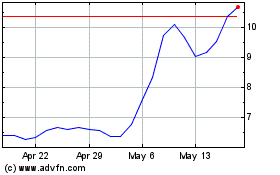

Cohen & (AMEX:COHN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cohen & (AMEX:COHN)

Historical Stock Chart

From Dec 2023 to Dec 2024