Italian Bank Shares Recover After Government Set Cap on Windfall Tax

August 09 2023 - 4:03AM

Dow Jones News

By Giulia Petroni

Shares in Italian banks trade higher on Wednesday after the

Italian government set a cap for the proposed windfall tax on

lenders' extra profits in a move to reassure markets.

At 0808 GMT, shares in Intesa Sanpaolo and UniCredit are up 2.5%

and 3.4%, respectively. Smaller banks Banco BPM and BPER Banca are

up 2.9% and 2.7% respectively, while Banca Monte dei Paschi di

Siena trades 3.4% higher.

The Ministry of Economy and Finance said in a statement that

proceeds from the tax wouldn't amount to more than 0.1% of lenders'

total assets in order to safeguard the banking system's

stability.

"The news is positive for the banking sector as it more clearly

defines the effects of the one-off taxation that, as currently

formulated, is expected to have much smaller impacts," said Equita

Sim's Andrea Lisi.

The shares recovering comes after the surprise announcement of

the new tax sparked a market selloff on Tuesday. The government

agreed on a one-off 40% windfall tax on the income made from higher

interest rates in 2023 or 2022, whichever is higher. Parliament

still needs to pass the legislation to introduce the levy.

Other European countries such as Spain and Hungary have adopted

similar taxes and, according to analysts, Italy's move could result

in other countries imposing bank taxes or levies to claw back

profits.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

August 09, 2023 04:48 ET (08:48 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

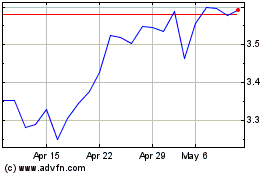

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Oct 2024 to Nov 2024

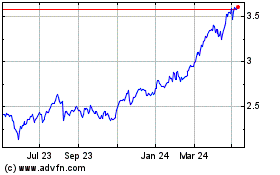

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Intesa Sanpaolo Spa (Italian Stock Exchange): 0 recent articles

More Intesa Sanpaolo Spa News Articles