Loopring Wobbles In Last 2 Months – Can LRC Stay In The Loop?

July 13 2022 - 5:45AM

NEWSBTC

The Loopring (LRC) price has entered a symmetrical triangle pattern

on the daily chart in the face of continuous bearish pressure.

This indicates that the bulls are retreating, so LRC must attract

buyers to achieve a successful breakout. However, a bearish

breakthrough is anticipated, and the token price may fall below the

important support at $0.30. Loopring is trading at $0.37 as of this

writing, a decrease of 4% over the last seven days, according

to statistics provided by Coingecko on Wednesday. The whole crypto

market began the year on a positive note. However, by the end of

January, it had already begun to indicate that 2022 would be quite

bumpy. Image - FX Empire Suggested Reading | Ethereum (ETH)

Continues To Lose Luster, Drops Below $1,100 Support Loopring

Dragged Down By Gloomy Market Today, the entire crypto market is

aggressively negative, having seen a mini-crash in both the months

of May and June. The present strong aggressive bearish trend of the

sector has also affected other cryptocurrencies, such as Loopring,

which is down 80% year-to-date. The coin’s trading volume is 69

million, while its market capitalization is 488 million. Loopring

has fluctuated in a descending triangle pattern during the course

of the past two months. In addition, LRC has retested the falling

trendline, which could ignite another bear cycle inside this

pattern. Loopring was one of the few projects in June that had

begun to exhibit indications of recovery. The first five days of

the project were marked by a significant bullish push. However,

this was followed by a significant bearish movement that led to a

41 percent price collapse. LRC total market cap at $494 million on

the daily chart | Source: TradingView.com LRC Faces Tough Road

Ahead The first 15 days of June also began to improve, resulting in

the reversal of some of the month’s losses because of a

nearly 40 percent price increase. In contrast, Loopring

appears to have continued its strong bearish trend over the past

week, shedding 14 percent of its value. Meanwhile, the same forces

affecting other markets, such as stocks, play a significant role in

the current downturn. Consumer prices are increasing at the highest

annual rate in more than 40 years, and the latest Federal

Reserve rate increase is still being felt on the bitcoin market.

Forecasts of an even more challenging economic climate are also

causing the price of Loopring and other altcoins to continue to

decrease. Suggested Reading | Tezos (XTZ) Nears 3-Week High –

Can Bulls Barrel Towards $1.80? Featured image from CHVNRadio,

chart from TradingView.com

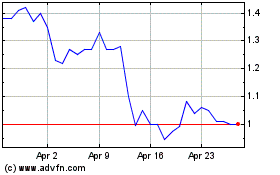

Tezos (COIN:XTZUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tezos (COIN:XTZUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024