AXA to Fully Exit Coal Industry in Europe and OECD Countries by 2030

November 27 2019 - 8:15AM

Dow Jones News

By Maitane Sardon

French insurer AXA SA (CS.FR) on Wednesday said that it will

exit the coal industry in the European Union and OECD countries by

2030, and the rest of the world by 2040, to align itself with the

Paris Agreement on climate change.

The insurer, which announced its divestment from the coal

industry four years ago, said its new coal investment policy

tightens existing restrictions on underwriting. It said it will

publish annual updates on its progress.

As part of its goal to be more environmentally responsible, AXA

said it will launch "transition bonds" to finance projects which

contribute to reducing CO2 emissions and moving away from fossil

fuels. It will also put 12 billion euros ($13.21 billion) in green

investments between 2020 and 2023.

AXA Chief Executive Thomas Buberl said "the climate emergency"

requires additional measures to ones that already exist in the

industry. He said AXA's goal is to accelerate its contribution

toward a low-carbon and resilient economy by focusing its

sustainable finance effort on the energy transition of major

industries.

The move comes as pressure mounts for financial companies to

support activities that protect the climate from harmful greenhouse

gas emissions. According to non-profit Rainforest Action Network,

coal power and coal mining finance is led by Chinese banks, with

European and U.S. banks doing more to restrict coal investment.

Other European finance companies that have recently announced

plans to reduce ties with coal include Societe Generale S.A. France

(GLE.FR) and Milan-based UniCredit S.p.A. (UCG.MI).

Write to Maitane Sardon at maitane.sardon@wsj.com

(END) Dow Jones Newswires

November 27, 2019 09:00 ET (14:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

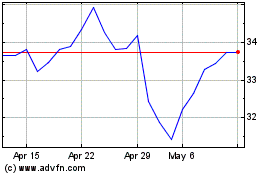

Axa (EU:CS)

Historical Stock Chart

From Apr 2024 to May 2024

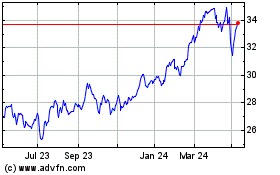

Axa (EU:CS)

Historical Stock Chart

From May 2023 to May 2024