Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

August 27 2024 - 3:30PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 3)*

5E

Advanced Materials, Inc.

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

33830Q109

(CUSIP

Number)

Mulyadi

Tjandra

1

Kim Seng Promenade #10-01

East

Tower, Great World City

Singapore

237994

+65

6737 3023

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

August

25, 2024

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b)

for other parties to whom copies are to be sent.

_____________

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 33830Q109 | 13D | Page 2 of 3 pages |

Explanatory

Note

This

Amendment No. 3 to Schedule 13D amends and supplements the statement on Schedule 13D filed with the United States Securities and Exchange

Commission on January 29, 2024 (as amended to date, the “Schedule 13D”), relating to the common stock, par value $0.01 per

share (the “Common Stock”), of 5E Advanced Materials, Inc., a Delaware corporation (the “Issuer”). Capitalized

terms used herein without definition shall have the meaning set forth in the Schedule 13D.

Item

4. Purpose of Transaction.

Item

4 of the Schedule 13D is hereby amended and supplemented with the following:

Debt

Commitment Letter

On

August 25, 2024, the Issuer entered into a commitment letter (the “Debt Commitment Letter”) with Ascend Global, pursuant

to which Ascend Global has agreed to purchase $3.0 million aggregate principal amount of the Issuer’s Notes in a private placement,

subject to the terms and conditions set forth therein (the “Debt Financing”). The funding of the Debt Financing pursuant

to the Debt Commitment Letter is contingent on the satisfaction of certain conditions set forth therein, including the Issuer’s

consummation of an equity financing (the “Equity Financing”) and the amendment of the Issuer’s existing Amended and

Restated Note Purchase Agreement. The Notes will be substantially identical to the Issuer’s outstanding secured convertible promissory

notes, and the conversion price for the Notes will be 125% of the price per share of the shares sold in the Equity Financing. Unless

otherwise agreed by the parties, the Debt Commitment Letter will terminate on September 17, 2024 if the Debt Financing has not been consummated

before such date.

The

foregoing description of the Debt Commitment Letter does not purport to be complete and is qualified in its entirety by the full text

of the agreement, which is included as an exhibit to this Schedule 13D.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item

6 of the Schedule 13D is hereby amended and supplemented with the following:

Item

4 above summarizes certain provisions of the Debt Commitment Letter and is incorporated herein by reference. A copy of the agreement

is attached as an exhibit to this Schedule 13D and is incorporated herein by reference.

Except

as set forth herein, none of the Reporting Persons has any contracts, arrangements, understandings or relationships (legal or otherwise)

with any person with respect to any securities of the Issuer, including but not limited to any contracts, arrangements, understandings

or relationships concerning the transfer or voting of such securities, finder’s fees, joint ventures, loan or option arrangements,

puts or calls, guarantees of profits, division of profits or losses, or the giving or withholding of proxies.

Item

7. Materials to be Filed as Exhibits

Item

7 of the Schedule 13D is hereby amended and supplemented with the following:

| CUSIP No. 33830Q109 | 13D | Page 3 of 3 pages |

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Date:

August 27, 2024

| |

Meridian

Investments Corporation |

| |

|

|

| |

By: |

/s/

Mulyadi Tjandra |

| |

Name: |

Mulyadi

Tjandra |

| |

Title:

|

Director |

| |

|

|

| |

Ascend

Global Investment Fund SPC for and on behalf of Strategic SP |

| |

|

|

| |

By: |

/s/

Mulyadi Tjandra |

| |

Name: |

Mulyadi

Tjandra |

| |

Title:

|

Director |

| |

|

|

| |

Ascend

Capital Advisors (S) Pte. Ltd. |

| |

|

|

| |

By: |

/s/

Mulyadi Tjandra |

| |

Name: |

Mulyadi

Tjandra |

| |

Title:

|

Director |

| |

|

|

| |

Ascend

Financial Holdings Limited |

| |

|

|

| |

By:

|

KEY

TIME VENTURES LIMITED, Director |

| |

|

|

| |

By: |

/s/

Lau Kar Yee |

| |

Name: |

Lau Kar Yee |

| |

Title:

|

Authorized

Signatory of Key Time Ventures Limited |

| |

/s/

Halim Susanto |

| |

Halim

Susanto |

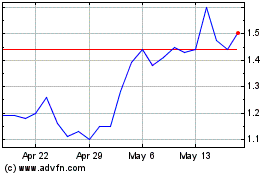

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Dec 2024 to Jan 2025

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Jan 2024 to Jan 2025