The Company has also signed an LOI with

Berlin-based health and life science company Sanity Group to better

take advantage of potential German adult-use cannabis

legalization

This news release constitutes a “designated

news release” for the purposes of the Company’s prospectus

supplement dated December 3, 2021, to its short form base shelf

prospectus dated April 22, 2021.

- Current annual revenue run rate exceeds $450 million,

maintaining High Tide’s position as Canada’s top revenue-generating

cannabis company1

- The Company celebrated its 11th consecutive quarter of positive

adjusted EBITDA2

- The Company now counts approximately 4.5 million total

customers globally across all platforms3

- The Company’s bricks-and-mortar locations generated same store

sales growth of 50% year-over-year and 9% sequentially in the

fourth fiscal quarter of 2022

- Largest non-franchised retailer in Canada with 151 locations

and approximately 950,000 Cabana Club members, making it the

largest bricks-and-mortar cannabis loyalty program in Canada

- Paid ELITE membership upgrades already exceed 6,000 members

since launching this first-of-its-kind initiative in Canada at the

end of November 2022

High Tide Inc. (“High Tide” or the “Company”)

(NASDAQ: HITI) (TSXV: HITI) (FSE: 2LYA), a leading retail-focused

cannabis company with bricks-and-mortar as well as global

e-commerce assets, filed its year-end audited 2022 financial

results on January 30, 2023, the highlights of which are included

in this news release. The full set of audited consolidated

financial statements for the fiscal years ended October 31, 2022,

and 2021 (the “Financial Statements”) and accompanying

management’s discussion and analysis can be accessed by visiting

High Tide’s website at www.hightideinc.com, and its profile pages

on SEDAR at www.sedar.com, and EDGAR at www.sec.gov.

2022 Fiscal Year – Financial Highlights

- Revenue increased by 97% to $356.9 million for the year ended

October 31, 2022, and increased sequentially by 14% to $108.2

million in the fourth quarter of 2022

- Gross profit increased by 58% to $101.0 million for the year

ended October 31, 2022, and increased sequentially by 15% to $29.5

million in the fourth quarter of 2022

- Gross profit margin was 28% for the year ended October 31,

2022, and was 27% in the fourth quarter of 2022, which was

consistent with each of the prior two quarters

- Salaries, wages and benefits represented 12% of revenue in the

fourth fiscal quarter of 2022 which compared to 15% in the fourth

fiscal quarter of 2021 and was consistent with the prior quarter.

General and administration expenses represented 7% of revenue in

the fourth fiscal quarter of 2022, which compared to 8% in the

fourth fiscal quarter of 2021 and was consistent with the prior

quarter

- Adjusted EBITDA4 was a record $14.6 million for the year ended

October 31, 2022, up 17% versus the prior year, and was $5.0

million for the fourth quarter of 2022, up 18% sequentially, and up

206% versus the fourth quarter of 2021

- Geographically, for the year ended October 31, 2022, $290.4

million of revenue was earned in Canada (an increase of 93%), $59.3

million in the United States (an increase of 100%), and $7.1

million internationally (an increase of 671%). In the fourth

quarter of fiscal 2022, revenue was $93.9 million in Canada (an

increase of 16% sequentially), $13.2 million in the United States

(an increase of 4% sequentially), and $1.2 million internationally

(a decrease of 37% sequentially). This decrease is related to a

global slowdown in sales of CBD products

- Cabanalytics data sales from the entire retail ecosystem,

including bricks and mortar and e-commerce platforms, were $21.7

million for the fiscal year that ended October 31, 2022, compared

to $12.2 million for the fiscal year ended October 31, 2021.

Sequentially, Cabanalytics data sales increased to $6.4 million

from $5.5 million in the third fiscal quarter

- The Company’s bricks-and-mortar locations generated same-store

sales growth of 50% year-over-year and 9% sequentially in the

fourth fiscal quarter of 2022. Given the success of our innovative

discount club model, as well as the optional membership upgrade to

ELITE, the Company anticipates same-store sales to continue to be

strong compared to the industry average in the first fiscal quarter

of 2023

- During the fourth fiscal quarter of 2022, the Company completed

its annual impairment testing. As a result of this testing, driven

primarily by a slowdown in the global CBD sector as seen amongst

our major United States CBD competitors, the Company recorded

impairment charges of $48.6 million, primarily relating to

goodwill. The Company notes that these are non-cash charges, with

no impact on its ability to raise debt capital from its senior

lender, and that online CBD sales represented only 6% of

consolidated revenue for the fourth fiscal quarter of 2022

- Cash on hand as of October 31, 2022, totalled $25.1 million,

compared to $14.0 million as of October 31, 2021

“I am thrilled to share these results, which, once again,

deliver record-breaking revenue and adjusted EBITDA which further

solidifies High Tide’s position as the largest revenue-generating

cannabis company in Canada with a current annual run rate of over

$450 million. While these numbers demonstrate exponential revenue

growth, it’s also important to note that we have maintained

adjusted EBITDA level profitability for 11 consecutive quarters and

that we were cash flow positive from operations during the last

fiscal year. In our opinion, this is because we have the strongest

retail concept in Canadian cannabis, something that is backed up by

the fact that our Cabana Club loyalty program now has approximately

950,000 members across 151 Canadian stores. I am also excited to

report that we have already upgraded over 6,000 members into ELITE.

As we continue to introduce more ELITE offerings, we anticipate

upgrades to continue throughout 2023, providing us with an

additional high-margin recurring revenue stream to further boost

our bottom line.

On top of all this, our same-store sales increased by 50 percent

year-over-year, something that is an anomaly amongst North American

cannabis companies. Our bricks-and-mortar margins have slowly but

steadily ticked higher over the last two quarters, and we expect

this to continue, which will help amplify the impact of our

anticipated same-store sales increases. Our growing customer

loyalty and value-focused strategy have resulted in the rapid

conversion of illicit market consumers and have helped to increase

our market share by approximately 1% per quarter for the last four

quarters. With these increases, Canna Cabana now serves roughly 13%

of Canadian cannabis consumers outside of Quebec. We also continue

to be a global player in the retail sale of consumption accessories

through our world-leading e-commerce platforms and our Canadian

bricks and mortar stores.” said Raj Grover, President and Chief

Executive Officer of High Tide.

“Considering the challenging macro environment and where our

equity value stands today, we have meaningfully slowed down our

M&A activity and are primarily looking at smaller, highly

accretive bricks-and-mortar opportunities to focus on free cash

flow generation from our existing business lines. I want to

sincerely thank our customers, team members, and shareholders for

another stellar year as the retail market leader in Canada, and I

look forward to delivering more of the same in 2023, with continued

market share gains and further improved cash flow generation. I

also want to acknowledge our industry and government partners who

worked tirelessly to ensure that we, as an industry, continue to

make progress toward greater sustainability within the cannabis

sector.” added Mr. Grover.

Letter of Intent with Sanity Group

High Tide also announced that it has entered into a non-binding

letter of intent (the “LOI”) with the Berlin-based health and life

science company, Sanity Group (the “Sanity Transaction”). With big

progress on legislation expected this spring, the LOI is designed

to leverage synergies between both complementary companies and

position each to take advantage of potential German adult use

legalization within their respective supply chain verticals. With a

well-established track record in Germany with respect to medical

cannabis, finished pharmaceuticals, and cannabinoid-based consumer

goods, High Tide believes that Sanity Group is the best-positioned

potential partner in its home market of Germany.

Sanity Group and High Tide intend to work together on

go-to-market strategies, identification of quality M&A

opportunities, sourcing of high-quality real estate, expansion

within European markets, and regulatory compliance topics such as

licensing and government outreach. Subject to relevant laws and

regulations, High Tide, aims to support Sanity Group in building a

retail consumer brand strategy using its decade-long experience

serving cannabis consumers in Canada, the United States and Europe,

as well as providing targeted assistance in product display and

advertising opportunities (product and brand promotion) across High

Tide’s assets in Germany and other European markets in due

course.

“We want to be well positioned to bring this success to the

German market, should the government proceed with its publicly

stated goal to legalize cannabis adult use. This is why we are

proud to partner with a top player in the German medical cannabis

space like Sanity Group, particularly since our business models are

complementary in nature,” said Mr. Grover.

“We are very excited and proud to lay the foundation for a

strong and trustful partnership in case of recreational cannabis

legalization in Germany with a top player like High Tide through

this letter of intent. High Tide stands for great experience and

expertise in building retail cannabis brand strategies like no

other player. We strongly believe in the mutual value of this

partnership, added Finn Hänsel,” Chief Executive Officer of Sanity

Group.

Fiscal Fourth Quarter 2022 – Operational Highlights

- The Company closed on its acquisition of assets from Choom

Holdings Inc. through the Companies’ Creditors Arrangement Act

Proceedings, adding 9 operating retail cannabis stores to the

Company’s bricks-and-mortar portfolio across British Columbia,

Alberta and Ontario for $5.3 million

- The Company entered into and closed a binding commitment letter

with Connect First Credit Union Ltd. (“connectFirst”) for a $19

million credit facility with an initial 5-year term, at

connectFirst’s floor interest rate

- The Globe and Mail’s Report on Business magazine recognized the

Company for a second year in a row as one of Canada’s top-growing

companies for 2022, ranking 21st out of 430 Canadian companies,

with an audited growth rate of 1,970% over three years

- The Company entered into a definitive agreement to add two

retail cannabis stores in British Columbia via the acquisition of

1171882 B.C. Ltd., operating as Jimmy’s Cannabis Shop BC

- The Company announced that its Colorado-based subsidiary,

NuLeaf Naturals, launched its groundbreaking Full Spectrum Multi

Cannabinoid oil and plant-based softgels for sale in Manitoba

through the Manitoba Liquor & Lotteries Corporation and in

Ontario through the Ontario Cannabis Store

- Membership in the Cabana Club loyalty program increased to over

827,000 members as of October 31,2022

- The Company added 13 new stores: 3 in British Columbia, 9 in

Alberta and 1 in Ontario

Subsequent Events

- The Company was declared the highest revenue-generating

cannabis company in Canada5

- The Company reached its communicated goal of 150

bricks-and-mortar stores across the country

- The Company launched ELITE, the first-of-its-kind cannabis paid

membership loyalty program in Canada converting over 6,000 members

to ELITE status and generating over $180,000 in high margin

revenue

- The Company opened 10 new stores: 3 in British Columbia, 1 in

Manitoba and 6 in Ontario

- The Company initially launched cannabis seed sales through its

subsidiaries GrassCity and Smoke Cartel and has now commenced sales

on its Daily High Club and Dankstop e-commerce platforms

- The Company completed the roll out of its proprietary Fastendr

technology across 120 Canna Cabana locations

- The Company now sponsors 302 children internationally through

World Vision, after having committed to sponsoring two additional

children for every new store that opens in Canada

- Canna Cabana membership numbers as of today stands at

approximately 950,000 members

_____________________

1 Based on reporting by New Cannabis

Ventures as of November 14, 2022. For the New Cannabis Ventures’

senior listing, segmented cannabis-only sales must generate more

than US$25 million per quarter (CAD$31 million) – for full details,

see:

https://www.newcannabisventures.com/cannabis-company-revenue-ranking/

2 Adjusted EBITDA is a non-IFRS financial

measure

3 This number includes all customers in

High Tide’s global database across Cabana Club, Grasscity.com,

SmokeCartel.com, DailyHighClub.com, Dankstop.com,

NuLeafNaturals.com, FABCBD.com, BlessedCBD.co.uk, and

BlessedCBD.de

4 Adjusted EBITDA is a non-IFRS financial

measure

5 Based on reporting by New Cannabis

Ventures as of November 14, 2022. For the New Cannabis Ventures’

senior listing, segmented cannabis-only sales must generate more

than US$25 million per quarter (CAD$31 million) – for full details,

see:

https://www.newcannabisventures.com/cannabis-company-revenue-ranking/

Selected financial information for the

fourth quarter and year ended October 31, 2022: (Expressed in

thousands of Canadian Dollars)

Three months ended October

31

Audited Year Ended October

31

2022

2021

Change

2022

2021

Change

$

$

$

$

Revenue

108,249

53,867

101

%

356,852

181,123

97

%

Gross Profit

29,520

17,538

68

%

100,952

63,983

58

%

Gross Profit Margin

27

%

33

%

(6

%)

28

%

35

%

(7

%)

Total Operating Expenses

(83,428

)

(22,389

)

273

%

(173,262

)

(82,657

)

110

%

Adjusted EBITDA

5,018

1,641

206

%

14,620

12,503

17

%

Loss from Operations6

(53,915

)

(4,794

)

1025

%

(72,310

)

(18,674

)

287

%

Net loss

(52,502

)

(4,176

)

1157

%

(70,848

)

(35,037

)

102

%

Loss per share (Basic and Diluted)

(0.85

)

(0.09

)

839

%

(1.14

)

(0.84

)

36

%

The following is a reconciliation of

Adjusted EBITDA to Net Loss: (Expressed in thousands of Canadian

Dollars)

Three Months Ended October

31

Year Ended October 31

2022

2021

2022

2021

Net (loss) income

(52,502

)

(4,176

)

(70,848

)

(35,037

)

Income taxes (recovery)

(1,782

)

(1,418

)

(2,915

)

(730

)

Accretion and interest

782

1,515

4,921

8,150

Depreciation and amortization

8,249

1,458

30,169

23,565

EBITDA 7

(45,253

)

(2,621

)

(38,673

)

(4,052

)

Foreign exchange loss (gain)

(14

)

473

310

539

Transaction and acquisition costs

2,444

483

5,458

4,892

Debt restructuring gain

-

-

-

(1,145

)

(Gain) loss revaluation of derivative

liability

(3,166

)

(1,564

)

(10,497

)

6,989

Loss (gain) on extinguishment of

debenture

609

73

354

589

Impairment loss

48,592

2,676

48,681

2,733

Share-based compensation

2,091

2,301

8,080

4,879

Loss (gain) on revaluation of marketable

securities

81

291

489

547

Gain on extinguishment of financial

liability

(366

)

(161

)

418

(161

)

Gain on disposal of property and

equipment

-

(309

)

-

(3,306

)

Adjusted EBITDA 7

5,018

1,642

14,620

12,504

6 Loss from operations, excluding non-cash

impairment charges was $5.3 million for the three months ended

October 31, 2022 which compared to a loss of $2.1 million for the

three months ended October 31, 2021. Excluding these charges, the

Company generated a loss from operations of $23.6 million for the

year ended October 31, 2022 which compares to a loss from

operations of $15.9 million for the year ended October 31,

2021.

7 Earnings before interest, taxes,

depreciation, and amortization (“EBITDA”) and Adjusted EBITDA.

These measures do not have a standardized meaning prescribed by

IFRS and are therefore unlikely to be comparable to similar

measures presented by other issuers. Non-IFRS measures provide

investors with a supplemental measure of the Company’s operating

performance and therefore highlight trends in Company’s core

business that may not otherwise be apparent when relying solely on

IFRS measures. Management uses non-IFRS measures in measuring the

financial performance of the Company.

Outlook:

High Tide is the market leader in Canadian bricks and mortar

cannabis retail, with 151 locations across the country and a

loyalty base of approximately 950,000 Cabana Club members. The

Company’s target is to add 40-50 new retail locations in calendar

2023, with Ontario representing the lion’s share of the increase.

At the end of November, The Company launched Cabana ELITE, its

premium paid membership offering and has already onboarded over

6,000 members. The Company expects this number to steadily increase

over the coming quarters.

With the continued increase in same-store sales and a wider

retail footprint, High Tide is currently on an annual revenue run

rate of over $450 million.

Throughout 2022, High Tide deployed its customized Fastendr™

technology in 120 locations across Canada, with this rollout

continuing throughout 2023, including an opportunity to start

licensing this technology towards the end of 2023.

Since mid-2022, High Tide has been launching white-label

products through its Cabana Cannabis Co and NuLeaf Naturals brands

in Ontario, Manitoba and Saskatchewan. The Company is actively

rolling out more SKUs through the course of the year and in

conjunction with other higher-margin revenue streams, such as the

sale of cannabis seeds in the United States and ELITE membership

fees, which should result in consolidated gross margins remaining

steady and ticking higher in the quarters ahead.

Webcast and Conference Call

The Company will host a webcast and conference call to discuss

its audited results and outlook at 11:30 AM (Eastern Time)

tomorrow, Tuesday, January 31, 2023.

Webcast Link for High Tide Earnings Event:

https://events.q4inc.com/attendee/917199613

Participants may pre-register for the webcast by clicking on the

link above prior to the beginning of the live webcast. Three hours

after the live webcast, a replay of the webcast will be available

at the same link above.

Participants may access the audio of the High Tide earnings

event through either the new webcast format or the conference call

line below. However, any participant who wishes to ask a question

must access the event via conference call, as the webcast does not

support live questions.

Participant Details

Joining by Telephone:

Canada dial-in number (Toll-Free):

1 833 950 0062

Canada dial-in number (Local):

1 226 828 7575

United States:

1 844 200 6205

United States (Local):

1 646 904 5544

All other locations:

+1 929 526 1599

Access code:

817464

*Participants will need to enter the participant access code

before being met by a live operator*

ATM Program Quarterly Update

Pursuant to the Company’s at-the-market equity offering program

(the “ATM Program”) that allows the Company to issue up to

$40 million (or the equivalent in U.S. dollars) of common shares

(“Common Shares”) from treasury to the public from time to

time, at the Company’s discretion and subject to regulatory

requirements, as required pursuant to National Instrument 44-102 –

Shelf Distributions and the policies of the TSX Venture Exchange

(the “TSXV”), the Company announces that, during its fourth

quarter ended October 31, 2022, the Company has issued an aggregate

of 256,757 Common Shares over the TSXV and Nasdaq Capital Market

(“Nasdaq”), for aggregate gross proceeds to the Company of

$0.5 million.

Pursuant to an equity distribution agreement dated December 3,

2021, entered into among the Company, ATB Capital Markets Inc. and

ATB Capital Markets USA Inc. (the “Agents”), associated with

the ATM Program (the “Equity Distribution Agreement”), a

cash commission of less than $0.01 million on the aggregate gross

proceeds raised was paid to the Agents in connection with their

services under the Equity Distribution Agreement during the fourth

quarter ended October 31, 2022.

The Company intends to use the net proceeds of the ATM Program

if any, and at the discretion of the Company, to fund strategic

initiatives, it is currently developing, to support the growth and

development of the Company’s existing operations, funding future

acquisitions as well as working capital and general corporate

purposes.

Common Shares issued pursuant to the ATM Program will be issued

pursuant to a prospectus supplement dated December 3, 2021 (the

“Canadian Prospectus Supplement”) to the Company’s final

base shelf prospectus dated April 22, 2021, filed with the

securities commissions or similar regulatory authorities in each of

the provinces and territories of Canada (the “Canadian Shelf

Prospectus”) and pursuant to a prospectus supplement dated

December 3, 2021 (the “U.S. Prospectus Supplement”) to the

Company’s U.S. base prospectus dated September 17, 2021 (the

“U.S. Base Prospectus”) included in its registration

statement on Form F-10 (the “Registration Statement”) and

filed with the U.S. Securities and Exchange Commission (the

“SEC”). The Canadian Prospectus Supplement and Canadian

Shelf Prospectus are available for download from SEDAR at

www.sedar.com, and the U.S. Prospectus Supplement, the U.S. Base

Prospectus and Registration Statement are accessible via EDGAR on

the SEC’s website at www.sec.gov.

The ATM Program is effective until the earlier of (i) the date

that all Common Shares available for issue under the ATM Program

have been sold, (ii) the date the Canadian Prospectus Supplement in

respect of the ATM Program or Canadian Shelf Prospectus is

withdrawn and (iii) the date that the ATM Program is terminated by

the Company or Agents.

ABOUT HIGH TIDE

High Tide is a leading retail-focused cannabis company with

bricks-and-mortar as well as global e-commerce assets. The Company

is the largest non-franchised cannabis retail chain in Canada, with

151 current locations spanning British Columbia, Alberta,

Saskatchewan, Manitoba and Ontario. The Company is also North

America's first cannabis discount club retailer, under the Canna

Cabana banner, which is the single-largest cannabis retail brand in

Canada, with additional locations under development across the

country. High Tide's portfolio also includes retail kiosks and

smart locker technology – Fastendr™. High Tide has been serving

consumers for over a decade through its established e-commerce

platforms, including Grasscity.com, Smokecartel.com,

Dailyhighclub.com, and Dankstop.com and more recently in the

hemp-derived CBD space through Nuleafnaturals.com, FABCBD.com,

BlessedCBD.co.uk, BlessedCBD.de, and Amazon United Kingdom, as well

as its wholesale distribution division under Valiant Distribution,

including the licensed entertainment product manufacturer Famous

Brandz. High Tide was featured in the Report on Business Magazine's

ranking of Canada's Top Growing Companies in both 2021 and 2022 and

was named as one of the top 10 performing diversified industries

stocks in the 2022 TSX Venture 50™. High Tide's strategy as a

parent company is to extend and strengthen its integrated value

chain while providing a complete customer experience and maximizing

shareholder value.

For more information about High Tide, please visit

www.hightideinc.com and its profile pages on SEDAR at www.sedar.com

and EDGAR at www.sec.gov.

Neither the TSXV nor its Regulation Services Provider (as that

term is defined in the policies of the TSXV) accepts responsibility

for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking information” within

the meaning of applicable Canadian securities legislation. These

statements relate to future events or future performance. The use

of any of the words “could”, “intend”, “expect”, “believe”, “will”,

“projected”, “estimated” and similar expressions and statements

relating to matters that are not historical facts are intended to

identify forward-looking information and are based on the Company’s

current belief or assumptions as to the outcome and timing of such

future events.

The forward-looking information and forward-looking statements

contained herein include, but are not limited to, statements

regarding: the Company’s business objectives and milestones and the

anticipated timing of, and costs in connection with, the execution

or achievement of such objectives and milestones (including,

without limitation, proposed acquisitions, with a focus on smaller,

highly accretive bricks-and-mortar opportunities to focus on free

cash flow generation from existing business lines); the Company

improving cash flow generation; the Company’s future growth

prospects and intentions to pursue one or more viable business

opportunities; the development of the Company’s business and future

activities following the date hereof; expectations relating to

market size and anticipated growth in the jurisdictions within

which the Company may from time to time operate or contemplate

future operations; expectations with respect to economic, business,

regulatory and/or competitive factors related to the Company or the

cannabis industry generally; the market for the Company’s current

and proposed product offerings, as well as the Company’s ability to

capture market share; the Company’s strategic investments and

capital expenditures, and related benefits; the distribution

methods expected to be used by the Company to deliver its product

offerings; the competitive landscape within which the Company

operates and the Company’s market share or reach; the performance

of the Company’s business and the operations and activities of the

Company; the Company adding the number of additional cannabis

retail store locations the Company proposes to add to the Company’s

business, with Ontario representing the lion’s share of the

increase, upon the timelines indicated herein, and the Company

remaining on a positive growth trajectory; same-store sales and

consolidated gross margins (including, without limitation, from

ELITE and bricks-and-mortar) continuing to increase in the first

fiscal quarter of 2023 and beyond; the Company making meaningful

increases to its revenue profile; the Company expanding in the

German market; the Company deploying Fastendr™ technology across

the Company’s retail stores upon the timelines disclosed herein,

including licensing this technology towards the end of 2023; the

Company continuing to increase its revenue through the first fiscal

quarter of 2023, and the remainder of the year; the Company

continuing to integrate and expand its CBD brands; the Company

completing the development of its cannabis retail stores; the

Company’s ability to generate cash flow from operations and from

financing activities; the realization of cost savings, synergies or

benefits from the Company’s recent and proposed acquisitions, and

the Company’s ability to successfully integrate the operations of

any business acquired within the Company’s business; the

anticipated sales from continuing operations for the financial year

of the Company ending October 31, 2023; Cabana Club and ELITE

loyalty programs membership continuing to increase; the anticipated

changes to and effects of the ELITE program on the business and

operations of the Company; the Company hitting its forecasted

revenue and sales projections for the first fiscal quarter of 2023;

the Company’s expectations from its Cabana Cannabis Co. and Nuleaf

Naturals white label products; the Company launching Cabana

Cannabis Co. and Nuleaf Naturals white label products in the

jurisdictions and on the timelines outlined herein; the intention

of the Company to complete the ATM Program and any additional

offering of securities of the Company; the aggregate amount of the

total proceeds that the Company will receive pursuant to the ATM

Program, connectFirst credit facility and/or any future offering;

the Company’s expected use of the net proceeds from the ATM

Program, connectFirst credit facility and/or any future offering;

the listing of Common Shares offered in the ATM Program and/or any

future offering; the anticipated effects of the ATM Program,

connectFirst credit facility and/or any future offering on the

business and operations of the Company; legislative changes

occurring in Germany with respect to adult use cannabis; the

Company completing the Sanity Transaction; the intended effects of

the Sanity Transaction and synergies created by its completion as

outlined herein; the intended effects of adult use cannabis

becoming legalized in German; and the Company continuing to grow

its online retail portfolio through further strategic and accretive

acquisitions.

Forward-looking information in this press release are based on

certain assumptions and expected future events, namely: current and

future members of management will abide by the Company’s business

objectives and strategies from time to time established by the

Company; the Company will retain and supplement its board of

directors and management, or otherwise engage consultants and

advisors having knowledge of the industries (or segments thereof)

within which the Company may from time to time participate; the

Company will have sufficient working capital and the ability to

obtain the financing required in order to develop and continue its

business and operations; the Company will continue to attract,

develop, motivate and retain highly qualified and skilled

consultants and/or employees, as the case may be; no adverse

changes will be made to the regulatory framework governing

cannabis, taxes and all other applicable matters in the

jurisdictions in which the Company conducts business and any other

jurisdiction in which the Company may conduct business in the

future; the Company will be able to generate cash flow from

operations, including, where applicable, the distribution and sale

of cannabis and cannabis products; the Company will be able to

execute on its business strategy as anticipated; the Company will

be able to meet the requirements necessary to obtain and/or

maintain authorizations required to conduct the business; general

economic, financial, market, regulatory, and political conditions,

including the impact of the COVID-19 pandemic, will not negatively

affect the Company or its business; the Company will be able to

successfully compete in the cannabis industry; cannabis prices will

not decline materially; the Company will be able to effectively

manage anticipated and unanticipated costs; the Company will be

able to maintain internal controls over financial reporting and

disclosure, and procedures in order to ensure compliance with

applicable laws; the Company will be able to conduct its operations

in a safe, efficient and effective manner; general market

conditions will be favourable with respect to the Company’s future

plans and goals; the Company will reach the anticipated sales from

continuing operations for the financial year of the Company ending

October 31, 2023; the Company will complete its proposed

acquisitions and transactions; the Company will hit its forecasted

revenue and sales projections for the first fiscal quarter of 2023;

Cabana Club and ELITE loyalty programs membership will continue to

increase; the Company will make changes to the ELITE program and it

will have the anticipated effects on the business and operations of

the Company as outlined here; the Company will deploy Fastendr™

technology across the Company’s retail stores upon the timelines

disclosed herein and license this technology; the Company will

launch Cabana Cannabis Co. and Nuleaf Naturals white label products

in the jurisdictions and on the timelines outlined herein and such

products will achieved the results and have the anticipated effects

as disclosed herein; same-store sales and consolidated gross

margins (including, without limitation, from ELITE and

bricks-and-mortar) will continue to increase in the first fiscal

quarter of 2023 and beyond; the Company will make meaningful

increases to its revenue profile; the Company will expand in the

German market; the Company will continue to increase its revenue

through the first fiscal quarter of 2023, and the remainder of the

year; the Company will continue to integrate and expand its CBD

brands; the Company will add the additional cannabis retail store

locations to the Company’s business, with Ontario representing the

lion’s share of the increase, and remain on a positive growth

trajectory; the Company will complete the development of its

cannabis retail stores; the Company will complete the ATM Program;

the Company’s will use of the net proceeds from the ATM Program,

connectFirst credit facility and/or any future offering as outlined

herein; the Company will list the Common Shares offered in the ATM

Program and/or any future offering; the ATM Program, connectFirst

credit facility, and any future offering will have the anticipated

effects on the business and operations of the Company; Germany will

make legislative changes and/or legalize adult use cannabis; the

Company will complete the Sanity Transaction and it will have the

intended effects of the Company and create synergies between the

parties as more particularly outlined herein; German adult use

cannabis will have the intended effects as more particularly

outlined herein; and the Company will continue to grow its online

retail portfolio through further strategic and accretive

acquisitions.

These statements involve known and unknown risks, uncertainties

and other factors, which may cause actual results, performance or

achievements to differ materially from those expressed or implied

by such statements, including but not limited to: the Company’s

inability to attract and retain qualified members of management to

grow the Company’s business and its operations; unanticipated

changes in economic and market conditions (including changes

resulting from the COVID-19 pandemic) or in applicable laws; the

impact of the publications of inaccurate or unfavourable research

by securities analysts or other third parties; the Company’s

failure to complete future acquisitions or enter into strategic

business relationships; interruptions or shortages in the supply of

cannabis from time to time available to support the Company’s

operations from time to time; unanticipated changes in the cannabis

industry in the jurisdictions within which the Company may from

time to time conduct its business and operations, including the

Company’s inability to respond or adapt to such changes; the

Company’s inability to secure or maintain favourable lease

arrangements or the required authorizations necessary to conduct

the business and operations and meet its targets; the Company’s

inability to secure desirable retail cannabis store locations on

favourable terms; risks relating to projections of the Company’s

operations; the Company’s inability to effectively manage

unanticipated costs and expenses, including costs and expenses

associated with product recalls and judicial or administrative

proceedings against the Company; risk that the Company will not

reach the anticipated sales from continuing operations for the

financial year of the Company ending October 31, 2023; risk that

the Company will not hit its forecasted revenue and sales

projections for the first fiscal quarter of 2023; risk that Cabana

Club and/or ELITE loyalty programs memberships will decrease and/or

plateau; risks that the Company will not make changes to the ELITE

program and/or it may not have the intended effects on the business

and operations of the Company; risk that the Company will be unable

to deploy Fastendr™ technology across the Company’s retail stores

and/or license this technology or on the timelines disclosed herein

or at all; risk that the Company will be unable to launch Cabana

Cannabis Co. and/or Nuleaf Naturals white label products in the

jurisdictions and on the timelines outlined herein and/or that such

products will be unable to achieve the results and/or have the

intended effects as disclosed herein; risk that same-store sales

and/or consolidated gross margins (including, without limitation,

from ELITE and bricks-and-mortar) will not increase, but decease

and/or plateau; risk that the Company will be unable to increase

its revenue profile; risk that the Company will be unable to

increase its revenue through the first fiscal quarter of 2023, and

the remainder of the year, but that it will decease and/or plateau;

risk that the Company will be unable to expand in the German

market; risk that the Company will be unable to continue to

integrate and expand its CBD brands; risk that the Company will be

unable to grow its online retail portfolio through further

strategic and accretive acquisitions; risk that the Company will be

unable to add additional cannabis retail store locations to the

Company’s business, with Ontario representing the lion’s share of

the increase and remain on a positive growth trajectory; risks that

the Company will be unable to complete the development of any or

all of its cannabis retail stores; risk the Company will not

complete the ATM Program; risks surrounding the Company’s inability

to list the Common Shares offered in the ATM Program and/or any

future offering; risks surrounding the Company’s failure to utilize

the use of proceeds from the ATM Program, connectFirst credit

facility and/or any future offering as expected; risks surrounding

the ATM Program, connectFirst credit facility and/or any future

offering not have its anticipated effects on the business and

operations of the Company; risks that there will not be legislative

changes in Germany; risks that the Company will be unable to close

the Sanity Transaction and/or that the transaction will not have

its intended effects on the Company; risks that the legalization of

adult use cannabis will not have the intended effects on the

Company’s business and operations; risks surrounding the sale of

hemp seeds; risks surrounding the legality of delta-8

tetrahydrocannabinol (“Delta-8”) derived from hemp; risks

surrounding the uncertainty and legality of Delta-8 and delta-9

tetrahydrocannabinol (“Delta-9”) state to state; risk that the

United States Drug Enforcement Administration could consider the

Company’s Delta-8 products an illegal controlled substance under

the Controlled Substances Act (the “CSA”) or Federal Analogue Act

in the United States; risk that state or federal regulators or law

enforcement could take the position that the Delta-8 and Delta-9

products and/or in-process hemp extract are/is a Schedule I

controlled substance in violation of the CSA and similar state

laws; risk that the Company’s Delta-9 products could be considered

by state law enforcement and state regulators to be marijuana

illegal under state laws criminalizing the possession,

distribution, trafficking and sale of marijuana; risk that should

the Company become subject to enforcement action by federal or

state agencies, the Company could: (i) be forced to stop offering

some or all of it Delta-8 and Delta-9 products or stop all business

operations, (ii) be subject to other civil or criminal sanctions,

(iii) be required to defend against such enforcement and if

unsuccessful could cause the Company to cease its operations; and

risk that enforcement or regulatory action at the United States

federal and/or state level could adversely impact the listings of

the Common Shares on the TSXV and Nasdaq.

Readers are cautioned that the foregoing list is not exhaustive.

Readers are further cautioned not to place undue reliance on

forward-looking statements, as there can be no assurance that the

plans, intentions or expectations upon which they are placed will

occur. Such information, although considered reasonable by

management at the time of preparation, may prove to be incorrect

and actual results may differ materially from those

anticipated.

Forward-looking statements contained in this press release are

expressly qualified by this cautionary statement and reflect the

Company’s expectations as of the date hereof and are subject to

change thereafter. The Company undertakes no obligation to update

or revise any forward-looking statements, whether as a result of

new information, estimates or opinions, future events or results or

otherwise or to explain any material difference between subsequent

actual events and such forward-looking information, except as

required by applicable law.

CAUTIONARY NOTE REGARDING FUTURE ORIENTED FINANCIAL

INFORMATION

This press release may contain future oriented financial

information (“FOFI”) within the meaning of Canadian securities

legislation, about prospective results of operations, financial

position or cash flows, based on assumptions about future economic

conditions and courses of action, which FOFI is not presented in

the format of a historical balance sheet, income statement or cash

flow statement. The FOFI has been prepared by management to provide

an outlook of the Company’s activities and results and has been

prepared based on a number of assumptions including the assumptions

discussed under the heading above entitled “Cautionary Note

Regarding Forward-Looking Statements” and assumptions with respect

to the costs and expenditures to be incurred by the Company,

capital expenditures and operating costs, taxation rates for the

Company and general and administrative expenses. Management does

not have, or may not have had at the relevant date, firm

commitments for all of the costs, expenditures, prices or other

financial assumptions which may have been used to prepare the FOFI

or assurance that such operating results will be achieved and,

accordingly, the complete financial effects of all of those costs,

expenditures, prices and operating results are not, or may not have

been at the relevant date of the FOFI, objectively

determinable.

Importantly, the FOFI contained in this press release are, or

may be, based upon certain additional assumptions that management

believes to be reasonable based on the information currently

available to management, including, but not limited to, assumptions

about: (i) the future pricing for the Company’s products, (ii) the

future market demand and trends within the jurisdictions in which

the Company may from time to time conduct the Company’s business,

(iii) the Company’s ongoing inventory levels, and operating cost

estimates, (iv) the Company’s net proceeds from the ATM Program and

connectFirst credit facility. The FOFI or financial outlook

contained in this press release do not purport to present the

Company’s financial condition in accordance with IFRS as issued by

the International Accounting Standards Board, and there can be no

assurance that the assumptions made in preparing the FOFI will

prove accurate. The actual results of operations of the Company and

the resulting financial results will likely vary from the amounts

set forth in the analysis presented in any such document, and such

variation may be material (including due to the occurrence of

unforeseen events occurring subsequent to the preparation of the

FOFI). The Company and management believe that the FOFI has been

prepared on a reasonable basis, reflecting management’s best

estimates and judgments as at the applicable date. However, because

this information is highly subjective and subject to numerous risks

including the risks discussed under the heading above entitled

“Cautionary Note Regarding Forward-Looking Statements” and under

the heading “Risk Factors” in the Company’s public disclosures,

FOFI or financial outlook within this press release should not be

relied on as necessarily indicative of future results.

Readers are cautioned not to place undue reliance on the FOFI,

or financial outlook contained in this press release. Except as

required by Canadian securities laws, the Company does not intend,

and does not assume any obligation, to update such FOFI.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230130005764/en/

INFORMATION

Media Inquiries Omar Khan Chief Communications and Public

Affairs Officer omar@hightideinc.com

Investor Inquiries Vahan Ajamian Capital Markets Advisor

vahan@hightideinc.com

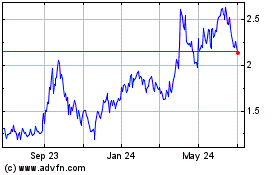

High Tide (NASDAQ:HITI)

Historical Stock Chart

From Mar 2024 to Apr 2024

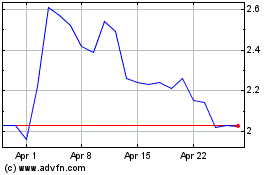

High Tide (NASDAQ:HITI)

Historical Stock Chart

From Apr 2023 to Apr 2024