FALSE000185574700018557472024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): August 7, 2024

Blend Labs, Inc.

(Exact name of Registrant, as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40599 | | 45-5211045 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

415 Kearny Street

San Francisco, California 94108

(Address of principal executive offices, including zip code)

(650) 550-4810

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value of $0.00001 per share | | BLND | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 8, 2024, Blend Labs, Inc. (the “Company” or “Blend”) issued a press release announcing its financial results for the second fiscal quarter ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure

On August 8, 2024, Blend posted supplemental investor materials on the investor relations section of its website (investor.blend.com). Blend announces material information to the public about Blend, its products and services and other matters through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, webcasts, the investor relations section of its website (investor.blend.com), its blog (blend.com/blog) and its X account (@blendlabsinc) in order to achieve broad, non-exclusionary distribution of information to the public and for complying with its disclosure obligations under Regulation FD.

The information in Item 2.02 and Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events

On August 7, 2024, the Company's board of directors authorized the repurchase of up to $25.0 million of the Company’s Class A common stock. The Company’s board of directors expects to assess any future repurchase programs based on the Company’s balance sheet, expected free cash flow, and alternative investment opportunities at the time. Any future authorization will be approved and executed consistent with the Company’s capital allocation strategy.

Repurchases may be made from time to time through open market repurchases or through privately negotiated transactions subject to market conditions, applicable legal requirements and other relevant factors. Open market repurchases may be structured to occur in accordance with the requirements of Rule 10b-18 of the Securities Exchange Act of 1934, as amended. The Company may also, from time to time, enter into Rule 10b5-1 plans to facilitate repurchases of its shares under this authorization. The repurchase program does not obligate the Company to acquire any particular amount of its Class A common stock, and it may be suspended at any time at the Company’s discretion. The timing and actual number of shares repurchased may depend on a variety of factors, including price, general business and market conditions, and alternative investment opportunities.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

Exhibit

No. | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Blend Labs, Inc. |

| Date: August 8, 2024 | | |

| | By: | /s/ Amir Jafari |

| | Name: | Amir Jafari |

| | Title:

| Head of Finance and Administration (Principal Financial Officer) |

Blend Announces Second Quarter 2024 Financial Results

Meets Revenue Guidance and Outperforms Operating Loss Target in Second Quarter 2024

August 8, 2024

SAN FRANCISCO -- Blend Labs, Inc. (NYSE:BLND), the leading platform for digital banking solutions, today announced its second quarter 2024 financial results.

“The second quarter marked another strong quarter for Blend, as we signed several important deals with new customers across mortgage and consumer banking,” said Nima Ghamsari, Head of Blend. “Despite continued pressures on the mortgage industry, we’re excited about the new investments we made in the Blend Platform and the success we achieved in expanding our relationships with key customers through their increased adoption of our add-on products. In Consumer Banking, we achieved $8 million of revenue in the quarter for the first time ever, with positive momentum thanks to the successful deployment and ramp of our solutions.

As always, we’re focused on maintaining our position as a leader in digital banking innovation and on continuing to build new features that help our customers be successful. Over the coming months, we expect to go live with several product developments with our customers, including the latest phase of our instant home equity and next generation refinance experiences. We expect the second half of 2024 to be pivotal for Blend, and as the mortgage market recovers, we expect we will be in an even stronger position given the actions we have taken to form a built to last company. We’re also thrilled to announce our first ever share buyback program of up to $25 million, which reflects our Board’s confidence in our business and path ahead.”

Recent Highlights

•Welcoming New Mortgage Customers: Blend welcomed several new mortgage customers, including Horizon Bank, an $8 billion financial institution based in the Midwest, as well as First National Bank of Fort Smith, who partnered with Blend to streamline their mortgage lending and home equity businesses.

•Outpacing Expectations For Our Consumer Banking Suite: The second quarter marks the first time our Consumer Banking Suite generated $8 million of revenue in a quarter, representing 37% of year-over-year growth. The Consumer Banking Suite is picking up momentum from successful implementations with large customers like Navy Federal Credit Union as well as new customer additions, such as Andrews Federal Credit Union, a multi-billion dollar credit union based in Maryland, who recently chose Blend to power the deposit account opening experience for their members.

•Delivering Increased Value Across Our Full Product Suite As Economic Value Per Funded Loan Reaches A New High: Blend’s economic value per funded loan, which we use to measure the economic value derived from each transaction in our mortgage suite, reached a new high of $97 for the second quarter. This increase can be attributed to a combination of better renewal pricing and increased adoption and utilization of our attach products.

•Deploying Next-Generation Product Enhancements: Blend continues to invest and enhance its leading digital banking platform. The Company is in the process of implementing new AI features into the account opening experience for one of its largest customers, which we expect will significantly boost the customer’s efficiency once rolled out. We have also been developing our instant home equity product and are preparing to launch it with a key customer during the third quarter.

•Improving Net Operating Loss: Blend GAAP net operating loss once again decreased significantly in the quarter compared to the same period last year. The Company significantly decreased operating expenses over the past year, and is continuing to progress toward achieving non-GAAP operating profitability.

•Share Repurchase Program: Blend today announced that its Board of Directors authorized a share repurchase program providing for the repurchase of up to $25 million of its Class A common stock. The program underscores the Board’s strong confidence in Blend’s differentiated digital banking platform and market opportunities that are not yet fully reflected in the Company’s current market valuation.

Second Quarter 2024 Financial Highlights

Revenue

•Total company revenue in 2Q24 was $40.5 million, composed of Blend Platform segment revenue of $28.7 million and Title segment revenue of $11.8 million.

•Within the Blend Platform segment, Mortgage Suite revenue decreased by 17% year-over-year to $18.5 million.

•Consumer Banking Suite revenue totaled $8.0 million in 2Q24, an increase of 37% as compared to the prior-year period.

•Professional services revenue totaled $2.2 million in 2Q24, consistent with the same period last year.

Gross Margin & Profitability

•Blend GAAP and non-GAAP gross profit margin were approximately 54%, down slightly compared to 55% on both a GAAP and non-GAAP basis in 2Q23.

•GAAP Blend Platform segment gross profit was $20.3 million in 2Q24, down from $22.1 million in 2Q23. Non-GAAP Blend Platform segment gross profit was $20.5 million in 2Q24, down from $22.4 million in 2Q23.

•GAAP and non-GAAP Software platform gross margins were 79% in 2Q24, down slightly compared to 80% on a GAAP basis and 81% on a non-GAAP basis in 2Q23.

•GAAP loss from operations was $13.3 million, compared to $36.7 million in 2Q23. Non-GAAP loss from operations was $5.6 million, compared to $17.9 million in 2Q23.

•GAAP net loss per share attributable to common stockholders was $0.09 compared to $0.18 in 2Q23. Non-GAAP consolidated net loss per share was $0.02 compared to $0.09 in 2Q23.

Liquidity, Cash, & Capital Resources

•As of June 30, 2024, Blend has cash, cash equivalents, and marketable securities, including restricted cash, totaling $119.9 million, with no outstanding debt after the Company’s term loan was repaid in full in April upon receiving a $150 million investment from Haveli Investments.

•Blend cash used in operating activities was $6.7 million in 2Q24, compared to $34.4 million in 2Q23. Free cash flow was $(8.5) million in 2Q24, compared to $(34.6) million in 2Q23. Unlevered free cash flow was $(6.9) million in 2Q24, compared to $(27.4) million in 2Q23.

Third Quarter 2024 Outlook

Blend is providing guidance for the third quarter of 2024 as follows:

| | | | | |

| $ in millions |

Q3 2024 Guidance |

Blend Platform Segment Revenue | $28.0 – $31.0 |

Title Segment Revenue | $11.5 – $12.5 |

| Blend Labs, Inc. Consolidated Revenue | $39.5 – $43.5 |

| |

| Non-GAAP Net Operating Loss | $(7.0) – $(4.0) |

Blend’s 3Q24 guidance reflects our internal estimate of U.S. aggregate industry mortgage originations in 3Q24.

Note that economic conditions, including those affecting the levels of real estate and mortgage activity, as well as the financial condition of some of our financial customers, remain highly uncertain.

We have not provided the forward-looking GAAP equivalent to our non-GAAP Net Operating Loss outlook or a GAAP reconciliation as a result of the uncertainty regarding, and the potential variability of, stock-based compensation, which is affected by our hiring and retention needs and future prices of our stock, and non-recurring, infrequent or unusual items.

Webcast Information

On Thursday, August 8, 2024 at 4:30 pm ET, Blend will host a live discussion of its second quarter 2024 financial results. A link to the live discussion will be made available on the Company’s investor relations website at https://investor.blend.com. A replay will also be made available following the discussion at the same website.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements may relate to, but are not limited to, quotations of management; the “Third Quarter 2024 Outlook” section above; Blend’s expectations regarding its financial condition and operating performance, including growth opportunities, investments and plans for future operations and competitive position; Blend’s partnerships and expectations related to such partnerships on Blend’s products and business; Blend’s products, pipeline, and technologies; Blend’s customers and customer relationships, including the businesses of such customers and their position in the market; Blend’s cost reduction efforts and ability to achieve profitability in the future; projections for mortgage loan origination volumes, including projections provided by third parties; other macroeconomic and industry conditions; and Blend’s expectations for changes in revenue, as well as assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other comparable terminology that concern Blend’s expectations, strategy, plans or intentions. You should not put undue reliance on any forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by which such performance or results will be achieved, if at all.

Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith beliefs and assumptions as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks and uncertainties include the risks that: changes in economic conditions, such as mortgage interest rates, credit availability, real estate prices, inflation or consumer confidence, adversely affect our industry, markets and business, we fail to retain our existing customers or to acquire new customers in a cost-effective manner; our customers fail to maintain their utilization of our products and services; our relationships with any of our key customers were to be terminated or the level of business with them significantly reduced over time; we are unable to compete in highly competitive markets; we are unable to manage our growth; we are unable to make accurate predictions about our future performance due to our limited operating history in an evolving industry and evolving markets; we are unable to successfully integrate or realize the benefits of our acquisition of Title365; our restructuring actions do not result in the desired outcomes or adversely affect our business, impairment charges on certain assets have an adverse effect on our financial condition and results of operations; risks related to the investment from Haveli, including the governance rights of Haveli and potential dilution as a result of the investment; changes to our expectations regarding our share repurchase program; or we are unable to generate sufficient cash flows or otherwise maintain sufficient liquidity to fund our operations and satisfy our liabilities. Further information on these risks and other factors that could affect our financial results are set forth in our filings with the Securities and Exchange Commission, including in our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 that will be filed following this press release. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this press release may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. These factors could cause actual results, performance, or achievement to

differ materially and adversely from those anticipated or implied in the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. Except as required by law, Blend does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise.

About Non-GAAP Financial Measures and Other Performance Metrics

In addition to financial measures prepared in accordance with GAAP, this press release and the accompanying tables contain, and the conference call will contain, non-GAAP financial measures, including non-GAAP gross profit and non-GAAP gross profit margin, non-GAAP software platform gross profit and gross margin, non-GAAP Blend Platform segment gross profit and gross margin, non-GAAP operating expenses, non-GAAP loss from operations, non-GAAP net operating loss, and non-GAAP consolidated net loss per share. Our management uses these non-GAAP financial measures internally in analyzing our financial results and believes they are useful to investors, as a supplement to the corresponding GAAP financial measures, in evaluating our ongoing operational performance and trends, in allowing for greater transparency with respect to measures used by our management in their financial and operational decision making, and in comparing our results of operations with other companies in the same industry, many of which present similar non-GAAP financial measures to help investors understand the operational performance of their businesses.

We adjust the following items from our non-GAAP financial measures as detailed in the reconciliations below:

Stock-based compensation. We exclude stock-based compensation, which is a non-cash expense, from our non-GAAP financial measures because we believe that excluding this cost provides meaningful supplemental information regarding operational performance. In particular, companies calculate stock-based compensation expense using a variety of valuation methodologies and subjective assumptions, and expense related to stock-based awards can vary significantly based on the timing, size and nature of awards granted.

Loss on transfer of subsidiary. We exclude loss on transfer of our subsidiary in India to a third party, which is primarily comprised of impairment charges related to certain assets transferred as part of the agreement, costs incurred to settle certain liabilities arising from the agreement, and one-time legal costs incurred to facilitate the transaction. These costs are non-recurring in nature and we do not believe they have a direct correlation to the operation of our business.

Compensation realignment costs. We exclude the compensation realignment costs incurred in connection with the change in our compensation strategy from our non-GAAP financial measures. These costs relate to amortization of one-time two-installment cash bonus payment made to certain employees in lieu of previously committed equity-based awards, driven by an organizational initiative to standardize our equity compensation program. We believe that excluding these charges for purposes of calculating the non-GAAP financial measures provides more meaningful period to period comparisons.

Restructuring costs. We exclude restructuring costs as these costs primarily include employee severance, executive transition costs and other costs directly associated with resource realignments incurred in connection with changing strategies or business conditions. These costs can vary significantly in amount and frequency based on the nature of the actions as well as the changing needs of our business and we believe that excluding them provides easier comparability of pre- and post-restructuring operating results.

Transaction-related costs. We exclude costs related to mergers and acquisitions from our non-GAAP financial measures as we do not consider these costs to be related to organic continuing operations of the acquired business or relevant to assessing the long-term performance of the acquired assets. These adjustments allow for more accurate comparisons of the financial results to historical operations and forward looking guidance. These costs include financial advisory, legal, accounting and other transactional costs incurred in connection with acquisition activities, and non-recurring transition and integration costs.

Gains related to carrying value adjustments of non-marketable equity securities. We exclude gains related to the carrying value adjustments of non-marketable equity securities because we do not believe these non-cash gains have a direct correlation to the operation of our business.

Foreign currency gains and losses. We exclude unrealized gains and losses resulting from remeasurement of assets and liabilities from foreign currency into the functional currency as we do not believe these gains and losses to be indicative of our business performance and excluding these gains and losses provides information consistent with how we evaluate our operating results.

Net income or loss allocated to noncontrolling interest and accretion of redeemable noncontrolling interest to redemption value. We exclude net income or loss allocated to noncontrolling interest and accretion of redeemable noncontrolling interest to its redemption value from our non-GAAP net loss per share calculation as we measure our non-GAAP net loss per share on a consolidated basis.

Accretion of Series A redeemable preferred stock to its redemption value. We exclude the accretion of Series A redeemable convertible preferred stock to its redemption value from our non-GAAP net loss per share calculation as we measure our non-GAAP net loss per share on a consolidated basis.

Litigation contingencies. We exclude costs related to litigation contingencies, which represent reserves for legal settlements. These costs are non-recurring in nature and we do not believe they have a direct correlation to the operation of our business.

Loss on extinguishment of debt. We exclude the write offs of unamortized debt issuance costs and debt discounts related to the extinguishment of our term loan and termination of the credit agreement from our non-GAAP financial measures. These costs are non-recurring in nature and we do not believe they have a direct correlation to the operation of our business.

In addition, our non-GAAP financial measures include measures related to our liquidity, such as free cash flow, unlevered free cash flow and free cash flow margin. Free cash flow is defined as net cash flow from operating activities less cash spent on additions to property, equipment, internal-use software and intangible assets. Unlevered free cash flow is defined as free cash flow before cash paid for interest on our outstanding debt. Free cash flow margin is defined as free cash flow divided by total revenue. We believe information regarding free cash flow, free cash flow margin and unlevered free cash flow provide useful information to investors as a basis for comparing our performance with other companies in our industry and as a measurement of the cash generation that is available to invest in our business and meet our financing needs. However, given our debt service obligations and other contractual obligations, unlevered free cash flow does not represent residual cash flow available for discretionary expenditures. In April 2024, we repaid in full all amounts outstanding and payable under our debt obligations and therefore eliminated any debt service obligations.

It is important to note that the particular items we exclude from, or include in, our non-GAAP financial measures may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the same industry. In addition, other companies may utilize metrics that are not similar to ours.

The non-GAAP financial information is presented for supplemental informational purposes only and is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. There are material limitations associated with the use of non-GAAP financial measures since they exclude significant expenses and income that are required by GAAP to be recorded in our financial statements. Please see the reconciliation tables at the end of this release for the reconciliation of GAAP and non-GAAP results. Management encourages investors and others to review Blend’s financial information in its entirety and not rely on a single financial measure.

Economic Value per Funded Loan in our Mortgage Suite represents the contractual rates for mortgage and mortgage-related products multiplied by the number of loans funded or transactions completed, as applicable, by a customer in the specified period, divided by the total number of loans funded by all Mortgage Suite customers in that same period. Additionally, the value derived from partnerships and verification of income products that is associated with the mortgage application stage is aligned with the timing of funding the related loan (typically a 3 month delay from the time of application). We use Economic Value per Funded Loan to measure our success at broadening the client relationships from the underlying mortgage transactions and selling additional products through our software platform.

About Blend

Blend is the infrastructure powering the future of banking. Financial providers — from large banks, fintechs, and credit unions to community and independent mortgage banks — use Blend’s platform to transform banking experiences for their customers. Blend powers billions of dollars in financial transactions every day. To learn more, visit www.blend.com.

Blend Labs, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except per share amounts)

(Unaudited) | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 45,450 | | | $ | 30,962 | |

| Marketable securities and other investments | 67,153 | | | 105,960 | |

Trade and other receivables, net of allowance for credit losses of $91 and $149, respectively | 19,602 | | | 18,345 | |

| Prepaid expenses and other current assets | 10,315 | | | 14,569 | |

| Total current assets | 142,520 | | | 169,836 | |

| Property and equipment, net | 7,617 | | | 3,945 | |

| Operating lease right-of-use assets | 7,516 | | | 8,565 | |

| Intangible assets, net | 2,099 | | | 2,108 | |

| Deferred contract costs | 2,020 | | | 2,453 | |

| Restricted cash, non-current | 7,294 | | | 7,291 | |

| Other non-current assets | 16,344 | | | 11,867 | |

| Total assets | $ | 185,410 | | | $ | 206,065 | |

| Liabilities, redeemable equity and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,084 | | | $ | 2,170 | |

| Deferred revenue | 20,832 | | | 8,984 | |

| Accrued compensation | 3,225 | | | 5,562 | |

| Other current liabilities | 16,383 | | | 14,858 | |

| Total current liabilities | 41,524 | | | 31,574 | |

| Operating lease liabilities, non-current | 5,172 | | | 6,982 | |

| Other non-current liabilities | 1,571 | | | 2,228 | |

| Debt, non-current, net | — | | | 138,334 | |

| Total liabilities | 48,267 | | | 179,118 | |

| Commitments and contingencies | | | |

| Redeemable noncontrolling interest | 49,169 | | | 46,190 | |

Series A redeemable convertible preferred stock, par value $0.00001 per share: 200,000 shares authorized, 150 and 0 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 133,445 | | | — | |

| Stockholders’ equity: | | | |

| Class A, Class B and Class C Common Stock, par value $0.00001 per share: 3,000,000 (Class A 1,800,000, Class B 600,000, Class C 600,000) shares authorized; 254,207 (Class A 248,985, Class B 5,222, Class C 0) and 249,910 (Class A 240,262, Class B 9,648, Class C 0) shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 2 | | | 2 | |

| Additional paid-in capital | 1,335,928 | | | 1,321,944 | |

| Accumulated other comprehensive loss | 304 | | | 441 | |

| Accumulated deficit | (1,381,705) | | | (1,341,630) | |

| Total stockholders’ equity | (45,471) | | | (19,243) | |

Total liabilities, redeemable equity and stockholders’ equity | $ | 185,410 | | | $ | 206,065 | |

Blend Labs, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | | | | | | |

| Software platform | $ | 26,475 | | | $ | 28,115 | | | $ | 48,211 | | | $ | 51,085 | |

| Professional services | 2,221 | | | 2,216 | | | 4,325 | | | 3,950 | |

| Title | 11,784 | | | 12,484 | | | 22,891 | | | 25,116 | |

| Total revenue | 40,480 | | | 42,815 | | | 75,427 | | | 80,151 | |

| Cost of revenue | | | | | | | |

| Software platform | 5,674 | | | 5,486 | | | 10,849 | | | 11,289 | |

| Professional services | 2,681 | | | 2,705 | | | 5,304 | | | 5,511 | |

| Title | 10,447 | | | 11,131 | | | 19,455 | | | 24,005 | |

| Total cost of revenue | 18,802 | | | 19,322 | | | 35,608 | | | 40,805 | |

| Gross profit | 21,678 | | | 23,493 | | | 39,819 | | | 39,346 | |

| Operating expenses: | | | | | | | |

| Research and development | 12,916 | | | 22,091 | | | 27,099 | | | 48,348 | |

| Sales and marketing | 9,370 | | | 16,128 | | | 19,585 | | | 33,696 | |

| General and administrative | 12,524 | | | 19,646 | | | 26,459 | | | 40,327 | |

| | | | | | | |

| | | | | | | |

| Restructuring | 207 | | | 2,349 | | | 1,190 | | | 15,132 | |

| Total operating expenses | 35,017 | | | 60,214 | | | 74,333 | | | 137,503 | |

| Loss from operations | (13,339) | | | (36,721) | | | (34,514) | | | (98,157) | |

| Interest expense | (1,648) | | | (7,947) | | | (6,747) | | | (15,516) | |

| Other income (expense), net | (4,411) | | | 3,232 | | | 1,242 | | | 6,114 | |

| Loss before income taxes | (19,398) | | | (41,436) | | | (40,019) | | | (107,559) | |

| Income tax expense | (23) | | | (53) | | | (65) | | | (124) | |

| Net loss | (19,421) | | | (41,489) | | | (40,084) | | | (107,683) | |

| Less: Net loss attributable to noncontrolling interest | 14 | | | 258 | | | 9 | | | 1,035 | |

| Net loss attributable to Blend Labs, Inc. | (19,407) | | | (41,231) | | | (40,075) | | | (106,648) | |

| Less: Accretion of redeemable noncontrolling interest to redemption value | (1,527) | | | (1,592) | | | (2,988) | | | (3,648) | |

| Less: Accretion of Series A redeemable convertible preferred stock to redemption value | (2,661) | | | — | | | (2,661) | | | — | |

| Net loss attributable to Blend Labs, Inc. common stockholders | $ | (23,595) | | | $ | (42,823) | | | $ | (45,724) | | | $ | (110,296) | |

| | | | | | | |

| Net loss per share attributable to Blend Labs, Inc. common stockholders: | | | | | | | |

| Basic and diluted | $ | (0.09) | | | $ | (0.18) | | | $ | (0.18) | | | $ | (0.45) | |

| Weighted average shares used in calculating net loss per share: | | | | | | | |

| Basic and diluted | 253,069 | | | 244,262 | | | 252,000 | | | 242,861 | |

| | | | | | | |

| Comprehensive loss: | | | | | | | |

| Net loss | $ | (19,421) | | | $ | (41,489) | | | $ | (40,084) | | | $ | (107,683) | |

| Unrealized (loss) gain on marketable securities | (42) | | | (773) | | | (146) | | | 48 | |

| Foreign currency translation (loss) gain | — | | | (11) | | | 9 | | | (29) | |

| Comprehensive loss | (19,463) | | | (42,273) | | | (40,221) | | | (107,664) | |

Less: Comprehensive loss attributable to noncontrolling interest | 14 | | | 258 | | | 9 | | | 1,035 | |

| Comprehensive loss attributable to Blend Labs, Inc. | $ | (19,449) | | | $ | (42,015) | | | $ | (40,212) | | | $ | (106,629) | |

Blend Labs, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Operating activities | | | | | | | |

| Net loss | $ | (19,421) | | | $ | (41,489) | | | $ | (40,084) | | $ | (107,683) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | |

| Stock-based compensation | 7,271 | | 14,364 | | 15,342 | | 30,756 |

| Depreciation and amortization | 558 | | 626 | | 1,122 | | 1,256 |

| Amortization of deferred contract costs | 253 | | 761 | | 519 | | 1,745 |

| Amortization of debt discount and issuance costs | 170 | | 759 | | 690 | | 1,489 |

| Amortization of operating lease right-of-use assets | 842 | | 809 | | 1,703 | | 1,615 |

| Gain on investment in equity securities | — | | — | | (4,417) | | — |

| Loss on extinguishment of debt | 5,476 | | — | | 5,476 | | — |

| Other | (92) | | (2,025) | | (326) | | (3,372) |

| Changes in operating assets and liabilities: | | | | | | | |

| Trade and other receivables | (1,409) | | (1,580) | | (1,227) | | 1,320 |

| Prepaid expenses and other assets, current and non-current | 2,486 | | 1,058 | | 3,453 | | (3,911) |

| Deferred contract costs, non-current | 177 | | (993) | | 433 | | (776) |

| Accounts payable | (1,217) | | 1,217 | | (1,489) | | 1,889 |

| Deferred revenue | (708) | | (1,076) | | 11,848 | | 3,275 |

| Accrued compensation | (1,961) | | (6,294) | | (2,337) | | (5,318) |

| Operating lease liabilities | (1,096) | | (914) | | (2,146) | | (1,917) |

| Other liabilities, current and non-current | 2,005 | | 387 | | 906 | | (1,411) |

| Net cash used in operating activities | (6,666) | | (34,390) | | $ | (10,534) | | $ | (81,043) |

| Investing activities | | | | | | | |

| Purchases of marketable securities | (28,217) | | (8,751) | | (76,529) | | (194,957) |

| Sale of available-for-sale securities | — | | — | | 100,297 | | — |

| Maturities of marketable securities | 5,000 | | 40,139 | | 15,600 | | 197,709 |

| Additions to property, equipment, internal-use software development costs and intangible assets | (1,867) | | (170) | | (3,831) | | (474) |

| Net cash provided by investing activities | (25,084) | | 31,218 | | 35,537 | | 2,278 |

| Financing activities | | | | | | | |

| Proceeds from exercises of stock options, including early exercises, net of repurchases | 95 | | 1 | | 714 | | 22 |

| Taxes paid related to net share settlement of equity awards | (3,213) | | (1,092) | | (7,019) | | (3,532) |

| Repayment of long-term debt | (144,500) | | — | | (144,500) | | — |

| Net proceeds from the issuance of the Series A redeemable convertible preferred stock and the Warrant | 149,375 | | — | | 149,375 | | — |

| Payment for issuance costs related to the Series A redeemable convertible preferred stock and the Warrant | (9,077) | | — | | (9,077) | | — |

| Net cash used in financing activities | (7,320) | | (1,091) | | (10,507) | | (3,510) |

| Effect of exchange rates on cash, cash equivalents, and restricted cash | (1) | | 5 | | (5) | | 13 |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (39,071) | | (4,258) | | 14,491 | | (82,262) |

| Cash, cash equivalents, and restricted cash at beginning of period | 91,815 | | 51,553 | | 38,253 | | 129,557 |

| Cash, cash equivalents, and restricted cash at end of period | $ | 52,744 | | $ | 47,295 | | $ | 52,744 | | $ | 47,295 |

| Reconciliation of cash, cash equivalents, and restricted cash within the condensed consolidated balance sheets: | | | | | | | |

| Cash and cash equivalents | $ | 45,450 | | $ | 34,980 | | $ | 45,450 | | $ | 34,980 |

| Restricted cash | 7,294 | | 12,315 | | 7,294 | | 12,315 |

| Total cash, cash equivalents, and restricted cash | $ | 52,744 | | $ | 47,295 | | $ | 52,744 | | $ | 47,295 |

| Supplemental disclosure of cash flow information: | | | | | | | |

| Cash paid for income taxes | $ | 67 | | $ | (53) | | $ | 76 | | $ | 48 |

| Cash paid for interest | $ | 1,621 | | $ | 7,189 | | $ | 6,150 | | $ | 14,100 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental disclosure of non-cash investing and financing activities: | | | | | | | |

| Vesting of early exercised stock options | $ | 172 | | $ | 256 | | $ | 356 | | $ | 1,014 |

| Operating lease liabilities arising from obtaining new or modified right-of-use assets | $ | — | | $ | — | | $ | 654 | | $ | 327 |

| Stock-based compensation included in capitalized internal-use software development costs | $ | 494 | | $ | — | | $ | 1,130 | | $ | — |

| Accretion of redeemable noncontrolling interest to redemption value | $ | 1,527 | | $ | 1,592 | | $ | 2,988 | | $ | 3,648 |

| Accretion of Series A redeemable convertible preferred stock to redemption value | $ | 2,661 | | $ | — | | $ | 2,661 | | $ | — |

| Issuance costs accrued in connection with the Series A redeemable convertible preferred stock and the Warrant | $ | 403 | | $ | — | | $ | 403 | | $ | — |

Blend Labs, Inc.

Revenue Disaggregation

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | |

| 2024 | | 2023 | | |

| Blend Platform: | | | | | | | YoY change |

| Mortgage Suite | $ | 18,454 | | 64 | % | | $ | 22,271 | | 73 | % | | (17) | % |

| Consumer Banking Suite | 8,021 | | 28 | % | | 5,844 | | 20 | % | | 37 | % |

| Total software platform | 26,475 | | 92 | % | | 28,115 | | 93 | % | | (6) | % |

| Professional services | 2,221 | | 8 | % | | 2,216 | | 7 | % | | — | % |

| Total Blend Platform | 28,696 | | 100 | % | | 30,331 | | 100 | % | | (5) | % |

| Title | 11,784 | | | | 12,484 | | | | (6) | % |

| Total revenue | $ | 40,480 | | | | $ | 42,815 | | | | (5) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | |

| 2024 | | 2023 | | |

| Blend Platform: | | | | | | | YoY change |

| Mortgage Suite | $ | 33,532 | | 64 | % | | $ | 40,066 | | 73 | % | | (16) | % |

| Consumer Banking Suite | 14,679 | | 28 | % | | 11,019 | | 20 | % | | 33 | % |

| Total software platform | 48,211 | | 92 | % | | 51,085 | | 93 | % | | (6) | % |

| Professional services | 4,325 | | 8 | % | | 3,950 | | 7 | % | | 9 | % |

| Total Blend Platform | 52,536 | | 100 | % | | 55,035 | | 100 | % | | (5) | % |

| Title | 22,891 | | | | 25,116 | | | | (9) | % |

| Total revenue | $ | 75,427 | | | | $ | 80,151 | | | | (6) | % |

Blend Labs, Inc.

Reconciliation of GAAP to non-GAAP Measures

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 |

| GAAP | | Non-GAAP adjustments(1) | | Non-GAAP |

| Gross

Profit | Gross Margin | | | Gross

Profit | Gross Margin |

| Blend Platform | | | | | | | |

| Software platform | $ | 20,801 | | 79 | % | | $ | 3 | | | $ | 20,804 | | 79 | % |

| Professional services | (460) | | (21) | % | | 119 | | | (341) | | (15) | % |

| Total Blend Platform | 20,341 | | 71 | % | | 122 | | | 20,463 | | 71 | % |

| Title | 1,337 | | 11 | % | | — | | | 1,337 | | 11 | % |

| Total | $ | 21,678 | | 54 | % | | $ | 122 | | | $ | 21,800 | | 54 | % |

| | | | | | | |

| Three Months Ended June 30, 2023 |

| GAAP | | Non-GAAP adjustments(1) | | Non-GAAP |

| Gross

Profit | Gross Margin | | | Gross

Profit | Gross Margin |

| Blend Platform | | | | | | | |

| Software platform | $ | 22,629 | | 80 | % | | $ | 9 | | | $ | 22,638 | | 81 | % |

| Professional services | (489) | | (22) | % | | 253 | | | (236) | | (11) | % |

| Total Blend Platform | 22,140 | | 73 | % | | 262 | | | 22,402 | | 74 | % |

| Title | 1,353 | | 11 | % | | 2 | | | 1,355 | | 11 | % |

| Total | $ | 23,493 | | 55 | % | | $ | 264 | | | $ | 23,757 | | 55 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2024 |

| GAAP | | Non-GAAP adjustments(1) | | Non-GAAP |

| Gross

Profit | Gross Margin | | | Gross

Profit | Gross Margin |

| Blend Platform | | | | | | | |

| Software platform | $ | 37,362 | | 77 | % | | $ | 7 | | | $ | 37,369 | | 78 | % |

| Professional services | (979) | | (23) | % | | 254 | | | (725) | | (17) | % |

| Total Blend Platform | 36,383 | | 69 | % | | 261 | | | 36,644 | | 70 | % |

| Title | 3,436 | | 15 | % | | 15 | | | 3,451 | | 15 | % |

| Total | $ | 39,819 | | 53 | % | | $ | 276 | | | $ | 40,095 | | 53 | % |

| | | | | | | |

| Six Months Ended June 30, 2023 |

| GAAP | | Non-GAAP adjustments(1) | | Non-GAAP |

| Gross

Profit | Gross Margin | | | Gross

Profit | Gross Margin |

| Blend Platform | | | | | | | |

| Software platform | $ | 39,796 | | 78 | % | | $ | 22 | | | $ | 39,818 | | 78 | % |

| Professional services | (1,561) | | (40) | % | | 593 | | | (968) | | (25) | % |

| Total Blend Platform | 38,235 | | 69 | % | | 615 | | | 38,850 | | 71 | % |

| Title | 1,111 | | 4 | % | | 137 | | | 1,248 | | 5 | % |

| Total | $ | 39,346 | | 49 | % | | $ | 752 | | | $ | 40,098 | | 50 | % |

Blend Labs, Inc.

Reconciliation of GAAP to non-GAAP Measures

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| GAAP operating expenses | $ | 35,017 | | | $ | 60,214 | | | $ | 74,333 | | | $ | 137,503 | |

| Non-GAAP adjustments: | | | | | | | |

Stock-based compensation(1) | 7,148 | | | 14,100 | | | 15,065 | | | 30,004 | |

Compensation realignment costs(3) | 254 | | | 1,778 | | | 1,155 | | | 2,874 | |

Restructuring(4) | 207 | | | 2,349 | | | 1,190 | | | 15,132 | |

Litigation contingencies(10) | — | | | (245) | | | — | | | (245) | |

Transaction-related costs(5) | — | | | 596 | | | — | | | 1,034 | |

| Non-GAAP operating expenses | $ | 27,408 | | | $ | 41,636 | | | $ | 56,923 | | | $ | 88,704 | |

| | | | | | | |

| GAAP loss from operations | $ | (13,339) | | | $ | (36,721) | | | $ | (34,514) | | | $ | (98,157) | |

| Non-GAAP adjustments: | | | | | | | |

Stock-based compensation(1) | 7,271 | | | 14,364 | | | 15,342 | | | 30,756 | |

Compensation realignment costs(3) | 254 | | | 1,778 | | | 1,155 | | | 2,874 | |

Restructuring(4) | 207 | | | 2,349 | | | 1,190 | | | 15,132 | |

Litigation contingencies(10) | — | | | (245) | | | — | | | (245) | |

Transaction-related costs(5) | — | | | 596 | | | — | | | 1,034 | |

| Non-GAAP loss from operations | $ | (5,607) | | | $ | (17,879) | | | $ | (16,827) | | | $ | (48,606) | |

| | | | | | | |

| GAAP net loss | $ | (19,421) | | | $ | (41,489) | | | $ | (40,084) | | | $ | (107,683) | |

| Non-GAAP adjustments: | | | | | | | |

Stock-based compensation(1) | 7,271 | | | 14,364 | | | 15,342 | | | 30,756 | |

Loss on extinguishment of debt(12) | 5,531 | | | — | | | 5,531 | | | — | |

Compensation realignment costs(3) | 254 | | | 1,778 | | | 1,155 | | | 2,874 | |

Restructuring(4) | 207 | | | 2,349 | | | 1,190 | | | 15,132 | |

Litigation contingencies(10) | — | | | (245) | | | — | | | (245) | |

Transaction-related costs(5) | — | | | 596 | | | — | | | 1,034 | |

Gain on investment in equity securities(6) | — | | | — | | | (4,417) | | | — | |

Foreign currency gains and losses(7) | (3) | | | (23) | | | (10) | | | (157) | |

Loss on transfer of subsidiary(2) | 601 | | | — | | | 601 | | | — | |

| Non-GAAP net loss | $ | (5,560) | | | $ | (22,670) | | | $ | (20,692) | | | $ | (58,289) | |

| | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| GAAP basic net loss per share | $ | (0.09) | | | $ | (0.18) | | | $ | (0.18) | | | $ | (0.45) | |

| Non-GAAP adjustments: | | | | | | | |

Net loss attributable to noncontrolling interest(8) | — | | | — | | | — | | | — | |

Accretion of redeemable noncontrolling interest to redemption value(8) | 0.01 | | | 0.01 | | | 0.01 | | | 0.01 | |

Accretion of Series A redeemable convertible preferred stock to redemption value(9) | 0.01 | | | — | | | 0.01 | | | — | |

Stock-based compensation(1) | 0.03 | | | 0.06 | | | 0.06 | | | 0.13 | |

Loss on extinguishment of debt(12) | 0.02 | | | — | | | 0.02 | | | — | |

Compensation realignment costs(3) | — | | | 0.01 | | | 0.01 | | | 0.01 | |

Restructuring(4) | — | | | 0.01 | | | 0.01 | | | 0.06 | |

Litigation contingencies (10) | — | | | — | | | — | | | — | |

Transaction-related costs(5) | — | | | — | | | — | | | — | |

Gain on investment in equity securities(6) | — | | | — | | | (0.02) | | | — | |

Foreign currency gains and losses(7) | — | | | — | | | — | | | — | |

Loss on transfer of subsidiary(2) | — | | | — | | | — | | | — | |

| Non-GAAP basic net loss per share | $ | (0.02) | | | $ | (0.09) | | | $ | (0.08) | | | $ | (0.24) | |

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | Six Months Ended June 30, |

| 2024 | | 2023 | 2024 | | 2023 |

| Net cash used in operating activities | $ | (6,666) | | | $ | (34,390) | | $ | (10,534) | | | $ | (81,043) | |

| Additions to property, equipment, internal-use software and intangible assets | (1,867) | | | (170) | | (3,831) | | | (474) | |

| Free cash flow | (8,533) | | | (34,560) | | (14,365) | | | (81,517) | |

| Cash paid for interest | 1,621 | | | 7,189 | | 6,150 | | | 14,100 | |

| Unlevered free cash flow | $ | (6,912) | | | $ | (27,371) | | $ | (8,215) | | | $ | (67,417) | |

| | | | | | |

| Revenue | $ | 40,480 | | | $ | 42,815 | | $ | 75,427 | | | $ | 80,151 | |

| Free cash flow margin | (21) | % | | (81) | % | (19) | % | | (102) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Notes: | | | | | | | | | |

(1) Stock-based compensation represents the non-cash grant date fair value of stock-based instruments utilized to incentivize our employees, for which the expense is recognized over the applicable vesting or performance period. | | |

| | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | |

| Stock-based compensation by function: | 2024 | | 2023 | | 2024 | | 2023 | | |

| Cost of revenue | $ | 123 | | | $ | 264 | | | $ | 277 | | | $ | 752 | | | |

| Research and development * | 2,567 | | | 4,829 | | | 5,919 | | | 12,960 | | | |

| Sales and marketing | 875 | | | 1,931 | | | 1,853 | | | 4,714 | | | |

| General and administrative | 3,706 | | | 7,340 | | | 7,293 | | | 12,330 | | | |

| Total | $ | 7,271 | | | $ | 14,364 | | | $ | 15,342 | | | $ | 30,756 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

* Net of $0.5 million and $1.1 million of additions to capitalized internal-use software for the three and six months ended June 30, 2024 and none for the three and six months ended June 30, 2023 |

(2) Loss on transfer of subsidiary represents a loss recognized in connection with the transfer of our subsidiary in India to a third-party and includes impairment charges related to certain assets transferred as part of the agreement, costs incurred to settle certain liabilities arising from the agreement, and one-time legal costs incurred to facilitate the transaction. |

(3) Compensation realignment costs relate to amortization of one-time cash bonus payment (paid in two installments in March and May 2023) to certain employees in lieu of previously committed equity-based awards, driven by an organizational initiative to standardize our equity compensation program. |

(4) The restructuring charges relate to our workforce reduction plans executed as part of our broader efforts to improve cost efficiency and better align our operating structure with our business activities. |

(5) Transaction-related costs include non-recurring due diligence, consulting, and integration costs recorded within general and administrative expense. |

(6) Gain on investment in equity securities represents an adjustment to the carrying value of the non-marketable security without a readily determinable fair value to reflect observable price changes. |

(7) Foreign currency gains and losses include transaction gains and losses incurred in connection with our operations in India. |

(8) Net loss attributable to noncontrolling interest and accretion of redeemable noncontrolling interest to redemption value relate to the 9.9% non-controlling interest in our Title365 subsidiary. |

(9) Accretion of Series A redeemable convertible preferred stock to its redemption value relates to the redemption rights outlined in the Haveli investment agreement. |

(10) Litigation contingencies represent reserves for legal settlements that are unusual or infrequent costs associated with our operating activities. |

(11) Loss on extinguishment of debt represents a write off of unamortized debt issuance costs and debt discounts related to the extinguishment of our term loan. |

Contacts:

Investor Relations

Bryan Michaleski

ir@blend.com

Media

press@blend.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

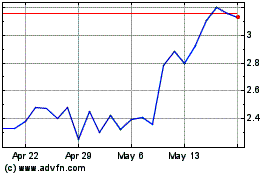

Blend Labs (NYSE:BLND)

Historical Stock Chart

From Sep 2024 to Oct 2024

Blend Labs (NYSE:BLND)

Historical Stock Chart

From Oct 2023 to Oct 2024