Marcus & Millichap’s Institutional Property Advisors Brokers Sale of Grocery-Anchored Regional Power Center in Central New Jersey

October 01 2024 - 12:50PM

Business Wire

Institutional Property Advisors (IPA), a division of Marcus

& Millichap (NYSE:MMI), announced the sale of Hamilton

Marketplace, a grocery-anchored regional power center in Hamilton

Township, New Jersey. The center sold for a total consideration of

over $100 million, making it the largest single-asset open-air

shopping center transaction to close in New Jersey since 2017.

“On the open market for the first time since development, the

offering drew a pool of private and institutional capital that we

haven’t seen since before the pandemic and interest from large

private family offices that know the value of controlling over 128

acres with highway frontage,” said Brad Nathanson, IPA executive

director. “Best-of-class power centers have had some of the

strongest resiliency and rent appreciation in the product type

since 2021, given the lack of new construction and high

re-tenanting cost that appreciated rents at an above average rate.

This created a demand driver for vintage power centers with strong

tenant bases.”

Nathanson and JP Colussi, IPA senior director, represented the

seller, SITE Centers, and procured the New Jersey-based buyer,

Paramount Realty.

“Hamilton Marketplace is in the top 1% of most-visited shopping

centers in the nation and one of the most-visited open-air shopping

centers in New Jersey,” said Colussi. “Its high anchor retention

and chain-leading sales volumes of top retailers make it one of the

nation’s best-performing grocery-anchored power centers. Of the 17

original anchors, 13 are still in place, and in the past three

years, nine anchor tenants exercised their contractual

obligations.”

Constructed in phases beginning in the early 2000s, the center

is anchored by a 65,155-square-foot ShopRite Supermarket. The

tenant roster includes Kohl’s, Ross, Staples, Barnes & Noble,

Michaels, Old Navy, Ulta, Burlington, and PetSmart.

“Retail fundamentals are the strongest that I have ever seen in

my 20-year career,” Nathanson added. “They are driving

institutions, REITs and all types of new private groups to push for

the reallocation of portfolios into large format shopping

centers.”

The last open-air shopping center to trade at over $100 million

in New Jersey was Centerton Square in Mt. Laurel, N.J. in 2017.

Nathanson and Colussi also represented the seller and procured the

buyer in that transaction.

About Institutional Property Advisors (IPA)

Institutional Property Advisors (IPA) is a division of Marcus

& Millichap (NYSE: MMI), a leading commercial real estate

services firm in North America. IPA’s combination of real estate

investment and capital markets expertise, industry-leading

technology, and acclaimed research offer customized solutions for

the acquisition, disposition and financing of institutional

properties and portfolios. For more information, please visit

www.institutionalpropertyadvisors.com

About Marcus & Millichap, Inc. (NYSE: MMI)

Marcus & Millichap, Inc. is a leading brokerage firm

specializing in commercial real estate investment sales, financing,

research and advisory services with offices throughout the United

States and Canada. As of December 31, 2023, the company had 1,783

investment sales and financing professionals in over 80 offices who

provide investment brokerage and financing services to sellers and

buyers of commercial real estate. The company also offers market

research, consulting and advisory services to clients. Marcus &

Millichap closed 7,546 transactions in 2023, with a sales volume of

approximately $43.6 billion. For additional information, please

visit www.MarcusMillichap.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241001666248/en/

Gina Relva, VP of Public Relations

Gina.Relva@MarcusMillichap.com

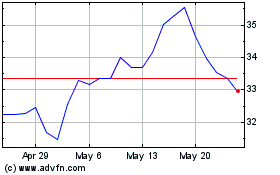

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Nov 2024 to Dec 2024

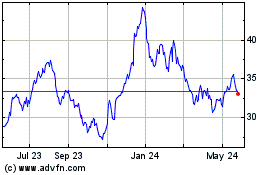

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Dec 2023 to Dec 2024