0000084129

false

0000084129

2023-10-15

2023-10-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

October 19, 2023 (October 15, 2023)

Rite

Aid Corporation

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-5742 |

|

23-1614034 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification Number) |

P.O.

Box 3165

Harrisburg,

Pennsylvania 17105

(Address of principal executive offices, including

zip code)

(717)

761-2633

(Registrant’s telephone number, including

area code)

N/A

(Former name

or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on

which registered |

| Common

Stock, $1.00 par value |

|

RAD |

|

The

New York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item

5.02. |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On October 15, 2023, Rite Aid

Corporation (the “Company”) appointed Carrie Teffner and Paul Keglevic to the Company’s Board of Directors (the

“Board”). Upon appointment, Mr. Keglevic and Ms. Teffner joined the Audit Committee of the Board, where Mr.

Keglevic will serve as Chair. Ms. Teffner was also appointed as a member of the Compensation Committee of the Board. In

connection with their respective appointments, Ms. Teffner and Mr. Keglevic will each be entitled to receive a cash

directors’ fee equal to $50,000 per month, payable in arrears, and reimbursement for travel and lodging expenses associated

with the directors’ services on the Board.

Ms. Teffner has over 30 years of strategic,

financial and operational leadership experience assisting retail and consumer product companies in driving growth and profitability.

She has deep expertise leading successful large-scale transformation initiatives and has served as Executive Vice President and Chief

Financial Officer at several Fortune 500 companies. Ms. Teffner currently serves on the boards of DXC Technology, International

Data Group and BFA Industries. She previously served on the boards of Ascena Retail Group, Avaya and GameStop.

Mr. Keglevic is an NACD-certified director

with over 45 years of leadership experience and deep expertise in finance and accounting, operational improvement and turnarounds, restructuring

and risk management across a range of industries. He has served as CEO, CFO, Chief Restructuring Officer and Chief Risk Officer at numerous

companies, most recently as CEO of Energy Future Holdings. Earlier in his career, Mr. Keglevic was a Partner and member of the U.S.

leadership team at PricewaterhouseCoopers. He currently serves on the boards of WeWork, Evergy and Envision Healthcare. Mr. Keglevic

previously served on the boards of Ascena Retail Group, Bonanza Creek Energy, Clear Channel Holdings, Cobalt International Energy and

Frontier Communications, among others.

Prior to their respective appointments, Ms. Teffner

and Mr. Keglevic, each entered into a letter agreement with the Company, dated as of July 5, 2023, pursuant to which Ms. Teffner

and Mr. Keglevic provided consulting services to the Company on matters relating to refinancing, restructuring and deleveraging

for the period between July 5, 2023 until their respective appointments on October 15, 2023. During such time, Ms. Teffner

and Mr. Keglevic each received $200,000 in the aggregate, consisting of monthly fees payable by the Company pursuant to their respective

letter agreements.

There were no arrangements or understandings between

either Ms. Teffner or Mr. Keglevic and any other person with respect to their appointment to the Board. Except as disclosed

herein, there are no other related-party transactions of the Company involving either Ms. Teffner or Mr. Keglevic.

Also, effective as of October 15, 2023, Elizabeth

“Busy” Burr rejoined the Audit Committee of the Board.

| Item

7.01. |

Regulation

FD Disclosure. |

On October 15, 2023, the Company issued a

press release announcing the appointments of Ms. Teffner and Mr. Keglevic to the Board. A copy of the press release is attached

hereto as Exhibit 99.1.

The information disclosed

under this Item 7.01, including Exhibit 99.1, is being “furnished” and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liabilities of such section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as

amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing. By filing this Current Report on

Form 8-K and furnishing this information, the Company makes no statement or admission as to the materiality of any information

in this Item 7.01 or Exhibit 99.1 attached hereto.

| Item

9.01. |

Financial

Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereto

duly authorized.

Date: October 19, 2023

| |

RITE AID CORPORATION |

| |

|

| |

By: |

/s/ Thomas Sabatino |

| |

Name: |

Thomas Sabatino |

| |

Title: |

Executive Vice President and Chief Legal

Officer |

Exhibit 99.1

Rite Aid Corporation Appoints Jeffrey S. Stein

Chief Executive Officer

Stein Succeeds Elizabeth “Busy”

Burr

PHILADELPHIA — Oct. 15,

2023 — Rite Aid Corporation (NYSE: RAD) (“Rite Aid” or the “Company”) today announced that its Board

of Directors has appointed Jeffrey S. Stein as Chief Executive Officer (CEO), Chief Restructuring Officer (CRO) and a member of the Board

of Directors, effective immediately. Mr. Stein succeeds Elizabeth (“Busy”) Burr, who has served as Interim CEO of Rite

Aid since January 2023. Ms. Burr will continue to serve on the Company’s Board.

Mr. Stein brings more than three

decades of experience as a leader and executive director at both public and private companies. Mr. Stein has particular expertise

in supporting companies that are driving meaningful business transformations and undergoing financial restructurings. This includes developing

and enhancing corporate growth and turnaround strategies, evaluating financing alternatives, analyzing capital investment programs, managing

complex litigation matters and assessing asset acquisition and disposition opportunities. As announced in a separate press release today,

Rite Aid has initiated a voluntary court-supervised process under Chapter 11 of the U.S. Bankruptcy Code. The Company is continuing to

operate in the ordinary course.

Bruce Bodaken, Rite Aid Chairman,

stated, “After a thorough and thoughtful search process, the Board unanimously agreed that Jeff is the right executive to lead Rite

Aid through its transformation. Jeff is a proven leader with a strong track record of guiding companies through financial restructurings.

We look forward to benefitting from his contributions and leveraging his expertise as we strengthen Rite Aid’s foundation and position

the business for long-term success.”

Mr. Stein said, “As CEO,

CRO, and a member of the Board of Directors, my priorities will include overseeing the actions now underway to strengthen the Company’s

financial position and further advance its journey to reach its full potential as a modern neighborhood pharmacy. I have tremendous confidence

in this business and the turnaround strategy that has been developed in recent months. I look forward to working closely with the Board,

management team, and our lenders and bond holders as we better position Rite Aid to deliver on our purpose of bringing people whole health

for life.”

“I am honored to have had the

opportunity to lead this incredible team during this pivotal transition period,” Ms. Burr said. “I can’t think

of a better leader than Jeff to take the reins at this stage of Rite Aid’s evolution, and I look forward to working closely with

him as I continue serving on the Board. I am grateful for the hard work and dedication of our associates during my tenure as Interim CEO,

and I’m confident they will give Jeff the same levels of support as the Company moves through the next phase of its transformation.”

“On behalf of the entire Board, I

thank Busy for the mark she has made as Rite Aid’s Interim CEO,” Mr. Bodaken said. “Busy has been a true culture

carrier for Rite Aid, and an avid cheerleader of our store, pharmacy and distribution center team members. Under her leadership, we have

continued to make significant progress on our turnaround initiatives to drive growth and reduce costs, and we look forward to her continued

contributions as a member of the Company’s Board.”

In addition to Mr. Stein, Rite

Aid has appointed Carrie Teffner and Paul Keglevic to its Board of Directors, also effective immediately:

| ● | Ms. Teffner has over 30 years of strategic, financial and operational leadership experience assisting retail and consumer product

companies in driving growth and profitability. She has deep expertise leading successful large-scale transformation initiatives and has

served as Executive Vice President and Chief Financial Officer at several Fortune 500 companies. Ms. Teffner currently serves on the boards

of DXC Technology, International Data Group and BFA Industries. She previously served

on the boards of Ascena Retail Group, Avaya and GameStop. |

| ● | Mr. Keglevic is an NACD-certified director with over 45 years of leadership experience and deep expertise in finance and accounting,

operational improvement and turnarounds, restructuring and risk management across a range of industries. He has served as CEO, CFO, Chief

Restructuring Officer and Chief Risk Officer at numerous companies, most recently as CEO of Energy Future Holdings. Earlier in his career,

Mr. Keglevic was a Partner and member of the U.S. leadership team at PricewaterhouseCoopers. He currently serves on the boards of

WeWork, Evergy and Envision Healthcare. Mr. Keglevic previously served on the boards of Ascena Retail Group, Bonanza Creek Energy,

Clear Channel Holdings, Cobalt International Energy and Frontier Communications, among others. |

With the appointments of Mr. Stein,

Ms. Teffner and Mr. Keglevic, Rite Aid’s Board of Directors will have nine members.

About Jeffrey S. Stein

Mr. Stein is Founder and Managing

Partner of Stein Advisors LLC, a financial advisory firm that provides consulting services to public and private companies experiencing

significant challenges, including financial and operational restructuring, complex contract renegotiation and litigation, and increased

regulatory oversight. He has served as an Executive Chairman, Chief Executive Officer, and Chief Restructuring Officer and as a director

on board committees including audit, compensation, corporate governance, finance, restructuring and risk management. Mr. Stein previously

served as Chief Executive Officer and Chief Restructuring Officer of GWG Holdings, Inc. and as Chief Restructuring Officer of Liberty

Steel Group Holdings Pte. Ltd., Whiting Petroleum Corporation, Philadelphia Energy Solutions, LLC and Westmoreland Coal Company.

Prior to founding Stein Advisors LLC

in 2010, Mr. Stein was a Co-Founder and Principal of Durham Asset Management LLC, a global event-driven distressed debt and special

situations equity asset management firm. From 2003 through 2009, Mr. Stein served as Co-Director of Research at Durham responsible

for the identification, evaluation and management of investments for the various Durham portfolios.

From 1997 to 2002, Mr. Stein

served as Co-Director of Research at The Delaware Bay Company, Inc., a boutique research and investment banking firm focused on the

distressed debt and special situations equity asset classes. Earlier in his career, he was an Associate and then an Assistant Vice President

in the Capital Preservation & Restructuring Group at Shearson Lehman Brothers.

Mr. Stein received a B.A. in

Economics from Brandeis University and an MBA in Finance and Accounting from New York University.

About Rite Aid

Rite Aid is a full-service pharmacy that

improves health outcomes. Rite Aid is defining the modern pharmacy by meeting customer needs with a wide range of vehicles that offer

convenience, including retail and delivery pharmacy, as well as services offered through our wholly owned subsidiaries, Elixir, Bartell

Drugs and Health Dialog. Elixir, Rite Aid’s pharmacy benefits and services company, consists of accredited mail and specialty pharmacies,

prescription discount programs and an industry leading adjudication platform to offer superior member experience and cost savings. Health

Dialog provides healthcare coaching and disease management services via live online and phone health services. Regional chain Bartell

Drugs has supported the health and wellness needs in the Seattle area for more than 130 years. Rite Aid employs more than 6,100 pharmacists

and operates more than 2,100 retail pharmacy locations across 17 states. For more information, visit www.riteaid.com.

Cautionary Statement Regarding

Forward-Looking Statements

This press release includes statements that may

constitute “forward-looking statements,” including expectations regarding the Company’s business plan and initiatives,

the Company’s ability to continue to operate its business as currently contemplated, the effect of the Chapter 11 reorganization,

the Company’s ability to emerge from the Chapter 11 reorganization as a stronger and more competitive enterprise, the Company’s

continued engagement in discussions with the potential bidders regarding the Company’s sale processes for all, or a portion of the

Company’s assets, including the Company’s ability to consummate any particular sale transaction, and other statements regarding

the Company’s plans and strategy. When used in this document, the words “will,” “target,” “expect,”

“continue,” “believe,” “seek, “anticipate,” “estimate,” “intend,” “could,”

“would,” “strives” and similar expressions are generally intended to identify forward-looking statements. These

statements are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. A number of important factors could cause actual results of the Company and its subsidiaries

to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, risks and

uncertainties outlined in the risk factors detailed in Item 1A. “Risk Factors,” of the Company’s Annual Report on Form 10-K

for the fiscal year ended March 4, 2023 (as filed with the Securities and Exchange Commission (“SEC”) on May 1,

2023) and other risk factors identified from time to time in the Company’s filings with the SEC. Readers should carefully review

these risk factors, and should not place undue reliance on the Company’s forward-looking statements. The Company undertakes no obligation

to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other

changes.

INVESTORS:

Byron Purcell (717)

975-3710

investor@riteaid.com

MEDIA:

Joy Errico (717)

975-5718

press@riteaid.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

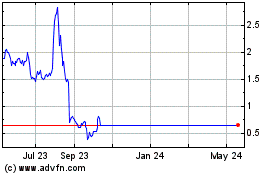

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Jan 2024 to Jan 2025