Barrick Gold Corporation (NYSE:GOLD) (TSX:ABX) – The government of

Papua New Guinea, Barrick Niugini Limited and New Porgera Limited

today signed an agreement to progress with the resumption of

operations at the Porgera gold mine, which have been suspended

since 2020.1

Porgera hosts an orebody with measured and

indicated resources of 10 million ounces2 and inferred resources of

3.4 million ounces.2 After initial ramp up and optimisation of the

Wangima pit, the mine is forecast to produce an average of 700,000

ounces per year, achieving a milestone towards its potential Tier

One3 status.

The New Porgera Progress Agreement (NPPA),

signed today, confirms that all parties are committed to reopening

the mine at the earliest opportunity, in line with the terms of the

Porgera Project Commencement Agreement and the New Porgera Limited

Shareholders Agreement both concluded in 2022. The New Porgera

project team will now move ahead with the filings for a special

mining lease and progressing the other conditions set out in the

Commencement Agreement for the reopening of the mine.

The equity in New Porgera is shared 51% by Papua

New Guinea (PNG) stakeholders, including local landowners and the

Enga provincial government. Economic benefits will be shared 53% by

the PNG stakeholders and 47% by Barrick Niugini Limited, which will

operate the mine.

After the signing ceremony, Barrick president

and chief executive Mark Bristow said there was strong support from

all stakeholders to get Porgera reopened as soon as possible.

“It’s been a long journey but in the process we

have secured the buy-in of all the stakeholders. For Barrick, the

reopening of the mine would represent another victory for our

host-country partnership model which has been so successful in

Tanzania and has now also been adopted for the new Reko Diq

copper-gold project in Pakistan,” Bristow said.

“Localization is an essential part of our

partnership philosophy so New Porgera will, whenever possible,

source the goods and services it requires from businesses genuinely

based and owned in Porgera, the Enga province and Papua New Guinea.

Similarly, it will give preference to locals in recruiting

employees for the reopening mine.”

Enquiries:

Investor and Media RelationsKathy du Plessis+44 20

7557 7738Email: barrick@dpapr.com

Website: www.barrick.com

Technical Information

The scientific and technical information

contained in this press release has been reviewed and approved by

Chad Yuhasz, P.Geo, Mineral Resource Manager, Latin America &

Asia Pacific, and Simon Bottoms, CGeol, MGeol, FGS, FAusIMM,

Mineral Resource Management and Evaluation Executive — each a

“Qualified Person” as defined in National Instrument 43-101 –

Standards of Disclosure for Mineral Projects.

Endnotes

- Porgera was placed on temporary

care and maintenance on April 25, 2020 and remains excluded from

our 2023 guidance. We expect to update our guidance to include

Porgera following both the execution of definitive agreements to

implement the Commencement Agreement and the finalization of a

timeline for the resumption of full mine operations.

- On a 100% basis. Estimated in

accordance with National Instrument 43-101 - Standards of

Disclosure for Mineral Projects as required by Canadian securities

regulatory authorities as of December 31, 2022. Measured resources

of 5.6 million tonnes grading 5.55 g/t, representing 1.0 million

ounces of gold. Indicated resources of 79.0 million tonnes grading

3.62 g/t, representing 9.2 million ounces of gold. Inferred

resources of 33.0 million tonnes grading 3.2 g/t, representing 3.4

million ounces of gold. Complete attributable mineral reserve and

mineral resource data for all of Barrick’s mines and projects,

including tonnes, grades, and ounces, can be found in the Mineral

Reserves and Mineral Resources Tables provided on pages 37 to 46 of

Barrick’s 2022 Annual Information Form and Form 40-F filed on SEDAR

at www.sedar.com and on EDGAR at www.sec.gov.

- On a 100% basis. A Tier One Gold

Asset is an asset with a reserve potential to deliver a minimum

10-year life, annual production of at least 500,000 ounces of gold

and total cash costs per ounce over the mine life that are in the

lower half of the industry cost curve.

Cautionary Statement on Forward-Looking

Information

Certain information contained or incorporated by

reference in this press release, including any information as to

our strategy, projects, plans or future financial or operating

performance, constitutes “forward-looking statements”. All

statements, other than statements of historical fact, are

forward-looking statements. The words “steers”, “progress”,

“committed”, “will”, “potential”, “optimisation”, “forecast”,

“achieve”, “opportunity” and similar expressions identify

forward-looking statements. In particular, this press release

contains forward-looking statements including, without limitation,

with respect to: the anticipated benefits of the New Porgera

Progress Agreement and progress toward the resumption of operations

at the Porgera mine under the Commencement Agreement; forecasted

production for Porgera following the ramp-up of operations and

optimisation of the Wangima pit; the level of support from all

stakeholders for the reopening of the Porgera mine; Barrick’s

partnership philosophy and the anticipated benefits from local

procurement and other initiatives; Barrick’s future plans, growth

potential, financial strength, investments and overall strategy;

and expectations regarding future price assumptions, financial

performance, shareholder returns and other outlook or guidance.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions including material

estimates and assumptions related to the factors set forth below

that, while considered reasonable by the Company as at the date of

this press release in light of management’s experience and

perception of current conditions and expected developments, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements and undue reliance

should not be placed on such statements and information. Such

factors include, but are not limited to: fluctuations in the spot

and forward price of gold, copper or certain other commodities

(such as silver, diesel fuel, natural gas and electricity); risks

associated with projects in the early stages of evaluation and for

which additional engineering and other analysis is required; the

timeline for execution and effectiveness of definitive agreements

to implement the binding Commencement Agreement between Papua New

Guinea and BNL and the timeline for resolution of outstanding tax

audits with Papua New Guinea’s Internal Revenue Commission; the

duration of the temporary suspension of operations at Porgera, the

conditions for the reopening of the mine and the timeline to

recommence operations; risks related to the possibility that future

exploration results will not be consistent with the Company’s

expectations, that quantities or grades of reserves will be

diminished, and that resources may not be converted to reserves;

changes in mineral production performance, exploitation and

exploration successes; risks that exploration data may be

incomplete and considerable additional work may be required to

complete further evaluation, including but not limited to drilling,

engineering and socioeconomic studies and investment; lack of

certainty with respect to foreign legal systems, corruption and

other factors that are inconsistent with the rule of law in Papua

New Guinea; changes in national and local government legislation,

taxation, controls or regulations and/or changes in the

administration of laws, policies and practices; expropriation or

nationalization of property and political or economic developments

in Papua New Guinea or other countries in which Barrick does or may

carry on business in the future; non-renewal of key licenses by

governmental authorities; failure to comply with environmental and

health and safety laws and regulations; contests over title to

properties, particularly title to undeveloped properties, or over

access to water, power and other required infrastructure; the

liability associated with risks and hazards in the mining industry,

and the ability to maintain insurance to cover such losses;

increased costs and physical risks, including extreme weather

events and resource shortages, related to climate change; damage to

the Company’s reputation due to the actual or perceived occurrence

of any number of events, including negative publicity with respect

to the Company’s handling of environmental matters or dealings with

community groups, whether true or not; litigation and legal and

administrative proceedings; operating or technical difficulties in

connection with mining or development activities, including

geotechnical challenges, tailings dam and storage facilities

failures, and disruptions in the maintenance or provision of

required infrastructure and information technology systems;

increased costs, delays, suspensions and technical challenges

associated with the construction of capital projects; risks

associated with working with partners in jointly controlled assets;

risks related to disruption of supply routes which may cause delays

in construction and mining activities, including disruptions in the

supply of key mining inputs due to the invasion of Ukraine by

Russia; risk of loss due to acts of war, terrorism, sabotage and

civil disturbances; risks associated with artisanal and illegal

mining; risks associated with Barrick’s infrastructure, information

technology systems and the implementation of Barrick’s

technological initiatives; the impact of inflation, including

global inflationary pressures driven by supply chain disruptions

caused by the ongoing Covid-19 pandemic and global energy cost

increases following the invasion of Ukraine by Russia; the ability

of management to implement its business strategy and enhanced

political risk in certain jurisdictions; uncertainty whether some

or all of Barrick's targeted investments and projects will meet the

Company’s capital allocation objectives and internal hurdle rate;

employee relations including loss of key employees; availability

and increased costs associated with mining inputs and labor; and

risks associated with diseases, epidemics and pandemics, including

the effects and potential effects of the global Covid-19 pandemic.

Barrick also cautions that its 2023 guidance may be impacted by the

ongoing business and social disruption caused by the spread of

Covid-19.

Many of these uncertainties and contingencies

can affect our actual results and could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All of the forward-looking statements made in

this press release are qualified by these cautionary statements.

Specific reference is made to the most recent Form 40-F/Annual

Information Form on file with the SEC and Canadian provincial

securities regulatory authorities for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect Barrick’s ability to achieve the expectations

set forth in the forward-looking statements contained in this press

release.

We disclaim any intention or obligation to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise, except as required

by applicable law.

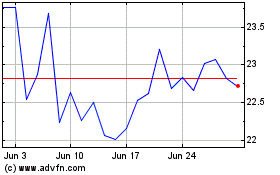

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Apr 2023 to Apr 2024