Barrick Gold Corporation (NYSE:GOLD) (TSX:ABX) – Barrick’s peerless

gold and rapidly growing copper portfolios now extend across all

the major gold and copper districts worldwide, providing the

company with a solid base from which to grow its production and

value, directed by a proven strategy and supported by a broad

spectrum of skills, says president and chief executive Mark Bristow

in the 2023 Annual Report published today.

“Discovery and development are the true drivers

of value and our strong focus on exploration is evident in our

widespread hunt for new discoveries with Tier One1 potential as

well as reserve replenishment opportunities,” he says.

He notes that Barrick has a unique record of

more than replacing depleted reserves. Last year, it increased its

gold reserves to 77 million ounces2 and replaced 112% of its annual

gold equivalent production. 2,3 Since 2019, it has organically

added 29 million ounces4 of attributable reserves which, on a 100%

basis, represents 44 million ounces4 of reserve addition across all

Barrick-managed mines.

“Our proven ability to replace the ounces of

gold and pounds of copper we mine, and the organic growth

opportunities embedded in our business, give us the confidence to

believe that we can deliver on and continue to extend our 10-year

gold and copper production forecast without dilutionary

acquisitions. As a result of this, we also continue to forecast an

increase of more than 30% in gold equivalent production by the end

of this decade.” 5

Year-on-year operating cash flow increased by

7%, free cash flow6 grew by 50% and adjusted net earnings7 rose by

12%. The performance of our business and the continued strength of

our balance sheet allowed us to maintain a robust dividend for our

shareholders in 2023.

“Barrick’s commitment to real sustainability has

long been the bedrock of the business and integrates all aspects of

environmental and community responsibilities. This strategy is

based on sharing the benefits of our operations with all our

stakeholders and is fundamental to our social licence to operate,”

Bristow said.

Also in the Annual Report, chairman John

Thornton says the foundational creed of the 2019 merger with

Randgold was that the best assets run by the best people would

deliver the best returns.

“Barrick’s focus on Tier One assets and the

results they are producing show unquestionably that its management

ranks in the forefront of the industry’s leadership. Through

continuing investment in human capital, Barrick is recruiting and

developing its next generation of high achievers,” he says.

Barrick’s 2023 Annual Report, Annual Information

Form and Form 40-F are now available on SEDAR+ (www.sedarplus.ca)

and EDGAR (www.sec.gov), respectively. An updated National

Instrument 43-101 technical report for the Turquoise Ridge Complex,

current as of December 31, 2023, is also available on SEDAR+ and

EDGAR.

To access the above-mentioned documents, please

visit www.barrick.com. Shareholders may also receive a copy of

Barrick’s audited financial statements without charge upon request

to Barrick’s Investor Relations Department, 161 Bay Street, Suite

3700, Toronto, Ontario, M5J 2S1 or to investor@barrick.com.

Enquiries

President and CEOMark Bristow+1 647 205 7694+44

788 071 1386

Senior EVP and CFO Graham Shuttleworth+1 647 262

2095+44 779 771 1338

Investor and Media RelationsKathy du Plessis+44

20 7557 7738Email: barrick@dpapr.com

Website: www.barrick.com

Endnotes

- A Tier One Gold Asset is an asset

with a $1,300/oz reserve with potential for 5 million ounces to

support a minimum 10-year life, annual production of at least

500,000 ounces of gold and with all-in sustaining costs per ounce

in the lower half of the industry cost curve. A Tier One Copper

Asset is an asset with a $3.00/lb reserve with potential for five

million tonnes or more of contained copper to support a minimum

20-year life, annual production of at least 200,000 tonnes, and

with all-in sustaining costs per pound in the lower half of the

industry cost curve. Tier One assets must be located in a world

class geological district with potential for organic reserve growth

and long-term geologically driven value addition.

- Estimated in accordance with

National Instrument 43-101 - Standards of Disclosure for Mineral

Projects as required by Canadian securities regulatory authorities.

Estimates are as of December 31, 2023, unless otherwise noted.

Proven mineral reserves of 250 million tonnes grading 1.85g/t,

representing 15 million ounces of gold, and 320 million tonnes

grading 0.41%, representing 1.3 million tonnes of copper. Probable

reserves of 1,200 million tonnes grading 1.61g/t, representing 61

million ounces of gold, and 1,100 million tonnes grading 0.38%,

representing 4.3 million tonnes of copper. Totals may not appear to

sum correctly due to rounding. Complete mineral reserve and mineral

resource data for all mines and projects referenced in this press

release, including tonnes, grades, and ounces, can be found in the

Mineral Reserves and Mineral Resources Tables included on pages

37-45 of Barrick’s 2023 Annual Information Form and Form 40-F filed

on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov

- Gold equivalent ounces calculated

from our copper assets are calculated using a gold price of

$1,300/oz and copper price of $3.00/lb.

- Proven and probable reserve gains

calculated from cumulative net change in reserves from year end

2019 to 2023.Reserve replacement percentage is calculated from the

cumulative net change in reserves from 2020 to 2023 divided by the

cumulative depletion in reserves from year end 2019 to 2023 as

shown in the table below:

|

Year |

Attributable

P&PGold(Moz) |

Attributable GoldAcquisition

&Divestments(Moz) |

Attributable

GoldDepletion(Moz) |

Attributable GoldNet

Change(Moz) |

|

2019a |

71 |

- |

- |

- |

|

2020b |

68 |

(2.2) |

(5.5) |

4.2 |

|

2021c |

69 |

(0.91) |

(5.4) |

8.1 |

|

2022d |

76 |

- |

(4.8) |

12 |

|

2023e |

77 |

- |

(4.6) |

5 |

|

2019 – 2023 Total |

N/A |

(3.1) |

(20) |

29 |

Totals may not appear to sum correctly due to

rounding.

Attributable acquisitions and divestments

includes the following: a decrease of 2.2 Moz in proven and

probable gold reserves from December 31, 2019 to December 31, 2020,

as a result of the divestiture of Barrick's Massawa gold project

effective March 4, 2020; and a decrease of 0.91 Moz in proven and

probable gold reserves from December 31, 2020 to December 31, 2021,

as a result of the change in Barrick's equity interest in Porgera

from 47.5% to 24.5% and the net impact of the asset exchange of

Lone Tree to i-80 Gold for the remaining 50% of South Arturo that

Nevada Gold Mines did not already own.

All estimates are estimated in accordance with

National Instrument 43-101 - Standards of Disclosure for Mineral

Projects as required by Canadian securities regulatory

authorities.

- Estimates as of December 31, 2019,

unless otherwise noted. Proven reserves of 280 million tonnes

grading 2.42 g/t, representing 22 million ounces of gold and

Probable reserves of 1,000 million tonnes grading 1.48 g/t,

representing 49 million ounces of gold.

- Estimates as of December 31, 2020,

unless otherwise noted. Proven reserves of 280 million tonnes

grading 2.37g/t, representing 21 million ounces of gold and

Probable reserves of 990 million tonnes grading 1.46g/t,

representing 47 million ounces of gold.

- Estimates as of December 31, 2021,

unless otherwise noted. Proven mineral reserves of 240 million

tonnes grading 2.20g/t, representing 17 million ounces of gold and

Probable reserves of 1,000 million tonnes grading 1.60g/t,

representing 53 million ounces of gold.

- Estimates as of December 31, 2022,

unless otherwise noted. Proven mineral reserves of 260 million

tonnes grading 2.26g/t, representing 19 million ounces of gold and

Probable reserves of 1,200 million tonnes grading 1.53g/t,

representing 57 million ounces of gold.

- Estimates are as of December 31,

2023, unless otherwise noted. Proven mineral reserves of 250

million tonnes grading 1.85g/t, representing 15 million ounces of

gold. Probable reserves of 1,200 million tonnes grading 1.61g/t,

representing 61 million ounces of gold.

5. Gold equivalent ounces calculated

from our copper assets are calculated using a gold price of

$1,300/oz and copper price of $3.00/lb. Barrick’s ten-year

indicative production profile for gold equivalent ounces is based

on the following assumptions:

|

Key Outlook Assumptions |

2024 |

2025+ |

|

Gold Price ($/oz) |

1,900 |

1,300 |

|

Copper Price ($/lb) |

3.50 |

3.00 |

|

Oil Price (WTI) ($/barrel) |

75 |

75 |

|

AUD Exchange Rate (AUD:USD) |

0.75 |

0.75 |

|

ARS Exchange Rate (USD:ARS) |

800 |

800 |

|

CAD Exchange Rate (USD:CAD) |

1.30 |

1.30 |

|

CLP Exchange Rate (USD:CLP) |

900 |

900 |

|

EUR Exchange Rate (EUR:USD) |

1.20 |

1.20 |

Barrick’s five-year indicative outlook is based

on our current operating asset portfolio, sustaining projects in

progress and exploration/mineral resource management initiatives in

execution. This outlook is based on our current reserves and

resources and assumes that we will continue to be able to convert

resources into reserves. Additional asset optimization, further

exploration growth, new project initiatives and divestitures are

not included. For the company’s gold and copper segments, and where

applicable for a specific region, this indicative outlook is

subject to change and assumes the following: new open pit

production permitted and commencing at Hemlo in the second half of

2025, allowing three years for permitting and two years for

pre-stripping prior to first ore production in 2027; Tongon will

enter care and maintenance by 2026; and production from the

Zaldívar CuproChlor® Chloride Leach Project (Antofagasta is the

operator of Zaldívar).

Our five-year indicative outlook excludes:

production from Fourmile; Pierina, and Golden Sunlight, both of

which are currently in care and maintenance; and production from

long-term greenfield optionality from Donlin, Pascua-Lama, Norte

Abierto and Alturas.Barrick’s ten-year indicative production

profile is subject to change and is based on the same assumptions

as the current five-year outlook detailed above, except that the

subsequent five years of the ten-year outlook assumes attributable

production from Fourmile as well as exploration and mineral

resource management projects in execution at Nevada Gold Mines and

Hemlo.

Barrick’s five-year and ten-year production

profile in this press release also assumes the re-start of Porgera,

as well as an indicative gold and copper production profile for

Reko Diq and an indicative copper production profile for the

Lumwana Super Pit expansion, both of which are conceptual in

nature.

6. “Free cash flow” is a non-GAAP

financial measure that deducts capital expenditures from net cash

provided by operating activities. Management believes this to be a

useful indicator of our ability to operate without reliance on

additional borrowing or usage of existing cash. Free cash flow is

intended to provide additional information only and does not have

any standardized definition under IFRS, and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. The measure is not

necessarily indicative of operating profit or cash flow from

operations as determined under IFRS. Other companies may calculate

this measure differently. Further details including a detailed

reconciliation of this non-GAAP financial performance measure to

its most directly comparable GAAP measure are incorporated by

reference and provided on page 71 of the MD&A accompanying

Barrick’s fourth quarter and full year 2023 financial statements

filed on SEDAR+ at www.sedarplus.ca and on EDGAR at

www.sec.gov.

7. “Adjusted net earnings” and

“adjusted net earnings per share” are non-GAAP financial

performance measures. Adjusted net earnings excludes the following

from net earnings: impairment charges (reversals) related to

intangibles, goodwill, property, plant and equipment, and

investments; acquisition/disposition gains/losses; foreign currency

translation gains/losses; significant tax adjustments; other items

that are not indicative of the underlying operating performance of

our core mining business; and tax effect and non-controlling

interest of the above items. Management uses this measure

internally to evaluate our underlying operating performance for the

reporting periods presented and to assist with the planning and

forecasting of future operating results. Management believes that

adjusted net earnings is a useful measure of our performance

because impairment charges, acquisition/disposition gains/losses

and significant tax adjustments do not reflect the underlying

operating performance of our core mining business and are not

necessarily indicative of future operating results. Adjusted net

earnings and adjusted net earnings per share are intended to

provide additional information only and does not have any

standardized definition under IFRS and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS. The measures are not necessarily

indicative of operating profit or cash flow from operations as

determined under IFRS. Other companies may calculate these measures

differently. Further details including a detailed reconciliation of

this non-GAAP financial performance measure to its most directly

comparable GAAP measure are incorporated by reference and provided

on page 70 of the MD&A accompanying Barrick’s fourth quarter

and full year 2023 financial statements filed on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov

Technical

InformationThe scientific and technical

information contained in this press release has been reviewed and

approved by Craig Fiddes, SME-RM, Lead, Resource Modeling, Nevada

Gold Mines; Richard Peattie, MPhil, FAusIMM, Mineral Resources

Manager: Africa and Middle East; Simon Bottoms, CGeol, MGeol, FGS,

FAusIMM, Mineral Resource Management and Evaluation Executive (in

this capacity, Mr. Bottoms is also responsible on an interim basis

for scientific and technical information relating to the Latin

America and Asia Pacific region); John Steele, CIM, Metallurgy,

Engineering and Capital Projects Executive; and Joel Holliday,

FAusIMM, Executive Vice-President, Exploration — each a “Qualified

Person” as defined in National Instrument 43-101 – Standards of

Disclosure for Mineral Projects.

All mineral reserve and mineral resource

estimates are estimated in accordance with National Instrument

43-101 – Standards of Disclosure for Mineral Projects. Unless

otherwise noted, such mineral reserve and mineral resource

estimates are as of December 31, 2023.

Cautionary Statement on

Forward-Looking Information Certain information

contained or incorporated by reference in this press release,

including any information as to our strategy, projects, plans or

future financial or operating performance, constitutes

“forward-looking statements”. All statements, other than statements

of historical fact, are forward-looking statements. The words

“potential”, “grow”, “maintain”, “opportunity”, “investment”,

“discovery”, “continue”, “extend”, “will”, “forecast”, “target”,

“developing”, “focus”, “believe” and similar expressions identify

forward-looking statements. In particular, this press release

contains forward-looking statements including, without limitation,

with respect to: Barrick’s forward-looking production guidance and

our five and ten-year production profiles for gold and copper;;

Barrick’s global exploration strategy and planned exploration

activities; our ability to convert resources into reserves and

future reserve replacement; Barrick’s strategy, plans, targets and

goals in respect of environmental and social governance issues; our

talent management initiatives; Barrick’s future plans, growth

potential, financial strength, investments and overall strategy;

and expectations regarding future price assumptions, financial

performance, shareholder returns and other outlook or guidance.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions including material

estimates and assumptions related to the factors set forth below

that, while considered reasonable by the Company as at the date of

this press release in light of management’s experience and

perception of current conditions and expected developments, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements and undue reliance

should not be placed on such statements and information. Such

factors include, but are not limited to: fluctuations in the spot

and forward price of gold, copper or certain other commodities

(such as silver, diesel fuel, natural gas and electricity); risks

associated with projects in the early stages of evaluation and for

which additional engineering and other analysis is required; risks

related to the possibility that future exploration results will not

be consistent with the Company’s expectations, that quantities or

grades of reserves will be diminished, and that resources may not

be converted to reserves; risks associated with the fact that

certain of the initiatives described in this press release are

still in the early stages and may not materialize; changes in

mineral production performance, exploitation and exploration

successes; risks that exploration data may be incomplete and

considerable additional work may be required to complete further

evaluation, including but not limited to drilling, engineering and

socioeconomic studies and investment; the speculative nature of

mineral exploration and development; lack of certainty with respect

to foreign legal systems, corruption and other factors that are

inconsistent with the rule of law; changes in national and local

government legislation, taxation, controls or regulations and/or

changes in the administration of laws, policies and practices; the

potential impact of proposed changes to Chilean law on the status

of value added tax refunds received in Chile in connection with the

development of the Pascua-Lama project and the Government of Mali’s

implementation of the agreed extension of the Loulo mining

convention; expropriation or nationalization of property and

political or economic developments in Canada, the United States or

other countries in which Barrick does or may carry on business in

the future; risks relating to political instability in certain of

the jurisdictions in which Barrick operates; timing of receipt of,

or failure to comply with, necessary permits and

approvalsnon-renewal of key licenses by governmental authorities;

failure to comply with environmental and health and safety laws and

regulations; increased costs and physical and transition risks

related to climate change, including extreme weather events,

resource shortages, emerging policies and increased regulations

relating to greenhouse gas emission levels, energy efficiency and

reporting of risks; the Company’s ability to achieve its

sustainability goals; contests over title to properties,

particularly title to undeveloped properties, or over access to

water, power and other required infrastructure; the liability

associated with risks and hazards in the mining industry, and the

ability to maintain insurance to cover such losses; damage to the

Company’s reputation due to the actual or perceived occurrence of

any number of events, including negative publicity with respect to

the Company’s handling of environmental matters or dealings with

community groups, whether true or not; risks related to operations

near communities that may regard Barrick's operations as being

detrimental to them; litigation and legal and administrative

proceedings; operating or technical difficulties in connection with

mining or development activities, including geotechnical

challenges, tailings dam and storage facilities failures, and

disruptions in the maintenance or provision of required

infrastructure and information technology systems; increased costs,

delays, suspensions and technical challenges associated with the

construction of capital projects; risks associated with working

with partners in jointly controlled assets; risks related to

disruption of supply routes which may cause delays in construction

and mining activities, including disruptions in the supply of key

mining inputs due to the invasion of Ukraine by Russia and

conflicts in the Middle East; risk of loss due to acts of war,

terrorism, sabotage and civil disturbances; risks associated with

artisanal and illegal mining; risks associated with Barrick’s

infrastructure, information technology systems and the

implementation of Barrick’s technological initiatives, including

risks related to cyber-attacks, cybersecurity breaches, or similar

network or system disruptions; the impact of global liquidity and

credit availability on the timing of cash flows and the values of

assets and liabilities based on projected future cash flows; the

impact of inflation, including global inflationary pressures driven

by supply chain disruptions, global energy cost increases following

the invasion of Ukraine by Russia and country-specific political

and economic factors in Argentina; adverse changes in our credit

ratings; fluctuations in the currency markets; changes in U.S.

dollar interest rates; risks arising from holding derivative

instruments (such as credit risk, market liquidity risk and

mark-to-market risk); risks related to the demands placed on the

Company's management; the ability of management to implement its

business strategy and enhanced political risk in certain

jurisdictions; uncertainty whether some or all of Barrick's

targeted investments and projects will meet the Company’s capital

allocation objectives and internal hurdle rate; whether benefits

expected from recent transactions are realized; business

opportunities that may be presented to, or pursued by, the Company;

our ability to successfully integrate acquisitions or complete

divestitures; risks related to competition in the mining industry;

employee relations including loss of key employees; availability

and increased costs associated with mining inputs and labor; risks

associated with diseases, epidemics and pandemics, including the

effects and potential effects of the global Covid-19 pandemic;

risks related to the failure of internal controls; and risks

related to the impairment of the Company’s goodwill and assets.

In addition, there are risks and hazards

associated with the business of mineral exploration, development

and mining, including environmental hazards, industrial accidents,

unusual or unexpected formations, pressures, cave-ins, flooding and

gold bullion, copper cathode or gold or copper concentrate losses

(and the risk of inadequate insurance, or inability to obtain

insurance, to cover these risks).

Many of these uncertainties and contingencies

can affect our actual results and could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All of the forward-looking statements made in

this press release are qualified by these cautionary statements.

Specific reference is made to the most recent Form 40-F/Annual

Information Form on file with the SEC and Canadian provincial

securities regulatory authorities for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect Barrick’s ability to achieve the expectations

set forth in the forward-looking statements contained in this press

release.

We disclaim any intention or obligation to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise, except as required

by applicable law.

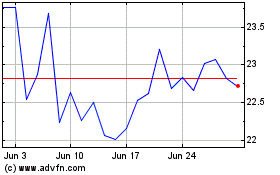

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Feb 2024 to Feb 2025