Barrick Recommends Shareholders Reject TRC Capital’s Below-Market “Mini-Tender” Offer for Common Shares

January 13 2025 - 6:00AM

Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) has received notice

of an unsolicited mini-tender offer made by TRC Capital

Investment Corporation (TRC Capital) to purchase up to 5,000,000 of

Barrick’s common shares, representing approximately 0.29% of

Barrick’s outstanding common shares, at a below-market price of

C$21.35 per share. Barrick does not endorse this unsolicited offer,

is not in any way affiliated or associated with TRC Capital or its

offer, and recommends that shareholders do not tender their shares

to this unsolicited mini-tender offer.

Barrick cautions shareholders that the

mini-tender offer has been made at a price below market price for

the Barrick common shares. TRC Capital's unsolicited below-market

offer price of C$21.35 per share represents a discount of

approximately 4.52% and 4.38%, respectively, to the closing price

of the Barrick common shares on the Toronto Stock Exchange and the

New York Stock Exchange on January 7, 2025, the last trading day

before the mini-tender offer was commenced.

TRC Capital has made several similar unsolicited

mini-tender offers for shares of other public companies.

Mini-tender offers are designed to avoid investor protections such

as disclosure and procedural requirements applicable to most

take-over bids and tender offers under Canadian and

U.S. securities laws. Both Canadian Securities Administrators

(CSA) and the U.S. Securities and Exchange Commission (SEC)

recommend that investors exercise caution with mini-tender offers

and have expressed serious concerns about mini-tender offers,

including the possibility that investors might tender to such

offers without understanding the offer price relative to the actual

market price of their securities.

The SEC has issued "tips for Investors"

regarding mini-tender offers, noting that some bidders, in making

the offers at below-market prices, are "hoping that they will catch

investors off guard if the investors do not compare the offer price

to the current market price." The SEC's advisory may be found on

the SEC website at

http://www.sec.gov/investor/pubs/minitend.htm.

The CSA's long-standing guidance on mini-tenders

can be found on the Ontario Securities Commission website at

www.osc.gov.on.ca/en/SecuritiesLaw_csa_19991210_61-301.jsp.

Brokers, dealers and other market participants

are encouraged to exercise caution and review the letter regarding

broker-dealer mini-tender offer dissemination and disclosures on

the SEC website at

www.sec.gov/divisions/marketreg/minitenders/sia072401.htm.

Barrick shareholders are urged to obtain current

market quotations for their shares, consult with their broker or

financial advisor and exercise caution with respect to TRC

Capital's unsolicited offer. According to TRC Capital's offer

documents, Barrick shareholders who have already tendered their

shares can withdraw their shares at any time before 11:59

p.m. (Toronto time) on February 6, 2025 by following

the procedures set forth in TRC Capital's offer documents.

Barrick requests that a copy of this news

release be included in any distribution to Barrick shareholders of

materials relating to TRC Capital's mini-tender offer for Barrick

common shares.

Barrick enquiriesInvestor and

media relationsKathy du Plessis+44 20 7557 7738Email:

barrick@dpapr.comWebsite: www.barrick.com

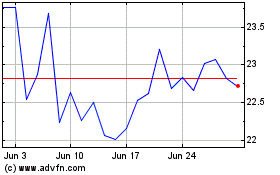

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Jan 2024 to Jan 2025