Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) today updated

its mineral resource estimate for its wholly-owned Fourmile project

in Nevada, resulting in a 192% increase in indicated resources (1.4

million ounces grading 11.76g/t), a 137% increase in inferred

resources (6.4 million ounces grading 14.1g/t) and a 35% increase

in grade relative to Barrick’s 2023 year-end mineral resource

estimate1.

The increases reflect the addition of 25 new

drill holes to the 2023 mineral resource estimate across the

southernmost portion of the orebody, immediately adjacent to the

Goldrush project at Cortez which is part of the Nevada Gold Mines

joint venture (NGM).

Speaking today at Barrick’s Investor Day in New

York, president and chief executive Mark Bristow said that the

Fourmile project was a truly world-class asset and could be

compared to the original Goldstrike deposit, the foundational asset

of Barrick which is now part of NGM’s Carlin.

“Our strategy of investing in organic growth

through exploration and mineral resource management has set us

apart from the industry. We believe in creating real value through

discovery and development rather than relying on an increase in the

gold price to justify high-premium mergers and acquisitions,” he

said.

“Since the formation of the NGM joint venture in

2019, we have added more than 19Moz of proven and probable mineral

reserves to the life of mine plan on a 100% basis2. This does not

yet reflect the additional exploration upside that we see today,

including Greater Leeville and Hanson in Cortez Underground,” said

Bristow.

Mineral resource management and evaluation

executive Simon Bottoms added that the updated mineral resource

estimate for Fourmile only covers approximately one-third of the

overall orebody as defined by drilling to date.

“To illustrate the potential value that a truly

world-class orebody like Fourmile has, we have completed a

preliminary economic assessment using conservative mining rates and

costs, all of which draw directly from the current Goldrush mine

plan. The results highlight the potential for annual operating cash

flows resulting from Fourmile to be more than 70% higher than the

already world-class Goldrush project3. For the next stage of the

project, we plan to start a three-year prefeasibility study in

2025, which will not only continue to define substantial resources

and reserves across the entire orebody from surface drilling, while

the northern Bullion Hill access is permitted and developed, but

will also undertake pilot autoclave and roaster test work,” Bottoms

said.

Enquiries:

|

President and CEOMark Bristow+1 647 205 7694+44 788 071 1386 |

Senior EVP and CFOGraham Shuttleworth+1 647 262 2095+44 779 771

1338 |

Investor and Media RelationsKathy du Plessis+44 20 7557 7738Email:

barrick@dpapr.com |

Website: www.barrick.com

Technical Information

The scientific and technical information

contained in this press release has been reviewed and approved by

Craig Fiddes, SME-RM, Lead, Resource Modeling, Nevada Gold Mines;

Simon Bottoms, CGeol, MGeol, FGS, FAusIMM, Mineral Resource

Management and Evaluation Executive; John Steele, CIM, Metallurgy,

Engineering and Capital Projects Executive; and Joel Holliday,

FAusIMM, Executive Vice-President, Exploration—each a “Qualified

Person” as defined in National Instrument 43-101 - Standards of

Disclosure for Mineral Projects.

All mineral reserve and mineral resource

estimates are estimated in accordance with National Instrument

43-101 - Standards of Disclosure for Mineral Projects. Unless

otherwise noted, such mineral reserve and mineral resource

estimates are as of December 31, 2023 except Fourmile, which is as

of November 22, 2024.

Endnote 1

Estimated in accordance with National Instrument

43-101 - Standards of Disclosure for Mineral Projects as required

by Canadian securities regulatory authorities.

|

Fourmile 2024 Gold Mineral

Resources1,2,3,4,5 |

|

|

|

|

|

|

|

|

|

|

As at November 22, 2024 |

MEASURED (M)6 |

|

INDICATED (I)6 |

|

(M) + (I)6 |

|

INFERRED7 |

|

|

Tonnes |

Grade |

Contained ozs |

|

Tonnes |

Grade |

Contained ozs |

|

Contained ozs |

|

Tonnes |

Grade |

Contained ozs |

|

Based on attributable ounces |

(Mt) |

(g/t) |

(Moz) |

|

(Mt) |

(g/t) |

(Moz) |

|

(Moz) |

|

(Mt) |

(g/t) |

(Moz) |

|

Fourmile underground (100%) |

— |

— |

— |

|

3.6 |

11.76 |

1.4 |

|

1.4 |

|

14 |

14.1 |

6.4 |

|

TOTAL |

— |

— |

— |

|

3.6 |

11.76 |

1.4 |

|

1.4 |

|

14 |

14.1 |

6.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See “Mineral Reserves and Resources Endnotes”. |

|

Fourmile 2023 Gold Mineral

Resources1,2,3,4,5 |

|

|

|

|

|

|

|

|

|

|

As at December 31, 2023 |

MEASURED (M)6 |

|

INDICATED (I)6 |

|

(M) + (I)6 |

|

INFERRED7 |

|

|

Tonnes |

Grade |

Contained ozs |

|

Tonnes |

Grade |

Contained ozs |

|

Contained ozs |

|

Tonnes |

Grade |

Contained ozs |

|

Based on attributable ounces |

(Mt) |

(g/t) |

(Moz) |

|

(Mt) |

(g/t) |

(Moz) |

|

(Moz) |

|

(Mt) |

(g/t) |

(Moz) |

|

Fourmile underground (100%) |

— |

— |

— |

|

1.5 |

10.04 |

0.48 |

|

0.48 |

|

8.2 |

10.1 |

2.7 |

|

TOTAL |

— |

— |

— |

|

1.5 |

10.04 |

0.48 |

|

0.48 |

|

8.2 |

10.1 |

2.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See “Mineral Reserves and Resources Endnotes”. |

Endnote 2

Proven and probable reserve gains at Nevada Gold

Mines calculated from cumulative net change in reserves from year

end 2019 to 2023, as shown in the table below (100% basis):

|

Year |

P&P Reserves(Moz) |

Acquisition &

Divestments(Moz)i |

Depletion(Moz) |

Net Change(Moz) |

|

2019a |

48 |

- |

(4.5 |

) |

4.5 |

|

2020b |

45 |

- |

(4.0 |

) |

0.85 |

|

2021c |

50 |

0.38 |

(4.3 |

) |

9.0 |

|

2022d |

48 |

- |

(3.7 |

) |

1.8 |

|

2023e |

47 |

- |

(3.5 |

) |

2.7 |

|

2019 – 2023 Total |

N/A |

0.38 |

(20 |

) |

19 |

- Net impact of the asset exchange of

Lone Tree to i-80 Gold for the remaining 50% of South Arturo that

NGM did not already own.

Totals may not appear to sum correctly due to

rounding.

All estimates are estimated in accordance with

National Instrument 43-101 - Standards of Disclosure for Mineral

Projects as required by Canadian securities regulatory

authorities.

a Estimates as of December 31, 2019, unless

otherwise noted. Proven reserves of 160 million tonnes grading

4.24 g/t, representing 22 million ounces of gold, and

Probable reserves of 410 million tonnes grading 2.02 g/t,

representing 26 million ounces of gold. Conversions may not

recalculate due to rounding.b Estimates as of December 31, 2020,

unless otherwise noted. Proven reserves of 150 million tonnes

grading 4.23g/t, representing 21 million ounces of gold, and

Probable reserves of 360 million tonnes grading 2.11g/t,

representing 24 million ounces of gold. Conversions may not

recalculate due to rounding.c Estimates as of December 31, 2021,

unless otherwise noted. Proven mineral reserves of 99 million

tonnes grading 4.82g/t, representing 15 million ounces of gold, and

Probable reserves of 420 million tonnes grading 2.58g/t,

representing 35 million ounces of gold. Conversions may not

recalculate due to rounding.d Estimates as of December 31,

2022, unless otherwise noted. Proven mineral reserves of

83 million tonnes grading 5.24g/t, representing 14 million

ounces of gold, and Probable reserves of 500 million tonnes grading

2.12g/t, representing 34 million ounces of gold. Conversions

may not recalculate due to rounding.e Estimates as of

December 31, 2023, unless otherwise noted. Proven mineral

reserves of 52 million tonnes grading 4.42g/t, representing

7.5 million ounces of gold, and Probable reserves of

530 million tonnes grading 2.35g/t, representing

40 million ounces of gold. Conversions may not recalculate due

to rounding.

Endnote 3

Fourmile financial metrics and production

metrics are based upon Barrick’s internal preliminary economic

assessment which is conceptual in nature because it includes

inferred mineral resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves, and there is no certainty that the preliminary economic

assessment will be realized. The preliminary economic

assessment for Fourmile is based upon $1,900/oz mineable

stope optimizer. The assumptions outlined within the preliminary

economic assessment have formed the basis for the

ongoing study and are made by a Qualified

Person. Fourmile is currently 100% owned by Barrick. As

previously disclosed, Barrick anticipates Fourmile being

contributed to the Nevada Gold Mines joint venture, at fair market

value, if certain criteria are met.

Mineral Reserves and Resources

Endnotes

- Mineral reserves

(“reserves”) and mineral resources (“resources”) have been

estimated as at December 31, 2023 except Fourmile, which is as

of November 22, 2024, (unless otherwise noted) in accordance with

National Instrument 43-101 - Standards of Disclosure for

Mineral Projects (“NI 43-101”) as required by Canadian securities

regulatory authorities. For United States reporting purposes, the

SEC has adopted amendments to its disclosure rules to modernize the

mineral property disclosure requirements for issuers whose

securities are registered with the SEC under the Securities and

Exchange Act of 1934, as amended (the “Exchange Act”). These

amendments became effective February 25, 2019 (the “SEC

Modernization Rules”) with compliance required for the first fiscal

year beginning on or after January 1, 2021. The SEC Modernization

Rules replace the historical property disclosure requirements for

mining registrants that were included in SEC Industry Guide 7,

which was rescinded from and after the required compliance date of

the SEC Modernization Rules. As a result of the adoption of the SEC

Modernization Rules, the SEC now recognizes estimates of

“measured”, “indicated” and “inferred” mineral resources. In

addition, the SEC has amended its definitions of “proven mineral

reserves” and “probable mineral reserves” to be substantially

similar to the corresponding Canadian Institute of Mining,

Metallurgy and Petroleum definitions, as required by NI 43-101.

U.S. investors should understand that “inferred” mineral resources

have a great amount of uncertainty as to their existence and great

uncertainty as to their economic and legal feasibility. In

addition, U.S. investors are cautioned not to assume that any part

or all of Barrick’s mineral resources constitute or will be

converted into reserves. Mineral resource and mineral reserve

estimations have been prepared by employees of Barrick, its joint

venture partners or its joint venture operating companies, as

applicable, under the supervision Craig Fiddes, Lead, Resource

Modeling, Nevada Gold Mines and reviewed by Simon Bottoms, CGeol,

MGeol, FGS, FAusIMM, Mineral Resource Management and Evaluation

Executive. Barrick’s normal data verification procedures have been

employed in connection with the calculations. Verification

procedures include industry-standard quality control practices.

Resources have been estimated using

varying cut-off grades, depending on both the type of

mine or project, its maturity and ore types at each

property.

- All mineral

resource and mineral reserve estimates of tonnes andAu oz are

reported to the second significant digit.

- For 2024,

Fourmile mineral resources have been estimated based on an assumed

gold price of US$1,900 per ounce, and long-term average exchange

rates of 1.30 CAD/US$. For 2023, mineral resources have been

estimated based on an assumed gold price of US$1,700 per ounce, and

long-term average exchange rates of 1.30 CAD/US$.

- All mineral

resources are reported inclusive of mineral reserves.

- Mineral

resources which are not mineral reserves do not have demonstrated

economic viability.

- All measured and

indicated mineral resource estimates of grade and all proven and

probable mineral reserve estimates of grade are reported to two

decimal places.

- All inferred

mineral resource estimates of grade for Au g/t, Ag g/t and Cu % are

reported to one decimal place.

Cautionary Statement on Forward-Looking

Information

Certain information contained or incorporated by

reference in this press release, including any information as to

our strategy, projects, plans, or future financial or operating

performance, constitutes “forward-looking statements”. All

statements, other than statements of historical fact, are

forward-looking statements. The words “progress”, “continue”,

“target”, “ramp up”, “potential”, “project”, and similar

expressions identify forward-looking statements. In particular,

this press release contains forward-looking statements including,

without limitation, with respect to: Barrick’s forward-looking

production guidance, including our ten-year outlook for gold and

copper and anticipated production growth from Barrick’s organic

project pipeline and reserve replacement; our expected progress

with respect to our growth projects, including our mine extension

projects at Leeville and the Pipeline region and the ramp up at

Goldrush; our exploration strategy; the potential for Fourmile to

become a world-class asset and anticipated annual operating cash

flows from the project; Barrick’s sustainability strategy; and

expectations, regarding future price assumptions, financial

performance and other outlooks or guidance.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions including material

estimates and assumptions related to the factors set forth below

that, while considered reasonable by the Company as at the date of

this press release in light of management’s experience and

perception of current conditions and expected developments, are

inherently subject to significant business, economic, and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements, and undue reliance

should not be placed on such statements and information. Such

factors include, but are not limited to: risks relating to

political instability in certain of the jurisdictions in which

Barrick operates; risks associated with projects in the early

stages of evaluation and for which additional engineering and other

analysis is required; fluctuations in the spot and forward price of

gold, copper, or certain other commodities (such as diesel fuel,

natural gas, and electricity); the speculative nature of mineral

exploration and development; changes in mineral production

performance, exploitation, and exploration successes; risks

associated with working with partners in jointly controlled assets;

changes in national and local government legislation, taxation,

controls or regulations and/ or changes in the administration of

laws, policies and practices; expropriation or nationalization of

property and political or economic developments in Canada, the

United States, or the other jurisdictions in which the Company or

its affiliates do or may carry on business in the future; risks

related to disruption of supply routes which may cause delays in

construction and mining activities, including disruptions in the

supply of key mining inputs due to the invasion of Ukraine by

Russia and conflicts in the Middle East; risk of loss due to acts

of war, terrorism, sabotage and civil disturbances; risks

associated with new diseases, epidemics and pandemics; litigation

and legal and administrative proceedings; employee relations

including loss of key employees; failure to obtain key licenses by

governmental authorities; increased costs and physical and

transition risks related to climate change, including extreme

weather events, resource shortages, emerging policies and increased

regulations related to greenhouse gas emission levels, energy

efficiency and reporting of risks; and availability and increased

costs associated with mining inputs and labor. In addition, there

are risks and hazards associated with the business of mineral

exploration, development and mining, including environmental

hazards, industrial accidents, unusual or unexpected formations,

pressures, cave-ins, flooding and gold bullion, copper cathode or

gold or copper concentrate losses (and the risk of inadequate

insurance, or inability to obtain insurance, to cover these

risks).

Many of these uncertainties and contingencies

can affect our actual results and could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All of the forward-looking statements made in

this press release are qualified by these cautionary statements.

Specific reference is made to the most recent Form 40-F/Annual

Information Form on file with the SEC and Canadian provincial

securities regulatory authorities for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect Barrick’s ability to achieve the expectations

set forth in the forward-looking statements contained in this press

release.

Barrick disclaims any intention or obligation to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise, except as required

by applicable law.

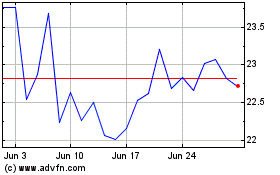

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Nov 2023 to Nov 2024