PyroGenesis Canada Inc. (http://pyrogenesis.com) (NASDAQ: PYR)

(TSX: PYR) (FRA: 8PY), a high-tech Company (hereinafter referred to

as the “Company” or “PyroGenesis”), that designs, develops,

manufactures and commercializes advanced plasma processes and

sustainable solutions to reduce greenhouse gases (GHG), is pleased

to announce today that, further to its press release dated April

27th, 2021, it has finalized its strategic acquisition of

AirScience Technologies Inc. and its subsidiaries (collectively,

“AST”) for an amended total cash consideration of approx. $4.4MM

(the “Purchase Price”).

The Purchase Price will be paid upon various

contract and business-related milestones. Should any of the

milestones not be reached within the next three (3) years, the

purchase price shall be adjusted downward. The Purchase Price shall

be paid as follows:

- Approximately 20% upon receipt of payment of US$4MM (approx.

Can$5MM) under an existing letter of credit from AST’s client

1,

- Approximately 20% upon final acceptance test/bank guarantee

from client 1,

- Approximately 25% upon receipt of final acceptance report for

client 2,

- Approximately 5% upon final acceptance test, or equivalent from

each of client 3 and 4 (total 10%), and

- Approximately 25% upon conversion of $4MM in pipeline to signed

contracts.

AST, a Montreal-based company, offers

technologies, equipment, and expertise in the area of biogas

upgrading, as well as air pollution controls. AST designs and

builds: (i) gas upgrading systems to convert biogas to renewable

natural gas (RNG); (ii) pyrolysis-gas purification; (iii) biogas

& landfill-gas flares and thermal oxidizers; and (iv)

purification of coke-oven gas (COG) (a by-product in the primary

steel industry arising from the conversion of coal into coke) into

high purity hydrogen, which is in high demand across the industry.

AST is also known for its line of landfill gas flares which reduce

greenhouse gas (“GHG”) emissions specifically from landfills.

PyroGenesis will operate AST as a wholly owned

subsidiary and retain the current management and staff, comprising

of approximately 20 employees. AST has current operations across

North America, Italy and India. The acquisition is expected to

positively impact PyroGenesis’ earnings per share in 2021

“We are extremely excited about today’s

announcement as it essentially springboards PyroGenesis into the

RNG market where we believe there is a significant unmet need for

RNG-providers, particularly in North America,” said P. Peter

Pascali, CEO and Chair of PyroGenesis. “This acquisition

effectively provides PyroGenesis with a 15+ year advantage compared

to building these operations from scratch. In addition, we will now

have a presence in Italy, and India (where AST has already

developed relationships with several multi-billion-dollar companies

who are currently using their technology). Moreover, this

acquisition provides potential synergies with our land-based waste

destruction offerings which, if successful, will significantly

increase their value to the market. AST’s technology complements

PyroGenesis’ existing offerings and further strengthens

PyroGenesis’ position as an emerging leader in GHG solutions for

sustainable long-term growth.”Mr. Pascali continues to discuss this

acquisition in the following Q&A format:

Q1. What is the significance of this

acquisition today?

A. This acquisition provides us

with an immediate entry into the RNG marketplace where we believe

there is a significant need for RNG providers particularly given

the trend towards regulating minimum required amounts of RNG within

gas pipelines.

Governments are now legislating requirements for

gas distributors to incorporate RNG into their pipelines. This has,

in turn, created a significant demand for biogas upgrading

facilities worldwide, but particularly in North America, and it is

this need that PyroGenesis is now targeting.

The movement to transition economies to net zero

emissions is evidenced by the US’ commitment to cut GHG emissions

in half by 2030, and to zero by no later than 2050.1

Closer to home, the Quebec Government recently

incorporated RNG and green hydrogen initiatives into their strategy

to reduce GHG emissions in their 2030 plan for a green economy. In

this plan, the Québec Government launched the first steps of the

plan, covering 2021-2026. This initiative was backed by a budget of

no less than $6.7 billion over the ensuing five years. More

specifically, it earmarked over $200 million for RNG projects in

the form of investments in the financing of RNG production and

distribution projects.2

In addition, this acquisition has provided

PyroGenesis with an immediate presence in both Italy and India and

established relationships with several multi-billion-dollar

companies. AST also boasts a list of satisfied clients which now

provides PyroGenesis with the “Golden Ticket”, described in

previous press releases. The Golden Ticket provides an opportunity

to i) cross sell other PyroGenesis offerings (such as replacing

fossil fuel burners with PyroGenesis’ proprietary plasma torches),

and/or (ii) propose plasma-based solutions to existing

problems.

______________________1 https://www.nbcnews.com/politics/white-house/biden-will-commit-halving-u-s-emissions-2030-part-paris-n1264892 2

https://www.bioenergy-news.com/news/rng-included-in-quebec-governments-green-economy-plans/

Q2. Can you describe the advantage of

this transaction for PyroGenesis’ shareholders?

A. Sure.

AST not only faced the natural growing pains of

an emerging company, such as access to capital to support growth,

but they were also challenged during COVID due to delayed payments

and supply chain issues, all at a time of increasing demand for

their products.

We believe PyroGenesis’ acquisition of AST will

now allow AST, under PyroGenesis, to realize its full potential by

providing the requisite skill set and assets to grow and meet

future demand. We expect that AST’s growth will be accelerated with

access to PyroGenesis’ (i) solid quality management system,

including ISO 9001 certification; (ii) multidisciplinary team of

engineers (including process, mechanical and electrical

engineering) and modeling capabilities (CFD, 3D mechanical, FEM

analysis, process modeling); (iii) expertise in maximizing

intellectual property through a robust patent strategy; (iv) newly

upgraded state-of-the art fabrication and warehousing facility

allowing for quick turnaround of equipment and parts to customers;

and (v) a track record of over 30 years history of doing business

with a long list of high-profile customers.

In discussions with clients during our due

diligence, we confirmed that any existing issues were entirely

manageable and there was clear interest to expand the relationship

under PyroGenesis ownership.

In summary, we have acquired AST for approx.

$4.4MM, which is to be paid upon the accomplishment of certain

milestones, each of which further validates and confirms AST’s

position in the marketplace. AST has a healthy backlog of over

$10MM of signed contracts, a pipeline of approx. $15MM (weighted

probability of approx. $8MM), receivables of approx. $5MM and debt

of approx. $2MM (the majority of which is expected to paid by

December 31, 2021 from AST’s cashflow).

Q3. Are they any less obvious hidden

gems within this acquisition?

A. Yes, in fact there is.

We believe that one of AST’s offerings is

ideally suited to significantly increase the value of one of our

land-based environmental offerings. The syngas produced by

PyroGenesis in, for example, its PRRS offering is quite similar to

the Coke Oven Gas (“COG”) that is cleaned and upgraded by AST. In

PyroGenesis’ case, the syngas is converted into electricity and

heat which are both low value products. In AST’s case, the COG is

purified, and hydrogen, which has a much higher value, is extracted

from it. As such, there is an opportunity to repurpose the syngas

generated by PyroGenesis’ PRRS offering by leveraging off of AST’s

technology, and thereby create higher value products such as

hydrogen, methanol and ethanol, and effectively increasing the

market value of PyroGenesis’ PRRS offering.

Q4. What are your expectations over the

next 12 - 18 months?

A. Our goal is to strengthen

AST’s operations, quality control systems, and increase the backlog

of signed contracts, all while delivering on existing contracts. As

this is completed over the next 12 to 18 months, we will

continually evaluate our options to accelerate the rollout of these

solutions in order to address the significant unmet need in the

market.

We also fully expect in the fullness of time,

and once PyroGenesis’ engineering team becomes more familiar with

AST’s processes, significant IP could be developed.

About PyroGenesis Canada

Inc.

PyroGenesis Canada Inc., a high-tech company, is

a leader in the design, development, manufacture and

commercialization of advanced plasma processes and sustainable

solutions which reduce greenhouse gases (GHG), and are economically

attractive alternatives to conventional “dirty” processes.

PyroGenesis has created proprietary, patented and advanced plasma

technologies that are being vetted and adopted by multiple

multibillion dollar industry leaders in four massive markets: iron

ore pelletization, aluminum, waste management, and additive

manufacturing. With a team of experienced engineers, scientists and

technicians working out of its Montreal office, and its 3,800 m2

and 2,940 m2 manufacturing facilities, PyroGenesis maintains its

competitive advantage by remaining at the forefront of technology

development and commercialization. The operations are ISO

9001:2015 and AS9100D certified, having been ISO certified since

1997. For more information, please visit: www.pyrogenesis.com.

This press release contains certain

forward-looking statements, including, without limitation,

statements containing the words "may", "plan", "will", "estimate",

"continue", "anticipate", "intend", "expect", "in the process" and

other similar expressions which constitute "forward- looking

information" within the meaning of applicable securities laws.

Forward-looking statements reflect the Corporation's current

expectation and assumptions and are subject to a number of risks

and uncertainties that could cause actual results to differ

materially from those anticipated. These forward-looking statements

involve risks and uncertainties including, but not limited to, our

expectations regarding the acceptance of our products by the

market, our strategy to develop new products and enhance the

capabilities of existing products, our strategy with respect to

research and development, the impact of competitive products and

pricing, new product development, and uncertainties related to the

regulatory approval process. Such statements reflect the current

views of the Corporation with respect to future events and are

subject to certain risks and uncertainties and other risks detailed

from time-to-time in the Corporation's ongoing filings with the

securities regulatory authorities, which filings can be found at

www.sedar.com, or at www.sec.gov. Actual results, events, and

performance may differ materially. Readers are cautioned not to

place undue reliance on these forward-looking statements. The

Corporation undertakes no obligation to publicly update or revise

any forward- looking statements either as a result of new

information, future events or otherwise, except as required by

applicable securities laws. Neither the Toronto Stock Exchange, its

Regulation Services Provider (as that term is defined in the

policies of the Toronto Stock Exchange) nor the NASDAQ Stock

Market, LLC accepts responsibility for the adequacy or accuracy of

this press release.

SOURCE PyroGenesis Canada Inc.

For further information please contact: Rodayna

Kafal, Vice President, IR/Comms. and Strategic BDPhone: (514)

937-0002, E-mail: ir@pyrogenesis.com

RELATED LINK: http://www.pyrogenesis.com/

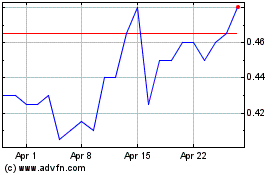

PyroGenesis Canada (TSX:PYR)

Historical Stock Chart

From Mar 2024 to Apr 2024

PyroGenesis Canada (TSX:PYR)

Historical Stock Chart

From Apr 2023 to Apr 2024