Transcontinental Inc. Announces Private Offering of $250 Million Senior Unsecured Notes

May 08 2014 - 11:34AM

Marketwired

Transcontinental Inc. Announces Private Offering of $250 Million

Senior Unsecured Notes

MONTREAL, QUEBEC--(Marketwired - May 8, 2014) - Transcontinental

Inc. (TSX:TCL.A)(TSX:TCL.B)(TSX:TCL.PR.D) announced today that it

has priced an offering of $250 million aggregate principal amount

of 3.897% senior unsecured notes ("the Notes") due in 2019. The

Notes are being offered through an agency syndicate led by CIBC

World Markets Inc. and Scotia Capital Inc. The Notes will be issued

at par for aggregate gross proceeds of $250 million. The offering

is expected to close on or about May 13, 2014, subject to customary

closing conditions. Transcontinental Inc. intends to use the net

proceeds of the offering to repay outstanding indebtedness under

its revolving credit facility and for general corporate

purposes.

The Notes will bear interest at a fixed annual rate of 3.897%,

payable in equal semi-annual instalments over the five-year term.

The Notes will be direct unsecured obligations of Transcontinental

Inc. and will rank pari passu with all other unsecured and

unsubordinated indebtedness of Transcontinental Inc. The Notes are

being offered in Canada on a private placement basis in reliance

upon exemptions from the prospectus requirements under applicable

securities legislation.

"Today's announced debt offering will provide the Corporation

with continued flexibility to pursue its transformation and execute

its growth strategy supported by a strong balance sheet.

Furthermore, the current environment provides the Corporation with

an opportunity to secure financing at attractive levels," said

Nelson Gentiletti, Chief Financial and Development Officer of

Transcontinental Inc.

The Notes have not been and will not be qualified for sale to

the public under applicable securities laws in Canada and,

accordingly, any offer and sale of the Notes in Canada will be made

on a basis which is exempt from the prospectus requirements of such

securities laws. The Notes have not been and will not be registered

under the United States Securities Act of 1933, as amended (the

"U.S. Securities Act") or any state securities laws and may not be

offered, sold or delivered in the United States of America or its

territories or possessions or to U.S. persons except in compliance

with the registration requirements of the U.S. Securities Act and

applicable state securities laws or pursuant to an exemption

therefrom. This press release does not constitute an offer to sell

or a solicitation of an offer to buy any of the Notes in the United

States.

About TC Transcontinental

Largest printer and a leading provider of media and marketing

activation solutions in Canada, TC Transcontinental creates

products and services that allow businesses to attract, reach and

retain their target customers. The Corporation specializes in print

and digital media, the production of magazines, newspapers, books

and custom content, mass and personalized marketing, interactive

and mobile applications, door-to-door distribution, and also

manufactures a range of flexible packaging products in the United

States.

Transcontinental Inc. (TSX:TCL.A)(TSX:TCL.B)(TSX:TCL.PR.D),

including TC Transcontinental, TC Media, TC Transcontinental

Printing and TC Transcontinental Packaging, has over 9,000

employees in Canada and the United States, and revenues of C$2.1

billion in 2013. Website www.tc.tc.

Forward-looking Statements

Our public communications often contain oral or written

forward-looking statements which are based on the expectations of

management and inherently subject to a certain number of risks and

uncertainties, known and unknown. By their very nature,

forward-looking statements are derived from both general and

specific assumptions. The Corporation cautions against undue

reliance on such statements since actual results or events may

differ materially from the expectations expressed or implied in

them. Forward-looking statements may include observations

concerning the Corporation's objectives, strategy, anticipated

financial results and business outlook. The Corporation's future

performance may also be affected by a number of factors, many of

which are beyond the Corporation's will or control. In addition,

the closing of the proposed offering of Notes is subject to general

market and other conditions and there can be no assurance that the

proposed offering of Notes will be completed or that the terms of

the proposed offering of Notes will not be modified. These factors

include, but are not limited to, the economic situation in the

world and particularly in Canada and the United States, structural

changes in the industries in which the Corporation operates, the

exchange rate, availability of capital, energy costs, competition,

the Corporation's capacity to engage in strategic transactions and

integrate acquisitions into its activities, the regulatory

environment, the safety of our packaging products used in the food

industry, innovation of our offering and concentration of our sales

in certain segments. The main risks, uncertainties and factors that

could influence actual results are described in Management's

Discussion and Analysis (MD&A) for the fiscal year ended on

October 31st, 2013, in the latest Annual Information Form and have

been updated in the MD&A for the first quarter ended January

31st, 2014 (available on SEDAR at www.sedar.com).

Unless otherwise indicated by the Corporation, forward-looking

statements do not take into account the potential impact of

nonrecurring or other unusual items, nor of divestitures, business

combinations, mergers or acquisitions which may be announced after

the date of May 8, 2014.

The forward-looking statements in this press release are made

pursuant to the "safe harbour" provisions of applicable Canadian

securities legislation.

The forward-looking statements in this release are based on

current expectations and information available as at May 8, 2014.

Such forward-looking information may also be found in other

documents filed with Canadian securities regulators or in other

communications. The Corporation's management disclaims any

intention or obligation to update or revise these statements unless

otherwise required by the securities authorities.

Media: Nathalie St-JeanSenior Advisor, Corporate

CommunicationsTC Transcontinental514

954-3581nathalie.st-jean@tc.tcwww.tc.tcFinancial Community:

Jennifer F. McCaugheySenior Director, Investor Relationsand

External Corporate CommunicationsTC Transcontinental514

954-2821jennifer.mccaughey@tc.tc / www.tc.tc

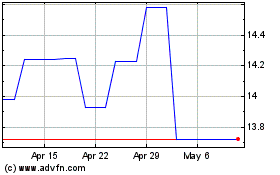

Transcontinental (TSX:TCL.B)

Historical Stock Chart

From Nov 2024 to Dec 2024

Transcontinental (TSX:TCL.B)

Historical Stock Chart

From Dec 2023 to Dec 2024