TSX VENTURE COMPANIES:

ALASKA HYDRO CORPORATION ("AKH")

(formerly Project Finance Corp. ("PF.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Name Change,

Short Form Offering Document, Non-Brokered Private Placement, Resume

Trading

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Filing Statement dated July 22, 2010. As a

result, at the opening Wednesday, September 8, 2010, the Company will no

longer be considered a Capital Pool Company. The Qualifying Transaction

includes the following:

1. Acquisition:

The acquisition of Cascade Creek LLC in consideration of the issuance of

23,761,458 common shares and 6,238,546 share acquisition warrants. Each

share acquisition warrant is convertible into one common share for no

additional consideration. 6,000,000 common shares are subject to an

overlay escrow requirement with release upon receipt of the Federal

Energy Regulatory Commission license for the Cascade Creek Project.

2. Name Change:

Pursuant to a resolution passed by the Company's Directors on July 20,

2010, the Company has changed its name as follows. There is no

consolidation of capital.

Effective at the opening Wednesday, September 8, 2010, the common shares

of Alaska Hydro Corporation will commence trading on TSX Venture

Exchange, and the common shares of Project Finance Corp. will be

delisted. The Company is classified as a 'Cleantech' company.

Capitalization: unlimited shares with no par value of which

37,504,958 shares are issued and

outstanding (excludes the above-referenced

6,238,546 share acquisition warrants)

Escrow: 22,636,458 consideration shares

6,238,546 share acquisition warrants

2,290,000 CPC escrow

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: AKH (new)

CUSIP Number: 01170T 10 8 (new)

3. Short Form Offering Document:

The Company's Short Form Offering Document dated July 26, 2010 was filed

with and accepted by TSX Venture Exchange on July 26, 2010. The Exchange

has now been advised that the Offering closed on September 3, 2010.

TSX Venture Exchange has been advised that closing occurred on September

3, 2010, for gross proceeds of $1,117,360.

Agent: Raymond James Ltd.

Offering: 6,983,500 Units (Each unit comprised of 1

share and 1 share purchase warrant

exercisable at $0.32 for a 5 year period.)

Unit Price: $0.16 per unit.

Agents' Warrants: 555,080 non-transferable warrants

exercisable to purchase one share at $0.16

per share to September 3, 2012.

Corporate Finance Fee: $33,000 plus applicable taxes plus 93,750

non-transferable warrants exercisable to

purchase one share at $0.16 per share to

September 3, 2012.

4. Private Placement-Non-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced August 25, 2010:

Number of Shares: 2,500,000 shares

Purchase Price: $0.16 per share

Warrants: 2,500,000 share purchase warrants to

purchase 2,500,000 shares

Warrant Exercise Price: $0.32 for a five year period

Number of Placees: 3 placees

The Exchange has been advised that the above transactions have been

completed.

Company Contact: Cliff Grandison

Company Address: 2633 Carnation Street

North Vancouver, BC V7H 1H6

Company Phone Number: (604) 929-3961

Company Fax Number: (604) 929-4996

------------------------------------------------------------------------

BAYFIELD VENTURES CORP. ("BYV")

BULLETIN TYPE: Halt

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

Effective at 6:51 a.m. PST, September 7, 2010, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

------------------------------------------------------------------------

BAYFIELD VENTURES CORP. ("BYV")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

Effective at 10:45 a.m., PST, September 7, 2010, shares of the Company

resumed trading, an announcement having been made over StockWatch.

------------------------------------------------------------------------

BOWOOD ENERGY INC. ("BWD")

BULLETIN TYPE: Halt

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

Effective at 6:06 a.m. PST, September 7, 2010, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

------------------------------------------------------------------------

BOWOOD ENERGY INC. ("BWD")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

Effective at 10:45 a.m., PST, September 7, 2010, shares of the Company

resumed trading, an announcement having been made over Marketwire.

------------------------------------------------------------------------

BTU CAPITAL CORP. ("BTU.P")

BULLETIN TYPE: Resume Trading, Regional Office Change

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated June 23, 2010 and the

Company's press release dated August 30, 2010, the Company's proposed

Qualifying Transaction has been terminated.

Effective at the opening on September 8, 2010 trading in the securities

of the Company will resume.

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Montreal,

Quebec to Vancouver, British Columbia.

------------------------------------------------------------------------

CANOEL INTERNATIONAL ENERGY LTD. ("CIL")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced July 15, 2010 and

September 3, 2010:

Convertible Debenture $75,000

Each $1 principal will receive 1 warrant

Conversion Price: Convertible into common shares at a price

of $0.20 of principal and/or unpaid

interest

Maturity date: September 30, 2014

Warrants Each warrant will entitle the holder to

purchase one common share and are

exercisable at the price of $0.50. The

warrants will be exercisable until

September 30, 2014

Interest rate: 15%

Number of Placees: 2 placees

Finders' Fees: $4,000 cash payable to General Research

GmbH

$2,000 cash payable to Prospero SRL

TSX-X

------------------------------------------------------------------------

CANOEL INTERNATIONAL ENERGY LTD. ("CIL")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced July 13, 2010 and

September 3, 2010:

Number of Shares: 472,917 units ("Units")

Each Unit consists of one common share and

one half of one common share purchase

warrant.

Purchase Price: $0.12 per Unit

Warrants: 236,459 share purchase warrants to purchase

236,459 shares

Warrant Exercise Price: $0.20 for up to 12 months from date of

issuance

Number of Placees: 3 placees

Finder's Fee: $1,584 cash and 16,500 warrants ("Finder

Warrants") payable to Canaccord Genuity

Corp.

- Each Finder Warrant is exercisable into

one common share at a price of $0.20 per

share for up to 12 months from date of

issuance.

------------------------------------------------------------------------

EDGEWATER EXPLORATION LTD. ("EDW")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing a definitive share purchase

agreement dated July 27th, 2010 (the "Agreement") between Edgewater

Exploration Ltd. (the "Company") and Rio Narcea Corporativa, S.L. ("Rio

Narcea Spain") to purchase all of the outstanding shares of Rio Narcea

Spain's wholly-owned subsidiary Rio Narcea Gold Mines S.L ("Rio

Narcea").

Malpica-Tuy Gold Project, Spain:

Rio Narcea owns a 100% interest in the Malpica-Tuy Gold Project

including the Corcoesto Gold Deposit in northwest Spain as well as an

additional 7 gold and gold-copper projects totaling 50,013 ha in

southwest Spain. The all-cash purchase terms are as follows:

- On Closing: US$1,000,000;

- Six (6) Months from Closing: US$4,000,000;

- Twelve (12) Months from Closing: US$3,000,000; and

- Total: US$8,000,000 cash

Rio Narcea Spain will retain a 1.5% Net Smelter Return ("NSR") Royalty

upon the commencement of commercial production from the Corcoesto Gold

Property subject to Edgewater having the right to re-purchase 1.0% of

the royalty at any time after Closing for US$1,500,000.

Finder's Fee: A finder's fee of 432,500 common shares will be issued to

Featherstone Capital Advisors Inc. ("Featherstone") in stages tied to

the proportion of consideration paid in connection with the Agreement.

Featherstone is engaged as financial and capital markets advisors to

Edgewater.

Insider / Pro Group Participation: N/A

For further information please read Edgewater's news releases dated May

5, 2010 and July 28, 2010 available on SEDAR for further information.

------------------------------------------------------------------------

EDGEWATER EXPLORATION LTD. ("EDW")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange ("Exchange") has accepted for filing documentation

with respect to a Non-Brokered Private Placement announced August 12,

2010:

Number of Shares: 10,413,000 Subscription Receipts. Each

Subscription Receipt will automatically

convert into a unit consisting of one

common share and one half of one common

share purchase warrant upon satisfaction of

certain release conditions, including

receipt of final Exchange approval of the

Company's recently announced acquisition of

Rio Narcea Gold Mines S.L. pursuant to an

agreement with Lundin Mining Corporation.

Purchase Price: $1.00 per share

Warrants: 5,206,500 share purchase warrants to

purchase 5,206,500 shares

Warrant Exercise Price: $1.40 for a three year period

Number of Placees: 54 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

George Salamis Y 20,000

Silka Investments Ltd. P 50,000

Catherine Seltzer P 25,000

Thomas Seltzer P 25,000

Roger Poirier P 1,000,000

Darren Wallace P 260,000

Mike Harrison P 50,000

Chris Roy P 150,000

Kevin Williams P 150,000

Chris Burchell P 30,000

Jeff Kennedy P 60,000

Patrick Soares Y 100,000

Cormark Securities Investment

Fund P 1,000,000

Ryan King Y 10,000

Michael Marosits P 60,000

Finders' Fees: $249,912 and 249,912 warrants payable to

Cormark Securities Inc.

$156,195 and 156,195 warrants payable to PI

Financial Corp.

$124,956 and 124,956 warrants payable to

Canaccord Genuity Corp.

$93,717 and 93,717 warrants payable to

Haywood Securities Inc.

- Each warrant is exercisable at a price of

$1.10 for an 18 month period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. (Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.)

------------------------------------------------------------------------

EMGOLD MINING CORPORATION ("EMR")

BULLETIN TYPE: Shares for Debt, Correction

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange bulletin dated September 3, 2010,

the bulletin should have read as follows:

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 2,813,575 shares at a deemed value of $0.15 per share and

2,813,575 warrants at an exercisable price of US$0.35 per share for five

years to settle outstanding debt for $422,036.26.

Number of Creditors: 2 Creditors

Insider / Pro Group Participation:

Insider=Y / Amount Deemed Price

Creditor Progroup=P Owing per Share # of Shares

Lang Mining Corporation

(Frank A. Lang) Y $236,239.75 $0.15 1,574,932

Frank A. Lang Y $185,796.51 $0.15 1,238,643

There will be a total of 2,813,575 warrants attached to the shares at an

exercisable price of US$0.35 per share for five years.

The Company shall issue a news release when the shares are issued and

the debt extinguished.

------------------------------------------------------------------------

ENDURANCE GOLD CORPORATION ("EDG")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing a Letter Agreement dated

August 20, 2010 between Endurance Gold Corporation (the "Company") and

True North Gems Inc. (the "Vendor"), whereby the Company has the right

to earn up to a 75% joint venture interest in the mineral claims

comprising the Bandito Property in Watson Lake District, Yukon. In

consideration, the Company will pay $125,000 ($25,000 upon regulatory

approval) in cash by December 31, 2012 and complete $1,000,000 in

exploration expenditures by December 31, 2013 to earn an initial 51%

interest. The Company has a further option to acquire an additional 24%

interest by issuing 200,000 shares and completing an additional

$1,000,000 in exploration expenditures prior to December 31, 2015.

------------------------------------------------------------------------

EYELOGIC SYSTEMS INC. ("EYE.A")

BULLETIN TYPE: Declaration of Dividend

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

The Issuer has declared the following dividend:

Dividend per Class A Share: $0.04

Payable Date: September 30, 2010

Record Date: September 23, 2010

Ex-Dividend Date: September 21, 2010

------------------------------------------------------------------------

FORMATION FLUID MANAGEMENT INC. ("FFM")

(formerly Dobhai Ventures Inc. ("DOB"))

BULLETIN TYPE: Name Change

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

Pursuant to a director's resolution dated August 10, 2010, the Company

has changed its name as follows. There is no consolidation of capital.

Effective at the opening Wednesday, September 8, 2010, the common shares

of Formation Fluid Management Inc. will commence trading on TSX Venture

Exchange, and the common shares of Dobhai Ventures Inc. will be

delisted.

Capitalization: Unlimited shares with no par value of which

38,544,243 shares are issued and

outstanding

Escrow: 17,722,500 shares

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: FFM (new)

CUSIP Number: 34637W109 (new)

------------------------------------------------------------------------

FORTRESS MINERALS CORP. ("FST")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing a share purchase agreement

(the 'SPA') between Fortress Minerals Corp. (the 'Corporation') and

Castalian Trading Ltd. (the 'Share Purchaser'), a party to a letter of

intent with Polymetal ('Polymetal') to purchase the Svetloye gold

deposit.

Pursuant to the SPA, the Share Purchaser will purchase all of the issued

shares of two of the Corporation's Cypriot subsidiaries which in turn

own 100% of the participatory interest in the Corporation's Russian

subsidiary, PD RUS, LLC ('PD RUS'), which holds the Svetloye License

(mining and exploration) located in Khabarovsk Krai within the Russian

Federation.

As part of the SPA transaction (the 'Sale Transaction'), intercompany

debt will be assigned or transferred, as applicable, to Polymetal ESOP

Limited, a 100% owned subsidiary of Polymetal. The aggregate

consideration to be realized by the Corporation in relation to the Sale

Transaction is US$9.25million in cash.

Insider / Pro Group Participation: N/A

For further information please read the Corporation's news release dated

August 4, 2010 available on SEDAR for further information.

------------------------------------------------------------------------

GOLDRUSH RESOURCES LTD. ("GOD")

BULLETIN TYPE: Halt

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

Effective at 6:28 a.m. PST, September 7, 2010, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

------------------------------------------------------------------------

GOLDRUSH RESOURCES LTD. ("GOD")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

Effective at 11:30 a.m., PST, September 7, 2010, shares of the Company

resumed trading, an announcement having been made over Market News

Publishing.

------------------------------------------------------------------------

GREEN SWAN CAPITAL CORP. ("GSW.P")

BULLETIN TYPE: Notice - QT Not Completed - Approaching 24 Months of

Listing

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

The shares of the Company were listed on TSX Venture Exchange on October

7, 2008. The Company, which is classified as a Capital Pool Company

('CPC'), is required to complete a Qualifying Transaction ('QT') within

24 months of its date of listing, in accordance with Exchange Policy

2.4.

The records of the Exchange indicate that the Company has not yet

completed a QT. If the Company fails to complete a QT by its 24-month

anniversary date of October 7, 2010, the Company's trading status may be

changed to a halt or suspension without further notice, in accordance

with Exchange Policy 2.4, Section 14.6.

------------------------------------------------------------------------

NOVUS ENERGY INC. ("NVS")

BULLETIN TYPE: Normal Course Issuer Bid

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has been advised by the Company that pursuant to a

Notice of Intention to make a Normal Course Issuer Bid dated September

3, 2010, it may repurchase for cancellation, up to 5,000,000 shares in

its own capital stock. The purchases are to be made through the

facilities of TSX Venture Exchange during the period September 13, 2010

to September 12, 2011. Purchases pursuant to the bid will be made by

National Bank Financial on behalf of the Company.

------------------------------------------------------------------------

PARAMAX RESOURCES LTD. ("PXM")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced May 4, 2010 and May 18, 2010:

Number of Shares: 16,500,000 shares

Purchase Price: $0.50 per share

Warrants: 8,250,000 share purchase warrants to

purchase 8,250,000 shares

Warrant Exercise Price: $0.80 for a two year period. If at any time

after four months and one day of closing

the volume weighted average trading price

for the Company shares is $1.00 or greater

for 20 consecutive trading days, the

Company may, within five days of such an

event, provide notice that the warrants

will expire on the 30th day after such

notice.

Number of Placees: 34 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

David Antony Y 50,000

Byron Lutes Y 20,000

The K2 Principal Fund LP Y 3,300,000

Agents' Fees: Canaccord Genuity Corp. receives

$202,702.50 and 405,405 non-transferable

warrants, each exercisable for one share at

a price of $0.50 for one year.

Byron Securities Ltd. receives $143,797.50

and 287,595 non-transferable warrants, each

exercisable for one share at a price of

$0.50 for one year.

PI Financial Corp. receives $99,000 and

198,000 non-transferable warrants, each

exercisable for one share at a price of

$0.50 for one year.

Thomas Weisel Partners Canada Inc. receives

$24,750 and 49,500non-transferable

warrants, each exercisable for one share at

a price of $0.50 for one year.

Wellington West Capital Markets Inc.

receives $24,750 and 49,500 non-

transferable warrants, each exercisable for

one share at a price of $0.50 for one year.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. (Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.)

------------------------------------------------------------------------

PEMBERTON ENERGY LTD. ("PBT")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 5,346,352 shares and 4,326,352 share purchase warrants to settle

outstanding debt for $267,317.62.

Number of Creditors: 10 Creditors

Insider / Pro Group Participation:

Insider=Y / Amount Deemed Price

Creditor Progroup=P Owing per Share # of Shares

Jerry Hale Y $30,000 $0.05 600,000

Swamp Energy

Services

Inc. (Matthew

Dodwell) Y $21,000 $0.05 420,000

Warrants: 4,326,352 share purchase warrants to

purchase 4,326,352 shares

Warrant Exercise Price: $0.10 for a two year period

The Company shall issue a news release when the shares are issued and

the debt extinguished.

------------------------------------------------------------------------

PRESCIENT MINING CORP. ("PMC")

(formerly Milk Capital Corp. ("MLK"))

BULLETIN TYPE: Name Change

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

Pursuant to a resolution passed by Directors on August 27, 2010, the

Company has changed its name as follows. There is no consolidation of

capital.

Effective at the opening September 8, 2010, the common shares of

Prescient Mining Corp. will commence trading on TSX Venture Exchange,

and the common shares of Milk Capital Corp. will be delisted. The

Company is classified as a 'Mining' company.

Capitalization: Unlimited shares with no par value of which

15,890,000 shares are issued and

outstanding

Escrow: 2,311,000 Escrow

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: PMC (new)

CUSIP Number: 74071D100 (new)

------------------------------------------------------------------------

RADIUS GOLD INC. ("RDU")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to

an Option Agreement between Radius Gold Inc. (the "Company") and Roger

Hulstein (the "Vendor"), whereby the Company has the option to earn a

100% interest in 100 claims located in the Watson Lake Mining District,

Yukon. In consideration, the Company will pay a total of $175,000 and

issue 200,000 common shares over a four year period ($35,000 and 50,000

shares in the first year). Commencing July 15, 2015 and each anniversary

thereafter, an advance royalty of $20,000 per year is payable until

commercial production. Upon commencement of commercial production, the

advance royalty payments cease and the Vendor is entitled to a 3.0% NSR,

which can be reduced to 2.0% at any time upon the Company paying $1.0

million to the Vendor.

Insider / Pro Group Participation: N/A

------------------------------------------------------------------------

SOLOMON RESOURCES LIMITED ("SRB")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 7, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 17, 2010:

Number of Shares: 1,880,000 non flow-through shares and

1,375,111 flow-through shares

Purchase Price: $0.15 per non flow-through share and $0.18

per flow-through share

Warrants: 3,255,111 share purchase warrants to

purchase 3,255,111 shares

Warrant Exercise Price: $0.30 for a period ending July 23, 2012. If

the average closing trading price of the

shares is equal to or exceeds $0.50 for 20

consecutive trading days after the expiry

of the four month restricted resale period,

the company may, upon notice to

warrantholders, shorten the expiry date of

the warrants to 25 days from the date of

notice.

Number of Placees: 37 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P # of Shares

David L. Hamilton-Smith P 100,000

Pathway Mining 2010 Flow-

Through LP Y 555,555

Finders' Fees: $23,961.60 cash, 21,120 finder's warrants

exercisable at $0.15 in the first year and

$0.30 in the second year, and 134,400

finder's warrants exercisable at $0.18 in

the first year and $0.30 in the second year

payable to Canaccord Genuity Corp.

$7,999.99 cash and 44,444 finder's warrants

exercisable at $0.18 in the first year and

$0.30 in the second year payable to Limited

Market Dealer Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

TSX-X

------------------------------------------------------------------------

TEUTON RESOURCES CORP. ("TUO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced July 19, 2010:

Number of Shares: 1,000,000 shares

Purchase Price: $0.45 per share

Warrants: 1,000,000 share purchase warrants to

purchase 1,000,000 shares

Warrant Exercise Price: $0.50 for a one year period

$0.65 in the second year

Number of Placees: 18 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Michael Ginn Y 50,000

Frank and Christine Gill Y 23,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

------------------------------------------------------------------------

TITAN TRADING ANALYTICS INC. ("TTA")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced July 23, 2010 and August

27, 2010:

Convertible Debenture $334,000

Conversion Price: Convertible into units consisting of one

common share and one common share purchase

warrant at $0.15 per Unit

Maturity date: 24 months from date of issuance

Warrants: Each warrant will have a term of six months

from the date of issuance of the notes and

entitle the holder to purchase one common

share. The warrants are exercisable at the

price of $0.30.

Interest rate: 12% per annum

Number of Placees: 11 placees

TSX-X

------------------------------------------------------------------------

TWOCO PETROLEUMS LTD. ("TWO")

BULLETIN TYPE: Bonus Warrants

BULLETIN DATE: September 7, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 1,500,000 common share purchase warrants ("Warrants") to Alberta

Treasury Branches in consideration for amending the terms of an existing

loan facility. Each warrant is exercisable for one common share at a

price of $0.30 per share for up to 24 months from date of issuance.

This transaction was disclosed in the Company's press releases dated

July 29 and September 3, 2010.

------------------------------------------------------------------------

UNIVERSAL WING TECHNOLOGIES INC. ("UAV")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 1,933,333 shares to settle outstanding debt for $290,000.

Number of Creditors: 1 Creditor

Insider / Pro Group Participation:

Insider=Y / Amount Deemed Price

Creditor Progroup=P Owing per Share # of Shares

Arctic Star

Diamond Corp. Y $290,000 $0.15 1,933,333

The Company shall issue a news release when the shares are issued and

the debt extinguished.

------------------------------------------------------------------------

VVC EXPLORATION CORPORATION ("VVC")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation of

a Purchase Agreement dated March 17, 2010 between VVC Exploracion de

Mexico S. de RL de CV (a wholly owned subsidiary of the Issuer) and

Invesmin San Miguel S de RL de CV (Insider: Andre St Michel. The

"Vendor") whereby the Company has acquired a 100% in three (3) mining

concessions (known as the Cumeral Property, covering an aggregate of 665

hectares) located in Sinaloa State Mexico.

The consideration payable to the Vendor consists of US$800,000 cash

(US$250,000 in the first year) payable over a three year period and

200,000 common shares of the Company. The Vendor will retain a 2% net

smelter return royalty.

A finder's fee is payable to Joel R. Rodriguez Barraza in the amount of

130,000 common shares.

For further information please refer to the Company's news releases

dated February 25, 2010 and July 22, 2010.

------------------------------------------------------------------------

VVC EXPLORATION CORPORATION ("VVC")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: September 7, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation of

a Purchase Agreement dated March 17, 2010 between VVC Exploracion de

Mexico S. de RL de CV (a wholly owned subsidiary of the Issuer) and

Grupo Minero Factor SA de CV (Insider: Jose Conrado Terrazas Cano. The

"Vendor") whereby the Company has acquired a 100% in mining concessions

(known as the La Tuna Property, covering 3,533 hectares) located in

Sinaloa State Mexico.

The consideration payable to the Vendor consists of US$40,000 cash and

300,000 common shares of the Company. The Vendor will retain a 2% net

smelter return royalty.

For further information please refer to the Company's news release dated

June 22, 2010.

------------------------------------------------------------------------

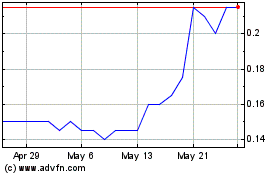

Endurance Gold (TSXV:EDG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Endurance Gold (TSXV:EDG)

Historical Stock Chart

From Dec 2023 to Dec 2024