Lavras Gold Corp. (TSXV: LGC) has filed the technical report for

the mineral resource estimate on the Cerrito Gold Prospect on SEDAR

(www.sedar.com).

The report has been prepared according to the

standards set out in NI 43-101 Standards of Disclosure for Mineral

Projects. It will also be made available on the Company’s website.

The report is called NI 43-101 Technical Report for the Cerrito

Gold Prospect, Rio Grande do Sul, Brasil. It is authored by

Volodymyr Myadzel, MAIG, and Frank Richard Baker, MIMMM, MAusIMM,

and is dated and effective May 31, 2022.

As previously announced on June 6, 2022, the

resource estimate shows that Cerrito has an indicated gold resource

of 187,650 ounces and an inferred gold resource of 293,468

ounces.

NI 43-101 MINERAL RESOURCE ESTIMATE FOR CERRITO

GOLD PROSPECT

|

|

|

|

Uncapped |

Capped |

|

Class |

Type |

Tonnes |

Gold (g/t) |

Gold (oz) |

Gold (g/t) |

Gold (oz) |

|

Indicated |

Saprolite |

474,461 |

0.87 |

13,327 |

0.78 |

11,858 |

|

|

Hard rock |

7,774,763 |

0.78 |

195,759 |

0.70 |

175,792 |

|

Inferred |

Saprolite |

286,235 |

0.80 |

7,338 |

0.66 |

6,094 |

|

|

Hard rock |

12,871,242 |

0.76 |

314,329 |

0.69 |

287,374 |

Notes

- Mineral resources are not mineral

reserves and do not have demonstrated economic viability. There is

no certainty that all or any part of the mineral resources

estimated will be converted into mineral reserves

- Assumes a gold cut-off grade of 0.3

grams per tonne (g/t)

- High grade samples were capped at a

grade of 3.07 g/t for the capped resource estimate

- Numbers may not sum due to

rounding

- The qualified person for the resource

estimate is Dr. Volodymyr Myadzel of VMG Consultoria e Soluções

Ltda.

- This estimate should be read in

conjunction with the full report, which is available on

www.sedar.com under the company’s profile.

Methodology for estimate

The gold resource for the Cerrito Prospect has been

estimated according to standards set out in National Instrument

43-101 – Standards of Disclosure for Mineral Projects (NI

43-101).

The Cerrito gold resource calculation is based on a

drilling database of 92 diamond drill holes totaling 14,593 metres

of drilling. Distances between drill holes varied from 25 and 100

meters from which 24 vertical sections were created having a

north-south orientation and an average distance of 50 meters

between sections.

Composite samples averaged 1.0 metre in length. The

block model was generated from the discretization of

three-dimensional solids into blocks of defined dimensions. The

process of discretization of the solid included the sub-blocking

process.

Initially, the model was filled with blocks

measuring 10 (X) by 10 (Y) by 10 (Z) metres, which were divided

into subunits of smaller size, with a factor for size subdivision

of 10 by 10 by 10 in contact with the surrounding three-dimensional

solids.

As a result, at the limit with solids, the size of

the blocks became 1.0 (X) by 1.0 (Y) by 1.0 (Z) metres. The initial

size of the blocks was chosen based on the morphology of the

mineralized geological bodies and the size of the exploration grid

at 1/2 of the main grid. The model contains 253,197 blocks.

The solid was used to create a block model within

the mineralized geological body and encode the respective blocks. A

digital model of the topographic surface was used to restrict the

block model along the vertical axis. The blocks were generated with

faces parallel to the north/south and east/west axes.

A capping grade of 3.07 g/t gold was applied to

minimize the impact of high-grade gold assay results on the overall

resource calculation. An uncapped and capped gold resource was

calculated to show the impact of capping on the overall gold

resource model.

The disclosed resource is based on a block model

interpolated by the Ordinary Kriging method. A 0.3 g/t gold cutoff

grade is assumed based on the near and at surface nature of the

Cerrito mineral deposit. The sensitivity of the gold resource

estimate to cut-off grade varying from 0.0 g/t gold to 5.0 g/t gold

is shown in the full report.

Classification of resources

The classification of resources was carried out in

accordance with NI 43-101 guidelines.

The resources were classified as Indicated and

Inferred according to the degree of reliability of the different

iterations and data used for the interpolation of the block model.

Solids were created and were used to stamp the inner blocks to each

of these reliability zones.

For the indicated resource, a solid that

encompasses an area with a 50-meter regular drilling grid was

created for areas in which more than 90% of the blocks were stamped

in the first to third iterations corresponding to 2 of the search

radii. For interpolation, a minimum of 1 hole and 2 composite

samples were used and the average distance of interpolation between

samples is 50 meters.

All other blocks were classified as inferred

resources.

Qualified

person

Dr. Volodymyr Myadzel of VMG Consultoria e Soluções

Ltda., a qualified person as defined by NI 43-101, has reviewed and

approved the scientific and technical information contained in this

release.

Lavras Gold: Exploring to realize the

potential of a multi-million ounce district in southern

Brazil

Lavras Gold (TSXV: LGC) is a Canadian exploration

company focused on realizing the potential of the Lavras do Sul

gold project (LDS Project) in Brazil. Located in the state of Rio

Grande do Sul, the LDS Project is believed to host an alkaline

porphyry gold-copper system. More than 23 gold prospects centred on

historic gold workings have been identified on the property, which

spans more than 22,000 hectares.

The Company’s vision is to maximize shareholder

value by applying a sustained systematic and technically-based

exploration program to the LDS Project and any other opportunities

that may arise.

Follow Lavras Gold on www.lavrasgold.com, as well

as on LinkedIn, Twitter, and YouTube.

Contact information

|

Michael DurosePresident &

CEO416-844-6284info@lavrasgold.com |

Annemarie BrissendenInvestor

Relations416-844-6284info@lavrasgold.com |

DISCLAIMERNeither the TSX Venture Exchange nor its

Regulation Services Provider (as defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of the content of this news release.

FORWARD-LOOKING INFORMATIONThis news release

contains certain “forward-looking information” within the meaning

of applicable securities laws. Forward looking information is

frequently characterized by words such as “plan”, “expect”,

“project”, “intend”, “believe”, “anticipate”, “estimate”, “may”,

“will”, “would”, “potential”, “proposed” and other similar words,

or statements that certain events or conditions “may” or “will”

occur. These statements, including statements with respect to

planned exploration activities and goals, the proposed

Consolidation and the timing thereof, are only objectives and

predictions. Forward-looking information is based on the opinions

and estimates of management at the date the information is

provided, and is subject to a variety of risks and uncertainties

and other factors that could cause actual events or results to

differ materially from those projected in the forward-looking

information, including the risks and factors that generally affect

exploration and the uncertainty of exploration results and the

ability to obtain regulatory approval for the Consolidation. For a

description of the risks and uncertainties facing the Company and

its business and affairs, readers should refer to the Company’s

Management’s Discussion and Analysis and Listing Statement recently

filed under the Company’s profile on www.sedar.com. The Company

undertakes no obligation to update forward-looking information if

circumstances or management’s estimates or opinions should change,

unless required by law. The reader is cautioned not to place undue

reliance on forward-looking information.

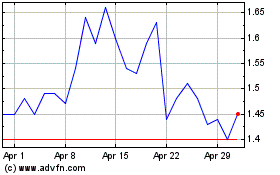

Lavras Gold (TSXV:LGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

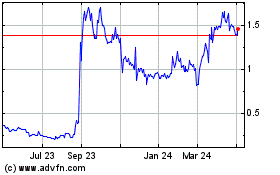

Lavras Gold (TSXV:LGC)

Historical Stock Chart

From Apr 2023 to Apr 2024