Prospera Energy Inc. announces record profitability in Q3 2022 as restructuring momentum accelerates

November 18 2022 - 1:00AM

Prospera Energy Inc.

PEI: TSX-V; OF6A:

FRA; OTC: GXRFF

2022 Q3

Highlights:

In the third quarter of 2022, Prospera continued

the restructuring efforts to be profitable and compliant, both

environmentally & regulatorily. PEI accelerated the

restructuring momentum by executing a significant well recompletion

and reactivation work over program during Q3. As a result, PEI

September exit production rate (gross) of 710 BOE/d is 40% higher

than the Q2 2022 production average.

During this quarter the Corporation

effectively:

- Achieved oil and

gas revenue of $3,752,046 in Q3 2022 vs. $982,966 in Q3 2021

- Achieved

positive EBITDA of $1,728,611 in Q3 2022 vs. negative EBITDA of

($1,118,624) in Q3 2021

- Realized Net

Income of $938,968 in Q3 2022 vs. Net Loss ($1,270,030) in Q3

2021

- Attained a net

production rate of 484 boe/d in Q3 2022 vs. 169 boe/d in Q3 2021;

September sales were 710 boe/d (gross), increasing from 557 boe/d

(gross) in July with an average net working interest of 78%. On

target for 1,500 boe/d (gross) 2022 exit rate

- Reported

positive Cash Flow from Operations of $2,801,621 for YTD 2022 vs.

negative Cash Flow from Operations of ($3,919,219) for YTD

2021

- Realized average

revenue pricing of $85.09/boe in Q3 2022 vs. $63.18/boe in Q3 2021.

This represents a 34.7% increase in pricing year over year

- Operating Costs

per boe have declined from $52.56/boe to $40.07/boe as

restructuring momentum accelerates

- Reported

positive operating netback of $1,532,985 or $34.78/boe, $24.74/boe

after G&A + Interest

Operating Income Summary:

| |

|

|

Increase (Decrease) |

|

|

Q3 2022 |

Q3 2021 |

Value |

% |

| Average sales

volumes: |

|

|

|

|

|

Natural gas (Mcf/d) |

119 |

|

81 |

|

38 |

|

47 |

% |

|

Oil and condensate (Bbl/d) |

464 |

|

156 |

|

308 |

|

197 |

% |

|

Total Net (Boe/d) |

484 |

|

169 |

|

315 |

|

186 |

% |

|

Liquids Composition (percentage) |

96 |

% |

92 |

% |

4 |

% |

4 |

% |

|

Average realized prices |

|

|

|

|

|

Natural gas ($/Mcf) |

4.03 |

|

3.38 |

|

0.65 |

|

19 |

% |

|

Oil ($/Bbl) |

87.70 |

|

66.89 |

|

20.81 |

|

31 |

% |

|

Average realized price ($/Boe) |

85.09 |

|

63.18 |

|

21.91 |

|

35 |

% |

|

Operating netback |

|

|

|

|

|

Natural gas |

43,769 |

|

25,156 |

|

18,613 |

|

74 |

% |

|

Oil |

3,706,896 |

|

957,810 |

|

2,749,086 |

|

287 |

% |

|

Total petroleum and natural gas sales |

3,750,664 |

|

982,966 |

|

2,767,698 |

|

282 |

% |

|

Royalties |

(451,488 |

) |

(102,247 |

) |

(349,241 |

) |

342 |

% |

|

Operating costs |

(1,766,191 |

) |

(1,354,610 |

) |

(411,581 |

) |

30 |

% |

|

Operating netback |

1,532,985 |

|

(437,891 |

) |

2,006,876 |

|

423 |

% |

Above should be read in conjunction with the

Company’s financial statements and related management’s discussion

and analysis for the quarter ended September 30, 2022. PEI’s Q3

2022 financial information can be found under the Company’s issuer

profile on SEDAR at www.sedar.com.

Message to Shareholders

-

As ESG initiatives continue, PEI has abandoned 16 wells amounting

to $599,812 in decommissioning liability (ARO) reduction in Q3

2022; 41 wells amounting to $986,209 in ARO reduction for YTD 2022.

PEI’s commitment to the environment remains a major focus

-

PEI’s management and advisors have spent considerable time

interpreting the drilling and completion results of the two

re-entry horizontal pilot wells resulting in a substantial Q4

development plan. This bodes well for PEI meeting the target 2022

exit production rate

About Prospera

Prospera is a public oil and gas exploration,

exploitation and development company focusing on conventional oil

and gas reservoirs in Western Canada. Prospera will use its

experience to develop, acquire, and drill assets with potential for

primary and secondary recovery.

For Further Information:

Shawn Mehler, PR Email:

shawn@prosperaenergy.comWebsite: www.prosperaenergy.com

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking

statements relating to the future operations of the Corporation and

other statements that are not historical facts. Forward-looking

statements are often identified by terms such as “will,” “may,”

“should,” “anticipate,” “expects” and similar expressions. All

statements other than statements of historical fact, included in

this release, including, without limitation, statements regarding

future plans and objectives of the Corporation, are forward looking

statements that involve risks and uncertainties. There can be no

assurance that such statements will prove to be accurate and actual

results and future events could differ materially from those

anticipated in such statements.

Although Prospera believes that the expectations

and assumptions on which the forward-looking statements are based

are reasonable, undue reliance should not be placed on the

forward-looking statements because Prospera can give no assurance

that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, risks associated with the oil and gas industry in

general (e.g., operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses, and health, safety and

environmental risks), commodity price and exchange rate

fluctuations and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures.

The reader is cautioned that assumptions used in

the preparation of any forward-looking information may prove to be

incorrect. Events or circumstances may cause actual results to

differ materially from those predicted, as a result of numerous

known and unknown risks, uncertainties, and other factors, many of

which are beyond the control of Prospera. As a result, Prospera

cannot guarantee that any forward-looking statement will

materialize, and the reader is cautioned not to place undue

reliance on any forward- looking information. Such information,

although considered reasonable by management at the time of

preparation, may prove to be incorrect and actual results may

differ materially from those anticipated. Forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement. The forward-looking statements

contained in this news release are made as of the date of this news

release, and Prospera does not undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as expressly required by Canadian securities

law.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

release.

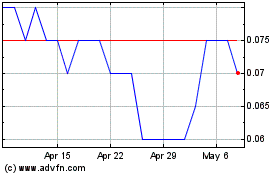

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Apr 2024 to May 2024

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From May 2023 to May 2024