Filed with the

Securities and Exchange Commission on November 5, 2015.

Registration Statement No. 333-205916

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

Form S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

ENER-CORE,

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

3511 |

|

46-0525350 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

| |

9400

Toledo Way

Irvine, California 92618

(949) 616-3300 |

|

| (Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices) |

| |

|

|

| |

Alain

J. Castro

Chief Executive Officer

9400 Toledo Way

Irvine, California 92618

(949) 616-3300 |

|

| (Name, address, including zip code,

and telephone number, including area code, of agent for service) |

|

|

| |

|

|

| |

Copies of all communications to: |

|

David

C. Lee

Shoshannah D. Katz

K&L Gates LLP

1 Park Plaza, Twelfth Floor

Irvine, CA 92614

(949) 253-0900

|

|

Jonathan

R. Zimmerman

Joshua L. Colburn

Faegre Baker Daniels LLP

2200 Wells Fargo Center

90 South Seventh Street

Minneapolis, Minnesota 55402

(612) 766-7000 |

Approximate date of commencement of

proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of 1933, check the following box. ☒

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is

a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is

a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o |

Accelerated filer o |

Non-accelerated filer o

(Do not check if a smaller

reporting company) |

Smaller reporting company ☒ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to

be Registered | |

Proposed

Maximum Aggregate

Offering Price(1)(2) | | |

Amount

of Registration

Fee(3) | |

| Units, each consisting of one share of

common stock, $0.0001 par value per share, and a warrant to purchase 0.25 of a share of common stock(4) | |

$ | 14,231,250 | | |

| 1,654 | |

| Common stock included in the units(5) | |

| | | |

| | |

| Warrants included in the units | |

| | | |

| | (6) | |

| Common stock underlying the

warrants included in the units(5) | |

$ | 4,269,375 | | |

| 497 | |

| Total: | |

$ | 18,500,625 | | |

$ | 2,151 | |

| (1) |

Estimated solely for the purpose of calculating the registration fee pursuant

to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) |

Includes the aggregate offering price of securities the underwriters have the option to purchase

in this offering. |

| (3) |

A registration fee of $2,673 was previously paid with Amendment No.1 to the Form S-1 filed

on September 18, 2015. |

| (4) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(i)

under the Securities Act. |

| (5) |

Pursuant to Rule 416(a) under the Securities Act, this registration statement shall be deemed

to cover additional securities that may be offered or issued to prevent dilution resulting from stock splits, stock dividends

or similar transactions. |

| (6) |

No registration fee is required pursuant to Rule 457(g) under the Securities Act. |

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting

pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell

these securities and it is not soliciting offers to buy these securities in any state or other jurisdiction where the offer or

sale is not permitted.

Subject

to Completion, Dated NOVEMBER 5, 2015

PRELIMINARY PROSPECTUS

Ener-Core, Inc.

2,250,000 Units

Each Unit Consisting of One Share of Common

Stock and

A Warrant to Purchase 0.25 of a Share

of Common Stock

We are offering 2,250,000

units. Each unit consists of one share of our common stock, $0.0001 par value per share, and a warrant to purchase 0.25 of a share

of our common stock. The common stock and warrants are immediately separable and will be issued separately.

We expect the public

offering price for the units will be between $4.50 and $5.50 per unit. This offering price range may vary from the trading price

of our common stock on the OTCQB Marketplace on any particular trading day. This price range reflects our assessment of the price

at which investors might be willing to participate in this offering, based on, among other things, the current low trading volume

of our common stock and market values and various valuation measures of other companies engaged in activities similar to ours.

See “Determination of Offering Price Range” on page 33 of this prospectus.

Our common stock is

currently quoted on the OTCQB Marketplace under the symbol “ENCR.” On November 4, 2015, the last reported sale price

of shares of our common stock on the OTCQB Marketplace was $6.00, however, the market price of our common stock on the OTCQB Marketplace

may not be indicative of the market price of our common stock if our common stock is listed on the NYSE MKT. Each warrant will

have an exercise price per whole share of common stock equal to 120% of the offering price per unit in this offering, will be

immediately exercisable and will expire on the fifth anniversary of the date of issuance.

In conjunction with

this offering, we have applied to list our units, common stock and the warrants on the NYSE MKT. There is no assurance, however,

that our units, common stock or the warrants will ever be listed on the NYSE MKT.

On May 6, 2013, we effected

a 30-for-1 forward split of our issued and outstanding shares of common stock by way of a stock dividend. On July 8, 2015, we

effected a 1-for-50 reverse split of our issued and outstanding shares of common stock. All share and per share information in

this prospectus gives effect to the 30-for-1 forward split and 1-for-50 reverse split, retroactively.

We are an “emerging

growth company” as defined under the Jumpstart Our Business Startups Act of 2012, and applicable Securities and Exchange

Commission rules, and have elected to comply with certain reduced public company reporting requirements. Please refer to the discussions

under “Summary-Implications of Being an Emerging Growth Company” and “Risk Factors” below concerning how

and when we may lose emerging growth company status and the various exemptions that are available to us.

Investing in our securities

involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

| Per Unit | | |

| Total | |

| Public offering price | |

$ | | | |

$ | | |

| Underwriting discount and commissions(1) | |

$ | | | |

$ | | |

| Proceeds to Ener-Core, Inc., before expenses | |

$ | | | |

$ | | |

| (1) |

See the section entitled “Underwriting” beginning on page 126 for a description

of the compensation payable to the underwriters. |

We have granted the

underwriters an option to purchase up to (i) an additional 337,500 units, (ii) an additional 337,500 shares and/or (iii)

additional warrants to purchase up to 84,375 warrant shares (such securities not to exceed, in the aggregate, 15% of each of the

shares and warrants underlying the units offered hereby, whether issued as part of the units or separately) from us within 30

days of the date of this prospectus.

The underwriters expect

to deliver the units against payment on or about , 2015.

Joint

Book-Running Managers

| Northland

Capital Markets |

Lake

Street Capital Markets |

The

date of this prospectus is , 2015.

Table

of Contents

You

should rely solely on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone

to provide any information or make any representations other than those contained in this prospectus. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to

sell, and seeking offers to buy, securities only in jurisdictions where such offers and sales are permitted. The information contained

in this prospectus is accurate only as of the date of this prospectus.

Unless

otherwise indicated, information contained in this prospectus concerning our industry, including our market opportunity, is based

on information from independent industry analysts, market research, publicly available information and industry publications.

The third-party sources from which we have obtained information are generally believed to be reliable, but we cannot assure you

that such information is accurate or complete. Management estimates contained in this prospectus are based on assumptions made

by us using our internal research data and our knowledge of such industry and market, including reference to publicly available

information released by independent industry analysts and third party sources, which we believe to be reasonable. In addition,

while we believe the market opportunity information included in this prospectus is generally reliable and is based on reasonable

assumptions, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed

under the heading “Risk Factors.” These and other factors could cause our future performance to differ materially

from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

For

investors outside the U.S.: Neither we nor any of the underwriters have done anything that would permit this offering or possession

or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering, in any

jurisdiction where action for that purpose is required, other than in the U.S. You are required to inform yourselves about and

to observe any restrictions relating to this offering and the distribution and possession of this prospectus and any such free

writing prospectus outside of the U.S.

PROSPECTUS

SUMMARY

This

summary highlights certain information contained in other parts of this prospectus. Because it is a summary, it does not contain

all of the information you should consider before investing in our securities. You should read the entire prospectus carefully,

including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of

Operations,” “Business” and our consolidated financial statements and related notes before deciding to invest

in our common stock. References in this prospectus to “Ener-Core,” “the Company,” “we,” “our,”

“ours,” “us,” or similar terms refer to Ener-Core, Inc. and its wholly-owned subsidiary, Ener-Core Power,

Inc., taken together, unless the context indicates otherwise.

Overview

We

design, develop, manufacture and have commercially deployed products based on proprietary technologies that generate base-load,

clean power from polluting waste gases that are otherwise typically destroyed or vented into the atmosphere by a variety of industries.

We

consider “power” to consist of industrial grade heat that can be used to (i) generate electricity by coupling our

technology with a variety of modified gas turbines, (ii) produce industrial-grade steam by coupling our technology with a variety

of modified steam boilers, or (iii) provide on-site heat at industrial facilities through heat exchanger applications. We also

design our technologies to provide power generation solutions with a significantly reduced air emissions profile compared to traditional

industrial power generation systems powered by fossil fuels. Whether our technology is applied to generate electricity, steam

or heat, we refer to our technology as “Power Oxidation,” and refer to our products as “Power Oxidizers”

(previously called “Gradual Oxidation” and “Gradual Oxidizers,” respectively, in our prior public disclosures).

Our patented Power Oxidizer turns one of the world’s most potent sources of air pollution into a profitable source of base-load

clean energy, while simultaneously reducing gaseous emissions from industrial facilities that contribute to air pollution and

climate change.

We

have experienced losses since inception and anticipate that we will continue to incur losses and negative cash flows for the foreseeable

future as we continue to further develop and deploy our power products.

Our

Opportunity

The

creation and release of waste gases, which lead to air pollution, is a byproduct of many modern industries. Industrial waste gases

take many forms and are often subject to governmental or regulatory oversight via air quality or air standards boards. The rules

and guidelines implemented by these boards lead to compliance costs for companies with industrial facilities that emit the waste

gases. With the worldwide concerns over the atmospheric emissions of greenhouse gases, air quality standards have become increasingly

stringent. For areas with industrial air pollution abatement regulations, industrial polluters currently have the following choices:

| |

(i) |

continue

to pollute and thereby pay substantial fines imposed by regulatory authorities, |

| |

|

|

| |

(ii) |

reduce

their air pollution through existing abatement solutions such as scrubbing or flaring, or |

| |

|

|

| |

(iii) |

institute

some combination of these solutions. |

Each

industrial location must choose the most economic mix of the available solutions, but each of these solutions represents both

a financial operating cost as well as an environmental cost.

Our

technology provides an alternative to the typical economic and environmental costs of hydrocarbon pollution abatement by providing

the ability for industrial facilities to productively utilize their waste gases to generate power, which can be sold or used internally,

while at the same time reducing both the atmospheric pollution resulting from those waste gases and any resulting pollution abatement

costs.

Our Technology

Our

technology involves the acceleration of a naturally occurring, gas oxidation process by injecting hydrocarbon gases into a controlled,

high temperature, high pressure, and oxygen rich environment. Oxidation is a natural and commonly observed chemical reaction that

occurs when a substance comes into contact with oxygen over a prolonged period of time, approximately 10 to 20 years for the waste

gases that we have targeted. The reaction is exothermic, which generates heat. By accelerating the reaction to 0.5–1.25

seconds within the controlled, steady state environment of our Power Oxidizers, the heat generated from the reaction is compounded

and we are able to capture and utilize the heat output within the heat profile ranges necessary to operate standard gas turbines

or steam boilers without actually igniting the gas.

Our

Products

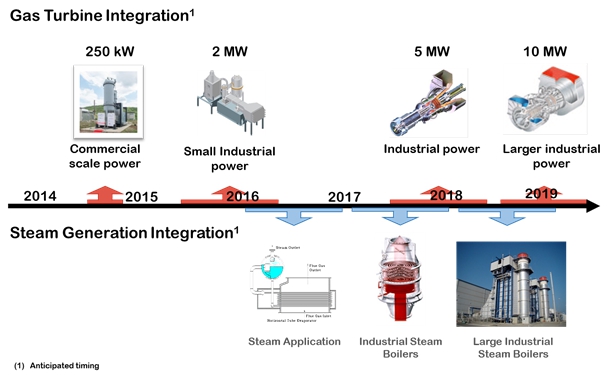

We

have developed a 250/333 kilowatt, or kW, Power Oxidizer that we integrate with a 250 kW and a 333 kW gas turbine to produce 250

kW and 333 kW “Powerstations,” respectively. We have two Powerstations currently in operation at a landfill site in

the Netherlands and at the Irvine campus of the University of California, Irvine, or UCI, and one additional Powerstation currently

in the production phase, which we expect to install at a landfill in Southern California.

We

are in the process of scaling up our Power Oxidizer systems to a significantly larger size of 2 megawatt, or MW, which has six

times more power capacity than the 333 kW system, as well as working with engineers from Dresser-Rand a.s., a subsidiary of Dresser-Rand

Group Inc., or Dresser-Rand, a Siemens company, to integrate this larger Power Oxidizer with Dresser-Rand’s “KG2”

2 MW gas turbine. Dresser-Rand has already sold two KG2/PO units, and we expect the first commercial deployments of KG2/PO units

to begin in 2016, assuming we are able to secure the funds we will require for these deployments.

In

the future, we expect to scale up our Power Oxidizer even further into the 5 MW to 10 MW range, as well as integrate our Power

Oxidizer technology with traditional steam boilers, thereby enabling the commercialization and deployment of systems that will

convert low-quality waste gases to steam (with no electrical power required) for customers that value industrial steam more than

electrical power within their operations. We do not yet have any agreements with these manufacturers, but we expect to negotiate

and enter into additional partnerships for the larger turbines and steam products within the next 18 months.

Licensing

Approach

In

order to expand our product line and better commercialize our technology, we expect to sell our products through partnerships

with larger, more established manufacturers through licensing agreements. Our licensing strategy enables us to commercialize our

Power Oxidizers through the established sales channels of large, multinational companies, while also enabling the end-customers

to procure their power generation or steam generation equipment from companies with large balance sheets and established brands.

On

November 14, 2014, we entered into a global commercial licensing agreement with Dresser-Rand, or the D-R Agreement, which grants

Dresser-Rand exclusive rights to commercialize the Ener-Core 2 MW Power Oxidizer bundled with the Dresser-Rand KG2 gas-turbine

product line, within the 1–4 MW power capacity/size category. As part of the D-R Agreement, Dresser-Rand agreed to pay us

a $1.6 million initial license fee under the condition that we were able to successfully scale up the technology from the current

size of 250 kW to a size of 2 MW. In addition, Dresser-Rand also agreed to achieve annual sales thresholds agreed to by both companies

in order to retain the commercial license over the long-term, after the initial system is installed and commissioned. As long

as these annual sales thresholds are met, as well as the other commercial, financial and technical obligations of both parties

under the D-R Agreement, the D-R Agreement will continue to be in force.

Markets

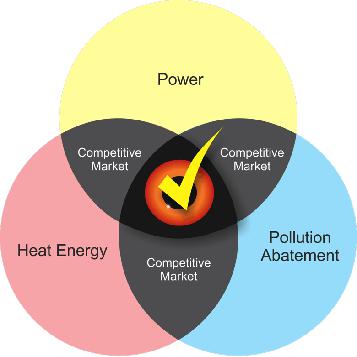

We

see our total potential market consisting of industrial facilities with permanent waste gas emissions sufficient to operate our

units on a constant basis. We evaluate our potential markets in two methods, geographically and vertically. Our most significant

sales opportunities are those where a customer’s demand for power, heat energy, and pollution abatement intersect as presented

in the schematic diagram below (opportunities not to scale):

We

believe the total addressable U.S. market size is at least $5 billion for our Power Oxidizer technology, based on our assumption

that our 333 kW Power Oxidizer is most appropriate for landfills and our 2 MW Power Oxidizer is most appropriate for our other

targeted markets. We also believe the total addressable market size in Europe, Japan and China provides us with potentially meaningful

opportunities.

Geographic

Target Markets

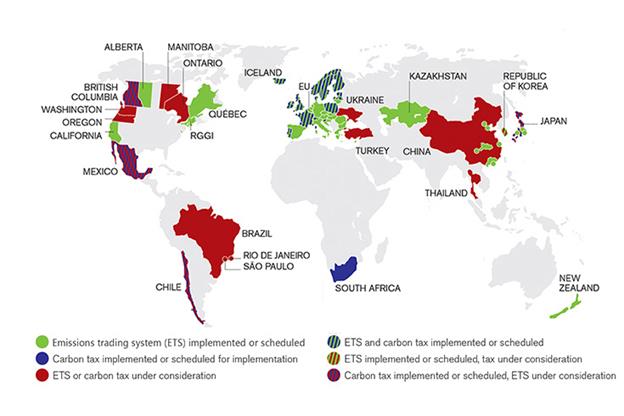

We

initially identified our geographic target markets to consist of North America, Europe, Japan and China, with selective evaluations

of other regions on a case-by-case basis. While we intend to focus primarily on the North American and European geographic markets

over the next year, we expect and intend to evaluate commercial opportunities in other geographic markets.

In

the United States, we are focused on opportunities where our low-quality fuels configuration and our ultra-low emissions configuration

provide competitive advantages. We are also focused on specific states where the wholesale electricity prices are the highest,

as this typically results in the most attractive return on investment scenarios for prospective customers. These states include

California, New Jersey, New York, Maine, New Hampshire, Massachusetts, Connecticut, Rhode Island and Vermont.

Internationally,

we have identified similar opportunities in Canada and western European countries with similar environmental and regulatory laws

as the United States, such as the Netherlands, Belgium, the United Kingdom, Germany, Italy, France and Spain.

Vertical

Markets

We

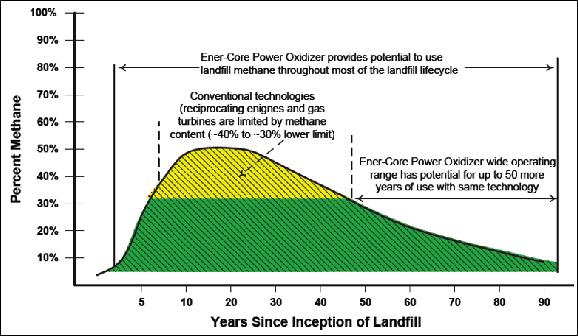

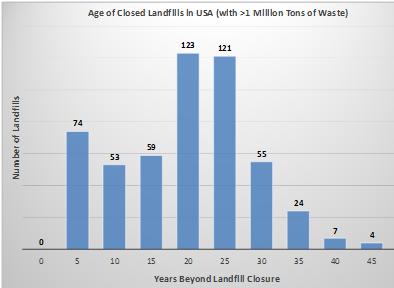

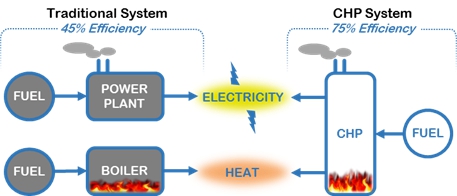

believe that our current products provide a superior value proposition for two customer types: (i) open and closed existing landfills,

and (ii) industrial facilities that could benefit from on-site combined heat/power, or CHP, generation coupled with waste gas

pollution abatement. In general, the projected economics seen to date indicate that sales into existing landfill plants will primarily

represent EC250 and EC333 sales opportunities and sales into other industrial facilities will typically involve our larger products.

We believe that our future steam product will primarily represent an attractive alternative to industrial facilities that value

on site steam production higher than on site electricity production. We also believe that larger sized Power Oxidizer turbines

of 5 MW and above, once developed, will likely be met with demand from large industrial facilities such as oil and gas refineries

and petrochemical plants.

Initially,

we will target the following markets:

| ● | Landfills; |

| | | |

| ● | Fuel-grade

and beverage ethanol/alcohol distilleries and related products production; |

| | | |

| ● | Rendering

and animal processing byproducts; |

| | | |

| ● | Coal

mine methane; |

| | | |

| ● | Aerospace

and defense instruments and materials manufacturing, and semiconductor and electronics

manufacturing; and |

| | | |

| ● | Petroleum

and petrochemical storage, distillation and petroleum production. |

Competitive

Advantages

As

compared to alternative technologies, Power Oxidation provides certain advantages over alternative energy-generation technologies,

including the following:

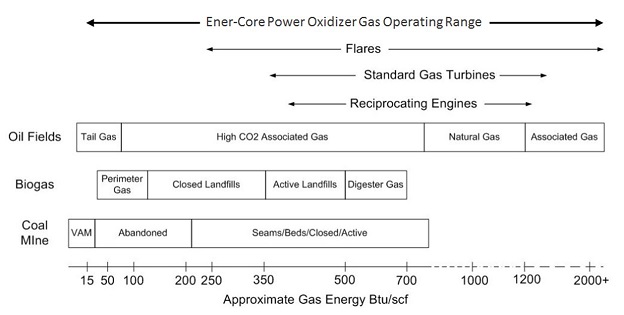

| |

● |

Operates

on a wider range of fuels. Our system is designed to operate on gases with energy densities as low as 50 BTU/scf (1700

kJ/m3). By comparison, most turbine, engine, and fuel cell systems require fuel quality of significantly higher energy densities. |

| |

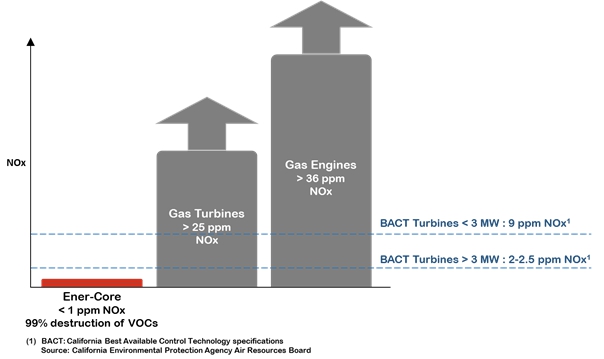

● |

Lower

air emissions. Our Power Oxidizer technology produces substantially lower emissions of Nitrous Oxides (NOx), Carbon Monoxide

(CO) and Volatile Organic Compounds (VOCs) than either combustion-based systems, like gas engines or gas turbines, or other

commonly deployed pollution abatement systems. |

| |

● |

No

chemicals or catalysts for pollution abatement or control. Today, most of the low-quality waste gases produced by industries

are processed through pollution abatement technologies that do not generate energy from the gases and are solely in place

to reduce the volume of emissions to the atmosphere. Unlike other pollution abatement systems, such as selective catalytic

reduction, our Power Oxidizer does not use chemicals or catalysts and, thus, cannot be rendered inactive from catalyst poisoning

or degradation. |

| |

● |

Requires

less fuel conditioning. Our system is capable of running on fuels with high levels of contaminants and is designed to

require substantially less fuel pre-treatment than competing systems. In most cases, our system is able to process the waste

gases from industrial processes without any of the fuel pre-treatment processes that are typically required by combustion-based

methods to remove impurities and contaminants prior to generating energy from gases. |

Selected

Risks Associated with Our Business and Industry

Our

Power Oxidation technologies also have certain disadvantages over alternative energy-generation technologies, including the following:

| |

● |

New

and unproven technology. Our Power Oxidation technologies have only been demonstrated commercially in a 250 kW product

and our technology has only been commercially available since 2013. Although we have received a purchase order for two of

our larger 2 MW Power Oxidizers, we currently have no commercial deployments of these larger units and have not demonstrated

their full commercial viability outside of our test facility. |

| |

● |

Commercial

viability. Our Power Oxidation products have had limited commercial installation and to date have been produced on a limited

scale. |

| |

● |

Unproven

and early stage value proposition. Our Power Oxidation solutions and our value proposition are not fully demonstrated

in multiple real world installations and to date have not been communicated widely among our potential customers. While we

believe that our value proposition is sound, the industries in which we are attempting to sell our products are conservative

and may discount, or not accept, our value proposition. |

| |

● |

Competes

with existing mature technologies. Our Power Oxidation products often cannot compete on a standalone cost basis solely

on either alternative power generation or pollution abatement solutions. Our product solutions currently make economic sense

in limited customer applications when pollution abatement and power generation are both required by a customer. |

In

addition, our business is subject to a number of other risks and uncertainties, including those highlighted in the section titled

“Risk Factors” immediately following this prospectus summary. These risks include, but are not limited to, the following:

| ● | we

have experienced losses since inception and anticipate that we will continue to incur

losses; |

| | | |

| ● | even

assuming completion of this offering, we will require substantial additional financing; |

| | | |

| ● | our

independent registered public accounting firm has expressed substantial doubt about our

ability to continue as a going concern; and |

| | | |

| ● | we

have identified material weaknesses in our internal control over financial reporting

and ineffective disclosure controls and procedures. |

Product

Commercialization To Date

| |

● |

Initial

Commercial Unit—250 kW Unit: In June 2014, our first commercial EC250 Powerstation was installed at a landfill in

the Netherlands that is owned and operated by Attero, one of the leading waste management companies in the Netherlands. |

| |

|

|

| |

● |

First

Licensing Agreement: On November 14, 2014, we entered into the D-R Agreement to develop and market Dresser-Rand’s

KG2-3GEF 2 MW gas turbine coupled with our Power Oxidizer. The D-R Agreement and ongoing integration provides for a scale-up

of our technology into the larger utility grade sized turbines requested by our customers. Under the D-R Agreement, Dresser-Rand

agreed to pay an initial license fee of $1.6 million, which is currently in escrow, and to commercialize the technology through

its sales and distribution channels. In July 2015, we successfully completed the first of two technical milestones, which

enabled Dresser-Rand to begin commercialization of the KG2-3GEF/PO turbines. |

| |

● |

Initial

Order—2 MW Unit into Distillery Market: On January 12, 2015, Pacific Ethanol, Inc. publicly announced that it had

placed an order with Dresser-Rand that included two KG2-3GEF/PO units. The order represents the first two commercial KG2 units

that are designed to include our Power Oxidizer units. In August 2015, after the completion of the first technical test, we

received a formal purchase order for $2.1 million for two Power Oxidizer units to be fulfilled and delivered in mid-2016. |

| |

● |

Additional

250 kW Commercial Unit: In May 2015, the Orange County Board of Supervisors approved a project to install an EC250 Powerstation

at the Santiago Canyon landfill in Orange County, California, and in August 2015, we received a purchase order for $900,000

for the EC250 Powerstation unit. The order represents an entry into a closed landfill opportunity that we believe has the

potential for additional sales in the future. |

Over

the next two years, we expect to continue our product commercialization efforts with the following expected deliverables and projects:

| |

● |

Completion

of Full Scale Acceptance Test—2 MW Unit: Under the D-R Agreement, the second technical test is the full-scale acceptance

test, or FSAT, which is required after achievement of the first technical milestone. The FSAT consists of the building and

installation of a full prototype of a working 2 MW KG2 unit at a site in Southern California, and then testing the prototype

under different operating conditions for performance and life cycle validation. We expect to complete the FSAT of the 2 MW

unit in the first half of 2016. The successful completion of the FSAT will also release the payment of the $1.6 million license

fee payment from Dresser-Rand that is currently in escrow. |

| |

● |

Fulfillment and Delivery of Existing Customer

Order Backlog of Approximately $4.6 Million: As of November 4,

2015, we had a backlog of approximately $3.0 million for our Power Oxidizers and approximately $1.6 million of Dresser-Rand

license fees. In the first half of 2016, we expect to (i) assemble, ship, and commission (a) the first two Power Oxidizers

for the two KG2 units sold by Dresser-Rand to Pacific Ethanol, and (b) the Santiago Canyon EC250 unit, and (ii) receive the

$1.6 million license fee payment from Dresser-Rand that is currently in escrow. |

| |

● |

Commercialization

of EC333 Powerstations and Additional KG2 Power Oxidizers: We have a pipeline of additional opportunities through Dresser-Rand

for KG2 Power Oxidizers and directly sold units for our EC333 Powerstations. We expect to receive additional purchase orders

for these products beginning in late 2015. |

| |

● |

New

Partnerships for 5.0 MW and Boiler Manufacturers: We are in preliminary discussions with additional partners for a 5 MW

Power Oxidizer and with boiler manufacturers that are interested in our 250/333 kW and 2 MW Power Oxidizers. We intend to

sign definitive agreements with one or more of these partners in 2016 for initial deliveries beginning in 2017. |

Corporate

Information

Ener-Core

was incorporated in Nevada in April 2010 under the name “Inventtech Inc.” Our operating subsidiary, Ener-Core

Power, Inc., was incorporated in Delaware in July 2012 under the name “Flex Power Generation, Inc.” Ener-Core

Power, Inc. became our subsidiary in July 2013 by way of a reverse merger transaction, or the Merger, as further described in

“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Reverse Merger.”

Effective

as of September 3, 2015, we changed our state of incorporation from the State of Nevada to the State of Delaware, or the Reincorporation,

pursuant to a plan of conversion dated September 2, 2015, following approval by our stockholders of the Reincorporation at our

2015 Annual Meeting of Stockholders held on August 28, 2015. In connection with the Reincorporation, we filed articles of conversion

with the State of Nevada and a certificate of conversion and certificate of incorporation with the State of Delaware. Upon effectiveness

of the Reincorporation, the rights of our stockholders became governed by the Delaware General Corporation Law, the certificate

of incorporation filed in Delaware and newly adopted bylaws. As a Delaware corporation following the Reincorporation, which we

refer to as Ener-Core Delaware, we are deemed to be the same continuing entity as the Nevada corporation prior to the Reincorporation,

which we refer to as Ener-Core Nevada. As such, Ener-Core Delaware continues to possess all of the rights, privileges and powers

of Ener-Core Nevada, all of the properties of Ener-Core Nevada and all of the debts, liabilities and obligations of Ener-Core

Nevada, including all contractual obligations, and continues with the same name, business, assets, liabilities, headquarters,

officers and directors as immediately prior to the Reincorporation. Upon effectiveness of the Reincorporation, all of the issued

and outstanding shares of common stock of Ener-Core Nevada automatically converted into issued and outstanding shares of common

stock of Ener-Core Delaware without any action on the part of our stockholders.

The

address of our corporate headquarters is 9400 Toledo Way, Irvine, California 92618, and our telephone number is (949) 616-3300. Our

website address is www.ener-core.com. The information that is contained on, or that may be accessed through, our website

is not a part of this prospectus. We have included references to our website in this prospectus solely as inactive textual references.

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the

Securities Act, as amended and modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible

to take advantage of exemptions from various disclosure and reporting requirements that are applicable to other public companies

that are not “emerging growth companies” including, but not limited to:

| ● | not

being required to comply with the auditor attestation requirements of Section 404(b)

of the Sarbanes-Oxley Act of 2002; |

| | | |

| ● | being

permitted to present only two years of audited financial statements and only two years

of related Management’s Discussion and Analysis of Financial Condition and Results

of Operations, in each case, instead of three years; |

| | | |

| ● | being

permitted to present the same number of years of selected financial data as the years

of audited financial statements presented, instead of five years; |

| | | |

| ● | reduced

disclosure obligations regarding executive compensation, including the omission of a

compensation disclosure and analysis; |

| | | |

| ● | not

being required to comply with any requirement that may be adopted by the Public Company

Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to

the auditor’s report providing additional information about the audit and the financial

statements; and |

| | | |

| ● | exemptions

from the requirements of holding a non-binding advisory vote on executive compensation

and stockholder approval of any golden parachute payments not previously approved. |

We

may choose to take advantage of some or all of the available exemptions. We have taken advantage of some of the reduced reporting

exemptions in this prospectus. Accordingly, the scope of the information contained herein may be different than the scope of the

information you receive from other public companies in which you hold stock. We do not know if some investors will find our shares

less attractive as a result of our utilization of these or other exemptions. The result may be a less active trading market for

our shares and our share price may be more volatile.

In

addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the

extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting

standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until

those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this exemption

from new or revised accounting standards, and therefore, we will be subject to the same new or revised accounting standards as

other public companies that are not emerging growth companies.

We

will remain an “emerging growth company” until the earliest of (a) the last day of the first fiscal year in which

our annual gross revenues exceed $1.0 billion, (b) the date that we become a “large accelerated filer” as

defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the

market value of our shares that are held by non-affiliates exceeds $700 million as of the last business day of our most recently

completed second fiscal quarter, (c) the date on which we have issued, during the previous three-year period, more than $1.0 billion

in nonconvertible debt, or (d) the last day of our fiscal year containing the fifth anniversary of the date of our first

sale of our common equity securities pursuant to an effective registration statement in the United States, which will occur on

December 31, 2017.

The

Offering

| Securities offered: |

2,250,000 units, each consisting of one share of our

common stock and a warrant to purchase 0.25 of a share of our common stock. The common stock and warrants are immediately

separable and will be issued separately. |

| |

|

| Offering price: |

$

per unit |

| |

|

| Units: |

|

| |

|

|

Number outstanding before this offering: |

0

|

| |

|

|

Number outstanding after this offering: |

2,250,000 |

| |

|

| Common stock: |

|

| |

|

| Number outstanding before this offering: |

2,464,160

|

| |

|

| Number outstanding after this offering: |

4,714,160 |

| |

|

| Warrants issued in this offering: |

|

| |

|

| Number of shares issuable upon exercise of outstanding warrants after this offering: |

562,500 |

| |

|

| Exercisability: |

Each warrant offered as part of a unit is exercisable for 0.25

of a share of common stock commencing on the consummation of this offering and expiring at 5:00 p.m., New York City time,

on the fifth anniversary of the date of issuance |

| |

|

| Exercise price per whole share of common stock: |

120% of the offering price of the units sold in this offering |

| |

|

| OTCQB Marketplace symbol: |

Shares of our common stock are currently quoted on the OTCQB Marketplace

under the symbol “ENCR.” |

| |

|

| Proposed listing: |

We have applied to list our units, common stock and the warrants

on the NYSE MKT in connection with this offering. No assurance can be given that such listings will be approved. |

| |

|

| Proposed symbols for: |

|

| |

|

| Units: |

ENCRU |

| |

|

| Common stock: |

ENCR |

| |

|

| Warrants: |

ENCR WS |

| |

|

Trading commencement and

separation of common stock and warrants: |

The

units will begin trading on or promptly after the date of this prospectus. Each of our

common stock and the warrants issuable in this offering will begin trading separately on

or promptly after the date of this prospectus.

Following

the date that the common stock and warrants begin trading separately, the units will continue to be listed for trading

and any securityholder may elect to trade the common stock and warrants separately or together as a unit. Even if the

component parts of the units are traded separately, the units will continue to be listed as a separate security, and consequently,

any subsequent securityholder owning common stock and warrants may elect to combine them together and trade them as a

unit. Securityholders will have the ability to trade our securities as a unit until such time as the warrants expire. |

| |

|

| Use of proceeds: |

We intend to use the net proceeds from this offering for working capital

and other general corporate purposes. See “Use of Proceeds.” |

| |

|

| Risk factors: |

Investing in our securities involves a high degree of risk. See “Risk

Factors” beginning on page 11 of this prospectus for a discussion of factors you should consider before making a decision

to invest in our securities. |

| |

|

| Common stock splits: |

On May 6, 2013, we effected a 30-for-1 forward split of our issued

and outstanding shares of common stock by way of a stock dividend. On July 8, 2015, we effected a 1-for-50 reverse split of

our issued and outstanding shares of common stock. All share and per share information in this prospectus gives effect to

the 30-for-1 forward split and 1-for-50 reverse split, retroactively. |

The number of shares

of common stock to be outstanding after this offering is based on 2,464,160 shares of common stock outstanding as of November

4, 2015 and does not include:

| |

● |

413,043 shares of common stock issuable upon the exercise of warrants outstanding as of

November 4, 2015, at a weighted average exercise price of $17.31 per share; |

| |

|

|

| |

● |

562,500 shares of common stock issuable upon the full exercise of the warrants offered

as part of the units; |

| |

● |

308,464 shares of common stock issuable upon the exercise of options outstanding as of

November 4, 2015, at a weighted average exercise price of $13.61 per share; |

| |

● |

300,000 shares of common stock reserved for future issuance under the Ener-Core, Inc. 2015

Omnibus Incentive Plan, or the 2015 Plan, as of November 4, 2015; |

| |

|

|

| |

● |

securities that may be issued to the underwriters upon exercise of their over-allotment option

to purchase additional securities from us; and |

| |

|

|

| |

● |

assuming a public offering price of $5.00, which is the midpoint of the price range on

the cover page of this prospectus, 500,000 shares and warrants to purchase 125,000 shares issuable upon conversion of the

senior secured promissory notes issued to certain accredited investors in April and May 2015, which will become convertible

into shares of our common stock and warrants to purchase shares of our common stock for a period of 30 days from the closing

of this offering at the offering price per share of common stock included in each unit offered hereby, or under certain other

circumstances as set forth in such notes. |

Summary Consolidated Financial Data

The

following tables set forth a summary of our historical financial data as of, and for the periods ended on, the dates indicated.

The consolidated statements of operations data for the years ended December 31, 2014 and 2013 and consolidated balance sheet data

as of December 31, 2014 and December 31, 2013 are derived from our audited consolidated financial statements included elsewhere

in this prospectus. The consolidated statements of operations data for the nine-month periods ended September 30, 2015 and 2014

and the consolidated balance sheet data as of September 30, 2015 are derived from our unaudited consolidated financial statements

included elsewhere in this prospectus. The unaudited consolidated financial statements were prepared on the same basis as the

audited consolidated financial statements. Our management believes that the unaudited consolidated financial statements include

all adjustments necessary to state fairly the information included in those statements.

You

should read this data together with our audited and unaudited consolidated financial statements and related notes to those statements

appearing elsewhere in this prospectus and the information under the caption “Management’s Discussion and Analysis

of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of our future results,

and results for the nine months ended September 30, 2015 are not necessarily indicative of results to be expected for the full

year ending December 31, 2015.

All

share and per share amounts have been adjusted to reflect the 30-for-1 forward split of our issued and outstanding shares of common

stock by way of a stock dividend on May 6, 2013 and the 1-for-50 reverse split of our issued and outstanding shares of common

stock on July 8, 2015, retroactively.

| | |

Year

Ended

December 31, | | |

Nine

Months Ended

September 30, | |

| | |

2014 | | |

2013 | | |

2015 | | |

2014 | |

| Consolidated Statements of Operations Data: | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 868,000 | | |

$ | 16,000 | | |

$ | — | | |

$ | 868,000 | |

| Cost of goods sold | |

| 1,170,000 | | |

| 112,000 | | |

| — | | |

| 847,000 | |

| Gross profit (loss) | |

| (302,000 | ) | |

| (96,000 | ) | |

| — | | |

| 21,000 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 5,449,000 | | |

| 4,802,000 | | |

| 3,475,000 | | |

| 4,017,000 | |

| Research

and development | |

| 3,156,000 | | |

| 2,257,000 | | |

| 2,636,000 | | |

| 2,259,000 | |

| Total operating expenses | |

| 8,605,000 | | |

| 7,059,000 | | |

| 6,111,000 | | |

| 6,276,000 | |

| Operating loss | |

| (8,907,000 | ) | |

| (7,155,000 | ) | |

| (6,111,000 | ) | |

| (6,255,000 | ) |

| Total other income (expenses),

net | |

| (1,626,000 | ) | |

| (26,000 | ) | |

| (2,490,000 | ) | |

| (1,514,000 | ) |

| Net loss | |

$ | (10,534,000 | ) | |

$ | (7,130,000 | ) | |

$ | (8,601,000 | ) | |

$ | (7,770,000 | ) |

| Per share information: | |

| | | |

| | | |

| | | |

| | |

| Loss per share—basic and

diluted | |

$ | (6.17 | ) | |

$ | (5.26 | ) | |

$ | (3.61 | ) | |

$ | (5.13 | ) |

| Weighted average common shares—basic and diluted | |

| 1,708,620 | | |

| 1,356,060 | | |

| 2,385,500 | | |

| 1,515,000 | |

| | |

As

of December 31, | | |

As

of September 30, | |

| | |

2014 | | |

2013 | | |

2015 | |

| Consolidated Balance Sheet Data: | |

| | |

| | |

| |

| Cash, cash equivalents and

restricted cash | |

$ | 2,226,000 | | |

$ | 1,251,000 | | |

$ | 1,522,000 | |

| Working capital | |

| 746,000 | | |

| 649,000 | | |

| (3,010,000 | ) |

| Total assets | |

| 3,293,000 | | |

| 2,976,000 | | |

| 4,814,000 | |

| Total liabilities | |

| 1,784,000 | | |

| 1,529,000 | | |

| 7,027,000 | |

| Total stockholders’ equity (deficit) | |

| 1,509,000 | | |

| 1,447,000 | | |

| (2,213,000 | ) |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together

with all of the other information contained in this prospectus, including our financial statements and the related notes thereto,

before making a decision to invest in our securities. The risks and uncertainties described below are not the only ones we face.

Additional risks and uncertainties not presently known to us, or that we currently believe are not material, also may become important

factors that affect us and impair our business operations. The occurrence of any of the events or developments discussed in the

risk factors below could have a material and adverse impact on our business, results of operations, financial condition and cash

flows, and in such case, our future prospects would likely be materially and adversely affected. If any of such events or developments

were to happen, the trading price of our common stock and the value of the warrants could decline, and you could lose part or

all of your investment. Further, our actual results could differ materially and adversely from those anticipated in our forward-looking

statements as a result of certain factors.

All

share and per share amounts have been adjusted to reflect the 30-for-1 forward split of our issued and outstanding shares of common

stock by way of a stock dividend on May 6, 2013 and the 1-for-50 reverse split of our issued and outstanding shares of our common

stock on July 8, 2015, retroactively.

Risks

Relating to Our Financial Condition and Capital Requirements

We

have experienced losses since inception and anticipate that we will continue to incur losses, which makes it difficult to assess

our future prospects and financial results.

We

have never been profitable and, as of September 30, 2015, we had an accumulated deficit of $26.6 million. We incurred net losses

of $8.6 million in the nine months ended September 30, 2015 and net losses of $10.5 million and $7.1 million in the years ended

December 31, 2014 and 2013, respectively. We expect to continue to incur net losses for the foreseeable future as we continue

to develop our products and seek customers and distribution for our products. Because of the risks and uncertainties associated

with developing and commercializing our products, we are unable to predict the extent of any future losses or when we will become

profitable, if at all. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly

or annual basis. If we are unsuccessful in addressing these risks, our business may fail and investors may lose all of their investment.

Our

limited operating history makes evaluating our business and future prospects difficult, and may increase the risk of your investment.

We

design, develop, and manufacture products based on proprietary technologies that aim to expand the power-generation range of gaseous

fuels. While we shipped our first commercial product, the Ener-Core Powerstation EC250, in November 2013, to date, our other manufacturing

efforts have been limited to our prototype units and the assembly of our Multi-Fuel Test Facility used in research and development.

As such, we have a limited operating history with respect to designing and manufacturing systems for producing continuous energy

from a broad range of sources, including previously unusable low quality waste gases, providing a limited basis for investors

to evaluate our business, operating results, and prospects.

While

the basic technology has been verified, we have only within the last couple years begun offering the EC250 and EC333 as commercial

systems and only recently received a purchase order for the KG2 Power Oxidizer system. This limits our ability to accurately forecast

the cost of producing and distributing our systems or technology or to determine a precise date on which our systems or technology

will be widely released.

Our

plan to complete the initial commercialization of our gas-to-heat and electricity conversion technology is dependent upon the

timely availability of funds and upon our finalizing the engineering, component procurement, build out, and testing in a timely

manner. Any significant delays would materially adversely affect our business, prospects, operating results, and financial condition.

Consequently, it is difficult to predict our future revenues and appropriately budget for our expenses, and we have limited insight

into trends that may emerge and affect our business. In the event that actual results differ from our estimates or we adjust our

estimates in future periods, our operating results and financial position could be materially and adversely affected. If the market

for transforming methane gas, especially low quality waste gases from landfills, coal mines, oil fields, and other low-quality

methane sources into continuous electricity does not develop as we currently expect, or develops more slowly than we currently

expect, our business, prospects, operating results, and financial condition will be materially harmed.

Even

assuming completion of this offering, we will require substantial additional financing. Failure to obtain such financing

may require us to cease our business activities and result in our stockholders losing some or all of their investment in us.

There is no assurance

that we will operate profitably or generate positive cash flow in the future. As of September 30, 2015, we had $1,522,000

in cash and cash equivalents (including restricted cash). We will require additional financing in order to proceed with the manufacture

and distribution of our products, including our EC250, EC333, KG2, and other Power Oxidizer products. During the next 12

months, we currently project our cash needs to be in excess of $10.0 million, currently budgeted for employee, occupancy and related

costs ($3.8 million), professional fees and business development costs ($1.2 million), research and development programs ($1.5

million), corporate filings ($0.5 million) and working capital ($3.5 million). We will require additional financing if the

costs of the development and operation of our existing technologies are greater than we have currently anticipated or if we are

not successful in earning revenues. Our sales and fulfillment cycle can exceed 24 months, and we do not expect to generate

sufficient revenue in the next 12 months to cover our operating costs.

We

anticipate that we will rely on additional debt or equity capital in order to continue to fund our business operations until such

time as we become profitable, which may never occur. Issuances of additional equity and/or convertible securities will result

in dilution to our existing stockholders. Our ability to obtain additional financing will be subject to a number of factors,

including market conditions, our operating performance and investor sentiment. We may not be able to obtain financing on commercially

reasonable terms or terms that are acceptable to us when it is required. If we are unable to raise sufficient additional

capital when required or on acceptable terms, we may have to significantly delay, scale back or discontinue the development or

commercialization of one or more of our products, restrict our operations or obtain funds by entering into agreements on unattractive

terms, which would likely have a material adverse effect on our business, stock price and our relationships with third parties

with whom we have business relationships. Further, if we do not obtain sufficient funds to continue operations, our business could

fail and investors could lose up to their entire investment.

Our

independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern,

and if we are unable to continue as a going concern, our securities will have little or no value.

Since

inception, we have experienced recurring operating losses and negative cash flows and we expect to continue to generate operating

losses and consume significant cash resources for the foreseeable future. Without additional financing, these conditions raise

substantial doubt about our ability to continue as a going concern, meaning that we may be unable to continue in operation for

the foreseeable future or realize assets and discharge liabilities in the ordinary course of operations. As a result, the reports

of our independent registered public accounting firms that accompany our audited consolidated financial statements for the years

ended December 31, 2014 and 2013, respectively, contain going concern qualifications and each such firm expressed substantial

doubt about our ability to continue as a going concern. In addition to our history of losses, our accumulated deficits as

of September 30, 2015, December 31, 2014 and December 31, 2013 were approximately $26.6 million, $18.0 million and $7.5 million,

respectively. At September 30, 2015, December 31, 2014 and 2013, we had cash and cash equivalents (including restricted cash)

of $1.5 million, $2.2 million and $1.3 million, respectively.

In

order to continue as a going concern, we will need, among other things, additional capital resources. Our management’s

plan is to obtain such resources by seeking additional equity and/or debt financing, including through this offering. During

2014, we raised a total of $4.6 million through debt financing and repaid $1.9 million of such debt financing and raised $4.0

million through equity financing. During 2015, we have raised a total of $5.0 million through debt financing and $810,000 through

equity financing. We may be required to raise capital on unfavorable terms, assuming opportunities to raise capital are even available

to us. Our failure to obtain additional capital would have an adverse effect on our financial position, results of operations,

cash flows, and business prospects, and ultimately on our ability to continue as a going concern. If we are unable to obtain

adequate capital, we could be forced to cease operations.

Any

incurrence of additional indebtedness could adversely affect our ability to operate our business, remain in compliance with existing

or future debt or commercial covenants, make payments on our debt and limit our growth.

As

of November 4, 2015, we had $5,044,000 of indebtedness outstanding, consisting of the principal balance and accrued interest

on outstanding senior secured promissory notes issued in April and May 2015 and balances due on capital lease financing. See

“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Subsequent

Events” for more information. Outstanding indebtedness could have important consequences for investors, including the

following:

| |

● |

if

we are unable to comply with the obligations of any agreements governing our indebtedness, including financial and other restrictive

covenants, such failure could result in an event of default under such agreements; |

| |

● |

the

covenants contained in our debt and commercial agreements may limit our ability to borrow additional funds, including restrictions

on use of certain of our intellectual property as collateral for future borrowings; |

| |

● |

we

may need to use a portion of our cash flows to pay principal and interest on our debt, which will reduce the amount of money

that we have for operations, working capital, capital expenditures, expansion, acquisitions or general corporate or other

business activities; |

| |

● |

we

may have a higher level of debt than some of our competitors, which could put us at a competitive disadvantage; |

| |

● |

we

may be more vulnerable to economic downturns and adverse developments in our industry or the economy in general; and |

| |

● |

our

debt level could limit our flexibility in planning for, or reacting to, changes in our business and the industry in which

we operate. |

Our

ability to meet our expenses and debt obligations will depend on our future performance, which will be affected by financial,

business, economic, regulatory and other factors. We will not be able to control many of these factors. We cannot be certain that

our cash flows will be sufficient to allow us to pay the principal and interest on our existing or future debt and meet our other

obligations. If we do not have enough money to service our existing or future debt, we may be required to refinance all or part

of our existing or future debt, sell assets, borrow more money or raise equity, which we may not be able to timely consummate

on terms acceptable to us, if at all.

Risks

Relating to Our Business and Industry

A

sustainable market for our technology and products may never develop or may take longer to develop than we currently anticipate,

which would materially adversely affect our results of operations and/or cause our business to fail.

Our

products are being sold into mature markets and represent an emerging and unproven technology. We cannot be certain as to whether

our targeted customers will accept our technology or will purchase our products in sufficient quantities to allow our business

to grow. To succeed, demand for our current products must increase significantly in existing markets and there must be strong

demand for products that we introduce in the future. If a sustainable market fails to develop or develops more slowly than we

currently anticipate, we may be unable to recover the losses we have incurred to develop our products, we may have further impairment

of assets, and we may be unable to meet our operational expenses. The development of a sustainable market for our systems may

be hindered by many factors, including some that are out of our control. Examples include:

| |

● |

customer

reluctance to try a new product or concept; |

| |

● |

the

relaxing of regulatory requirements or policies regarding the environment; |

| |

● |

potential

customers’ perception that our EC250, EC333, KG2 and other Power Oxidizer products that we may develop are not competitive

on a cost basis; |

| |

● |

the

costs associated with the installation and commissioning of our EC250, EC333, KG2 and other Power Oxidizer products that we

may develop; |

| |

● |

maintenance

and repair costs associated with our products; |

| |

● |

economic

downturns and reduction in capital spending; |

| |

● |

customer

perceptions of our products’ safety, quality and effectiveness; |

| |

|

|

| |

● |

customer

and potential customer awareness of our products; |

| |

● |

the

emergence of newer, more competitive technologies and products; |

| |

● |

the

financial and operational stability of our turbine partners; |

| |

● |

the

inability of our turbine partners to fulfill orders in a timely manner; |

| |

● |

excessive

warranty-related costs associated with parts replacement for Power Oxidizer or turbine components for Powerstations operating

in the field; and |

| |

● |

the

inability of our commercial partners to successfully sell and market our co-branded Power Oxidizer products. |

If

we are unable to develop effectively and promote our technology timely and gain recognition in our market segment, we may not

be able to achieve acceptable sales revenue and our results of operations and financial condition would then suffer. We cannot

predict the rate of adoption or acceptance of our technology by potential customers or prospective channel partners. While we

may be able to effectively demonstrate the feasibility of our technology, this does not guarantee the market will accept it, nor

can we control the rate at which such acceptance may be achieved. Failure to achieve productive relationships with a sufficient

number of prospective partners who are established resellers in the market segments of our target customers may impede adoption

of our solutions. Additionally, some potential customers in our target industries are historically risk-averse and have been slow

to adopt new technologies. If our technology is not accepted in the industrial combustion and power generation market, we may

not earn enough by selling or licensing our technology to support our operations, recover our research and development costs or

become profitable and our business could fail.

Our

products are unproven on a large-scale commercial basis and could fail to perform as anticipated.

The

Power Oxidizer has never been utilized on a large-scale commercial basis and we cannot predict all of the difficulties that may

arise when the technology is utilized on such scale. In addition, our technology has never operated at a profitable volume level.

It is possible that the technology may require further research, development, design and testing prior to implementation of a

large-scale commercial application. Accordingly, we cannot assure you that our technology will perform successfully on a large-scale

commercial basis, that it will be profitable to us or that our products will be cost competitive in the market.

We

may not be able to maintain effective product distribution channels, which could limit sales of our products.

We

may be unable to attract distributors, resellers and integrators, as planned, that can market our products effectively and provide

timely and cost-effective customer support and service. There is also a risk that, after we have established such relationships,

some or all of our distributors, resellers or integrators may be acquired, may change their business models or may go out of business,

any of which could have an adverse effect on our business. Further, our potential distributors, integrators and resellers may

carry competing products. The loss of important sales personnel, distributors, integrators or resellers could adversely affect

us.

Our

products involve a lengthy sales cycle and we may not anticipate sales levels appropriately, which could impair our results of

operations.

The

sale of our products typically involves a significant commitment of capital by customers, and such purchase decisions often require

substantial time, economic analysis, product testing and corporate approvals. Once a customer makes a formal decision to purchase

our product, the fulfillment of the sales order by us and our turbine partners will require a substantial amount of additional

time. For these reasons, the sales and fulfillment cycle associated with our products is typically lengthy and subject to a number

of significant risks over which we have little or no control. We currently expect to plan our production and inventory levels

based on internal forecasts of customer demand, which are highly unpredictable and can fluctuate substantially. If sales in any

period fall significantly below anticipated levels, our financial condition, results of operations and cash flow would suffer.

If demand in any period increases well above anticipated levels, we may have difficulties in responding, incur greater costs to

respond, or be unable to fulfill the demand in sufficient time to retain the order, which would negatively impact our operations

and our reputation. In addition, our operating expenses are based on anticipated sales levels, and a high percentage of our expenses

are generally fixed in the short term. As a result of these factors, a small fluctuation in the timing of sales could cause operating

results to vary materially from period to period and a small fluctuation in the timing of cash payments by our customers could

result in additional capital being required to fund our operating and inventory needs. Further, our operating results may be subject

to significant variations and, as such, our operating performance in one period may not be indicative of our future performance.

We

may incur significant warranty related costs, which may result in decreased gross profit per unit sold and reduce our ability

to achieve our profitability targets.

We

have sold, and our business plan anticipates that we will continue to sell, products with warranties. There can be no assurance

that the provision for estimated product warranty will be sufficient to cover our warranty expenses now or in the future. We cannot

ensure that our efforts to reduce our risk through warranty disclaimers will effectively limit our liability. As of September

30, 2015, we have accrued $30,000 in warranty expense related to our initial commercial units shipped to date. While we expect

warranty costs to decrease significantly on a per unit basis, the limited operating time for our commercial units makes our warranty

and other post-sale charges difficult to estimate. Further, we may, at times, undertake programs to enhance the performance of

units previously sold. Such enhancements may be provided at no cost or below our cost. If we choose to offer such programs, such

actions could result in significant additional costs to our business. For example, during 2014, we provided for a warranty reserve

of $242,000 for our initial EC250 commercial unit to allow for full replacement of key components primarily related to sub-components

furnished by our suppliers. If our commercial units have greater than expected warranty related expenses or if we experience warranty

costs associated with our oxidizer units, we may experience lower gross margins on our products or we may be required to increase

our expenses to re-engineer our Power Oxidizer products. Further, any significant incurrence of warranty expense in excess of

estimates could have a material adverse effect on our operating results, financial condition, and cash flow.

We

face intense competition and currently expect competition to increase in the future, which could prohibit us from developing a

customer base and generating revenue.

The

energy industry is characterized by intense competition. We compete with existing co-generation solutions and other power generation

solutions for our current and future customers. Those existing solutions have typically more mature technology and have a lower

equipment cost than our Power Oxidizer units. Our Power Oxidizers are typically more expensive per kilowatt of power capacity

when compared to the initial cost of equipment, and competing products typically have lower upfront costs than our Power Oxidizers.

Many of our existing and potential competitors have greater financial and commercial resources than us, and it may be difficult

for us to compete against them. Many of our existing and potential competitors have better name recognition and substantially

greater financial, technical, manufacturing, marketing, personnel, and/or research capabilities than we do. In addition, new competitors,

some of whom may have extensive experience in related fields or greater financial resources, may enter the market.

Although

at this time we do not believe that any of our potential competitors have technology similar to ours, if and when we release products

based on our technology, potential competitors may respond by developing and producing similar products. Many firms in the energy

industry have made and continue to make substantial investments in improving their technologies and manufacturing processes. Our

competitors may achieve substantial economies of scale and scope, thereby substantially reducing their fixed production costs

and their marginal production costs. In addition, they may be able to price their products below the marginal cost of production

in an attempt to establish, retain, or increase market share.

In

addition to our efforts to replace existing combustion technologies, we face competition from other companies in two sectors,

each with its distinct competitive landscape:

| |

● |

Low-quality

fuels—Where the gas source has an energy density (BTU/ft3) below the minimum level required by reciprocating engines

and standard gas turbines, a prospective customer can elect to do nothing and allow low BTU gas to simply be emitted into

the atmosphere or can purchase gas such as propane or natural gas, mix it with the low BTU gas to make combustion feasible,

and then flare the mixture. Because this alternative results in the destruction of the low BTU gas instead of converting the

gas into a form of energy that could be sold or monetized, we do not consider it to be a direct form of competition, however,

potential customers may utilize this approach in lieu of investing in our products. |

| |

● |

Ultra-low

emissions—Within applications where a customer is required to meet emissions regulations and controls limits, typically

by national, regional or local legislation, our systems compete with pollution control technologies, such as Selective Catalytic

Reduction, Dry-Low-NOx, or Dry-Low-Emissions systems, and in some cases, with low-emission flares and thermal oxidizers. As

many of our competitors are large, well-established companies, they derive advantages from production economies of scale,

worldwide presence, and greater resources, which they can devote to product development or promotion. |

In

light of the foregoing, it may be difficult for us to compete successfully in the energy market.

As

an alternative energy technology, our products are subject to wavering interest and levels of investment arising from the volatility

of traditional energy costs and pricing.

In

addition to environmental concerns, the market for alternative energy technologies is driven in part by customers’ desire

for stable, cost-effective energy production methods, including technologies that minimize waste or allow use of waste gases to

capture more value from traditional energy production methods. Although increases or volatility in the costs of traditional energy