ITRONICS ANNOUNCES CONTRACT TO VALUE ITS INTELLECTUAL PROPERTY TO OBTAIN NON-DILUTIVE FINANCING

September 21 2022 - 5:30AM

InvestorsHub NewsWire

ITRONICS ANNOUNCES CONTRACT TO

VALUE ITS INTELLECTUAL PROPERTY TO OBTAIN NON-DILUTIVE

FINANCING

Activity Update –

Reno,

NV -- September 21, 2022 -- InvestorsHub NewsWire -- Itronics

Inc. (OTC:ITRO)

announced today that it has signed a contract for valuation of its

Intellectual Property and is providing investors an update on

current Company progress.

Itronics has

entered a Statement of Work Engagement Letter with Fallingst

Technologies LLC to develop a valuation of Itronics' Intellectual

Property (IP) assets to support a leverage structured, IP-backed

non-dilutive financing transaction. Fallingst Technologies

works in a strategic partnership with Genoa Capital Partners to

enable needed product development and sales generation for

technology companies by leveraging their IP assets. Genoa Capital

Partners has arranged financing to enable this transaction for

Itronics. Fallingst Technologies financing can range from $10

million to more than $100 million.

"The

work program is staged to include a valuation to be followed by a

funding event," said Dr. John Whitney, Itronics President. "The

valuation work is scheduled to start immediately and is expected to

be completed before the end of the year. This will be followed by a

funding event. Itronics' business is based on use of its

proprietary technologies. Completion of this work is expected to

significantly increase the value of the Company."

A summary of progress on related Company developments follows:

-

The rising cost of energy is

increasing the value of the Company's portfolio of 'Zero Waste

Energy Saving Technologies'. A recently completed internal study

concludes that the new Rock Kleen Technology meets the requirements

to qualify for Greenhouse Gas Energy Offset

Credits.

Rock Kleen

is a revolutionary, disruptive technology that recovers residual

precious metals, base and ferrous metals, nutrient materials, and

industrial minerals from 'sub-ore

grade' mine

tailings.

The benefit of this is, after qualification by an independent third

party, the Company can sell Energy Offset Credits. Offset

credits are a transferrable instrument certified by governments or

independent certification bodies to represent a

CO2

emissions

reduction.

"Rock Kleen

projects could generate millions of dollars in Energy Offset

Credits for smaller projects while the potential for long term

projects is in the hundreds of millions of dollars" stated Dr.

Whitney.

-

After qualification, each Rock

Kleen project that the Company develops would be able to sell

Energy Offset Credits. The revenue generated by the sale of these

credits would enhance the economics of each project without any

increase in project costs.

-

The Company now has four potential

Rock Kleen projects under study for development. One project is for

processing iron mine tailings and iron-rich copper mine tailings

which were produced without the use of any cyanide. One project is

for processing silver mine cyanide heap leach tailings. One project

is for processing gold mine cyanide heap leach tailings and one

project is for processing gold mine cyanide mill tailings. These

are expected to be multi-year projects ranging from 10 to more than

50 years of project life.

-

The Company now believes that its

spent Printed Circuit Board Refining technology and its line of

GOLD'n GRO fertilizers may each be able to be qualified for

generating Energy Offset Credits. The energy savings in refining

were measured when the new furnace technology was being

developed.

The energy savings was found to be

40 percent and the Company received an award for that development.

The Company believes the refining technology can be qualified for

the Energy Offset Credits. Qualification of the GOLD'n GRO

fertilizers will be more complex, but the Company believes it may

be possible to separately qualify them for Energy Offset Credits as

well.

-

This year it is becoming apparent

that the cost of energy is being adjusted to much higher levels due

to shortages of all forms of energy on a global basis. Therefore,

the value of energy saving technologies will also increase

significantly.

Itronics, with its portfolio of

'Zero Waste Energy Saving Technologies', is well positioned to

benefit from the profound changes now occurring

worldwide.

-

Itronics reports that work on the

audit of its financial statements is advancing with completion

expected towards the end of 2022. Once Itronics' U.S. Securities

and Exchange Commission filings are current, trading of the stock

will resume for the public.

"We

would like to thank our investors for their continued support" said

Dr. Whitney. "Our portfolio of 'Zero Waste Energy Saving

Technologies' is making the world cleaner and greener and is now

being positioned to enhance the Company's continued drive to

profitability."

About Itronics

Headquartered in Reno, Nevada, Itronics Inc. is a 'Zero Waste

Energy Saving Technology' Company that produces GOLD'n GRO

multi-nutrient liquid fertilizers, silver bullion, and

silver-bearing glass. The Company's environmentally friendly

award winning GOLD'n GRO liquid fertilizers are used extensively in

agriculture in California.

Follow Itronics on Facebook:

https://www.facebook.com/itronicsinc

Follow Itronics on Twitter: https://twitter.com/itronicsinc

* * * * * * * * * *

VISIT OUR WEB SITE: http://www.itronics.com

Contact us

(775)-689-7696

("Safe Harbor" Statement under the Private Securities

Litigation Reform Act of 1995: This press release contains or may

contain forward-looking statements such as statements regarding the

Company's growth and profitability, growth strategy, liquidity and

access to public markets, operating expense reduction, and trends

in the industry in which the Company operates. The

forward-looking statements contained in this press release are also

subject to other risks and uncertainties, including those more

fully described in the Company's filings with the Securities and

Exchange Commission. The Company assumes no obligation to

update these forward-looking statements to reflect actual results,

changes in risks, uncertainties or assumptions underlying or

affecting such statements, or for prospective events that may have

a retroactive effect.)

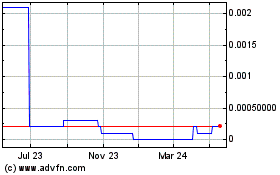

Itronics (CE) (USOTC:ITRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

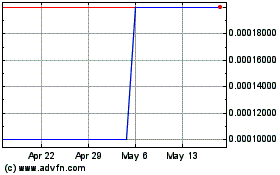

Itronics (CE) (USOTC:ITRO)

Historical Stock Chart

From Nov 2023 to Nov 2024