Vaycaychella; the Rise of World Series of Golf, Inc. (OTCMKTS: WSGF)

November 11 2020 - 8:29AM

InvestorsHub NewsWire

November 11, 2020 -- InvestorsHub NewsWire -- via BY JACOB

WATSON -- World Series of Golf, Inc.

(OTCMKTS:

WSGF) is making an explosive move up the charts on a massive

surge of volume after the Company reported it had acquired

Vaycaychella and launched a new business direction.

Vaycaychella originated operations in 2017 serving the short-term

vacation rental market. Vaycaychella’s mission is to serve

short-term vacation rental owners and investors with a peer-to-peer

(P2P) lending application (app).

This is big business; according to WSGF “the parallel and

industry pacing progress of Airbnb toward an anticipated $30

billion IPO has provided formidable optimism for the paradigm

shifting promise across multiple industries to include not only the

hospitality industry, but the overall housing and finance

industries as well. Airbnb has more rooms to rent (7 million) than

the five largest hotel operators combined (4.3 million) – Marriott,

Hilton, Intercontinental Wyndham and Hyatt.

World Series of Golf, Inc. (OTCMKTS:

WSGF) operating as Vaycaychella acquired in January of 2020,

Vaycaychella is developing a Vacation Rental Peer to Peer Lending

Technology Business. Following the acquisition of Vaycaychella by

WSGF, the managing director of Vaycaychella, William “Bill”

Justice, was appointed as the CEO and Chairman of WSGF. In addition

to managing Vaycaychella’s pilot customer base and managing the

development of the P2P lending app, Mr. Justice has worked to

update WSGF’s public disclosures in accordance with the guidelines

and rules issued by OTC Markets. Last week, WSGF was

designated by OTC Markets as “Current” in its required disclosures.

Now that the company is “Current” with OTC Markets, Mr. Justice

plans to submit an application with the Financial Industry

Regulatory Authority to change the company’s name from World Series

of Golf to Vaycaychella.

WSGF is up big after the Company introduced a new business

direction. The company’s new initiative has been in the works

for some time now, and in light of recent milestones addressed

herein, WSGF is excited to finally detail its new business

direction, and highlight anticipated, pending benchmark

achievements imminently anticipated.

In January of this year, as the result of efforts launched

earlier in 2019, WSGF acquired a business named Vaycaychella.

Vaycaychella originated operations in 2017 serving the short-term

vacation rental market. Vaycaychella’s mission is to serve

short-term vacation rental owners and investors with a peer-to-peer

(P2P) lending application (app). Vaycaychella’s plans

to introduce additional apps that serve short-term rental owners

and investors by, for example, providing discounted access to

rental amenity supplies, on demand maintenance services, insurance,

security and international banking and credit card processing.

Vaycaychella has built a pilot client base serving a Caribbean

based vacation property owner with 10 beachfront community vacation

homes currently under management. Vaycaychella

anticipates soon adding a small boutique hotel to its pilot client

base. In the coming days, Vaycaychella will begin beta testing for

its P2P lending app to connect prospective vacation property owners

with would be investors. Look for an announcement coming soon

asking to sign-up willing participants to test the beta

software.

While the onset of COVID created some cause for concern as to

the interim viability of the short-term rental market, the parallel

and industry pacing progress of Airbnb toward an anticipated $30

billion IPO has provided formidable optimism for the paradigm

shifting promise across multiple industries to include not only the

hospitality industry, but the overall housing and finance

industries as well. Airbnb has the potential to be a global,

seismic economic event spotlighting the unprecedented, and until

now, largely untapped potential of the sharing economy.

Airbnb has more rooms to rent (7 million) than the five largest

hotel operators combined (4.3 million) – Marriott, Hilton,

Intercontinental Wyndham and Hyatt.

In short, the advent of sharing economy technology like Airbnb,

Uber and we like to think, Vaycaychella apps, empowers everyday

individuals around the world to combine their personal resources

(homes, cars, savings and talent for example) under a single

organized business, that can compete with if not dominate any

traditional Fortune 500 competitor.

Currently running northbound in a hurry WSGF is an exciting

story developing in small caps; the stock is up big

after the Company reported it had acquired Vaycaychella and

launched a new business direction. Vaycaychella originated

operations in 2017 serving the short-term vacation rental

market. Vaycaychella’s mission is to serve short-term

vacation rental owners and investors with a peer-to-peer (P2P)

lending application (app). This is big business; according to WSGF

“the parallel and industry pacing progress of Airbnb toward an

anticipated $30 billion IPO has provided formidable optimism for

the paradigm shifting promise across multiple industries to include

not only the hospitality industry, but the overall housing and

finance industries as well. Airbnb has more rooms to rent (7

million) than the five largest hotel operators combined (4.3

million) – Marriott, Hilton, Intercontinental Wyndham and Hyatt.

WSGF has just 88 million shares out with AS topped at 90

million. We will be updating on WSGF when more details

emerge so make sure you are subscribed to Microcapdaily so you know

what’s going on with WSGF.

Source: https://microcapdaily.com/vaycaychella-the-rise-of-world-series-of-golf-inc-otcmkts-wsgf/128528/

Other stocks on the move:

TSNP,

CYDY and

OPTI.

SOURCE: JACOB

WATSON

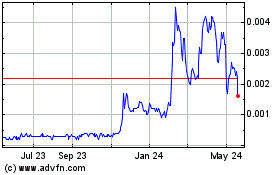

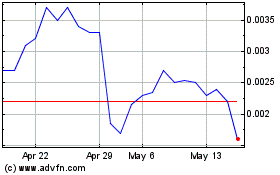

Optec (CE) (USOTC:OPTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Optec (CE) (USOTC:OPTI)

Historical Stock Chart

From Dec 2023 to Dec 2024