UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

March 23, 2009

TRIMAX CORPORATION

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

0-32749

(Commission File Number)

76-0616468

(IRS Employer Identification No.)

2 Lombard Street, Suite 204,

Toronto, Ontario, CANADA M5C 1M1

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code

(416) 832-9315

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 8 – Other Events

Item 1.01 Entry into a Material Definitive Agreement

On March 23, 2009, Trimax Corporation entered into a binding letter agreement with Exploraciones San Bernardo S.A. de C.V, a Mexican company, to purchase strategic mining claims the Mexican Company holds in the municipality of Alamos, Sonora, Mexico.

Pursuant to the letter agreement and once the Company has completed its due diligence, Trimax will issue Ten Million Shares of the Corporation’s common stock to the San Bernardo Subscribers, on closing, and a further Twenty Million Shares over two years to acquire 100% of the Claims.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(c) Exhibits

Exhibit No

.

Description

2

Letter Agreement

99

News Release

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TRIMAX CORPORATION

Date: March 24, 2009 ___

/s/ Robert Vivacqua

________________

Robert Vivacqua, President

EXHIBIT INDEX

|

|

|

|

Exhibit No.

|

Description

|

|

2

|

Letter Agreement By and Between Trimax Corporation entered into a binding letter agreement with Exploraciones San Bernardo S.A. de C.V dated March 23, 2009

|

|

99

|

News Release –Trimax Corporation announces binding letter agreement with Exploraciones San Bernardo S.A. de C.V

|

EXHIBIT 2

March 23, 2009

Exploraciones San Bernardo S.A. de C.V.:

C/O Athanasios Raptis

Boulevard Miguel Hidalgo 64

Colonia Centenario

Sonora, Mexico.

83260

Agreement for Purchase of

La Raquel 2, La Dura 8, La Dura 8, La Dura 5, La Dura 5, Prospect

Alamos, Sonora, Mexico

This letter sets forth terms of an agreement for sale and purchase (“Agreement”), which, when accepted shall form a binding Agreement between Exploraciones San Bernardo S.A. de C.V.: (“San Bernardo”), a Mexican Corporation, and Trimax Corporation (“Trimax”), a Nevada corporation, subject to the terms and conditions hereinafter set forth.

1.

This Agreement is entered into on the basis of the following representations and warranties made to Trimax by San Bernardo.

a)

San Bernardo is the owner of mining claims the “Raquel 2 – 9,451.575 hectares, La Dura 8 – 100 hectares, La Dura 8 – 109 hectares, La Dura 5- 90 hectares , La Dura 5- 500 hectares”, which has been described to Trimax, and which is herein referred to as the “Prospect;”

b)

San Bernardo is the legal owner of mining claims within the Prospect, covering approximately 10,250.575, hectares, in the municipality of Alamos, Sonora, as more particularly described on Exhibit “A” attached hereto, and which are henceforth referred to as “the Claims”

c)

San Bernardo represents that the Claims are in good standing and that they comply with all regulatory requirements and laws;

d)

San Bernardo is not in breach of any laws, ordinances, statutes, regulations, bylaws or decrees to which it is subject or which applies to it which may adversely affect the Claims;

e)

There are no legal claims being made nor are any claims anticipated to be made against San Bernardo or the Claims;

f)

No person, company or entity has any right, agreement or option to purchase any interest in, or portion of, the Claims;

g)

San Bernardo has the full and absolute right, power and authority to enter into this Agreement on the terms and conditions herein set forth, to carry out the transactions contemplated in this Agreement and to sell an undivided 100% of its respective legal and beneficial title and ownership of the Claims to Trimax;

h)

Any assignments of the claims interest that may be made from San Bernardo to Trimax shall conform to the regulations of the State of Nevada;

i)

There is no action, suit, judgment, litigation, strike, labour disturbance, proceeding or investigation against or pending against or involving San Bernardo which might adversely affect San Bernardo transferring One hundred percent (100%) of its respective legal and beneficial ownership of the Claims to Trimax, or which will result in any liability to Trimax in respect of the Claims;

j)

San Bernardo holds all permits, licenses, consents and authorities issued by any Government or governmental authority having jurisdiction or any subdivision thereof, including without limitation, any governmental department, commission, bureau, board or administrative agency which are necessary in relation to its respective ownership of the Claims and its respective ability to sell and transfer an undivided interest in those Claims to Trimax;

k)

San Bernardo is not in default or breach of any provision of any contract, agreement, lease, indenture or other instrument which may adversely affect the Claims or the sale and transfer of an undivided interest in the ownership of the Claims to Trimax;

l)

The sale or transfer of an undivided interest in the Claims to Trimax will not:

i)

violate any provisions of the constating documents of San Bernardo, or

ii)

result in or require the creation or imposition of any mortgage, deed of trust, pledge, lien, security interest, claim, charge, right of others or any encumbrances of any nature upon or with respect to the Claims, except as provided for in this Agreement.

m)

San Bernardo is a corporation duly incorporated, validly existing and in good standing under the laws of the municipality of Alamos, Sonora, Mexico, and is authorized to conduct business in the municipality of Alamos, Sonora, Mexico;

n)

San Bernardo knows of no environmental hazards that will adversely affect the property encompassed by the Claims. To the best of its knowledge and belief, all environmental laws and ordinances have been complied with.

2.

Trimax hereby represents and warrants as follows:

a)

That it is a public corporation duly incorporated in Nevada, and it is a corporation in good standing with no adverse civil or financial actions pending against it;

b)

Trimax will not be in breach of any of its founding documents in entering into this Agreement for purchasing an undivided interest in the Claims from San Bernardo;

c)

Trimax will obtain all authorizations as are necessary in order to enter into this Agreement to purchase an undivided interest in the Claims.

3.

San Bernardo and Trimax agree that the total option purchase price (“Purchase Price”) for an undivided One Hundred (100%) interest in the Claims shall be for a total of Thirty Million Shares of Trimax common stock, to be paid as follows:

a)

Upon closing, Trimax will deliver 10,000,000 Shares of Trimax common stock issued to “San Bernardo”.

b)

Six months from the closing, Trimax will make a further payment of 5,000,000 shares of Trimax issued to “San Bernardo”.

c)

One Year from the closing, Trimax will make a further payment of 5,000,000 shares of Trimax issued

to “San Bernardo”.

d)

Eighteen months from Closing, a further payment of 5,000,000 Shares of Trimax shall be issued to “San Bernardo”.

e)

Two years from the closing, a payment of 5,000,000 Shares of Trimax shall be issued to “San Bernardo”.

f)

In addition to equity payments, there will be a commitment to pay San Bernardo a 2% NET SMELTING RETURN (NSR) ON COMMERCIAL PRODUCTION.

g)

San Bernardo understands and acknowledges that it is an accredited investor, as the term is defined in Rule 501 promulgated by the United States Securities and Exchange Commission, and that the common shares of Trimax so issued shall be restricted and bear the following or similar legend:

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933. THEY MAY NOT BE OFFERED OR TRANSFERRED BY SALE, ASSIGNMENT, PLEDGE OR OTHERWISE UNLESS (I) A REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933 IS IN EFFECT, (II) THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL, WHICH OPINION IS SATISFACTORY TO THE COMPANY, TO THE EFFECT THAT SUCH REGISTRATION IS NOT REQUIRED UNDER THE SECURITIES ACT OF 1933. HEDGING TRANSACTIONS INVOLVING THESE SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE SECURITIES ACT OF 1933.”

If a due diligence title examination by Trimax reveals that San Bernardo owns a different number of net leasehold acres, the parties herein agree to adjust the Purchase Price accordingly.

4.

Trimax may purchase the claims through a subsidiary company, or purchase the claims and assign them to a subsidiary company.

5.

After payment of the Purchase Price, Trimax shall then have thirty (30) calendar days, which shall be until April 22, 2009, in which to conduct a due diligence review of San

Bernardo’s title to the Claims. San Bernardo shall provide to Trimax complete access to all of the Claims and all other relevant documentation in possession of San Bernardo with respect to the Claims in a data room at the following location: The Law Offices of Eduardo Robles in Hermocillo, Sonora, Mexico in order to assist Trimax in conducting an independent verification of San Bernardo’s ownership of the Claims. Should the number of net acres prove to be incorrect by a factor of greater than five percent (5%) than the number represented by San Bernardo in this Agreement, a proportionate adjustment shall be made between the parties.

6.

San Bernardo will work with Trimax to bring in financing of a minimum of $500,000 into Trimax, over the next twelve months, in order to pay for the development costs of the business. San Bernardo acknowledges that a portion of all future financings into the Company will be used to pay current payables due for service providers involved in assisting Trimax with its regulatory reporting requirements. After the closing, all future payables will be the responsibility of Trimax’s new management team.

7.

Concurrent with the closing, Trimax shall restructure its currently outstanding debt by conversion of the debt to shares of common stock and the exchange of common stock for all remaining broadband over power line business plans, trade secrets and proprietary information, and any remaining digital signage equipment.

8.

Following the closing, the Board of Directors of the Corporation shall adopt and approve Amended and Restated Articles of Incorporation, including a change in the name of the Company and a change in the capitalization of the Corporation so that the Company will have 200,000,000 of authorized shares of common stock and 20,000,000 authorized shares of preferred stock, par value $0.001 per share. The amendments to the Articles of Incorporation shall be made to increase the authorized share capital of the Company which is expected to allow the Company to make acquisitions as it moves forward to implement its business plan, and to provide the Company with more flexibility to conduct equity financings.

9.

At or prior to the time of Closing, Trimax’s current President, Robert Vivacqua shall tender his resignation and be replaced by a new President. Mr. Vivacqua’s resignation will be effective once all the financial restructuring has been completed.

10.

All notices and communications required or permitted under this Agreement shall be in writing and shall be effective when received by mail, certified mail, registered mail, return receipt requested, facsimile or hand delivery as follows:

Exploraciones San Bernardo S.A. de C.V.: -and-

Trimax Corporation

C/O Athanasios Raptis

2 Lombard St, Suite 204

Boulevard Miguel Hidalgo 64

Toronto, Ontario

Colonia Centario

M5C-1M1

Sonora, Mexico

83260

11.

Either party may, by written notice so delivered to the other, change the address to which notice shall thereafter be made.

12.

Until such time that San Bernardo has been paid the full Purchase Price, San Bernardo shall be provided, in advance, copies of all press releases regarding claims and other public announcements that may be issued by Trimax, its agents, partners or associates concerning the Prospect. San Bernardo shall have the right to edit press regarding the claims to its reasonable satisfaction. San Bernardo agrees to be reasonable and to provide expeditious input.

13.

This instrument contains the entire Agreement of the parties with respect to the transactions contemplated herein, supersedes any and all prior agreements or understandings, written or oral, and cannot be amended except by a writing signed by all of the parties. The parties agree to be reasonable with respect to any amendments sought by another party.

14.

In the event that any party is required to seek legal or equitable action to interpret or enforce any provision of this Agreement, the prevailing party shall be entitled to its reasonable costs and fees, including attorney fees.

15.

This Agreement may be executed by facsimile and in any number of counterparts, each of which shall be deemed an original instrument, but all of which together shall constitute one and the same instrument.

16.

The waiver of any breach or any term or condition of this Agreement shall not be deemed to constitute a waiver of any other breach of the same or any other term or condition of the Agreement.

17.

Both San Bernardo and Trimax will bear their own costs and expenses, including the fees of legal, accounting and other professional advisors engaged by them in connection with the transactions contemplated by this Agreement and its preparation.

18.

The parties shall perform such further acts and execute such other agreements or documents as may be reasonably necessary to carry out the intent and provisions of the Agreement.

19.

In addition to complying with any specific standards of conduct set forth herein, the parties have acted and shall continue to act toward each other in good faith in the negotiation, execution, delivery and performance of this Agreement.

20.

This Agreement and all transactions contemplated herein shall be interpreted in accordance with the laws of the State of Nevada and any proceeding arising between the Parties in any matter pertaining or related to this Agreement shall, to the extent permitted by law, be held in the City of Las Vegas, Nevada. The United States District Court in Las Vegas, Nevada shall be the proper venue for the adjudication of any dispute regarding this Agreement. This Agreement shall inure to the benefit of, and be binding upon, the parties hereto, their respective heirs, administrators, successors and assigns as the case may be.

21.

Time is of the essence of this Agreement.

If the foregoing accurately sets forth your understanding of our agreement, kindly sign this Agreement where indicated below and where indicated on Exhibit “A,” and return it to the office of

San Bernardo no later than March 25, 2009. Your signature and

acceptance will form a binding Agreement between us, subject only to the terms and conditions aforesaid.

Respectfully,

Exploraciones San Bernardo S.A. de C.V.:

By:___

/s/ Athanasios Raptis

_____________________

Athanasios Raptis

TERMS UNDERSTOOD AND AGREED TO AND THE WITHIN OFFER ACCEPTED

THIS 23

rd

DAY OF March , 2009.

Trimax Corporation

By:___

/s/

__

Robert Vivacqua

___________________

Robert Vivacqua, President

Exhibit “A”

The Claims

Attached to and made part of that certain Agreement for Purchase dated March 23, 2009, between Exploraciones San Bernardo S.A. de C.V.: (“San Bernardo”), and Trimax Corporation (“Trimax”), to wit:

EXHIBIT 99

News Release

NEGOTIATIONS IN PROGRESS TO ACQUIRE MEXICAN MINING CLAIMS

Las Vegas, Nevada - March 24, 2009 - Trimax Corporation

(OTCBB:

TMXN

) is pleased to announce that the management of the Company has signed a binding letter agreement with Exploraciones San Bernardo S.A. de C.V, a Mexican company, to purchase strategic mining claims the Mexican Company holds in the municipality of Alamos, Sonora, Mexico.

South Sonora in the Alamos area mining district is internationally renowned for its multi-metallic mining properties containing vast amounts of minerals including, gold, silver, copper, lead, zinc, graphite and tungsten. Mining records show that this area was first developed by the Spanish in the 16th century.

The directors of Trimax are committed to enhancing the assets of the company by thoroughly researching mining claims that have extensive exploration and development potential. Further news in this endeavor will be released as soon as it becomes available.

This press release contains statements, which may constitute "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. Those statements include statements regarding the intent, belief or current expectations of Trimax Corporation and members of its management as well as the assumptions on which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements. Important factors currently known to management that could cause actual results to differ materially from those in forward-statements include fluctuation of operating results, the ability to compete successfully and the ability to complete before-mentioned transactions. The company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results.

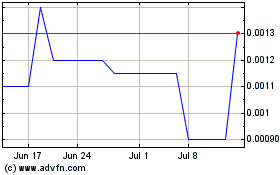

Trimax (PK) (USOTC:TMXN)

Historical Stock Chart

From Jun 2024 to Jul 2024

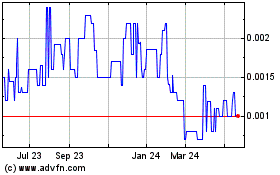

Trimax (PK) (USOTC:TMXN)

Historical Stock Chart

From Jul 2023 to Jul 2024