BlackRock Income Portfolio Update

April 23 2021 - 7:00AM

UK Regulatory

TIDMBRIG

The information contained in this release was correct as at 31 March 2021.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at:

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK INCOME & GROWTH INVESTMENT TRUST PLC (LEI:5493003YBY59H9EJLJ16)

All information is at 31 March 2021 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five Since

Month Months Year Years Years 1 April

2012

Sterling

Share price 1.8% 2.3% 21.7% 1.2% 15.0% 78.8%

Net asset value 3.9% 3.0% 25.2% 9.0% 26.5% 82.0%

FTSE All-Share Total Return 4.0% 5.2% 26.7% 9.9% 35.7% 76.5%

Source: BlackRock

BlackRock took over the investment management of the Company with effect from 1

April 2012.

At month end

Sterling:

Net asset value - capital only: 189.45p

Net asset value - cum income*: 191.51p

Share price: 171.00p

Total assets (including income): £46.2m

Discount to cum-income NAV: 10.7%

Gearing: 8.3%

Net yield**: 4.2%

Ordinary shares in issue***: 22,017,990

Gearing range (as a % of net assets): 0-20%

Ongoing charges****: 1.2%

* Includes net revenue of 2.06 pence per share

** The Company's yield based on dividends announced in the last 12 months as at

the date of the release of this announcement is 4.2% and includes the 2020

final dividend of 4.60p per share declared on 01 February 2021 and paid to

shareholders on 12 March 2021 and the 2020 interim dividend of 2.60p per share

declared on 24 June 2020 and paid to shareholders on 1 September 2020.

*** excludes 10,081,532 shares held in treasury

**** Calculated as a percentage of average net assets and using expenses,

excluding performance fees and interest costs for the year ended 31 October

2020.

Sector Analysis Total assets (%)

Financial Services 10.7

Support Services 9.9

Household Goods & Home Construction 8.5

Pharmaceuticals & Biotechnology 7.3

Mining 7.1

Oil & Gas Producers 6.3

Personal Goods 5.8

General Retailers 5.0

Banks 5.0

Life Insurance 4.9

Travel & Leisure 4.1

Media 4.0

Tobacco 4.0

Nonlife Insurance 3.0

Health Care Equipment & Services 2.8

General Industrials 2.3

Food & Drug Retailers 2.0

Industrial Metals & Mining 1.6

Electronic & Electrical Equipment 1.4

Electricity 1.1

Technology Hardware & Equipment 0.9

Real Estate Investment Trusts 0.6

Industrial Engineering 0.6

Net Current Assets 1.1

-----

Total 100.0

=====

Country Analysis Percentage

United Kingdom 93.2

United States 3.2

France 1.4

Italy 1.1

Net Current Assets 1.1

-----

100.0

=====

Top 10 holdings Fund %

AstraZeneca 6.0

Rio Tinto 5.0

Reckitt Benckiser 4.8

Unilever 4.1

RELX 4.0

British American Tobacco 4.0

Royal Dutch Shell 'B' 3.8

Standard Chartered 2.9

Smith & Nephew 2.8

Phoenix Group 2.8

Commenting on the markets, representing the Investment Manager noted:

Performance Overview:

The Company returned 3.9% during the month, underperforming the FTSE All-Share

which returned 4.0%.

Market Summary:

Global equity markets rose in March on the approval of further fiscal support

and the restart to come. The UK and US continued the rollout of successful

vaccine programmes while many European countries tightened lockdown

restrictions again due to struggles with rising infection rates and a sluggish

vaccination campaign.

Fiscal stimulus continued in the US with the approval of a COVID relief bill of

$1.9 trillion. US Treasury yields climbed close to one-year highs with the

10-year yield near 1.5% early in the month. The FOMC meeting indicated the

Fed's higher tolerance for inflation and that tapering bond purchases remains a

distant prospect.

On Budget Day in the UK, the Chancellor revealed several initiatives; one key

positive included the 130% 'super deduction' tax incentive to promote near-term

investment, and one key negative included a proposed increase in corporation

tax to 25% pre-announced for April 2023, lifting the overall UK tax burden to

its highest in 50 years. Progression of the roadmap out of lockdown continued

late in the month with the permittance of 6 people or two households meeting

outside. The FTSE All Share rose 4.0% during the month with Telecommunications,

Consumer Goods and Utilities outperforming while Basic Materials and Oil & Gas

underperformed.

Stocks:

Hiscox was a top detractor during the period; the company issued a poor trading

statement that highlighted further investments needed within its retail

business. Following recent floats and strong performance from Moonpig and The

Hut Group earlier in the quarter, the share prices fell back during March; both

companies were top detractors during the month.

Taylor Wimpey was a top positive contributor; the company had significant

upgrades at the FY results owing to higher expected margins. Reckitt Benckiser

benefitted as market optimism increased around the improved sales execution and

Standard Chartered benefitted from the value rotation and rising interest

rates; both companies were top positive contributors.

Portfolio Activity:

We remain constructive on economic growth and the tailwind to cyclical areas of

the stock market while remaining cognisant of more defensive companies'

increasingly attractive free cash flow generation.

During the month we added to Ferguson where the strength in the macro and their

ability to take share gave us confidence to further increase the position. We

reduced Hiscox after the release of a disappointing trade statement where our

investment thesis has been challenged in the short term. We sold our position

in Rightmove as we see better opportunities in other parts of the Company.

Outlook:

Despite the continuation of COVID-19 lockdowns globally, economic activity has

been less impacted as consumers and corporates have adapted their behaviours

since the development of effective vaccines. Looking ahead, the focus is firmly

on the cyclical recovery buoyed by ongoing monetary and fiscal support

overwhelming concerns around virus variants.

As economic activity rebounds this has caused some strains on supply chains

with specific industry shortages as well as building inflationary pressures

including significant increases in commodity prices versus 12 months ago. The

prospect of higher inflation has driven bond yields higher with central bankers

indicating their willingness, for now, to stay on the side-lines. We are also

cognisant of the evolution of relationships between China and the West and the

potential impact on industries and shares.

Turning to the UK specifically, we have, finally, got a Brexit deal that

provides increased clarity on the UK's trading relationship with the EU. This

is against a backdrop of UK valuations that have been extreme, trading at

multi-decade lows versus other international markets with a recent flurry of M&

A deals highlighting the dispersion and value on offer in the FTSE. We continue

to believe that this dispersion should narrow given the increased certainty and

reduced risk regarding Brexit in addition to the UK's strong vaccination

effort.

We view the dividend outlook for the UK market with renewed optimism as we

expect dividends, in aggregate, to be more resilient and to grow faster in the

future as those companies that had been overdistributing for a number of years

reset their dividends during the pandemic. Resilience was a crucial feature of

the Company and its underlying holdings in 2020 and while this will still be

important in 2021, we are excited by the approaching economic recovery and the

opportunity to deliver strong capital and dividend growth for our clients over

the long-term.

23 April 2021

END

(END) Dow Jones Newswires

April 23, 2021 08:00 ET (12:00 GMT)

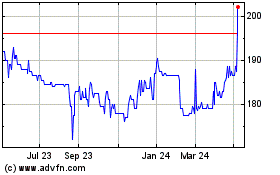

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

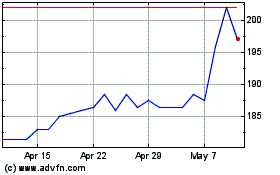

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Apr 2023 to Apr 2024