TIDMCCZ

RNS Number : 2665H

Castillo Copper Limited

26 July 2023

26 July 2023

CASTILLO COPPER LIMITED

("Castillo", or the "Company")

June 2023 Quarterly Activities Report

Castillo Copper Limited (LSE and ASX: CCZ), a base metal

explorer primarily focused on copper across Australia and Zambia,

is pleased to present shareholders its latest quarterly report for

the period 1 April to 30 June 2023.

HIGHLIGHTS:

-- EAST ZONE, BHA PROJECT, NSW

o Specialist, consultant, ANSTO, performed metallurgical

test-work on six samples from the Fence Gossan, Reefs and Tors

Tanks Prospects(1)

o The Total Rare Earth Element plus Yttrium ("TREY") grades for

the six samples ranged from 227 to 1,632 ppm TREY(1)

DEVELOPMENT WORK

Castillo has four properties comprising the NWQ Copper Project

in Mt Isa's copper-belt, the BHA Project near Broken Hill's world

class silver-zinc-lead deposit in NSW, the historic Cangai Copper

Mine and four assets across Zambia's copper-belt.

East Zone, BHA Project, NSW

On 13 April 2023, specialist consultant, ANSTO, was appointed to

undertake comprehensive metallurgical test-work on six samples from

Fence Gossan, Reefs and Tors Tanks Prospects to understand the

potential to extract rare earth elements ("REE") from shallow clay

zones.

The scope of work will focus on characterising REE leachability

from the six samples which comprise fresh pegmatite to highly

weathered clay, especially with Magnetic Rare Earth Oxide ("MREO")

grades ranging from 362-603ppm.

This is an important step towards advancing the viability of the

BHA Project's East Zone REE potential and securing interest from

prospective development partners, especially given the extent of

high-value MREO (Nd+Pr+Dy+Tb) within the system(1) .

On 14 June 2023, specialist consultant, ANSTO, performed

metallurgical test-work on six samples from the Fence Gossan,

Reefs, and Tors Tanks Prospects which produced the following

preliminary findings:

-- The Total Rare Earth Element plus Yttrium grades for the six

samples ranged from 227 to 1,632 ppm TREY;

-- The proportion of high-value Magnetic Rare Earth Oxides

(MREO; Nd+Pr+Dy+Tb) to Total REO (TREO) across the six samples

ranged from 22% to 27%; and

-- The best TREY extraction, using a direct leach process at pH 1, was 30%

The Board is reviewing next steps, including trialling alternate

leach tests proposed by ANSTO to improve extraction results(1)

.

PAYMENTS TO, OR TO AN ASSOCIATE OF, A RELATED PARTY OF THE

ENTITY DURING QUARTER DURING THE QUARTER

$202,000 was paid to related parties of Castillo relating to

executive director salary, non-executive director fees and

exploration expenditure paid to Field Crew, a related entity of

director David Drakeley.

SUMMARY OF THE EXPLORATION EXPITURE INCURRED DURING THE

QUARTER

Consulting fees Rates and mines

departments fees

Cangai $96,000 -

----------------------- -----------------------------------------

Broken Hill Alliance $28,000 $1,000

----------------------- -----------------------------------------

Mt Isa $77,000 $38,000

----------------------- -----------------------------------------

Zambia $27,000 $1,000

----------------------- -----------------------------------------

Total $228,000 $40,000

----------------------- -----------------------------------------

For further information, please contact:

Castillo Copper Limited +61 8 6558 0886

Dr Dennis Jensen (Australia), Managing Director

Gerrard Hall (UK), Chairman

SI Capital Limited (Financial Adviser and

Corporate Broker) +44 (0)1483 413500

Nick Emerson

Gracechurch Group (Financial PR) +44 (0)20 4582 3500

Harry Chathli, Alexis Gore, Henry Gamble

About Castillo Copper

Castillo Copper Limited is an Australian-based explorer

primarily focused on copper across Australia and Zambia. The group

is embarking on a strategic transformation to morph into a mid-tier

copper group underpinned by its core projects:

-- A large footprint in the Mt Isa copper-belt district,

north-west Queensland, which delivers significant exploration

upside through having several high-grade targets and a sizeable

untested anomaly within its boundaries in a copper-rich region.

-- Four high-quality prospective assets across Zambia's

copper-belt which is the second largest copper producer in

Africa.

-- A large tenure footprint proximal to Broken Hill's

world-class deposit that is prospective for

zinc-silver-lead-copper-gold and platinoids.

-- Cangai Copper Mine in northern New South Wales, which is one

of Australia's highest grading historic copper mines.

The group is listed on the LSE and ASX under the ticker

"CCZ."

References

1) Note - All information referenced is from CCZ ASX Releases,

as dated in text, from 1 January 2022 to 28 April 2022

inclusive

APPIX A: KEY PROJECTS

FIGURE A1: WEST AND EAST ZONE - BHA PROJECT, BROKEN HILL

REGION

Source: CCZ geology team

FIGURE A2: ZAMBIA COPPER-BELT PROJECTS

Source: CCZ geology team

FIGURE A3: NWQ COPPER PROJECT, MT ISA REGION

Source: CCZ geology team

APPIX B: INTEREST IN MINING TENEMENTS HELD

JACKADERRY (CANGAI)

New England Orogen in NSW

Tenement ID Ownership at start of Quarter Ownership at end of Quarter Change during the Quarter

------------------------------ ---------------------------- --------------------------

EL8635 100% 100% -

------------------------------ ---------------------------- --------------------------

EL8625 100% 100% -

------------------------------ ---------------------------- --------------------------

EL8601 100% 100% -

------------------------------ ---------------------------- --------------------------

BROKEN HILL

located within a 20km radius of Broken Hill, NSW

Tenement ID Ownership at start of Quarter Ownership at end of Quarter Change during the Quarter

------------------------------ ---------------------------- --------------------------

EL8599 100% 100% -

------------------------------ ---------------------------- --------------------------

EL8572 100% 100% -

------------------------------ ---------------------------- --------------------------

EL 8434 100% 100% -

------------------------------ ---------------------------- --------------------------

EL 8435 100% 100% -

------------------------------ ---------------------------- --------------------------

MT OXIDE

Mt Isa region, northwest Queensland

Tenement ID Ownership at start of Quarter Ownership at end of Quarter Change during the Quarter

------------------------------ ---------------------------- --------------------------

EPM 26513 100% 100% -

------------------------------ ---------------------------- --------------------------

EPM 26525 100% 100% -

------------------------------ ---------------------------- --------------------------

EPM 26574 100% 100% -

------------------------------ ---------------------------- --------------------------

EPM 26462 100% 100% -

------------------------------ ---------------------------- --------------------------

EPM 27440 100% 100% -

------------------------------ ---------------------------- --------------------------

ZAMBIA

Project Tenement ID Ownership at start of Ownership at end of Quarter Change during the Quarter

Quarter

-------------- --------------------------- ---------------------------- --------------------------

Lumwana North 23914-HQ-SEL 100% nil 100%

-------------- --------------------------- ---------------------------- --------------------------

Lumwana South 23913-HQ-SEL 100% nil 100%

-------------- --------------------------- ---------------------------- --------------------------

Mkushi 24659-HQ-LEL 100% 100% -

-------------- --------------------------- ---------------------------- --------------------------

Luanshya * 22448-HQ-LEL - - -

-------------- --------------------------- ---------------------------- --------------------------

Luanshya 25195-HQ-LEL 55% 55% -

-------------- --------------------------- ---------------------------- --------------------------

Luanshya 25273-HQ-LEL 55% 55% -

-------------- --------------------------- ---------------------------- --------------------------

Mwansa 25261-HQ-LEL 100% 100% -

-------------- --------------------------- ---------------------------- --------------------------

* CCZ can earn up to 80% by meeting previously disclosed milestones

The mining tenement interests relinquished during the quarter

and their location

-- Lumwana North 23914-HQ-SEL Zambia

-- Lumwana South 23913-HQ-SEL Zambia

-- Luanshya (1) 22448-HQ-LEL Zambia

(1) CCZs right to earn up to 80% by meeting previously disclosed

milestones lapsed during the quarter.

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Name of entity

-----------------------------------------------------

Castillo Copper Ltd

ABN Quarter ended ("current quarter")

--------------- ----------------------------------

52 137 606 476 30 June 2023

----------------------------------

Consolidated statement of cash flows Current quarter Year to date

(12 months)

$A'000 $A'000

1. Cash flows from operating

activities

1.1 Receipts from customers

1.2 Payments for

(a) exploration & evaluation

(b) development

(c) production

(d) staff costs

(e) administration and corporate

costs (192) (1,067)

1.3 Dividends received (see note

3)

1.4 Interest received 8 18

1.5 Interest and other costs of

finance paid

1.6 Income taxes paid

1.7 Government grants and tax

incentives

1.8 Other (provide details if

material)

---------------- -------------

Net cash from / (used in)

1.9 operating activities (184) (1,049)

----------------- ----------------------------------- ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire or for:

(a) entities

(b) tenements

(c) property, plant and equipment

(d) exploration & evaluation (268) (1,722)

(e) investments

(f) other non-current assets - (82)

2.2 Proceeds from the disposal

of:

(a) entities

(b) tenements

(c) property, plant and equipment

(d) investments

(e) other non-current assets

2.3 Cash flows from loans to other

entities

2.4 Dividends received (see note

3)

2.5 Other (provide details if

material)

---------------- -------------

Net cash from / (used in)

2.6 investing activities (268) (1,804)

----------------- ----------------------------------- ---------------- -------------

3. Cash flows from financing

activities

3.1 Proceeds from issues of equity

securities (excluding convertible

debt securities)

3.2 Proceeds from issue of convertible

debt securities

3.3 Proceeds from exercise of

options

3.4 Transaction costs related

to issues of equity securities

or convertible debt securities

3.5 Proceeds from borrowings

3.6 Repayment of borrowings

3.7 Transaction costs related

to loans and borrowings

3.8 Dividends paid

3.9 Other (provide details if

material)

---------------- -------------

3.10 Net cash from / (used in) - -

financing activities

----------------- ----------------------------------- ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 3,332 5,754

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (184) (1,049)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (268) (1,804)

4.4 Net cash from / (used in) - -

financing activities (item

3.10 above)

Effect of movement in exchange

4.5 rates on cash held 20 (1)

---------------- -------------

Cash and cash equivalents

4.6 at end of period 2,900 2,900

----------------- ----------------------------------- ---------------- -------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 2,808 3,240

5.2 Call deposits 92 92

5.3 Bank overdrafts

5.4 Other (provide details)

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 2,900 3,332

----------------- ----------------------------------- ---------------- -----------------

6. Payments to related parties of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 51(1)

----------------

6.2 Aggregate amount of payments to related 151(2)

parties and their associates included in

item 2

----------------

(1) Comprises director's fees for the quarter.

(2) Comprises consulting fees paid to the Managing Director

and exploration expenditure paid to Field Crew, a related entity

of director David Drakeley.

7. Financing facilities Total facility Amount drawn

Note: the term "facility' amount at quarter at quarter end

includes all forms of financing end $A'000

arrangements available to $A'000

the entity. Add notes as necessary

for an understanding of the

sources of finance available

to the entity.

7.1 Loan facilities

------------------- ----------------

7.2 Credit standby arrangements

------------------- ----------------

7.3 Other (please specify)

------------------- ----------------

7.4 Total financing facilities

------------------- ----------------

7.5 Unused financing facilities available at

quarter end

----------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

----------------- ---------------------------------------------------------------------------

8. Estimated cash available for future operating $A'000

activities

Net cash from / (used in) operating activities

8.1 (item 1.9) (184)

8.2 (Payments for exploration & evaluation classified (268)

as investing activities) (item 2.1(d))

8.3 Total relevant outgoings (item 8.1 + item (452)

8.2)

8.4 Cash and cash equivalents at quarter end 2,900

(item 4.6)

8.5 Unused finance facilities available at quarter

end (item 7.5)

-------

8.6 Total available funding (item 8.4 + item 2,900

8.5)

-------

Estimated quarters of funding available

8.7 (item 8.6 divided by item 8.3) 6.4

-------

Note: if the entity has reported positive relevant outgoings

(ie a net cash inflow) in item 8.3, answer item 8.7 as

"N/A". Otherwise, a figure for the estimated quarters

of funding available must be included in item 8.7.

8.8 If item 8.7 is less than 2 quarters, please provide answers

to the following questions:

8.8.1 Does the entity expect that it will continue to

have the current level of net operating cash flows for

the time being and, if not, why not?

-------------------------------------------------------------------

Answer: N/A

-------------------------------------------------------------------

8.8.2 Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

-------------------------------------------------------------------

Answer: N/A

-------------------------------------------------------------------

8.8.3 Does the entity expect to be able to continue its

operations and to meet its business objectives and, if

so, on what basis?

-------------------------------------------------------------------

Answer: N/A

-------------------------------------------------------------------

Note: where item 8.7 is less than 2 quarters, all of

questions 8.8.1, 8.8.2 and 8.8.3 above must be answered.

----------------- -------------------------------------------------------------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 25 July 2023

Authorised by: The Board of Directors

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDMZGZNLVMGFZG

(END) Dow Jones Newswires

July 26, 2023 05:15 ET (09:15 GMT)

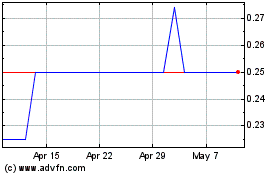

Castillo Copper (LSE:CCZ)

Historical Stock Chart

From Apr 2024 to May 2024

Castillo Copper (LSE:CCZ)

Historical Stock Chart

From May 2023 to May 2024