Man Group Launches Onshore Version Of Giant Hedge Fund

September 10 2009 - 12:04PM

Dow Jones News

Man Group PLC (EMG.LN) said Thursday it is launching an onshore

version of its AHL product, one of the largest single hedge funds

with some $20 billion assets under management, in a further sign of

the company's confidence in boosting sales to private

investors.

Man AHL Diversity is a managed-futures trading program, which

means it follows and seeks to exploit persistent market trends. It

will be managed by Man Investments, the asset management arm of Man

Group, and marketed by hedge fund advisory company Dexion Capital

Group.

The world's largest listed hedge fund aims to attract

sophisticated investors who will be able to buy in with a minimum

initial investment of just GBP100 from its launch in October.

"Historically, the performance of trend following managers has

tended to be uncorrelated to traditional stock and bond markets,"

said Tim Wong, chief executive of AHL.

"We saw that with AHL's highly impressive performance last year

when its best performing fund delivered 33% at the same time as

some equity markets fell 40%," he added.

Man Group has successfully wooed private investors even as

withdrawals by institutional investors have continued. In July the

company reported strong sales to private individuals, posting a

rebound to $3.4 billion in its first fiscal quarter to June 30.

The introduction of Man AHL Diversity onshore will give

individuals exposure to more than 90 global markets and 29

international exchanges trading continuously which makes for a

highly liquid product following trends in everything from

currencies and interest rates to agricultural assets and

metals.

-By Marietta Cauchi, Dow Jones Newswires; +44 207 842 9241;

marietta.cauchi@dowjones.com

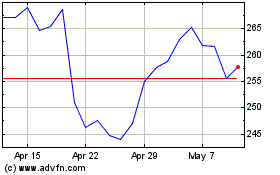

Man (LSE:EMG)

Historical Stock Chart

From Apr 2024 to May 2024

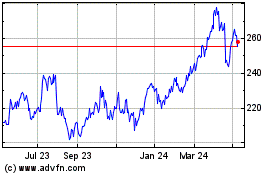

Man (LSE:EMG)

Historical Stock Chart

From May 2023 to May 2024