TIDMEUZ

RNS Number : 3977C

Europa Metals Ltd

19 October 2020

19 October 2020

Europa Metals Ltd

("Europa Metals", the "Company" or the "Group") (AIM, AltX:

EUZ)

EUR466,801.50 Grant Awarded by the CDTI Towards Exploration Work

at the

Toral Pb, Zn & Ag Project, Spain

Europa Metals, the European focused lead-zinc and silver

developer, is pleased to announce that, following an extensive

submission process, an interest -free loan by way of a grant of

EUR466,801.50 (the "Grant") has been awarded to the Company by the

Centre for the Development of Industrial Technology (CDTI) for use

towards research and development ("R&D") at the Company's

wholly owned Toral lead, zinc and silver project ("Toral" or the

"Toral Project") situated in the region of Castilla y León,

north-west Spain.

The CDTI is a Public Business Entity in Spain, under the

auspices of the Ministry of Science and Innovation, which fosters

the technological development and innovation of Spanish companies.

The Grant is categorised as a partly refundable loan (with a nil

per cent. interest rate) with the funds received to be allocated

towards the development of R&D technologies relating to the

recording and correction of drillhole deviation at the Toral

Project. Application for the Grant was made further to ongoing work

by Europa Metals and the AIR Institute, linked to the Salamanca

University, and drilling contractors Sondeos y Perforaciones

Industriales de Bierzo SA ("SPI").

Europa Metals will draw the Grant monies down in up to three

tranches, with the prior agreement of the CDTI, with the initial

tranche, comprising an amount of EUR163,380, to be received by the

Company imminently. The second and third tranches are scheduled to

be drawn down over the next 18 months subject to certain, defined,

operational milestones. The core objectives of the Innovation

Programme are to retrieve and process data from the Toral drilling

campaign in order to develop algorithmic software for use in

exploration campaigns to correct drilling deviation. Biannual

repayments of EUR21,822 begin in 2024, running for 7 years until

2031, with a fixed interest rate being set by the currently

prevailing Euribor rate of nil per cent.

Europa Metals anticipates that the Grant will enable the Company

to apply for reductions in taxes payable relating mainly to labour

costs and is satisfied that the terms of the Grant will not prevent

the Company from participating in other grant application processes

save where there is a specific technological overlap.

Once the funds have demonstrably been spent on appropriate

R&D exploration activity at the Toral Project by the Company,

70 per cent. of the total Grant will be repayable with the

balancing 30 per cent. then not required to be repaid.

Toral Project Update

At Toral, the Company is working towards finalisation of a new,

independent, economic report on the project, currently being

undertaken by Bara Consulting. Certain elements of a

Pre-Feasibility Study for the Toral Project are also underway with

the bore hole for hydrogeological testing now complete, which will

enable monitoring to commence. The Company looks forward to

updating the market, as appropriate, on anticipated further

operational progress in due course, including the expected renewal

of its three-year Investigation Permit for the Toral Project.

Laurence Read, CEO of Europa Metals, commented :

"Following our recent successful GBP2 million equity raise, I am

pleased to announce the awarding of this EUR466,801.50 Grant by the

Spanish Governmental agency, CDTI . This interest free loan is a

huge testament to the operational work performed at the Toral

Project and our team's ability to establish innovative partnerships

with local contractors and leading higher education establishments.

For some time, we have been progressing our work with the

University of Salamanca and SPI to assess how the development of

Toral could be utilised to assist the Castilla y León and Spain

with innovation in the field of exploration. Using Toral as a real

time project our partnership with the AIR Institute and SPI shall

field-test data collection and processing systems from the

exploration drill rigs once Europa Metals begins its

Pre-Feasibility Study drilling campaign, following completion of

the current ongoing economic study .

" Europa Metals is pursuing a number of grant initiatives and I

am pleased that the first successful application stems from the

Castilla y León itself. The Grant is on attractive terms and allows

money to be spent at the project level contributing to the R&D

aspects of the Company's Pre-Feasibility Study programme. I would

like to take this opportunity to thank the CDTI, for their backing

of our partnership , the Junta of Castilla y León for their ongoing

support and, of course, our colleagues who have once again

delivered on the Group's objectives ."

For further information on the Company, please visit

www.europametals.com or contact:

Europa Metals Ltd

Dan Smith, Non-Executive Director and Company Secretary

(Australia)

T: +61 417 978 955

Laurence Read, CEO (UK)

T: +44 (0)20 3289 9923

Linkedin: Europa Metals ltd

Twitter: @ltdeuropa

Vox: Europametals

Strand Hanson Limited (Nominated Adviser)

Rory Murphy/Matthew Chandler

T: +44 (0)20 7409 3494

Tavistock (PR and IR)

Emily Fenton, Barney Hayward, Oliver Lamb

T: +44 (0) 207 920 3150 / EuropaMetals@Tavistock.co.uk

Turner Pope Investments (TPI) Limited (Broker)

Andy Thacker

T: +44 (0)20 3657 0050

Sasfin Capital Proprietary Limited (a member of the Sasfin

group)

Sharon Owens

T (direct): +27 11 809 7762

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014.

Notes to Editors

Appendix : Further information on the Toral Project

Mineral Resource Estimate

The latest Mineral Resource Estimate (August 2020) for the Toral

deposit reported in accordance with JORC (2012) at a 4% cut-off was

as follows :

-- An Indicated resource of approximately 3.8Mt @ 8.3% Zn

Equivalent (including Pb credits), 4.7% Zn, 3.9% Pb and 30g/t Ag,

including:

o 180,000 tonnes of zinc, 150,000 tonnes of lead and 3.7 million

ounces of silver.

-- An Inferred resource of approximately 14Mt @ 6.5% Zn

Equivalent (including Pb credits), 4% Zn, 2.7% Pb and 23 g/t Ag,

including:

o 540,000 tonnes of zinc, 360,000 tonnes of lead and 10 million

ounces of silver.

-- A total resource of approximately 17Mt @ 6.9% Zn Equivalent

(including Pb credits), 4.1% Zn, 2.9% Pb and 24 g/t Ag,

including:

o 720,000 tonnes of zinc, 510,000 tonnes of lead and 14 million

ounces of silver.

Table 1 : Summary of Indicated and Inferred mineral resources

for the Toral property reported at a 4.0% Zn equivalent cut-off

grade (including Pb and Ag credits) and estimated grade and

tonnages at the various cut-off grades. Figures are rounded to

reflect the accuracy of the estimate and, as such, totals may not

cast .

Cut-Off Tonnes Density Zn_Eq Zn Eq Zn % Pb % Ag g/t Contained Contained Ag Troy Oz

Zn Eq (Millions) (Pb)% (PbAg)% Zn Tonnes Pb Tonnes (Millions)

(PbAg)% (000s) (000s)

Indicated

6 2.8 2.9 9.5 10 5.3 4.5 34 150 130 3.1

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

5 3.3 2.9 8.9 9.5 5 4.2 32 170 140 3.4

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

4 3.8 2.9 8.3 8.9 4.7 3.9 30 180 150 3.7

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

3 4.1 2.9 7.9 8.5 4.4 3.7 29 180 150 3.8

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

Inferred

6 8 2.9 7.8 8.3 4.7 3.4 28 370 270 7.2

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

5 10 2.9 7.2 7.7 4.4 3 26 450 310 8.6

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

4 14 2.9 6.5 6.9 4 2.7 23 540 360 10

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

3 17 2.9 5.9 6.3 3.7 2.4 20 610 400 11

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

Total

6 11 2.9 8.2 8.8 4.8 3.7 30 520 390 10

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

5 14 2.9 7.6 8.1 4.5 3.3 27 620 450 12

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

4 17 2.9 6.9 7.3 4.1 2.9 24 720 510 14

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

3 21 2.9 6.3 6.7 3.8 2.7 22 790 560 15

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

Transitional Oxide Material

4 3 2.9 5.2 5.7 2.6 2.9 27 75 83 2.5

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

Unweathered Fresh Rock

4 14 2.9 7.2 7.7 4.5 3 24 650 430 11

----------- -------- ----------- ---------- ----- ----- ------- ---------- ---------- -----------

*Zn Eq % is the calculated Zn equivalent incorporating lead

credits; (Zn Eq (Pb)% = Zn + Pb*0.926). Zn Eq (PbAg)% is the

calculated Zn equivalent incorporating silver credits as well as

lead; (Zn Eq (PbAg)% = Zn + Pb*0.926 + Ag*0.019). Zn equivalent

calculations were based on 3-year trailing average price statistics

obtained from the London Metal Exchange and London Bullion Market

Association giving an average Zn price of US$2,680/t, Pb price of

US$2,100/t and Ag price of US$16.2/oz.

Notes for Table 1 in this appendix:

1. No mineral reserve calculations have been undertaken. Mineral

resources that are not mineral reserves do not have demonstrated

economic viability.

2. Numbers are rounded to reflect the fact that an Estimate of

Resources is being reported as stipulated by JORC 2012. Rounding of

numbers may result in differences in calculated totals and

averages. All tonnes are metric tonnes.

3. Zn equivalent calculations were based on 3 year trailing

average price statistics obtained from the London Metal Exchange

and London Bullion Market Association giving an average Zn price of

US$2,680/t, Pb price of US$2,100/t and Ag price of US$16.2/Oz.

Recovery and selling factors were incorporated into the calculation

of Zn Eq values. It is the Company's opinion that all the elements

included in the metal equivalents calculation (zinc, lead and

silver) have a reasonable potential to be recovered and sold.

4. Zn Eq (PbAg)% is the calculated Zn equivalent incorporating

silver credits as well as lead and is the parameter used to define

the cut-off grade used for reporting resources (Zn Eq (PbAg)% = Zn

+ Pb*0.926 + Ag*0.019).

5. Zn Eq is the calculated Zn equivalent using lead credits and

does not include silver credits (Zn Eq = Zn + Pb*0.926).

6. The Mineral Resource Estimate set out above for the zinc,

lead and silver mineralisation in the Toral project area is based

on a 3D geologic model and wireframe restricted block model that

integrated the exploration work on the Toral project up to 21

January 2020. The block model used uniform cell size of 25x10x25m

to best suit the orientation of the mineralisation and sample

spacing. The block model was rotated by 20deg in plan view to best

match the trend of mineralisation. Sub cells were applied to better

fit the wireframe solid models and preserve accurate volume as much

as possible. Cells were interpolated at the parent block scale

using an Ordinary Kriging.

7. Following statistical analysis and assessment of the updated

assay composite database top cuts of 125g/t Ag were applied to the

data. No top cuts were applied for Zn or Pb.

8. The Indicated and Inferred mineral resource category for the

Toral zinc-lead-silver project set out in Table 1 (at cut-off

grades >4% Zn Equivalent) comply with the resource definitions

as described in the Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves. The JORC Code, 2012

Edition. Prepared by: The Joint Ore Reserves Committee of The

Australasian Institute of Mining and Metallurgy, Australian

Institute of Geoscientists and Minerals Council of Australia

(JORC).

9. The tonnes and grades reported at a cut-off grade of 3% Zn

equivalent are below the economic cut-off grade of 4% and as such

should not be considered mineral resources, they are shown here for

comparison purposes only.

Metallurgical Results

High-grade recovery results from second phase metallurgical

testing conducted by Wardell Armstrong International (April

2020):

o 83.7% Pb recovery to a 60.0% Pb concentrate;

o 87.1% Ag recovery to 1,350ppm Ag within Pb concentrate;

and

o 77% Zn recovery to a 59.1% Zn concentrate.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZZMMGMNZGGZM

(END) Dow Jones Newswires

October 19, 2020 02:00 ET (06:00 GMT)

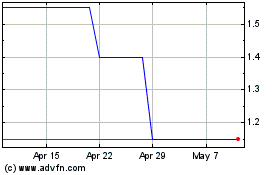

Europa Metals (LSE:EUZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Europa Metals (LSE:EUZ)

Historical Stock Chart

From Apr 2023 to Apr 2024