TIDMFTV

FORESIGHT VCT PLC

Final Results

31 December 2017

Foresight VCT plc, managed by Foresight Group CI Limited, today

announces the final results for the year ended 31 December 2017.

These results were approved by the Board of Directors on 10 April 2018.

The Annual Report will shortly be available in full at

www.foresightgroup.eu. All other statutory information can also be found

there.

Highlights

Ordinary Shares fund

-- Diversified portfolio of 29 actively managed investments.

-- Total net assets GBP140.4 million.

-- Net Asset Value per Ordinary Share increased by 6.5% from 83.6p (31

December 2016) to 89.0p including dividends. A 5.0p dividend was paid on

3 April 2017 and a 4.0p dividend was paid on 29 September 2017,

resulting in a NAV of 80.0p as at 31 December 2017.

-- The portfolio has seen an uplift in valuation of GBP11.7 million

during the year.

-- Eight new investments, totalling GBP17.6 million and two follow-on

investments totalling GBP0.3 million made during the year.

-- A total of GBP39.9 million raised through the issue of shares and the

offer closed in March 2017, six weeks after launch.

-- In July 2017 the Company successfully sold Blackstar Amplification,

Simulity Labs and The Bunker Secure Hosting, realising a total of

GBP16.9 million compared to an investment cost of GBP8.0 million.

-- The Board is pleased to declare an interim dividend for the year

ending 31 December 2018 of 5.0p per Ordinary Share, to be paid on 4 May

2018.

Planned Exit Shares fund

-- Following the sale of AlwaysON in January 2017 and Industrial

Engineering Plastics in July 2017, the Fund has now realised all its

investments.

-- An interim dividend for the year ended 31 December 2017 of 18.0p per

Planned Exit Share was paid on 13 April 2017.

-- A second interim dividend of 7.71p per Planned Exit Share was paid on

29 December 2017, resulting in a total return for Shareholders of

82.71p.

-- The Planned Exit Shares were removed on 24 January 2018 following a

General Meeting held on 23 January 2018.

Infrastructure Shares fund

-- Following the sale of all 11 infrastructure assets in the portfolio,

the Fund has now realised all its investments.

-- An interim dividend of 93.05p per Infrastructure Share was paid on 29

December 2017, resulting in a total return for Shareholders of 115.05p.

-- The Infrastructure Shares were removed on 24 January 2018 following a

General Meeting held on 23 January 2018.

Chairman's Statement

I am delighted to present the Audited Annual Report for Foresight VCT

plc for the year ended 31 December 2017. The past year has seen some

very significant development of the Company, including the effective

completion of the wind-down of both the Planned Exit and Infrastructure

Share classes. During December 2017, I provided shareholders with

detailed information on the wind-down, which was approved at a General

Meeting. Subsequently both the Planned Exit and Infrastructure Share

classes were removed in January this year. As a consequence, whilst some

final details relating to these share classes are contained later in

this statement, I intend to concentrate on the performance of the

Ordinary Shares Fund, which will form the continuing share class of the

Company.

ORDINARY SHARES FUND

The Directors, together with the Manager, have an agreed long term

strategy for the Fund which includes the following four key objectives:

-- Increasing and then maintaining the net assets significantly above

GBP150 million

-- Paying an annual dividend to shareholders of at least 5.0p per

Ordinary Share and endeavouring to maintain, or increase, NAV per

Ordinary Share year on year

-- Completing a significant number of new and follow on qualifying

investments every year

-- Offering a programme of regular share buy backs at a discount in the

region of 10% to the prevailing NAV.

For this and future statements, I intend to focus on performance in

relation to these key objectives.

NET ASSET VALUE

Following a successful fundraising period at the end of the 2016/17 tax

year, the net assets of the Ordinary Shares Fund increased to GBP140.4

million as at 31 December 2017, from GBP107.0 million as at 31 December

2016. It remains the Board's belief that to support the other key

objectives, it would be beneficial to increase the Fund's net assets

over the coming years. With some GBP61 million of funds currently

available for investment, however, it is not the Board's intention to

raise more money in the near future.

During the year ended 31 December 2017 the net asset value ("NAV") per

Ordinary Share rose by 5.4p, representing an annual increase of 6.5%.

After deducting the dividends of 9.0p per share paid during the year,

NAV per Ordinary Share as at 31 December 2017 was 80.0p compared with

83.6p as at 31 December 2016.

DIVIDS

In line with the objective of paying regular annual dividends of at

least 5p per share, an interim dividend of 5.0p per Ordinary Share was

paid on 3 April 2017 based on an ex-dividend date of 16 March 2017, with

a record date of 17 March 2017.

Following successful sales of several portfolio investments, in

particular Simulity Labs in July 2017, a second interim dividend of 4.0p

per Ordinary Share was paid on 29 September 2017 based on an ex-dividend

date of 14 September 2017, with a record date of 15 September 2017.

The Board is pleased to declare an interim dividend for the year ending

31 December 2018 of 5.0p per Ordinary Share, to be paid on 4 May 2018

based on an ex-dividend date of 19 April 2018, with a record date of 20

April 2018.

The Board notes that the Company has achieved its target of paying an

annual dividend of at least 5p per share for each of the past seven

years. During this period, however, the total return per Ordinary Share

has remained relatively static, rising 5.4% from 207.5p per share on 1

January 2011 to 218.7p per share at 31 December 2017. It is this

performance which the Board wishes to improve in future years.

INVESTMENT PERFORMANCE AND PORTFOLIO ACTIVITY

A detailed analysis of the investment portfolio performance over the

past year is given in the Manager's Review. At the year end, the Fund

held a diversified portfolio of qualifying investments in UK businesses,

across a broad range of sectors.

The Board believes it is important for the long term performance of the

Fund to identify a regular flow of new investments. The Manager

completed eight new investments for the Fund during 2017. These new

investments absorbed GBP17.6 million of funds held for investment and

reflects the Manager's success in sourcing attractive growth capital

investments in qualifying companies. The Board closely monitors the

extent and nature of the pipeline of investment opportunities and

anticipates that the Manager will be able to increase the level of new

investments during 2018.

In July 2017, the Fund successfully sold three investments, generating

total proceeds of GBP16.9 million compared to an original total

investment cost of GBP8.0 million and a combined book value at date of

disposal of GBP11.6 million. The sale of Simulity Labs is particularly

pleasing since, after an investment period of only eight months, it

generated a return of almost three times cost, with disposal proceeds of

GBP11.4 million compared to an original investment cost of GBP4 million.

In addition, following our year end, the deferred consideration for

Simulity was received in full, generating a further GBP0.3m.

Since the end of the year, the Fund has sold ICA, generating proceeds of

GBP1.3 million compared to an original investment cost of GBP0.9

million.

FUNDRAISING

The Board took the opportunity to raise new funds in the Ordinary Shares

Fund at the start of 2017. In just six weeks, GBP39.9 million of new

capital was raised from new and existing shareholders. On behalf of the

Board and the Manager, I would like to thank shareholders for their

support. We believe that this demonstrates the improving investor

support for the Ordinary Shares Fund and will assist the Fund to achieve

its key objectives.

The Board appreciates that in order for the Fund to be able to achieve

its key objectives, the Manager needs to source and complete attractive

new qualifying investment opportunities. Over the past two calendar

years, new investments have amounted to GBP22.4 million and at 31

December 2017, the Fund held GBP62 million of funds available for

investment. After allowing for a cash margin to meet annual operating

requirements, the Board and the Manager believe that the Fund is well

positioned to take advantage of attractive investments being sourced

across the UK by the Manager for at least the coming 24 months.

BUYBACKS

During the year, the Company repurchased 2 million Ordinary Shares for

cancellation at an average discount of 10.1%. The Board and the Manager

consider that the ability to offer to buy back Ordinary Shares at a

target discount in the region of 10% is fair to both continuing and

selling shareholders, and is an appropriate way to help underpin the

discount to NAV at which the Ordinary Shares trade.

MANAGEMENT CHARGES, CO-INVESTMENT AND INCENTIVE ARRANGEMENTS

The annual management fee on the Ordinary Shares Fund is an amount equal

to 2.0% of net assets, excluding cash balances above GBP20 million which

are charged at a reduced rate of 1.0%. This has produced an ongoing

charges ratio for the year ended 31 December 2017 of 2.2% of net assets,

which is among the lower when compared to competitor VCTs.

The Board believes it to be advantageous to align, as far as may be

practical, the interests of the Manager with those of shareholders. To

that end, new co-investment and incentive arrangements were approved by

shareholders on 8 March 2017. These oblige Foresight Group and

individual members of their private equity team to co-invest alongside

the Ordinary Shares Fund in exchange for entitlement to performance

incentive payments, which are subject to the achievement of 'per

investment' and 'fund as a whole' performance hurdles. Details of these

arrangements can be found in note 14 to the accounts.

Since March 2017, co-investments have totalled GBP0.3 million alongside

the Company's investment of GBP16.5 million. Currently the 'fund as a

whole' threshold has not been achieved and no incentive payment is due.

OUTLOOK

The Board and the Manager intend to continue to build on the progress

achieved during 2017. We believe that the investments currently held

within the Fund should grow further through 2018 and that the current

pipeline will provide worthwhile new investment opportunities in the

months ahead. Provided the current level and quality of new investment

is maintained, the Board believes that the Fund will be well positioned

to meet its key objectives, providing shareholders with regular

dividends and maintained capital growth.

PLANNED EXIT SHARES FUND

Following the full realisation of the Fund's assets, a dividend of 7.71p

per Planned Exit Share was paid on 29 December 2017 based on an

ex-dividend date of 21 December 2017, with a record date of 22 December

2017. This brought the Fund's total return for Shareholders to 82.71p,

which represents a decrease of 0.2% on the total return per Planned Exit

Share as at 31 December 2016 of 82.9p.

The original objective of the Planned Exit Shares Fund was to provide

investors with a return of 110p per share through a combination of

dividends and share buybacks by the sixth anniversary of the closure of

the original offer, due in June 2016. The final outcome for Planned Exit

Shareholders was very far from that anticipated at its inception. The

reasons have been summarised in previous annual reports during the life

of the Fund. Both the Board and the Manager recognise that the final

return represented poor overall performance and regret that this was

significantly behind the original target.

INFRASTRUCTURE SHARES FUND

Following the full realisation of the Fund's assets, a dividend of

93.05p per Infrastructure Share was paid on 29 December 2017 based on an

ex-dividend date of 21 December 2017, with a record date of 22 December

2017. This brought the Fund's total return for Shareholders to 115.05p,

which represents an increase of 10.9% on the total return per

Infrastructure Share as at 31 December 2016 of 103.7p. While behind the

return objectives contained in the original prospectus, the Board

believes the overall performance of the Infrastructure Shares Fund to be

reasonable, particularly when viewed against the background of

significant changes in both market conditions and VCT qualification

rules during the life of the Fund.

This total return is net of a performance incentive fee paid to the

Manager in accordance with the arrangements set out in the prospectus.

Details of these arrangements can be found in note 14 to the accounts.

BOARD COMPOSITION

The Board regularly reviews its own performance and undertakes

succession planning to maintain an appropriate level of independence,

experience and skills in order for it to be in a position to discharge

its responsibilities. Peter Dicks, a founder member of the Board and a

past Chairman, has served the Company with great commitment and

distinction throughout this period. He has, however, decided to retire

at this year's Annual General Meeting.

After commissioning an independent professional search, the Board was

delighted to secure the services of Margaret Littlejohns as a Director

of the Company. Margaret, who was appointed a Non-Executive Director of

the Company in October last year, is an experienced fund director. She

currently sits on the Boards of the Henderson High Income Trust,

JPMorgan Mid Cap Investment Trust and UK Commercial Property Trust. Her

earlier career was largely with Citigroup followed by a period from 2004

during which, with her husband, she set up and ran a self storage

business which she successfully sold in 2016. A short biography of each

of the Directors is contained on pages 32 to 34 of the accounts.

ANNUAL GENERAL MEETING

The Company's Annual General Meeting will take place on 22 May 2018 at

2.00pm. I look forward to welcoming you to the Meeting, which will be

held at the offices of Foresight Group in London. Details can be found

on page 78 of the accounts.

John Gregory

Chairman

Telephone 01296 682751

Email: j.greg@btconnect.com

10 April 2018

Manager's Review

ORDINARY SHARES FUND

Portfolio Summary

As at 31 December 2017 the portfolio of the Ordinary Shares Fund

comprised 36 investments with a total cost of GBP65.6 million and a

valuation of GBP78.0 million. The portfolio is diversified by sector,

transaction type and maturity profile. Details of the ten largest

investments by valuation, including an update on their performance, are

provided on pages 16 to 20 of the accounts.

The main reason for the difference between the cost and value of

investments in the TMT sector is Autologic, with a cost of GBP3.8

million. In July 2017, the sale of Autologic's operating subsidiaries

was agreed with Opus Group AB of Sweden. Although healthy returns were

achieved in the early years of this investment, since a part disposal in

2012 the performance has been disappointing. Following repayment of some

loans during 2017 Autologic is now valued at nil and will be dissolved

in due course.

The value of investments in the Industrials & Manufacturing sector is

much greater than cost largely due to Aquasium, which is valued at

GBP4.0 million against a cost of GBP0.3 million and Specac, valued at

GBP3.8 million against a cost of GBP1.3 million.

NEW INVESTMENTS AND FOLLOW-ON FUNDING

It has been an active year for the Ordinary Shares fund, having

completed new investments in eight companies and two follow-on

commitments, totalling GBP17.9 million. During the second half of the

year, the fund added three new portfolio companies: 200 Degrees, an

artisan coffee chain and roasting business; Nano Interactive, a leading

advertising technology business and Powerlinks Media, a realtime trading

platform for advertisements. These new investments are in addition to

those reported at the half year: Poundshop.com; Ollie Quinn; Fresh

Relevance; Cinelabs and Mowgli Street Food. A summary on each is

provided on the next page.

As follow-on investments, in July 2017 a further tranche of GBP224,723

was invested in molecular diagnostics business Biofortuna as part of a

GBP900,000 funding round alongside Foresight 4 VCT plc and co-investors

to further develop its blood typing products. In October 2017, the Fund

committed GBP34,159 of additional growth capital to Idio as part of a

GBP543,000 equity raise from existing investors.

POUNDSHOP.COM

The first investment of 2017 was a GBP1.7 million growth capital

investment in Poundshop.com. Launched in February 2014, Poundshop.com is

an online-only single price retailer, founded and chaired by Steve Smith,

the founder of Poundland. Since investment, sales have increased, the

company has launched a new website and moved to a new, larger warehouse

which has enabled it to increase the number of items stocked.

OLLIE QUINN

In March 2017, a GBP3.0 million investment was completed in Ollie Quinn,

a branded retailer of prescription glasses, sunglasses and

non-prescription polarised sunglasses. Following a period of rapid

growth, follow-on funding of GBP650k was provided in January 2018 to

support the company's working capital and current site optimisation

strategy. Due to slower than projected revenue growth and an earlier

than forecast follow-on funding requirement, a 25% provision has been

made against the cost of this investment at 31 December 2017.

FRESH RELEVANCE

The third investment, of GBP2.1 million, was completed in Fresh

Relevance, a mail marketing and web personalisation platform, in March

2017. Based in Southampton, Fresh Relevance is a high growth, marketing

technology business, providing online retailers with marketing tools

including triggered emails and web personalisation. The capital will be

used to fund increased sales resource, launch a US office and introduce

a higher level of service and consultancy, all of which should help

increase average order values. Progress to date is positive.

MOWGLI STREET FOOD

The Fund also invested GBP1.6 million in Mowgli, a fast-casual chain of

restaurants founded in 2014, serving Indian street food. Since

investment, Mowgli has traded well, opening a new site in Birmingham,

and is planning a fifth branch for Q1 2018. The modern focus on healthy,

light, flavoursome dishes differentiates Mowgli from traditional Indian

restaurants, as does its provision of a wide range of gluten-free,

vegetarian and vegan dishes. This is the first investment alongside the

Foresight Regional Investment LP, a GBP40 million institutional private

equity fund. The LP funded the replacement capital element of the

transaction, which the Fund, under the rules changes introduced in 2015,

was unable to provide.

CINELABS

The Fund has invested GBP2.2 million in Cinelabs, which is the UK's only

full-service film laboratory, offering film processing, scanning,

distribution, digitisation, restoration and archive management to

clients in the media and entertainment industries such as the BFI, ITV

and FIFA. Sales increased during 2017, reflecting good growth of the

underlying client base, and the pipeline for 2018 looks promising.

NANO INTERACTIVE

In October 2017, the Fund invested GBP3.4 million of growth capital in

Nano Interactive. The company, founded in 2014 by two experienced

advertising technology executives, is engaged in search retargeting; a

form of online advertising where relevant adverts are shown to users

based on key words from their recent search history. The company uses

its proprietary data management platform to optimise search campaigns

for its global customer base. The funding will support plans to expand

internationally and invest in sales, marketing and product development,

as well as the roll-out of its INSIST platform.

200 DEGREES

In November 2017, GBP0.9 million was invested in 200 Degrees Holdings to

support its growth plans. 200 Degrees was initially established as a

supplier of coffee beans and machines. The company has since evolved

into a wholesale business and coffee chain, with a Barista School and a

total of six coffee shops across five cities. The investment will

support the management team in opening new stores, while building the

company's wholesale business. Since investment, performance has been

driven by strong trading at a number of stores and operational

improvements at newer sites.

POWERLINKS MEDIA

The final investment of 2017 was a GBP2.7 million investment in

Powerlinks Media, an advertising technology company, in December 2017.

Unlike traditional digital adverts, PowerLinks ads are visually styled

to align with the surrounding webpage or mobile app, delivering a

non-intrusive, "native" user experience. The investment follows a year

of success and expansion, which has seen PowerLinks' market surpass

4,000 advertising campaigns from 140 connected advertisers, driving

revenue growth. The investment is intended to accelerate PowerLinks'

expansion in the US, with planned additions across the sales, client

services and technology teams.

PIPELINE

Foresight Group continues to work hard to develop and deliver attractive

investment opportunities for the Company. Foresight Group's private

equity team has strong connections within the community of businesses,

advisors and professional service firms, which have been further

bolstered through the recent recruitment of Matthew Evans-Young,

previously at Synova Capital and KPMG, as an Origination Manager.

Matthew will lead on the establishment of a dedicated direct origination

practice within Foresight Group's private equity team. By proactively

contacting target companies, this initiative aims to deliver exclusive

access to new deals. Foresight Group's dedicated direct origination

resource is already having a positive impact on the level and

consistency of the teams' origination efforts with an increase in off

market opportunities being seen. Whilst this is a long-term investment

and off market opportunities generally take longer to convert, it is

encouraging to see this strategy begin to produce results.

Foresight Group is firmly established as a key player in the investment

range of GBP1 million to GBP5 million and is acknowledged for its

appetite to transact and support ambitious SME management teams. The

team typically analyses around 100 new investment opportunities each

month, of which only a handful will be deemed of sufficient quality to

require full evaluation for a potential investment.

As at 31 December 2017, the Ordinary Shares Fund had GBP61.9 million in

cash and money market funds. This will be utilised for new and follow-on

investments, as well as buybacks and ongoing running expenses.

REALISATIONS

During the year to 31 December 2017, the Fund generated total proceeds

of GBP18.2 million, principally through the sale of Simulity Labs,

Blackstar Amplification and The Bunker Secure Hosting, which realised

GBP16.9 million compared to a cost of GBP8.0 million.

Loan repayments contributed a total of GBP547,748 from Autologic

Diagnostics Group and the final loan repayment of GBP166,667 made by

Aquasium Technology. The Fund continues to hold an equity position in

Aquasium, which manufactures, services and refurbishes electron beam

welding equipment and vacuum furnaces. Proceeds were also received from

the sale of the Fund's remaining shares in AIM-listed ZOO Digital, which

supplies software and services for authored content and subtitling to

media businesses and post-production firms. Deferred consideration was

also received from the sales of O-Gen Acme Trek and Trilogy in 2016, and

Alaric Systems in 2013.

During the year, the Ordinary Shares fund realised losses amounting to

GBP2.3 million, which had already been provided for in full, following

the liquidation of Abacuswood and The Skills Group, and the disposal of

AlwaysOn Group.

SIMULITY

In July 2017 the Manager successfully completed the sale of Simulity

Labs to ARM, the world's leading semiconductor IP company. The

transaction generated proceeds of GBP11.7 million (including deferred

consideration) from an initial GBP4.0 million investment just eight

months previously. Established in 2009, Simulity provides embedded

communications software and related server systems for both SIM cards

and embedded SIMs ('eSIMs'). Since investment in October 2016, Simulity

successfully transitioned to a software licensing business model,

launched its eSIM technology, increased valuable recurring revenue

streams, improved gross margins materially and grew its international

sales presence, making the company an attractive acquisition target.

BLACKSTAR

The Fund originally invested in Blackstar Amplification, an

award-winning Northampton-based designer and manufacturer of innovative

guitar amplifiers, in 2012. The Fund provided growth capital and helped

restructure the company's shareholder base and strengthened its

management team. Blackstar more than doubled turnover over four years,

expanded internationally, establishing itself as the number two

amplifier brand in the UK and USA and broadened its product catalogue.

The sale was implemented by a management buyout, supported by the

company's manufacturing and distribution partners, and nearly doubled

the Fund's original investment.

THE BUNKER

The Fund acquired its investment in The Bunker from Foresight 2 VCT plc

as part of the merger in December 2015. Having first invested in May

2006, the Foresight VCTs have been longstanding shareholders in The

Bunker, which builds, hosts and manages high security, high availability

IT data centres, providing competitive data storage solutions. The

growth capital provided by the Foresight VCTs was used to materially

scale The Bunker's data storage facilities. The business experienced a

compound annual growth rate of over 14% of recurring revenues for the

past three years with annual revenues growing to more than GBP9 million

compared to GBP1.8 million at investment. The Bunker was acquired by

Palatine Private Equity, generating an overall return of 2.44 times over

the life of the investment.

ICA

Post-year end, in February 2018, the Fund realised its position in ICA

Digital ("ICA"), a managed print services business based in Surrey,

realising an overall 2.4 times return, through a trade sale to ASL

Group. During the course of the investment, Foresight Group supported

management to execute a focused sales strategy, in particular developing

high-margin contracted service revenues.

The Manager continues to engage with a range of potential acquirers of

several portfolio companies, with demand for these high growth

businesses demonstrated by both private equity and trade buyers.

DISPOSALS IN THE YEARED 31 DECEMBER 2017

Original Cost/ Take-On Value Proceeds Realised (Loss)/Gain Valuation at 31 December 2016

Company Detail (GBP) (GBP) (GBP) (GBP)

Abacuswood Limited Dissolved Full 478,684 - (478,684)^ -

AlwaysON Group Limited disposal 1,473,271 - (1,473,271)^ -

Aquasium Technology

Limited Loan repayment 166,667 166,667 - 166,667

Autologic Diagnostics Loan repayment 547,748 547,748 - 547,748

Group Limited

Blackstar Amplification Full disposal 2,500,000 3,857,000 1,357,000 3,822,050

Holdings Limited

Simulity Labs Limited Full disposal 4,000,000 11,410,920* 7,410,920 4,000,000

The Bunker Secure

Hosting Full disposal 1,537,348 1,680,684 143,336 1,656,835

Limited

The Skills Group Limited

(formerly AtFutsal) Dissolved 391,301 563 (390,738)^ -

ZOO Digital Group plc Full disposal 40,307 57,675 17,368 53,742

Total disposals 11,135,326 17,721,257 6,585,931 10,247,042

In addition to the above, deferred consideration of GBP199,106 was

received by the Fund from the sale of O-Gen Acme Trek Limited, GBP24,003

was received from the sale of Trilogy and GBP280,499 was received from

the sale of Alaric Systems.

^This loss refers to the transfer on disposal between unrealised and

realised reserves and has no impact on NAV in the current year.

* Does not reflect an additional GBP257,846 deferred consideration

received in February 2018.

POST YEAR DISPOSALS

Valuation

at 31

Realised December

Original Cost/ Take-On Value Proceeds Gain/(Loss) 2016

Company Detail (GBP) (GBP) (GBP) (GBP)

ICA

Group Full

Limited disposal 885,232 1,290,701* 405,469 880,894

*Including deferred consideration due in April 2018.

KEY PORTFOLIO DEVELOPMENTS

The Ordinary Shares Fund has benefitted from strong performance of the

underlying portfolio with a total net valuation change of GBP12.0

million, driven primarily by the agreed sale of Simulity Labs at a value

GBP7.7 million above cost, as detailed above. The valuation of the

Company's largest investment, Datapath, fell by GBP1.6 million but

remains significantly above book cost. The reduction is due to ongoing

investment in the business, as detailed further on page 16 of the

accounts, which we believe will support further a long-term increase in

value. Material changes in valuation, defined as an increase or decrease

of GBP1 million or more since 31 December 2016, are detailed in the

table below. Where these companies do not appear in the Top Ten

Investments section of the report, an update on underlying developments

that have driven changes in value is provided below.

Company Valuation Methodology Valuation Change (GBP)

Simulity Labs Limited Sold 7,410,920

Discounted revenue

Ixaris Systems Limited multiple 2,234,435

Aquasium Technology Discounted earnings

Limited multiple 1,980,168

Thermotech Solutions Discounted earnings

Limited multiple 1,602,958

Aerospace Tooling Holdings Discounted earnings

Limited multiple 1,069,807

Procam Television Holdings Discounted earnings

Limited multiple (1,635,609)

Discounted earnings

Datapath Group Limited multiple (1,628,430)

CoGen Limited Discounted cash flow (1,087,383)

THERMOTECH SOLUTIONS

Thermotech, which designs, installs and maintains customised air

conditioning and fire sprinkler systems, has performed well in the year,

with strong sales and an improvement in EBITDA. This has been

attributable to good performance across the Fire and Mechanical Services

divisions and the synergies that the company is now benefitting from

following the acquisition of Oakwood in 2016. The company has continued

to expand its portfolio of retail clients and won a number of sizeable

new contracts.

AEROSPACE TOOLING

Aerospace Tooling is an engineering company specialising in the

refurbishment of high-value aerospace and industrial gas turbine

components. The business has made a significant recovery, underlined by

supportive trade from industrial customers. Improvements in operational

performance are beginning to deliver favourable results.

COGEN

CoGen develops, builds, owns and operates waste to energy and combined

heat and power ('CHP') plants. During the year, the company sold its 20%

stake in Ince Park for a proposed consideration of GBP1.75m, however,

construction problems persist at Birmingham Bio Power plant. The plant

continued to experience downtime, reducing electrical output, and the

project company is now preparing for an arbitration process with the

construction contractor. This, together with increased costs on some

projects has led to a reduced valuation.

PROCAM TELEVISION

Procam Television is a leading broadcast hire company, supplying

equipment and crew for location TV production. The reduction in

valuation reflects a disappointing 2017 following a strong performance

in the prior year. Growth from Procam Projects and True Lens Services

failed to offset a softer year in some other divisions. This, together

with a significant investment in staff and equipment and financing

obligations, resulted in the business raising additional funding in

December 2017.

OUTLOOK

While there remains a significant amount of uncertainty as to how the UK

will be affected by its exit from the European Union, Foresight Group

continues to see a strong pipeline of interesting investment

opportunities and expressions of interest from potential acquirers of

portfolio companies.

In the Autumn Budget 2017 the Government announced a plan to unlock over

GBP20 billion of patient capital investment in innovative companies with

the opportunity for growth. The Government's response to the Patient

Capital Review recognises the positive role that VCTs play in providing

long term patient capital. The proposed adjustments to the VCT scheme

rules fall within the Fund's existing investment strategy.

Foresight Group will continue to monitor and adapt to market and

regulatory changes to ensure the Company and its portfolio is

well-placed to deliver returns to its investors.

PLANNED EXIT SHARES FUND

Portfolio Summary

Following the sale of the two final holdings, alwaysOn in January 2017

and Industrial Engineering Plastics in July 2017, the Fund realised all

of its portfolio investments. The Board completed the transfer of the

Trilogy Entitlements, the outstanding entitlement to consideration held

in escrow in respect of the sale of holdings in Trilogy Communications

Holdings Limited, to the Ordinary Shares fund in exchange for GBP265,712

on 6 December 2017. Deferred consideration of GBP57,329 was also

received in relation to the sale of Trilogy in 2016. This resulted in

the assets of the Planned Exit Shares fund being fully realised. The

Board paid a dividend of 7.71p per Planned Exit Share to shareholders on

the register as at 22 December

2017. Ignoring tax reliefs, this dividend payment brought the total

return on a Planned Exit Share to 82.71p.

Following approval of the requisite resolutions at the general meetings

and separate class meetings of the Company held on 23 January 2018 and

24 January 2018 respectively, the Board of the Company completed the

removal of the Planned Exit Shares.

ALWAYSON

alwaysON provides data backup services, connectivity and Microsoft's

Skype for Business collaboration software to SMEs and larger

enterprises. Given the company's cash constraints, a decision was made

to seek an exit rather than fund further losses. Despite challenging

trading conditions the sale was completed in January 2017, generating

proceeds of GBP2.0 million against an investment cost of GBP1.8 million.

INDUSTRIAL ENGINEERING PLASTICS

Industrial Engineering Plastics ("IEP") is a plastics distributor and

fabricator, supplying a wide range of industries with ventilation and

pipe fittings, plastic welding rods, hygienic wall cladding, plastic

tanks and sheets. In light of some of the structural challenges within

IEP's markets, the Manager pursued multiple conversations with potential

trade acquirers. As a result, two acquisition offers were received early

in 2017 before an offer with one of IEP's competitors was agreed at a

price marginally below the most recent valuation, and a loss against the

original investment of GBP1.6 million.

DISPOSALS IN THE YEARED 31 DECEMBER 2017

Original Valuation

Cost/ at 31

Take-On Realised December

Value Proceeds Gain/(Loss) 2016

Company Detail (GBP) (GBP) (GBP) (GBP)

AlwaysON

Group

Limited Full disposal 1,839,970 2,032,608 192,638 2,032,608

Industrial

Engineering

Plastics

Limited Full disposal 1,556,416 492,550 (1,063,866) 508,150

Total disposals 3,396,386 2,525,158 (871,228) 2,540,758

In addition to the above, deferred consideration of GBP323,041 was

received by the Fund from the sale of Trilogy in the year ended 31

December 2016.

INFRASTRUCTURE SHARES FUND

Portfolio Summary

Due to changes in VCT regulations, the Fund could no longer pursue its

investment strategy of investing in infrastructure assets, including

secondary Private Finance Initiatives ("PFI") assets and solar

infrastructure. As such, the Board notified shareholders of its

intention to dispose of the entire Infrastructure shares portfolio on 18

July 2017, shortly after the fifth anniversary of the Fund's closing.

Accordingly, a third party valuation was undertaken and we conducted a

marketing process for the 11 assets held in the Infrastructure Shares

Fund. After offering the assets on the open market, the sale of all

investments was achieved, realising GBP28.1 million against a cost of

GBP22.1 million and a valuation at 30 June 2017 of GBP24.8 million. Five

of the non-solar infrastructure investment assets were sold to funds

managed by Equitix Investment Management Limited. The three solar

investment assets and the remaining three non-solar infrastructure

investment assets were sold to other Foresight funds, on the basis of

the independent valuation.

On 15 December 2017, following the realisation of all the remaining

investments, the Board declared a final dividend of 93.05p per

Infrastructure Share. This was paid on the 29 December 2017, bringing

the total return per Infrastructure Share to 115.05p, after which no

value remained in the Infrastructure Shares.

Following approval of the requisite resolutions at the general meetings

and separate class meetings of the Company held on 23 January 2018 and

24 January 2018 respectively, the Board of the Company completed the

removal of the Infrastructure Shares.

DISPOSALS IN THE YEARED 31 DECEMBER 2017

Original Cost/

Take-On Value Proceeds Realised Gain/(Loss) Valuation at 31 December 2016

Company Detail (GBP) (GBP) (GBP) (GBP)

Criterion

Healthcare

Holdings Full

Limited disposal 4,005,616 5,705,000 1,699,384 4,878,473

FS Hayford Full

Farm Limited disposal 3,660,070 4,613,371 953,301 3,994,205

FS Ford Farm Full

Limited disposal 3,952,524 4,052,195 99,671 3,691,083

Drumglass

HoldCo Full

Limited disposal 2,526,475 3,064,632 538,157 3,025,435

FS Tope Full

Limited disposal 2,561,418 2,812,353 250,935 2,793,924

Stirling

Gateway HC Full

Limited disposal 2,069,978 3,322,000 1,252,022 2,244,070

Wharfedale SPV

(Holdings) Full

Limited disposal 1,314,923 1,537,278 222,355 1,395,225

Lochgilphead

HoldCo Full

Limited disposal 493,186 1,416,772 923,586 637,969

Staffordshire

HoldCo Full

Limited disposal 1,041,077 667,269 (373,808) 454,860

Sandwell

HoldCo Full

Limited disposal 282,646 619,525 336,879 216,332

Stobhill

HoldCo Full

Limited disposal 231,987 337,974 105,987 193,738

Total disposals 22,139,900 28,148,369 6,008,469 23,525,314

Russell Healey

Head of Private Equity

Foresight Group

10 April 2018

Unaudited Non-Statutory Analysis of the Share Classes

Income Statements

for the year ended 31 December 2017

Ordinary Shares Fund Planned Exit Shares Fund Infrastructure Shares Fund

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Realised

gains/(losses)

on

investments - 7,090 7,090 - (548) (548) - 6,008 6,008

Investment

holding

gains/(losses) - 4,886 4,886 - 606 606 - (1,385) (1,385)

Income 614 - 614 4 - 4 952 - 952

Investment

management

fees (654) (1,963) (2,617) (7) (22) (29) (68) (1,066)* (1,134)

Other expenses (521) - (521) (42) - (42) (636) - (636)

(Loss)/return

on ordinary

activities

before

taxation (561) 10,013 9,452 (45) 36 (9) 248 3,557 3,805

Taxation - - - - - - - - -

(Loss)/return

on ordinary

activities

after

taxation (561) 10,013 9,452 (45) 36 (9) 248 3,557 3,805

Return per

share (0.3)p 6.0p 5.7p (0.4)p 0.3p (0.1)p 0.8p 10.9p 11.7p

*Includes GBP863,000 paid performance incentive fee.

Balance Sheets

at 31 December 2017

Ordinary Planned Exit Infrastructure

Shares Fund Shares Fund Shares Fund

GBP'000 GBP'000 GBP'000

Fixed assets

Investments held at fair value

through profit or loss 77,963 - -

Current assets

Debtors 887 - -

Money market securities and other

deposits 60,482 - -

Cash 1,388 21 108

62,757 21 108

Creditors

Amounts falling due within one

year (291) (21) (108)

Net current assets 62,466 - -

Net assets 140,429 - -

Capital and reserves

Called-up share capital 1,756 114 324

Share premium account 97,687 - -

Capital redemption reserve 451 3 1

Distributable reserve 26,505 815 (4,151)

Capital reserve 1,357 (932) 3,826

Revaluation reserve 12,673 - -

Equity shareholders' funds 140,429 - -

Number of shares in issue 175,601,977 11,404,314 32,495,246

Net asset value per share 80.0p 0.0p 0.0p

Reconciliations of Movements in Shareholders' Funds

for the year ended 31 December 2017

Called-up Capital

share redemption Distributable

capital Share premium account reserve reserve Capital reserve Revaluation reserve Total

Ordinary Shares Fund GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 January 2017 1,280 96,071 431 5,247 (3,770) 7,787 107,046

Share issues in the

year 496 42,110 - - - - 42,606

Expenses in relation to

share issues* - (1,718) - - - - (1,718)

Repurchase of shares (20) - 20 (1,476) - - (1,476)

Cancellation of share

premium - (38,776) - 38,776 - - -

Realised gains on

disposal of

investments - - - - 7,090 - 7,090

Investment holding

gains - - - - - 4,886 4,886

Dividends paid - - - (15,481) - - (15,481)

Management fees charged

to capital - - - - (1,963) - (1,963)

Revenue loss for the

year - - - (561) - - (561)

As at 31 December 2017 1,756 97,687 451 26,505 1,357 12,673 140,429

*Expenses in relation to share issues include advisor fees (GBP686,000)

and promoters fees (GBP958,000) for the 2017 fund raise and trail

commission in relation to prior year fund raises (GBP74,000).

Called-up Capital

share redemption Distributable

Planned Exit capital Share premium account reserve reserve Capital reserve Revaluation reserve Total

Shares Fund GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 January

2017 114 2,095 3 1,705 (362) (606) 2,949

Trail

commission in

relation to

prior year

share issues - (8) - - - - (8)

Cancellation of

share premium - (2,087) - 2,087 - - -

Realised losses

on disposal of

investments - - - - (548) - (548)

Investment

holding gains - - - - - 606 606

Dividends paid - - - (2,932) - - (2,932)

Management fees

charged to

capital - - - - (22) - (22)

Revenue loss

for the year - - - (45) - - (45)

As at 31

December 2017 114 - 3 815 (932) - -

Called-up Share Capital

share premium redemption Distributable Capital Revaluation

capital account reserve reserve reserve reserve Total

Infrastructure

Shares Fund GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 January

2017 324 14,375 1 11,591 (1,116) 1,385 26,560

Trail

commission in

relation to

prior year

share issues - (33) - (95) - - (128)

Cancellation of

share premium - (14,342) - 14,342 - - -

Realised gains

on disposal of

investments - - - - 6,008 - 6,008

Investment

holding

losses - - - - - (1,385) (1,385)

Dividends paid - - - (30,237) - - (30,237)

Management fees

charged to

capital - - - - (1,066) - (1,066)

Revenue return

for the year - - - 248 - - 248

As at 31

December 2017 324 - 1 (4,151) 3,826 - -

Audited Income Statement

for the year ended 31 December 2017

Year ended Year ended

31 December 2017 31 December 2016

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Realised gains/(losses)

on investments - 12,550 12,550 - (3,262) (3,262)

Investment holding

gains - 4,107 4,107 - 8,279 8,279

Income 1,570 - 1,570 2,916 - 2,916

Investment management

fees (729) (3,051)* (3,780) (534) (1,601) (2,135)

Other expenses (1,199) - (1,199) (596) - (596)

(Loss)/return on

ordinary activities

before taxation (358) 13,606 13,248 1,786 3,416 5,202

Taxation - - - (220) 220 -

(Loss)/return on

ordinary activities

after taxation (358) 13,606 13,248 1,566 3,636 5,202

(Loss)/return per

share:

Ordinary Share (0.3)p 6.0p 5.7p 0.4p 2.8p 3.2p

Planned Exit Share (0.4)p 0.3p (0.1)p 0.3p 2.9p 3.2p

Infrastructure Share 0.8p 10.9p 11.7p 3.4p 0.9p 4.3p

*Includes GBP863,000 paid performance incentive fee relating to the

Infrastructure Shares Fund.

The total column of this statement is the profit and loss account of the

Company and the revenue and capital columns represent supplementary

information.

All revenue and capital items in the above Income Statement are derived

from continuing operations. No operations were acquired or discontinued

in the year.

The Company has no recognised gains or losses other than those shown

above, therefore no separate statement of total comprehensive income has

been presented.

Audited Reconciliation of Movements in Shareholders' Funds

Capital

Year ended 31 Called-up redemption Distributable

December share capital Share premium account reserve reserve Capital reserve Revaluation reserve Total

2017 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1

January

2017 1,718 112,541 435 18,543 (5,248) 8,566 136,555

Share issues

in the year 496 42,110 - - - - 42,606

Expenses in

relation to

share

issues* - (1,759) - (95) - - (1,854)

Repurchase of

shares (20) - 20 (1,476) - - (1,476)

Cancellation

of share

premium - (55,205) - 55,205 - - -

Realised

gains on

disposal of

investments - - - - 12,550 - 12,550

Investment

holding

gains - - - - - 4,107 4,107

Dividends

paid - - - (48,650) - - (48,650)

Management

fees charged

to capital - - - - (3,051) - (3,051)

Revenue loss

for the

year - - - (358) - - (358)

As at 31

December

2017 2,194 97,687 455 23,169** 4,251** 12,673 140,429

* Expenses in relation to share issues include advisor

fees (GBP686,000) and promoters fees (GBP958,000)

for the 2017 Ordinary Shares Fund raise and trail

commission in relation to prior year fund raises (GBP115,000).

** Total distributable reserves at 31 December 2017

total GBP27,420,000 (2016: GBP13,295,000).

Capital

Year ended 31 Called-up redemption Distributable

December share capital Share premium account reserve reserve Capital reserve Revaluation reserve Total

2016 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1

January

2016 1,305 77,016 421 31,654 (605) 287 110,078

Share issues

in the year 427 37,312 - - - - 37,739

Expenses in

relation to

share

issues - (1,787) - - - - (1,787)

Repurchase of

shares (14) - 14 (991) - - (991)

Realised

losses on

disposal of

investments - - - - (3,262) - (3,262)

Investment

holding

gains - - - - - 8,279 8,279

Dividends - - - (13,686) - - (13,686)

Management

fees charged

to capital - - - - (1,601) - (1,601)

Tax credited

to capital - - - - 220 - 220

Revenue

return for

the year - - - 1,566 - - 1,566

As at 31

December

2016 1,718 112,541 435 18,543 (5,248) 8,566 136,555

Audited Balance Sheet

at 31 December 2017

Registered Number: 03421340

As at As at

31 December 31 December

2017 2016

GBP'000 GBP'000

Fixed assets

Investments held at fair value through profit or loss 77,963 92,217

Current assets

Debtors 887 2,193

Money market securities and other deposits 60,482 30,976

Cash 1,517 11,361

62,886 44,530

Creditors

Amounts falling due within one year (420) (192)

Net current assets 62,466 44,338

Net assets 140,429 136,555

Capital and reserves

Called-up share capital 2,194 1,718

Share premium account 97,687 112,541

Capital redemption reserve 455 435

Distributable reserve 23,169 18,543

Capital reserve 4,251 (5,248)

Revaluation reserve 12,673 8,566

Equity Shareholders' funds 140,429 136,555

Net asset value per share:

Ordinary Share 80.0p 83.6p

Planned Exit Share 0.0p 25.9p

Infrastructure Share 0.0p 81.7p

The financial statements on pages 56 to 77 of the Annual Report and

Accounts were approved by the Board of Directors and authorised for

issue on 10 April 2018 and were signed on its behalf by:

John Gregory

Chairman

Audited Cash Flow Statement

for the year ended 31 December 2017

Year Year

ended ended

31 December 31 December

2017 2016

GBP'000 GBP'000

Cash flow from operating activities

Investment income received 2,457 2,768

Deposit and similar interest received 113 98

Investment management fees paid (3,797) (2,118)

Secretarial fees paid (113) (110)

Other cash payments (902) (848)

Net cash outflow from operating activities (2,242) (210)

Returns on investing activities

Purchase of investments (17,869) (4,877)

Net proceeds on sale of investments 48,394 9,287

Net proceeds on deferred consideration 561 64

Return of cash held on behalf of investee companies - (548)

Net cash inflow from investing activities 31,086 3,926

Financing

Proceeds of fund raising 39,384 36,028

Expenses of fund raising (1,247) (886)

Repurchase of own shares (1,336) (1,329)

Equity dividends paid (45,983) (12,961)

Movement in money market funds (29,506) (16,088)

Net cash (outflow)/inflow from financing activities (38,688) 4,764

Net (outflow)/inflow of cash in the year (9,844) 8,480

Reconciliation of net cash flow to movement in net

funds

(Decrease)/increase in cash and cash equivalents for

the year (9,844) 8,480

Net cash and cash equivalents at start of year 11,361 2,881

Net cash and cash equivalents at end of year 1,517 11,361

Analysis of changes in net

debt At 1 January 2017 Cashflow At 31 December 2017

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 11,361 (9,844) 1,517

Notes

1. These are not statutory accounts in accordance with S436 of the

Companies Act 2006. The full audited accounts for the year ended 31

December 2017, which were unqualified and did not contain statements

under S498(2) of the Companies Act 2006 or S498(3) of the Companies Act

2006, will be lodged with the Registrar of Companies. Statutory accounts

for the year ended 31 December 2017 including an unqualified audit

report and containing no statements under the Companies Act 2006 will be

delivered to the Registrar of Companies in due course.

2. The audited Annual Financial Report has been prepared on the basis of

accounting policies set out in the statutory accounts of the Company for

the year ended 31 December 2017. All investments held by the Company are

classified as 'fair value through the profit and loss'. Unquoted

investments have been valued in accordance with IPEVC guidelines. Quoted

investments are stated at bid prices in accordance with the IPEVC

guidelines and Generally Accepted Accounting Practice.

3. Copies of the Annual Report will be sent to shareholders and will be

available for inspection at the Registered Office of the Company at The

Shard, 32 London Bridge Street, London, SE1 9SG and can be accessed on

the following website: www.foresightgroup.eu.

4.

Net asset value per share

The net asset value per share is based on net assets at the end of the

year and on the number of shares in issue at that date.

31 December 2017 31 December 2016

Ordinary Planned Infrastructure Ordinary Planned Infrastructure

Shares Exit Shares Shares Shares Exit Shares Shares

Fund Fund Fund Fund Fund Fund

Net

assets GBP140,429,000 GBPnil GBPnil GBP107,046,000 GBP2,949,000 GBP26,560,000

No. of

shares

at year

end 175,601,977 11,404,314 32,495,246 127,985,288 11,404,314 32,495,246

Net asset 80.0p 0.0p 0.0p 83.6p 25.9p 81.7p

value

per

share

5. Return per share

Year ended 31 December 2017 Year ended 31 December 2016

Planned

Ordinary Planned Infrastructure Ordinary Exit Infrastructure

Share Exit Share Share Share Share Share

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total return after taxation 9,452 (9) 3,805 3,442 367 1,393

Total return per share (note a) 5.7p (0.1)p 11.7p 3.2p 3.2p 4.3p

Revenue return from ordinary activities after

taxation (561) (45) 248 423 32 1,111

Revenue return per share (note b) (0.3)p (0.4)p 0.8p 0.4p 0.3p 3.4p

Capital return from ordinary shares after taxation 10,013 36 3,557 3,019 335 282

Capital return per share (note c) 6.0p 0.3p 10.9p 2.8p 2.9p 0.9p

Weighted average number of shares in issue in the

year 165,748,167 11,404,314 32,495,246 109,561,757 11,488,663 32,502,653

Notes:

a) Total return per share is total return after taxation divided by the

weighted average number of shares in issue during the year.

b) Revenue return per share is revenue return after taxation divided by

the weighted average number of shares in issue during the year.

c) Capital return per share is capital return after taxation divided by

the weighted average number of shares in issue during the year.

6. Annual General Meeting

The Annual General Meeting will be held at 2.00pm on 22 May 2018 at the

offices of Foresight Group LLP, The Shard, 32 London Bridge Street,

London, SE1 9SG.

7. Income

Year ended Year ended

31 December 31 December

2017 2016

GBP'000 GBP'000

Loan stock interest 820 2,133

Dividends receivable 637 685

Overseas based Open Ended Investments Companies ("OEICs") 113 98

1,570 2,916

8. Investments

2017 2016

Company GBP'000 GBP'000

Quoted investments - 54

Unquoted investments 77,963 92,163

77,963 92,217

Quoted Unquoted Total

Company GBP'000 GBP'000 GBP'000

Book cost as at 1 January 2017 40 84,373 84,413

Investment holding gains 14 7,790 7,804

Valuation at 1 January 2017 54 92,163 92,217

Movements in the year:

Purchases at cost - 17,869 17,869

Disposal proceeds (57) (48,337) (48,394)

Realised gains* 17 11,706 11,723

Investment holding (losses)/gains* (14) 4,562 4,548

Valuation at 31 December 2017 - 77,963 77,963

Book cost at 31 December 2017 - 65,611 65,611

Investment holding gains - 12,352 12,352

Valuation at 31 December 2017 - 77,963 77,963

*Refer to Ordinary Shares Fund and Planned Exit Shares

Fund footnotes for detail.

Quoted Unquoted Total

Ordinary Shares Fund GBP'000 GBP'000 GBP'000

Book cost as at 1 January 2017 40 58,837 58,877

Investment holding gains 14 7,260 7,274

Valuation at 1 January 2017 54 66,097 66,151

Movements in the year:

Purchases at cost - 17,869 17,869

Disposal proceeds (57) (17,664) (17,721)

Realised gains* 17 6,569 6,586

Investment holding (losses)/gains** (14) 5,092 5,078

Valuation at 31 December 2017 - 77,963 77,963

Book cost at 31 December 2017 - 65,611 65,611

Investment holding gains - 12,352 12,352

Valuation at 31 December 2017 - 77,963 77,963

*Deferred consideration of GBP504,000 was received by the Ordinary

Shares fund in the year and is included within realised gains in the

income statement.

** The above receipt was offset by a decrease in the deferred

consideration debtor of GBP450,000. A further GBP258,000 of deferred

consideration was recognised in the year and is included in investment

holding gains in the income statement.

Quoted Unquoted Total

Planned Exit Shares Fund GBP'000 GBP'000 GBP'000

Book cost as at 1 January 2017 - 3,396 3,396

Investment holding losses - (855) (855)

Valuation at 1 January 2017 - 2,541 2,541

Movements in the year:

Disposal proceeds - (2,525) (2,525)

Realised losses* - (871) (871)

Investment holding gains** - 855 855

Valuation at 31 December 2017 - - -

Book cost at 31 December 2017 - - -

Investment holding gains - - -

Valuation at 31 December 2017 - - -

*Deferred consideration of GBP323,000 was received by the Planned Exit

Shares fund in the year and is included within realised losses in the

income statement.

** The above receipt was offset by a decrease in the deferred

consideration debtor of GBP249,000.

Quoted Unquoted Total

Infrastructure Shares Fund GBP'000 GBP'000 GBP'000

Book cost as at 1 January 2017 - 22,140 22,140

Investment holding gains - 1,385 1,385

Valuation at 1 January 2017 - 23,525 23,525

Movements in the year:

Disposal proceeds - (28,148) (28,148)

Realised gains - 6,008 6,008

Investment holding losses - (1,385) (1,385)

Valuation at 31 December 2017 - - -

Book cost at 31 December 2017 - - -

Investment holding gains - - -

Valuation at 31 December 2017 - - -

9. Related party transactions

No Director has an interest in any contract to which the Company is a

party.

10. Transactions with the manager

Foresight Group CI Limited, which acts as manager to the Company in

respect of its investments, earned fees of GBP3,780,000 (including an

GBP863,000 performance incentive fee) during the year (2016:

GBP2,135,000).

Foresight Fund Managers Limited, Company Secretary until November 2017,

received fees of GBP113,000 (2016: GBP110,000) during the year.

At the balance sheet date there was GBPnil (2016: GBP17,000) due to

Foresight Group CI Limited and GBPnil (2016: GBPnil) due to Foresight

Fund Managers Limited. No amounts have been written off in the year in

respect of debts due to or from the related parties.

END

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Foresight VCT PLC via Globenewswire

http://www.foresightgroup.eu/

(END) Dow Jones Newswires

April 10, 2018 11:38 ET (15:38 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

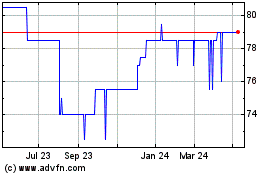

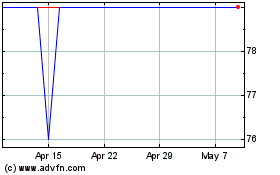

Foresight Vct (LSE:FTV)

Historical Stock Chart

From Apr 2024 to May 2024

Foresight Vct (LSE:FTV)

Historical Stock Chart

From May 2023 to May 2024