TIDMGRP

RNS Number : 8210Y

Greencoat Renewables PLC

14 September 2020

Greencoat Renewables PLC

Interim Results to 30 June 2020

Dublin, London | 14 September 2020: Greencoat Renewables PLC

("Greencoat Renewables" or the "Company"), the renewable

infrastructure company invested in euro-dominated assets, is

pleased to announce its Interim Results for the six month period

ended 30 June 2020.

Highlights

-- Portfolio generation was on budget at 688GWh, with asset availability also on budget.

-- Power price capture was in line with expectations, with the

highly contracted nature of the Group's revenues unaffected by

price movements seen elsewhere in the sector.

-- Net cash generation (Group and wind farm SPVs) was EUR40

million (gross of SPV level debt repayment), resulting in a gross

dividend cover for the period of 2.1x.

-- Successful entry into continental Europe with acquisition of

51.9MW French portfolio of wind farms at Pasilly, Sommette and

Saint Martin. In addition, the Group continued its consolidation of

the Irish wind market with acquisition of Letteragh wind farm. GAV

grew to EUR1,139 million at 30 June 2020.

-- Post-period acquisition of a 50 per cent investment in

Carrickallen wind farm increasing the portfolio to 20 wind farms

and net generating capacity to 538MW at 11 September 2020.

-- The Company declared total dividends of 3.03 cent per share with respect to the period.

-- EUR494.5 million as Aggregate Group Debt at 30 June 2020, equivalent to 43 per cent. of GAV.

Commenting on today's results, Ronan Murphy, Non-Executive

Chairman of Greencoat Renewables, said:

"I am pleased to announce another strong six months of

performance for Greencoat Renewables. Given the circumstances, I

and the Board also feel fortunate that our company has been able to

continue operating relatively unaffected, where many others have

not.

In the first six months of the year, we have continued to grow

the portfolio with ongoing consolidation in Ireland and our first

acquisitions on the continent - a source of significant opportunity

for the company. We have also delivered strong operational

performance and robust dividend cover in keeping with the company's

strategy. The outlook for the business remains positive with a

strong pipeline for further growth both in Ireland and Northern

Europe.

Lastly, I am proud of the work done to support our staff,

contractors, and local communities through the challenges of the

past few months, whilst continuing to supply the grid and wider

society with clean electricity."

Key Metrics

As at 30 June 2020:

Market Capitalisation EUR763.0 million

Share price 121.0 cent

Dividends with respect to the period EUR19.1 million

Dividends with respect to the period 3.03 cent

per share

GAV EUR1,138.7 million

NAV EUR644.3 million

NAV per share 102.2 cent

Details of the conference call for analysts and investors:

A conference call for analysts and investors will be held at

10.00 am BST today, 14 September 2020. To register for the call

please contact FTI Consulting by email at

greencoat@fticonsulting.com .

Presentation materials will be posted on the Company's website,

www.greencoat-renewables.com from 7.00 am.

---S ---

For further details contact:

Greencoat Capital LLP (Investment Manager)

Bertrand Gautier

Paul O'Donnell

Tom Rayner +44 20 7832 9400

FTI Consulting (Investor Relations & Media)

Jonathan Neilan +353 1 765 0886

Melanie Farrell greencoat@fticonsulting.com

Davy (Broker, NOMAD and Euronext Growth Adviser)

Fergal Meegan

Barry Murphy

Ronan Veale +353 1 679 6363

RBC Capital Markets (Joint Broker)

Matthew Coakes

Jonathan Hardy

Elizabeth Evans +44 20 7653 4000

About Greencoat Renewables PLC

Greencoat Renewables PLC is an investor in euro-denominated

renewable energy infrastructure assets. Initially focused solely on

the acquisition and management of operating wind farms in Ireland,

the Company is now also investing in wind and solar assets in

certain other Northern European countries with stable and robust

renewable energy frameworks. It is managed by Greencoat Capital

LLP, an experienced investment manager in the listed renewable

energy infrastructure sector.

At a Glance

Summary

Greencoat Renewables PLC is a sector-focused listed renewable

infrastructure company, investing in renewable electricity

generation assets. The Company's aim is to provide investors with

an annual dividend that increases progressively whilst growing the

capital value of its investment portfolio in the long term through

reinvestment of excess cash flow and the prudent use of portfolio

leverage.

Chairman's Statement

I am pleased to present the Interim Report of Greencoat

Renewables PLC for the six months ended 30 June 2020 .

In a very challenging period for the economy and society as a

whole, we are fortunate to invest and operate in a sector that is

largely insulated from the many challenges seen elsewhere. As a

management team we have been striving to ensure the safety of

staff, within our business but also those of our service providers,

to support the local communities in which we operate, and to

continue providing renewably-generated electricity to the grid.

It is now three years since the Company listed, and the Group

has become one of the largest owners of onshore wind assets in

Ireland while also successfully positioning itself to take

advantage of the increasing market of secondary opportunities in

Ireland and northern Europe. We have achieved this goal, while

continuing to deliver target returns to investors, and annually

displacing c.260,000 of tonnes of carbon emissions.

Performance

Portfolio generation and availability were both on budget for

the first half of the year resulting in 688GWh of generation. Net

cash generation from the Group and wind farm SPVs was EUR40.0

million(1) resulting in strong dividend cover for the period of

2.1x(1) .

Wind speeds were high in the first half of the year for the

Irish portfolio, however there was a higher than expected level of

uncompensated grid curtailment mostly due to lower electricity

demand as a result of the COVID-19 pandemic.

Dividend

In line with our policy of increasing the Company's annual

dividend between 0 and CPI, the target dividend for 2020 was set at

6.06 cent per share. The Company paid a quarterly dividend of 1.515

cent per share with respect to Q1 2020 and paid a dividend of the

same amount with respect to Q2 2020, giving a total of 3.03 cent

per share for the period. The Company also declared a quarterly

dividend of 1.515 cent per share with respect to Q2 2020, which was

paid on 28 August 2020.

NAV per share decreased slightly in the period from 101.6 cent

per share (ex-dividend) on 31 December 2019 to 100.7 cent per share

(ex-dividend) on 30 June 2020, primarily due to lower short-term

inflation and higher short-term curtailment assumptions.

Acquisitions

The past 3 years have seen a period of sustained growth and net

generating capacity stood at 528MW at 30 June 2020, with added

geographical diversification through the Group's first investment

into northern Europe, acquiring 3 French wind farms in June.

(1) Net cash generation and dividend cover are shown gross of

SPV level debt repayments. Net cash generation was EUR34.8 million

and dividend cover was 1.8x net of SPV level debt repayment.

During the period, the Group acquired the 14.1MW Letteragh wind

farm in County Clare, Ireland, which receives revenue contracted

under the REFIT 2 scheme.

The Group also made a 50 per cent investment in the 20.5MW

Carrickallen wind farm in County Cavan in July 2020, which further

demonstrates the Group's continued and growing presence in the

Irish secondary market.

Gearing

At the start of the period, Group and SPV borrowings amounted to

EUR366.9 million (36 per cent of GAV). Following the acquisitions

made in the period, Group and SPV borrowings amounted to EUR494.5

million equating to 43 per cent of GAV as at 30 June 2020, with

average gearing at 40 per cent during the period.

Following completion of the 50 per cent investment in

Carrickallen, Group gearing was 44 per cent of GAV.

The Company's policy is to keep overall borrowings at a prudent

level (limited to 60 per cent of GAV) in order to reduce risk,

while ensuring that the Group is always at least fully invested,

thus ensuring efficient use of shareholders' capital.

Principal Risks and Uncertainties

As detailed in the Company's Annual Report for the year ended 31

December 2019, the principal risks and uncertainties affecting the

Group are unchanged:

-- dependence on the Investment Manager;

-- regulatory and Brexit risk;

-- financing risk; and

-- risk of investment returns becoming unattractive.

Also, as detailed in the Company's Annual Report for the year to

31 December 2019, the principal risks and uncertainties affecting

the investee companies are as follows:

-- changes in government policy on renewable energy;

-- a decline in the market price of electricity after the period of contracted subsidy;

-- risk of low wind resource;

-- lower than expected lifespan of the wind turbines;

-- risk of market structure change; and

-- health and safety and the environment.

During the period, an additional principal risk was identified

in relation to the ongoing COVID-19 pandemic. Electricity demand

has reduced, and curtailment has noticeably increased in Ireland as

a consequence. Wind farm availability has not been significantly

affected nor has turbine operations and maintenance, which

continues with appropriate social distancing and diligent use of

personal protective equipment where major component changes have

been necessary and social distancing has not been possible. Further

detail regarding COVID-19 and its impact on the Group is included

within the going concern section of Note 1 to the financial

statements.

The principal risks outlined above remain the most likely to

affect the Group and its investee companies in the second half of

the year.

Outlook

Due to the contracted nature of the portfolio's revenue under

the respective Irish and French subsidy schemes, there is no

material exposure to the current low market power prices and

dividend cover is expected to remain robust for the rest of the

year, despite the difficulties presented by the COVID-19

pandemic.

The Board continues to view Ireland as a very attractive market

for further investment, and believes the Company is very well

placed to continue its aggregation strategy and deliver value for

its shareholders.

Following the recent first successful auction, we expect the

Group to target investments in RESS assets, both in wind and solar

PV. Given the emergence of a growing pool of solar assets in

Ireland, the Group intends to seek approval at The Company's next

General Meeting to include Irish solar as part of the Company's

investment policy.

The Group also recently completed its first successful

investment outside of Ireland. With an attractive emerging pipeline

in the Nordic region, the Company also amended its investment

policy to add Denmark, Norway and Sweden to the list of

jurisdictions the Group can invest in, approved by way of

shareholder resolution at the Company's AGM in April.

The Board continues to be supportive of value-accretive growth

through further investments, and believes such growth will be in

the shareholders' interest, as it:

-- provides additional economies of scale at Group level;

-- supports diversification of both geographic and technological exposure;

-- increases market power with service providers and asset sellers; and

-- increases liquidity in our shares.

The Board remains confident in the Company's outlook for the

future, and in the disciplined approach of the Investment Manager

to future investment opportunities and the continued effective

management of the Group's growing portfolio.

ESG

Sustainability is central to all activities the Group undertakes

and we recognise that investing responsibly is critical to our

performance and growth over the longer term. Given the nature of

our business, our most significant impact is the displacement of

carbon emissions and we are extremely proud to generate sufficient

carbon-free electricity to power 357,000 homes.

During the COVID-19 pandemic, we have taken all possible steps

to support and protect employees, contractors and all affected

stakeholders. We are fortunate that the nature of our work has

allowed wind farm operations to continue uninterrupted, albeit with

some alterations to our maintenance programme and optimisation

initiatives to abide by government safety guidance.

From the outset of the pandemic, I am pleased that we were able

to accelerate the release of funds from our Community Support

Programme and have managed to prioritise initiatives that are

actively aiding local communities surrounding our wind farms that

have been adversely impacted by COVID-19.

The Board and Governance

Following the advice of the government on social distancing,

travel and measures to prohibit public gathering in order to

minimise the spread of COVID-19, the Company decided to change the

location of its AGM and hold it with the minimum necessary quorum

of two shareholders present. A recording of the AGM was made and is

available for shareholders on the Company's website

(www.greencoat-renewables.com).

Conclusion

In conclusion, the Board is very pleased with the continued

progress that the Company has made in the first half of 2020 and is

reassured by its future growth prospects.

Rónán Murphy

Chairman

13 September 2020

Investment Manager's Report

Information about Investment Manager

The Investment Manager is responsible for the day-to-day

management of the Company's investment portfolio in accordance with

the Company's investment objective and policy, subject to the

overall supervision of the Board.

The Investment Manager is an experienced manager of renewable

infrastructure assets and is authorised and regulated by the

Financial Conduct Authority in the UK.

Investment Portfolio

The Group's investment portfolio as at 30 June 2020 consisted of

SPVs which hold the following underlying operating wind farms:

Wind Farm Country Turbines Operator PPA Total Ownership Net

MW Stake MW

Republic

Ballybane of Ireland Enercon EnergyPro Energia 48.3 100% 48.3

Republic

Beam Hill of Ireland Vestas EnergyPro Erova 14.0 100% 14.0

Republic

Cloosh Valley of Ireland Siemens SSE SSE 108.0 75% 81.0

Republic

Garranereagh of Ireland Enercon Statkraft Bord Gáis 9.2 100% 9.2

Republic Supplier

Glanaruddery of Ireland Vestas EnergyPro Lite 36.3 100% 36.3

Republic

Gortahile of Ireland Nordex Statkraft Energia 20.0 100% 20.0

Republic

Killala of Ireland Siemens EnergyPro Electroroute 17.0 100% 17.0

Republic

Killhills of Ireland Enercon SSE Brookfield 36.8 100% 36.8

Republic

Knockacummer of Ireland Nordex SSE Brookfield 100.0 100% 100.0

Republic Naturgy

Knocknalour of Ireland Enercon Statkraft / Energia 9.2 100% 9.2

Republic

Letteragh of Ireland Enercon Statkraft SSE 14.1 100% 14.1

Republic

Lisdowney of Ireland Enercon EnergyPro Naturgy 9.2 100% 9.2

Republic

Monaincha of Ireland Nordex Statkraft Bord Gáis 36.0 100% 36.0

Pasilly France Gamesa Greensolver EDF 20.0 100% 20.0

Republic

Raheenleagh of Ireland Siemens ESB ESB 35.2 50% 17.6

Republic Supplier

Sliabh Bawn of Ireland Siemens Wind Prospect Lite 64.0 25% 16.0

Sommette France Nordex Greensolver EDF 21.6 100% 21.6

Saint Martin France Senvion Greensolver EDF 10.3 100% 10.3

Tullynamoyle Republic

II of Ireland Enercon Statkraft Bord Gáis 11.5 100% 11.5

--------------- ------------- ---------- --------------- ---------------- ------ ---------- ------

Total 528.1

----------------------------------------------------------------------------- ------ ---------- ------

Portfolio Performance

Portfolio generation for the six months ended 30 June 2020 was

on budget at 688GWh. Wind resource was above budget and

availability was in line with expectations, however significant

levels of curtailment across the portfolio were experienced during

the period, which had an adverse impact on generation. Had

curtailment been in line with budget, portfolio generation would

have exceeded budget by c.10 per cent.

The Irish portfolio experienced high levels of curtailment

during the period through a combination of high wind speeds, and a

decrease in electricity demand as a result of the COVID-19

pandemic. Scheduled maintenance and upgrade works to the

transmission network were also postponed due to the transformer

failure at Moneypoint. These rescheduled works are commencing at

present and are expected to cause further grid disruptions until

2022, when curtailment is expected to revert back to our long-term

forecast.

The Investment Manager has been actively involved in the

industry consultation on the EU Clean Energy Package with a view to

achieving compensation for curtailed volumes for renewable

generators in Ireland.

Notable issues and asset management activities during the period

were:

-- low availability at Lisdowney due to lightning striking a

turbine in March, which required a turbine blade to be replaced.

The turbine returned to full operation in May and it is expected

that the repair cost and lost revenue will be claimed through

insurance;

-- an asset management services tender process was initiated

during the period and framework management services agreements were

agreed for 8 SPVs achieving cost savings through increased

economies of scale;

-- specific response funds were made available to local

communities surrounding some wind farms following the COVID-19

outbreak. For example, at Glanaruddery, these funds were used to

purchase a van to make food deliveries to locals, who were

self-isolating and unable to leave their homes.

Changes to work procedures and certain work restrictions were

applied across the portfolio, following government guidelines in

response to the COVID-19 pandemic. Some maintenance works were

delayed as a result, however, portfolio performance was not

materially impacted.

An Bord Pleanála has recently determined that the underground

grid connection in respect of Raheenleagh wind farm and

Knockacummer wind farm constitutes development which is not

exempted development. Such determinations have been made in respect

of a number of wind farms over the last few years. As was common in

the industry at the time the wind farm was constructed, planning

permission was not obtained for the grid connection, albeit

declarations were obtained from either the local County Council or

An Bord Pleanála to confirm that planning permission was not

required. The recent determinations of An Bord Pleanála is

therefore at odds with those pre-existing declarations. There are a

number of routes open to regularise the planning status of the grid

connection and the Company is considering currently how best to do

so.

Health and safety

Health and safety is of paramount importance to both the Company

and the Investment Manager. The Investment Manager also has its own

health and safety forum where best practices are discussed and key

learnings from incidents from across the industry are shared.

There were no major incidents in the period ended 30 June 2020.

Independent health and safety audits are planned for the second

half of the year covering sites not previously audited.

Acquisitions

In February 2020, the Group acquired the 14.1MW Letteragh wind

farm in County Clare, Ireland, for EUR34 million (excluding

acquired cash, including acquisition costs).

In June 2020, the Group completed its acquisition of a portfolio

of 3 operating wind farms in France for an enterprise value of

EUR95 million. The portfolio consisted of the 20.0MW Pasilly wind

farm in the Burgundy region, the 21.6MW Sommette wind farm in the

Picardy region and the 10.3MW Saint Martin wind farm in the

Saint-Martin-l'Ars region. The Group retained EUR66.9 million of

project level debt as part of the acquisition.

These assets benefit from 100 per cent of their revenue being

contracted under the French FIT scheme until 2033 and are the

Group's first investment outside of Ireland.

In July 2020, the Group made a 50 per cent investment in the

20.5MW Carrickallen wind farm for EUR21 million. The wind farm is

located in County Cavan, Ireland and benefits from revenues

contracted under the REFIT 2 scheme.

Financial Performance

Dividend cover for the six months ended 30 June 2020 was 1.8x

net and 2.1x gross of project level debt repayment.

Cash balances (Group and wind farm SPVs) increased by EUR6.9

million to EUR41.5 million.

Group and wind farm SPV cash flows For the six months ended

30 June 2020

Net (1) Gross (1)

EUR 000 EUR 000

Net cash generation (1) 34,760 40,026

Dividends paid (19,060) (19,060)

Project Capex & PSO Cashflow (2) (11,137) (11,137)

Project level debt repayment - (5,266)

Acquisitions (3) (58,626) (58,626)

Acquisition costs (835) (835)

Equity issuance - -

Equity issuance costs (142) (142)

Net drawdown under debt facilities 66,000 66,000

Upfront finance costs (4,033) (4,033)

Movement in cash (Group and wind farm SPVs) 6,927 6,927

Opening cash balance (Group and wind farm SPVs) 34,547 34,547

Ending cash balance (Group and wind farm SPVs) 41,474 41,474

Net cash generation (1) 34,760 40,026

Dividends 19,060 19,060

Dividend cover 1.8x 2.1x

(1) The dividend cover tables above are shown as two scenarios:

the first reflects cash generation net of the Group's share of

project level debt repayment at Cloosh Valley, Raheenleagh and

Sliabh Bawn (EUR5,266k), and the second shows the net cash

generation gross of these SPV level debt repayments.

(2) Cashflows reflect residual capital expenditure from acquired

SPVs (covered by the vendor of the SPVs) plus REFIT working capital

movements with the PSO relating to wind farm SPVs.

(3) Acquisition consideration is net of the acquired SPV cash of

EUR7,852k.

For the six months ended

Net Cash Generation - Breakdown 30 June 2020

Net Gross

EUR'000 EUR'000

Revenue 66,279 66,279

Operating expenses (17,892) (17,892)

Tax / VAT 481 481

--------------------------------- ------------- ------------

Wind farm operating cashflow 48,868 48,868

Project level debt interest (2,891) (2,891)

Project level debt repayment (5,266) -

--------------------------------- ------------- ------------

Wind farm cashflow 40,711 45,977

Management fee (3,029) (3,029)

Operating expenses (901) (901)

Ongoing finance costs (1,819) (1,819)

VAT (202) (202)

--------------------------------- ------------- ------------

Group cashflow (5,951) (5,951)

Net cash generation 34,760 40,026

--------------------------------- ------------- ------------

For the six months ended

Net Cash Generation - Reconciliation to Net Cash Flows from Operating Activities 30 June 2020

Net Gross

EUR'000 EUR'000

Net cash flows from operating activities (1) 10,108 10,108

Movement in cash balances of wind farm SPVs (2) (3,367) (3,367)

SPV capex and PSO cashflow (3) 11,108 11,108

Repayment of debt at SPV level (2) - 5,266

Repayment of shareholder loan investment (1) 18,704 18,704

Finance costs (1) (5,854) (5,854)

Upfront finance costs (cash) (4) 4,061 4,061

---------------------------------------------------------------------------------- ------------- ------------

Net cash generation 34,760 40,026

---------------------------------------------------------------------------------- ------------- ------------

(1) Condensed Consolidated Statement of Cash Flows

(2) Note 8 to the Financial Statements

(3) EUR11,137k cashflows reflect residual capital expenditure

from acquired SPVs and REFIT working capital movements with the PSO

relating to wind farm SPVs less EUR29k SPV working capital

(4) EUR238k facility arrangement fees plus EUR1,164k

professional fees (note 12 to the Financial Statements) plus

EUR2,659k capitalised loan costs being the difference between the

EUR272,000k drawn revolving credit facility at 30 June 2020, and

EUR269,341k of Group loans and borrowings (note 12 to the Financial

Statements).

The decrease in portfolio valuation of EUR10.9 million is

predominately due to portfolio depreciation and adjustments to

short term inflation.

A dividend of EUR9.5 million (1.5075 cent per share) was paid in

February 2020 with respect to the quarter ended 31 December 2019. A

dividend of EUR9.6m (1.515 cent per share) was paid in May 2020

with respect to the quarter ended 31 March 2020.

A further dividend of EUR9.5m (1.515 cent per share) was paid on

the 28 August 2020 with respect to the quarter ended 30 June

2020.

The share price at 30 June 2020 was 121.0 cent, representing an

18.4 per cent. premium to NAV.

cent per share

NAV at 31 December 2019 103.1

Less February 2020 dividend (1.5)

NAV at 31 December 2019 (ex dividend) 101.6

NAV at 30 June 2020 102.2

Less August 2020 dividend (1.5)

NAV at 30 June 2020 (ex dividend) 100.7

Movement in NAV (ex dividend) (0.9)

Reconciliation of Statutory Net Assets to Reported NAV

As at As at

30 June 2020 31 December 2019

EUR'000 EUR'000

DCF valuation 1,080,249 982,411

Other relevant assets (wind farm SPVs) 17,941 111

Cash (wind farm SPVs) 33,011 28,527

---------------------------------------- -------------- ------------------

Fair value of investments (1) 1,131,201 1,011,049

Cash (Group) 8,463 6,020

Other relevant liabilities (952) (127)

---------------------------------------- -------------- ------------------

GAV 1,138,712 1,016,942

Aggregate Group Debt (2) (494,451) (366,942)

---------------------------------------- -------------- ------------------

NAV 644,261 650,000

Reconciling items - -

---------------------------------------- -------------- ------------------

Statutory net assets 644,261 650,000

Shares in issue 630,619,469 630,619,469

NAV per share (cent) 102.2 103.1

---------------------------------------- -------------- ------------------

(1) The fair value of investments are shown gross of EUR222,451k

debt and swap fair values held at wind farm SPV level that are not

included in the equivalent figure in the Consolidated Statement of

Financial Position.

(2) Aggregate Group debt reflects EUR272,000k of amounts drawn

under the Group's revolving credit facility, gross of EUR2,659k

capitalised finance costs. It also includes EUR222,451k of debt and

swap fair values held at wind farm SPV level that are not included

in the equivalent figure in the Consolidated Statement of Financial

Position.

Gearing

As at 30 June 2020, the Group had EUR494.5 million of debt

outstanding, equating to 43 per cent of GAV. This debt outstanding

comprised EUR272.0 million of amounts drawn under the Group's

revolving credit facility as well the EUR222.5 million of the

Group's proportionate share of asset level, long-term project

finance debt (including the fair value of associated interest rate

swaps).

In July 2020, the Group drew a further EUR21 million from its

revolving credit facility to acquire a 50 per cent interest in

Carrickallen, leaving Group gearing at 44 per cent of GAV.

Outlook

The outlook for the Group remains very positive, with strong

performance from the existing portfolio and a healthy pipeline of

further attractive investment opportunities, both in Ireland and in

northern Europe.

In the wider electricity market, short and medium term power

prices have been impacted by the COVID-19 pandemic. However, as 98%

of the portfolio's revenues are contracted until 2028 at the

earliest, these power price fluctuations have a negligible

short-term impact on the portfolio's cash flows. This combined with

the Company's business model has led to resilient cashflows and

robust dividend cover during the COVID-19 pandemic.

Irish Wind Market

The Irish wind market remains a very attractive jurisdiction for

growth with over 4.2GW of operating capacity installed.

The successful completion of the first RESS auction in August

2020 further evidenced the Irish government's commitment to

generate 70 per cent of electricity from renewable sources by 2030,

with subsequent auctions expected to take place annually. This

year's auction process saw 400MW of wind and 800MW of solar PV

awarded fixed price support contracts guaranteeing the price of

wholesale electricity until 2038. Achieving Ireland's 2030

commitment would increase capacity of onshore wind to 8GW, as well

as 3.5GW of offshore wind and 1.5GW of solar PV and therefore a

further c.EUR15 billion of investment opportunities.

The Group will target investments in new RESS assets, both in

wind and solar, and we believe the Group is very well placed to

find value and continue its growth strategy.

In addition to increasing its generation capacity, Ireland is

still expected to experience growth in the demand for electricity

in the medium and long term, particularly from the development of a

substantial number of datacentres, which are seeking to source

their power requirements exclusively from renewables. It is

currently estimated that there will be 1.2 GW of datacentre

capacity in Ireland by 2025. We are continuing to observe a growing

number of renewable generation assets enter into direct corporate

PPAs with large datacentre users and we believe this opportunity

will continue to grow.

Potential Market Entry into Continental Europe

The Group is continuing to explore investment opportunities in

the very large asset pools of Belgium, France, Germany, the

Netherlands and the Nordics. We have an active pipeline in these

countries and the Group is benefitting from the strong

relationships with asset owners and advisors in northern

Europe.

We are considering assets with a range of revenue contracts,

including government support regimes and corporate PPAs. These

assets may provide the opportunity to capture additional value for

Group, particularly in the Nordic markets where unsubsidised

renewables development has seen significant growth. It is expected

that the portfolio will continue to have a significant proportion

of fixed-price revenue underpinning its cash flows.

Condensed Consolidated Statement of Comprehensive Income

(unaudited)

For the six months ended 30 June 2020

For the six months ended For the six months ended

Note 30 June 2020 30 June 2019

EUR'000 EUR'000

Return on investments 3 21,756 20,147

Other income 39 37

--------------------------------------------------------- ----- ------------------------- -------------------------

Total income and gains 21,795 20,184

Operating expenses 4 (4,382) (3,188)

Investment acquisition costs (835) (234)

--------------------------------------------------------- ----- ------------------------- -------------------------

Operating profit 16,578 16,762

Finance expense 12 (3,257) (3,052)

--------------------------------------------------------- ----- ------------------------- -------------------------

Profit for the period before tax 13,321 13,710

Taxation 5 - -

--------------------------------------------------------- ----- ------------------------- -------------------------

Profit for the period after tax 13,321 13,710

Profit and total comprehensive income attributable to:

Equity holders of the Company 13,321 13,710

Earnings per share

--------------------------------------------------------- ----- ------------------------- -------------------------

Basic and diluted earnings from continuing operations

during the period (cent) 6 2.11 3.00

--------------------------------------------------------- ----- ------------------------- -------------------------

The accompanying notes form an integral part of the condensed

consolidated interim financial statements.

Condensed Consolidated Statement of Financial Position

(unaudited)

As at 30 June 2020

Note 30 June 2020 31 December 2019

EUR'000 EUR'000

Non current assets

Investments at fair value through profit or loss 8 908,750 850,107

-------------------------------------------------- ----- ------------- -----------------

908,750 850,107

Current assets

Receivables 10 286 3,343

Cash and cash equivalents 8,463 6,020

-------------------------------------------------- ----- ------------- -----------------

8,749 9,363

Current liabilities

Payables 11 (3,897) (3,470)

Loans and borrowings 12 - (206,000)

Net current assets/(liabilities) 4,852 (200,107)

Non current liabilities

Loans and borrowings 12 (269,341) -

-------------------------------------------------- ----- ------------- -----------------

Net assets 644,261 650,000

-------------------------------------------------- ----- ------------- -----------------

Capital and reserves

Called up share capital 14 6,306 6,306

Share premium account 14 385,669 385,669

Other distributable reserves 180,876 199,936

Retained earnings 71,410 58,089

-------------------------------------------------- ----- ------------- -----------------

Total shareholders' funds 644,261 650,000

-------------------------------------------------- ----- ------------- -----------------

Net assets per share (cent) 15 102.2 103.1

-------------------------------------------------- ----- ------------- -----------------

Authorised for issue by the Board on 13 September 2020 and

signed on its behalf by:

Rónán Murphy Kevin McNamara

Chairman Director

The accompanying notes form an integral part of the condensed

consolidated interim financial statements.

Condensed Consolidated Statement of Changes in Equity

(unaudited)

For the six months ended 30 June 2020

For the six Other

months Distributable Retained

ended 30 June Share capital Share premium Reserves earnings Total

2020 Note EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Opening net

assets

attributable to

shareholders (1

January 2020) 6,306 385,669 199,936 58,089 650,000

Issue of share - - - - -

capital

Share issue costs - - - - -

Interim dividends

paid in the

period 7 - - (19,060) - (19,060)

Profit and total

comprehensive

income for the

period - - - 13,321 13,321

------------------ ----- ---------------- ----------------- ----------------- ---------------- ---------

Closing net

assets

attributable to

shareholders 6,306 385,669 180,876 71,410 644,261

------------------ ----- ---------------- ----------------- ----------------- ---------------- ---------

After taking account of cumulative unrealised gains in fair

value of investments of EUR75,300,316, the total reserves

distributable by way of a dividend as at 30 June 2020 were

EUR176,985,497.

For the six months ended 30 June 2019

For the six Other

months Distributable Retained

ended 30 June Share capital Share premium Reserves earnings Total

2019 Note EUR000 EUR000 EUR'000 EUR'000 EUR'000

Opening net assets

attributable to

shareholders (1 January

2019) 3,800 120,009 229,153 40,992 393,954

Issue of share capital 1,400 146,300 - - 147,700

Share issue costs - (2,431) - - (2,431)

Interim dividends paid in

the period - - (13,539) - (13,539)

Profit and total

comprehensive income for

the period - - - 13,710 13,710

Closing net assets

attributable to

shareholders 5,200 263,878 215,614 54,702 539,394

-------------------------- ---------------- ---------------- ----------------- ---------------- ---------

After taking account of cumulative unrealised gains in fair

value of investments of EUR68,765,871, the total reserves

distributable by way of a dividend as at 30 June 2019

EUR201,550,071.

The accompanying notes form an integral part of the condensed

consolidated interim financial statements.

Condensed Consolidated Statement of Cash Flows (unaudited)

For the six months ended 30 June 2020

For the six months ended For the six months ended

Note 30 June 2020 30 June 2019

EUR'000 EUR'000

Net cash flows from operating activities 16 10,108 4,459

Cash flows from investing activities

Acquisition of investments (66,478) (34,452)

Investment acquisition costs (835) (4,457)

Repayment of shareholder loan investments 8 18,704 14,733

--------------------------------------------------------- ----- ------------------------- -------------------------

Net cash flows from investing activities (48,609) (24,176)

Cash flows from financing activities

Issue of share capital - 147,700

Payment of issue costs (142) (2,443)

Dividends paid 7 (19,060) (13,539)

Amounts drawn down on loan facilities 12 306,000 -

Amounts repaid on loan facilities 12 (240,000) (111,031)

Finance costs (5,854) (2,948)

--------------------------------------------------------- ----- ------------------------- -------------------------

Net cash flows from financing activities 40,944 17,739

Net increase/(decrease) in cash and cash equivalents

during the period 2,443 (1,978)

Cash and cash equivalents at the beginning of the period 6,020 3,036

Cash and cash equivalents at the end of the period 8,463 1,058

--------------------------------------------------------- ----- ------------------------- -------------------------

The accompanying notes form an integral part of the condensed

consolidated interim financial statements.

Notes to the Unaudited Condensed Consolidated Financial Statements

For the six months ended 30 June 2020

1. Significant accounting policies

Basis of accounting

The condensed consolidated nancial statements included in this

Interim Report have been prepared in accordance with IAS 34

"Interim Financial Reporting".

The interim financial statements have been prepared in

accordance with IFRS to the extent that they have been adopted by

the EU and with those parts of the Companies Act 2014 (including

amendments by the Companies (Accounting) Act 2017) applicable to

companies reporting under IFRS. The financial statements have been

prepared on the historical cost basis, as modified for the

measurement of certain financial instruments at fair value through

profit or loss.

These condensed consolidated nancial statements are presented in

Euro ("EUR") which is the currency of the primary economic

environment in which the Group operates and are rounded to the

nearest thousand, unless otherwise stated.

These condensed nancial statements do not include all

information and disclosures required in the annual nancial

statements and should be read in conjunction with the Group's

consolidated annual nancial statements as of 31 December 2019. The

audited annual accounts for the year ended 31 December 2019 have

been delivered to the Companies Registration Office. The audit

report thereon was unmodi ed.

Review

The Interim Report has not been audited or formally reviewed by

the Company's Auditor in accordance with the International

Standards on Auditing (ISAs) (Ireland) or International Standards

on Review Engagements (ISREs).

Going concern

As at 30 June 2020, the Group had net assets of EUR644.3 million

(31 December 2019: EUR650.0 million) and cash balances of EUR8.5

million (31 December 2019: EUR6.0 million) which are sufficient to

meet current obligations as they fall due.

In the period prior to 30 June 2020 and up to the date of this

report, the outbreak of COVID-19 has had a negative impact on the

global economy. As this situation is both unprecedented and

evolving, it raises some uncertainties and additional risks for the

Group.

The Directors and Investment Manager are actively monitoring

this and its potential effect on the Group and its SPVs. In

particular, they have considered the following specific key

potential impacts:

-- Unavailability of key personnel at the Investment Manager or Administrator;

-- Increased volatility in the fair value of investments;

-- Disruptions to maintenance or repair at the investee company level.

In considering the above key potential impacts of COVID-19 on

the Group and SPV operations, the Directors have assessed these

with reference to the mitigation measures in place. At the Group

level, the key personnel at the Investment Manager and

Administrator have successfully implemented business continuity

plans to ensure business disruption is minimised, including remote

working, and all staff are continuing to assume their day-today

responsibilities.

SPV revenues are derived from the sale of electricity and is

received through power purchase agreements in place with reputable

providers of electricity to the market and also through government

subsidies. Therefore the Directors and the Investment Manager do

not expect a significant impact on revenue and cash flows of the

SPVs. The SPVs also have various risk mitigation plans in place to

ensure, as far as possible, electricity generation from the sites

are maintained. The SPVs have contractual operating and maintenance

agreements in place with large and reputable providers. Wind farm

availability has not been significantly affected: wind farms may be

accessed and operated remotely in some instances; otherwise social

distancing has been possible in large part and personal protective

equipment has been used where not possible, for instance where

major component changes have been necessary. The Investment Manager

is confident that there are appropriate continuity plans in place

at each provider to ensure that the underlying wind farms are

maintained appropriately and that any faults would continue to be

addressed in a timely manner.

Based on the assessment outlined above, including the various

risk mitigation measures in place, the Directors do not consider

that the effects of COVID-19 have created a material uncertainty

over the assessment of the Group as a going concern.

On the basis of this review, and after making due enquiries, the

Directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for at least 12

months from the date of approval of this report. Accordingly, they

continue to adopt the going concern basis in preparing the

financial statements.

Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board of Directors, as a

whole.

The key measure of performance used by the Board to assess the

Group's performance and to allocate resources is the total return

on the Group's net assets, as calculated under IFRS, and therefore

no reconciliation is required between the measure of profit or loss

used by the Board and that contained in the condensed consolidated

financial statements.

For management purposes, the Group is organised into one main

operating segment, which invests in wind farm assets.

All of the Group's income is generated within Ireland and

France. All of the Group's non-current assets are located in

Ireland and France.

Seasonal and cyclical variations

The Group's results do not vary signi cantly during reporting

periods as a result of seasonal activity.

2. Investment management fees

Under the terms of the Investment Management Agreement, the

Investment Manager is entitled to a management fee from the

Company, which is calculated quarterly in arrears and remains at 1

per cent of NAV per annum on that part of NAV up to and including

EUR1 billion, as disclosed in the Company's Annual Report for the

year ended 31 December 2019.

Investment management fees paid or accrued in the period were as

follows:

For the six For the six

months ended months ended

30 June 2020 30 June 2019

EUR'000 EUR'000

Investment management fees 3,247 2,415

---------------------------- -------------- --------------

3,247 2,415

---------------------------- -------------- --------------

As at 30 June 2020, EUR1,627,104 was payable in relation to

investment management fees (31 December 2019: EUR1,409,550).

3. Return on investments

For the six For the six

months ended months ended

30 June 2020 30 June 2019

EUR'000 EUR'000

Dividends received (note 17) 8,551 -

Unrealised movement in fair value of investments (note 8) 7,226 14,301

Interest on shareholder loan investment 5,979 5,846

21,756 20,147

----------------------------------------------------------- -------------- --------------

4. Operating expenses

For the six For the six

months ended months ended

30 June 2020 30 June 2019

EUR'000 EUR'000

Investment management fees (note 2) 3,247 2,415

Other expenses 561 476

Group and SPV administration fees 401 157

Non-executive Directors' remuneration 129 100

Fees to the Company's Auditor:

for audit of the statutory financial statements 41 37

for other services 3 3

---------------------------------------------------- -------------- --------------

4,382 3,188

---------------------------------------------------- -------------- --------------

The fees to the Company's Auditor include EUR3,000 (2019:

EUR3,000) payable in relation to a limited review of these interim

financial statements, and estimated accruals apportioned across the

year for the audit of the statutory financial statements.

5. Taxation

Taxable income during the period was offset by management

expenses and the tax charge for the period ended 30 June 2020 is

EURnil (30 June 2019: EURnil). The Group has tax losses carried

forward available to offset against current and future profits as

at 30 June 2020 of EUR399,458 (30 June 2019: EUR505,879).

6. Earnings per share

For the six For the six

months ended months ended

30 June 2020 30 June 2019

Profit attributable to equity holders of the Company - EUR'000 13,321 13,710

Weighted average number of ordinary shares in issue 630,619,469 457,348,066

---------------------------------------------------------------------------- -------------- --------------

Basic and diluted earnings from continuing operations in the period (cent) 2.11 3.00

---------------------------------------------------------------------------- -------------- --------------

7. Dividends declared with respect to the period

Interim dividends paid during the period ended 30 June 2020 Dividend per Total

Share cent Dividend

With respect to the quarter ended 31 December 2019 1.5075 9,506

With respect to the quarter ended 31 March 2020 1.5150 9,554

------------------------------------------------------------- ------------- ----------

3.0225 19,060

------------------------------------------------------------- ------------- ----------

Interim dividends declared after 30 June 2020 and not accrued in the period Dividend per Total

Share cent Dividend

With respect to the quarter ended 30 June 2020 1.5150 9,554

----------------------------------------------------------------------------- ------------- ----------

1.5150 9,554

----------------------------------------------------------------------------- ------------- ----------

As disclosed in note 18, the Board approved a dividend of 1.515

cent per share on 30 July 2020 in relation to the quarter ended 30

June 2020, bringing total dividends declared with respect to the

period to 3.03 cent per share. The record date for the dividend was

7 August 2020 and the payment date was 28 August 2020.

8. Investments at fair value through profit or loss

For the period ended 30 June 2020 Loans Equity interest Total

EUR'000 EUR'000 EUR'000

Opening balance 435,336 414,771 850,107

Additions (note 17) 57,182 9,440 66,622

Shareholder loan interest capitalised (note 17) 1,339 - 1,339

Repayment of shareholder loan investments (note 17) (18,704) - (18,704)

Unrealised movement in fair value of investments (note 3) 2,160 7,226 9,386

----------------------------------------------------------- --------- ---------------- ---------

477,313 431,437 908,750

----------------------------------------------------------- --------- ---------------- ---------

For the period ended 30 June 2019 Loans Equity interest Total

EUR'000 EUR'000 EUR'000

Opening balance 419,016 338,383 757,399

Additions 2,895 31,557 34,452

Repayment of shareholder loan investments (14,733) - (14,733)

Unrealised movement in fair value of investments (note 3) 379 14,301 14,680

----------------------------------------------------------- --------- ---------------- ---------

407,557 384,241 791,798

----------------------------------------------------------- --------- ---------------- ---------

The unrealised movement in fair value of investments of the

Group during the period was made up as follows:

For the six For the six

months ended months ended

30 June 2020 30 June 2019

EUR'000 EUR'000

Decrease in valuation of investments (10,842) (7,364)

Movement in swap fair values at SPV 129 -

level

Repayment of debt at SPV level 5,266 -

Loan interest capitalised (note 17) (1,339) -

Repayment of shareholder loan investments

(note 17) 18,704 14,733

Movement in cash balances of SPVs (3,367) 7,077

Acquisition costs 835 234

------------------------------------------- -------------- --------------

9,386 14,680

------------------------------------------- -------------- --------------

Fair value measurements

As disclosed in the Company's Annual Report for the year ended

31 December 2019, IFRS 13 "Fair Value Measurement" requires

disclosure of fair value measurement by level. The level of fair

value hierarchy within the financial assets or financial

liabilities ranges from level 1 to level 3 and is determined on the

basis of the lowest level input that is significant to the fair

value measurement.

The fair value of the Group's investments is ultimately

determined by the underlying fair values of the SPV investments.

Due to their nature, they are always expected to be classified as

level 3, as the investments are not traded and contain unobservable

inputs. There have been no transfers between levels during the six

months ended 30 June 2020. All other financial instruments are

classified as level 2.

Sensitivity analysis

The fair value of the Group's investments is EUR908,749,884 (31

December 2019: EUR850,106,884). The following analysis is provided

to illustrate the sensitivity of the fair value of investments to a

change in an individual input, while all other variables remain

constant. The Board considers these changes in inputs to be within

reasonable expected ranges. This is not intended to imply the

likelihood of change or that possible changes in value would be

restricted to this range.

Change in fair value of

Input Base case Change in input investments Change in NAV per share

EUR'000 cent

Discount rate 6 - 7 per cent + 0.25 per cent (21,055) (3.3)

- 0.25 per cent 21,772 3.5

Energy yield P50 10 year P90 (59,633) (9.5)

10 year P10 59,273 9.4

Forecast by leading

Power price consultant - 10 per cent (44,587) (7.1)

+ 10 per cent 44,464 7.1

Inflation rate 2.0 per cent - 0.5 per cent (32,198) (5.1)

+ 0.5 per cent 34,539 5.5

Asset Life 30 years - 5 years (81,458) (12.9)

+ 5 years 66,087 10.5

-------------------------------------------------------------- -------------------------- ------------------------

The sensitivities above are assumed to be independent of each

other. Combined sensitivities are not presented.

9. Unconsolidated subsidiaries, associates and joint ventures

The following table shows subsidiaries of the Group acquired

during the period. As the Company is regarded as an investment

entity under IFRS, these subsidiaries have not been consolidated in

the preparation of the financial statements:

Registered Ownership Interest as at

Investment Place of Business Office 30 June 2020

Seahound Wind Developments Riverside One, Sir John

Limited Ireland Rogerson's Quay, Dublin 2 100%

Société d'Exploitation 20, Avenue de la Paix, 67000

du Parc Eolien du Tonnerois France Strasbourg, France 100%

20, Avenue de la Paix, 67000

Parc Eolien Des Tournevents SAS France Strasbourg, France 100%

20, Avenue de la Paix, 67000

Parc Eolien Des Courtibeux SAS France Strasbourg, France 100%

---------------------------------- ------------------- ---------------------------------- -------------------------

There are no changes to unconsolidated subsidiaries of the Group

and there is no changes to associates and joint venture of the

group as disclosed in the Company's Annual Report for the year

ended 31 December 2019.

There have been no changes to security deposits or guarantees as

disclosed in the Company's Annual Report for the year ended 31

December 2019.

10. Receivables

30 June 2020 31 December 2019

EUR'000 EUR'000

Sundry receivables 184 180

Prepayments 62 77

Accrued income 29 2,959

VAT receivable 11 127

------------------------------------ ------------- -----------------

286 3,343

------------------------------------ ------------- -----------------

11. Payables

30 June 2020 31 December 2019

EUR'000 EUR'000

Investment management fees payable 1,627 1,410

Acquisition costs payable 1,115 1,007

Other payables 952 722

Loan interest payable 157 124

Commitment fee payable 39 36

Other finance costs payable 7 -

Share issue costs payable - 171

------------------------------------ ------------- -----------------

3,897 3,470

------------------------------------ ------------- -----------------

12. Loans and borrowings

30 June 2020 31 December 2019

EUR'000 EUR'000

Opening balance 206,000 362,031

Revolving Credit Facility

Drawdowns 306,000 80,900

Repayments (240,000) (236,931)

Finance costs capitalised

Finance costs capitalised (2,898) -

Amortisation 239 -

Closing balance 269,341 206,000

----------------------------- ---------- -----------------

Reconciled as:

Current liabilities - 206,000

----------------------------- ---------- -----------------

Non current liabilities 269,341 -

----------------------------- ---------- -----------------

For the six months ended For the six

30 June 2020 months ended

30 June 2019

EUR'000 EUR'000

Loan interest 1,562 2,749

Professional fees 1,164 17

Commitment fees 293 242

Facility arrangement fees 238 44

--------------------------- ------------------------- --------------

Finance expense 3,257 3,052

--------------------------- ------------------------- --------------

The loan balance as at 30 June 2020 is measured at amortised

cost whereas the 31 December 2019 has not been adjusted to reflect

amortised cost, as the amount was not materially different to the

outstanding balance.

On the 1 April 2020, the Group entered into a new EUR280 million

revolving credit facility with CIBC, RBC and Santander, refinancing

the previously drawn facility. The new facility has a refreshed 3

year tenor and a margin of 1.30 per cent per annum and commitment

fee of 0.46 per cent per annum.

On 17 June 2020, the Group amended its revolving credit facility

to increase the facility size to EUR305 million with no change to

margin or commitment fee.

As at 30 June 2020, the principal balance of the facility was

EUR272,000,000 (31 December 2019: EUR206,000,000), accrued interest

was EUR156,684 (31 December 2019: EUR123,600) and the outstanding

commitment fee was EUR38,806 (31 December 2019: EUR36,540).

13. Contingencies & Commitments

At the time of acquisition, wind farms which had less than 12

months' operational data may have a wind energy true-up applied,

whereby the purchase price for these wind farms may be adjusted so

that it is based on a 2 year operational record, once operational

data has become available.

The following wind energy true-ups remain outstanding and the

maximum adjustments are as follows: Letteragh EUR2,500,000,

Killala: EUR2,000,000, and Knocknalour EUR489,000.

During 2019, the Group acquired Killala wind farm for an initial

consideration of EUR37.2 million for the 5 operating turbines on

the site. An additional turbine is currently under construction and

the Group has agreed to pay further consideration to the existing

developer contingent on the final turbine becoming operational,

which is expected to be in the final quarter of 2020.

14. Share capital - ordinary shares

At 30 June 2020, the Company had authorised share capital of

2,000,000,000 ordinary shares of EUR0.01 each.

Date Issued and fully paid Number of shares issued Share capital Share premium Total

EUR'000 EUR'000 EUR'000

1 January 2020 Opening balance 630,619,469 6,306 385,669 391,975

30 June 2020 630,619,469 6,306 385,669 391,975

----------------------------------------- ------------------------ -------------- -------------- --------

Shareholders are entitled to all dividends paid by the Company

and, on a winding up, provided the Company has satisfied all of its

liabilities, the Shareholders are entitled to all of the residual

assets of the Company.

15. Net assets per share

30 June 2020 31 December 2019

Net assets - EUR'000 644,261 650,000

Number of ordinary shares issued 630,619,469 630,619,469

---------------------------------- ------------- -----------------

Total net assets - cent 102.2 103.1

---------------------------------- ------------- -----------------

16. Reconciliation of operating profit for the period to net

cash from operating activities

For the six months ended For the six months ended

30 June 2020 30 June 2019

EUR'000 EUR'000

Operating profit for the period 16,578 16,762

Adjustments for:

Unrealised movement in fair value of investments (notes 3 & 8) (7,226) (14,301)

Investment acquisition costs 835 234

Loan interest capitalised (1,339) -

Decrease in receivables 812 1,297

Increase in payables 448 467

---------------------------------------------------------------- ------------------------- -------------------------

Net cash flows from operating activities 10,108 4,459

---------------------------------------------------------------- ------------------------- -------------------------

17. Related party transactions

During the period, the Company advanced interest-free loans to

Holdco of EURnil (30 June 2019: EUR145,397,635), and Holdco made

repayments of EUR18,150,000 (30 June 2019: EUR14,200,000). During

the period, the Company also received shareholder loan repayments

from Knockacummer of EUR1,994,445 (30 June 2019: EURnil) and

Killhills of EUR573,187 (30 June 2019: EURnil).

The below table shows the Group's dividend and management fee

income:

For the six months ending 30 June 2020 For the six months ending 30 June 2019

Management Management

Fee income Dividend Income Fee income Dividend Income

EUR000 EUR000 EUR000 EUR000

Cloosh Valley - 5,028 - -

Ballybane 13 2,750 12 -

Beam Hill - 773 - -

Knockacummer 13 - 12 -

Killhills 13 - 13 -

39 8,551 37 -

--------------- ----------------- ---------------------- ----------------- ----------------------

The table below shows the Group's shareholder loans with the

wind farm investments

Loans Loans Loan interest Loan Repayments Loans Accrued Total

at 1 advanced capitalised at 30 interest

January in the in the June at 30

2020 period period 2020 June 2020

(1) (2)

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Knockacummer 120,329 - - (3,163) 117,166 1,337 118,503

Monaincha 69,668 - 373 (2,004) 68,037 113 68,150

Glanaruddery 51,310 - 213 (1,390) 50,133 84 50,217

Ballybane 41,773 - 218 (1,883) 40,108 67 40,175

Letteragh - 29,979 - (1,130) 28,849 160 29,009

Killhills 24,946 - 175 (574) 24,547 73 24,620

Killala 27,006 - - (3,309) 23,697 133 23,830

Gortahile 19,632 - 102 (2,045) 17,689 29 17,718

Kostroma 16,473 - 104 - 16,577 28 16,605

Tullynamoyle

II 16,239 - 80 (1,158) 15,161 26 15,187

Sommette - 13,590 - - 13,590 45 13,635

Garranereagh 13,659 - 74 (662) 13,071 21 13,092

Lisdowney 11,282 - - (659) 10,623 54 10,677

Sliabh Bawn 9,224 1,050 - - 10,274 5 10,279

Pasilly - 9,020 - - 9,020 30 9,050

Cloosh Valley 7,015 - - - 7,015 - 7,015

Knocknalour 6,522 - - (727) 5,795 33 5,828

Saint Martin - 3,543 - - 3,543 12 3,555

Raheenleagh 168 - - - 168 - 168

435,246 57,182 1,339 (18,704) 475,063 2,250 477,313

--------------- --------- ---------- -------------- ---------------- -------- ----------- --------

(1) Excludes accrued interest at 31 December 2019 of EUR90,210.

(2) During the period, shareholder loans across some SPVs were

restructured resulting in the capitalisation of EUR1,339k of

accrued shareholder loan interest.

18. Subsequent events

On 8 July 2020, the Group announced the 50 per cent acquisition

of the 20.5MW Carrickallen wind farm in County Cavan, Ireland.

On 30 July 2020, the Company announced a dividend of EUR9.6

million, equivalent to 1.515 cent per share. The record date for

the dividend was 7 August 2020 and the payment date was 28 August

2020.

19. Board approval

The Group's Interim Report and Financial Statements were

approved by the Board of Directors on 13 September 2020.

Company Information

Directors (all non-executive) Registered Company Number

Rónán Murphy 598470

Emer Gilvarry

Kevin McNamara

Marco Graziano (appointed 30 January 2020) Registered Office

Riverside One

Investment Manager Sir John Rogerson's Quay

Greencoat Capital LLP Dublin 2

4(th) Floor The Peak

5 Wilton Road

London SW1V 1AN Registered Auditor

BDO

Beaux Lane House

Company Secretary Mercer Street Lower

Ocorian Administration (UK) Limited Dublin 2

27/28 Eastcastle Street

London W1W 8DH Legal Advisers

McCann Fitzgerald

Administrator Riverside One

Northern Trust International Fund Sir John Rogerson's Quay

Administration Services (Ireland) Limited Dublin 2

Georges Court

54-62 Townsend Street

Dublin 2 Euronext Growth Advisor, NOMAD and Broker

J&E Davy

Depositary Davy House

Northern Trust International Fiduciary 49 Dawson Street

Services (Ireland) Limited Dublin 2

Georges Court

54-62 Townsend Street

Dublin 2 Account Banks

Allied Irish Banks plc.

40/41 Westmoreland Street

Registrar Dublin 2

Computershare Investor Services

(Ireland) Limited Northern Trust International Fiduciary

3100 Lake Drive Services (Ireland) Limited

Citywest Business Campus Georges Court

Dublin 24 56-62 Townsend Street

Dublin 2

Defined Terms

Admission Document means the Admission Document of the Company

published on 31 December 2019

Aggregate Group Debt means the Group's proportionate share of

outstanding third party debt.

AGM means Annual General Meeting of the Company

Ballybane means Ballybane Windfarms Limited

BDO means the Company's Auditor as at the reporting date

Beam Hill means Beam Wind Limited

Brexit mean the withdrawal of the United Kingdom from the

European Union

Board means the Directors of the Company

Carrickallen means Carrickallen Wind Farm

Cloosh Valley means Cloosh Valley Wind Farm Holdings DAC and

Cloosh Valley Wind Farm DAC

Company means Greencoat Renewables PLC

CPI means Consumer Price Index

DCF means Discounted Cash Flow

ESG means the Environmental, Social and Governance

EU means the European Union

Euronext means the Euronext Dublin, formerly the Irish Stock

Exchange

FIT means Feed-In Tariff

GAV means Gross Asset Value as defined in the Admission

Document

Garranereagh means Sigatoka Limited

Glanaruddery means Glanaruddery Windfarms Limited and

Glanaruddery Energy Supply Limited

Gortahile means Gortahile Windfarm Limited

Group means Greencoat Renewables PLC, Holdco, Holdco 2 and

Holdco 3

Holdco means GR Wind Farms 1 Limited

Holdco 2 means Greencoat Renewables 1 Holdings Limited

Holdco 3 means Greencoat Renewables 2 Holdings Limited

IAS means International Accounting Standards

IFRS means International Financial Reporting Standards

Investment Management Agreement means the agreement between the

Company and the Investment Manager

Investment Manager means Greencoat Capital LLP

Killala means Killala Community Wind Farm DAC

Killhills means Killhills Windfarm Limited

Knockacummer means Knockacummer Wind Farm Limited

Knocknalour means Knocknalour Wind Farm Holdings Limited and

Knocknalour Wind Farm Limited

Kostroma Holdings means Kostroma Holdings Limited

Letteragh means Seahound Wind Developments Limited

Lisdowney means Lisdowney Wind Farm Limited

Monaincha means Monaincha Wind Farm Limited

NAV means Net Asset Value as defined in the Admission

Document

NAV per Share means the Net Asset Value per Ordinary Share

NOMAD means a company that has been approved as a nominated

advisor for the Alternative Investment Market (AIM), by Euronext

Dublin and London Stock Exchange

Pasilly means Société d'Exploitation du Parc Eolien du

Tonnerois

PPA means Power Purchase Agreement entered into by the Group's

wind farms

PSO means Public Support Obligation

Solar PV means solar photovoltaic

Raheenleagh means Raheenleagh Power DAC

RBC means Royal Bank of Canada

REFIT means Renewable Energy Feed-In Tariff

RESS means Renewable Energy Support Scheme

Review Section means the front end review section of this report

(including but not limited to the Chairman's Statement and the

Investment Manager's Report)

Santander means Abbey National Treasury Services Plc (trading as

Santander Global Corporate Banking)

Sliabh Bawn means Sliabh Bawn Holding DAC, Sliabh Bawn Supply

DAC and Sliabh Bawn Power DAC

Sommette means Parc Eolien Des Tournevents SAS

Solar PV means a solar photovoltaic system, which is a power

system designed to supply usable solar power by means of

photovoltaics.

SPVs means the Special Purpose Vehicles, which hold the Group's

investment portfolio of underlying operating wind farms

Saint Martin means Parc Eolien Des Courtibeux SAS

TSR means Total Shareholder Return

Tullynamoyle II means Tullynamoyle Wind Farm II Limited

UK means United Kingdom of Great Britain and Northern

Ireland

Forward Looking Statements and other Important Information

This document may include statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "plans", "projects",

"will", "explore" or "should" or, in each case, their negative or

other variations or comparable terminology or by discussions of

strategy, plans, objectives, goals, future events or

intentions.

These forward-looking statements include all matters that are

not historical facts. They may appear in a number of places

throughout this document and may include, but are not limited to,

statements regarding the intentions, beliefs or current

expectations of the Company, the Directors and/or the Investment

Manager concerning, amongst other things, the investment objectives

and investment policy, financing strategies, investment

performance, results of operations, financial condition, liquidity,

prospects, and distribution policy of the Company and the markets

in which it invests.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to future events and depend on

circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future

performance. The Company's actual investment performance, results

of operations, financial condition, liquidity, distribution policy

and the development of its financing strategies may differ

materially from the impression created by, or described in or

suggested by, the forward-looking statements contained in this

document.

In addition, even if actual investment performance, results of

operations, financial condition, liquidity, distribution policy and

the development of its financing strategies, are consistent with

any forward looking statements contained in this document, those

results or developments may not be indicative of results or

developments in subsequent periods. A number of factors could cause

results and developments of the Company to differ materially from

those expressed or implied by the forward looking statements

including, without limitation, general economic and business

conditions, global renewable energy market conditions, industry

trends, competition, changes in law or regulation, changes in

taxation regimes, the availability and cost of capital, currency

fluctuations, changes in its business strategy, political and

economic uncertainty. Any forward-looking statements herein speak

only at the date of this document.

As a result, you are cautioned not to place any reliance on any

such forward-looking statements and neither the Company nor any

other person accepts responsibility for the accuracy of such

statements.

Subject to their legal and regulatory obligations, the Company,

the Directors and the Investment Manager expressly disclaim any

obligations to update or revise any forward- looking statement

contained herein to reflect any change in expectations with regard

thereto or any change in events, conditions or circumstances on

which any statement is based.

In addition, this document may include target figures for future

financial periods. Any such figures are targets only and are not

forecasts. Nothing in this document should be construed as a profit

forecast or a profit estimate.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UOOBRRWUKAAR

(END) Dow Jones Newswires

September 14, 2020 02:00 ET (06:00 GMT)

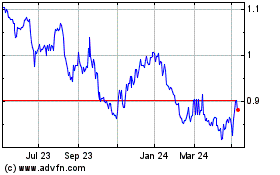

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

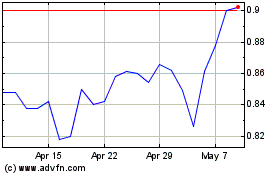

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Apr 2023 to Apr 2024