TIDMIOM

RNS Number : 5843U

Iomart Group PLC

07 April 2021

7 April 2021

iomart Group plc

("iomart" or the "Group" or the "Company")

Pre-close Trading Update

iomart Group plc (AIM: IOM), the cloud computing company,

provides its pre-close trading statement for the year ended 31

March 2021 ahead of the announcement of its full year results.

Group trading performance

iomart expects to deliver a continued stable financial

performance in the second half of the year. The third, and

unexpected, COVID-19 UK lock down hindered the green shoots of

growth we had expected in the second half of the year, causing

results to be at the lower end of expectations. However, the Group

remains strongly profitable, and the Board is confident iomart has

a strong basis for growth once UK business confidence returns and

the strategic actions currently in progress under new CEO Reece

Donovan have been fully implemented.

For the year to 31 March 2021, the Group expects to report

revenue of approximately GBP112 million (FY20: GBP112.6 million),

adjusted EBITDA (1) of approximately GBP41.5 million (FY20: GBP43.5

million) and adjusted profit before tax (2) of approximately GBP20

million (FY20: GBP22.8 million). We have seen revenue growth within

our core area of managed cloud services, but overall the Cloud

Services division experienced a contraction, primarily due to a

drop in non-recurring hardware reselling activities as customers

delayed investment decisions. The Group has maintained its sales

team throughout the COVID-19 pandemic in order to position the

Company optimally once business confidence returns and has not made

use of any Government furlough support. This, combined with the

specific mix in revenue in the year, has resulted in a lower

adjusted EBITDA margin of approximately 37.1% (FY20: 38.6%). This

margin level remains higher than the industry average and

consistent with expectations.

The Group's cash generation has been strong and ahead of the

Board's expectations, with the year-end cash position increasing to

approximately GBP23 million at 31 March 2021 (31 March 2020:

GBP15.5 million). The revolver loan drawn amount remains unchanged

from last year and along with lease liabilities the Board expects

net debt to be approximately GBP56 million at 31 March 2021 (31

March 2020: GBP57.6 million).

Outlook

The Group's revenue profile continues to transition away from

legacy self-managed infrastructure revenue to managed cloud

revenue, which by its competitive nature tends to have initially

lower margins which expand over time and represent a better long

term growth opportunity. This trend will continue as the Group

refocuses towards higher growth sectors, with managed cloud

services at the heart of the iomart offering. While the success of

the transition will take time to flow through into results, the

Board is confident iomart's valuable datacentre and network

infrastructure, market-leading cloud expertise, highly recurring

revenue and significant customer base means the business is well

positioned to execute on its strategy and return to an accelerated

growth trajectory over the medium term.

The Board expects to continue to use selective M&A to

augment the growth strategy. The Group's strong balance sheet

allows the proactive consideration of acquisitions to broaden the

Group's skills and capabilities in new areas.

The Board remains confident in the outlook for the long-term

prospects for iomart.

The Group will host a Capital Markets Day on 5 May 2021, to

provide greater insight into the evolution of its strategy.

Reece Donovan, CEO of iomart Group plc, commented:

"iomart has performed resiliently during these unprecedented

times, proving the strength of our recurring revenue model, the

value our customers place on the services we deliver, and the

commitment of our teams. We are in a period of transition for

iomart, building on a strong starting position in terms of our

financial strength, business model and market position. We look

forward to updating investors further on our revitalised strategy

at the Capital Markets Day in May. We have high confidence levels

on the future success of iomart and our ability to be a leading

cloud service provider, supporting customers in each step of their

cloud journey."

(1) adjusted EBITDA means earnings before interest, tax,

depreciation, amortisation, share based payment charges, gains or

losses on revaluation of contingent consideration, acquisition

related costs and non-recurring items.

(2) adjusted profit before tax means profits before, tax, share

based payment charges, amortisation of acquired intangibles, gains

or losses on revaluation of contingent consideration, acquisition

related costs and non-recurring items.

For further information:

iomart Group plc Tel: 0141 931 6400

Reece Donovan, Chief Executive Officer

Scott Cunningham, Chief Financial Officer

Peel Hunt LLP (Nominated Adviser and Joint Tel: 020 7418 8900

Broker)

Edward Knight, Paul Gillam, Nick Prowting

Investec Bank PLC (Joint Broker) Tel: 020 7597 4000

Patrick Robb, Virginia Bull, Sebastian Lawrence

Alma PR Tel: 020 3405 0205

Caroline Forde, Helena Bogle, Joe Pederzolli

About iomart Group plc

For over 20 years iomart Group plc (AIM: IOM) has been helping

growing organisations to maximise the flexibility, cost

effectiveness and scalability of the cloud. From data centres we

own and operate in the U.K., and from connected facilities across

the globe, we can provide multiple secure infrastructure solutions

from branch office backups, to hyper cloud migrations, and

everything in between, delivered typically with a 24/7 managed

service. Our team of over 400 dedicated staff work with our

customers at the strategy stage through to delivery and ongoing

management, to implement the secure cloud solutions that deliver to

their business requirements.

For further information about the Grou p, please visit www.iomart.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTIFMPTMTBMBAB

(END) Dow Jones Newswires

April 07, 2021 02:00 ET (06:00 GMT)

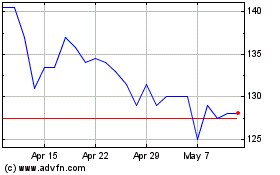

Iomart (LSE:IOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

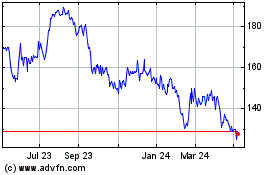

Iomart (LSE:IOM)

Historical Stock Chart

From Apr 2023 to Apr 2024