Lancashire Hld Ltd Notice of Redemption

April 12 2021 - 1:00AM

UK Regulatory

TIDMLRE

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

LEI: 5493002UNUYXLHOWF752

For immediate release

NOTICE OF REDEMPTION

to the holders of

LANCASHIRE HOLDINGS LIMITED

(the "Issuer")

$130,000,000 5.70% Senior Notes due 2022

(the "Notes")

CUSIP Nos.: Regulation S - G5361WAA2 and Rule 144A - 513774AA7

ISIN Nos.: Regulation S - USG5361WAA20 and Rule 144A - US513774AA79

12 April 2021

Hamilton, Bermuda

The Issuer has today given notice to holders of the outstanding Notes of the

Issuer that, in accordance with the terms of the Notes, the Issuer has decided

to redeem all of its outstanding Notes on 13 May 2021 (the "Redemption Date").

Citibank, N.A. acts as paying agent under the Notes.

The redemption price payment will be made in accordance with the terms of the

Notes. Notice of the redemption price will be given to holders of the

outstanding Notes on or around the second trading day prior to the Redemption

Date. All terms of the Notes remain unchanged until redemption.

To view the notice, please click on the link below:

https://mma.prnewswire.com/media/1484670/Notice_of_Redemption.pdf

The Issuer will request the Financial Conduct Authority to cancel the listing

of the Notes and the London Stock Exchange plc to cancel the admission to

trading of the Notes on or shortly after the Redemption Date.

For further information, please contact:

Lancashire Holdings Limited

Christopher Head +44 20 7264 4145

Group Company Secretary

chris.head@lancashiregroup.com

Jelena Bjelanovic +44 20 7264 4066

Group Head of Investor Relations

jelena.bjelanovic@lancashiregroup.com

This release contains information, which may be of a price sensitive nature,

that the Issuer is making public in a manner consistent with the Market Abuse

Regulation (EU) No 596/2014 ("EU MAR") in the European Economic Area, EU MAR

as it forms part of the domestic law of the U.K. by virtue of the European

Union (Withdrawal) Act 2018 (as amended, including by the European Union

(Withdrawal Agreement) Act 2020) and other regulatory obligations.

The information was submitted for publication, through the agency of the

contact persons set out above, at 07:00 BST on 12 April 2021.

IMPORTANT NOTICES

Certain statements contained in this announcement constitute "forward-looking

statements" with respect to the Issuer and its subsidiary undertakings (the "

Group"). All statements other than statements of historical facts included in

this announcement are, or may be deemed to be, forward-looking statements.

Without limitation, any statements preceded or followed by or that include the

words "believes", "anticipates", "aims", "plans", "projects", "forecasts",

"guidance", "intends", "expects", "estimates", "predicts", "may", "can",

"likely", "will", "seeks", "should", or, in each case, their negative or

comparable terminology and similar statements are of a future or

forward-looking nature. Such forward-looking statements involve known and

unknown risks, uncertainties and other important factors that could cause the

actual results, performance or achievements of the Group to be materially

different from future results, performance or achievements expressed or implied

by such forward-looking statements. For a description of some of these factors,

see the Issuer's annual report and accounts for the year ended 31 December 2020

(the "Annual Report and Accounts"). In addition to those factors contained in

the Annual Report and Accounts, any forward-looking statements contained in

this announcement may be affected by the impact of the ongoing COVID-19

pandemic on the Group's clients, the debt capital markets, the securities in

the Group's investment portfolio and on global financial markets generally, as

well as any governmental or regulatory changes or judicial interpretations,

including policy coverage issues arising therefrom. For the avoidance of doubt,

nothing in this announcement constitutes a notice of redemption of any other

existing indebtedness.

END

(END) Dow Jones Newswires

April 12, 2021 02:00 ET (06:00 GMT)

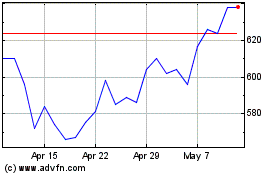

Lancashire (LSE:LRE)

Historical Stock Chart

From Apr 2024 to May 2024

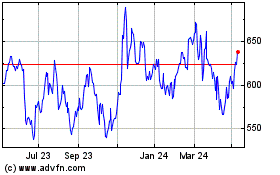

Lancashire (LSE:LRE)

Historical Stock Chart

From May 2023 to May 2024