TIDMNET

RNS Number : 6987P

Netcall PLC

11 October 2023

11 October 2023

NETCALL PLC

("Netcall", the "Company" or the "Group")

Final Results for the Year Ended 30 June 2023

Accelerating organic growth and higher profitability

Netcall plc (AIM: NET), a leading provider of intelligent

automation and customer engagement software, today announces its

audited results for the year ended 30 June 2023.

Financial highlights

FY23 FY22

-------------------------------- --------- --------- -----

Total Revenue GBP36.0m GBP30.5m +18%

Cloud services revenue GBP16.6m GBP10.7m +55%

-------------------------------- --------- --------- -----

Total annual contract value(1)

("ACV") GBP27.9m GBP24.2m +15%

Cloud services ACV GBP18.1m GBP15.0m +21%

-------------------------------- --------- --------- -----

Adjusted EBITDA(2) GBP8.0m GBP6.4m +25%

Profit before tax GBP4.0m GBP2.3m +74%

Adjusted basic earnings per

share 3.33p 2.15p +55%

-------------------------------- --------- --------- -----

Group cash at period end GBP24.8m GBP17.6m +41%

Net funds at period end GBP24.3m GBP13.4m +81%

-------------------------------- --------- --------- -----

Final ordinary dividend per

share 0.83p 0.54p +54%

-------------------------------- --------- --------- -----

Operational highlights

-- Continued good demand for Liberty solutions, with strong contribution

from new customer acquisition

-- Total revenue increased by 18% driven by Cloud services which

accounted for more than 80% of new product bookings

-- Intelligent Automation solutions now accounts for more than

half of Group revenue increasing by 34% to GBP18.5m (FY22:

GBP13.8m)

-- Customer Engagement customers that have purchased Intelligent

Automation solutions increased by 6 percentage points to 21%

-- Cloud net retention rate (3) of 113% (FY22: 152%) or 122%

(FY22: 117%) excluding the effect of the significant contract

win announced in June 2022 and renewed in July 2023

-- Current Remaining Performance Obligations, being contracted

revenue expected to be recognised within FY24, increased by

18% to GBP31.4m (FY23: GBP26.5m)

-- Contract with S&P 500 firm using Liberty platform in more

than 60 countries replaced with new five-year contract valued

in total at $20m, representing a $6m uplift to the remaining

contract value

-- Positive sales momentum continued to date in FY24

-- With more than a third of Customer Engagement solutions now

deployed as a cloud service and the pipeline increasing, the

Board has decided to invest further in the Group's development

and technology teams to capitalise on growing demand and support

future growth

Henrik Bang, Chief Executive, said:

"Netcall had a strong year of trading, delivering double digit

organic revenue and profit growth which was fueled by a strong

demand for our cloud services as we transition to a predominately

cloud-based business.

"We have continued to see strong demand for our offering as

customers increasingly prioritise automation and improvements to

customer experience, which, in addition to solid cross and

up-sales, also resulted in an increased number of new customer

wins.

"Based on the increased wins and growing pipeline in Customer

Engagement cloud sales with more than a third of such solutions now

deployed in the cloud, the Board has decided to increase

investments into this offering to meet anticipated future demand,

gain operational efficiencies and deliver an improved

proposition.

"Sales momentum has remained strong into the start of the new

financial year and our significant order book alongside our

increasing recurring revenues and strong pipeline of new business

opportunities, gives the Board confidence in the Group's continued

success."

(1) ACV, as of a given date, is the total of the value of each

cloud and support contract divided by the total number of years of

the contract (save that the contract renewal announced on 20 July

2023 is included in FY23 ACV at the new annual amount of $4m).

(2) Profit before interest, tax, depreciation and amortisation

adjusted to exclude the effects of share-based payments,

acquisition, impairment, profit or loss on disposals, contingent

consideration and non-recurring transaction costs.

(3) Cloud net retention rate is calculated by starting with the

Cloud ACV from all customers twelve months prior to the period end

and comparing it to the Cloud ACV from the same customers at the

current period end. The current period ACV includes any cross- or

up-sales and is net of contraction or churn over the trailing

twelve months but excludes ACV from new customers in the current

period. The Cloud net retention rate is the total current period

ACV divided by the total prior period ACV.

(4) Based on Scope 1 emissions (direct emissions from owned or

controlled sources) and Scope 2 emissions (indirect emissions from

the generation of purchased electricity, steam, heating and cooling

consumed by the Company) following the UK Government GHG Conversion

Factors for Company Reporting.

For further enquiries, please contact:

Netcall plc Tel. +44 (0) 330

333 6100

Henrik Bang, CEO

Michael Jackson, Chairman

James Ormondroyd, Group Finance Director

Canaccord Genuity Limited (Nominated Tel. +44 (0) 20

Adviser and Broker) 7523 8000

Simon Bridges / Andrew Potts

Singers Capital Markets (Joint Broker) Tel. +44 (0) 20

Harry Gooden / Asha Chotai 7496 3000

Alma PR Tel. +44 (0) 20

3405 0205

Caroline Forde / Hilary Buchanan / Matthew

Young

About Netcall

Netcall's Liberty software platform with Intelligent Automation

and Customer Engagement solutions helps organisations transform

their businesses faster and more efficiently, empowering them to

create leaner, more customer-centric organisations.

Netcall's customers span enterprise, healthcare and government

sectors. These include two-thirds of the NHS Acute Health Trusts

and leading corporates such as Legal and General, Lloyds Banking

Group, Santander and Aon.

Prior to publication the information communicated in this

announcement was deemed by the Company to constitute inside

information for the purposes of article 7 of the Market Abuse

Regulations (EU) No 596/2014 as amended by regulation 11 of the

Market Abuse (Amendment) (EU Exit) Regulations No 2019/310 ('MAR').

With the publication of this announcement, this information is now

considered to be in the public domain.

Overview

The Group delivered another year of growth, with solid sales

momentum and strong cash generation. Revenue grew 18% to GBP36.0m

(FY22: GBP30.5m) and adjusted EBITDA increased 25% to GBP8.0m

(FY22: GBP6.4m).

As Netcall continues its transition to a predominantly

cloud-based business with 72% (FY22: 65%) of its revenue coming

from recurring revenue contracts, we achieved good progress against

each of our four core strategic pillars. New customer acquisition

progressed particularly well during the year, contributing to

overall growth. We have also continued to work closely with

existing customers resulting in a strong cross and up-sales

performance, reflected in the Cloud net retention rate of 113% or

122% excluding the effect of the significant contract win announced

in June 2022 and renewed in July 2023. Netcall's partner base

continued to expand throughout FY23 with bookings increasing by

approximately a quarter. These results were underpinned by

continuous product releases, including enhancements to Liberty AI,

which was originally released in April 2022.

The main growth driver in the period continued to be our cloud

offerings where revenues increased by 55% to GBP16.6m, as secular

trends including the move to cloud computing, increased use of

automation and intensified focus on improving customer experience

continue to benefit the Group. Revenues from Intelligent Automation

solutions increased by 34% to GBP18.5m (FY22: GBP13.8m), now

representing over half of total revenues for the year. This has

materially contributed to Cloud revenues, which have grown 30% CAGR

over the last 5 years.

The momentum towards cloud services also meant that other

revenue streams declined by 1% to GBP19.4m (FY22: GBP19.7m), with

lower professional services as enterprise accounts increasingly use

accredited IT service providers for application development and

support together with fewer call-back and SMS transactions in the

year.

The ongoing sales momentum is also reflected in Cloud annual

contract value ('ACV') which increased 21% to GBP18.1m (FY22:

GBP15.0m), contributing to Total ACV growth of 15% to GBP27.9m

(FY22: GBP24.2m). Underlying cloud ACV, excluding the significant

contract announced in June 2022 and renewed in July 2023, increased

33% and underlying Total ACV grew 20%.

As announced at the end of the year, the Group's landmark $19m

three-year cloud subscription contract with a S&P 500 financial

services firm was renegotiated at the end of the period, after the

customer instigated an internal review of its vendor landscape. As

a result, we have now agreed a replacement five-year contract

valued at $20m in total (the "Contract Renewal") representing a $6m

uplift to the remaining contract value, with an expected revenue

contribution of $4m per annum over the extended term.

The Group's changing business model to cloud and recurring

revenue streams has translated into excellent cash flow and a

significant increase in net funds which at year end was GBP24.3m

(30 June 2022: GBP13.4m).

Current Trading and Outlook

Sales momentum has remained strong into the start of the new

financial year with cloud solutions performing particularly well

which, together with visibility of GBP31.4m of contracted revenue

expected to be recognised in FY24, provides good forward momentum

and revenue visibility.

In addition, the Company has a strong sales pipeline with the

majority of opportunities being for cloud solutions combined with

an ongoing new product pipeline which we expect will provide new

sales opportunities.

Based on the increased wins in Customer Engagement cloud sales,

with more than a third of such solutions now deployed in the cloud,

and a growing pipeline the Board has decided to increase

investments into this offering to meet anticipated future demand,

gain operational efficiencies and deliver an improved proposition.

The Group will make a step change investment of approximately

GBP1.0m pa in its development and technology teams, mainly

occurring in FY25. In addition, cloud computing expenses within

cost of sales will be approximately GBP0.5m higher, also largely

expected in FY25 and which in future periods will be volume

dependent. The underlying operating margin is expected to remain

robust and over time benefit from the increased investment in cloud

solutions.

The Group's strong balance sheet and cash generation supports

continued investment in our growth strategies which are underpinned

by supportive macro-trends for both cloud computing, automation and

customer experience. Therefore, the Board remains confident in the

Group's future success.

Business Review

Netcall unifies Intelligent Automation and Customer Engagement

software, providing organisations with an easy-to-use platform that

enables rapid process automation and improved customer engagement.

From councils interacting with citizens, NHS trusts helping

patients, or financial services firms servicing customers, there is

increasing pressure on organisations to improve operations to

deliver successful outcomes for stakeholders. This is achieved

through the Liberty platform which enables organisations to improve

operational efficiencies as well as customer and employee

experiences.

In the current economic environment which has increased the need

for cost efficiencies, business automation remains a key strategic

priority for organisations, creating a significant opportunity for

improvements. In the face of rising costs, skill shortages and

evolving consumer expectations, organisations are turning to

solutions such as Low-code development, Robotic Process Automation

(RPA), AI and machine learning, as well as omni-channel engagement

as an interconnected toolkit for implementing automation programmes

more effectively.

Addressing these challenges sits at the core of Netcall's

Liberty platform which provide a 'one-stop-shop' Digital

Transformation suite. The integration of Intelligent Automation and

Customer Engagement technologies on one easy to use platform with

the inclusion of industry specific implementations are key

differentiating factors that have contributed to increased demand

during the period.

The Liberty platform's main product categories are:

Intelligent Automation

-- Liberty Create : Enables both professional and non-professional

developers to create enterprise grade applications that

drive automated workflows and business processes using

Low-code software. Liberty Create uses an intuitive drag-and-drop

environment for faster development and combines easy

integration to other parts of the Liberty platform, as

well as third party solutions such as SAP and Salesforce.

-- Liberty RPA : AI-powered robotic process automation

frees up people from mundane and repetitive tasks, enabling

them to be more productive. RPA speeds up processing

times, reduces errors and improves overall efficiency.

-- Liberty AI : Offers richer insights to data, predicts

outcomes and improves business decision making. Through

machine learning Liberty AI scales, delivers and enhances

customer experiences across the entire enterprise.

Customer Engagement

-- Liberty Converse : Seamless customer engagement using

our complete omni-channel contact centre solution including

conversational messaging, chatbots and AI-powered virtual

agents. Converse blends practical AI and automation with

agent-assisted technology to boost operational and agent

productivity, reduce costs and improve customer experience.

Strategy

Netcall helps customers turn their digital strategies into

successful journeys and build smarter, leaner and more

customer-centric organisations making them more effective,

competitive and sustainable.

Our main market verticals are financial services, healthcare,

and public sector industries, which in the period accounted for 89%

of total Group revenues, with the Liberty platform also being

implemented in other sectors like utilities and transportation. The

Group's target customers are typically operating complex businesses

with large numbers of customers, employees and stakeholders, and in

many cases are subject to a high level of regulation.

The flexibility of the platform and its cloud deployment enables

customers to rapidly scale the platform usage to support their

expansion plans across the world.

Netcall pursues its market opportunity through execution of its

growth strategy centred on four strategic pillars: new customer

acquisition, growth within the existing base, ongoing product

innovation and partner network expansion.

Customer base expansion

Despite the challenging economic environment, contribution from

new customer acquisition increased significantly during the year.

Cloud solutions continues to be the primary driver of new business

opportunities, accounting for the majority of the new customer wins

in the period. Demand for the Group's sector-tailored solutions,

particularly CitizenHub for local councils, proved in demand,

demonstrating the strong referenceability the Group's has

established in this sector.

Land and expand

The opportunity available for the Group within its extensive

customer base remains significant and cross/upselling products has

been a major contributor to growth during the year, as customers

increasingly deploy upgrades and new Netcall solutions. The number

of Customer Engagement customers who have also purchased

Intelligent Automation solutions increased in the year to 21% from

15% in FY22.

Netcall's Community continues to be a valuable resource

connecting our customer base by providing a forum for knowledge

sharing, training, and providing pre-built accelerators and modules

to enrich customers' interaction with the Liberty platform

solutions. This community continues to grow, and currently consists

of more than 4,500 members including developers and administrators.

As part of the Community, Netcall launched its Academy, which

offers more than 150 eLearning courses on a range of Netcall

solutions and in its initial phase has seen more than 2,000

delegates enrolling to available courses.

Growing the partner channel

Netcall's growing partner network includes large global advisory

firms as well as specialised technology experts, offering

opportunities in existing markets while also expanding the Group's

reach into adjacent sectors and geographies. Throughout the period,

the partner network has shown steady growth, with order bookings

increasing by approximately a quarter, and it remains a priority to

further increase the contribution from our expanding partner

network.

Innovation and product enhancement

Innovation and platform expansion continually provide customers

with new capabilities and features to enhance the value of the

platform, generating new opportunities for the business. During the

year this included a wide range of new features including Microsoft

Teams integration which allows organisations to embed video calling

within their applications and AI Optical Character Recognition

processing of documents enabling the delivery of intelligent

document management capabilities together with enhancements to

Liberty AI offering customers new capabilities and pre-trained AI

models.

Netcall was an early adopter of AI/ML type technologies such as

speech recognition, OCR and computer vision which are used by many

customers today. In April 2022, Netcall enhanced its AI footprint

by launching Liberty AI, building Artificial Intelligence

capabilities into the Liberty platform allowing customers to use

custom or pre-trained private AI models in their apps or

interactions. Today a growing number of sales engagements are

exploring the use of Liberty AI capabilities.

Recent studies(1) , show generative AI can unlock significant

benefits within both the software development delivery cycle, and

customer and agent experience within Intelligent Automation and

Customer Engagement solutions. Netcall believes that in order to

most effectively capitalise on AI, it needs to be fully integrated

into a platform that offers a wide range of capabilities, as well

as the tools to deploy and govern them securely, to all teams in

the enterprise, not just specialist data scientists.

As a Group, Netcall is cognisant of the developments of AI and

the increased demand for adoption into a range of business systems.

As part of its AI strategy, Netcall's roadmap will enable customers

to:

-- Deploy further Private AI models tailored to customer

needs, built on their data, giving reliable and accurate

results for bespoke use-cases.

-- Connect to Public AI models, incorporating intelligence

within workflows while retaining control over the data

the organisation is willing to share.

-- And, embed Generative AI within the platform to enable

features such as natural language authoring, code generation

and communication sentiment and summarisation, to further

increase the value customers can derive from Liberty.

During the year, Netcall increased its investments in AI and is

planning to continue these investments as the market develops.

(1) McKinsey: July 2023, "The economic potential of generative

AI"

Cloud first investments

Cloud contact centre market growth rates are forecast to

accelerate(1) as decision makers implement solutions to modernise

their customer service operations, including supporting a broader

mix of communications channels, conversational AI and virtual

assistant capabilities.

A third of Netcall's Customer Engagement solutions are now

deployed in the cloud and the related Cloud Services ACV grew by

37% year over year. This momentum has continued into the beginning

of the FY24, supported by a growing Customer Engagement solution

pipeline.

Therefore, the Board has decided to increase investments into

this cloud service offering to meet this growing market

opportunity, gain operational efficiencies and deliver an improved

proposition by consolidating all cloud computing activities on a

single public cloud platform. The Group will make a step change

investment of approximately GBP1.0m pa in its development and

technology teams, mainly occurring in FY25. In addition, cloud

computing expenses within cost of sales will be approximately

GBP0.5m higher, also largely expected in FY25 and which in future

periods will be volume dependent. The underlying operating margin

is expected to remain robust and over time benefit from the

increased investment in cloud solutions.

(1) Gartner:

https://www.gartner.com/en/newsroom/press-releases/2023-07-31-gartner-says-conversational-ai-capabilities-will-help-drive-worldwide-contact-center-market-to-16-percent-growth-in-2023

ESG initiatives

The Group remains focused on managing its impact on the

environment. During the period, Netcall has continued to progress

against its ambition to be carbon neutral by the end of 2026.

Netcall has measured and is voluntarily reporting its total Scope 1

and Scope 2 emissions which have reduced by 48% to 32.2 tCO2e

compared to the 2020 Baseline of 66.6 tCO2e. The Group has started

to measure and analyse Scope 3 emissions, which cover indirect

emissions that occur in a company's value chain and for the first

time, Netcall is reporting on a subset of Scope 3 emissions;

business travel. Emissions for business travel and accommodation

were 78.5 tCO2e with employee commuting responsible for 12.0

tCO2e.

Moreover, to track progress on its carbon reduction strategy,

Netcall has populated and utilised the Environmental Management

System (EMS) built on the Liberty Create Low-code Application

Platform. The implementation of the EMS supports management of key

actions and improvements for environmental performance. The EMS app

is also available to Netcall customers through the AppShare to

support Netcall's customers' own objectives.

The Group is also pleased to report that is has seen a 9%

improvement in energy intensity ratio to 0.96 tCO2e per GBP1m

revenue.

In addition, the Board recognises that Netcall's solutions have

a wider reach and impact on our customers and communities. More

than 1 million patients have logged into our NHS applications,

whilst our technology supports 1 in 4 UK councils, and 2 in 5 UK

police forces. Netcall's solutions are designed to enable

organisations to become more efficient and effective in delivering

better services and thereby also enabling them to operate more

sustainably.

Internally, the Group continues to evolve its employee value

proposition. Our employee engagement score puts us in the top

quartile of more than a 1000 UK and Global Technology businesses

surveyed on Culture Amp, an employee satisfaction-focused platform

made up of 21 million answered questions.

Financial Review

A key financial metric monitored by the Board is the growth in

the ACV base year-on-year. This reflects the annual value of new

business won, together with upsell into the Group's existing

customer base as it delivers against its land and expand strategy,

less any customer contraction or cancellation. It is an important

metric for the Group, as it is a leading indicator of future

revenue.

The Group continues its transition to a digital cloud business

with Cloud ACV 21% higher at GBP18.1m (FY22: GBP15.0m). The growth

in Cloud ACV contributed to a 15% growth in total ACV to GBP27.9m

(FY22: GBP24.2m). The underlying Cloud and Total ACV growth

excluding the effect of the significant contract announced 20 July

2023 was 33% and 20% respectively.

The table below sets out ACV at the three financial year

ends:

GBP'm ACV FY23 FY22 FY21

--------------------------- ----- ----- -----

Cloud services 18.1 15.0 9.4

Product support contracts 9.8 9.2 9.1

Total ACV 27.9 24.2 18.5

=========================== ===== ===== =====

Group revenue for the year grew by 18% to GBP36.0m (FY22:

GBP30.5m). The year-on-year increase was primarily driven by growth

in both Intelligent Automation solutions by 34% to GBP18.5m (FY22:

GBP13.8m), and Customer Engagement solutions by 6% to GBP17.0m

(FY22: GBP16.0m) of which the Customer Engagement Cloud services

revenue stream grew by 20% to GBP3.6m (FY22: GBP3.0m).

The table below sets out revenue by component for the last three

financial year ends:

GBP'm Revenue FY23 FY22 FY21

-------------------------------------------------- ----- ----- -----

Cloud services 16.6 10.7 8.3

Product support contracts 9.4 9.0 9.0

-------------------------------------------------- ----- ----- -----

Total Cloud services & Product support contracts 26.0 19.7 17.3

Communication services 2.6 3.0 2.9

Product 2.2 2.2 2.7

Professional services 5.2 5.5 4.3

Total Revenue 36.0 30.5 27.2

-------------------------------------------------- ----- ----- -----

Reflecting the year-over-year growth in ACV, Cloud services

revenue (subscription and usage fees of our cloud-based offerings)

was 55% higher at GBP16.6m (FY22: GBP10.7m) and product support

contract revenue grew by 5% to GBP9.40m (FY22: GBP8.97m). This

increased recurring revenues from Cloud service and Product support

contracts to 72% of total revenue (FY22: 65%).

Communication services revenue were GBP2.56m (FY22: GBP3.00m)

due to fewer call-back and messaging transactions in the financial

services segment.

Product revenue (software license sales with supporting

hardware) was maintained at GBP2.24m (FY22: GBP2.24m) due to

continuing customer demand for on-premise license expansions or

upgrades. As previously communicated, this revenue stream continues

to change within periods subject to customers' preferences for

buying on-premise or cloud contracts. The trend is, as expected,

accelerating toward cloud contracts.

Professional services revenue was GBP5.21m (FY22: GBP5.51m) as a

number of enterprise accounts, signed up in previous years, onboard

global IT service providers to support further application

development and support. The overall demand for our professional

services is dependent on: the mix of direct and indirect sales of

our solutions, in the latter case the Group's partners provide the

related services directly for the end customer; and whether a

customer requires the support of a full application development

service or support to enable their own development teams.

Group Remaining Performance Obligations ("RPO"), being the total

of future contracted revenue with customers that have not yet been

recognised, inclusive of deferred income, at year end was GBP54.5m

(FY22: GBP54.4m) demonstrating the material amount of revenue

available to the Group to be recognised in future periods. Within

this, current RPO, being revenue due to be recognised within the

next 12 months, increased by 18% to GBP31.4m (FY22: GBP26.5m).

The Group's adjusted EBITDA was 25% higher at GBP8.00m (FY22:

GBP6.41m), at a margin of 22% of revenue (FY22: 21%). The improved

margin reflecting the higher contribution from Cloud services in

the sales mix partially offset by continued investment in headcount

and pay growth.

The higher adjusted EBITDA led to a 19% increase in operating

profits to GBP3.81m (FY22: GBP3.19m) with the final Oakwood

Technologies BV contingent consideration expense of GBP0.37m (FY22:

GBP0.06m) and higher share-based payment charges of GBP1.64m (FY22:

GBP0.96m).

To support the acquisition of MatsSoft Limited in 2017, the

Company issued a GBP7m Loan Note with options over 4.8m new

ordinary shares of 5p each priced at 58p. The Loan Note was

unsecured, had an annual interest rate of 8.5% payable quarterly in

arrears and was repayable in six instalments from 30 September 2022

to 31 March 2025. The Company made an initial repayment of GBP3.5m

in November 2021, a scheduled repayment of GBP0.6m in September

2022 and in October 2022 redeemed the final GBP2.9m of the Loan

Notes. Accordingly, total finance costs reduced to GBP0.14m

(H1-FY22: GBP0.66m). In September 2022, the options were exercised

and the Company received GBP2.8m in proceeds and issued 4.8m new

ordinary shares of 5p each. with the amount in excess of nominal

value, GBP2.56m, credited to the share premium account.

As a result, profit before tax was 73% higher at GBP4.00m (FY22:

GBP2.31m).

The Group recorded a tax credit of GBP0.21m (FY22: credit of

GBP0.09m) benefiting from tax relief available from the exercise of

share options during the period.

Basic earnings per share was 2.69 pence (FY22: 1.61 pence) and

increased by 55% to 3.33 pence on an adjusted basis (FY22: 2.15

pence). Diluted earnings per share was 2.52 pence (FY22: 1.52

pence) and increased by 53% to 3.12 pence on an adjusted basis

(FY22: 2.04 pence).

Cash generated from operations increased by 12% to GBP11.2m

(FY22: GBP9.99m). The Group deferred GBP2.21m of VAT payments

during March and June 2020 due to Covid-19, which was repayable in

monthly instalments from March 2021 to January 2022. Adjusting for

the effect of VAT deferral and consideration paid to the vendors of

Oakwood Technologies BV (acquired in October 2020) accounted for as

post completion services, cash generated from operations increased

to GBP11.6m (FY22: GBP11.5m) a conversion of 145% (FY22: 179%) of

adjusted EBITDA.

Spending on research and development, including capitalised

software development, was 22% higher at GBP4.98m (FY22: GBP4.07m)

of which capitalised software expenditure was GBP2.27m (FY22:

GBP1.61m).

Total capital expenditure was GBP2.74m (FY22: GBP1.94m); the

balance after capitalised development, being GBP0.48m (FY22:

GBP0.33m) relating to IT equipment and software.

As a result of these factors, net funds were GBP 24.4 m at 30

June 2023 (30 June 2022: GBP13.4m).

Dividend

In line with the Company's dividend policy to pay-out 25% of

adjusted earnings per share, the Board is proposing a final

dividend for this financial year of 0.83p (FY22: 0.54p). If

approved, the final dividend will be paid on 9 February 2024 to

shareholders on the register at the close of business on 29

December 2023.

Audited consolidated income statement for the year ended 30 June

2023

2023 2022

GBP'000 GBP'000

----------------------------------------- --------- ---------

Revenue 36,040 30,458

Cost of sales (5,768) (5,021)

Gross profit 30,272 25,437

Administrative expenses (26,522) (22,363)

Other gains/(losses) - net 62 113

------------------------------------------ --------- ---------

Adjusted EBITDA 8,003 6,405

Depreciation (377) (437)

Amortisation of acquired intangible

assets (522) (522)

Amortisation of other intangible assets (1,287) (1,239)

Post-completion services (see note 4) (365) (56)

Share-based payments (1,640) (964)

------------------------------------------ --------- ---------

Operating profit 3,812 3,187

Finance income 344 6

Finance costs (155) (881)

------------------------------------------ --------- ---------

Finance costs - net 189 (875)

Profit before tax 4,001 2,312

Tax credit 205 88

------------------------------------------ --------- ---------

Profit for the year 4,206 2,400

========================================== ========= =========

Earnings per share - pence

Basic 2.69 1.61

Diluted 2.52 1.52

========================================== ========= =========

All activities of the Group in the current and prior periods are

classed as continuing. All of the profit for the period is

attributable to the shareholders of Netcall plc.

Audited consolidated statement of comprehensive income for the

year ended 30 June 2023

2023 2022

GBP'000 GBP'000

------------------------------------------------- -------- --------

Profit for the year 4,206 2,400

Other comprehensive income

Items that may be reclassified to profit

or loss

Exchange differences arising on translation

of foreign operations 8 (14)

Total other comprehensive income for

the year 8 (14)

-------------------------------------------------- -------- --------

Total comprehensive income for the year 4,214 2,386

================================================== ======== ========

All of the comprehensive income for the year is attributable to

the shareholders of Netcall plc.

Audited consolidated balance sheet at 30 June 2023

2023 2022

GBP'000 GBP'000

--------------------------------------------- ------ --------- ---------

Assets

Non-current assets

Property, plant and equipment 699 477

Right-of-use assets 298 539

Intangible assets 30,453 29,976

Deferred tax assets 1,767 906

Financial assets at fair value through

other comprehensive income 72 72

Total non-current assets 33,289 31,970

--------------------------------------------- ------ --------- ---------

Current assets

Inventories 31 37

Other current assets 2,333 2,767

Contract assets 599 888

Trade receivables 4,468 3,704

Other financial assets at amortised cost 57 8

Cash and cash equivalents 24,753 17,605

--------------------------------------------- ------ --------- ---------

Total current assets 32,241 25,009

--------------------------------------------- ------ --------- ---------

Total assets 65,530 56,979

--------------------------------------------- ------ --------- ---------

Liabilities

Non-current liabilities

Contract liabilities 787 525

Borrowings - 2,304

Lease liabilities 292 521

Deferred tax liabilities 1,151 899

Total non-current liabilities 2,230 4,249

--------------------------------------------- ------ --------- ---------

Current liabilities

Trade and other payables 7,232 7,963

Contract liabilities 20,578 16,005

Borrowings - 1,167

Lease liabilities 113 177

Total current liabilities 27,923 25,312

----------------------------------------------------- --------- ---------

Total liabilities 30,153 29,561

----------------------------------------------------- --------- ---------

Net assets 35,377 27,418

============================================= ====== ========= =========

Equity attributable to owners of Netcall

plc

Share capital 8,108 7,587

Share premium 5,574 3,015

Other equity 4,900 4,900

Other reserves 3,056 4,462

Retained earnings 13,739 7,454

--------------------------------------------- ------ --------- ---------

Total equity 35,377 27,418

============================================= ====== ========= =========

Audited consolidated statement of cash flows for the year ended

30 June 2023

2023 2022

GBP'000 GBP'000

----------------------------------------------- -------- --------

Cash flows from operating activities

Profit before income tax 4,001 2,312

Adjustments for:

Depreciation and amortisation 2,186 2,198

Share-based payments 1,640 964

Finance costs - net (189) 875

Other non-cash expenses 6 -

Changes in operating assets and liabilities,

net of effects from purchasing of subsidiary

undertaking:

Decrease in inventories 7 47

Increase in trade receivables (765) (1,064)

Decrease in contract assets 281 32

(Increase)/ decrease in other financial

assets at amortised cost (49) 3

Decrease/ (increase) in other current

assets 416 (1,237)

(Decrease)/ increase in trade and other

payables (1,148) 1,040

Increase in contract liabilities 4,835 4,817

Cash flows from operations 11,221 9,987

------------------------------------------------ -------- --------

Analysed as:

Cash flows from operations before VAT

deferral scheme and payment of post

completion service consideration 11,597 11,500

Net effect of VAT deferral scheme - (1,407)

Payment of post completion service

consideration (376) (106)

------------------------------------------------ -------- --------

Interest received 344 6

Interest paid (8) (7)

Income taxes paid - (1)

Net cash inflow from operating activities 11,557 9,985

------------------------------------------------ -------- --------

Cash flows from investing activities

Payment for property, plant and equipment (458) (134)

Payment of software development costs (2,267) (1,610)

Payment for proprietary software - (136)

Payment for other intangible assets (19) (57)

Net cash outflow from investing activities (2,744) (1,937)

------------------------------------------------ -------- --------

Cash flows from financing activities

Proceeds from issues of ordinary shares 3,079 53

Interest paid on Loan Notes (204) (759)

Repayment of borrowings (3,500) (3,500)

Lease payments (214) (169)

Dividends paid to Company's shareholders (839) (554)

------------------------------------------------ -------- --------

Net cash outflow from financing activities (1,678) (4,929)

------------------------------------------------ -------- --------

Net increase in cash and cash equivalents 7,135 3,119

Cash and cash equivalents at beginning

of the financial year 17,605 14,520

Effects of exchange rate on cash and

cash equivalents 13 (34)

================================================ ======== ========

Cash and cash equivalents at end of

financial year 24,753 17,605

================================================ ======== ========

Audited consolidated statement of changes in equity at 30 June

2023

Share Share Other Other Retained

capital premium equity reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------- --------- -------- ---------- ---------- --------

Balance at 30 June 2021 7,534 3,015 4,900 3,840 5,317 24,606

------------------------------- --------- --------- -------- ---------- ---------- --------

Proceeds from share issue 53 - - - (1) 52

Increase in equity reserve

in relation to options

issued - - - 775 - 775

Tax credit relating to

share options - - - 153 - 153

Reclassification following

exercise or lapse of options - - - (292) 292 -

Dividends paid - - - - (554) (554)

------------------------------- --------- --------- -------- ---------- ---------- --------

Transactions with owners 53 - - 636 (263) 320

------------------------------- --------- --------- -------- ---------- ---------- --------

Profit for the year - - - - 2,400 2,400

Other comprehensive income

for the year - - - (14) - (14)

------------------------------- --------- --------- -------- ---------- ---------- --------

Total comprehensive income

for the year - - - (14) 2,400 2,386

------------------------------- --------- --------- -------- ---------- ---------- --------

Balance at 30 June 2022 7,587 3,015 4,900 4,462 7,454 27,418

------------------------------- --------- --------- -------- ---------- ---------- --------

Proceeds from share issue 521 2,559 - - - 3,080

Increase in equity reserve

in relation to options

issued - - - 1,099 - 1,099

Tax credit relating to

share options - - - 405 - 405

Reclassification following

exercise or lapse of options - - - (2,918) 2,918 -

Dividends paid - - - - (839) (839)

------------------------------- --------- --------- -------- ---------- ---------- --------

Transactions with owners 521 2,559 - (1,414) 2,079 3,745

------------------------------- --------- --------- -------- ---------- ---------- --------

Profit for the year - - - - 4,206 4,206

Other comprehensive income

for the year - - - 8 - 8

------------------------------- --------- --------- -------- ---------- ---------- --------

Total comprehensive income

for the year - - - 8 4,206 4,214

------------------------------- --------- --------- -------- ---------- ---------- --------

Balance at 30 June 2023 8,108 5,574 4,900 3,056 13,739 35,377

------------------------------- --------- --------- -------- ---------- ---------- --------

Notes to the financial information for the year ended 30 June

2023

1. General information

Netcall plc (AIM: "NET", "Netcall", or the "Company"), is a

leading provider of customer engagement software, is a limited

liability company and is quoted on AIM (a market of the London

Stock Exchange). The Company's registered address is Suite 203,

Bedford Heights, Brickhill Drive, Bedford, UK MK41 7PH and the

Company's registered number is 01812912.

2. Basis of preparation

The Group financial statements consolidate those of the Company

and its subsidiaries (together referred to as the 'Group').

The financial information set out in these final results has

been prepared in accordance with UK-adopted International

Accounting Standards in conformity with the requirements of the

Companies Act 2006. The accounting policies adopted in this results

announcement have been consistently applied to all the years

presented and are consistent with the policies used in the

preparation of the statutory accounts for the period ended 30 June

2023.

The consolidated financial information is presented in sterling

(GBP), which is the Company's functional and the Group's

presentation currency.

The financial information set out in these results does not

constitute the Company's statutory accounts for 2023 or 2022.

Statutory accounts for the years ended 30 June 2023 and 30 June

2022 have been reported on by the Independent Auditors; their

report was (i) unqualified; (ii) did not draw attention to any

matters by way of emphasis; and (iii) did not contain a statement

under 498(2) or 498(3) of the Companies Act 2006.

Statutory accounts for the year ended 30 June 2022 have been

filed with the Registrar of Companies. The statutory accounts for

the year ended 30 June 2023 will be delivered to the Registrar in

due course. Copies of the Annual Report 2023 will be posted to

shareholders on or about 19 November 2023. Further copies of this

announcement can be downloaded from the website www.netcall.com

.

As a result of the level of cash generated from operating

activities the Group has maintained a healthy liquidity position as

shown on the consolidated balance sheet. The Board has carried out

a going concern review and concluded that the Group has adequate

cash to continue in operational existence for the foreseeable

future. To support this the Directors have prepared cash flow

forecasts for a period in excess of 12 months from the date of

approving the financial statements. When preparing the cash flow

forecasts the Directors have reviewed a number of scenarios,

including the severe yet plausible downside scenario, with respect

to levels of new business and client retention. In all scenarios

the Directors were able to conclude that the Group has adequate

cash to continue in operational existence for the foreseeable

future.

3. Segmental analysis

Management consider that there is one operating business segment

being the design, development, sale and support of software

products and services, which is consistent with the information

reviewed by the Board when making strategic decisions. Resources

are reviewed on the basis of the whole of the business

performance.

The key segmental measure is adjusted EBITDA which is profit

before interest, tax, depreciation, amortisation, , acquisition and

reorganisation expenses and share-based payments, which is set out

on the consolidated income statement.

4. Material profit or loss items

The Group identified the following item in the prior year which

was material due to the significance of its nature and/or its

amount. It is listed separately here to provide a better

understanding of the financial performance of the Group in this and

the prior year.

2023 2022

GBP'000 GBP'000

------------------------------------- -------- --------

Post completion services expense(1) (365) (56)

(365) (56)

------------------------------------- -------- --------

(1) The former owners of Oakwood Technologies BV acquired in

October 2020 continued to work in the business following its

acquisition and in accordance with IFRS 3 a proportion of the

contingent consideration arrangement is treated as remuneration and

expensed in the income statement. The final payment under this

arrangement of GBP0.38m was made during the year.

5. Earnings per share

The basic earnings per share is calculated by dividing the net

profit attributable to equity holders of the Company by the

weighted average number of ordinary shares in issue during the

year, excluding those held in treasury.

30 June 30 June

2023 2022

---------------------------------------------------- -------- --------

Net earnings attributable to ordinary shareholders

(GBP'000) 4,206 2,400

Weighted average number of ordinary shares

in issue (thousands) 156,352 149,462

---------------------------------------------------- -------- --------

Basic earnings per share (pence) 2.69 1.61

---------------------------------------------------- -------- --------

The diluted earnings per share has been calculated by dividing

the net profit attributable to ordinary shareholders by the

weighted average number of shares in issue during the year,

adjusted for potentially dilutive shares that are not

anti-dilutive.

30 June 30 June

2023 2022

----------------------------------------------- -------- --------

Weighted average number of ordinary shares

in issue (thousands) 156,352 149,462

Adjustments for share options (thousands) 10,630 8,150

Weighted average number of potential ordinary

shares in issue (thousands) 166,982 157,612

----------------------------------------------- -------- --------

Diluted earnings per share (pence) 2.52 1.52

----------------------------------------------- -------- --------

Adjusted earnings per share have been calculated to exclude the

effect of acquisition, contingent consideration and reorganisation

costs, share-based payment charges, amortisation of acquired

intangible assets and with a normalised rate of tax. The Board

believes this gives a better view of on-going maintainable

earnings. The table below sets out a reconciliation of the earnings

used for the calculation of earnings per share to that used in the

calculation of adjusted earnings per share:

GBP'000 30 June 2023 30 June 2022

--------------------------------------------------------------- ------------- -------------

Profit used for calculation of basic and diluted EPS 4,206 2,400

--------------------------------------------------------------- ------------- -------------

Share-based payments 1,640 964

Post-completion services (see note 4) 365 56

Amortisation of acquired intangible assets 522 522

Unwinding of discount - contingent consideration & borrowings 29 116

Tax effect of adjustments (1,548) (842)

Profit used for calculation of adjusted basic and diluted EPS 5,214 3,216

--------------------------------------------------------------- ------------- -------------

30 June 30 June

2023 2022

--------------------------------------------- -------- --------

Adjusted basic earnings per share (pence) 3.33 2.15

Adjusted diluted earnings per share (pence) 3.12 2.04

--------------------------------------------- -------- --------

6. Dividends

Statement of changes June 2022 balance

Cash flow statement in equity sheet

Year to June 2023 Paid Pence per share (GBP'000) (GBP'000) (GBP'000)

--------------------- --------- ---------------- -------------------- --------------------- ---------------------

Final ordinary

dividend for the

year to June 2022 31/1/23 0.54p 839 839 -

--------------------- --------- ---------------- -------------------- --------------------- ---------------------

839 839 -

------------------------------- ---------------- -------------------- --------------------- ---------------------

Statement of changes June 2022 balance

Cash flow statement in equity sheet

Year to June 2022 Paid Pence per share (GBP'000) (GBP'000) (GBP'000)

--------------------- --------- ---------------- -------------------- --------------------- ---------------------

Final ordinary

dividend for the

year to June 2021 8/2/22 0.37p 554 554 -

554 554 -

------------------------------- ---------------- -------------------- --------------------- ---------------------

It is proposed that this year's final ordinary dividend of 0.83p

pence per share will be paid to shareholders on 9 February 2024.

Netcall plc shares will trade ex-dividend from 28 December 2023 and

the record date will be 29 December 2023. The estimated amount

payable is GBP1.33m. The proposed final dividend is subject to

approval by shareholders at the Annual General Meeting and has not

been included as a liability in these financial statements.

7. Net funds reconciliation

30 June 30 June

GBP'000 2023 2022

------------------------------------------- -------- --------

Cash and cash equivalents 24,753 17,605

Borrowings - fixed interest and repayable

within one year (1) - (1,167)

Borrowings - fixed interest and repayable

after one year (1) - (2,304)

Lease liabilities (405) (698)

------------------------------------------- -------- --------

Net funds 24,348 13,436

------------------------------------------- -------- --------

(1) To support the acquisition of MatsSoft Limited in August

2017, the Company issued a GBP7m Loan Note with options over 4.8m

new ordinary shares of 5p each priced at 58p. The Loan Note was

unsecured, had an annual interest rate of 8.5% payable quarterly in

arrears and was repayable in six instalments from 30 September 2022

to 31 March 2025. The Loan Note was initially allocated a fair

value of GBP6.42m and the share option a fair value of GBP0.58m.

The discount on the carrying value of the Loan Note was amortised

via the profit and loss account over the expected option life of

five years. The Company made an initial repayment of GBP3.5m in

November 2021, a scheduled repayment of GBP0.6m in September 2022

and in October 2022 redeemed the final GBP2.9m of the Loan Notes.

In September 2022, options were exercised and the Company received

GBP2.8m in proceeds and issued 4.8m new ordinary shares of 5p

each.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BIBDGUGBDGXG

(END) Dow Jones Newswires

October 11, 2023 02:00 ET (06:00 GMT)

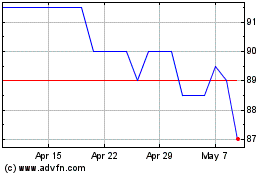

Netcall (LSE:NET)

Historical Stock Chart

From Apr 2024 to May 2024

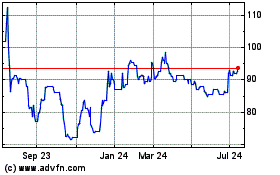

Netcall (LSE:NET)

Historical Stock Chart

From May 2023 to May 2024