TIDMSEE

RNS Number : 0874U

Seeing Machines Limited

31 March 2021

31 March 2021

Seeing Machines Limited

("Seeing Machines" or the "Company)

Half year results and financial report

Seeing Machines Limited (AIM: SEE), the advanced computer vision

technology company that designs AI-powered operator monitoring

systems to improve transport safety, today publishes its unaudited

results and financial report for the six months to 31 December 2020

("H1 2021").

Financial Highlights:

-- Operational revenue of A$18.1m (H1 2020: A$15.8m) reflecting

comparative growth of 15% on previous period. Underlying revenue

growth using constant currencies is 19% year on year (exchange rate

as at 1 July 2020).

o Aftermarket (Fleet and Off-Road) revenue grew by 17% to A$15m

(H1 2020: A$12.9m)

o Annualised Recurring Revenues including royalties of A$15.5m,

representing growth of 17.4% (H1 2020: A$13.2m)

o OEM (Automotive and Aviation) revenue of A$3.1m (H1 2020:

A$2.97m), representing a 5% increase on previous period

-- Net loss of A$16.8m, representing an improvement of 33%

compared with the same period last year (H1 2020: A$24.9m)

-- Cash at 31 December 2020 of A$52.3m (31 December 2019: A$47.4m)

-- Range of cost-saving initiatives, introduced through height

of COVID-19 pandemic, has resulted in improved cost base management

aimed at contributing to better operational performance and

improved cash balance.

OEM Highlights:

-- Driver Monitoring System (DMS) technology now firmly

established as fundamental to improved safety on roads, underpinned

by regulation and standards, as well as to the increasingly smart

vehicle interior for carmakers;

-- The number of active automotive RFQs (Requests For Quotes)

requesting DMS has increased accordingly across major automotive

markets;

-- Cadillac Escalade by General Motors, is now available on

roads with Driver Attention System featuring Seeing Machines

technology, bringing total current production vehicles to five,

aross three OEM programs;

-- Automotive three-pillar embedded product strategy launched to

support carmakers with a range of integration options for DMS;

-- Seeing Machines now formally working with a range of

semi-conductor companies including Qualcomm Technologies and

Omnivision Technologies to extend the deliver of its DMS.

Aftermarket Highlights:

-- Max Verberne appointed to lead the Aftermarket business,

bringing a wealth of industry understanding having led telematics

businesses for over ten years including with Radius Telematics

Australia and Ctrack by Inseego, and has previously managed

divisions and channels for Siemens across Australia and New

Zealand;

-- Business continues to grow despite challenging global

conditions as Guardian hardware sales remain consistent with

ongoing momentum around safety technology in commercial transport

and logistics, and installation rates in Southern Hemisphere,

accelerate;

-- Guardian connections as at 31 December 2020 of 26,597

represents growth in installed base of over 3,000 units in the six

months prior, contributing to unrivalled set of naturalistic

driving data which now exceeds 6.3 billion kilometres and underpins

ongoing development of the Company's DMS platform technology.

Investment Highlights:

-- Investment by leading US based insititutional investors has

strengthened Seeing Machines' balance sheet and positioned the

Company to initiate a range of strategies to support incremental

growth objectives across its key transport markets.

Outlook:

Seeing Machines continues to trade in line with expectations for

FY2021.

Guardian connections are expected to accelerate as COVID-19

challenges subside with the global vaccine rollout and H2 2021 is

expected to see an incremental growth in Aftermarket related

revenue.

As the Company expects to be in production with existing OEM

customers on more than 30 distinct car models within the next two

calendar years, the current makeup of Automotive revenue is set to

change from NRE (Non-Recurring Revenue) to signficantly higher

margin based royalty revenue.

Paul McGlone, CEO of Seeing Machines commented: "The first half

of FY2021 has been pleasing and we are buoyed by the progress in

Fleet, as well as the significant increase in RFQ activity in

Automotive across key markets as carmakers ready themselves for

mounting safety standards and technology advances inside the cabin,

all supported by camera-based DMS. We are now in production on five

car models, working across three OEMs, and that is set to ramp up

signficantly over the coming two years.

"Further, I'm delighted with the interest we are seeing from

both UK and US based institutional investors, as DMS becomes more

and more relevant across all key Seeing Machines transport sectors.

We are now positioned to look beyond the near term and leverage our

strengthened balance sheet to grow company opportunities across

core markets."

Enquiries:

Seeing Machines Limited +61 2 6103 4700

Paul McGlone - CEO

Sophie Nicoll - Corporate Communications

Cenkos Securities plc (Nominated Adviser and

Broker)

Neil McDonald

Pete Lynch +44 131 220 6939

Stifel Nicolaus Europe Limited (Joint Broker) +44 20 7710 7600

Alex Price

Nick Adams

Lionsgate Communications (Media Enquiries) +44 7791 892509

Jonathan Charles

Seeing Machines (LSE: SEE), a global company founded in 2000 and

headquartered in Australia, is an industry leader in vision-based

monitoring technology that enable machines to see, understand and

assist people. Seeing Machines' technology portfolio of AI

algorithms, embedded processing and optics, power products that

need to deliver reliable real-time understanding of vehicle

operators. The technology spans the critical measurement of where a

driver is looking, through to classification of their cognitive

state as it applies to accident risk. Reliable "driver state"

measurement is the end-goal of Driver Monitoring Systems (DMS)

technology. Seeing Machines develops DMS technology to drive safety

for Automotive, Commercial Fleet, Off-road and Aviation. The

company has offices in Australia, USA, Europe and Asia, and

supplies technology solutions and services to industry leaders in

each market vertical.

www.seeingmachines.com

Review of Operations

Financial Results

As reported at the end of FY2020, the Company has identified two

key operating segments, OEM and Aftermarket, reflecting the

different paths to market for our products. The OEM segment

includes the Automotive and Aviation businesses which generate

largely license based revenue, channeled through Tier 1 customers.

The Aftermarket segment includes Fleet and Off-Road and generates

revenue from a mix of direct and indirect customers who retro-fit

Seeing Machines technology into commercial vehicles.

The Company's total sales revenue for H1 FY2021 (excluding

foreign exchange gains and finance income) increased by 14.6% to

A$18.1m (H1 FY2020: A$15.8m).

Business unit H1FY21 H1FY20 Variance

$'000 $'000 %

OEM 3,103 2,965 5

Aftermarket 15,040 12,866 17

Sales Revenue 18,143 15,831 15

Monitoring services revenue in Aftermarket grew by more than 42%

to A$5.8m for the half year, compared to

A$4.1m for the same period last year. Installed Guardian units

increased by over 3,000 to 26,597 connected units representing a

15.6% growth in connections over the six month period (FY20: 23,000

units), demonstrating ongoing momentum for Aftermarket, despite the

challenges posed by COVID-19.

Total OEM revenue increased 5% to A$3.1m compared to the same

period last year (H1 FY2020: A$3m).

Currently, OEM revenue is primarily made up of Non-recurring

Engineering (NRE), which is revenue provided by OEMs to fund the

development of DMS technology solutions and feature sets for their

specific requirements. Over the next few years, the nature of OEM

revenue will change to consist primarily of royalty revenue, and

will increase significantly as OEMs begin mass production on

vehicles under existing Seeing Machines DMS technology program

awards.

The Australian Government COVID-19 Grant, JobKeeper, increased

other income by A$1.6m to A$1.7m (2019: A$0.3m). Seeing Machines

qualified for the initial phase of the JobKeeper Grant which ran

from 1 March 2020 to 27 September 2020. Additional COVID-19 cost

reduction initiatives reduced the cost base by A$3.5m for the

period with a range of permanent (A$1.6m) and temporary initiatives

(A$1.9m) which included a temporary 4-day work week, CEO and

Director fee reductions and enforced travel restrictions. Of the

total A$12m identified COVID cost-saving initiatives, the Company

has achieved A$8.4m, in permanent and temporary savings and grants

to date with remaining savings expected to be achieved by end of

FY2021.

On 23 October 2020, Seeing Machines issued 372,000,000 new

ordinary shares of no par value each ("New Ordinary Shares") to

Federated Hermes, a well known US institutional investor, at a

price of 4.10 pence per New Ordinary Share, raising gross proceeds

of approximately US$20,000,000 (the "Purchase"). Subsequent to 31

December 2020, on 22 March 2021, Seeing Machines issued an

additional 68,403,430 New Ordinary Shares to another US based

investor, Toronado Fund, at a premium price of 10.50 pence per New

Ordinary Share, raising gross proceeds of approximately

US$10,000,000. The net proceeds of these Placings strengthen the

Company's

balance sheet as well as facilitating a range of incremental

growth initiatives.

Cash and cash equivalents at 31 December totaled A$52.4m

(H1FY20: A$47.4m).

We highlight this report is unaudited. There is no requirement

for the interim financial statements to be subject to audit review

by the external auditor and accordingly no audit or review has been

conducted.

Interim Consolidated Statement of Financial Position -

Unaudited

31 Dec 30 Jun

AS AT Notes 2020 2020

Unaudited Reviewed

A$000 A$000

---------------------------------------- -------------------- ---------------- ------------

ASSETS

CURRENT ASSETS

Cash and cash equivalents 9 52,361 38,138

Trade and other receivables 8 9,592 9,584

Inventories 7 4,102 4,743

Current financial assets 8 332 512

Other current assets 3,480 4,233

---------------- ------------

TOTAL CURRENT ASSETS 69,867 57,210

---------------- ------------

NON-CURRENT ASSETS

Property, plant & equipment 6 3,171 3,208

Right-of-use assets 3,847 4,371

Intangible assets 10 1,084 899

---------------- ------------

TOTAL NON-CURRENT ASSETS 8,102 8,478

---------------- ------------

TOTAL ASSETS 77,969 65,688

---------------- ------------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 8 7,651 7,874

Provisions 3,897 3,763

Current financial liabilities 8 378 553

Contract liabilities 647 263

Interest-bearing loans and borrowings 8 1,141 1,057

TOTAL CURRENT LIABILITIES 13,714 13,510

---------------- ------------

NON-CURRENT LIABILITIES

Interest-bearing loans and borrowings 8 5,196 5,766

Provisions 186 215

---------------- ------------

TOTAL NON-CURRENT LIABILITIES 5,382 5,981

---------------- ------------

TOTAL LIABILITIES 19,096 19,491

---------------- ------------

NET ASSETS 58,873 46,197

================ ============

EQUITY

Contributed equity 244,730 217,204

Accumulated losses (201,454) (184,638)

Other reserves 15,597 13,631

---------------- ------------

Equity attributable to equity holders

of the parent 58,873 46,197

---------------- ------------

TOTAL EQUITY 58,873 46,197

================ ============

The above interim consolidated statement of financial position

should be read in conjunction with the accompanying notes.

Interim Consolidated Statement of Comprehensive Income -

Unaudited

FOR THE HALF-YEARED 31 DECEMBER 2020 2019

Notes Unaudited Reviewed

A$000 A$000

------------------------------------------- -------- ---------------- -----------------

Sale of goods and licence fees 9,159 8,721

Rendering of services 8,981 6,947

Research revenue 3 163

---------------- -----------------

Revenue 3 18,143 15,831

---------------- -----------------

Cost of sales (11,804) (10,221)

---------------- -----------------

Gross profit 4 6,339 5,610

---------------- -----------------

Net (loss)/gain in foreign exchange (2,002) 433

Finance income 196 569

Other income 1,672 323

Expenses

Research and development expenses 5 (8,853) (12,016)

Customer support and marketing expenses (3,194) (4,328)

Operations expenses (3,476) (5,463)

General and administration expenses (7,186) (9,769)

Finance costs (267) (307)

---------------- -----------------

Loss before tax (16,771) (24,948)

---------------- -----------------

Income tax expense - (4)

---------------- -----------------

Loss after income tax (16,771) (24,952)

Loss for the period

Attributable to:

Equity holders of the parent (16,771) (24,952)

---------------- -----------------

Other comprehensive (loss)/ income - to

be

reclassified subsequently to profit or

loss

Exchange differences on translation of

foreign operations (22) 130

---------------- -----------------

Other comprehensive (loss)/income net

of tax (22) 130

---------------- -----------------

Total comprehensive loss (16,793) (24,822)

---------------- -----------------

Total comprehensive loss attributable

to:

Equity holders of the parent 16,793 24,822

================ =================

Total comprehensive loss for the period (16,793) (24,822)

================ =================

Earnings per share for loss attributable

to the ordinary equity holders of

the parent:

Basic earnings per share (0.01) (0.02)

Diluted earnings per share (0.01) (0.02)

The above interim consolidated statement of comprehensive income

should be read in conjunction with the accompanying notes.

Interim Consolidated Statement of Changes in Equity -

Unaudited

Employee

Foreign Equity

Currency Benefits

Contributed Treasury Accumulated Translation & Other Total

Equity Shares Losses Reserve Reserve Equity

--------------------------

A$000 A$000 A$000 A$000 A$000 A$000

-------------------------- ------------- --------- ----------- ------------- ---------- --------

As at 1 July 2019 217,204 (1,109) (137,928) (1,738) 11,051 87,480

------------- --------- ----------- ------------- ---------- --------

Loss for the half

year - - (24,952) - - (24,952)

Other comprehensive

income - - - 130 - 130

------------- --------- ----------- ------------- ---------- --------

Total comprehensive

income - - (24,952) 130 - (24,822)

Transactions with

owners in their capacity

as owners:

Reclassification of

treasury shares - 1,109 - - (1,109) -

Shares issued 263 - - - - 263

Employee shares held

in trust - - - - 1,680 1,680

------------- --------- ----------- ------------- ---------- --------

At 31 December 2019

- Audited 217,467 - (162,880) (1,608) 11,622 64,601

============= ========= =========== ============= ========== ========

As at 1 July 2020 217,204 - (184,638) (1,516) 15,147 46,197

Loss for the period - - (16,771) - - (16,771)

Other comprehensive

income - - - (22) - (22)

------------ ------------------ ------- --------- --------

Total comprehensive

loss - - (16,771) (22) - (16,793

------------ ------------------ ------- --------- ----------

Transactions with

owners in their capacity

as owners:

Share-based payments

(Note 12) - - - - 1,943 1,943

Shares issued 27,526 - - - - 27,526

Employee shares held - - - - - -

in trust

------------ ------------------ ------- --------- ----------

At 31 December 2020

- Unaudited 244,730 - (201,409) (1,538) 17,090 58,873

============ ================== ======= ========= ==========

The above interim consolidated statement of changes in equity

should be read in conjunction with the accompanying notes.

Interim Consolidated Statement of Cash Flows - Unaudited

31 Dec 31 Dec

2020 2019

Unaudited Reviewed

-------------------------------------------

Notes A$000 A$000

------------------------------------------------------------- ---------- ---------

Operating activities

Receipts from customers (inclusive

of GST) 18,519 21,082

Payments to suppliers (inclusive

of GST) (32,556) (36,512)

Receipt of government grants 1,565 -

Interest received 45 367

Interest paid (267) (307)

Income tax paid - (4)

---------- ---------

Net cash flows used in operating

activities (12,694) (15,374)

---------- ---------

Investing activities

Purchase of property, plant and equipment 6 (92) (681)

Payments for intangible assets (190) (233)

Purchase/(maturity) of term deposits 180 9,049

---------- ---------

Net cash flows (used in)/from investing

activities 102 8,135

---------- ---------

Financing activities

Proceeds from issue of new shares 28,160 -

Cost of capital raising (634) -

Payment of lease liabilities 8 - (387)

Repayment of borrowings (700) (292)

---------- ---------

Net cash flows from/(used in) financing

activities 26,826 (679)

---------- ---------

Net foreign exchange difference 193 459

Cash and cash equivalents at 1 July 38,138 54,809

Net increase/(decrease) in cash and

cash equivalents 14,030 (7,918)

---------- ---------

Cash and cash equivalents at 31 December 9 52,361 47,350

========== =========

The above interim consolidated statement of cash flows should be

read in conjunction with the accompanying notes.

Notes to the interim consolidated financial statements

1 Corporate information

The interim consolidated financial statements of Seeing Machines

Limited and its subsidiaries (collectively, the Group) for the

half-year ended 31 December 2020 were authorised for issue in

accordance with a resolution of the directors on 25 March 2021.

Seeing Machines Limited (the parent) is a company limited by

shares incorporated in Australia whose shares are publicly traded

on the AIM market of the London Stock Exchange.

2 Basis of preparation and changes to the Group's accounting policies

(a) Basis of preparation

The interim consolidated financial statements for the half year

ended 31 December 2020 have been prepared in accordance with AASB

134 Interim Financial Reporting in order to fulfil the reporting

requirements of Rule 18 of the London Stock Exchange's AIM Rules

for Companies issued July 2016.

The interim consolidated financial statements do not include all

the information and disclosures required in the annual financial

statements and should be read in conjunction with the Group's

annual consolidated financial statements as at 30 June 2020.

There is no requirement for the interim financial statements to

be subject to audit or review by the external auditor and

accordingly no audit or review has been conducted.

(b) New standards, interpretations and amendments adopted by the Group

The accounting policies adopted in the preparation of the

interim consolidated financial statements are consistent with those

followed in the preparation of the Group's annual consolidated

financial statements for the year ended 30 June 2020, except for

the adoption of new standards effective as of 1 July 2020.

Several amendments and interpretations apply for the first time

in 2020, but do not have an impact on the interim consolidated

financial statements of the Group.

Amendments to IFRS 3: Definition of a Business

The amendment to IFRS 3 clarifies that to be considered a

business, an integrated set of activities and assets must include,

at a minimum, an input and a substantive process that together

significantly contribute to the ability to create output.

Furthermore, it clarified that a business can exist without

including all of the inputs and processes needed to create outputs.

These amendments had no impact on the consolidated financial

statements of the Group, but may impact future periods should the

Group enter into any business combinations.

Amendments to IFRS 7, IFRS 9 and IAS 39: Interest Rate Benchmark

Reform

The amendments to IFRS 9 and IAS 39 Financial Instruments:

Recognition and Measurement provide a number of reliefs, which

apply to all hedging relationships that are directly affected by

interest rate benchmark reform. A hedging relationship is affected

if the reform gives rise to uncertainties about the timing and or

amount of benchmark-based cash flows of the hedged item or the

hedging instrument. These amendments had no impact on the

consolidated financial statements of the Group as it does not have

any interest rate hedge relationships.

Amendments to IAS 1 and IAS 8: Definition of Material

The amendments provide a new definition of material that states

"information is material if omitting, misstating or obscuring it

could reasonably be expected to influence decisions that the

primary users of general purpose financial statements make on the

basis of those financial statements, which provide financial

information about a specific reporting entity."

The amendments clarify that materiality will depend on the

nature or magnitude of information, either individually or in

combination with other information, in the context of the financial

statements. A misstatement of information is material if it could

reasonably be expected to influence decisions made by the primary

users. These amendments had no impact on the consolidated financial

statements of, nor is there expected to be any future impact to the

Group.

Conceptual Framework for Financial Reporting issued on 29 March

2018

The Conceptual Framework is not a standard, and none of the

concepts contained therein override the concepts or requirements in

any standard. The purpose of the Conceptual Framework is to assist

the IASB in developing standards, to help prepares develop

consistent accounting policies where there is no applicable

standard in place and to assist all parties to understand and

interpret the standards.

The revised Conceptual Framework includes some new concepts,

provides updated definitions and recognition criteria for assets

and liabilities and clarifies some important concepts.

These amendments had no impact on the consolidated financial

statements of the Group.

Classification of operating expenses

The Group has revised the presentation of operating expenses

within the categories of research and development, customer support

and marketing, operations and general and administration.

Management believes this provides more relevant information to

stakeholders as it more fairly reflects the split between business

functions and key activity drivers. Comparatives have been restated

to reflect this change in presentation.

2 Revenue from contracts with customers

Set out below is the disaggregation of the Group's revenue from

contracts with customers:

For the half year ended 31 December 2020

Segments OEM Aftermarket Total

Unaudited Unaudited Unaudited

A$000 A$000 A$000

----------------- ------------ -------------

Type of goods or service

Hardware and Installations 221 6,679 6,900

Non-recurring Engineering 2,101 797 2,898

Paid Research 3 - 3

Driver Monitoring - 5,811 5,811

Licensing 778 1,753 2,531

----------------- ------------ -------------

Total revenue from contracts with customers 3,103 15,040 18,143

================= ============ =============

Geographical markets

Australia 315 6,567 6,882

North America 50 5,370 5,420

Asia-Pacific (excluding Australia) 270 1,740 2,010

Europe 2,468 734 3,202

Other - 629 629

----------------- ------------ -------------

Total revenue from contracts with customers 3,103 15,040 18,143

================= ============ =============

Timing of revenue recognition

Goods and services transferred at a

point in time 1,002 6,679 7,681

Goods and services transferred over

time 2,101 8,361 10,462

----------------- ------------ -------------

Total revenue from contracts with customers 3,103 15,040 18,143

================= ============ =============

For the half year ended 31 December 2019

Segments OEM Aftermarket Total

Unaudited Unaudited

A$000 A$000 A$000

---------- ------------ -------

Type of goods or service

Hardware and Installations 717 6,321 7,038

Non-recurring Engineering 1,998 - 1,998

Paid Research 153 568 721

Driver Monitoring - 4,065 4,065

Licensing 87 1,922 2,009

---------- ------------ -------

Total revenue from contracts with customers 2,955 12,876 15,831

========== ============ =======

Geographical markets

Australia 108 4,598 4,706

North America 365 5,100 5,465

Asia-Pacific (excluding Australia) 196 1,079 1,275

Europe 2,286 446 2,732

Other - 1,653 1,653

---------- ------------ -------

Total revenue from contracts with customers 2,955 12,876 15,831

========== ============ =======

Timing of revenue recognition

Goods and services transferred at a

point in time 957 6,563 7,520

Goods and services transferred over

time 1,998 6,313 8,311

---------- ------------ -------

Total revenue from contracts with customers 2,955 12,876 15,831

========== ============ =======

The Group recognised impairment losses on receivables and

contract assets arising from contracts with customers, included

under Administrative expenses in the statement of profit or loss,

amounting to A$27,000 for the half year ended 31 December 2020

(H1FY20:A$241,000). The company has reclassified comparative

revenues into the two key operating segments, OEM and Aftermarket,

reflecting the different paths to market for our product.

3 Segment information

The following tables present revenue and gross profit

information for the Group's operating segments for the half year

ended 31 December 2020 and 2019, respectively:

OEM Aftermarket Total

FOR THE HALF YEARED 31 DECEMBER 2020

A$000 A$000 A$000

------------------------------------------- ----------- ------------- ----------

Segment revenue 3,103 15,040 18,143

----------- ------------- ----------

Segment gross profit 1,174 5,165 6,339

=========== ============= ==========

OEM Aftermarket Total

FOR THE HALF YEARED 31 DECEMBER 2019

A$000 A$000 A$000

------------------------------------------- ----------- ------------- ----------

Segment revenue 2,955 12,876 15,831

----------- ------------- ----------

Segment gross profit 1,325 4,285 5,610

=========== ============= ==========

4 Research and development expenses

The total research and development expenses in H1FY20 was

$8,853,287 (H1FY19: $12,015,664). Research and development expense

relates to ongoing investment in the group's core technology.

5 Property, plant and equipment

Acquisitions and disposals

During the half year ended 31 December 2020, the Group acquired

assets with a cost of A$92,000 (H1FY20: A$681,284).

No assets were disposed by the Group during the half year ended

31 December 2020.

6 Inventories

During the half year ended 31 December 2020, the Group wrote

down stock to the value of A$343,000 which had been provided for

during FY20.

Consolidated entity

31 Dec 30 Jun

2020 2020

Unaudited Audited

A$000 A$000

---------- --------

Finished goods (at lower of cost and net realisable

value) 4,184 5,168

Write-down of inventories for the period (82) (425)

---------- --------

Total inventories at the lower of cost and

net realisable value 4,102 4,743

========== ========

7 Financial assets and financial liabilities

Set out below, is an overview of financial assets, other than

cash and short-term deposits, held by the Group as at 31 December

2020 and 30 June 2020:

31 Dec 30 Jun

Unaudited Audited

--------------- -----------

A$000 A$000

Debt instruments at amortised cost

Trade and other receivables 9,592 9,584

Current Financial Assets 332 512

--------------- -----------

Total 9,924 10,096

--------------- -----------

Total current 9,924 10,096

--------------- -----------

Set out below is an overview of financial liabilities held by

the Group as at 31 December 2020 and 30 June 2020:

31 Dec 30 Jun

Unaudited Audited

A$000 A$000

---------- --------

Financial liabilities at amortised cost

Trade and other payables 7,651 7,874

Financial guarantee contracts 378 553

Non-current interest bearing loans and borrowings

Lease liabilities 5,196 5,766

Current interest bearing loans and borrowings

Lease liabilities 1,141 1057

---------- --------

Total 14,377 15,250

---------- --------

Total current 9,181 9,484

---------- --------

Total non-current 5,196 5,766

---------- --------

8 Cash and cash equivalents

For the purpose of the interim condensed statement of cash

flows, cash and cash equivalents are comprised of the

following:

31 December 30 June

2020 2020

Unaudited Audited

A$000 A$000

----------- --------

Cash at bank and in hand 52,361 38,138

Total cash and cash equivalents 52,361 38,138

=========== ========

9 Intangible assets

During the half year ended 31 December 2020, the Group purchased

intangibles totalling A$190,000 (H1FY20: A$233,042). These

purchases are related to trademark and patent applications. There

were no disposals of intangible assets during the period and the

net movement in intangible assets net of amortisation was

($183,799), relating to amortisation of capitalised development

costs.

10 Dividends paid

No dividends or distributions have been made to members during

the half year reporting period and no dividends or distributions

have been recommended or declared by the directors in respect of

the half year reporting period.

11 Share-based payments

LTI 2020 - Performance Rights or share options offers -

Executive and key staff

From 1 July 2015, senior staff and other key staff are offered

long term incentive (LTI) performance rights or share options.

Under this structure, the staff are only able to exercise the

rights, and have new ordinary shares issued to them, if any

performance, market and vesting conditions are met. These

conditions typically include a performance condition requiring the

staff member to achieve a minimum "meets expectations" rating and

some rights have included a market condition in the form of a

minimum Target Share Price (TSP). The vesting period ranges from 9

months to 5 years from the end of the relevant financial year or

grant date. Performance rights or options are often offered as part

of the annual remuneration review and may be offered at other

times. Any offer of performance rights or options requires Board

approval and, when granted, is announced to the market.

In November 2020 the Company awarded a total of 29,964,495

performance rights in respect of ordinary shares to

Executive and key staff to be issued at nil cost. The rights

were valued at the spot rate of the shares at grant date, and the

value is amortised over the vesting period. The rights vest

annually over 3 years in equal tranches with the first vesting date

being 1 July 2021 and require the employee to remain continuously

employed by the Company until each relevant vesting date. If an

employee leaves before the rights vest and the service condition is

therefore not met, the rights lapse.

In some cases, for 'good leavers', determined on a discretionary

basis by management, options are prorated for service in the

current period and that portion are vested on termination, and the

remaining rights are cancelled.

There is no cash settlement of the rights.

2020 - Ordinary Shares

In November 2020 the Company issued a total of 1,604,166

ordinary shares to non-executive directors in lieu of some cash

remuneration for FY 2020. The shares were valued at grant date at

GBP0.04. The number of Ordinary Shares received by each individual

was calculated at an issue price of 4 pence per Ordinary Share,

being the average daily VWAP over the 5 trading days to 30

September 2019.

12 Commitments

At 31 December 2020, the Group had commitments of A$23,674,000

(H1FY20: A$27,781,500) relating to the manufacturing contract for

the Group's Guardian 2.1 product to January 2022.

13 Related party disclosures

The following table provides the total amount of transactions

that have been entered into with related parties during the half

year ended 31 December 2020 and 2019:

Balance Granted as Acquired Balance

1-Jul Remuneration or 31-Dec

sold for

cash

'000 '000 '000 '000

------- ------------- --------- -----------

Director shares:

Directors' securities 2020 6,837 1,604 450 8,441

Directors' securities 2019 5,031 1,222 233 6,387

14 Events after the reporting period

On 22 March 2021, Seeing Machines issued 68,403,430 new ordinary

shares of no par value each (the "New Ordinary Shares") to US based

Toronado Capital Management, at a price of 10.50 pence per New

Ordinary Share, raising gross proceeds of approximately

US$10,000,000 (the "Purchase").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZGFFKMMGMZG

(END) Dow Jones Newswires

March 31, 2021 02:00 ET (06:00 GMT)

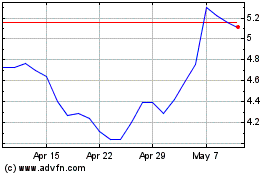

Seeing Machines (LSE:SEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Seeing Machines (LSE:SEE)

Historical Stock Chart

From Apr 2023 to Apr 2024