TIDMSQZ

RNS Number : 7093B

Serica Energy plc

12 October 2020

Serica Energy plc

("Serica" or the "Company")

Operations Update

London, 12 October 2020 - Serica Energy plc (AIM: SQZ) is

pleased to provide the following operations update.

Highlights

-- Commencement of offshore operations to prepare the Rhum R3 well for production

-- Successful installation of first Columbus subsea equipment

-- Significantly improved gas prices

-- No COVID-19 interruptions to operations or production

Rhum Field: R3 Intervention Project

Offshore operations on the R3 Intervention project have

commenced. Awilco Drilling's WilPhoenix semi-submersible drilling

rig, has arrived on location and is safely installed over the R3

well.

The Rhum field is situated some 380 km NE of Aberdeen in a water

depth of 109 metres. Field development was sanctioned in 2003 and

production started in December 2005. Rhum has subsea completions

which are tied back to the Bruce platform complex which lies 44 km

south of Rhum. The original development plan consisted of three

wells but the third of these wells (R3) has never been put into

production.

The current work programme will involve recovering equipment

left in the well by the previous operator and removing an

obstruction that is believed to be in place across parts of the

downhole completion. The well will then be recompleted. Rig

operations are planned to last approximately 70 days. R3 is already

connected to the subsea production infrastructure and it is

expected that operations to commence production from R3 will take

place in early 2021.

Rhum wells produce predominantly gas with minor levels of

condensate. Average Rhum production from the existing two wells in

2019 was 13,775 boe/d net to Serica's 50% field interest. A

successful recompletion of R3 will increase the production capacity

utilising the existing production facilities located on the Bruce

platform and will, therefore, not lead to any significant

additional CO(2) emissions. This is in line with Serica's stated

objective of reducing the carbon intensity of the operations

associated with our production. Further details on Serica's

commitment to ESG (Environment, Social & Governance) can be

found at www.serica-energy.com/downloads/ESG-report-2019.pdf

A further update on the R3 Intervention project will be provided

when rig operations are completed.

Columbus Development

In late September an important milestone was achieved in the

Columbus development project with the successful installation of

the seabed tie-in structure.

Columbus will be developed by a single subsea well, which will

be connected to the Arran to Shearwater pipeline through which

Columbus gas and condensate production will be exported co-mingled

with Arran field production.

The Arran to Shearwater pipeline has been installed and the

first Arran well has been spudded. The installation of the

Shearwater to Columbus umbilical is complete and the Columbus

tie-in structure has been placed on the seabed adjacent to the

proposed wellhead location.

The jack-up rig Maersk Resilient has been contracted to drill

the Columbus development well which is planned for the first half

of 2021. First production is expected from Columbus in the second

half of 2021 with expected production rates net to Serica of 3,500

- 4,000 boe/d to be achieved shortly thereafter.

Commodity Prices

Over 80% of Serica's production is gas and spot gas prices have

continued to strengthen following the historically low prices

encountered earlier this year. In January this year, average Heren

NBP day-ahead spot prices were around 28p/therm but then fell

significantly during the early stages of the COVID lock down

reaching below 10p/therm on a number of days.

Subsequently, the recovery in gas prices has been strong and in

September average spot prices were over 29.5p/therm, a substantial

increase over the low point in the first half of the year. The

average price in October to date has exceeded 35p/therm. Serica's

gas price hedging programme yielded significant gains in the first

half of the year and provides further support into 2022.

COVID-19

There have been no confirmed cases of COVID-19 on any of our

installations nor, to date, any interruptions to production caused

from COVID-19 infections on our or third-party facilities. Serica

has not furloughed or laid off any staff during 2020 nor utilized

any of the various government schemes that have been made available

to support industry during the current pandemic.

Serica has assessed the risk of COVID-19 related matters

impacting the availability of equipment and/or personnel for the R3

and Columbus projects and has determined that any such risk

currently is insufficient to prevent the execution of these

projects.

Mitch Flegg, Chief Executive of Serica Energy, commented:

"We are entering an exciting period of value-adding operations.

The R3 Intervention project has the potential to add significant

production volumes and can provide valuable optionality to the

management of Rhum wells and reservoir. The Columbus development

will add further production and diversity to our portfolio.

Serica's net production levels remain strong despite the added

complexities associated with operating remote installations in a

socially distanced manner. Gas prices have recovered significantly

and the gas futures price outlook is good. Our balance sheet

remains robust with significant cash reserves, no debt and limited

decommissioning liabilities. This will enable us to execute these

projects whilst simultaneously continuing to look to take advantage

of current market conditions by pursuing opportunities to further

expand our portfolio."

Additional Information

Rhum is a gas condensate field producing from two subsea wells,

R1 and R2, tied into the Bruce facilities through a 44km pipeline.

Rhum production is predominantly gas which is exported to St Fergus

for delivery into the National Transmission System. Small

quantities of associate condensate are exported onshore via the

Forties Pipeline System. The field has produced at relatively

constant rates through the past year.

The third well, R3, requires intervention work before it can be

brought on production. In 1H 2019, investigative work to assess the

condition of the well and associated control systems was

successfully carried out and the data gathered was incorporated

into planning for the R3 intervention. On 12 May 2020 Serica

announced that it had entered into a contract for the provision of

a drilling rig for the intervention work on R3 well on behalf of

the Rhum partners.

Regulatory

This announcement is inside information for the purposes of

Article 7 of Regulation 596/2014.

The technical information contained in the announcement has been

reviewed and approved by Fergus Jenkins, VP Technical at Serica

Energy plc. Mr. Jenkins (MEng in Petroleum Engineering from

Heriot-Watt University, Edinburgh) is a Chartered Engineer with

over 25 years of experience in oil & gas exploration,

development and production and is a member of the Institute of

Materials, Minerals and Mining (IOM3) and the Society of Petroleum

Engineers (SPE).

Enquiries:

Serica Energy plc +44 (0)20 7457 2020

Tony Craven Walker, Executive Chairman

Mitch Flegg, CEO

Peel Hunt (Nomad & Joint Broker) +44 (0)20 7418 8900

Richard Crichton / David McKeown / Alexander

Allen

Jefferies (Joint Broker) +44 (0)20 7029 8000

Tony White / Will Soutar

Instinctif Partners +44 (0)20 7457 2020

Mark Garraway / Sarah Hourahane / Dinara +44 (0)7493 867

Shikhametova 435

+44 (0)7580 817

276

serica@instinctif.com

NOTES TO EDITORS

Serica Energy is a British independent oil and gas exploration

and production company with a portfolio of exploration, development

and production assets.

Serica is the operator of the producing Bruce, Keith and Rhum

fields in the UK Northern North Sea, holding interests of 98%, 100%

and 50% respectively. Serica also holds an 18% non-operated

interest in the producing Erskine field in the UK Central North Sea

and a 50% operated interest in the Columbus Development.

Further information on the Company can be found at

www.serica-energy.com .

The Company's shares are traded on the AIM market of the London

Stock Exchange under the ticker SQZ and the Company is a designated

foreign issuer on the TSX. To receive Company news releases via

email, please subscribe via the Company website.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFFTIDLLLII

(END) Dow Jones Newswires

October 12, 2020 02:00 ET (06:00 GMT)

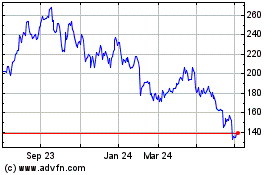

Serica Energy (LSE:SQZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

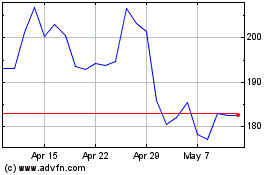

Serica Energy (LSE:SQZ)

Historical Stock Chart

From Apr 2023 to Apr 2024