Imperial Reports Second Quarter Production and Red Chris Construction Progress

July 15 2014 - 6:29PM

Marketwired Canada

Imperial Metals Corporation (TSX:III) reports that metal production for the

second quarter 2014 from its Mount Polley, Huckleberry(1) and Sterling mines

was, on an aggregate basis, 16.6 million pounds copper, 13,867 ounces gold and

59,289 ounces silver.

At Mount Polley the second quarter average daily throughput was 23,404 tonnes

per day, up by 23% compared to the first quarter. Metal production totalled 12.0

million pounds copper, 11,867 ounces gold and 33,813 ounces silver; increases of

46%, 24% and 35% respectively compared to the first quarter 2014.

Huckleberry copper production was up 67% in the second quarter 2014 compared to

the first quarter, from 5.5 million pounds to 9.2 million pounds. The SAG mill

has performed well since the restart on April 5, with throughput averaging

15,213 tonnes per day for the second quarter, up from the first quarter average

of 9,967 tonnes per day. Softer ore from the Main Zone pit and adjustments in

the mill resulted in a steady increase in the mill throughput rate during the

second quarter. In the first week of July, the mill throughput averaged 20,433

tonnes per day.

Sterling mining operations resumed on June 17, 2014 after the mine received an

air emissions permit issued in accordance with new regulations. Due to the

suspension of operations no gold was shipped during the second quarter compared

to 2,104 ounces gold shipped during the first quarter. Subsequent to the end of

the second quarter, approximately 1,500 ounces gold was shipped in early July.

On-site construction at Red Chris is well advanced. Interior steel, mechanical

installation, and the tailings and reclaim water systems are 93% complete.

Piping and electrical work (including the powerline from Tatogga to the

minesite) continues to progress at a satisfactory rate, and will be completed on

time for the commissioning and start-up of milling operations at Red Chris.

Mining operations have already commenced at Red Chris with the first excavation

of ore grade material from the East zone. This material is being stockpiled for

commencement of milling operations.

The 287kv Northwest Transmission Line (NTL) from Skeena substation near Terrace

to Bob Quinn is now complete, and BC Hydro reports the Bob Quinn substation was

energized today. Construction of the 93km Iskut extension of the NTL from Bob

Quinn to Tatogga continues to progress. All towers for the Iskut extension are

targeted to be in place by the end of July. Energization of the Iskut extension

has been delayed somewhat as a result of the delivery of faulty implosion

sleeves. These sleeves are used to splice the conductors. Implosion sleeves are

specifically designed metallic sleeves with a small engineered charge wrapped

around the sleeve. The charge creates an implosive compression, seamlessly

joining two conductor ends. At present the new implosion sleeves are targeted to

be on site by the end of July. Due to delays associated with the faulty

implosion sleeves, the completion and energization of the Iskut extension is now

anticipated to be in September 2014. Commissioning and start up of the Red Chris

milling operations will follow.

(1) stated as Imperial's 50% allocation of Huckleberry production

About Imperial

Imperial is an exploration, mine development and operating company based in

Vancouver, British Columbia. The Company operates the Mount Polley copper/gold

mine in British Columbia and the Sterling gold mine in Nevada. Imperial has 50%

interest in the Huckleberry copper mine and has 50% interest in the Ruddock

Creek lead/zinc property, both in British Columbia. Imperial is in development

of its wholly owned Red Chris copper/gold property in British Columbia.

Cautionary Note Regarding "Forward-Looking Information"

This press release contains "forward-looking information" or "forward-looking

statements" within the meaning of Canadian and United States Securities Laws,

which we will refer to as "forward-looking information". Except for statements

of historical fact relating to the Company, certain information contained herein

constitutes forward-looking information. If we discuss mine plans; costs and

timing of current and proposed exploration, development, production and

marketing; capital expenditures; construction of transmission lines; cash flow;

working capital requirements and the requirement for additional capital;

operations; revenue; margins and earnings; future prices of copper and gold;

future foreign currency exchange rates; future accounting changes; future prices

for marketable securities; future resolution of contingent liabilities; receipt

of permits; or other matters that have not yet occurred, we are making

statements considered to be forward-looking information or forward-looking

statements under Canadian and United States Securities Laws.

The forward-looking information in this press release may include words and

phrases about the future, such as: plan, expect, forecast, intend, anticipate,

estimate, budget, scheduled, believe, may, could, would, might or will. We can

give no assurance the forward-looking information will prove to be accurate. It

is based on a number of assumptions management believes to be reasonable,

including but not limited to: the continued operation of the Company's mining

operations, no material adverse change in the market price of commodities or

exchange rates, that the mining operations will operate and the mining projects

will be completed in accordance with their estimates and achieve stated

production outcomes and such other assumptions and factors as set out herein. It

is also subject to risks associated with our business, including but not limited

to: risks inherent in the mining and metals business; commodity price

fluctuations and hedging; competition for mining properties; sale of products

and future market access; mineral reserves and recovery estimates; currency

fluctuations; interest rate risks; financing risks; regulatory and permitting

risks; environmental risks; joint venture risks; foreign activity risks; legal

proceedings; and other risks that are set out in the Company's current

Management's Discussion & Analysis. If our assumptions prove to be incorrect or

risks materialize, our actual results and events may vary materially from what

we currently expect as provided in this press release. We recommend review of

the Company's current Management's Discussion & Analysis, which includes

discussion of material risks that could cause actual results to differ

materially from our current expectations. Forward-looking information is

designed to help you understand management's current views of our near and

longer term prospects, and it may not be appropriate for other purposes. We will

not necessarily update this information unless we are required to by securities

laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Brian Kynoch

President

604.669.8959

Andre Deepwell

Chief Financial Officer

604.488.2666

Gordon Keevil

Vice President Corporate Development

604.488.2677

Sabine Goetz

Shareholder Communications

604.488.2657

investor@imperialmetals.com

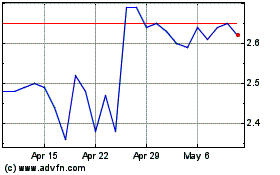

Imperial Metals (TSX:III)

Historical Stock Chart

From Mar 2024 to Apr 2024

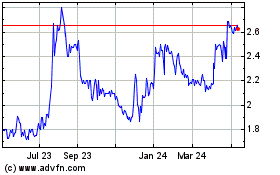

Imperial Metals (TSX:III)

Historical Stock Chart

From Apr 2023 to Apr 2024