By Paul Ziobro and Lillian Rizzo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 16, 2018).

The liquidation of Toys "R" Us Inc. has sent the toy industry

reeling, leaving Mattel Inc., Hasbro Inc. and other manufacturers

without a large chain devoted to selling games and dolls and

forcing them to scramble to secure other outlets to carry their

items.

Toys "R" Us, which had more than $11 billion in revenue in its

last fiscal year, is one of the retail chains that were once seen

by vendors as "category killers" and have emerged as crucial checks

on the power of Amazon.com Inc. Stores like Best Buy Co. and Barnes

& Noble Co. provide electronics manufacturers and book

publishers with vast networks of physical showrooms.

The likely death of Toys "R" Us, which early Thursday filed

plans to liquidate its U.S. operations and other businesses, means

the $27 billion U.S. toy industry will no longer have a national

partner to showcase its wares year-round, test experimental

products and find the next Shopkins or ZhuZhu Pet.

It was a quick unraveling for Toys "R" Us since its September

chapter 11 bankruptcy filing. In a call with employees Wednesday,

Toys "R" Us Chief Executive David Brandon described a cascading

series of events, starting with what he described as a

"devastating" holiday season that led to plans to close more stores

and then to exit from the baby-products business to focus on

toys.

"The hole that we dug in the holiday season put us in a position

where our lender became justifiably nervous as the company was

continuing to consume cash," Mr. Brandon said.

Ultimately, the company is expected to liquidate its entire U.S.

operation, a decision that would affect 33,000 jobs. The company

also is liquidating operations in other countries, and plans to

sell its business in Canada, Central Europe and Asia.

Now, 70 years after Charles Lazarus opened what would become

America's main toy destination, its stores may disappear from U.S.

soil.

"This industry has been devastated," said Tom Murdough, founder

of Simplay3 Co., which makes plastic play sets and ridable

vehicles. "This is a major, major hit to the industry."

In five decades of selling toys, Mr. Murdough hasn't known a day

without Toys "R" Us. He founded and sold both Little Tikes Co. and

Step2 Co. in the past and he now is the CEO of Simplay3, which he

said gets between 20% and 30% of its sales through Toys "R" Us.

Toy makers don't anticipate recouping all of their sales this

year, or ever, if Toys "R" Us goes away permanently without a

replacement. UBS estimates that Hasbro would lose close to 3% of

its sales for the year if Toys "R" Us liquidates, while Mattel

stands to lose slightly more.

Hasbro CEO Brian Goldner said the maker of Nerf blasters and My

Little Pony dolls is looking for new places to take its inventory.

But that is more challenging earlier in the year compared with the

end, when retailers are trying to fill shelves with holiday

toys.

"There will be some disruption, more short term than long term,

and then we move forward with growth," Mr. Goldner said at an

investor conference this month.

The toy-industry growth rate could slump going forward, too.

Toys "R" Us was primarily responsible for uncovering what would

become the next big thing, since it took chances that other

retailers avoided. "There aren't going to be as many breakout hits,

not as many new items that can blossom," said BMO Capital Markets

analyst Gerrick Johnson. "Toys 'R' Us was a testing ground for a

lot of things."

Toy maker shares, including those of Mattel, Hasbro, Spin Master

Corp. and Jakks Pacific Inc. were trading down slightly at midday

Thursday.

Toy sales may be concentrated in the other two large retailers,

Target Corp. and Walmart Inc., in the near term. Those mass

retailers primarily sell the top-selling items instead of taking

risks, Mr. Johnson said. That means market shares could also build

among the larger toy companies, too. "Small companies won't have an

opportunity to shine," he said.

Some toy companies have expanded their presence in unexpected

places in recent years, so the blow isn't as bad as it might have

been when Toys "R" Us held a larger share of the market. Jeremy

Padawer, co-president of Wicked Cool Toys, the maker of Cabbage

Patch dolls and Pokémon toys, says that not only has Amazon.com

become a bigger part of its business, but sites like Zulily.com,

retailers like Hallmark and even grocers and drugstores have become

options to sell its toys.

Mr. Padawer said Wicked Cool is redoubling efforts to find new

retail outlets, even though he doesn't expect to be able to replace

all of its Toys "R" Us sales, which he estimates at 15% of the

business, over the next year.

"While painful, we recognize there is an immediate opportunity

to replace some of the business," Mr. Padawer said. "It will be a

mutual dance between buyers seeking market share and opportunistic

merchants."

Corrections & Amplifications Tom Murdough previously founded

and sold a company called Little Tikes Co. An earlier version of

this article incorrectly stated the name of the company was Little

Tykes. (March 15, 2018)

Write to Paul Ziobro at Paul.Ziobro@wsj.com and Lillian Rizzo at

Lillian.Rizzo@wsj.com

(END) Dow Jones Newswires

March 16, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

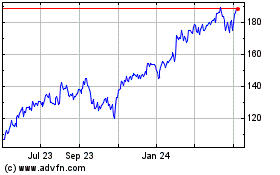

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024